Abstract

This paper suggests innovative investment strategies drawing on return seasonalities. By means of an out-of-sample study of the German stock market, we report that these long–short investment strategies earn on average raw returns up to 233 basis points per month throughout two decades from 1998 to 2017. On a monthly basis, this documents an outperformance of the corresponding Heston and Sadka (J Financ Econ 87(2):418–445, 2008) strategy by 66%. This outperformance is robust in magnitude even after adjusting for common risk factors along both the three-factor Fama and French (J Financ Econ 33(1):3–56, 1993) model and the four-factor Carhart (J Finance 52(1):57–82, 1997) model. Categorizing stocks into three risk profiles lets us conclude that long–short momentum portfolios of stocks with a low-risk profile generate robust investment performance.

Similar content being viewed by others

1 Introduction

Investment strategies drawing on past return information now have a long tradition in finance and are well documented in a correspondingly large body of research. We add to this strand of the literature by providing new evidence on the German stock market. We suggest and analyze two innovative investment strategies which make use of the explanatory power of past returns for future returns. Thus, the proposed investment strategies exploit so-called return seasonalities in the stock market. In brief, those portfolio strategies are based on cross-sectional return autocorrelations.

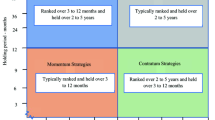

The body of research on investment strategies which draw on the self-explanatory power of stock returns can be split in three fields: short-run momentum strategies, long-run reversal strategies, and strategies bearing on return seasonalities.

Following Jegadeesh (1990) and Jegadeesh and Titman (1993), a vast body of research emerged on the profitability of short-term momentum strategies covering different asset classes and spreading national and international markets. At the very heart of those momentum strategies is the short-term return continuation. Namely, investments that have been winners (losers) in the past will continue being winners (losers) in the near future. Momentum profits have been found to be persistent in international equity markets (Rouwenhorst 1998; Griffin et al. 2003; Nijman et al. 2004), including Germany (Schiereck et al. 1999; Franz and Regele 2016; Schmidt 2017). Moreover, short-term momentum has been documented in alphas (Zaremba et al. 2019) in commodity futures markets (Erb and Harvey 2006; Miffre and Rallis 2007; Chaves and Viswanathan 2016) and foreign exchange markets (Okunev and White 2003). However, recent studies argue that momentum profits are driven by stocks’ past performance throughout selected months prior to portfolio formation rather than by a tendency of short-term return continuation (Novy-Marx 2012; Gong et al. 2015).

In the aftermath of De Bondt and Thaler’s (1985) findings, the profitability of long-term reversal strategies had been studied extensively by an armada of empirical financial economists. Long-term reversal strategies build on the observation that in the long-run returns exhibit reversals. More precisely, investments which have been winners (losers) in the past will feature negative (positive) returns three to five years later. Put differently, the reversal can be interpreted as the correction of some overreaction.Footnote 1 Strategies exploiting this long-term mean-reverting pattern, also referred to as contrarian strategies, have been proven to generate significant excess returns in national and international equity markets [see, e.g., De Bondt and Thaler (1987) and Chopra et al. (1992), and Richards (1997) and Balvers et al. (2000)], including Germany (Stock 1990), as well as in currency values (Engel and Hamilton 1990). However, Miffre and Rallis (2007) do not find evidence for long-term reversal in commodity futures markets. Chaves and Viswanathan (2016) support this finding, but find evidence for mean-reversion in commodity spot markets.

The third strand of research on investment strategies drawing on the self-explanatory power of stock returns started with Lo and MacKinlay (1990) who argue that return reversals are linked to cross-sectional return autocorrelations rather than being caused by market overreaction. In this vein, Heston and Sadka (2008) study the profitability of long–short equity portfolios formed on grounds of stocks’ past performance and report that the returns of winner–loser portfolios are mostly attributable to the stocks’ past performance during annually lagged months in formation periods of different lengths. Put differently, they document that annually lagged stock returns are drivers of future long–short portfolio returns. This result is found to be persistent in a sample of nearly four decades length from 1965 to 2002 in the US market. In a companion study, Heston and Sadka (2010) confirm this result in several international developed equity markets for up to five years. Li et al. (2018) extend this study to 42 international markets, and find the pattern to persist in developed but not in emerging markets. Similarly, Keloharju et al. (2016) document such return seasonalities for several asset classes. Schmidt (2017), however, finds the annual Heston and Sadka (2008) pattern in the German market to be persistent only until 2004. Zaremba (2019) demonstrates a strong and robust return seasonality in international government bonds. Brown et al. (2017) document an intra-quarter seasonality in the aggregate performance of US active domestic equity mutual funds in excess of the market. Using an approach which is methodologically similar to the one suggested in the present paper, Scherbina and Schlusche (2020) rely on the explanatory power of past stock returns across individual stocks, thus, identify so-called leader–follower pairs of stock, and document the performance of long–short portfolios sorting stock based on informational leadership.

The present paper picks up Heston and Sadka’s (2008) findings on the importance of lagged returns for the profitability of winner–loser portfolios. However, applying their approach we suggest strategies that do not rely on ex-ante information. That is, we identify seasonalities employing data available at each portfolio formation date. Similar to Heston and Sadka (2008), we run the cross-sectional OLS regression

in month t and for each lag k, where \(r_{i,t}\) is the return of stock i in month t and the lagged variable \(r_{i,t-k}\) is the return of stock i in month \(t-k\). The slope coefficient \(\gamma _{k,t}\) is referred to as return response. \(\alpha _{k,t}\) and \(\varepsilon _{k,t}\) are the intercept and the residual, respectively.

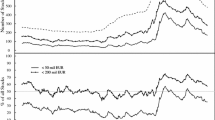

Figure 1 plots t-statistics of the average return responses from cross-sectional regressions of monthly stock returns on monthly lagged stock returns for different lags in the German stock market. Inspecting the plot, we observe that the annually lagged returns—except for the 9-year lag—have predictive power for returns in the German stock market on the one hand. But, there are also nonannual lags—up to the three-year lag—which feature self-explanatory power for returns in the German stock market on the other hand. In particular, nonannual lags—up to 12 months—reveal the existence of momentum in the German stock market. Compared to the findings in Heston and Sadka (2008) and Keloharju et al. (2016), the annual lags in the German stock market turn out not to be as distinct as in the US stock market.

These observations lay down both our research agenda and this paper’s contribution. First, we explore whether the seasonal investment strategies proposed by Heston and Sadka (2008) are also profitable in the German stock market in our sample period. Second, we suggest two innovative investment strategies which exploit the blurred pattern of return lags with self-explanatory power in the German stock market and assess the profitability of these new strategies. Third, we scrutinize the profitability of these new investment strategies by identifying its drivers. We achieve this identification by splitting the stocks in our sample in three categories with different risk profile as suggested by Conrad and Yavuz (2017). Consequently, our analysis is a natural complement to Heston and Sadka’s (2008) and Heston and Sadka’s (2010) studies.

Corresponding to the research agenda mentioned above, the results of our analysis are threefold. First, we report that Heston and Sadka’s (2008) investment strategies which exploit the cross-sectional return autocorrelation at annual lags also perform well in the German stock market. Annual strategies—that is strategies which exploit the self-explanatory power of stock returns at annual lags as depicted in Fig. 1—feature statistically significant monthly raw returns of up to \(1.37\%\) on average. We report statistically significant Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas of those annual strategies which amount up to \(1.54\%\) and \(1.12\%\) per month, respectively. Although correcting for fundamental risk reduces the performance of annual strategies, there is a decent outperformance left from exploiting annual return autocorrelation in the German stock market.

