Abstract

This study aims to contribute to the long-standing debate on technology-push versus demand-pull mechanisms to support the creation and diffusion of innovations. We argue that in addition to the traditional push–pull dichotomy, technological change drivers must be differentiated by whether they are exogenous or endogenous to the economic system and must be assessed against their contribution to both the creation and the diffusion of innovation. We apply this perspective to study innovation in the renewable energy (RE) industry in 15 European Union countries. We find that public R&D investments, public policies, and per capita income positively affect either innovation creation or diffusion. However, impacts differ depending on the innovation dimension considered. Economic growth is relatively ineffective at stimulating innovation creation. In contrast, it is a strong driver of RE diffusion with a nonlinear, U-shaped impact that has both a direct cause and an indirect cause. Our findings highlight the importance of deploying diverse policy instruments simultaneously to enhance the effectiveness of clean energy policies.

Graphic abstract

Similar content being viewed by others

Notes

In this paper, we are especially interested in analyzing the impact of innovation mechanisms that can be activated, either directly or indirectly, through policy instruments. Thus, we will not discuss endogenous technology-push mechanisms (i.e., corporate R&D investments), as they are clearly outside the scope of our study.

See Aflaki et al. (2018) for a recent study of this kind.

We appreciate the guidance of the editor (Subash Sikdar) in avoiding the controversy over the rich country–poor country debate regarding RE innovation and number of patents.

For a couple of countries (Belgium, Greece, Ireland, and Luxembourg), the R&D data are missing for several years, thus making our sample as an unbalanced panel data.

Available at: http://www.iea.org/policiesandmeasures/renewableenergy/

A more detailed discussion of methodologies is presented in “Appendix 1.”

For the sake of brevity, this paper omits a detailed discussion on the various panel data tests (e.g., cross-sectional dependence, panel unit root, and panel cointegration) employed to analyze the time-series properties of the data. In addition, a discussion about the descriptive statistics of the variables is also excluded from the main analysis. These unreported results are available in a companion appendix to this paper.

The regression results remain broadly the same across different specifications with bootstrapped standard errors.

Our analysis stood up to several robustness experiments, including alternative dependent variables, model specifications (i.e., different lag specification for REP index) and estimation techniques (i.e., pooled estimation). These unreported results are available in a Supplement from the corresponding author.

We thank the editor (Subash Sikdar) for guiding us to limit the conclusion of the study to the data under consideration (i.e., the EU-15 countries).

This so-called “policy mix” is further elaborated in Borrás and Edquist (2013), which also recommended a careful combination of instrument mixes to address specific problem.

The CIPS stands for cross-sectionally augmented IPS panel unit root test. It is modified version of the original IPS panel unit root test which does not permit cross-sectional dependence in the panel. See Pesaran (2007) for further discussion.

This is not the only panel unit root test available in the literature. However, the CIPS test is most widely used in the empirical analysis and serves the purpose in hand.

Since \(y\) is I(1), \({y}_{t}^{2}=({{y}_{t-1}+{e}_{t})}^{2}={y}_{t-1}^{2}+{e}_{t}^{2}+2{y}_{t-1}{e}_{t}\). Since \({y}_{t}\) is orthogonal to \({e}_{t}\), this implies that \({y}_{t}^{2}\) is also I(1). We thank Stefano Fachin for pointing this out to us.

These unreported results are available from the corresponding author on request.

References

Aflaki S, Basher SA, Masini A (2018) Is your valley as green as it should be? Incorporating economic development into environmental performance indicators. Clean Technol Environ Policy 20:1903–1915

Aguirre M, Ibikunle G (2014) Determinants of renewable energy growth: a global sample analysis. Energy Policy 69:374–384

Baltagi BH, Pesaran HM (2007) Heterogeneity and cross section dependence in panel data models: theory and applications. J Appl Econ 22:229–232

Banja M, Jégard M, Monforti-Ferrario F, Dallemand J-F, Taylor N, Motola V, Sikkema R (2017) Renewables in the EU: an overview of support schemes and measures. EUR 29100 EN, Publication Office of the European Union, Luxembourg. ISBN 978-92-79-79361-5. https://doi.org/10.2760/521847, JRC110415

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51:1173–1182

Basher SA, Masini A, Aflaki S (2015) Time series properties of the renewable energy diffusion process: implications for energy policy design and assessment. Renew Sustain Energy Rev 52(2015):1680–1692

