Abstract

This paper studies the negative loop caused by the interaction between pessimistic estimates of potential output and the effects of fiscal policy in Europe during 2008–2014. We argue that policymakers’ reliance on overly pessimistic views of potential output led to a large adjustment in fiscal policy. Contractionary fiscal policy, via hysteresis effects, caused a reduction in potential output that in part validated the original pessimistic forecasts and led to a second round of fiscal consolidation. The paper concludes by discussing alternative frameworks for fiscal policy that could avoid this negative loop in future crises.

Similar content being viewed by others

Notes

For example: “one cannot ignore that these results also portray a picture of a failing institutional framework for fiscal policy. One that has been focused on the concepts of sustainability and coordination without much success, at a time where it should have been focused on strengthening automatic stabilizers and designing a proper framework for the conduct of fiscal policy over the business cycle.” (Fatas and Mihov 2009, p. 56).

How this gets implemented depends on how automatic stabilizers are defined. In some cases, they are a function of cyclical variables (such as unemployment), and they might not react to a permanent change in output. In other cases, since taxes react to income, there will be a decrease in the tax revenues that will require an adjustment of tax rates or spending to restore the desired primary balance.

In the case of automatic stabilizers, and in the presence of a negative shock, the cyclical decrease in the budget balance increases debt and might also require a future budgetary adjustment.

As long as shocks to GDP are symmetric and the mismeasurement of potential output or the output gap is also symmetric.

There has been renewed interest in the literature recently because of the persistence of GDP after the 2008 crisis (Rawdanowicz et al. 2014).

Although the IMF had recently begun to move toward a common centralized methodology, closer to those of the OECD and the European Union (IMF 2015). In the case of the European Union, member countries also produce macroeconomic scenarios for their economies as part of their Stability and Convergence Program updates. These forecasts involve a combination of judgment and models similar to the EU common methodology (Mc Morrow et al. 2017).

Countries included in the sources are listed in the Data Appendix. The OECD also produces estimates of potential output. We have checked the robustness of some of our results using OECD estimates. The results are available in the longer working paper version of this paper.

We start our analysis with the April 2007 issue because it precedes the decrease in growth rates we witnessed at the end of 2007. The National Bureau of Economic Research declared December 2007 as the starting month for the US recession. The Centre for Economic Policy Research concluded that the euro area had entered a recession in the first quarter of 2008.

Data downloaded from https://ec.europa.eu/info/business-economy-euro/indicators-statistics/economicdatabases/macro-economic-database-ameco/ameco-database_en. Accessed on May 13, 2018.

For example, since October 2014 the WEO has started using updated data based on ESA2010 criteria.

This is the same approach followed by Blanchard and Leigh (2013). An appendix at the end of the paper describes in detail the calculation of forecast errors for actual and potential GDP.

Calculating forecast errors for potential output is more complicated than for GDP. Revisions to current levels of potential output tend to lead to revisions of past levels of potential output. In our calculations we ignore these historical revisions. What we are comparing is how our long-term forecasts of GDP change as time passes and for that we need a comparison based on the actual level of potential output. Using the growth rates would underestimate the revisions to our forecasts. We explain in detail the methodology we use to deal with ex-post revisions of potential output estimates in the longer working paper version of this paper (Fatas 2018).

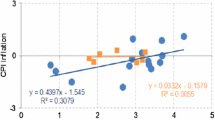

Results are practically identical if we remove year dummies or fixed effects. Clustered standard errors are in parentheses using Driscoll and Kraay (1998).

In the regressions, we try to maximize the number of observations (countries) even if the panel is not always balanced. The number of countries for which some data are missing is small, and removing those countries from the estimates does not change any of our results. The Europe and euro area samples do not match exactly across the IMF and AMECO databases. The appendix lists the countries in each of these samples.

The AMECO database provides an alternative measure of long-term GDP forecasts, called “trend output.” Trend output is built using a methodology that produces a smoother time series. Using our specification, we find that this alternative series is also very reactive to GDP changes.

The DFE indicators combine a bottom-up, narrative approach on the revenue side and a more standard top-down approach on the expenditure side. See Carnot and Fernandez (2015). The DFE indicator is the average for the euro area as reported in the AMECO database; the planned change in structural balance is our unweighted average of changes reported for that year by the IMF WEO.

We calculate the forecast errors relative to the GDP growth measured from the April 2012 WEO. This is slightly different from the way it is done in Blanchard and Leigh (2013), who used the latest available WEO to do that comparison. The reason for choosing 2012 is that later we plan to look at how the forecast errors in real time changed policymakers’ decisions.

These price effects were persistent over time. We have checked the persistence of these effects by replicating these regressions using our six-year forecast errors.

In Fatas (2018), we show using the DFE indicator that these changes in plans led to actual tightening of fiscal policy.

All the analysis is shifted by 2 years. The April 2014 vintage of the IMF WEO is being used as a source of the actual GDP and potential data.

