Abstract

Buying a house changes a household’s balance sheet by simultaneously reducing liquidity and introducing mortgage payments, which may leave the household more exposed to other shocks. We examine how this change impacts consumer credit beyond the mortgage. Using a large panel, we show that on acquiring a mortgage, credit card debt increases by about $1500 in the short term, severe delinquencies increase by 2.2 percentage points, and credit card utilization—the fraction of a consumer’s credit card limit that is used—increases by 11 percentage points. In the long term, credit card balances increase by $3900 and delinquencies by 9.1 percentage points. In our sample period before the 2008 financial crisis, credit limits increased faster than debt in the long run, pushing down long-term utilization. After the financial crisis, debt increased faster than credit limits in the long run, and credit card utilization rates rose upon the acquisition of a new mortgage, consistent with larger down payments leaving households more constrained.

Similar content being viewed by others

1 Introduction

Buying a house is a major event for most families. It simultaneously adds a large asset and a large debt to the household balance sheet. Moreover, it changes the mix of the household’s portfolio, because making the down payment may leave the household “asset rich but cash poor” (Kaplan et al., 2014). Furnishing a new house may require additional spending and other unexpected expenses. In addition, the simultaneous reduction in liquidity and introduction of mortgage payments may leave the household more exposed to other shocks and sensitive to house price changes (Campbell & Cocco, 2007) although less exposed to rent changes.Footnote 1 All these factors suggest that households may turn to other sources of liquidity to fill in the gaps.Footnote 2

We examine how this large change in the household balance sheet affects other consumer credit use, focusing particularly on credit cards, risk score, and delinquencies. Credit cards are widely held, and provide an important way for many people to build credit history and become qualified for a mortgage. Credit cards are also one of the primary sources of liquidity for all households in the United States, regardless of mortgage status.Footnote 3 Although we look at credit card debt and limits separately, we focus on credit utilization—the fraction of a consumer’s credit card limit that is used.Footnote 4 Higher credit utilization is a useful indication of being liquidity constrained, since it indicates the holder is close to exhausting one source of liquidity. Risk scores are closely related to the availability of mortgage credit, credit card credit, and other sources of consumer credit. Changes in delinquency status indicate possible difficulties with liquidity. Finally, we briefly consider the use of home equity loans and lines of credit as an alternative source of post-mortgage liquidity.

Studying the relationship between mortgage debt and other sources of consumer credit is essential for understanding how consumers treat various types of debt, consumer liquidity and exposure to shocks following a major change in financial status. It is also very important in several areas of policy. Following the 2008 financial crisis, what kinds of debts consumers prioritized paying became an important question for bank exposure as well as homeowner relief (see, for example, Andersson et al., 2013; Cohen-Cole & Morse, 2010). Understanding how and when consumers acquired other debt is important for understanding this prioritization and designing relief programs. In addition, recent scholarship has suggested that the large consumption response of households to tax rebates used for fiscal policy (Parker et al., 2013) comes from wealthy but illiquid consumers (Kaplan & Violante, 2014). Because the largest illiquid asset for most consumers is their home, how consumers behave when they are likely to be at their most illiquid following a mortgage acquisition is directly informative about the importance of this channel. Finally, debt-to-income rules are used in many countries to determine who can qualify for a mortgage or to limit bank risk.Footnote 5 These rules are predicated on keeping consumers from taking on too much debt and becoming likely to default. The extent to which consumers can manage shocks using other debt, such as credit cards, helps understand how strict these rules should be.

To understand these relationships, we use a large panel of credit reports, the New York Fed/Equifax Consumer Credit Panel (CCP), which enables us to track changes for a given individual upon their acquisition of a mortgage, rather than comparing credit card use and other consumer credit outcomes across individuals. Mortgage holding, credit card use, and risk score are positively correlated with income, so comparing across individuals in a cross section mixes the effects of having a mortgage, credit card use, risk score, and income. Instead, we use the panel to examine changes in consumer credit use from 6 years before the acquisition of a first-time mortgage to 6 years after. Rather than treat acquisition of a mortgage as an exogenous shock—which is likely of limited interest because families may plan for years to buy a house—we instead consider the portfolio changes that accompany a very large increase in debt and assets and ask how important sources of liquidity changes in response. Our data are at the consumer level, not at the level of the household. We consider how this limitation might affect the interpretation of our results in the next section. We examine the role of joint mortgages in affecting our results and find that the results are similar for joint and individual mortgages.

We show that a new mortgage is associated with two changes in credit card use: a debt effect increases credit card spending, while a credit effect leads to higher credit limits. For the short run, we find a robust and statistically significant positive effect of new-mortgage acquisition on credit card utilization of approximately 11 percentage points. In the long run, the credit effect exceeded the debt effect before the 2008 financial crisis, pushing down long-term utilization. In our sample period after the financial crisis, the debt effect dominated in the long run, and credit card utilization rates rose upon the acquisition of a new mortgage, consistent with larger down payments leaving households more constrained.

There is evidence that after the crisis, lending standards became more stringent: people who acquired a mortgage after the crisis had a significantly higher credit score than those who did not acquire a mortgage; before the crisis there was no significant difference between those who did and did not acquire a mortgage. The effect is significant, even though credit card supply standards became more stringent at the same time. For example, 0% APR credit cards, which were common before the financial crisis, became rare afterward. We test the hypothesis that larger down payments help explain the changes in credit card use we see after the crisis using a small merged sample of credit records and down payment information. We do not find strong evidence for or against the hypothesis.

Obtaining a mortgage is also systematically related to other consumer credit outcomes. On average, delinquencies are at their lowest point in the mortgage acquisition quarter, but then increase sharply. We show that controlling for age, delinquencies are several percentage points higher several years after mortgage acquisition than before, suggesting that consumers may be more exposed to shocks after a mortgage, consistent with a liquidity channel. This increase is similar before and after the crisis. One reason for the similarity may be that the combination of larger down-payments and tighter lending standards worked in opposite directions and roughly canceled each other. Risk scores tend to be somewhat volatile around mortgage acquisition as delinquencies and credit card utilization change, hard inquiries enter a credit report as a consumer applies for a mortgage, and a new installment loan is added the report. Controlling for age, risk scores are generally slightly lower 2 years after obtaining a mortgage than 2 years before. Home equity loans (HELOANs) and home equity lines of credit (HELOCs) are relatively rare, but might provide an alternate source of liquidity for some consumers. Yet only 6.3% of consumers in our sample who obtain a HELOC do so in the first year after acquiring a mortgage, and 31% of HELOAN holders obtain one in the first year. We do not find strong evidence that consumers systematically substitute for their credit card balances: approximately one-third of the consumers with a HELOC of HELOAN increased their credit card balances, one-third lowered them, and one-third did not substantially change their credit card balances after obtaining them.

The rest of the paper is organized as follows. Section II reviews the relevant literature and discusses different channels by which acquiring a mortgage may affect, and be affected by, other household decisions. Section III describes the data sources used in the analysis. Section IV presents summary statistics on homeownership, mortgage holdings, delinquencies, risk score, and credit card use. Section V shows the regression models and their results. Section VI concludes.

2 What happens around mortgage acquisition?

This paper uses the event of acquiring a mortgage to help understand other credit market outcomes. A new mortgage represents a large change in the household balance sheet, so it may affect many decisions. In turn, households may plan for a mortgage, so changes may start even before the acquisition and expectations matter. Finally, other changes, such as a positive income shock or a change in household size may affect when a household is looking to buy a new home. This section discusses several channels through which mortgage acquisition and other outcomes may interact and the existing literature about them. We return to these channels in interpreting our empirical results.