T-statistics of average return responses. Monthly cross-sectional OLS regressions of the form \(r_{i,t} = \alpha _{k,t} + \gamma _{k,t} r_{i,t-k} + \varepsilon _{k,t}\) are calculated in month t and for each lag k, where \(r_{i,t}\) is the return of stock i in month t. The lagged variable \(r_{i,t-k}\) is the return of stock i in month \(t-k\). The slope coefficients \(\gamma _{k,t}\) are referred to as return responses. The date t cross section is estimated using all stocks i in our sample for which lagged returns \(r_{i,t-k}\) are available. The regression is run for every month t from January 1998–December 2017 (240 months) and for the lags \(k=1,\ldots ,120\). \(\bar{\gamma }_k\) are the means of time-series averages of \(\gamma _{k,t}\) conditional on lag k. For each lag k, we perform two-tailed t-tests on \(\bar{\gamma }_k\). The figure plots the corresponding t-statistics for each lag k. Circles mark t-statistics at annual lags. The dashed lines bound the \(95\%\) confidence corridor

Second, we document that our innovative investment strategies—that is strategies which make use of return autocorrelations of some fixed or variable number of return lags but not necessarily of annual return lags and, therefore, are called lag count strategies—generate statistically significant average raw returns of up to \(1.86\%\) per month. The corresponding Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas of the proposed investment strategies reach up to \(2.08\%\) and \(1.08\%\) on a monthly basis, respectively. Thus, the suggested investment strategies which are more flexible in portfolio formation beat Heston and Sadka’s (2008) annual strategies in terms of raw returns as well as on a risk-adjusted basis. If at all, fundamental risk only absorbs a minor part of the proposed strategies’ raw return performance. Moreover, our innovative investment strategies are in line with recent findings in the field of momentum (Novy-Marx 2012; Gong et al. 2015). That is, investment performance is driven by stocks’ past performance in selected months prior to portfolio formation rather than by a tendency of static return continuation.

Third, we redo the analysis for both Heston and Sadka’s (2008) seasonal strategies and our innovative strategies by categorizing stocks into three groups which differ with respect to their risk profile. That is at portfolio formation date each stock is assigned a risk profile initially. Next, portfolios are formed solely from stocks within the respective risk category. In our sample, a strategy relying on a variable number of return lags and drawing on low-risk stocks performs best. On average, this strategy generates a monthly raw return of \(2.33\%\) compared to the \(1.40\%\) which an annual strategy along Heston and Sadka (2008) returns using both the same stocks and the same general formation period. Thus, we report a relative outperformance of \(66\%\) produced by a strategy which exploits a variable number of cross-sectional return autocorrelation lags.

Besides this extraordinary performance, we report a robust investment performance for the groups of stocks of the top and bottom risk tertile across lag count strategies. Put differently, the groups of high- and low-risk profile stocks generate meaningful and statistically significant raw returns, and Fama and French (1993) three-factor alphas as well as Carhart (1997) four-factor alphas in our sample. However, the investment strategies which rely on return autocorrelations of some fixed or variable number of return lags almost always outperform the Heston and Sadka (2008) annual portfolio strategies.

In the German stock market, we find that low-risk stocks—that is stocks with a high market capitalization and a low book-to-market ratio—generate robust out-of-sample investment performance on the one hand and that those stock characteristics are drivers of the reported results in the German stock market on the other hand.

The remainder of this paper proceeds as follows: Sect. 2 provides some institutional background on the German stock market. There, we highlight some specifics of the German stock market which are relevant to our study. We describe the data used in this study additionally. In Sect. 3, we describe in detail the portfolio strategies explored in this paper. Furthermore, the results of both Heston and Sadka’s (2008) seasonal investment strategies and the innovative investment strategies drawing on cross-sectional return autocorrelation in the German stock market are presented. The stock characteristics or risk profiles driving the profitability are assessed in Sect. 4. The robustness of the reported findings is scrutinized in Sect. 5, thoroughly. Section 6 concludes.

2 Institutional background and data

At the very heart of any investment strategy is the underlying investment universe. In the following, we provide some institutional background on the German stock market and describe the data which we use in this study.

Our sample comprises monthly returns of stocks listed on the Frankfurt Stock Exchange spanning four decades and ranging from January 1978 to December 2017. These stock return data are taken from Thomson Reuters Datastream (TDS) and is used both in the cross-sectional regression (1) and for the calculation of the various investment strategies’ returns.

Ince and Porter (2006) point out that data from TDS contain systematic errors and, hence, has to be handled with care. Brückner (2013) analyzes these issues concerning German equity data. Following Brückner (2013), we apply a series of screens and adjustments to the data. Upon retrieving equity data for the German market from TDS, we solely filtered for primary quotes stemming from Deutsche Börse AG or Xetra. Next, we screen static information of individual time-series. Incorrectly categorized securities—that is nonequities—are excluded. Furthermore, we drop stocks with an error message in either their price, market value, book value per share, or shares outstanding. Additionally, we rely on Deutsche Börse AG time-series data if data are available from both Deutsche Börse AG and Xetra. Next, we check the country code of each remaining stock using country information provided by Thomson Reuters Datastream as well as the first two places of each stock’s ISIN ensuring that we do not have foreign stocks in our sample.

Additionally, we apply the following adjustments to the data each portfolio formation date. First, we exclude stocks from the analysis whose prices did not move during three months prior to portfolio formation date. This exclusion accounts for stock delistings on the one hand and means that seemingly illiquid stocks are not part of our investment strategies on the other hand.Footnote 2 Essentially, this procedure is similar to Ince and Porter (2006) who delete all monthly observations with zero return at the end of the sample period.

Second, stocks with a market value below EUR 50 m at portfolio formation date are also excluded from the analysis (Cf. Schmidt (2017)).

Note that all data adjustments solely rely on information available at portfolio formation date. Thus, we do not employ forward looking information in portfolio formation. All in all, the adjustments to the data are parsimonious.

When calculating Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas of the various investment strategies in this paper, we use data provided by Schmidt et al. (2019). These data comprise fundamental risk factors for the German stock market as well as for the risk-free rate of return at monthly frequency.

Count of stocks in the analysis. The figure depicts the number of stocks available in the German market listed on the Frankfurt Stock Exchange as a function of time for the period January 1978–December 2017. It reveals unique characteristics of the German market due to several structural breaks, i.e., the German reunification 1989, the boom of the new economy around 2000, and the economic boom prior to the Global financial crisis in 2007

When assessing investment performance for different risk profiles, we categorize stocks in our sample according to the market capitalization and the book-to-market ratio. For this categorization, we also rely on monthly data taken from TDS. Preventing the look-ahead bias in accounting data, we calculate the book-to-market ratio following Fama and French (1992).

At the end of December 2017, our sample comprises roughly 500 stocks which are listed on the Frankfurt Stock Exchange. Note that Frankfurt Stock Exchange is Germany’s major stock exchange. Among the European stock markets, Frankfurt Stock Exchange is ranked third in terms of market capitalization, behind London Stock Exchange and Euronext.

Figure 2 plots the number of stocks in our analysis which are listed on the Frankfurt Stock Exchange over time. At the end of the depicted four decades from 1978 to 2017 the count of listed stocks more than quadrupled with a low of less than 130 and a peak of around 850 stocks. Thus, the number of stocks for our analysis notably varies over time. Anyway, the growth of the stock count documents a strengthened capital market orientation of both corporations and investors.

A couple of political events and economic incidents can be linked to the stock count evolution directly. For instance, the German reunification led to an immediate increase of the stock count as formerly state-owned firms went public.Footnote 3 The late 1990s again saw a tremendous increase of the stock count in Germany. This was due to the newly created market segment for high-tech stocks of the new economy which had been extremely successful at that time. At the end of the 1990s, the stock count had more than doubled throughout the preceding decade. The post-millennial burst of the new economy bubble resulted in a 10% decline of the stock count which had been more than compensated by an economic boom in Germany until 2008. In 2008 the US subprime crisis started traveling Europe and in the years to follow the European sovereign debt crisis emerged. Both events affected the count of listed stocks adversely. In general, the German reunification shocked the stock count, whereas economic booms and crises translated more slowly in changes of the stock count throughout the sample period.

