Abstract

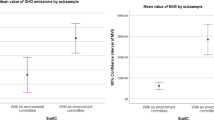

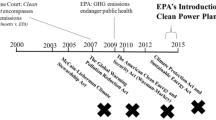

This paper examines the relationship between institutional pressure of national carbon pricing policy and the voluntary environmental disclosures (VED) of electricity-generating firms. Using a sample of 103 firms from forty-four countries for 2015–2017, we find that the implementation of carbon pricing policies at the national level increases the VED quantity significantly. Put differently, firms located in the carbon pricing countries disclose more environmental information than those in non-carbon pricing countries. Besides, we also provide evidence that firms adopting internal carbon reduction strategies disclose more information than firms with no carbon reduction strategies. Overall, our findings are consistent with the view of the coercive isomorphism branch of the institutional theory that the government's policy for one aspect of environmental issues (i.e., emissions reduction) may have a pervasive indirect impact on the other environmental aspects (i.e., VED) of the organizations.

Similar content being viewed by others

Notes

For further details, access to https://climate.nasa.gov/evidence/

Carbon tax is a type of charge on carbon emissions from the use of fossil fuel content (Hoeller and Coppel 1991).

ETS is a government-mandated cap-and-trade system that enables businesses to purchase a government 'permit' if they emit greenhouse gas to regulate emissions by offering financial incentives to achieve emission reduction targets (Stavins 2003).

Voluntary environmental disclosures entail the discretionary publication of information concerning firm’s environmental performance and activities (e.g., energy consumption, GHG emissions, water consumption, waste management, and biodiversity management) to broader stakeholders to remove information asymmetry (Borie et al. 2016).

According to DiMaggio and Powell (1983, p. 150), "Coercive isomorphism results from both formal and informal pressures exerted on organizations by other organizations upon which they are dependent and by cultural expectations within which organizations function.".

This annually released report offers a comprehensive summary of current and emerging global carbon pricing instruments, including international, national, and sub-national initiatives. It also examines trends in the development and implementation of carbon price instruments in the near future (World Bank 2019).

According to the Companies ACT 2006 (Strategic Report and Director’s) Regulation 201[1], UK is the first country that requires its firms to include GHG emission data in their annual reports. In 2012, France also introduced the “Grenelle II” law, which requires (in article 225) specific industries (our sample, electricity-generating sector fall in the category) to publish “social and environmental report” with their annual reports.

For further details, access to https://database.globalreporting.org/search

We note that the sample electricity firms of this study are not selected in a strictly random manner. Instead, they are chosen based on their domicile of origin in carbon pricing or non-carbon pricing countries. Although our test could suffer from selection bias as environmental disclosures are discretionary in nature (Clarkson et al. 2013); however, we believe that sample selection bias due to the selection process would be minimal for the following reasons. First, when firms voluntarily provide environmental disclosures, they do not consider these disclosures to be used for a research study. Even if they consider it, it is difficult to observe any incentives to bias the results because of the keen eye of the key stakeholders of the environmentally sensitive firms (Bewley and Li 2000). Second, the amount of environmental disclosure observed does show significant variation across the firms (see Table 3). Finally, we have selected all the sample firms (population) for each sample country. Thus, the concern for selectivity bias is reduced significantly.

Global Reporting Initiative (GRI) published G4 guidelines in 2013 and GRI standards in 2018. GRI guidelines are used by the companies to disclose their most significant effects—be they positive or negative—on the environment, society, and the economy.

The environmental performance index (EPI) score was repetitive for 2015 and 2016. EPI score for every country is produced jointly by Yale University and Columbia University in every 2 years. All environmental variables included in the EPI score calculation are inspired by the Millennium Development Goals set up by the United Nations (Halkos and Zisiadou 2018). For further details, access to https://epi.yale.edu/.

Eight percent of the sample does not have any VED, and twenty-seven percent of the sample had a VED score, following Wiseman (1982), below .3.