2.1 Liquidity channel

A mortgage changes the household portfolio by simultaneously reducing liquidity through the down payment, adding a large asset, and a large debt with required monthly payments. This portfolio change may cause the household to alter its use of other sources of liquidity. For example, it may use credit cards more or may seek to acquire a home equity loan. The average liquidity impact of a mortgage may vary depending on the lending standards: before the 2008 financial crisis, down payments were smaller (Li & Goodman, 2014; Scanlon et al., 2011), so these relationships may vary before and after the crisis.

Our paper examines how consumer credit changes on mortgage acquisition. An extensive literature considers how holding a mortgage and changes in home equity affect other debt. Some papers suggest that mortgage debt and credit card debt or consumption serve as complements. Agarwal & Qian (2017) find that a negative shock to home equity access causes a decrease in credit card spending, but they do not measure credit card debt. Mian et al. (2013) suggest that housing net worth functions as collateral for consumption and access to credit, and a decline in housing value may cause a negative response in credit card spending due to a credit constraint. The findings by Telyukova (2013) and Kaplan et al. (2014) suggest that homeowners are more likely to use credit card debt to smooth consumption, because they have massive illiquid wealth but little liquid wealth. Therefore, as mortgage debt increases, so does credit card debt.

A series of papers examine the related question of how changes in home equity affect consumer credit (Mann, 2009; Mian & Sufi, 2011; Kartashova & Tomlin, 2017). Brown et al. (2015) examine the substitution pattern from home-equity-based debt to credit card debt from 1999 to 2012. They find that consumers sometimes substitute between housing debt and non-mortgage borrowing, including credit card debt. The substitution patterns are heterogeneous across consumers and vary with credit scores and with age cohorts. Mian & Sufi (2011) find that households with higher credit card utilization rates increase their debt more strongly in response to increases in home equity.

At the end of the mortgage, Scholnick (2009) finds a significant reduction in the use of credit card debt for consumption smoothing following the final mortgage payment (that is, the last payment that eliminates the remaining mortgage balance) when that payment is large. The study also finds that when the final mortgage payment is small, a significant increase in credit card consumption follows. Using Consumer Expenditure Survey data, Coulibaly & Li (2006) provide similar evidence supporting the consumption-smoothing theory.

Another branch of the literature deals with prioritization of payments among the various types of debt and with liquidity preservation. Andersson et al. (2013), Cohen-Cole & Morse (2010), and Keys et al. (2014) show that households sometimes prioritize mortgage debt over credit card payments, and sometimes they do the reverse to preserve their liquidity. The priorities change with the arrival of an economic crisis and/or with changes in interest rates.

Very few studies track the same consumers over time to analyze a relationship between changes in mortgage debt or home equity and credit card debt or spending. Agarwal & Qian (2017) use panel data from a bank in Singapore to track individuals from 2010 through 2012, and Scholnick (2009) uses monthly bank account data from a Canadian bank to track individuals from 2004 through 2006. Mian & Sufi (2011) and Brown et al. (2015) use US data from Equifax, but both studies focus on changes in home equity for existing homeowners. In contrast, we examine what happens to consumers’ credit card debt when they acquire a mortgage for the first time (we refer to it as the first-time mortgage).

2.2 Credit score and default channel

Planning for and then acquiring a mortgage may affect other measures of credit access and use. In particular, consumers who want to obtain a mortgage and have good terms on it may seek to improve their credit scores beforehand. It is unclear how many consumers actively seek to improve their credit scores, but the credit industry is full of advice for how to do so before a mortgage.Footnote 6 Consumers may improve their score by paying off any past due debt and reducing their credit card utilization rate, both of which negatively affect the credit score. After acquiring a mortgage, consumers have an “installment loan” on their records which, assuming the consumer is current, generally improves credit scores.Footnote 7 Better credit scores often allow a consumer to obtain a higher credit limit on existing credit cards or seek other credit cards. Applying for a mortgage, will typically involve several “hard inquiries” into the credit report which negatively impacts the credit score for a short time.

As discussed in the liquidity channel above, after a mortgage, the household may be liquidity constrained. If it is hit with negative shocks, this may increase the likelihood that a default occurs because it has a lower liquid cash buffer.

2.3 Income and consumption channels

An income increase may similarly increase a household’s desire to consume housing or make the housing its desires affordable, causing both mortgage acquisition and other changes in credit use. In the cross section, we show that mortgage holders have substantially higher income than non-mortgage holders. The interactions between a positive income shock, down payment, and mortgage acquisition are complex (Ortalo-Magné & Rady, 2006), because credit constraints may cause young households to delay home purchase or buy a smaller home than they might like, given their current income. In addition, some households may acquire housing based on the expectation of future income changes. Mortgage financing is based on current income, so households may be limited in their ability to buy housing based on the expectation of future income increases.

Many people who are taking out a mortgage for the first time are also changing the way they consume housing. Renting carries risks of price rises or eviction while owning has greater certainty about the cost of housing, but carries asset risk (Sinai & Souleles, 2005) and may raise the cost of mobility (Ferreira et al., 2010). While many of these changes represent more slowly evolving risks, and therefore are unlikely to have large impacts within 2 years of mortgage acquisition, it is nevertheless possible that changing risks around housing consumption may alter other consumer credit use.

2.4 Household formation channel

Individuals obtaining a mortgage may be also increasing the size of the families to which they belong around the same time, which may affect credit card use independently. Couple formation and particularly marriage are positively associated with the transition to homeownership (Mulder, 2006). For example, Miller & Park (2018) find that recognition of same-sex marriages—which occurred in different states at different times—caused a 6–16% increase in same-sex mortgage applications. Having children is also positively associated with homeownership. Using PSID data through the 1980s, the mean time from couple formation to homeownership was 2 years (Clark et al., 1994). The mean number of years for a couple without children to have children after acquiring a home is about 3 years; 38.7% had children within 2 years of acquiring a home. However, a large portion of families that transition to homeownership have children first. Having children tends to raise household consumption (Browning & Ejrnæs, 2009). Higher consumption may result in more payment use of credit cards and credit card debt. On the other hand, parents whose children move out save only a small portion of the freed resources in Italy and Germany (Rottke & Klos, 2016), so the impact of children is not necessarily straightforward.

This household size channel suggests that mortgage acquisition may be partly a signal of changing household size which also affects consumption and credit card use. Many people are forming partnerships, getting married, and having children around the same time as mortgage acquisition. The literature does not suggest that these changes in household composition are generally in the same quarter as mortgage acquisition; they may come either before or after mortgage acquisition. Rather than a sharp change at mortgage acquisition, household composition effects suggest that there is likely to be a trend around the same time as mortgage acquisition as more households have children.

The impact of marriage and couple formation on individual credit card debt is not obvious. There may be economies of scale which reduce overall consumption and debt. Alternatively, couple formation may allow the household to behave strategically, with one member of a couple taking on most credit card debt, or only one member applying for a mortgage. Such strategic household interactions have been used to explain the credit card debt puzzle (Bertaut et al., 2009). One indication of the importance of couple formation for mortgages is the fraction of mortgages in which more than one person is listed. Most people who hold a mortgage hold one with someone else (see Fig. 1, the data source for which we discuss in the next section).