Compared to the stock count of the US market, the German stock market is small. Furthermore, the German stock market had been affected by events—more precisely, by the German reunification and the European sovereign debt crisis—which did not affect the US economy alike. The corresponding huge variation of the stock count in the German stock market could weaken the self-explanatory power of lagged cross-sectional stock returns in regression (1) as stocks are added to or removed from the cross section when lagged returns become available or are not observed anymore, respectively.

Additionally, the variation of the stock count is relevant for portfolio formation in our study. For instance, decile portfolios formed in the late 1990s only comprise around 13 stocks, whereas decile portfolios after the year 2000—accounting for the data adjustments mentioned above—consist of around 40–50 stocks at least. Therefore, we decide to check the profitability of the analyzed investment strategies with alternative portfolio sizes. Thus, we trade off improved portfolio diversification and a less pronounced differentiation of winner stocks and loser stocks in long–short portfolios.

3 Seasonalities in the German stock market

In this section, we study the performance of investment strategies which draw on seasonalities in the German stock market. First, we analyze strategies exploiting seasonalities alike Heston and Sadka (2008). Next, we suggest and study those strategies which are motivated by the blurred pattern of statistically significant average return responses as depicted in Fig. 1. We refer to the latter investment strategies as lag count strategies. Besides reporting both raw and risk-adjusted investment performance, we provide a description of the underlying investment strategies—that is of portfolio formation—in detail.

3.1 Seasonal strategies

All seasonal investment strategies require both the choice of a general formation period and the determination of a stock’s performance therein. Our analysis comprises four different general formation periods which span 1 year, 2–5 years, 6–10 years, or 1–10 years prior to the portfolio formation date. Following Heston and Sadka (2008), we determine a stock’s past performance from all months (/all months with annual lag/all months except for months with annual lag) in the general formation period. The corresponding seasonal investment strategy is labeled All (/Annual/Nonannual). For instance, when analyzing the strategy Annual which uses a general formation period of 2–5 years, a stock’s past performance is determined by its mean return throughout the annually lagged months 24, 36, 48, and 60 prior to portfolio formation. The month 12 prior to portfolio formation is discarded as it is not element of the general formation period.

Next, all stocks in the sample are sorted on grounds of their past performance and portfolios are formed. Alike Heston and Sadka (2008), we study equally weighted decile portfolios—numbered 1 to 10—which contain stocks with ascending past performance. Hence, portfolio 1 comprises stocks with the worst past performance (loser stocks), whereas portfolio 10 consists of stocks which performed best (winner stocks). The decile spread portfolio 10–1 is a zero investment portfolio with past winner stocks long and past loser stocks short.

In the following, we report raw returns as well as risk-adjusted performance of all portfolios which are formed along the above strategies and draw on different general formation periods.

Raw returns

Table 1 shows average monthly raw returns of decile portfolios and the decile spread portfolio. The panels A to D each cover a different general formation period and the three seasonal strategies mentioned above.

The strategy All in panel A represents a classic momentum strategy. Stocks are sorted on grounds of their performance throughout all months of the past year. The decile spread portfolio earns an excess return of 223 basis points per month. This result is reminiscent of Jegadeesh and Titman’s (1993) findings. However, the decile spread portfolio of the strategy Annual relying only on annually lagged past returns accounts for a huge part of the investment performance of the strategy All and yields a monthly excess return of 137 basis points. Note that both excess returns are highly statistically significant with p-values virtually being zero. On grounds of this observation, one can argue that past returns lagged by 12 months are predictors for the performance of winners over losers. Finally, badly performing stocks—more precisely, portfolios 1 to 4—do not exhibit a reversal.

Inspection of panel B reveals that only the decile spread of the strategy Annual earns a significantly positive monthly excess return of \(0.71\%\). Thus, the past performance of stocks in the general formation period 2–5 years prior to the formation date can predict the performance of winners over losers. More precisely, annually lagged past returns 2–5 years prior to the formation date help to form a profitable winner–loser portfolio. Note that almost all of the portfolios 2–5 across all strategies feature statistically significantly positive returns although the stocks had a weak performance throughout the general formation period. Hence, one observes some reversal. Stocks performing badly in the past generate positive performance. This observation of long-term reversal is akin to that of De Bondt and Thaler (1985).

Panel C reports that past stock performance in the general formation period 6–10 years prior to portfolio formation date is not helpful in predicting a performance of winners over losers. A notable exception is the decile spread portfolio of the strategy Nonannual which earns a significantly negative monthly excess return of \(-\,0.53\%\) and thus documents long-term reversal that stems from stocks in portfolios 1–5 which performed poorly in the past.

Panel D shows the results when portfolio formation relies on past stock performance from ten years prior to formation date. The decile spread portfolio of the strategy Annual earns a highly statistically significant excess return of \(1.04\%\) per month.

Mostly, the results reported in Table 1 are consistent with the findings of Heston and Sadka (2008) for the US stock market. Actually, annually lagged past returns prove helpful in explaining the performance of winners over losers in the German stock market. Unlike Heston and Sadka (2008), the strategy Annual does not work out for the general formation period 6–10 years prior to formation date. However, this does not invalidate the findings of the strategy Annual when using the maximum history of past performance. Ultimately, we observe that most of the performance of decile spread portfolios using the strategy Annual stems from past return information which dates back one year.

Risk-adjusted performance

Recalling the raw returns’ results above, we now scrutinize whether the reported performance remains after controlling for fundamental risk factors and momentum along Fama and French (1993) and Carhart (1997). Doing this is straightforward for two rationales. First, as the decile portfolios in earlier years of the sample are somewhat small as regards the number of stocks they might be poorly diversified. In particular, the decile spread portfolio might not be a true arbitrage portfolio. Although it is a zero investment portfolio it might not be free of fundamental risk. Second, most of the raw returns performance can be attributed to momentum. Thus it is of interest to analyze to which extent this performance can be explained by a momentum risk factor beyond fundamental risk.

Tables 2 and 3 report monthly alphas of decile portfolios and the decile spread portfolio while controlling for fundamental risk and momentum according to Fama and French (1993) and Carhart (1997), respectively. Again, the panels A to D each relate to different general formation periods. Each panel collects the alphas of the three seasonal strategies.

Comparing the alphas in Tables 2 and 3 to the raw returns’ results in Table 1 yields two observations. First, let us inspect the panels A. Note that the decile portfolios 1–5 of stocks with bad performance throughout one year prior to the formation date did not earn statistically significant raw returns across all strategies. However, on a risk-adjusted basis these portfolios exhibit statistically significant negative alphas. Thus, stocks with a bad past performance throughout the last year continue underperforming. Second, take a look at panels B–D. Almost all decile portfolios which reported statistically significant positive raw returns do not display statistically significant alphas. Across the three general formation periods, this loss of performance proves that the raw returns of those decile portfolios are solely a compensation for fundamental risk.

Matching the results for the decile spread portfolio from Tables 1, 2 and 3 reveals two findings. First, panel C shows that the strategy Annual does not feature neither statistically significant raw returns nor statistically significant alphas. Hence, past stock performance in the general formation period 6–10 years prior to the formation date does not allow for predicting a performance of winners over losers neither in terms of raw returns nor when correcting for fundamental risk factors and momentum. Second and most notably, the strategy Annual yields highly statistically significant three- and four-factor alphas of the decile spread portfolio which amount to \(1.54\%\) and \(1.12\%\) per month when drawing on stock performance of one year prior to portfolio formation (Panels A). When taking stock performance of the previous ten years into account for portfolio formation, the corresponding monthly three- and four-factor alphas of the winner–loser portfolio equal \(0.87\%\) and \(0.77\%\) (Panels D). Although accounting for fundamental risk factors and momentum reduces the raw returns performance of the decile spread portfolio as could be expected, the strategy Annual generates highly statistically significant and economically relevant monthly alphas.

So far, our analysis of seasonal strategies in the German stock market alike Heston and Sadka (2008) delivers the insight that the strategy Annual produces remarkable and economically relevant raw and risk-adjusted performance of winner–loser portfolios when exploiting past return performance from one year or up to ten years prior to portfolio formation, that is from the shortest and longest general formation period. This finding corresponds to the fact that almost all average return responses in Fig. 1 are reported to be statistically significant at annual lags. Note that the average return responses at nonannual lags—except for some—are not statistically significant.