References

Abeywardana N, Panditharathna K (2016) The extent and determinants of voluntary disclosures in annual reports: evidence from banking and finance companies in Sri Lanka. Account Finance Res 5(4):147–162

Acerete B, Gasca M, Llena F (2019) Analysis of environmental financial reporting in the Spanish toll roads sector. Spanish J Finance Account/Revista Española de Financiación y Contabilidad 48(4):430–463

Al-Tuwaijri SA, Christensen TE, Hughes KE (2004) The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Acc Organ Soc 29(5):447–471. https://doi.org/10.1016/S0361-3682(03)00032-1

Alrazi B, Bahari NS, Husin NM (2016a) A preliminary analysis of carbon disclosure among the electricity generation companies in Asia. Int J Innov Technol Manag 7(2):67

Alrazi B, De Villiers C, Van Staden CJ (2016b) The environmental disclosures of the electricity generation industry: a global perspective. Account Bus Res 46(6):665–701

Andrew J, Cortese CL (2011) Carbon disclosures: Comparability, the carbon disclosure project and the greenhouse gas protocol. Aust Account Bus Finance J 5(4):5–18

Bae H (2014) Voluntary disclosure of environmental performance: Do publicly and privately owned organizations face different incentives/disincentives? Am Rev Public Admin 44(4):459–476

Baranzini A, Van den Bergh JC, Carattini S, Howarth RB, Padilla E, Roca J (2017) Carbon pricing in climate policy: seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip Rev Clim Change 8(4):e462

Bewley K, Li Y (2000) Disclosure of environmental information by Canadian manufacturing companies: a voluntary disclosure perspective, vol 1. Emerald Group Publishing Limited, Bingley

Birchall SJ, Murphy M, Milne MJ (2015) Evolution of the New Zealand voluntary carbon market: an analysis of CarboNZero client disclosures. Soc Environ Account J 35(3):142–156

Boesso G, Kumar K (2007) Drivers of corporate voluntary disclosure. Account Auditing Account J 20(2):269–296. https://doi.org/10.1108/09513570710741028

Borie S, Decq J, Wang X, Alberola E, Afriat M, Gourdon T (2016) Review of voluntary and regulatory carbon reporting by companies around the world. International Nuclear Information System, France. Retrieved from http://inis.iaea.org/search/search.aspx?orig_q=RN:48007335

Boyce JK (2018) Carbon pricing: effectiveness and equity. Ecol Econ 150:52–61

Braam GJ, de Weerd LU, Hauck M, Huijbregts MA (2016) Determinants of corporate environmental reporting: The importance of environmental performance and assurance. J Clean Product 129:724–734

Brammer S, Pavelin S (2006) Voluntary Environmental Disclosures by Large UK Companies. J Bus Finance Account 33(7–8):1168–1188. https://doi.org/10.1111/j.1468-5957.2006.00598.x

Brammer S, Pavelin S (2008) Factors influencing the quality of corporate environmental disclosure. Bus Strat Environ 17(2):120–136. https://doi.org/10.1002/bse.506

Bui B, Houqe MN, Zaman M (2020) Climate governance effects on carbon disclosure and performance. Br Account Rev 52(2):100880. https://doi.org/10.1016/j.bar.2019.100880

Campbell D, Shrives P, Bohmbach-Saager H (2001) Voluntary disclosure of mission statements in corporate annual reports: signaling what and to whom? Bus Soc Rev 106(1):65–87

Cho CH, Patten DM (2007) The role of environmental disclosures as tools of legitimacy: A research note. Acc Organ Soc 32(7):639–647

Choi BB, Lee D, Psaros J (2013) An analysis of Australian company carbon emission disclosures. Pacific Account Rev 25(1):58–79. https://doi.org/10.1108/01140581311318968

Choi JK, Bakshi BR, Haab T (2010) Effects of a carbon price in the US on economic sectors, resource use, and emissions: an input–output approach. Energy Policy 38(7):3527–3536

CIA (2013) The World Factbook 2012–13. Central Intelligence Agency, Langley

Clarkson PM, Fang X, Li Y, Richardson G (2013) The relevance of environmental disclosures: Are such disclosures incrementally informative? J Account Public Policy 32(5):410–431. https://doi.org/10.1016/j.jaccpubpol.2013.06.008