3 Data sources and construction

Our primary data source is the New York Fed/Equifax Consumer Credit Panel (CCP). The panel, prepared by the Federal Reserve Bank of New York, contains quarterly observations of a nationally representative, randomly drawn sample of 5% of all US individuals with a credit report.Footnote 8 To maintain computational tractability, for our sample we use a randomly selected 5% subsample of the individuals from the CCP sample. The unit of observation for these data is a consumer-quarter. The panel runs from the first quarter of 1999 to the present. We use data from the first quarter of 1999 through the fourth quarter of 2017 as our sample. Since the primary purpose for collecting these data is to help lenders price and monitor credit given to individuals, they contain extensive information on payment and loan history, including balances and payment information for credit card accounts, mortgages, and several other types of loans. For each consumer, all of their credit cards are included. Because the CCP tracks individual credit records, it does not directly provide information on households. We do observe whether there is another person listed on the mortgage. Figure 1 shows that nearly 80% of people with mortgages in 1999 held it jointly, although this declined to about 65% in 2017.Footnote 9 We show some results only for non-joint mortgages to understand whether having another person on the mortgage changes results.

To identify how many mortgages an individual has, as well as when these mortgages were opened, we use the Consumer Credit Panel’s tradeline data. The tradeline data track mortgages on a quarterly basis, and a unit of observation is a consumer-mortgage-quarter. From the tradeline data, we can find the exact date when each mortgage was originated, and we can identify whether a mortgage is traditional or a home equity line of credit (HELOC)/home equity loan (HELOAN), as well as whether the loan ended in default, charge-off, or transfer.

To create a usable panel over a long period, we make several minor adjustments to the sample. The Equifax data for a given consumer may be missing values for a few quarters from an otherwise complete time panel. Typically this occurs because unused bankcards are not updated every quarter. When that is the case, we impute data with reasonable values to preserve the panel.Footnote 10 The CCP is kept demographically balanced by sampling new accounts and not updating accounts associated with individuals reported as deceased. We include accounts that started or ended between the first day of 1999 and the final day of 2017. As we show in the next section, mortgage acquisition is most common after age 35, so the sample typically includes a person for a number of years before they acquire a mortgage and a number of years after, except at the beginning and end of the sample. The ultimate sample includes 500,000 to 670,000 individuals in any given year. The Equifax tradeline data hold records of every mortgage transaction. Table 1 reports the numbers of individuals in our sample who acquire a mortgage, always hold a mortgage, or never hold a mortgage during our sample period. The table also shows the numbers of individuals who pay off their mortgage, and those who become delinquent or default on their mortgage.

In the analysis that follows, we examine how each consumer’s credit changed around the time they acquired their first mortgage. For mortgage acquirers, we analyze the data for each of the 25 quarters before they got their mortgage and each of the 25 quarters after they got it, plus the quarter when the mortgage was obtained.

For the analysis in this paper, we use all of the observations available, even for consumers with incomplete panels. Thus, even though we show observations from 25 quarters before through 25 quarters after the acquisition of a mortgage, our analysis includes people who are in the sample for any amount of time, not just for the entire 12 years. This is because the tradeline data track individual mortgages and include the date when a given mortgage was opened. If a person exists in the data for only one quarter and has a mortgage, we can infer from the data when that mortgage was opened, and thus for every quarterly observation for that person, we can calculate how long they have had the mortgage. We then can label each observation in terms of the number of quarters that elapsed relative to the acquisition. For example, if we observe a person in Q1 of 2003 and see that their mortgage was opened in Q1 of 1999, we include the observation and mark it as 16 quarters after the mortgage was opened.Footnote 11

Much of the analysis considers whether there are important differences before and after the 2008 financial crisis. In our analysis, the pre-crisis period includes every observation from Q1 of 1999 through Q3 of 2007. The crisis period runs from Q4 of 2007 through Q2 of 2009. The post-crisis period is defined as Q3 of 2009 through Q4 of 2017, the end of our sample period. To be included in the pre-crisis subsample, a mortgage must have been acquired before Q4 of 2007. To be included in the post-crisis subsample, a mortgage must have been acquired after Q2 of 2009.

To supplement our analysis, we use data from the Survey of Consumer Payment Choice (SCPC), an annual survey implemented by the Federal Reserve Bank of Boston and now conducted by the Federal Reserve Bank of Atlanta. The SCPC is a 30-minute online questionnaire focused mainly on two concepts: (1) adoption of bank accounts and payment instruments (including cash holdings) and (2) use of payment instruments (according to respondents’ recall), defined as the number of payments made with each instrument from those accounts. Additionally, the survey includes information on demographics of the respondents and some household financial characteristics. The SCPC has been conducted annually since 2008, using the RAND Corporation’s American Life Panel (ALP) through 2014 and using the University of Southern California’s Understanding America Study (UAS) since then.

Finally, for some of our analysis, we use CRISM (Equifax Credit Risk Insights for McDash), an anonymous credit file match from Equifax consumer credit database to Black Knight’s McDash loan level mortgage dataset to obtain data on down payments and incomes of mortgage recipients.Footnote 12 Although the CRISM data do not provide down payment and income information directly, they include a debt-to-income ratio, an original loan amount, and an appraisal amount. To calculate the down payment, we subtract the original loan amount from the appraisal amount. To calculate income, we divide the original loan amount by the debt-to-income ratio.Footnote 13 The CRISM data have several limitations: they start in 2005, so we can observe down payment data from only a very short time preceding the financial crisis; the income measure is derived from the debt-to-income ratio; the house-price measure is based on the appraisal amount which are not necessarily the same although they are frequently exactly the same (Calem et al., 2017; Nakamura, 2010); and only a subset of the CCP sample can be merged with the CRISM data. For these reasons, we do not use these variables for the main part of our analysis. Instead, we use the data to supplement our primary specifications. Appendix Table A1 shows the resulting sample size for matches from the CCP to CRISM. The resulting matched sample is much smaller than the CCP sample, particularly for consumers whose incomes are reported. We matched CRISM data for 21,625 first-time mortgage acquirers out of 145,899 individuals who acquired their first mortgage in our sample.

4 Summary statistics

4.1 Homeownership and mortgage holding

We focus our analysis on first-time mortgage acquisitions. The reason for this focus is that refinances or second mortgages do not fundamentally change the household’s balance sheet, whereas a first-time mortgage does.

The fraction of consumers holding a mortgage remained more or less steady until 2008, and then gradually declined each year until the end of the sample in 2017. The distribution for the rate of mortgage acquisition by year (Appendix Fig. 1) reflects a similar decline after the financial crisis: the percentage of consumers acquiring a mortgage after 2008 was lower than it was during the years prior to 2008. The lowest rate of mortgage acquisition was in 2017, when less than 1% of consumers acquired a mortgage.

The fraction of consumers with a mortgage increased with age until its peak at age 48, when 44% of consumers held a mortgage, and then declined monotonically with age. The percentage of consumers acquiring a mortgage at each age is skewed to the left: the percentage rose quickly with age and peaked at age 40, when 2.7% of consumers acquired a mortgage (see Appendix Fig. 2).Footnote 14 Although we do not specifically study the impact of paying off or defaulting on a mortgage, it is useful to look at the two major ways that mortgages come off a household’s balance sheet. The rate of default by age mirrors the distribution of mortgage holding: it rose with age until its peak between ages 40 and 50, and then it declined. The rate of mortgage default by year increased starting in 2008 with the financial crisis, peaked in 2010, and then declined every year until the end of our sample period (Appendix Fig. 3). At its peak, the mortgage-default rate was 2.3%. An additional 3.9% of mortgage holders were delinquent on their mortgages in 2010.Footnote 15

Income and home ownership are strongly positively correlated. The Survey of Consumer Finances (SCF), a triennial survey of consumers conducted by the Federal Reserve Board, shows that from 2010 through 2016 the median annual household income for homeowners was more than twice the size of the median annual household income for those who did not own a home. Based on SCPC data, the fraction of consumers who own a home increased monotonically with income in every year of the survey. In 2017, 85% of consumers in the top income bracket (those with an annual household income of more than $100,000) owned a home, compared with 34% in the lowest income group (an annual household income of less than $25,000). Overall, the rate of homeownership declined slightly over time, with the lowest-income group seeing the largest drop.

