Abstract

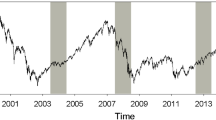

The global minimum-variance portfolio is a typical choice for investors because of its simplicity and broad applicability. Although it requires only one input, namely the covariance matrix of asset returns, estimating the optimal solution remains a challenge. In the presence of high dimensionality in the data, the sample covariance estimator becomes ill-conditioned and leads to suboptimal portfolios out-of-sample. To address this issue, we review recently proposed efficient estimation methods for the covariance matrix and extend the literature by suggesting a multifold cross-validation technique for selecting the necessary tuning parameters within each method. Conducting an extensive empirical analysis with three datasets based on the Russell 3000, we show that choosing the specific tuning parameters with the proposed cross-validation improves the out-of-sample performance of the global minimum-variance portfolio. In addition, we identify estimators that are strongly influenced by the choice of the tuning parameter and detect a clear relationship between the selection criterion within the cross-validation and the evaluated performance measure.

Similar content being viewed by others

Notes

DeMiguel et al. (2009b) additionally show that the mean-variance portfolio is outperformed out-of-sample by the minimum-variance portfolio not only in terms of risk, but as well in respect to the return-risk ratio.

This class of estimators was first introduced by Stein (1986).

Section 2.4 offers more details on this type of estimators.

Following this definition and assuming K common factors with \(K<n\), a covariance matrix estimator based on factor models only needs to estimate \(K(K+1)/2\) covariance entries and is thus more stable.

For the operational use of POET, the threshold value c needs to be determined, so that the positive-definiteness of \(\widehat{{\varSigma }}^{c}_{u,K}\) is assured in finite samples. The choice of c can therefore occur from a set, for which the respective minimal eigenvalue of the errors’ covariance matrix after thresholding is positive. The minimal constant c that guarantees positive-definiteness is then chosen. For more details, see Fan et al. (2013).

This idea was first proposed by Dempster (1972) with the so-called covariance selection model.

This ensures that no penalty is applied to the asset returns’ sample variances.

Goto and Xu (2015) induce sparsity to enhance robustness and lower the estimation error within portfolio hedging strategies, Brownlees et al. (2018) develop a procedure called “realized network” by applying GLASSO as a regularization procedure for realized covariance estimators, and Torri et al. (2019) analyze the out-of-sample performance of a minimum-variance portfolio, estimated with GLASSO.

For clarity in the notation, we do not differentiate between covariance estimators. The procedure is applied to all methods equally.

The price history originates from http://www.kibot.com/.

As a reference, De Nard et al. (2019) consider a study setup with concentration ratios \(q\approx \left\{ 0.08, 0.4, 0.8\right\} \).

To account for possible differences in the results due to randomization, we performed the study with various random seeds and reached similar results.

For the sake of completeness, we have also performed a block bootstrap as in Ledoit and Wolf (2011). The corresponding significant values are comparable to those from the HAC test and are therefore not reported.

The other datasets produce similar results. For reference, see Fig. 4, “Appendix A”.

“Appendix B” compares further datasets. Overall, the results are similar in tendency, but are less pronounced due to a lower dimensionality in the data.

Similar reduction in turnover takes place in the case of the \(\hbox {LW}^{\mathrm{CC}}\) estimator, as well.

References

Arlot, S., Celisse, A.: A survey of cross-validation procedures for model selection. Stat. Surv. 4, 40–79 (2010). https://doi.org/10.1214/09-SS054

Bai, J., Ng, S.: Determining the number of factors in approximate factor models. Econometrica 70(1), 191–221 (2002). https://doi.org/10.1111/1468-0262.00273

Banerjee, O., Ghaoui, L.E., d’Aspremont, D.: Model selection through sparse maximum likelihood estimation for multivariate Gaussian or binary data. J. Mach. Learn. Res. 9(3), 485–516 (2008)