Alternative portfolio sizes

In the previous analyses, we focused on studying the decile spread portfolio in order to assess the performance of the strategies Annual versus Nonannual. As mentioned in Sect. 2, decile portfolios contain only a small number of stocks during the first two decades of our sample. Thus, the winner–loser portfolio might be insufficiently diversified. In the following we challenge the decile methodology with both a quintile approach and the procedure suggested by Lo and MacKinlay (1990).

The quintile approach is identical to the decile methodology except for the fact that stocks are grouped into five equally weighted portfolios with equal stock count based on past performance. By 5–1 we denote the zero-investment portfolio with past winner stocks long and past loser stocks short and refer to it as quintile spread portfolio. Thus, the quintile spread portfolio contains 40% of the stocks available at formation date. That is twice as many as in the decile spread portfolio.

According to the Lo and MacKinlay (1990) procedure, a stock is categorized as winner (loser) if its past performance exceeds (falls behind) the average past performance of all stocks at formation date. A stock’s portfolio weight is determined by the difference between its past performance and the average past performance of all stocks. Analogously, 2–1 denotes the zero-investment portfolio with past winner stocks long and past loser stocks short. Note that this spread portfolio contains all stocks available at formation date.

Table 4 reports monthly average raw returns and three-factor Fama and French (1993) alphas and four-factor Carhart (1997) alphas of winner–loser portfolios using the quintile approach and the Lo and MacKinlay (1990) procedure.

Inspection of Table 4 yields two observations. First, the strategy Annual earns statistically significant positive average raw returns using both the quintile approach and the Lo and MacKinlay (1990) procedure. However, the reported average raw returns are smaller than those obtained from the decile approach. This loss in performance can be explained as follows. As both the winner portfolio and the loser portfolio contain more stocks, we give up a sharper distinction of winners and losers by extending the stock count compared to the decile approach. Hence, the spread between winner stocks and loser stocks in the winner–loser portfolio becomes less pronounced.

Second, the three-factor Fama and French (1993) alphas and four-factor Carhart (1997) alphas of winner–loser portfolios are in line with the findings in decile spread portfolios. Note that performance or its statistical significance becomes less pronounced in portfolio size. This applies to all three seasonal strategies. However, if one implements seasonal strategies applying the decile approach we point out that it is more prone to smaller stocks and, thus, likely to be subject to higher transactions costs.

Interim conclusion

Having studied Heston and Sadka’s (2008) seasonal strategies in the German stock market, we can record the following results. First, exploiting past return performance of stocks at annual lags by means of winner–loser portfolios generates statistically significant and economically relevant positive performance both in terms of raw returns as well as adjusted for fundamental risk factors and momentum. Thus, Heston and Sadka’s (2008) findings are confirmed in the German stock market throughout our sample period. Second, the smaller portfolio size—in terms of stock count—in the German stock market compared to the US stock market is not an issue that affects the results adversely. Rather, we report that larger portfolios dilute the clear distinction between winner stocks and loser stocks and sacrifice performance.

3.2 Lag count strategies

In the preceding section, our analysis of seasonal strategies in the German stock market alike Heston and Sadka (2008) had been substantiated by the cross-sectional return autocorrelation pattern revealed in Fig. 1 which showed highly statistically significant average return responses at annual lags. However, compared to the US stock market this return autocorrelation pattern is blurred. There are even average return responses at nonannual lags which are positive and highly statistically significant.Footnote 4 This observation is at the very heart of the innovative strategies which we suggest and study in the following.

Facing the blurred cross-sectional return autocorrelation pattern in the German stock market, we form portfolios on grounds of past performance from those lagged months in the general formation period which feature the most significant self-explanatory power in the cross section of stocks. Mapping the previous analysis, the general formation period spreads the ten years prior to portfolio formation date. At formation date, we run the cross-sectional regression (1) either for each month of the general formation period (10-year history) or for all months prior to formation date (full history). Put differently, we generate average return responses \(\bar{\gamma }_k\) for lags \(k=1, \ldots , 120\) at formation date either from a ten year history or from the full history available.Footnote 5

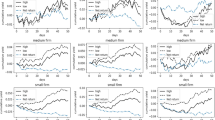

Having generated the average return responses \(\bar{\gamma }_k\) for lags \(k=1, \ldots , 120\) at formation date, we pick either the \(J\in \lbrace 1, 5, 10\rbrace \) lags which feature the most statistically significant positive average return responses or all lags with positive average return responses which are statistically significant at the level \(\delta \in \lbrace 0.10, 0.05, 0.01\rbrace \).Footnote 6 Next, we sort stocks at portfolio formation date according to their past performance in these respective lagged months of the general formation period and form winner–loser portfolios either equally weighted according to the decile methodology and the quintile approach or following the Lo and MacKinlay (1990) procedure. As before, the corresponding spread portfolios are referred to as 10–1, 5–1, and 2–1. Note that for the first (/second) set of strategies the count of lagged months included when determining past performance is fixed (/is ex-ante unknown and might vary across formation dates). We refer to an investment strategy of the first or second set as fixed lag count strategy (FLC) or variable lag count strategy (VLC), respectively. Figure 3 exemplifies the portfolio formation in June 2003 and stresses the out-of-sample nature of our analysis.Footnote 7

Portfolio formation in June 2003. The graph highlights the autocorrelation pattern calculated in June 2003 using data from June 1983–May 2003. Each month t from June 1993 until May 2003 (10-year history) we perform the cross-sectional OLS regression \(r_{i,t} = \alpha _{k,t} + \gamma _{k,t} r_{i,t-k} + \varepsilon _{k,t}\) for lags \(k \in \lbrace 1,\ldots ,120 \rbrace \). \(\bar{\gamma }_k\) are the means of time-series averages of \(\gamma _{k,t}\) conditional on lag k. For each lag k, we perform two-tailed t-tests on \(\bar{\gamma }_k\). The figure plots the corresponding t-statistics for each lag k. In our 10-year history variable lag count strategy (VLC) with \(\delta =0.01\), the portfolio in June 2003 picks stocks based on their average past performance throughout those lagged months in which the return responses are statistically significant at the 1% level. The dashed lines bound the \(99\%\) confidence corridor. Circles mark t-statistics at annual lags. The plus sign markers highlight the lags 3, 4, 5, 6, 7, 9, 10, 12, 24, 72, 95, and 97 with average return responses that are statistically significant at the \(1\%\) level. Hence, the strategy determines past performance throughout the months March 2003, February 2003, January 2003, December 2002, November 2002, September 2002, August 2002, June 2002, June 2001, June 1997, July 1995, and May 1995. The decile spread portfolio, for example, buys the top 10% past performers (winner stocks) and sells the bottom 10% past performers (loser stocks). In our 10-year history fixed lag count strategy (FLC) with \(J=5\), the portfolio in June 2003 picks stocks based on their average past performance throughout the 5 months with the most significant lagged average return responses. These are the lags 5, 6, 9, 12 and 24. Hence, the strategy determines past performance throughout the months January 2003, December 2002, September 2002, June 2002, and June 2001

Fixed lag count (FLC) strategy

Table 5 reports monthly average raw returns, three-factor Fama and French (1993) alphas, and four-factor Carhart (1997) alphas of spread portfolios using the decile methodology, the quintile approach, and the Lo and MacKinlay (1990) procedure. The FLC strategy draws either on a 10-year history (Panel A) or the full history (Panel B) and spans 240 months from January 1998 to December 2017.