4.2 Credit card use and homeownership

Credit card holding and use are different for consumers who own a home compared with those who do not; among homeowners, there are differences in credit card debtFootnote 16 between those who have a mortgage and those who do not. Using 2016 SCPC data, Table 2 shows the rate of credit card holding (adoption), credit card use (the share of all transactions paid with a credit card), and the dollar value of unpaid credit card balances. All of the statistics are calculated for all homeowners, mortgage holders, outright owners (no mortgage), and non-homeowners.

Homeowners (with or without a mortgage) are much more likely to hold a credit card than are non-homeowners. Among credit card holders, homeowners (with or without a mortgage) have significantly higher shares of credit card transactions compared with non-homeowners. Non-homeowners also have lower unpaid credit card balances, on average, than do homeowners with a mortgage. However, homeowners who do not have a mortgage (outright owners) have lower unpaid credit card balances compared with homeowners who have a mortgage. This last finding indicates a positive correlation between mortgage debt and credit card debt but not between homeownership and credit card debt.

Using Equifax data, Table 3 shows credit card adoption rates, mean balances, limits on all credit cards, and credit card utilization (balances divided by limits) for first-time mortgage holders and non-mortgage holders. All of the statistics are at a person-quarter level and include all credit card accounts for a given person. The results are qualitatively similar to those based on the SCPC data in Table 2: mortgage holders are more likely to have a credit card, have higher credit card balances, and have higher credit card limits. However, even though mortgage holders have nearly three times as much as non-mortgage holders in credit card balances, the two groups use very similar fractions of their respective credit card limits; that is, the utilization rates for the two subsamples are nearly the same. This is because credit card limits are proportionally higher for mortgage holders. With regard to credit cards, mortgage holders act differently in many ways from non-holders, but not necessarily because they have a mortgage. In the next section, we examine how individual credit card use changes over time around the acquisition of a mortgage.

4.3 Credit card use and mortgage status over time

We first examine how overall credit card use evolved for mortgage holders and non-mortgage holders over the sample period. Figure 2 depicts the average credit card limits, balances, and utilization for mortgage holders and non-mortgage holders over the 1999–2017 period, based on the Equifax data. Compared with non-mortgage holders, mortgage holders, on average, have higher credit card limits and higher balances throughout the sample period (blue lines), but their credit card utilization (the percentage of the credit card limit that a cardholder uses) is nearly the same as that of non-mortgage holders. Credit card limits dropped during the financial crisis for those with and those without a mortgage, but so did the credit card balances, leaving credit card utilization approximately constant throughout the sample period.

Credit utilization is a useful normalization that captures how much of available credit is being used. Because mortgage holders have higher credit limits and higher incomes in general, they could also have more credit card debt. By examining utilization, we can instead ask whether mortgage holders and non-mortgage holders use the credit available to them in the same way.Footnote 17 High utilization is an indication of being liquidity constrained, since the holder is close to the credit limit for one source of liquidity. It seems that, on average, mortgage holders and non-mortgage holders have very similar credit utilization, despite different credit limits. Similar utilization rates are suggestive that, on average, mortgage holders are not more liquidity constrained than non-mortgage holders. Of course, planning for and obtaining a mortgage may affect risk score and so credit limits directly. We examine other measures of credit use such as delinquencies and credit score next.

The differences between mortgage holders and non-mortgage holders could be due to some underlying differences between the two subgroups of consumers, but it is also possible that credit card utilization or debt changes over time as a result of acquiring a mortgage.

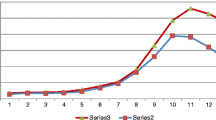

Figure 3 examines credit card debt and utilization for those who acquired their first mortgage at some point during our sample period, and break down the sample period into two periods: before the 2007–2009 financial crisis and after it. The quarter when the mortgage was acquired is labeled as Quarter 0 in the graphs.

As shown in Fig. 3, both before and after the crisis, consumers’ credit card debt rises steeply about the time they acquire a mortgage. Utilization also increases immediately after the mortgage acquisition. Before the crisis, however, utilization falls, suggesting that credit is increasing. After the crisis, utilization increases sharply and stays high. This could be because after the crisis, mortgage-lending standards in general—and down payment requirements in particular—became much stricter. After the crisis, as consumers prepared to make their down payment, they may have been more liquidity constrained than homebuyers were before the crisis, and therefore they relied more heavily on credit cards for their liquidity needs and as a source of credit. We examine the risk score of mortgage acquirers next and examine down payment size in more detail in the section Consumer credit dynamics around mortgage acquisition.

4.4 Risk score, delinquency, and mortgage holding

A borrower’s Equifax risk score is one of the measures lenders use to determine whether to approve a loan. If they approve the loan, lenders also use the risk score to help set the terms of the loan. The exact formula used to calculate the risk score is proprietary, but it is a good predictor of whether the consumer is likely to repay a mortgage, credit card balances, and other loans on schedule. An Equifax risk score can range from 280 to 850. The higher the score, the lower the credit risk. A borrower’s FICO score, which is more commonly used, can range from 300 to 850. A higher FICO score also indicates lower credit risk. Although the values of the two measures may differ, the Equifax risk score and the FICO score quantify the same concept and are correlated. Both the FICO score and the Equifax risk score are ordinal, and rank consumers based on the likelihood of a new loan they have taken fallen 90 or more days past due over the coming 24 months.

In each period until 2008, the average Equifax risk score of mortgage acquirers was roughly equal to that of non-acquirers (Fig. 4). After the financial crisis, the average risk score of acquirers increased substantially, while the average risk score of non-acquirers rose only slightly, leading to a large difference between the two groups of consumers. The large increase in the average risk score for consumers who got their first mortgage after the financial crisis is consistent with the hypothesis that mortgage-lending standards became more stringent. A two-sample t-test confirms that the gap between acquirers and non-acquirers increased significantly from the pre-crisis period to the post-crisis period. Before the crisis, the average risk score for mortgage acquirers was not significantly different from that for non-acquirers, indicating that the lending criteria were relatively loose.Footnote 18 Note that the acquirers include only the individuals who got a mortgage in that particular quarter.

Figure 5 shows the fraction of consumers with a delinquency and the average delinquency amount around getting a mortgage before the crisis (left panel) and after the crisis (right panel), while Fig. 6 shows the Equifax risk score around getting a mortgage before the crisis (left panel) and after the crisis (right panel). The fraction of consumers with a delinquency and the delinquency amount both show a notable V shape, hitting their lowest at the mortgage acquisition. Consistent with lending standards having tightened and higher risk scores, after the crisis the fraction with a delinquency at mortgage acquisition is nearly zero, while before the crisis nearly 4% of mortgage acquirers had a delinquency. Two years after acquiring a mortgage, the fraction of consumers with a delinquency is as high as it was 2 years before acquiring a mortgage and the average delinquent debt is higher. The higher delinquent debt may reflect that credit card limits increase post-mortgage, making it possible for debt to be higher.