Bayer P, Urpelainen J (2016) It is all about political incentives: democracy and the renewable feed-in tariff. J Polit 78:603–619

Borrás S, Edquist C (2013) The choice of innovation policy instruments. Technol Forecast Soc Chang 80:1513–1522

Braun FG, Schmidt-Ehmcke J, Zloczysti P (2010) Innovative activity in wind and solar technology: empirical evidence on knowledge spillovers using patent data. CEPR discussion papers 7865

Cameron AC, Trivedi PK (1998) Regression analysis of count data. Cambridge University Press, New York

Conti C, Mancusi ML, Sanna-Randaccio F, Sestini R, Verdolini E (2018) Transition towards a green economy in Europe: Innovation and knowledge integration in the renewable energy sector. Research Policy 47:1996–2009

Corradini M, Costantini V, Mancinelli S, Mazzanti M (2014) Unveiling the dynamic relation between R&D and emission abatement. Ecol Econ 102:48–59

Costantini V, Crespi F, Martini C, Pennacchio L (2015) Demand-pull and technology-push public support for eco-innovation: the case of the biofuels sector. Res Policy 44:577–595

De Hoyos RE, Sarafidis V (2006) Testing for cross-sectional dependence in panel-data models. Stata J 6:482–496

de Jäger D, Rathmann M (2008) Policy instrument design to reduce financing costs in renewable energy technology projects. Report for the IEA Implementing Agreement on Renewable Energy Technology Deployment (RETD), Ecofys Int. BV, Utrecht

Di Stefano G, Gambardella A, Verona G (2012) Technology push and demand pull perspectives in innovation studies: current findings and future research directions. Res Policy 41:1283–1295

Eberhardt M, Teal F (2013) No mangoes in the tundra: spatial heterogeneity in agricultural productivity analysis. Oxf Bull Econ Stat 75:914–939

Field BC (1994) Environmental economics: an introduction. McGraw-Hill, New York

Fouquet D, Johansson TB (2008) European renewable energy policy at crossroads—focus on electricity support mechanisms. Energy Policy 36:4079–4092

Frees EW (1995) Assessing cross-sectional correlation in panel data. J Econ 69:393–414

Friedman M (1937) The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J Am Stat Assoc 32:675–701

Granger CWJ, Newbold P (1974) Spurious regressions in econometrics. J Econ 2:111–120

Hausman JA, Hall BH, Griliches Z (1984) Econometric models for count data with an application to the patents-R and D relationship. Econometrica 52:909–938

Holly S, Pesaran MH, Yamagata T (2010) A spatio-temporal model of house prices in the USA. J Econ 158:160–173

Jenner S, Groba F, Indvik J (2013) Assessing the strength and effectiveness of renewable electricity feed-in tariffs in European Union countries. Energy Policy 52:385–401

Grossman GM, Krueger AB (1995) Economic growth and the environment. Quart J Econ 110:353–377

Hall BH (1988) The relationship between firm size and firm growth in the US manufacturing sector. J Ind Econ 35:583–606

Hicks R, Tingley D (2011) Causal mediation analysis. Stata J 11:609–615

Hoffmann VH, Trautmann T, Schneider M (2008) A taxonomy for regulatory uncertainty—application to the European emission trading scheme. Environ Sci Policy 11:712–722

Hoppmann J, Peters M, Schneider M, Hoffmann VH (2013) The two faces of market support—how deployment policies affect technological exploration and exploitation in the solar photovoltaic industry. Res Policy 42:989–1003

IEA (2007) Climate policy uncertainty and investment risk. In: Support of the G8 plan of action. International Energy Agency, Paris

IEA (2011) Deploying renewables: best and future policy practice. OECD/IEA, Paris

IEA (2013) World energy outlook. OECD/IEA, Paris

IPCC (2011) IPCC special report on renewable energy sources and climate change mitigation. Prepared by working group III of the intergovernmental panel on climate change. Cambridge University Press, Cambridge

IRENA (2013) Intellectual property rights: the role of patents in renewable energy technology innovation. Retrieved from https://www.irena.org/publications/2013/Jun/Intellectual-Property-Rights-The-Role-of-Patents-in-Renewable-Energy-Technology-Innovation

Jäger-Waldau A (2007) Photovoltaics and renewable energies in Europe. Renew Sustain Energy Rev 11:1414–1437