The coefficient of column (2) is also consistent with our earlier results, but standard errors are larger, so it becomes nonsignificant. But the 2SLS specification, our preferred one, remains highly significant.

One way to test for this hypothesis is to compare the two-year with the six-year forecast error from the IMF database using the first fiscal consolidation as an example. If it was all measurement error, we would see a reversion to trend and possibly a negative correlation between forecast errors. That is not what we observe in the data. The six-year forecast error looks very similar to the two-year error, confirming the persistence of the pattern.

Kuang and Mitra (2018) reach a similar conclusion using different methodologies.

When we talk about mismeasurement of potential output, we are focusing on the tendency of short-term growth fluctuations to influence long-term GDP forecasts and how it leads to a procyclical bias in fiscal policy. Our paper has nothing to say about the possibility that on average forecasts are too optimistic or too pessimistic.

As an example, in a precrisis analysis, Turrini and Larch (2009) acknowledge the weaknesses of the current methodology in measuring the output gap but dismiss its importance and conclude that the problems can easily be addressed with minor tweaks to the methodology.

This type of volatility would be very persistent, but as long as symmetry holds, there will be no clear ex ante bias in terms of whether this helps or hurts long-term GDP.

Fatas et al. (2018) map hysteresis estimates and self-defeating fiscal consolidations. Auerbach and Gorodnichenko (2017) reach similar conclusions using a larger sample of fiscal shocks among OECD economies. House et al. (2017) also confirm the persistent effects of fiscal policy changes in European countries and the possibility of self-defeating fiscal consolidations.

There are some dissenting voices to the view that longer horizons are superior. For example, Mc Morrow et al. (2017) worry that looking at forecasts over longer periods might just translate into even more optimistic forecasts during booms that will lead to more procyclicality. However, their concern is about procyclical behavior during booms and the fact that extending the number of years until it is allowed to return to trend will lead to more procyclicality. Their argument does not apply in the presence of negative shocks. We do want to increase the number of years to avoid procyclicality.

Similar conclusions are reached by Kuusi (2017).

Coibion et al. (2018) rely on models that identify supply and demand shocks by assuming that only supply shocks have permanent effects on GDP. This assumption runs contrary to the idea that all types of shocks generate hysteresis and permanent effects.

References

Andrle, Michal, John C. Bluedorn, Luc Eyraud, Tidiane Kinda, Petya Koeva Brooks, Gerd Schwartz, and Anke Weber. 2015. Reforming fiscal governance in the European Union. IMF Staff Discussion Note 15/19. Washington, DC: International Monetary Fund.

Auerbach, Alan J., and Yuriy Gorodnichenko. 2011. “Fiscal multipliers in recession and expansion”. NBER Working Paper, National Bureau of Economic Research, Cambridge, MA.

Auerbach, Alan J., and Yuriy Gorodnichenko. 2017. Fiscal stimulus and fiscal sustainability. Cambridge, MA: National Bureau of Economic Research.

Benassy-Quere, Agnes, Markus Brunnermeier, Henrik Enderlein, Emmanuel Farhi, Marcel Fratzscher, Clemens Fuest, Pierre-Olivier Gourinchas, and others. 2018. “Reconciling risk sharing with market discipline: A constructive approach to Euro area reform.” CEPR Policy Insight 91, Centre for Economic Policy Research, London.

Blanchard, Olivier, Eugenio Cerutti, and Lawrence Summers. 2015. “Inflation and activity—two explorations and their monetary policy implications.” NBER Working Paper, National Bureau of Economic Research, Cambridge, MA.

Blanchard, Olivier J., and Daniel Leigh. 2013. Growth forecast errors and fiscal multipliers. Cambridge, MA: National Bureau of Economic Research.

Blanchard, Olivier J., and Lawrence H. Summers. 1986. “Hysteresis and the European unemployment problem”. In NBER Macroeconomics Annual 1986, vol. 1. Cambridge, MA: MIT Press.

Carnot, Nicolas, and Francisco de Castro Fernandez. 2015. The discretionary fiscal effort: An assessment of fiscal policy and its output effect. European Economy, Economic Paper 543, European Commission, Brussels.

Claeys, Gregory, Zsolt M. Darvas, and Alvaro Leandro. 2016. A proposal to revive the European fiscal framework. Brussels: Bruegel Policy Contribution.

Coibion, Olivier, Yuriy Gorodnichenko, and Mauricio Ulate. 2017. “The cyclical sensitivity in estimates of potential output.” NBER Working Paper, National Bureau of Economic Research, Cambridge, MA.

Coibion, Olivier, Yuriy Gorodnichenko, and Mauricio Ulate. 2018. Real-time estimates of potential GDP: Should the fed really be hitting the brakes?. Washington, DC: Policy Futures, Center on Budget and Policy Priorities.