Thorough inspection of Table 5 yields a series of observations. First, all spread portfolios of FLC strategies earn highly statistically significant raw returns irrespective of employing a 10-year history or the full history of stock return information. The maximum monthly average raw return of the FLC strategies amounts to \(1.71\%\) and outperforms Heston and Sadka’s (2008) annual strategy in the German stock market. Second, the raw return performance of spread portfolios decreases in portfolio size with two exceptions (Panel B, \(J=5\) and \(J=10\)). However, in general the decile methodology proves more successful than the quintile approach. And the quintile approach outperforms the Lo and MacKinlay (1990) procedure. Third, using the decile methodology, the FLC strategies produce highly statistically significant monthly three-factor Fama and French (1993) alphas and four-factor Carhart (1997) alphas amounting to \(1.85\%\) and \(1.19\%\), respectively. Note, that correcting for momentum risk reduces alpha performance but an economically relevant risk-adjusted performance still remains. Compared with the best alphas of Heston and Sadka’s (2008) annual strategy, the FLC strategy earns in addition 31 basis points and 7 basis points per month, respectively. In general, the three- and four-factor alphas of the FLC strategy are in line with the respective raw returns when using the quintile approach and the Lo and MacKinlay (1990) procedure. This observation matches perfectly our finding when studying seasonal strategies. Fourth, almost all statistically significant three- and four-factor alphas of the decile spread portfolios are greater when drawing on the full history (Panel B) compared to the 10-year history (Panel A). Thus, the cross-sectional return autocorrelation pattern using the full history of stock return information in our sample adds economic value beyond what can be achieved employing a 10-year history.

Variable lag count (VLC) strategy

As mentioned above, the VLC strategy identifies all lagged months with positive average return responses which are statistically significant at certain levels. In contrast to the FLC strategy, we do not ex-ante restrict to a fixed number of lagged months which are taken into account for portfolio formation. Table 6 reports monthly average raw returns, three-factor Fama and French (1993) alphas, and four-factor Carhart (1997) alphas of spread portfolios using the decile methodology, the quintile approach, and the Lo and MacKinlay (1990) procedure. As before, the VLC strategy relies on either a 10-year history (Panel A) or the full history (Panel B). The analysis ranges from January 1998 to December 2017 and, thus, also stretches 20 years.

At first sight, the VLC strategy results look quite similar to those obtained from the FLC strategy above. For instance, all spread portfolios earn highly statistically significant raw returns. Also, the raw return performance strictly decreases in portfolio size with one exception (Panel B, \(\delta =0.10\)).

Second, both the 10-year history as well as the full history approach feature statistically significant raw returns and three-factor Fama and French (1993) alphas. Though the 10-year history approach yields the best performing strategy (Panel A, \(\delta =0.01\)), strategies within the full history approach generate robust results. In fact, the VLC strategy that relies on a 10-year history and determines past performance from all lags which are significant at the \(\delta =0.01\) level is the only strategy that dominates its full history approach counterpart. We conclude that a strategy that draws on only the most significant lags is suited best for capturing dynamically changing autocorrelation patterns.

Third, all spread portfolios produce highly statistically significant alpha performance above the Fama and French (1993) benchmarks. However, most of our strategies strongly load on the momentum factor and thus do not generate significant four-factor Carhart (1997) alphas. The only exception is the same VLC strategy within the 10-year history approach that dominates its full history counterpart, the \(\delta =0.01\) strategy. The decile spread portfolio realizes a monthly raw return of up to \(1.86\%\) and, thus, outperforms Heston and Sadka’s (2008) annual strategy by 82 basis points per month. It also clearly dominates in terms of risk-adjusted performance. Note that the VLC strategy yields three-factor Fama and French (1993) alphas and four-factor Carhart (1997) alphas above Heston and Sadka’s (2008) seasonal strategies. That is \(2.08\%\) and \(1.08\%\) compared to \(0.87\%\) and \(0.77\%\) per month, respectively. Finally, the VLC strategy’s performance increases in the significance level required from the average return responses besides a small number of exceptions. Thus, relying on lagged months with extremely statistically significant average return responses in portfolio formation pays off.

Interim conclusion

Our analysis of the innovative lag count strategies can be summarized as follows. In the German stock market, FLC strategies outperform Heston and Sadka’s (2008) seasonal strategies both in terms of raw returns and after controlling for fundamental risk factors and momentum. VLC strategies, however, correlate significantly with the momentum factor. With a raw return performance of up to \(1.86\%\) per month and a monthly four-factor Carhart (1997) alpha of \(1.19\%\), our FLC and VLC strategies generate an economically relevant performance throughout two decades. The FLC strategy virtually dominates the VLC strategy in all dimensions, that is in raw returns and after risk-adjustment. Put differently, relying on a pre-determined certain count of lags with the most significant average return responses yields better results than employing all lagged months with average return responses of pre-determined significance. Furthermore, the decile methodology provides a sufficiently sharp distinction of winner stocks and loser stocks although the decile portfolios are somewhat small compared to the US stock market. However, quintile portfolios and portfolios formed according to Lo and MacKinlay (1990) do not differentiate between winner stocks and loser stocks as sharp as do the smaller decile portfolios. All in all, the blurred pattern of cross-sectional return autocorrelations in the German stock market can be exploited with the suggested lag count strategies beyond what Heston and Sadka (2008) achieve with an annual strategy.

4 Drivers of seasonalities

In the above analysis, we reported the performance of investment strategies exploiting seasonalities alike Heston and Sadka (2008) in the German stock market. Furthermore, we suggested and analyzed so-called lag count strategies which improved on seasonal strategies as regards both raw and risk-adjusted investment performance. However, the purpose of the present section is to better understand the sources of this investment performance. Put differently, we scrutinize the stock characteristics which drive this performance in the German stock market.

Our above results documented that larger and, thus, better diversified portfolios lose investment performance. This had been observed for both the seasonal strategies and the lag count strategies. Hence, we conclude that stocks differ with respect to the extent to which they follow the cross-sectional return autocorrelation pattern. More precisely, some stocks add more to the return autocorrelation pattern in the cross section than other stocks. Consequently, identifying those stocks which are more likely to give rise to the cross-sectional return autocorrelation pattern might help us to sharpen both the seasonal strategies and our lag count strategies. In doing this, we follow Conrad and Yavuz’s (2017) approach.

Analogously to Conrad and Yavuz (2017), all stocks are categorized by size and book-to-market ratio in three risk profiles at portfolio formation date. Size is measured by market capitalization and book-to-market ratio is calculated according to Fama and French (1992). At portfolio formation date, we sort stocks into size tertiles giving us small, medium-sized, and big stocks. Independent of the size sort, we sort stocks into book-to-market (BM) ratio tertiles yielding high BM, medium BM, and low BM stocks. Having these two sorts and following Conrad and Yavuz (2017), we classify a stock as high-risk profile stock if it qualifies as either small stock or high BM stock and is at least element of the middle tertile of the other sort. Hence, the high-risk profile category subsumes small stocks with high or medium BM on the one hand and high BM stocks which are small- or medium-sized on the other hand. Correspondingly, the low-risk profile category comprises big stocks with low BM or medium BM and low BM stocks which are big or medium-sized. The medium-risk profile is made up of the remainder of stocks which belong to neither the high-risk profile nor the low-risk profile category.

Next, we analyze seasonal strategies along Heston and Sadka (2008) as well as the proposed lag count strategies for each risk profile separately. That is we keep track of the performance of investment strategies which employ stocks of the respective risk profile. According to our previous results, we only report the performance of the winner–loser spread portfolios using the decile methodology.

4.1 Seasonal strategies

Table 7 reports average monthly raw returns as well as three-factor Fama and French (1993) alphas and four-factor Carhart (1997) alphas of the decile spread portfolios for each risk profile throughout two decades ranging from January 1998 to December 2017. The panels A–D refer to different general formation periods. Each panel collects the seasonal strategies All, Annual, and Nonannual which differ with respect to the determination of a stock’s past performance as described before.

Inspection of Table 7 provides a couple of insights. Let us start with having a look at the raw return performance. Remember that the decile spread portfolio earned a raw return of \(2.23\%\) per month (Cf. Table 1, panel A, All) following the strategy All. Panel A now highlights that this pooled return stems from both high-risk and low-risk profile stocks. The strategy All drawing on these two risk profiles earns highly statistically significant monthly raw returns of \(2.78\%\) and \(2.36\%\), respectively. Thus, the separation of stocks along risk profiles sharpens the raw return performance, whereas the aggregate analysis implies a dilution.