Johnstone N, Hascic I, Popp D (2010) Renewable energy policies and technological innovations: evidence based on patent counts. Environ Resource Econ 45:133–155

Klaassen G, Miketa A, Larsen K, Sundqvist T (2005) The impact of R&D on innovation for wind energy in Denmark, Germany and the United Kingdom. Ecol Econ 54:227–240

Marques AC, Fuinhas JA (2012) Are public policies towards renewables successful? Evidence from European countries. Renew Energy 44:109–118

Masini A, Menichetti E (2012) The impact of behavioral factors in the renewable energy investment decision making process: conceptual framework and empirical findings. Energy Policy 40:28–38

Mazzucato M, Semieniuk G (2018) Financing renewable energy: who is financing what and why it matters. Technol Forecast Soc Chang 127:8–22

Meyer NI, Koefoed AL (2003) Danish energy reform: policy implications for renewables. Energy Policy 31:597–607

Mowery D, Rosenberg N (1979) The influence of market demand upon innovation: a critical review of some recent empirical studies. Res Policy 8:102–153

Mowery DC, Nelson RR, Martin B (2010) Technology policy and global warming: why new policy models are needed (or why putting old wine in new bottles won’t work). Res Policy 39:1011–1023

Nemet GF (2009) Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res Policy 38:700–709

Nesta L, Vona F, Nicolli F (2014) Environmental policies, competition and innovation in renewable energy. J Environ Econ Manag 67:396–411

Park JY, Phillips PCB (1999) Asymptotics for nonlinear transformations of integrated time series. Econ Theory 15:269–298

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Cambridge working papers in economics no. 0435. Faculty of Economics, University of Cambridge

Pesaran HM (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74:967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross section dependence. J Appl Econ 22:265–312

Ragwitz M (2007) Assessment and optimization of renewable energy support schemes in the European electricity market. Final report. OPTRES

Rosenberg N (1990) Why do firms do basic research (with their own money)? Res Policy 19:165–174

Sartorius C (2005) Crystalline and thin-film photovoltaic cells: competition or lock-in? In: Sartorius C, Zundel S (eds) Time strategies, innovation, and environmental policy. Edward Elgar, Cheltenham, pp 33–155

Söderholm P, Klaassen G (2007) Wind power in Europe: a simultaneous innovation-diffusion model. Environ Resource Econ 36:163–190

Stern N (2007) The economics of climate change: the stern review. Cambridge University Press, New York

Stiglitz JE (2014) Leaders and followers: perspectives on the Nordic model and the economics of innovation. NBER working paper 20492, Cambridge

van den Heuvel STA, van den Bergh JCJM (2009) Multilevel assessment of diversity, innovation and selection in the solar photovoltaic industry. Struct Change Econ Dyn 20:50–60

Watanabe C, Wakabayashi K, Miyazawa T (2000) Industrial dynamism and the creation of a “virtuous cycle” between R&D, market growth and price reduction: the case of photovoltaic power generation development in Japan. Technovation 20:299–312

Zachmann G, Serwaah A, Peruzzi M (2014) When and how to support renewables? Letting the data speak. Bruegel working paper 2014/01

Acknowledgements

A previous version of this paper is circulated as “Does economic growth matter? Technology-push, demand-pull and endogenous drivers of innovation in the renewable energy industry.” We thank the editor and five anonymous referees for their constructive comments. We also thank Markus Eberhardt, Stefano Fachin, and A.K. Enamul Haque for useful discussions; the seminar participants at the 26th Annual POMS Conference in Washington, DC and East West University, Bangladesh, for helpful comments; and Megan Foster for meticulous proofreading and numerous suggestions on an earlier version. This work was supported by the Qatar National Research Fund (a member of The Qatar Foundation) for providing financial support to this project through research Grant NPRP 5-873-5-133.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Econometrics methods