Clarkson PM, Li Y, Richardson GD, Vasvari FP (2008) Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Acc Organ Soc 33(4):303–327

Clarkson PM, Overell MB, Chapple L (2011) Environmental reporting and its relation to corporate environmental performance. Abacus 47(1):27–60

Cohen MA (2001) Information as a policy instrument in protecting the environment: what have we learned? Environ Law Reporter 31(4):10431

Cohen MA, Viscusi WK (2012) The role of information disclosure in climate mitigation policy. Climate Change Econ 3(4):1250020. https://doi.org/10.1142/S2010007812500200

Cormier D, Magnan M (1999) Corporate environmental disclosure strategies: determinants, costs and benefits. J Account Auditing Finance 14(4):429–451. https://doi.org/10.1177/0148558X9901400403

Cormier D, Magnan M, Van Velthoven B (2005) Environmental disclosure quality in large German companies: economic incentives, public pressures or institutional conditions? Eur Account Rev 14(1):3–39

Cowan S, Deegan C (2011) Corporate disclosure reactions to Australia’s first national emission reporting scheme. Account Finance 51(2):409–436. https://doi.org/10.1111/j.1467-629X.2010.00361.x

Cui L-B, Fan Y, Zhu L, Bi Q-H (2014) How will the emissions trading scheme save cost for achieving China’s 2020 carbon intensity reduction target? Appl Energy 136:1043–1052

D'Amico E, Coluccia D, Fontana S, Solimene S (2016) Factors influencing corporate environmental disclosure. Bus Strat Environ 25(3):178–192

da Silva Monteiro SM, Aibar-Guzmán B (2010) Determinants of environmental disclosure in the annual reports of large companies operating in Portugal. Corp Soc Responsib Environ Manag 17(4):185–204

de Aguiar TRS, Bebbington J (2014) Disclosure on climate change: Analysing the UK ETS effects. Account Forum 38(4):227–240. https://doi.org/10.1016/j.accfor.2014.10.002

Deegan C (2002) Introduction: The legitimising effect of social and environmental disclosures–a theoretical foundation. Account Auditing Account J 15(3):282–311

Deegan C (2013) Financial accounting theory, 4th edn. McGraw-Hill Australia, Sydney

Deegan C, Gordon B (1996) A study of the environmental disclosure practices of Australian corporations. Account Bus Res 26(3):187–199

Del Río P, Labandeira X (2009) Barriers to the introduction of market-based instruments in climate policies: an integrated theoretical framework. Environ Econ Policy Stud 10(1):41–68

Deswanto RB, Siregar SV (2018) The associations between environmental disclosures with financial performance, environmental performance, and firm value. Soc Respons J 14(1):180–193. https://doi.org/10.1108/SRJ-01-2017-0005

DiMaggio PJ, Powell WW (1983) The iron cage revisited: Collective rationality and institutional isomorphism in organizational fields. Am Sociol Rev 48(2):147–160

Dragomir VD (2010) Environmentally sensitive disclosures and financial performance in a European setting. J Account Org Change 6(3):359–388

Egbunike AP, Tarilaye N (2018) Firms specific attributes and voluntary environmental disclosure in nigeria: evidence from listed manufacturing companies. Acad Account Financial Stud J 21(3):1–9

Enache L, Hussainey K (2020) The substitutive relation between voluntary disclosure and corporate governance in their effects on firm performance. Rev Quant Financ Acc 54(2):413–445

Ferraro PJ, Uchida T (2007) Stock market reactions to information disclosure: new evidence from Japan’s pollutant release and transfer register. Environ Econ Policy Stud 8(2):159–171

Field AP (2009) Discovering statistics using SPSS : (and sex, drugs and rock'n'roll), 3rd edn. SAGE, London

Freedman M, Jaggi B (2009) Global warming and corporate disclosures: a comparative analysis of companies from the European Union, Japan and Canada. Adv Environ Account Manag 4:129–160

Fullerton D, Heutel G (2007) Who bears the burden of a tax on carbon emissions in Japan? Environ Econ Policy Stud 8(4):255–270