Driscoll, John C., and Aart C. Kraay. 1998. Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics 80: 549–560.

Fatas, Antonio. 2000a. Do business cycles cast long shadows? Short-run persistence and economic growth. Journal of Economic Growth 5: 147–162.

Fatas, Antonio. 2000b. Endogenous growth and stochastic trends. Journal of Monetary Economics 45: 107–128.

Fatas, Antonio. 2018. “Fiscal policy, potential output and the shifting goalposts.” CEPR Discussion Paper DP13149, Centre for Economic Policy Research, London.

Fatas, Antonio, and Ilian Mihov. 2009. “Fiscal policy.” In EMU at Ten: Should Sweden, Denmark and the UK Join? Stockholm: SNS Economic Policy Group.

Fatas, Antonio, and Ilian Mihov. 2013. “Recoveries.” CEPR discussion paper, Centre for Economic Policy Research, London.

Fatas, Antonio, and Ilian Mihov, and Lawrence H. Summers. 2018. “The permanent effects of fiscal consolidations.” Journal of International Economics 238–250.

Friedman, M. 1993. The plucking model of business fluctuations revisited. Economic Inquiry 31: 171–177.

Gechert, Sebastian, Gustav A. Horn, Christoph Paetz, et al. 2017. Long-term effects of fiscal stimulus and austerity in Europe. Oxford Bulletin of Economics and Statistics 81 (3): 647–666.

Haltmaier, Jane. 2013. “Do recessions affect potential output? FRB International Finance Discussion Paper 1066, Federal Reserve Board, Washington, DC.

House, Christopher L., Linda L. Tesar, and Christian Probsting. 2017. “Austerity in the Aftermath of the Great Recession.” NBER Working Paper 23417, National Bureau of Economic Research, Cambridge, MA.

International Monetary Fund (IMF). 2015. “Where are we headed? Perspectives on potential output.” Chapter 3, World Economic Outlook, Washington, DC, April.

International Monetary Fund Independent Evaluation Office (IEO). 2014. “An Assessment of IMF Medium Term Forecasts of GDP Growth.” Washington, DC.

Irish Fiscal Advisory Council (IFAC). 2015. “The EU expenditure benchmark: Operational issues for Ireland in 2016.” Analytical Note 7, Dublin.

Jordà, Òscar, and Alan M. Taylor. 2016. The time for austerity: Estimating the average treatment effect of fiscal policy. Economic Journal 126: 219–255.

Kuang, Pei, and Kaushik Mitra. 2018. “Potential output pessimism and austerity in the European Union.” University of Birmingham.

Kuusi, Tero. 2017. Does the structural budget balance guide fiscal policy pro-cyclically? Evidence from the Finnish Great Depression of the 1990s. National Institute Economic Review 239: R14–R31.

Martin, Robert, and Beth Anne Wilson. 2013. Potential output and recessions: Are we fooling ourselves? Unpublished.

Mc Morrow, Kieran, Werner Roeger, and Valerie Vandermeulen. 2017. “Evaluating medium term forecasting methods and their implications for EU output gap calculations.” Economic and Financial Affairs Discussion Paper, European Commission, Brussels.

Neftçi, Salih N. 1984. Are economic time series asymmetric over the business cycle? Journal of Political Economy 92: 307–328.

Rawdanowicz, Łukasz, Romain Bouis, Kei-Ichiro Inaba, and Ane Kathrine Christensen. 2014. Secular stagnation: Evidence and implications for economic policy. Paris: Organisation for Economic Co-operation and Development.

Reifschneider, Dave, William Wascher, and David Wilcox. 2015. Aggregate supply in the United States: Recent developments and implications for the conduct of Monetary policy. IMF Economic Review 63: 71–109.

Stadler, George W. 1990. “Business cycle models with endogenous technology.” American Economic Review 763–778.

Turrini, Alessandro, and Martin Larch. 2009. “The cyclically-adjusted budget balance in EU fiscal policy making: A love at first sight turned into a mature relationship.” Economics Papers 374, Economic and Financial Affairs Discussion Paper, European Commission, Brussels.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This paper was prepared for the “The Euro at 20,” a conference organized by the IMF and the Central Bank of Ireland in Dublin, June 25–26, 2018. I would like to thank the discussant, the editors, and two anonymous referees as well as the conference participants for their helpful comments.

Data Appendix

Data Appendix

1.1 Country Groups

AMECO: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and UK.

IMF WEO: Austria, Belgium, Canada, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Luxembourg, Malta, The Netherlands, New Zealand, Norway, Portugal, Singapore, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Taiwan, UK, and USA.

Rights and permissions

About this article

Cite this article

Fatás, A. Fiscal Policy, Potential Output, and the Shifting Goalposts. IMF Econ Rev 67, 684–702 (2019). https://doi.org/10.1057/s41308-019-00087-z

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41308-019-00087-z