Cross-sectional dependence

It has now become customary to test for the presence of cross-sectional dependence (CSD) in panel data models because the individual units in the panel (countries, in our case) are likely to exhibit strong correlations due to their exposure to common macroeconomic, technological, legal/institutional, political, environmental, health and sociological shocks. Our panel data comprising the EU-15 countries are expected to be affected by similar shocks, albeit in different magnitude, making the panel highly prone to CSD. For example, one may expect, a priori, a high level of CSD in RE deployment due to the implementation of common RE policies across the EU (i.e., the EU directive) as well as cross-border spillover of RE technologies (Corradini et al. 2014). Likewise, the increased business cycle correlation across the EU economies makes the case for CSD more compelling. Neglecting CSD could lead to significant size distortions in the panel unit root and cointegration tests that assume cross-sectional independence (Baltagi and Pesaran 2007). To this end, we use the test of error cross-dependence (the CD test) developed by Pesaran (2004). The CD test statistic is based on the average of the pairwise Pearson’s correlation coefficients \(\hat{\rho }_{ij}\) of the residual obtained from the panel data model and it is given by:

under the null hypothesis of no CSD (i.e., \(\hat{\rho }_{ij} = \hat{\rho }_{ji} = corr\left( {u_{it} ,u_{jt} } \right) = 0 {\text{for}} i \ne j\)). The test has a mean exactly at zero for fixed values of T and N under a wide range of panel data models, including nonstationary models. In addition, we also make use of the tests proposed by Friedman (1937) and Frees (1995). The Friedman (1937) test is based on the average Spearman’s correlation and is given by:

where \(\hat{r}_{ij}\) is the simple estimate of the rank correlation coefficient of the residuals. In comparison, the Frees (1995) test is based on the sum of the squared rank correlation coefficients and equals:

Unlike the \(CD\) and \(R_{AVE}\) tests, the \(R_{AVE}^{2}\) test is robust to the alternating sign of the correlation.

Panel unit root test

The panel unit root test considered in our application is the test proposed by Pesaran (2007), which follows the common correlated effects (CCE) approach and filters out the CSD by augmenting the augmented Dickey–Fuller (ADF) regressions with cross-sectional averages. The cross-section augmented ADF (CADF) regressions, carried out separately for each country, are given by:

where \(\overline{\omega }_{t}\) denotes the cross-section mean of \(\omega_{it}\). The CIPS statisticFootnote 12 is a simple cross-sectional average of \(\tilde{t}_{i}\) defined by:

where \(\tilde{t}_{i}\) is the ordinary least squares t-ratio of \(b_{i}\) in the CADF regression above.

Panel cointegration test

Following Holly et al. (2010), we adopt a two-stage procedure to assess the possibility of cointegration between log of contribution of the renewable share and its determinants as shown in Eq. (1) in the main analysis. In both stages, the procedure allows for unobserved common factors that could be potentially correlated with the observed regressors. Using the CCE estimator, we first estimate Eq. (1) and obtain the residuals. We then apply the CIPS panel unit root test discussed above to these residuals:

If the presence of a unit root in \(\hat{u}_{it}\)’s can be rejected, we can conclude that the variables are cointegrated.

The CCEMG panel estimator

To estimate Eq. (1) for the RE diffusion model, we used the common correlated effect (CCE) estimator of Pesaran (2006), which is robust to the presence of CSD and can handle cointegrated relationships. This is done by augmenting Eq. (1) with the cross-sectional averages of the independent and dependent variables:

where \(\delta_{i}\) are the individual specific loading coefficients of the cross-sectional averages of all observable variables in the model. The \(\widehat{{\beta_{i} }}\) coefficient estimates the effect of income on RE’s contribution after controlling for common factors in the data. The dynamics and common unobserved factors are modeled in the error terms \(\epsilon_{it}\), which are assumed to have the following structure:

where \({\varvec{f}}_{t}\) is an \(m \times 1\) vector of unobserved common effects and \(\epsilon_{it}\) represents the country-specific (idiosyncratic) errors that are assumed to be distributed independently of the regressors \({\varvec{x}}_{it}\) and \({\varvec{f}}_{t}\). However, \(\epsilon_{it}\) is allowed to be weakly dependent across i. The CCE estimator is based on the assumption that \({\varvec{x}}_{it}\) is generated as:

where \(a_{i}\) is a \(k \times 1\) vector of individual effects, \(\lambda_{i}\) is a \(m \times k\) factor of loading matrices with fixed components and \(v_{it}\) represents the specific components of \({\varvec{x}}_{it}\) distributed independently of the common effects and across i. The CCE estimator is equivalent to ordinary least squares technique applied to an auxiliary regression such as Eq. (2). The CCE mean group (CCEMG) estimator, which has been adopted in our application, is a simple average of the individual CCE estimators, \(\beta_{i}\):

As pointed out by Eberhardt and Teal (2013), the CEE estimator is robust when the cross-section dimension N is small; when variables are nonstationary (cointegrated or not), subject to structural breaks; and/or in the presence of “weak” unobserved common factors (spatial spillover) and global/local business cycles.