Gallego-Alvarez I, Ortas E, Vicente-Villardón JL, Álvarez Etxeberria I (2017) Institutional constraints, stakeholder pressure and corporate environmental reporting policies. Bus Strat Environ 26(6):807–825. https://doi.org/10.1002/bse.1952

Gamerschlag R, Möller K, Verbeeten F (2011) Determinants of voluntary CSR disclosure: empirical evidence from Germany. RMS 5(2):233–262. https://doi.org/10.1007/s11846-010-0052-3

Gao LS, Connors E (2011) Corporate environmental performance, disclosure and leverage: an integrated approach. International Review of Accounting, Banking and Finance, p 1

Garcia-Sanchez I-M, Cuadrado-Ballesteros B, Frias-Aceituno J-V (2016) Impact of the institutional macro context on the voluntary disclosure of CSR information. Long Range Plan 49(1):15–35

Giannarakis G, Zafeiriou E, Sariannidis N (2017) The Impact of carbon performance on climate change disclosure. Bus Strat Environ 26(8):1078–1094. https://doi.org/10.1002/bse.1962

Gonzalez-Gonzalez JM, Ramírez CZ (2016) Voluntary carbon disclosure by Spanish companies: an empirical analysis. IntJ Clim Change Strat Manag 8(1):57–69

Grauel J, Gotthardt D (2016) The relevance of national contexts for carbon disclosure decisions of stock-listed companies: a multilevel analysis. J Clean Product 133:1204–1217

Greene WH (2003) Econometric analysis, 8th edn. Pearson, New York, NY

GRI (2013) G4 Guidelines-Reporting principles and standard disclosures. GRI, Amsterdam

Guesser T, Hein N, Pfitscher ED, Lunkes RJ (2015) Environmental impact management of Brazilian companies: analyzing factors that influence disclosure of waste, emissions, effluents, and other impacts. J Clean Product 96:148–160

Habbash M, Hussainey K, Awad AE (2016) The determinants of voluntary disclosure in Saudi Arabia: an empirical study. IJAAPE 12(3):213–236

Halkos G, Zisiadou A (2018) Relating environmental performance with socioeconomic and cultural factors. Environ Econ Policy Stud 20(1):69–88

Harris J (2019) What drives voluntary greenhouse gas emissions disclosure? EDHEC Business School, France. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3508437

Hausman J (1978) Specification tests in econometrics. Econometrica (pre-1986) 46(6):1251. https://doi.org/10.2307/1913827

Henriques I, Sadorsky P (1996) The determinants of an environmentally responsive firm: an empirical approach. J Environ Econ Manag 30(3):381–395

Hoeller P, Coppel J (1991) Energy taxation and price distortions in fossil fuel markets: some implications for climate change policy. Economics Department. Working Papers No. 110. OECD, Paris

Huang C-L, Kung F-H (2010) Drivers of environmental disclosure and stakeholder expectation: evidence from Taiwan. J Bus Ethics 96(3):435–451

Ioannou I, Li SX, Serafeim G (2015) The effect of target difficulty on target completion: The case of reducing carbon emissions. Account Rev 91(5):1467–1492

IPCC (2014) Climate change 2014: impacts, adaptation, and vulnerabilit. Summaries, frequently asked questions, and cross-chapter boxes. A contribution of working group II to the fifth assessment report of the intergovernmental panel on climate change. Retrieved from http://ipccwg2.gov/AR5/images/uploads/WGIIAR5-TS_FGDall.pdf

ISO (2007) ISO 14000. Environmental management. International Organizaton for Standardization, Geneva

Jorgensen BN, Soderstrom NS (2006) Environmental disclosure within legal and accounting contexts: an international perspective. Columbia University, New York

Junior RM, Best P (2017) GRI G4 content index: Does it improve credibility and change the expectation–performance gap of GRI-assured sustainability reports? Sustainability Accounting, Management and Policy Journal 8(5):571–594

Kaufman N, Obeiter M, Krause E (2016) Putting a price on carbon: reducing emissions. World Resources Institute, Washington, DC. Retrieved from http://wri.org/carbonpricing