Best, M.J., Grauer, R.R.: On the sensitivity of mean-variance-efficient portfolios to changes in asset means: some analytical and computational results. Rev. Financ. Stud. 4(2), 315–342 (1991a)

Best, M.J., Grauer, R.R.: Sensitivity analysis for mean-variance portfolio problems. Manag. Sci. 37(8), 980–989 (1991b)

Bickel, P.J., Levina, E.: Covariance regularization by thresholding. Ann. Stat. 36(6), 2577–2604 (2008). https://doi.org/10.1214/08-AOS600

Bollerslev, T., Patton, A.J., Quaedvlieg, R.: Modeling and forecasting (un)reliable realized covariances for more reliable financial decisions. J. Econ. 207(1), 71–91 (2018). https://doi.org/10.1016/j.jeconom.2018.05.004

Broadie, M.: Computing efficient frontiers using estimated parameters. Ann. Oper. Res. 45(1), 21–58 (1993). https://doi.org/10.1007/BF02282040

Brodie, J., Daubechies, I., De Mol, C., Giannone, D., Loris, I.: Sparse and stable Markowitz portfolios. Proc. Natl. Acad. Sci. 106(30), 12267–12272 (2009). https://doi.org/10.1073/pnas.0904287106

Brownlees, C., Nualart, E., Sun, Y.: Realized networks. J. Appl. Econ. 33(7), 986–1006 (2018). https://doi.org/10.1002/jae.2642

Cai, T., Liu, W.: Adaptive thresholding for sparse covariance matrix estimation. J. Am. Stat. Assoc. 106(494), 672–684 (2011). https://doi.org/10.1198/jasa.2011.tm10560

Callot, L.A.F., Kock, A.B., Medeiros, M.C.: Modeling and forecasting large realized covariance matrices and portfolio choice. J. Appl. Econ. 32(1), 140–158 (2017). https://doi.org/10.1002/jae.2512

Christoffersen, P., Jacobs, K.: The importance of the loss function in option valuation. J. Financ. Econ. 72, 291–318 (2004)

De Nard, G., Ledoit, O., Wolf, M.: Factor models for portfolio selection in large dimensions: The good, the better and the ugly. J. Financ. Econ. (2019). https://doi.org/10.1093/jjfinec/nby033

DeMiguel, V., Garlappi, L., Nogales, F.J., Uppal, R.: A generalized approach to portfolio optimization: improving performance by constraining portfolio norms. Manag. Sci. 55(5), 798–812 (2009a). https://doi.org/10.1287/mnsc.1080.0986

DeMiguel, V., Garlappi, L., Uppal, R.: Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Rev. Financ. Stud. 22(5), 1915–1953 (2009b). https://doi.org/10.1093/rfs/hhm075

Dempster, A.P.: Covariance selection. Biometrics 28, 157–175 (1972)

Elton, E.J., Gruber, M.J.: Estimating the dependence structure of share prices-implications for portfolio selection. J. Finance 28(5), 1203–1232 (1973)

Engle, R.F., Ledoit, O., Wolf, M.: Large dynamic covariance matrices. J. Bus. Econ. Stat. 37(2), 363–375 (2019). https://doi.org/10.1080/07350015.2017.1345683

Fan, J., Zhang, J., Yu, K.: Vast portfolio selection with gross-exposure constraints. J. Am. Stat. Assoc. 107(498), 592–606 (2012). https://doi.org/10.1080/01621459.2012.682825

Fan, J., Liao, Y., Mincheva, M.: Large covariance estimation by thresholding principal orthogonal complements. J. R. Stat. Soc. Ser. B (Statistical Methodology) 75(4), 603–680 (2013). https://doi.org/10.1111/rssb.12016

Fan, J., Liao, Y., Liu, H.: An overview of the estimation of large covariance and precision matrices. Econ. J. 19(1), C1–C32 (2016). https://doi.org/10.1111/ectj.12061

Friedman, J., Hastie, T., Tibshirani, R.: Sparse inverse covariance estimation with the graphical lasso. Biostatistics 9(3), 432–441 (2008). https://doi.org/10.1093/biostatistics/kxm045

