Abstract

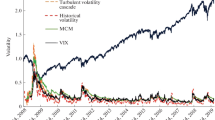

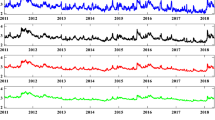

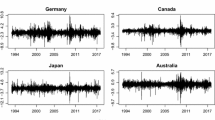

We analyze empirical evidence of flocking stock volatilities according to the Cucker–Smale (C–S) mechanism. By using daily realized volatilities of stocks listed on Dow Jones Industrial Average from January, 2007 to December, 2009, we calibrate key parameters such as time-varying coupling strength, communication weight and stochastic noise in coupling of a benchmark C–S model in Bae et al. (Math Models Methods Appl Sci 25:1299–1335, 2015). Our numerical solutions show that the flocking mechanism explains average volatility dynamics better than a stochastic volatility model without the mechanism over the sample period. The model’s empirical implications are found from cyclicality of Volatility Flocking Index (VFI), an aggregate measure of differences between volatilities. Results from Granger causality tests after vector autoregression estimation show that VFI helps us predict the implied volatility index, and weighted average return of S&P500 Index.

Source: Authors’ calculation based on the price data provided by Thomson Reuters Eikon. (Color figure online)

Similar content being viewed by others

Notes

The list of firms is available in the “Appendix A”.

The results are available upon request.

We may compare cyclical movement of the \(VFI_t\) with some macro variables such as interest rates, term spread, credit spread, and monetary aggregates (M1, M2, and M3). VIX and the rate of return of S&P500 show a stock market’s signal in a timely manner relative to production indicators including “Building Permit” and industrial production.

We find that VFI is a stationary process according to results of augmented Dickey–Fuller test. These test results are available upon request.

References

Ahn, S., Bae, H., Ha, S., Kim, Y., & Lim, H. (2013). Application of flocking mechanism to the modeling of stochastic volatility. Mathematical Models and Methods in Applied Science, 23(9), 1603–1628.

Andersen, T. (1996). Return volatility and trading volume: An information flow interpretation of stochastic volatility. The Journal of Finance, 51(1), 169–204.

Andersen, T., Bollerslev, T., Diebold, F., & Ebens, H. (2001). The distribution of realized stock return volatility. Journal of Financial Economics, 61(1), 43–76.

Andersen, T. G., Bollerslev, T., & Diebold, F. X. (2002). Parametric and nonparametric volatility measurement. Cambridge, MA: National Bureau of Economic Research.

Andersen, T. G., Bollerslev, T., Diebold, F. X., & Labys, P. (2003). Modeling and forecasting realized volatility. Econometrica, 71(2), 579–625.

Ang, A., & Chen, J. (2002). Asymmetric correlations of equity portfolios. Journal of Financial Economics, 63(3), 443–494.

Avery, C., & Zemsky, P. (1998). Multidimensional uncertainty and herd behavior in financial markets. The American Economic Review, 88(4), 724–748.

Bae, H., Ha, S., Kim, Y., Lee, S., Lim, H., & Yoo, J. (2015). A mathematical model for volatility flocking with a regime switching mechanism in a stock market. Mathematical Models and Methods in Applied Science., 25(7), 1299–1335.

Baillie, R., & Bollerslev, T. (1996). Fractionally intergrated generalized autoregressive conditional heteroskedasticity. Journal of Econoometrics, 74(1), 3–30.

Bellomo, N. (2008). Modeling complex living systems: A kinetic theory and stochastic game approach approach. Boston: Birkhäuser.

Bellomo, N., Bellouquid, A., Nieto, J., & Soler, J. (2010b). Multiscale biological tissue models and flux-limited chemotaxis for multicellular growing systems. Mathmatical Models Methods and Applied Science, 20, 1179–1207.

Bellomo, N., Berestycki, H., Brezzi, F., & Nadal, J. (2010a). Mathematics and complexity in life and human sciences. Mathmatical Models Methods and Applied Science, 20, 1391–1395.

Bellomo, N., Knopoff, D., & Soler, J. (2013). On the difficult interplay between life, “complexity”, and mathematical sciences. Mathmatical Models Methods and Applied Science, 23(10), 1861–1913.

Bertotti, M., & Delitala, M. (2008). Conservation laws and asymptotic behavior of a model of social dynamics. Nonlinear Analysis Real World Applications, 9, 183–196.

Bertotti, M., & Delitala, M. (2010). Cluster formation in opinion dynamics: A qualitative analysis. Zeitschrift für Angewandte Mathematik und Physik, 61, 583–602.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(May/June), 637–654.

Blasco, N., Corredor, P., & Ferreruela, S. (2012). Does herding affect volatility? Implications for the Spanish stock market. Quantitative Finance, 12(2), 311–327.

Bollerslev, T., Engle, R. F., & Wooldridge, J. M. (1988). A capital asset pricing model with time-varying covariances. Journal of Political Economy, 96(1), 116–131.

Chandrasekhar, C. K., Bagyalakshmi, H., Srinivasan, M. R., & Gallo, M. (2016). “Partial ridge regression under multicollinearity. Journal of Applied Statistics, 43(13), 2462–2473.

Chou, R. (2006). Volatility persistence and stock valuations: Some empirical evidence using GARCH. Journal of Applied Econometrics, 3(4), 279–294.

Christie, A. (1982). The stochastic behavior of common stock variances: Value, leverage, and interest rate effects. Journal of Financial Economics, 10(4), 407–432.

