Abstract

In this paper, we examine the impact of distracting events to audit committee members on the firms’ earnings quality. Specifically, we focus on major events occurring simultaneously at other firms in which the audit committee members also serve as board members or CEOs. We find that during the years of major events, the number of board meetings at event firms significantly increases while there is no difference in board meetings at non-event firms. During this period, distracted directors miss more board meetings at the non-event firms than non-distracted directors. Consequently, firms with more distracted audit committee members have lower earnings quality. Our results indicate that director distractions, not director busyness, are associated with the decline in earnings quality. Notably, this decline in earnings quality at non-event firms is confined to the distraction years and audit committee members only. Our results have implications for shareholders and policy makers in assessing the tradeoffs between hiring experienced, qualified directors and the potential distractions that may result from their other commitments.

Similar content being viewed by others

Notes

The anecdote of Carolyn Woo serving as a director at both AON Corporation and NiSource Inc. provides a simple example. Ms. Woo missed more meetings at AON Corporation around the same time as the merger between NiSource and Columbia Energy. During the same period, the financial reporting quality at AON declines.

The filings can be obtained at http://securities.stanford.edu/filings.html.

To be exact, we define a distraction as occurring if the event date falls between 395 days before the fiscal year end to 30 days before the fiscal year end. We do this to allow the effect of the distraction to materialize in the meeting attendance data reported in the next proxy statement. Our results are similar if we define the distraction window as from the previous fiscal year end to this fiscal year end.

The sample period for our main analyses on earnings quality is from 1996 to 2018.

We use the number of board meetings as an observable measure of director workload and assume that non-observable measures of workload such as reading reports and traveling are highly correlated with board meetings (Gray and Nowland 2018).

References

Adams RB, Ferreira D (2008) Do directors perform for pay? J Acc Econ 46:154–171

Ahern KR, Harford J (2014) The importance of industry links in merger waves. J Finance 69:527–576

Booth JR, Deli DN (1996) Factors affecting the number of outside directorships held by CEOs. J Financ Econ 40:81–104

Brown AB, Dai J, Zur E (2016) The effect of director busyness on monitoring and advising: evidence from a natural experiment. Working Paper

Chou T-K, Feng H-L (2018) Multiple directorships and the value of cash holdings. Rev Quant Finance Acc 53:663–699

Cohen DA, Zarowin P (2010) Accrual-based and real earnings management activities around seasoned equity offerings. J Acc Econ 50:2–19

Cohen DA, Dey A, Lys TZ (2008) Real and accrual-based earnings management in the pre-and post-Sarbanes–Oxley periods. Acc Rev 83:757–787

Core JE, Holthausen RW, Larcker DF (1999) Corporate governance, chief executive officer compensation, and firm performance. J Financ Econ 51:371–406

Dechow P, Ge W, Schrand C (2010) Understanding earnings quality: a review of the proxies, their determinants and their consequences. J Acc Econ 50:344–401

Fama EF (1980) Agency problems and the theory of the firm. J Polit Econ 88:288–307

Fama EF, Jensen MC (1983) Separation of ownership and control. J Law Econ 26:301–325

Ferris SP, Jagannathan M, Pritchard AC (2003) Too busy to mind the business? Monitoring by directors with multiple board appointments. J Finance 58:1087–1111

Fich EM, Shivdasani A (2006) Are busy boards effective monitors? J Finance 61:689–724

Gande A, Lewis CM (2009) Shareholder-initiated class action lawsuits: shareholder wealth effects and industry spillovers. J Financ Quant Anal. https://doi.org/10.1017/S0022109009990202

Gray S, Nowland J (2018) Director workloads, attendance and firm performance. Acc Res J 31(2):214–231

Harford J, Schonlau RJ (2013) Does the director labor market offer ex post settling-up for CEOs? The case of acquisitions. J Financ Econ 110:18–36

Hauser R (2018) Busy directors and firm performance: evidence from mergers. J Financ Econ 128:16–37

Jones JJ (1991) Earnings management during import relief investigations. J Acc Res 29:193–228

Kaplan SN, Reishus D (1990) Outside directorships and corporate performance. J Financ Econ 27:389–410

Krouse S, Lublin JS (2017) Big investors want directors to stop sitting on so many boards. Wall Street J. https://www.wsj.com/articles/big-investors-want-directors-to-stop-sitting-on-so-many-boards-1506418201?st=3xdtsdtp6t07eek. Accessed 16 July 2020

Linck JS, Netter JM, Yang T (2008) The effects and unintended consequences of the Sarbanes–Oxley act on the supply and demand for directors. Rev Financ Stud 22:3287–3328

Masulis RW, Mobbs S (2014) Independent director incentives: Where do talented directors spend their limited time and energy? J Financ Econ 111:406–429

Masulis RW, Zhang EJ (2019) How valuable are independent directors? Evidence from external distractions. J Financ Econ 132:226–256

Muravyev A, Talavera O, Weir C (2016) Performance effects of appointing other firms’ executive directors to corporate boards: an analysis of UK firms. Rev Quant Finance Acc 46:25–45

Sharma VD, Iselin ER (2012) The association between audit committee multiple-directorships, tenure, and financial misstatements. Audit J Pract Theory 31:149–175

Stein LC, Zhao H (2019) Independent executive directors: how distraction affects their advisory and monitoring roles. J Corp Finance 56:199–223

Tanyi PN, Smith DB (2014) Busyness, expertise, and financial reporting quality of audit committee chairs and financial experts. Audit J Pract Theory 34:59–89

Wang RR, Verwijmeren P (2020) Director attention and firm value. Financ Manag 49:361–387