Negative binomial regression

As stated earlier, for the RE innovation model with patent counts as the dependent variable, Eq. (1) is estimated using both Poisson and negative binomial estimators. However, since patent data typically are overdispersed (i.e., the variance exceeds the mean), the negative binomial estimator is generally preferred over the Poisson estimator. In both models, we allow country fixed effects to partly address the differences in patent quality across countries (Costantini et al. 2015). As the dependent variable \(y_{it}\) has a Poisson distribution with parameter \(\mu_{it}\), which in turn depends on a vector of exogenous variables \(x_{it}\), the fixed effects Poisson regression model for panel data is given as (Cameron and Trivedi 1998):

where \(\alpha_{i}\) is the fixed effects.

One way to estimate the above model is by means of conventional Poisson regression using maximum likelihood. However, the Poisson model is known to suffer from overdispersion problem and an excess in zeros. Efficient estimation of overdispersed model can be achieved by assuming that \(y_{it}\) have a negative binomial distribution, which generalizes Poisson regression by accounting for cross-sectional heterogeneity. The negative binominal model of Hausman et al. (1984) is given as:

where \({\Gamma }\) is the gamma function, \(\theta_{i}\) is assumed to be constant over time for each individual and \(\lambda_{it}\) is defined as:

The mean and variance of \(y_{it}\) are given by \(E\left( {y_{it} } \right) = \theta_{i} \lambda_{it}\) and \(var\left( {y_{it} } \right) = \left( {1 + \theta_{i} } \right)\theta_{i} \lambda_{it}\). Therefore, the variance to mean ratio is \(\left( {1 + \theta_{i} } \right)\). Thus, the negative binomial model allows for overdispersion with the original Poisson a limiting case as \(\lambda \to \infty\).

The mediation model

Finally, to test hypothesis 4 we conducted a mediation analysis to understand if and to what extent the effect of economic growth (a treatment variable) on RE diffusion (the outcome variable) is mediated by RE policies (a potential mediator). The model for RE diffusion (including mediator) and for the mediator are given as:

where Y (outcome) is RE diffusion, a (treatment) is economic growth, and m is the mediator (i.e., RE policies). To conduct the analysis, we used the “medeff” routine by Hicks and Tingley (2011) in Stata.

Appendix 2: Preliminary results

Descriptive statistics

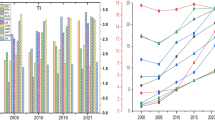

Figure 1 presents linear plots for panel data for the dependent and independent variables. The variables are shown in the way they are entered in the regression equations (i.e., log transformed, where applicable). All variables exhibit a smooth upward trend, except for RE R&D, which shows some volatility. The plot of the RE policy index fits the most common feature of the RE policy landscape: in the 1990s, RE policies were in place in only a handful of countries, but they grew exponentially after 2000. The log of RE share depicts an interesting trend of convergence in RE sources across the EU-15 countries. However, the logs of real per capita GDP—widely recognized as being unit root processes—show country variation in income among the EU-15 nations.

Further details about these variables emerge from Table 5, which presents mean and standard deviation for the dependent and independent variables. For the sake of greater comparability, these descriptive statistics have been obtained using the original data. Among the EU15 countries in the period of our analysis most of the innovation in RE industry took place in Germany, which displays the highest number of patent applications in the sample (nearly 45% of total). Moreover, the innovation process appears to be highly concentrated too: four countries (Denmark, France, Germany, and the UK) account for over 70% of invention in the renewable industry in the EU15. Regarding the RE diffusion pattern, over the full sample, the average share of RE in most countries is low (5% or less), with the exception of Denmark, Finland, and Portugal. However, since 2000, the diffusion of RE has increased noticeably in countries such as Finland, Germany, and Spain. France remains an outlier, with a negligible contribution of RE to total energy.

Income per capita ranges from $16,940 (Portugal) to $69,966 (Luxembourg), with the majority of the countries showing a per capita income above the $30,000 threshold. To make an individual country’s RE position conditional on its income level, Table 6 depicts a matrix that maps countries according to the country’s position regarding renewable development and its average income level relative to the rest of the group over the sample period. Italy, Portugal, and Spain are clearly the champions in fostering the growth of nonhydro-RE sources. In contrast, Belgium and the UK trail other nations.