Kleimeier S, Viehs M (2018) Carbon disclosure, emission levels, and the cost of debt. Working Paper. Maastricht University. The Netherlands. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2719665

Kolk A, Levy D (2003) Multinationals and global climate change: issues for the automotive and oil industries. Res Glob Strat Manag 9:171–193. https://doi.org/10.1016/S1064-4857(03)09008-9

Kolk A, Levy D, Pinkse J (2008) Corporate responses in an emerging climate regime: the institutionalization and commensuration of carbon disclosure. Eur Account Rev 17(4):719–745

Kolk A, Perego P (2010) Determinants of the adoption of sustainability assurance statements: An international investigation. Bus Strat Environ 19(3):182–198

Kumar S, Shetty S (2018) Does environmental performance improve market valuation of the firm: evidence from Indian market. Environ Econ Policy Stud 20(2):241–260

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Finance 52(3):1131–1150

Lahouel BB (2016) Eco-efficiency analysis of French firms: a data envelopment analysis approach. Environ Econ Policy Stud 18(3):395–416

Lan Y, Wang L, Zhang X (2013) Determinants and features of voluntary disclosure in the Chinese stock market. China J Account Res 6(4):265–285. https://doi.org/10.1016/j.cjar.2013.04.001

Li A, Lin B (2013) Comparing climate policies to reduce carbon emissions in China. Energy Policy 60:667–674

Li D, Huang M, Ren S, Chen X, Ning L (2018) Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J Bus Ethics 150(4):1089–1104

Luo L (2019) The influence of institutional contexts on the relationship between voluntary carbon disclosure and carbon emission performance. Account Finance 59(2):1235–1264

Luo L, Tang Q (2014) Does voluntary carbon disclosure reflect underlying carbon performance? J Contemporary Account Econ 10(3):191–205

Mateo-Márquez AJ, González-González JM, Zamora-Ramírez C (2019) Countries’ regulatory context and voluntary carbon disclosures. Sustain Account Manag Policy J 11(2):383–408

Meng L, Guo J, e., Chai, J., & Zhang, Z. (2011) China’s regional CO2 emissions: characteristics, inter-regional transfer and emission reduction policies. Energy Policy 39(10):6136–6144

Moroney R, Windsor C, Aw YT (2012) Evidence of assurance enhancing the quality of voluntary environmental disclosures: an empirical analysis. Account Finance 52(3):903–939

Nobanee H, Ellili N (2016) Corporate sustainability disclosure in annual reports: Evidence from UAE banks: Islamic versus conventional. Renew Sustain Energy Rev 55:1336–1341

Orazalin N, Mahmood M (2018) Economic, environmental, and social performance indicators of sustainability reporting: Evidence from the Russian oil and gas industry. Energy Policy 121:70–79

Pinnuck M, Ranasinghe A, Soderstrom NS, Zhou J (2019) Restatement of CSR reports: frequency, magnitude, and determinants. Magnitude, and Determinants. Working Paper. University of Melbourne, Australia. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3095090

Plumlee M, Brown D, Hayes RM, Marshall RS (2015) Voluntary environmental disclosure quality and firm value: Further evidence. J Account Public Policy 34(4):336–361

Post J, Preston L (2012) Private management and public policy the principle of public responsibility. Stanford University Press, Palo Alto

Prado-lorenzo JM, Gallego-alvarezGarcia-sanchez IIM (2009) Stakeholder engagement and corporate social responsibility reporting: the ownership structure effect. Corp Soc Responsib Environ Manag 16(2):94–107. https://doi.org/10.1002/csr.189

Rahman S (2018) Impact of carbon pricing on voluntary environmental disclosures of electricity generating sector: a multi country analysis. RMIT University, Melbourne

Rahman S, Khan T, Siriwardhane P (2019) Sustainable development carbon pricing initiative and voluntary environmental disclosures quality. Bus Strat Environ 28(6):1072–1082

Rankin M, Windsor C, Wahyuni D (2011) An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system: Australian evidence. Account Audit Account J 24(8):1037–1070