Frost, P.A., Savarino, J.E.: An empirical Bayes approach to efficient portfolio selection. J. Financ. Quant. Anal. 21(3), 293–305 (1986). https://doi.org/10.2307/2331043

Goto, S., Xu, Y.: Improving mean variance optimization through sparse hedging restrictions. J. Financ. Quant. Anal. 50(6), 1415–1441 (2015)

Halbleib, R., Voev, V.: Forecasting covariance matrices: a mixed approach. J. Financ. Econ. 14(2), 383–417 (2016). https://doi.org/10.1093/jjfinec/nbu031

Hautsch, N., Kyj, L.M., Oomen, R.C.A.: A blocking and regularization approach to high-dimensional realized covariance estimation. J. Appl. Econ. 27(4), 625–645 (2012). https://doi.org/10.1002/jae.1218

Hjort, N.L.: Pattern Recognition and Neural Networks. Cambridge University Press, Cambridge (1996)

Jagannathan, R., Ma, T.: Risk reduction in large portfolios: why imposing the wrong constraints helps. J. Finance 58(4), 1651–1683 (2003)

James, W., Stein, C.: Estimation with quadratic loss. In Proceedings of the Fourth Berkeley Symposium on Mathematical Statistics and Probability, Volume 1: Contributions to the Theory of Statistics, pp. 361–379. University of California Press, Berkeley, California (1961)

Jing, B.-Y., Pan, G., Shao, Q.-M., Zhou, W.: Nonparametric estimate of spectral density functions of sample covariance matrices: a first step. Ann. Stat. 38(6), 3724–3750 (2010). https://doi.org/10.1214/10-AOS833

Jobson, J.D., Korkie, B.M.: Performance hypothesis testing with the Sharpe and Treynor measures. J. Finance 36(4), 889–908 (1981)

Lam, C.: Nonparametric eigenvalue-regularized precision or covariance matrix estimator. Ann. Stat. 44(3), 928–953 (2016). https://doi.org/10.1214/15-AOS1393

Lam, C., Feng, P.: A nonparametric eigenvalue-regularized integrated covariance matrix estimator for asset return data. J. Econ. 206(1), 226–257 (2018). https://doi.org/10.1016/j.jeconom.2018.06.001

Ledoit, O., Wolf, M.: Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empir. Finance 10(5), 603–621 (2003). https://doi.org/10.1016/S0927-5398(03)00007-0

Ledoit, O., Wolf, M.: Honey, I shrunk the sample covariance matrix. J. Portfolio Manag. 30(4), 110–119 (2004a)

Ledoit, O., Wolf, M.: A well-conditioned estimator for large-dimensional covariance matrices. J. Multivar. Anal. 88(2), 365–411 (2004b). https://doi.org/10.1016/S0047-259X(03)00096-4

Ledoit, O., Wolf, M.: Robust performance hypothesis testing with the Sharpe ratio. J. Empir. Finance 15, 850–859 (2008)

Ledoit, O., Wolf, M.: Robust performances hypothesis testing with the variance. Wilmott 2011(55), 86–89 (2011). https://doi.org/10.1002/wilm.10036

Ledoit, O., Wolf, M.: Nonlinear shrinkage estimation of large-dimensional covariance matrices. Ann. Stat. 40(2), 1024–1060 (2012). https://doi.org/10.1214/12-AOS989

Ledoit, O., Wolf, M.: Spectrum estimation: a unified framework for covariance matrix estimation and PCA in large dimensions. J. Multivar. Anal. 139, 360–384 (2015). https://doi.org/10.1016/j.jmva.2015.04.006

Ledoit, O., Wolf, M.: Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets Goldilocks. Rev. Financ. Stud. 30(12), 4349–4388 (2017). https://doi.org/10.1093/rfs/hhx052