Turning to the share of RE R&D spending as a percentage of the total R&D spending in the fossil and renewable sectors, a large fraction of energy R&D spending in the EU-15 countries (barring France) is devoted to RE. This is not surprising, given that these countries are a net importer of fossil fuels and seek to develop renewables to improve energy security. In terms of the share of RE in total national R&D budgets, Denmark and the Netherlands have the highest ratios, whereas for the ratio of the share of RE R&D to GDP, the leading countries are Denmark, Finland, the Netherlands and Sweden.

The average levels of the REP index also differ markedly among the EU-15, including their volatility. Although, in general, it is tempting to conclude that countries with a higher REP index have a greater number of policies devoted to RE sources, the limitation of this argument is that it ignores the associated volatility or policy uncertainty. For example, the average REP index in the UK is the highest, but its standard deviation is also very high (coefficient of variation higher than 1), which makes the UK very vulnerable to policy uncertainty. Within the RE policy arena the situation of Spain and Portugal is very fragile. In these countries, there were few and unstable accumulated policies (with the coefficient of variation for the REP index exceeding 1). By contrast, in Germany and Denmark, RE policies are numerous and are stable, compared to their EU peers.

Panel data tests

This section presents the results of various panel data tests (i.e., cross-sectional dependence, panel unit root test, and panel cointegration test) discussed in the previous section. Each test is discussed in turn below. First, we apply three alternative tests to examine the extent of CSD in our panel data. All three tests test the null hypothesis of cross-sectional independence against the alternative hypothesis of CSD. The CD test statistic of Pesaran (2004) is 15.94 with a p-value of 0.00, which clearly rejects the null hypothesis of cross-sectional independence in the panel. The results for Friedman’s (1937) \(R_{AVE}\) test also yield a similar conclusion: the test statistic 103.76 (p = 0.00), suggesting that strong CSD is present in the data. However, both the CD and \(R_{AVE}\) tests share a common weakness in that they miss out cases of CSD where correlations sign alternates (De Hoyos and Sarafidis 2006). The test statistic \(\left( {R_{AVE}^{2} } \right)\) of Frees (1995) is, however, not subject to this drawback. The \(R_{AVE}^{2}\) test statistic is 3.29 (p = 0.00), which also rejects the null hypothesis of cross-sectional independence. Moreover, the average absolute value of the off-diagonal elements of the cross-sectional correlation matrix of the residual is 0.47, which is very high. Overall, the results indicate that there is enough evidence to suggest the presence of CSD in the data.

Second, given the strong presence of CSD in the data, we have employed the CIPS panel unit root test of Pesaran (2007), which allows for CSD.Footnote 13 The CIPS statistic is based on the cross-sectional average of the individual ADF t-statistics of each unit in the panel. Under the null hypothesis, the CIPS assumes that a series is nonstationary. Given the short length of the individual units (T = 23), we consider a maximum of two lags and allow both constant and deterministic trends in the test regression. For the dependent variable (RE share), the results of the CIPS test statistic with lags p = 1 and 2 are − 1.75 and − 1.37 (intercept only) and − 1.74 and − 1.24 (with intercept and trend). At the 5% significance level, the critical values of the CIPS statistic for N = 20 and T in the range of 20–30 are about − 2.25 and − 2.76 with a constant and constant and trend, respectively. Therefore, according to the CIPS statistic, the null hypothesis of a unit root cannot be rejected at the 5% level.

Likewise, for the log of real GDP per capita, the CIPS test statistics are − 1.83 and − 1.92 (intercept) and − 2.32 and − 2.36 (intercept and trend) for lag lengths of 1 and 2, respectively. These test statistics are lower than the 5% critical values reported just above, suggesting that the series is nonstationary. Note that nonstationarity in the log of GDP per capita implies that its quadratic form (i.e., the square of the log of GDP per capita) is also nonstationary.Footnote 14 Park and Phillips (1999) have shown that the usual I(1) asymptotics hold for regressions with a nonlinear transformation (such as power) of the time series. However, we could not test for the presence of a unit root in the log of R&D spending, as some observations were missing. Nonetheless, the plots of R&D spending (see Fig. 1c) indicate that the series are trending upward over time, leading us to conclude that a unit root might be present in the R&D spending data.