The path of risk score around mortgage acquisition in Fig. 6 is somewhat different than delinquencies. Risk score is generally increasing before a mortgage, consistent with declining delinquencies. After a short delay, risk score continues to increase pre-crisis; post-crisis, risk score decreases after several quarters. Having a large installment loan paid on time, such as a mortgage, is typically good for the credit score, so acquiring a mortgage affects the credit score directly. The average increase in risk score in the 5 years before mortgage acquisition is substantially larger post-crisis. One way to improve credit scores is by decreasing credit card utilization; utilization fall only slightly in the 5 years before mortgage acquisition before the crisis, while it falls substantially during the same period after the crisis.

5 Consumer credit dynamics around mortgage acquisition

In this section, we estimate how measures of credit card debt, default, and risk score change around mortgage acquisition at the individual level by tracking the same people over time. Our goal is to understand the dynamics of other consumer outcomes at the point of mortgage acquisition. We then discuss how these results support or challenge alternate hypotheses about household choices. We begin by showing a full event study model that allows for effects to differ at each quarter before and after the acquisition of a mortgage. We then move to simpler models that estimates the short- and long-term differences and allow us to consider interactions with risk scores and pre-mortgage utilization.

We show the dynamics for several consumer credit variables including credit card debt and utilization, risk score, and delinquencies. We examine the use of home equity as a source of liquidity in the last section.

5.1 Full event study model

5.1.1 Estimation approach

We estimate the following full event study model which allows impacts to vary before and after the 2008 financial crisis:

where yjt is the dependent variable including risk score, credit card defaults, credit card balances, limits, or utilization for individual j at time t; ijt is an indicator for quarter t relative to the quarter when j’s mortgage was acquired; Δyjt is a one quarter change; and f(Agejt) is an age polynomial (age and age squared); and postCrisis is a dummy variable equal to 1 for observations after the financial crisis (2009–2017) and 0 before (1999–2007). We focus on specifications that allow the dynamics to differ from before and after the crisis because of evidence that lending standards became stricter, so the relationships may change.Footnote 19

Because the dependent variables are first differences, individual fixed effects drop out so that we can control for any fixed but unobservable individual effects. For example, fixed differences in income between individuals will drop out with the first difference. However, differencing does not remove changes that occur at the same time as mortgage acquisition such as an increase in income or the birth or adoption of a child, so these channels may still be operative.

We estimate Eq. (1) for individuals who acquired their first mortgage at some point during our sample. The coefficient of interest is βt, which shows the change in yjt relative to the period when individual j acquired a mortgage. For mortgage acquirers, each of individual j’s observations is normalized such that period 26 is set to the period of acquiring a mortgage.

5.1.2 Results

Figures 7–12 show estimated coefficients on the consecutive quarters for the change in dependent variable of interest yjt from estimating Eq. (1). We show the dynamics for credit card balances (Fig. 7), limits (Fig. 8), credit utilization (Fig. 9), credit score (Fig. 10), and credit card defaults (Figs. 11 and 12) to examine different possible impact channels. The distribution of the estimated coefficients over time shows changes before and after the acquisition of a mortgage. We plot the coefficients from the pre-crisis and post-crisis periods together to ease comparison. Note that the dependent variable is first-differenced, so the cumulative effect is the sum of coefficients.

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in credit card balances. Vertical bars show confidence intervals around the estimated coefficients. Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in credit card limits. Vertical bars show confidence intervals around the estimated coefficients. Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in credit card utilization (percent). Vertical bars show confidence intervals around the estimated coefficients. Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in Equifax Risk Score. Vertical bars show confidence intervals around the estimated coefficients. Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in credit card delinquency amount (sum of 90 DPD, 120+ DPD and severe derogatory amount). Vertical bars show confidence intervals around the estimated coefficients. Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Estimated coefficients of indicators for the number of quarters since (or before) mortgage acquisition. Dependent variable is quarterly change in credit card delinquency status (with any 90 DPD, 120+ DPD and severe derogatory accounts). Vertical bars show confidence intervals around the estimated coefficients. (Linear Probability Model). Source: Authors’ calculations based on New York Fed Consumer Credit Panel/Equifax. Estimates includes quarter effects and an age quadratic

Figure 7 shows the estimated coefficients \(\widehat \beta _t\) from estimating Eq. (1) with the change in credit card balances as the dependent variable, using OLS (see Appendix Table A2 for coefficients). Before and after the crisis, credit balances rise sharply about the time consumers obtain their mortgage. However, after the crisis, consumers increase their credit card balances in the same quarter when they get their mortgage. In contrast, before the crisis, the increase in credit card balances does not occur until after the mortgage is obtained, and the increase is smaller in magnitude. The effect of a new mortgage on credit card debt is greater after the financial crisis. Even nearly 6 years out the coefficients are close to zero, indicating that there appears to be a permanent increase in credit card debt at the time of mortgage acquisition.

Figure 8 and Appendix Table A3 display the estimated coefficients with changes in credit card limits as the dependent variable. The change in credit limits is rarely statistically significant. Limits increase more prior to and immediately following a mortgage acquisition in the period after the crisis than in the period before it. We characterize the increase in credit limit upon obtaining a mortgage as a credit effect.

The difference in credit card utilization during the two time periods is more dramatic (Fig. 9 and Appendix Table A4): utilization rises upon mortgage acquisition in both periods; however, after the crisis, utilization increases substantially during the quarter of mortgage acquisition, whereas before the crisis, the increase is more modest and does not take place until after the mortgage acquisition. The coefficients are close to zero after 2 years, indicating cumulative permanent increase in utilization which is substantially larger post crisis.

Risk scores (Fig. 10 and Appendix Table A5) have several increases or decreases around getting a mortgage. The size of the effect is quite small, however, generally less than 1 or 2 on scale that ranges from 300 to 850.

The fraction with a credit card delinquency and the amount delinquent (Figs. 11 and 12 and Appendix Table A6) show a notable increase in delinquencies in the 2 years following mortgage acquisition. The coefficients eventually return to zero, but because the coefficients measure the change from quarter to quarter, delinquencies are cumulatively several percentage points higher 6 years post mortgage both before and after the crisis.

5.1.3 Discussion and interpretation

The profiles in Figs. 7–12 are generally consistent with the liquidity channel being important, although they do not rule out other channels. On acquiring a mortgage, consumers increase their use of another form of liquidity, credit card debt, substantially. Because credit limits do not increase as much, and may decline slightly after several years, credit utilization increases sharply immediately following mortgage acquisition. Higher credit utilization is suggestive that consumers are more liquidity constrained. The increase in defaults following mortgage acquisition provides further evidence that households who have just obtained a mortgage are more liquidity constrained. The effect of a new mortgage on credit card debt and utilization is greater after the financial crisis. This result is consistent with the hypothesis that after the crisis, mortgage lending standards became stricter, and larger down payments were required to obtain a mortgage. As a result, consumers might have begun relying on credit cards for liquidity—and thus increased their used of credit card debt and raised their utilization.

The credit score channel does not seem to be quantitatively important. Controlling for age, risk score increases only slightly before mortgage acquisition. Default amounts are not decreasing before mortgage acquisition (Fig. 11), although the fraction of the population with a default is modestly decreasing (Fig. 12). While some consumers may be consciously attempting to increase their credit score before mortgage, it does not seem that the impact is large or widespread. In contrast to the summary Figs. 3, 5, and 6 discussed earlier, the estimates shown in Figs. 7–12 control for age trends.Footnote 20 Doing so removes the typical decrease in credit card debt, utilization, and default that occurs as consumers age, and explains why we see a V-shape for delinquency in Fig. 5, but not in Figs. 11 and 12.