A similar observation holds true for the strategy Nonannual in panel A and the strategy Annual in panel D. These strategies employing either high- or low-risk profile stocks generate a raw return performance which cannot be obtained from pooling the stocks. For instance, the strategy Annual in panel D using high- or low-risk profile stocks earn a highly statistically significant raw return of \(1.43\%\) or \(1.40\%\) per month, respectively. Again, this outperforms the \(1.04\%\) monthly raw return from pooling all stocks (Cf. Table 1, panel D, Annual).

Next, we turn to the discussion of the decile spread portfolios’ risk-adjusted performance when analyzing stocks with different risk profile. The strategy All in panel A using high- or low-risk profile stocks generates highly statistically significant three-factor Fama and French (1993) alphas of \(3.02\%\) and \(2.50\%\) per month which exceed the risk-adjusted performance when stocks are pooled (Cf. Table 2, panel A, All). Similarly, the strategy Annual in panel D employing stocks in the high- and low-risk profile features three-factor Fama and French (1993) alphas of \(1.07\%\) and \(1.26\%\) which exceed the risk-adjusted performance from pooling stocks (Cf. Table 2, panel D, Annual).

Let us now turn to the four-factor Carhart (1997) performance. On the one hand, the strategy Annual in panel A employing high-risk profile stocks earns a four-factor Carhart (1997) alpha of \(1.14\%\) per month which slightly dominates its pooled counterpart (Cf. Table 3, panel A, Annual). On the other hand, the strategy Annual in panel D using the low-risk profile stocks generates a highly statistically significant monthly four-factor Carhart (1997) alpha of \(1.40\%\) which outperforms the corresponding alpha in the pooled setting by 63 basis points (Cf. Table 3, panel D, Annual).

Interim conclusion

Analyzing Heston and Sadka’s (2008) seasonal strategies in the German stock market for different risk profiles yields two clear-cut findings compared to stock pooling. First, both raw return performance and risk-adjusted performance of the Heston and Sadka (2008) seasonal strategies become more pronounced when stocks are categorized by risk profile. Hence, categorizing stocks by risk profile adds investment value. However, the pooling of risk profiles dilutes the performance of those strategies. Second, statistically significant performance of the Heston and Sadka (2008) seasonal strategies—in terms of both raw returns and three- or four-factor alphas—can be attributed to high- and low-risk profile stocks, predominantly. We can conclude that the raw or risk-adjusted performance of seasonal strategies from a pooled analysis can be attributed to risk profiles which sharpen the analysis and even yield better results.

4.2 Lag count strategies

We now analyze the suggested lag count strategies for stocks classified by risk profile. As described above, the lag count strategies are grounded on the cross-sectional return autocorrelation pattern which is determined at portfolio formation date. Analyzing risk categories allows us to address the question which stock characteristics essentially drive the cross-sectional return autocorrelation pattern in the German stock market.

As we study the lag count strategies for categories of stocks with different risk profile, it is important to emphasize that we assess the past return performance of all stocks from those lagged months which are identified using the average return responses determined from the whole cross section of available stocks. Thus, we do not determine a return autocorrelation pattern specific to a risk profile. Literally, we do not trim our empirical analysis to each risk profile. That is, the past performance of stocks across risk profiles is determined from the same past lagged months at portfolio formation date. As we potentially lose investment performance by neglecting risk profile-specific return autocorrelation patterns, our results can be judged conservative in this respect. However, if we find differences in the performance of our lag count strategies across risk profiles, we can conclude which risk profile adds most to the market-wide return autocorrelation pattern.

Fixed lag count strategy

Table 8 collects average monthly raw returns, three-factor Fama and French (1993) alphas, and four-factor Carhart (1997) alphas of decile spread portfolios for each risk profile throughout two decades ranging from January 1998 to December 2017. Underlying panels A and B are cross-sectional return autocorrelation patterns at portfolio formation date which employ a 10-year history or the full history of stock return information, respectively. Each panel carries three fixed lag count strategies which differ with respect to the number \(J\in \lbrace 1, 5, 10\rbrace \) of lagged months for determining the past performance of stocks within the respective risk profile.

Let us inspect Table 8. Panel A reports that the FLC strategy \(\left( J=10\right) \) employing high-risk profile stocks and low-risk profile stocks generate highly statistically significant raw returns of \(2.17\%\) and \(1.96\%\) per month, respectively. Thus, risk profiling improves the raw performance beyond the same strategy’s pooled monthly raw return (Cf. Table 5, panel A, \(J=10\)).

A similar observation applies to the risk-adjusted performance. The FLC strategy \(\left( J=10\right) \) using stocks with a high-risk profile and a low-risk profile produces highly statistically significant monthly three-factor Fama and French (1993) alphas of \(2.32\%\) and \(1.99\%\), respectively. Again, this dominates the same strategy’s three-factor Fama and French (1993) alpha absent risk profiling (Cf. Table 5, panel A, \(J=10\)).

Next, the FLC strategy \(\left( J=10\right) \) drawing on high-risk profile stocks and a low-risk profile stocks features statistically significant four-factor Carhart (1997) alphas of \(1.58\%\) and \(0.92\%\), respectively. This risk-adjusted performance does not fall short on the same strategy’s four-factor Carhart (1997) alpha when stocks are pooled (Cf. Table 5, panel A, \(J=10\)).

Finally, the analysis underlying panel B differs from panel A as regards the general formation period. Instead of using only a 10-year history, the past performance of the sample stocks available at portfolio formation date is determined relying on average return responses which are determined employing the full history of available stock return data. This full history approach also reports that risk profiling pays off in terms of improved raw return performance as well as better risk-adjusted performance compared to the pooled analysis (Cf. Table 5, panel B). However, the full history approach is not generally dominant compared to the analysis drawing on a 10-year history.

Variable lag count strategy

Table 9 exhibits average monthly raw returns, three-factor Fama and French (1993) alphas, and four-factor Carhart (1997) alphas of decile spread portfolios in the period January 1998 to December 2017 for different risk profiles. Panels A and B use cross-sectional return autocorrelation patterns at portfolio formation date which employ stock return information from a 10-year history or the full history, respectively. Each panel displays three variable lag count strategies which differ with respect to the significance level \(\delta \in \lbrace 0.01, 0.05, 0.10\rbrace \) required for an average return response such that the corresponding lagged month is considered in the determination of stocks’ past performance within the respective risk profile.

Inspection of Table 9 yields the following insights. We start with looking at panel A. The winner–loser portfolios using low-risk profile stocks feature raw returns, three-factor Fama and French (1993) alphas, and four-factor Carhart (1997) alphas which are highly statistically significant and improve upon the performance which can be achieved without categorizing stocks by risk profile. Note that the VLC strategy \(\left( \delta =0.01\right) \) employing stocks with low-risk profile yields a raw performance as well as three- and four-factor alphas of \(2.33\%\), \(2.42\%\), and \(1.61\%\) per month. These figures report an improvement of 47 basis points, 34 basis points, and 53 basis points compared to the corresponding performance measures when stocks are pooled (Cf. Table 6, panel A, 10–1).

Comparing panel B to panel A yields the observation that employing the full history of stock return information instead of solely relying on a 10-year history of stock return information is not helpful in creating further outperformance of the VLC strategies. Panel B reports that low-risk profile stocks feature highly statistically significant performance in both raw returns and three-factor Fama and French (1993) alphas across all VLC strategies \(\delta \in \lbrace 0.01, 0.05, 0.10\rbrace \) using the full history. Furthermore, inspection of panel B reveals that the returns of VLC strategies relying on the full history when determining average return responses heavily load on the Carhart (1997) momentum factor. This is documented by the absence of any statistically significant four-factor Carhart (1997) alpha.