Given the presence of stochastic trends in the data, a practical implication for inference is that the least squares estimation of the model in Eq. (1) cannot reliably distinguish between a true long-run relationship and a spurious regression (Granger and Newbold 1974). A panel time-series estimator can address this concern over spurious regression, as discussed below. Another implication is that nonstationarity in time series poses a serious problem for forecasting the future path of the contribution of RE in the energy mix as a function of income, as current shocks have permanent effects on their levels. For a further discussion, see Basher et al. (2015).

Finally, based on the results above we then test for the existence of the long-run equilibrium relationships of Eq. (9) for the panel as a whole. To this end, we apply the CIPS(p) panel unit root test described above to the estimated residuals as shown in Eq. (9), including an intercept and with lag orders p = 1, 2, and 3. We obtained the results − 3.617, − 2.687, and − 2.30, respectively. These test statistics exceed the 5% critical value (around − 2.25) of the CIPS statistic for the intercept case and for panel dimensions similar to ours. The results suggest rejection of a unit root in the residuals of Eq. (9), indicating that the variables in question are indeed cointegrated.

Appendix 3: Robustness check

Our analysis stood up to a good number of robustness experiments, including alternative specifications or estimation techniques. Note that these sensitivity analyses were conducted for the RE diffusion model only. The first sensitivity analysis was conducted by adding hydropower to the contribution of RE. An interesting result that emerged was that across countries, hydro-RE was more variable than nonhydro-RE. This challenges the commonly held view that only wind and solar energy are variable; hydropower can be subject to even greater fluctuations of energy supply (e.g., drought or rainfall variability). For brevity, the estimation is conducted on the full specification by applying the CCEMG estimator (i.e., column [5] in Table 3 in the main text). The time-series properties (unit root, cointegration) of hydro-RES are almost identical to those of nonhydro-RE. This suggests a long-run equilibrium relationship between the log of RE share and its determinants. The estimated parameters of the variables have the correct sign but not statistically significant. Thus, our results are robust to the inclusion of hydropower in the data, although better results (in statistical terms) are obtained using the nonhydro-RE.Footnote 15

Second, we also consider cumulative nonhydro-RE capacity (as a percentage of total capacity) as an alternative dependent variable. As pointed out by Jenner et al. (2013), the choice of cumulative capacity is appropriate if the objective is to examine links between FIT policies and the decision to invest in solar or wind capacity. This is because, unlike generation or supply, cumulative capacity reflects expected (not actual) returns on investment. The estimation results are almost similar to those of the original model. Except for RE R&D share, which shows a negative sign, all other variables have the correct sign. But, once again, the estimates are not statistically significantly different from zero. Thus, our results also survive the choice of RES capacity as an alternative dependent variable in the model.

Third, we conducted an experiment allowing first and second lags of the REP index separately in the regression model, since there might be a time lag between the implementation of RE policies and the resulting diffusion of RE sources. However, these changes did not improve the results relative to the baseline findings reported in Table 4. The estimated lag coefficients are negative but insignificant, whereas the coefficients of income and income retained their expected signs, losing some significance.

Finally, we augmented Eq. (1) with an interaction term between our RE policy variable and GDP per capita to see how these two variables work together in explaining the variation in RE. In this case, the estimated coefficients for RE policy are negative and that for GDP is positive. However, the coefficient of the interaction term has a positive sign, implying that an additional increase in GDP per capita yields a higher increase in RE. This supports the notion that in a market economy, demand-pull approaches encourage firms to generate clean energy through market signals and creating incentives. Finally, we have also considered the pooled version of the CCE estimator of Pesaran (2006) in order to gain efficiency in the parameter estimates by restricting the individual slope coefficients \(\beta_{i}\) to be the same across the cross-section units. However, the results are once again no better than those of the CCEMG estimator reported in column [5] of Table 4. These results are not discussed here to conserve space.

Rights and permissions

About this article

Cite this article

Aflaki, S., Basher, S.A. & Masini, A. Technology-push, demand-pull and endogenous drivers of innovation in the renewable energy industry. Clean Techn Environ Policy 23, 1563–1580 (2021). https://doi.org/10.1007/s10098-021-02048-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-021-02048-5

Keywords

- Evaluation of science and technology policies

- Technology innovation and diffusion

- Renewable energy

- Empirical modeling