Ledoit, O., Wolf, M.: Optimal estimation of a large-dimensional covariance matrix under Stein’s loss. Bernoulli 24(4B), 3791–3832 (2018). https://doi.org/10.3150/17-BEJ979

Ledoit, O., Wolf, M.: Analytical nonlinear shrinkage of large-dimensional covariance matrices. Ann. Stat. Forthcoming (2020)

Liu, X.: Portfolio selection via shrinkage by cross validation. J. Finance Account. 2(4), 74–81 (2014)

Lo, A.W., Patel, P.N.: 130/30: The new long-only. J. Portfolio Manag. 34(2), 12–38 (2008)

Markowitz, H.M.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Merton, R.C.: On estimating the expected return on the market: an exploratory investigation. J. Financ. Econ. 8, 323–361 (1980). https://doi.org/10.3386/w0444

Michaud, R.O.: The Markowitz optimization enigma: Is ‘optimized’ optimal? Financ. Anal. J. 45(1), 31–42 (1989)

Pantaleo, E., Tumminello, M., Lillo, F., Mantegna, R.N.: When do improved covariance matrix estimators enhance portfolio optimization? An empirical comparative study of nine estimators. Quant. Finance 11(7), 1067–1080 (2011). https://doi.org/10.1080/14697688.2010.534813

Silverman, B.W.: Density Estimation for Statistics and Data Analysis, vol. 26. CRC Press, Baco Raton (1986)

Stein, C.: Inadmissibility of the usual estimator for the mean of a multivariate normal distribution. Technical report, Stanford University (1956)

Stein, C.: Lectures on the theory of estimation of many parameters. J. Soviet Math. 34(1), 1373–1403 (1986). https://doi.org/10.1007/BF01085007

Tibshirani, R.: Regression shrinkage and selection via the lasso. J. R. Stat. Soc. 58(1), 267–288 (1996)

Torri, G., Giacometti, R., Paterlini, S.: Sparse precision matrices for minimum variance portfolios. Comput. Manag. Sci. 16(3), 375–400 (2019). https://doi.org/10.1007/s10287-019-00344-6

Tu, J., Zhou, G.: Markowitz meets Talmud: a combination of sophisticated and naive diversification strategies. J. Financ. Econ. 99(1), 204–215 (2011). https://doi.org/10.1016/j.jfineco.2010.08.013

Warton, D.I.: Penalized normal likelihood and ridge regularization of correlation and covariance matrices. J. Am. Stat. Assoc. 103(481), 340–349 (2008). https://doi.org/10.1198/016214508000000021

Witten, D.M., Friedman, J.H., Simon, N.: New insights and faster computations for the graphical lasso. J. Comput. Graph. Stat. 20(4), 892–900 (2011). https://doi.org/10.1198/jcgs.2011.11051a

Yuan, M., Lin, Y.: Model selection and estimation in the Gaussian graphical model. Biometrika 94(1), 19–35 (2007). https://doi.org/10.1093/biomet/asm018

Zakamulin, V.: A test of covariance-matrix forecasting methods. J. Portfolio Manag. 41(3), 97–108 (2015). https://doi.org/10.3905/jpm.2015.41.3.097

Zhao, Z., Ledoit, O., Jiang, H.: Risk reduction and efficiency increase in large portfolios: leverage and shrinkage. University of Zurich, Department of Economics, Working Paper (2020). https://doi.org/10.2139/ssrn.3421538

Acknowledgements

We would like to thank the editor Markus Schmid and the anonymous referees for their constructive comments and recommendations, which helped to improve the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

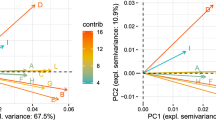

A covariance parameters

See Fig. 4.

B GMV

C GMV-130/30

Rights and permissions

About this article

Cite this article

Husmann, S., Shivarova, A. & Steinert, R. Cross-validated covariance estimators for high-dimensional minimum-variance portfolios. Financ Mark Portf Manag 35, 309–352 (2021). https://doi.org/10.1007/s11408-020-00376-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-020-00376-y