Acknowledgements

We would like to thank the Editor, Cheng-Few Lee, and an anonymous referee for helpful comments that improve the paper. We also thank Laurel Franzen, Timothy Haight, Larry Kalbers, Satoshi Koibuchi (discussant), Zining Li, David Offenberg, Micah Officer, Qian (Jane) Xie (discussant), and seminar participants at Loyola Marymount University, the 2018 Financial Management Association Annual Meeting, and the 2018 Western Economic Association International Annual Meeting for helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Definitions and sources of data used in this study

This appendix presents the definitions and sources of all variables used in this study

Director-firm-year variables

Variable | Definition | Source(s) |

|---|---|---|

Attend less than 75% of board meetings | Indicator variable in the ISS RiskMetrics database | ISS RiskMetrics |

Distracted director | Indicator variable equal to 1 if the director is experiencing a distracting event (lawsuit, merger, or acquisition) at another directorship | ISS RiskMetrics, Thomson Reuters SDC M&A, Securities Class Action Clearinghouse at Stanford University |

Audit committee member | Member or chairman of the audit committee | ISS RiskMetrics |

Director tenure | Number of years a director has served on the board | ISS RiskMetrics |

Director age | Director age | ISS RiskMetrics |

Director ownership | Percent of common shares outstanding held by the director, including fully exercised stock options | ISS RiskMetrics |

Number of independent directorships | Number of total independent directorships held by the director within the ISS RiskMetrics dataset | ISS RiskMetrics |

High-ranked directorship | Indicator variable equal to 1 if this directorship is at least 10% larger than the director’s smallest directorship as measured by market capitalization | ISS RiskMetrics |

Firm-year variables

Variable | Definition | Source(s) |

|---|---|---|

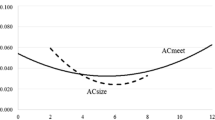

Absolute value of discretionary accruals | Modified–Jones model (see below) | Compustat |

Distracted audit committee members (% of audit committee size) | Number of distracted audit directors divided by number of directors on audit committee | ISS RiskMetrics |

Distracted independent directors (% of total independent directors) | Number of distracted directors divided by number of independent directors | ISS RiskMetrics |

Distracted audit committee members (% of total independent directors) | Number of directors who are both distracted and on audit committee divided by number of independent directors | ISS RiskMetrics |

Distracted non-audit committee members (% of total independent directors) | Number of directors who are both distracted and not audit committee members divided by number of independent directors | ISS RiskMetrics |

Less than 50% of the audit committee is distracted | An indicator variable equal to one if at least one audit committee member is distracted but less than 50% of the audit committee is distracted. | ISS RiskMetrics |

At least 50% of the audit committee is distracted | An indicator variable equal to one if at least 50% of the audit committee is distracted | ISS RiskMetrics |

Number of board meetings | Number of times the board meets during the year | ExecuComp, Corporate Library |

Post-SOX | Indicator variable equal to one if the fiscal year falls after 2001 | Compustat |

Ln (Assets) | Natural log of total assets (AT) | Compustat |

Return on Assets (ROA) | Operating Income/Assets (variable OIBDP/AT in Compustat) | Compustat |

Tobin’s Q | (Total assets − book value of equity + market value of equity)/Total Assets (AT − sum(SEQ, TXDB, ITCB, -PREF) + PRCC_C*CSHO)/AT | Compustat |

Loss | Indicator variable equal to one if income before extraordinary items (IB) is negative | Compustat |

Market leverage | (Long-term debt + Current debt)/(Total Assets − Book equity + Market cap) (DLTT + DLC)/(AT − CEQ + PRCC_F*CSHO) | Compustat |

Board size | Number of directors on the board | ISS RiskMetrics |

Percent independent directors | Number of independent directors on the board/Board size | ISS RiskMetrics |

CEO ownership | Percent of common shares outstanding at fiscal year-end owned by the CEO | ExecuComp and Compustat |

CEO tenure | Current year minus year became CEO | ExecuComp |

CEO-Chairman duality | Indicator variable equal to 1 if the CEO also serves as Chairman of the board | ExecuComp |

CEO bonus as % of total compensation | Bonus compensation as a percentage of total CEO compensation | ExecuComp |

Option grants as % of outstanding shares | New option grants during the fiscal year scaled by total outstanding shares | ExecuComp |

Unexercised exercisable options as % of outstanding shares | Number of unexercised options that have vested by fiscal year end, scaled by total outstanding shares | ExecuComp |

Unexercised un-exercisable options as % of outstanding shares | Number of unexercised options that have not vested by fiscal year end, scaled by total outstanding shares | ExecuComp |

Appendix 2: Modified Jones Model (Dechow et al. 2010)

For each 2-digit SIC industry group, we estimate Eq. (1) annually, requiring at least 8 observations for each industry-year combination and winsorize all of the regression variables at the 1% level.

Firm-specific discretionary accruals (DA) are computed as the residual from Eq. (1).

Variable | Definition | Compustat data item |

|---|---|---|

ibc | Earnings before extraordinary items | ibc |

cfo | Cash flow from operations | oancf − xidoc |

at | Total assets | at |

∆sales | Change in sales | sales |

∆rec | Change in net receivables | rect |

ppe | Gross property, plant, and equipment | ppegt |

Rights and permissions

About this article

Cite this article

Elkinawy, S., Spizman, J. & Tran, H. The effect of distracted audit committee members on earnings quality. Rev Quant Finan Acc 56, 1191–1219 (2021). https://doi.org/10.1007/s11156-020-00923-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-020-00923-8