The dilution of investment performance by pooling stocks is present even for the VLC strategies and becomes obvious from comparison of panels B in Tables 6 and 9. The VLC strategy \(\delta =0.10\) using low-risk profile stocks earns a highly statistically significant monthly raw return of \(1.41\%\). The same strategy with high-risk profile stocks and medium-risk profile stocks does not. When stocks are pooled, this strategy only produces a corresponding raw return of \(1.01\%\) per month demonstrating the dilution.

Interim conclusion

Categorizing stocks by size and book-to-market ratio as suggested by Conrad and Yavuz (2017) improves the investment performance of both the seasonal strategies along Heston and Sadka (2008) as well as the suggested lag count strategies which exploit the blurred cross-sectional return autocorrelation pattern in the German stock market. Analyzing different risk profiles helps to enhance the investment performance.

Comparing the evidence in panels A of Tables 8 and 9 to the findings in panel D of Table 7, we conclude that the lag count strategies employing a fixed or variable count of lagged months for the determination of the stocks’ past performance improve on Heston and Sadka’s (2008) seasonal strategies also when different risk profiles are studied.

In particular, the VLC strategy yields more pronounced results than the FLC strategy. From this perspective, we argue that it pays off to account for the lagged months with the most significant average return responses—that is, VLC strategies with \(\delta =0.01\)—rather than pre-determining the number of lagged months exogenously.

Most notably, low-risk profile stocks deliver stable performance for VLC strategies independent of lag determination from a 10-year history or the full history. Hence, the cross-sectional return autocorrelation pattern in the German stock market seems to be generated by big stocks with low and intermediate book-to-market ratio primarily although high-risk profile stocks also follow this pattern but to a lesser extent.

5 Robustness

In this section, we focus on issues which are relevant to assessing the robustness of the proposed lag count strategies. First, we scrutinize whether value weighting of stocks lets vanish the reported performance of our lag count strategies. This allows to address the impact of transaction cost indirectly. Second, we report the risk-adjusted performance of the suggested lag count strategies with respect to alternative benchmarks—that is the Fama and French (2015) five-factor model as well as the Hou et al. (2015) q-factor model—and, thus, challenge our lag count strategies with more recent hurdles than Heston and Sadka (2008) could do. Third, we scrutinize potentially bad pre-1990 data quality being a driver of our results by restricting our sample to post-1990 data. Finally, we explore whether the reported performance of the lag count strategies is driven by calendar-time effects.

5.1 Value weighting and transaction costs

Naturally, the proposed lag count strategies require monthly portfolio rebalancing upon being implemented as investment strategies. In this respect, our strategies are akin to Heston and Sadka’s (2008) seasonal strategies. Consequently, the investment management employing the suggested lag count strategies is accompanied by transaction costs which consume part of the reported performance.

Novy-Marx and Velikov (2016) report that trading equally weighted portfolios is more expensive. Note that weighting stocks equally in a portfolio implies that small stocks—measured in terms of their market capitalization—relatively have more emphasis in the portfolio compared to big stocks. Consequently, rebalancing a portfolio with strong exposure to small and less liquid stocks means higher transaction costs. Another observation of Novy-Marx and Velikov (2016) is that equally weighted portfolios outperform the corresponding value-weighted portfolios.

In the context of our study, Novy–Marx and Velikov’s (2016) findings mean that the reported performance of our lag count strategies is biased upwards as we employ equal weighting and, thus, are subject to higher transaction cost. Therefore, we scrutinize whether the proposed lag count strategies are robust to value weighting. If the performance of the lag count strategies is robust to value weighting then the lag count strategies prove useful as candidate investment strategies now coming along with lower transaction cost.

Schmidt (2017) reports that most studies of the German stock market rely on equally weighted portfolios, whereas value weighting provides a more realistic assessment of investment performance for real-world investment managers. Drawing on Franz and Regele’s (2016) findings, Schmidt (2017) also stresses the transaction costs associated with managing the short leg—that is, the short sales—of long–short strategies. By studying value-weighted lag count strategies, we provide investment managers with an alternative performance assessment. Additionally, we report results for both the short leg and the long leg of our lag count strategies separately in order to gain insights as regards the source of investment performance.

Table 10 collects both average monthly raw returns and Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas of value-weighted decile spread portfolios as well as of the corresponding long and short leg in the period January 1998 to December 2017 for the FLC strategies \(J\in \lbrace 1, 5, 10\rbrace \) and the VLC strategies \(\delta \in \lbrace 0.01, 0.05, 0.10\rbrace \). Panels A and B use cross-sectional return autocorrelation patterns at portfolio formation date which employ stock return information from a 10-year history or the full history, respectively.

Let us first have a look at the results of the FLC strategies on the left-hand side of Table 10. The decile spread portfolios feature statistically significant raw return performance. Thus, value weighting yields virtually the same results as equal weighting (Cf. Table 5). In particular, the best value-weighted FLC strategy in panel A \(\left( J=10\right) \) yields a highly statistically significant monthly \(2.03\%\) raw return and exceeds the performance of the equally weighted counterpart by 39 basis points.

Second, we inspect the results of the VLC strategies on the right-hand side of Table 10. The best performing value-weighted VLC strategy in panel A \(\left( \delta =0.01\right) \) earns a highly statistically significant raw return which amounts to \(2.26\%\) per month, whereas the corresponding equally weighted VLC strategy—which also is best performing—only yields \(1.86\%\) per month (Cf. Table 6).

Third, the documented results for the long leg (Winner) and the short leg (Loser) in Table 10 reveal that the statistically significant raw return performance of value-weighted FLC and VLC strategies can be attributed to the long legs of the decile spread portfolios. In contrast, the short legs of the value-weighted decile spread portfolios alone do not produce statistically significant raw returns. From this perspective, our results corroborate Schmidt’s (2017) view that the short leg of long–short investment strategies is costly. Rebalancing the short leg generates transaction costs but does not add extra return on average.

Fourth, we report Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas for the decile spread portfolios. We point out that the value-weighted strategies which generate statistically significant raw returns also feature statistically significant returns adjusted for the Fama and French (1993) three-factor alphas. Consistent with our earlier results, the Carhart (1997) momentum factor absorbs a large portion of the performance we generate.

Let us summarize the discussion so far in order to address the issue regarding transaction costs. The value-weighted FLC and VLC strategies feature a lower exposure to illiquid and, thus, costly to trade small stocks by construction but offer at best an even higher raw return performance than the corresponding equally weighted FLC and VLC strategies. We interpret this strong raw return performance—paralleled by a robust three-factor Fama and French (1993) performance—in favor of the proposed lag count strategies with respect to transaction costs.

Additionally, unreported results show that the value-weighted decile spread portfolio of Heston and Sadka’s (2008) strategy All earns on average a raw return of \(1.77\%\) (p-value 0.028) per month. Hence, the value-weighted decile spread portfolios of both the FLC strategy \(\left( J=10\right) \) and the VLC strategy \(\left( \delta =0.01\right) \) improve on that performance by 26 basis points and 49 basis points, respectively.

Obviously, we tackle the issue as regards transaction costs solely indirectly by value weighting and comparison to Heston and Sadka (2008). Clearly, our study does not account for transaction cost measures explicitly as do Franz and Regele (2016). This is far beyond the purpose of the study which focuses on exploiting the blurred autocorrelation patterns of returns in the German stock market. We emphasize that the suggested FLC and VLC strategies require monthly rebalancing and, thus, are associated with substantial transaction costs. In this respect, our study is comparable to Heston and Sadka (2008) which also is subject to monthly rebalancing. However, our results which improve on Heston and Sadka (2008) allow for arguing that transaction costs can be sustained by the suggested FLC and VLC strategies much better than can Heston and Sadka’s (2008) seasonal strategies.

5.2 Alternative factor models

In Sect. 3, we documented the risk-adjusted performance of the suggested lag count strategies along both the Fama and French (1993) three-factor model and the Carhart (1997) four-factor model (Cf. Tables 5 and 6). Now, we challenge our FLC strategies and VLC strategies with more recent benchmarks in order to assess their risk-adjusted performance alternatively. Hereby, we rely on the Fama and French (2015) five-factor model and the Hou et al. (2015) q-factor model.