Cucker, F., & Smale, S. (2007). Emergent behavior in flocks. IEEE Transactions on Automatic Control, 52(5), 852–862.

Di Masi, G. B., Kabanov, Y. M., & Runggaldier, W. J. (1995). Mean-variance hedging of options on stocks with Markov volatilities. Theory of Probability and its Applications, 39(1), 172–182.

Engle, R. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50(4), 987–1007.

Engle, R., & Ng, V. (1993). Measuring and testing the impact of news on volatility. The Journal of Finance, 48(5), 1749–1778.

Erb, C., Campbell, R., & Harvey, T. V. (1994). Forecasting international equity correlations. Financial Analysts Journal, 50(6), 32–45.

Fama, E. (1965). The behavior of stock-market prices. The Journal of Business, 38(1), 34–105.

Fetecau, R. C., & Eftimie, R. (2010). An investigation of a nonlocal hyperbolic model for self-organization of biological groups. Journal of mathematical biology, 61(4), 545–579.

Franses, P. H., & Van Dijk, D. (2000). Non-linear time series models in empirical finance. Cambridge: Cambridge University Press.

Galam, S., Gefen, Y., & Shapir, Y. (1982). Sociophysics: A new approach of sociological collective behavior. Journal of Mathematical Sociology, 9(1), 1–13.

Galam, S., & Zucker, J. (2000). From individual choice to group decision-making. Physica A, 287(3–4), 644–659.

Gourieroux, C., & Monfort, A. (1997). Time series and dynamic models (Vol. 3). Cambridge: Cambridge University Press.

Graham, J. (1999). Herding among investment newsletters: Theory and evidence. Journal of Finance, 54(1), 237–268.

Guilkey, D. K., & Murphy, J. L. (1975). Directed ridge regression techniques in cases of multicollinearity. Journal of the American Statistical Association, 70(352), 769–775.

Hafner, C. M., & Herwartz, H. (1998). Structural analysis of portfolio risk using beta impulse response functions. Statistica Neerlandica, 52(3), 336–355.

Ha, S., Jeong, E., Kang, J., & Kang, K. (2012). Emergence of multi-cluster configurations from attractive and repulsive interactions. Mathematical Models and Methods in Applied Science, 22(8), 1250013.

Ha, S., Lee, K., & Kim, K. (2013). A mathematical model for multi-name credit based on the community flocking. Quantitative Finance, 15(5), 841–851.

Ha, S. Y., Lee, K., & Levy, D. (2009). Emergence of time-asymptotic flocking in a stochastic Cucker–Smale system. Communications in Mathematical Sciences, 7(2), 453–469.

Ha, S. Y., & Tadmor, E. (2008). From particle to kinetic and hydrodynamic description of flocking. Kinetic and Related Models, 1(3), 415–435.

Hamao, Y., Masulis, R., & Ng, V. (1990). Correlations in price changes and volatility across international stock markets. Review of Financial Studies, 3(2), 281–307.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatilities. Journal of Finance, 42(2), 281–300.

Kang, J. H., Ha, S. Y., Kang, K. K., & Jeong, E. (2014). How do cultural class emerge from assimilation and distinction? An extension of the Cucker–Smale model. Journal of Mathematical Sociology, 38(1), 47–71.

Lin, W., Engle, R., & Ito, T. (1994). Do bulls and bears move across borders? International transmission of stock returns and volatility. Review of Financial Studies, 7(3), 507–538.

Natividad, B., Pilar, C., & Sandra, F. (2012). Does herding affect volatility? Implications for the Spanish stock market. Quantitative Finance, 12(2), 311–327.

Nelson, D. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59(1), 347–370.

Park, A., & Sabourian, H. (2011). Herding and contrarian behavior in financial markets. Econometrica, 79(4), 973–1026.

Poon, S.-H., & Granger, C. W. J. (2003). Forecasting volatility in financial markets: A review. Journal of Economic Literature, 41(2), 478–539.

Stein, E., & Stein, J. (1991). Stock price distributions with stochastic volatility: An analytic approach. Review of Financial Studies, 4(4), 727–752.

Vicsek, T., Czirók, A., Ben-Jacob, E., Cohen, I., & Schochet, O. (1995). Novel type of phase transition in a system of self-driven particles. Physical Review Letters, 75, 1226–1229.

Wagner, F. (2003). Volatility cluster and herding. Physica A: Statistical Mechanics and its Applications, 322, 607–619.

Weidlich, W. (2003). Sociodynamics—A systematic approach to mathematical modelling in the social sciences. Chaos, Solitons and Fractals, 18(3), 431–437.

Wiggins, J. (1987). Option values under stochastic volatility. Journal of Financial Economics, 19(2), 351–372.

Author information

Authors and Affiliations

Corresponding author

Additional information

Bae (2018R1D1A1A09082848), Ha (NRF-2017R1A2B2001864), Kim (NRF-2016R1D1A1A09917026), Lim (NRF-2019R1I1A3A03059382) and Yoo (NRF-2017S1A5A8022379) were supported by National Research Foundation (NRF) of Republic of Korea. Bae and Yoo were supported by Ajou university research fund.

Rights and permissions

About this article

Cite this article

Bae, HO., Ha, SY., Kim, Y. et al. Volatility Flocking by Cucker–Smale Mechanism in Financial Markets. Asia-Pac Financ Markets 27, 387–414 (2020). https://doi.org/10.1007/s10690-019-09299-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-019-09299-9