Reid EM, Toffel MW (2009) Responding to public and private politics: Corporate disclosure of climate change strategies. Strateg Manag J 30(11):1157–1178

Reynolds T, Flores A (1989) Foreign law: Current sources of basic legislation in jurisdictions of the world. Rothman and Co., Littleton

Ronaghi M, Reed M, Saghaian S (2020) The impact of economic factors and governance on greenhouse gas emission. Environ Econ Policy Stud 22(2):153–172

Rowlands I (2000) Beauty and the beast? BP's and Exxon's positions on global climate change. Environ Plann C Gov Policy 18(3):339

Sampong F, Song N, Boahene KO, Wadie KA (2018) Disclosure of CSR performance and firm value: New evidence from South Africa on the basis of the GRI guidelines for sustainability disclosure. Sustainability 10(12):4518

Shetty S, Kumar S (2017) Are voluntary environment programs effective in improving the environmental performance: evidence from polluting Indian Industries. Environ Econ Policy Stud 19(4):659–676

Stanny E (2013) Voluntary disclosures of emissions by US firms. Bus Strat Environ 22(3):145–158

Stanny E (2018) Reliability and Comparability of GHG Disclosures to the CDP by US Electric Utilities. Soc Environ Account J 38(2):111–130

Stavins RN (2003) Experience with market-based environmental policy instruments. In: Mäler K-G, Vincent JR (eds) Handbook of environmental economics, vol 1. Environmental Degradation and Institutional Responses. Elsevier Sci., Amsterdam, pp 355–435

Suchman MC (1995) Managing legitimacy: strategic and institutional approaches. Acad Manag Rev 20(3):571–610

Suijs J, Wielhouwer JL (2019) Disclosure policy choices under regulatory threat. RAND J Econ 50(1):3–28. https://doi.org/10.1111/1756-2171.12260

Sumiani Y, Haslinda Y, Lehman G (2007) Environmental reporting in a developing country: a case study on status and implementation in Malaysia. J Clean Product 15(10):895–901. https://doi.org/10.1016/j.jclepro.2006.01.012

Szklo AS, Schaeffer R, Schuller ME, Chandler W (2005) Brazilian energy policies side-effects on CO2 emissions reduction. Energy Policy 33(3):349–364

Tang Q, Luo L (2012) Transparency of corporate carbon disclosure: international evidence. J Int Financial Manag Account 23(2):93–120. https://doi.org/10.2139/ssrn.1885230

Unerman J, O’Dwyer B (2007) The business case for regulation of corporate social responsibility and accountability. Account Forum 31(4):332–353

Van Staden CJ, Hooks J (2007) A comprehensive comparison of corporate environmental reporting and responsiveness. Br Account Rev 39(3):197–210

Villiers Cd, van Staden CJ (2011) Where firms choose to disclose voluntary environmental information. J Account Public Policy 30(6):504–525. https://doi.org/10.1016/j.jaccpubpol.2011.03.005

Wegener M, Elayan FA, Felton S, Li J (2013) Factors influencing corporate environmental disclosures. Accounting Perspectives 12(1):53–73

Wiseman J (1982) An evaluation of environmental disclosures made in corporate annual reports. Acc Organ Soc 7(1):53–63. https://doi.org/10.1016/0361-3682(82)90025-3

World Bank (2019) State and trends of carbon pricing 2019. World Bank, Washington

Zeng S, Xu X, Yin H, Tam CM (2012) Factors that drive Chinese listed companies in voluntary disclosure of environmental information. J Bus Ethics 109(3):309–321

Zhao L, Yang C, Su B, Zeng S (2020) Research on a single policy or policy mix in carbon emissions reduction. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.122030

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Anwar, M., Rahman, S. & Kabir, M.N. Does national carbon pricing policy affect voluntary environmental disclosures? A global evidence. Environ Econ Policy Stud 23, 211–244 (2021). https://doi.org/10.1007/s10018-020-00287-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-020-00287-2

Keywords

- Carbon pricing

- Emission reduction

- Electricity-generating firms

- Voluntary environmental disclosures (VED)