The sharp increase in credit card debt and utilization immediately after mortgage acquisition suggests that the household size channel does not explain most of the change in credit card use. The literature reviewed in Section II suggests that having children and getting married often occur within several years of mortgage acquisition but not necessarily in the quarter of mortgage acquisition. If household size explained the increase in credit card use, we might expect to see an increase in credit card use starting several years before mortgage acquisition and continuing for several years after, rather than a sharp increase on mortgage acquisition. Similarly if an increase in income explains mortgage acquisition and changes in spending on a credit card, we would expect to see the increases occurring before mortgage acquisition. The increase in delinquency post-mortgage also suggests that the role of income increases in explaining both mortgage acquisition and other credit use is not large. Of course, this evidence is suggestive and does not rule out the household size channel or income channels which are likely to operate to some degree. We turn to specifications which can partially control for other factors in the next two sections.

5.2 Model with risk score interactions

5.2.1 Estimation approach

We next employ a simpler model that pools the effects estimated in the event study but allows us to study interactions with risk scores. We focus on utilization here, rather than also considering debt or delinquencies because changes in risk score are correlated with changes in debt and delinquencies. The next two sections also consider debt and delinquencies in broader models. More specifically, for each mortgage acquirer we estimate short-term and long-term effects of mortgage acquisition to test how long those effects last:

where ΔUtilshort is the average utilization for the two quarters after acquisition minus the average utilization for the two quarters before acquisition:Footnote 21

and riskScore is a mean of the consumer’s Equifax risk scores for the two quarters prior to the mortgage acquisition. We normalize this variable by subtracting the mean pre-acquisition risk score across all consumers and dividing by 100. We similarly estimate Eq. (2) with the long-term change in utilization ΔUtillong defined as the difference in the average utilization over relative quarters –24 to –5 and 5 to 24 (that is, 24 quarters before/after the acquisition, but excluding the four quarters immediately before or after as they are included in the short-term utilization change).

5.2.2 Results

The first column of Table 4 shows the short-term change only controlling for age where the intercept captures the average short-term change in utilization. Column II includes a dummy variable for the post-crisis period, and Column III adds the risk score and an interaction term of post-crisis and risk score. The average short-term increase in utilization upon acquiring a mortgage is 11.4 percentage points. Consistent with Fig. 9, the increase is significantly larger after the crisis, at 13.1 percentage points (Column II). Interacting with the risk score in Column III suggests that the increase in utilization is larger among those with higher risk scores, but this effect is smaller post-crisis. The estimated effect sizes are large compared to the average 30–35% utilization in Fig. 2. Column IV shows the same regression as in Column III, but restricts the sample to include only individual mortgages. The estimates are very close.

Table 5 shows similar regressions for the long-term change in utilization. As the event study coefficients in Figs. 7, 8, and 9 show, the short-term impact is much larger than the long-term effect. Overall, the long-term impact is not statistically significant (Column I). However, there is a substantial difference between the two time periods: the long-term effect is negative before the crisis, but it becomes positive and significant after the crisis. Credit utilization is 1.1 percentage point higher in the long term for those who acquire a mortgage after the crisis (Column II), and the effect is similar after we control for risk score (Column III). The long-term increase in credit utilization rises with risk score, but this effect diminishes after the crisis (Column III). Restricting the sample to only include individual mortgages, the impact of risk score before and after the crisis is nearly the same, except that pre-crisis utilization seems to have increased in the long-term for individuals (the intercept) rather than decreasing.

5.2.3 Discussion and interpretation

One explanation for the larger short-term post-crisis increase in utilization could be a change in the composition of mortgage acquirers. In Fig. 4, we document that the average risk score of mortgage acquirers post-crisis was higher than it was pre-crisis. Including the risk score allows us to examine the risk score channel independently. The increase in utilization after the crisis is approximately the same whether risk score is included or not, suggesting that the risk score channel and the change in the composition of borrowers after the crisis does not explain the increase in credit card utilization. There is evidence that the risk score channel does matter, at least before the crisis. Consumers with risk scores more than the average tend to increase utilization by a larger amount both in the short and long term before the crisis.

The short-term impact on utilization is nearly the same for individual mortgages as it is for all mortgages. Mortgages with only one person listed are not necessarily only held by households with only one adult. Households with financial interlinked adults, whether married or not, may decide strategically to only include one person on the mortgage. Doing so may limit the size of the mortgage because only one income will be considered. However, joint mortgages do not necessarily imply financial interdependence. That the impact on short-term utilization is nearly the same for individual mortgages as for all mortgages suggests that the household size channel is not important in determining the impact on utilization.

The change over time in the long-term effect of a new mortgage on credit card utilization suggests that before the crisis, the debt effect (increased borrowing) was relatively small, but the credit effect (increased limits) seems to have been larger, pushing down long-term utilization rates. After the crisis, the reverse was true: the debt effect was larger, but the credit effect was smaller. As a result, long-term utilization dropped before the crisis but increased after the crisis.

5.3 Model with utilization interactions

5.3.1 Estimation approach

If people who are typically liquidity constrained are more likely to increase their credit card debt, increase their credit card utilization, and have delinquencies, the impact of a mortgage may be much larger for individuals who use more of their credit. To test whether short-term changes in utilization or delinquency differ depending on the typical level of utilization, we estimate the following equation for the short-term change in utilization, short-term change in delinquencies, and short-term change in credit card debt:

where avgUtil is the average utilization from relative quarters –24 to –5. This measure of average utilization captures whether someone is typically using much of their available credit, but is not mechanically linked to the short-term change in utilization.

5.3.2 Results

The results are presented in Table 6 for utilization and Table 7 for delinquency and credit card balances. Risk score is normalized to have zero mean and is divided by 100. Average pre-acquisition utilization is in percentage points and is not demeaned. Because results with multiple interactions are difficult to interpret, we show the predictive margins for utilization at various pre-mortgage average utilization (avgUtil) and risk scores in Fig. 13. Before the crisis, the short-term change in utilization generally decreases as risk scores rise, and it decreases with pre-mortgage utilization. In general, credit card utilization increases for people with low credit scores and low utilization and decreases for those with higher credit scores or higher utilization. Acquiring a mortgage appears to affect credit card utilization in very different ways across the risk-score and utilization distributions. The relatively small average effect of acquiring a mortgage before the crisis appears to be the result of relatively large positive and negative effects balancing out each other. Limiting the sample to mortgages with only one person in Table 6, column III, the results are nearly the same.

Table 7 shows a short-term increase in delinquency of 2.2 percentage points, even controlling for risk score and utilization. The increase is approximately the same before and after the crisis and does not depend on pre-acquisition utilization. Average pre-acquisition utilization does matter for other results, so we discuss results at a mean utilization of 30%. Credit card debt increases by 1500 dollars in the short term before the crisis and almost exactly the same amount for people with 30% pre-acquisition utilization post crisis. As pre-acquisition utilization increases, so does the short-term increase in credit card debt. Post-crisis, people with higher pre-acquisition utilization increase their debt significantly more. In the long-term, delinquency is 9.1 percentage points higher at 30% pre-acquisition utilization, and 6.8 percentage points higher post crisis. Long-term credit card debt increases by 3900 dollars pre-crisis at 30% utilization, and nearly the same amount post crisis.