Table 11 exhibits both Fama and French (2015) five-factor alphas and Hou et al. (2015) q-factor alphas per month of equally weighted decile spread portfolios in the period January 1998 to December 2017 for the FLC strategies \(J\in \lbrace 1, 5, 10\rbrace \) and the VLC strategies \(\delta \in \lbrace 0.01, 0.05, 0.10\rbrace \). Panels A and B use cross-sectional return autocorrelation patterns at portfolio formation date which employ stock return information from a 10-year history or the full history, respectively.

Again we start with inspecting the results of the FLC strategies on the left-hand side of Table 11. All FLC strategies yield statistically significant risk-adjusted performance. Again, the FLC strategy in panel A \(\left( J=10\right) \) earns a monthly Fama and French (2015) five-factor alpha of \(1.33\%\) and a Hou et al. (2015) q-factor alpha of \(1.62\%\) per month both being highly statistically significant.

Turning to the VLC strategies on the right-hand side of Table 11 shows that the VLC strategy with the best risk-adjusted performance in panel A \(\left( \delta =0.01\right) \) delivers a Fama and French (2015) five-factor alpha of \(1.68\%\) as well as a Hou et al. (2015) q-factor alpha of \(1.92\%\). Both monthly alphas are highly statistically significant.

We point out that the risk-adjusted results documented in Table 11 are consistent with earlier findings. The risk-adjusted performance of the FLC strategies slightly dominates that of the VLC strategies in terms of statistical significance. Comparing the risk-adjusted performance in Tables 5 and 6 delivers a similar observation.

Finally, almost all lag count strategies—except for the least demanding VLC strategy \(\left( \delta =0.10\right) \)—outperform the alternative benchmark models and feature statistically significant monthly alphas. Thus, the lag count strategies generate returns which are beyond explanation by the risk factors of Fama and French (2015) and Hou et al. (2015). On grounds of the presented evidence, we conclude that the suggested lag count strategies are robust to alternative benchmark models and deliver economically significant returns in excess of the Fama and French (2015) five-factor model and the Hou et al. (2015) q-factor model.

5.3 Data quality

This section addresses the serious concerns of Brückner (2013) regarding the poor quality of pre-1990 German TDS equity data. Since the suggested FLC and VLC strategies draw on past stock return information, we want to ensure that our results are not driven by potentially corrupt stock return information from the pre-1990 sample returns. Therefore, we scrutinize the suggested FLC and VLC strategies with sample data starting in January 1990. Thus, one can assess the guess of poor data quality being a driver of the reported results.

Table 12 reports average monthly raw returns as well as Fama and French (1993) three-factor alphas and Carhart (1997) four-factor alphas of decile spread portfolios of FLC and VLC strategies from January 2010 to December 2017. Panel A employs equally weighted portfolios, while panel B reports results of value-weighted portfolios.

Inspection of the equally weighted returns in panel A reveals three insights. First, all FLC and VLC strategies generate highly statistically significant raw returns up to \(2.57\%\) per month. Second, Fama and French (1993) three-factor alphas are also highly statistically significant and amount up to \(2.32\%\) per month (Sub-panel A.1, \(J=10\)). Third, Carhart (1997) four-factor alphas are positive and significant for only a handful of strategies (Sub-panel A.1, \(J=5\) and \(J=10\), and sub-panel A.2, \(\delta =0.05\) and \(\delta =0.10\)). Fourth, the performance can be attributed to the long leg of the spread portfolios, that is the portfolio of past winner stocks.

Panel B collects the value-weighted returns of the FLC and VLC strategies. All FLC and VLC strategies feature statistically significant average monthly raw returns up to \(1.93\%\) except for two (Sub-panel B.2, \(J=1\) and \(J=5\)) although smaller in magnitude compared to their equally weighted counterparts, but also originating from the long portfolio leg of the spread portfolios. A highly statistically significant Fama and French (1993) three-factor alpha can be reported for the most profitable FLC strategy (Sub-panel B.1, \(J=10\)) as well as for all VLC strategies based on the 10-year history approach (Sub-panel B.1).

From comparison of panels A and B, we conclude that relatively overweighting small stocks and relatively underweighting large stocks by means of equally weighted portfolio strategies pays off even in the post-1990 era in the German stock market and in risk-adjusted terms. Hence, this finding is reminiscent of the small firm effect in the spirit of Banz (1981). Nonetheless, equally weighted strategies regularly are subject to higher transaction costs compared to their value-weighted counterparts. Thus, the performance surplus might be absorbed by transaction costs. The fact that value weighting of portfolios diminishes profitability compared to equally weighted portfolios is well-known (Cf. Novy-Marx and Velikov 2016). Finally, we concede that our value-weighted strategies do not outperform the Carhart (1997) benchmark.

Comparing the results in the post-1990 sample to those in the full sample lets us conclude that the performance of equally weighted FLC and VLC strategies in the full sample is confirmed in the post-1990 sub-sample. Thus, the guess that our results in the full sample are driven by poor quality of pre-1990 German TDS equity data cannot be supported.

5.4 January-type effects

As a further robustness check, we scrutinize whether the results of our lag count strategies are driven by the January effect or the turn-of-the-year effect (Rozeff and Kinney 1976; Cooper et al. 2006). Put differently, we check whether the performance of our lag count strategies is driven by stock returns in the months of January and/or of December. Consequently, we redo our raw return analysis but skip any portfolios with holding periods encompassing these months.

We find that both the Heston and Sadka (2008) strategies and our lag count strategies yield statistically significant outperformance to a similar extent independent of the performance in the months of January and/or of December. Thus, we conclude that neither the January effect nor the turn-of-the-year effect drive our findings. Detailed results are available upon request.

6 Conclusion

This paper provides a threefold contribution to the body of research on investment strategies which exploit the self-explanatory power of stock returns. First, we study the profitability of seasonal strategies alike Heston and Sadka (2008) in the German stock market. Grounded on the evidence as regards a blurred cross-sectional return autocorrelation pattern of average return responses in the German stock market, we suggest two innovative investment strategies—referred to as fixed lag count strategy and variable lag count strategy—and test their performance in the German stock market throughout two decades. Third, we identify those stock characteristics which drive the scrutinized investment strategies’ performance along categorizing German stocks in the spirit of Conrad and Yavuz (2017).

Our findings are striking. The seasonal strategies of Heston and Sadka (2008) also work in the German stock market. However, the lag count strategies improve on Heston and Sadka’s (2008) seasonal strategies by exploiting a less clear-cut return autocorrelation pattern in the cross section of German stocks. This improved investment performance is documented in raw terms as well as after adjustment for common fundamental risk factors and momentum using the three-factor Fama and French (1993) and four-factor Carhart (1997) benchmarks, respectively. Besides being highly statistically significant, the reported performance measures are economically relevant in magnitude. Categorizing stocks in the German stock market further enhances the investment performance and allows for unveiling the stock characteristics which drive the investment performance of the lag count strategies predominantly. Our results prove robust to value weighting as well as to both the Fama and French (2015) five-factor model and Hou et al. (2015) q-factor model.

More detailed results for the German stock market can be summarized as follows. The best results are obtained from winner–loser strategies which employ past stock performance from those lagged months whose average return responses turn out to be the most significant, that is the VLC strategy with \(\delta =0.01\). Maximum performance is delivered by low-risk profile stocks. These also feature stable performance independent of the extent of the employed history of past stock return information which generates the return autocorrelation pattern in the German stock market. In general, pooling stocks across risk profiles results in a reduced investment performance as medium-risk profile stocks mostly imply a dilution.

We hypothesize that the lag count strategies outperform purely seasonal strategies of Heston and Sadka (2008) in those stock markets which feature a blurred return autocorrelation pattern in the cross section. Scrutinizing this hypothesis in an international context is the natural next step on our research agenda.

Notes