5.3.3 Discussion and interpretation

Post-crisis, the impact shifts in important ways that differ across the utilization and risk-score distributions. First, at low pre-mortgage average credit card utilization, short-term utilization increases by several percentage points for all risk scores following the acquisition of a mortgage. Second, an increase in pre-mortgage utilization has a smaller negative effect on the post-mortgage change in utilization. For the lowest risk scores, higher pre-mortgage utilization tends to mean larger increases in utilization, which is the opposite of the effect pre-crisis. The combined shift means that, even when we hold the distributions of pre-mortgage credit utilization and risk scores constant, there is a much larger increase in credit card utilization post-crisis driven by an increase at all utilization levels and risk scores. There is similarly a short-term increase in delinquency and credit card balances, even holding credit utilization and risk scores constant. These results are consistent with the liquidity channel being important, even while controlling for the risk score channel. To the extent that pre-acquisition utilization or risk score are correlated with household size, for example, if larger households use more of their available credit, controlling for these factors helps remove the impact of household size. Moreover, because the results are similar for mortgages with only one person, the household size channel does not seem to be responsible for the short-term results.

In summary, credit card utilization spikes upon the acquisition of a mortgage, and the increase is larger post-crisis. After the first two quarters following the acquisition of a mortgage, credit utilization falls from the sharp initial increase, but on average it remains higher in the long term. The long-term impact appears to be stable before and after the crisis, with the difference mostly explained by the higher risk scores of post-crisis mortgage acquirers. There is an overall increase in delinquencies and credit card debt in both the short and long term, even after controlling for risk score and pre-acquisition average utilization. The increase in delinquencies and debt in the short term is consistent with the liquidity channel, but the income and household size channels may help explain the long term changes.

5.4 Model with down payment

5.4.1 Estimation approach

To test our hypothesis that changes in the consumer credit-mortgage relationship are caused by lending criteria becoming more stringent after the financial crisis, we use CRISM, a match from Equifax consumer credit database to Black Knight’s McDash loan level mortgage dataset to include down payment and income information for each mortgage. We test whether the effect of a mortgage acquisition on consumer credit outcomes can be explained by differences between down payments before the crisis and those after the crisis.

If the increase in credit card utilization, credit card debt, and delinquencies, were caused by lenders’ requiring higher down payments, then a higher down payment should have a positive effect on these other credit outcomes and including a measure of down-payment size should reduce or eliminate the importance of the post-crisis dummy. Down payment requirements are typically specified in terms of a percentage of the house sale price, and the minimum required down payment may vary with a buyer’s income. For example, a lender could require a minimum down payment of 20% of the price of the house as a condition for approving a mortgage. We want to test whether that requirement became more stringent after the financial crisis. To control for the effect of changes in house prices, we include the down payment as a ratio of down payment to sale price. The CRISM data do not include sale prices of houses, but they do include appraisals, which we use as proxies for sale prices. We also estimate a specification with the ratio of down payment to income.

We estimate the variations of the following equation:

replacing the short-term change in utilization with long-term changes in utilization (Table 9), long-term changes in delinquencies (Table 10), and long-term changes in credit card balances (Table 10).

5.4.2 Results

Tables 8–10 show the regression results. Unfortunately, the CRISM data have several limitations, and the merged sample is substantially smaller than the original CCP/Equifax sample (see Appendix Table A1). To test whether the previous results still hold in this reduced sample, Column I in Table 8 replicates the specification in Eq. (2) only using the CRISM sample (the full sample results are in Column III of Table 4); Column II shows the results with the down payment and income included as a ratio of down payment/income; Column III includes the down payment and income separately in log form; Column IV includes the ratio of down payment to appraisal (proxy for sale price); and Column V shows the results with the down payment and appraisal included separately in logs; and Column IV restricts the sample to only mortgages with only one individual. Table 9 shows the same specifications for long-term changes in utilization. Table 10 shows similar results for the long-term change in delinquency and credit card balances.

The results in Tables 8 and 9 differ in important ways from the comparable results in Tables 4 and 5 with the full sample. In Table 8 Column I for the matched sample, there does not seem to be a significant or large increase in utilization before the crisis as there was in Column III in Table 4, although there is an increase post-crisis. Similarly, while Table 5 Column III shows a decline in long-term utilization before the crisis, which is reversed post-crisis, Table 9 Column I does not show significant changes either before or after.

Consistently across columns in Table 8, as the down payment increases, the change in utilization decreases. The coefficients on down payment in Table 9 are not generally statistically significant, but in Column III, larger incomes lead to smaller increases in utilization and Column V, larger appraisals to smaller increases in utilization. The results in Table 10 suggest a possible role for increased down payments in increasing long-term delinquency status and in decreasing credit card debt, but the results are not consistent across different ways of defining the down payment size.

5.4.3 Discussion and interpretation

We interpret these results cautiously, given the small sample and lack of consistency across specifications. Yet the effect of the size of the down payment on short-term utilization change (controlling for income or sale price) is negative in Table 8 Columns II through V, the opposite of what one would expect if, holding everything else constant, a higher down payment reduced liquidity. One interpretation is that while larger down payments may have an effect on liquidity, the liquidity effect is less important than the selection effect who is able to or has the preferences to have saved enough to have a larger down payment (holding current income constant). One possible explanation is that “impatient” people do not save for large down payments, so the impact of a mortgage or mortgage payments on other liquidity is larger for them. An alternative explanation, consistent with the income channel, is that income increases are relatively recent for many people acquiring a house for the first time and so have not had a chance to save much compared to current income. Being able to afford a larger down payment, relative to current income, may be indicative of having had that income for longer. The down payment becomes insignificant in the long run in the credit card utilization regressions (Table 9).

Although the measures of down payment size are not consistently significant in Table 10 for the long-term change in delinquency and credit card balance, the results in the restrict sample controlling for down payment are largely consistent with the results in Table 7. Post-acquisition, there is a statistically and economically significant increase in delinquencies, which appears smaller post-crisis, and a statistically and economically significant increase in credit card debt, which is also smaller post crisis.

Keys et al. (2014) find that a decline in the size of mortgage payments due to lower mortgage rates leads to a reduction in credit card debt among credit-constrained households. But a decline in the size of mortgage payments can be generated by larger down payments, even if mortgage rates remain unchanged. A larger down payment required by the lender also would reduce the size of the mortgage and therefore lead to smaller mortgage payments, even without changes in mortgage interest rates. Thus, a larger down payment—and the resulting smaller mortgage payments—could lead to lower credit card debt and lower credit card utilization.

5.5 Borrowing against home equity: HELOC and HELOAN

When a consumers buy a house and acquires a mortgage, they might have access to other types of loans that were not previously available to them, namely a home equity line of credit (HELOC) or a home equity loan (HELOAN). HELOCs and HELOANs both extract value from the equity on a home and add to the homeowner’s debt. A HELOAN is a lump sum, whereas a HELOC allows the borrower to draw money as needed. So instead of increasing their credit card debt and credit card utilization, consumers might increase their borrowing through these other loans. Brown et al. (2015) find that there is a nearly one-for-one substitution of home equity debt for credit card debt after a change in home equity. Alternatively, perhaps the liquidity impact of a mortgage is small if the equity is immediately available as a HELOC or HELOAN. Because these sources of credit provide liquidity that may complicate the relationship between mortgages and other sources of debt, we investigate the prevalence and use of HELOCs and HELOANs.

We use the Equifax tradeline data as a source of information on HELOCs and HELOANs. Of the 145,899 first-time mortgage acquirers in our sample, 14.9% have at least one HELOC record. One can obtain a HELOC immediately after purchasing a home, and the acquisition process involves fewer steps than are required for a mortgage. In our sample of mortgage acquisitions, 6.3% of the people who obtained a HELOC did so within 1 month of acquiring a mortgage, and 16% got their HELOC within the first year. The timing suggests that, while HELOCs may be a longer-term source of liquidity for some households, for most they are not a direct substitute for credit cards in the short term after the acquisition of a mortgage. The mean length of time between getting a mortgage and getting a HELOC is nearly 5 years, but the distribution is skewed right, so the median is much shorter.

HELOANs are somewhat more common than HELOCs in our data and are more likely to be taken out soon after a mortgage acquisition: 23% of HELOAN holders acquired theirs in the same month that they got a mortgage, and 31% obtained a HELOAN within 1 year of getting a mortgage. In our data, the mean length of time between getting a mortgage and getting a HELOAN is 34 months.

We look for evidence that consumers substitute HELOCs or HELOANs for credit card debt after getting a mortgage. For consumers who open a HELOC or HELOAN account, we observe quarterly changes in their credit card balances for 2 years after the account is opened. We do not find any evidence that consumers systematically substitute for their credit card balances: approximately one-third of the consumers with a HELOC of HELOAN increased their credit card balances, one-third lowered them, and one-third did not substantially change their credit card balances. Mean credit card balances declined very slightly in the first quarter following the acquisition of a HELOC or HELOAN, but balances were higher after a year. Regardless of whether the loan was a HELOC or HELOAN, the result was the same for credit card balances.

HELOCs and HELOANs were much more common before the crisis, which may explain both the lack of clear substitution between HELOCs or HELOANs and credit cards, and why there is so small a relationship between credit cards and mortgages before the crisis. Figure 14 shows that for several years before the crisis, HELOCs and HELOANs were very common. From 2003 through 2007, there was approximately 0.4 new HELOC/HELOAN for every new mortgage, suggesting it was quite easy to generate liquidity from home equity. From 2009 on, however, there was less than 0.2 new HELOC/HELOAN for every new mortgage. The number of new mortgages was much lower after 2008, but the number of new HELOC/HELOANs was even lower. Before the crisis, HELOC/HELOANs may have been the easiest and cheapest way to deal with liquidity issues following the acquisition of a mortgage, whereas after the crisis households may have turned to credit cards as HELOC/HELOANs became more difficult to obtain.

6 Conclusion

We find that acquiring a first-time mortgage is associated with other changes in consumer credit. A debt effect tends to increase credit card spending, and a credit effect leads to higher credit limits, possibly because lenders see timely mortgage payments. We find a robust and statistically significant effect of new-mortgage acquisition on credit card utilization, or the fraction of a consumer’s credit card limit that is used. In the short term, the effect is strong and positive. The long-term effect on utilization changed over time: we find that before the 2007–2009 financial crisis, the debt effect was relatively small, but the credit effect seems to have been larger, pushing down long-term utilization. In our sample period after the crisis, the reverse apparently was true: the debt effect of obtaining a new mortgage was higher, consistent with larger down payments leaving households more liquidity constrained. One way that this constraint appears is an increase in delinquencies in the short and long term. These effects persist after controlling for risk score and pre-acquisition average utilization.

Judging by credit card use, it does not seem that mortgage acquisition drastically changes access to liquidity in the long term. While mortgage acquisition is associated with an increase in credit card utilization rates in the short term, over the long term, the impact is relatively small, even though there does appear to be an increase in delinquencies. Moreover, the average credit utilization for mortgage holders is the same as for non-mortgage holders. Because credit cards are one of the key sources of liquidity for American households, these findings cast doubt on approaches that rely on mortgage holders being particularly liquidity constrained long after mortgage acquisition. To be sure, some mortgage holders may be constrained, but beyond the period right around the mortgage acquisition, mortgage acquirers do not seem to be any more constrained on average than they were before mortgage acquisition, or than the average non-mortgage holder.

Notes

Although mortgage payments may not be higher than the rent payments a household used to make, there are typically high fixed costs of buying a house, including but not limited to the down payment.

We define liquidity as cash and other liquid assets available to a consumer, such as bank account deposits.

Calculations from the Survey of Consumer Finances (SCF) suggest that the median household has more available liquidity on credit cards (the total credit card limit minus the debt) than in liquid savings. The Report on the Economic Well-Being of U.S. Households (Board of Governors of the Federal Reserve System, 2018) similarly suggests that credit cards are either the most or second-most (after cash) frequently used source of liquidity to cover shocks.

The measure includes all of a given consumer’s cards, so both the credit limit and credit card balances are at an individual level. Credit card debt includes convenience debt, which is paid at the end of each month, as well as revolving debt, which is carried over from month to month. The data do not allow us to distinguish between these two types of credit card debt. Based on the Survey of Consumer Payment Choice (SCPC), almost 60% of credit card holders carried some unpaid balances during the previous 12 months (Greene & Stavins, 2018).

For example, see the Bank of England Prudential Regulation Authority’s rules on loan-to-income ratios (see: https://www.bankofengland.co.uk/prudential-regulation/publication/2014/implementing-the-fpcs-recommendation-on-loan-to-income-ratios-in-mortgage-lending, accessed November 1, 2019) or the US Consumer Financial Protection Bureau’s ability-to-repay rule (see: https://www.consumerfinance.gov/ask-cfpb/what-is-the-ability-to-repay-rule-why-is-it-important-to-me-en-1787/, accessed November 1, 2019).

See, for example, “4 Steps to Getting Your Credit Mortgage-Ready” on the Experian website (by Ismat Mangla, March 19, 2019, https://www.experian.com/blogs/ask-experian/how-to-get-your-credit-ready-for-a-mortgage/) or “How to Improve Your Credit Before Applying for a Mortgage” from USAA (https://www.usaa.com/inet/wc/advice-real-estate-improve-your-credit-before-applying-for-a-mortgage?akredirect=true) or the “How to deal with “bad credit”—or no credit—when you want to buy a home” from the CFPB (by Megan Thibos, March 17, 2017, https://www.consumerfinance.gov/about-us/blog/bad-credit-or-no-credit-when-you-want-buy-home/).

See “How to Lower Debt and Boost Your Credit Score In One Shot” (by Jim Akin, April 2, 2018, https://www.experian.com/blogs/ask-experian/how-to-lower-debt-and-boost-your-credit-score-in-one-shot/).

A description of the data can be found at https://www.newyorkfed.org/research/staff_reports/sr479.html.

The reporting of a joint mortgage appears to have changed somewhat over time. Figure 1 shows the combined percentage of mortgages with codes for “Joint” and “Shared.” The Joint or Shared status of a mortgage is determined by the Equal Credit Opportunity Act (ECOA) code appended to the mortgage. ECOA codes appear to be reported frequently with a lag, so we label a new mortgage Joint or Shared if it gets a Joint or Shared ECOA code within four quarters of acquisition. With this definition, we match 138,000 out of 146,000 first mortgage acquisitions. Reporting “Shared” became much more important for several years from 2004 to 2006, replacing “Joint” codes. Other than this period, the share of joint and shared mortgages that are “Joint” was relatively constant at approximately 65%. The fall in joint and shared mortgages in Fig. 1 is similar to the fall in co-borrowing mortgage applications in HMDA documented by Jakucionyte & Singh (2020).