Abstract

Estimating potential output and the corresponding output gap plays a key role, not only for inflation forecasting and the assessment of the economic cycle, but also for the fiscal governance of the European Union (EU). Potential output is, however, an unobservable and extremely uncertain variable. Empirical measurements differ considerably depending on the econometric approach adopted, the specification of the data generating process and the dataset used. The method adopted at the EU level, which was agreed within the Output Gap Working Group, has been subject to considerable debate. The fiscal councils of the various Member States contribute to the discussion over the output gap modelling. This paper aims at estimating the potential output of the Italian economy, using a combination of five different models proposed by the relevant literature. More specifically, in addition to a statistical filter, we use unobserved components models based on the Phillips curve, the Okun law and the production function. The approach adopted allows to reconcile the parsimony of the econometric specification with the economic interpretation of the results. Estimates of the output gap obtained with the five selected models present important properties: low pro-cyclicity, stability with respect to the preliminary data and consistency with the economic theory. The use of multiple models also enables the construction of confidence bands for the output gap estimates, which are helpful for policy analysis. In the empirical application for Italy, estimates and forecasts of the output gap recently produced by relevant organisations tend to fall within the confidence interval calculated on the basis of the five selected models.

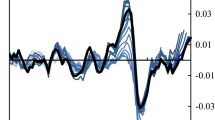

The confidence bands were constructed by adding and subtracting twice the conditional standard deviation of the component. The lower left-hand panel shows the difference between inflation and expectations and the exogenous variables (\(\pi _t-{\tilde{\gamma }}_e \pi _t^e-\sum _k {\tilde{\beta }}_k x_{kt}\)) along with the contribution of the output gap to inflation

The confidence bands were constructed by adding and subtracting twice the conditional standard deviation of the component. The lower left-hand panel shows the difference between inflation and expectations and the exogenous variables (\(\pi _t-{\tilde{\gamma }}_e \pi _t^e-\sum _k {\tilde{\beta }}_k x_{kt}\)) along with the contribution of the output gap to inflation

Similar content being viewed by others

Notes

For more on this issue, see PBO Focus Paper (2015) “The new policies of the European Commission on flexibility in the Stability and Growth Pact”, no. 1 (in Italian).

See Cacciotti et al. (2017).

It adopts a classic approach based on the likelihood for the Phillips curve leading to the calculation of the NAWRU. A Bayesian estimation is made to estimate the trend of TFP, and the HP filter is applied to decompose the other components of output.

The estimates of the MEF and the EC differ because the macroeconomic forecasts of the two institutions are different and because they reflect the choices of certain initial parameters (constraints on the variances of the stochastic processes of NAWRU and the a priori of the TFP model), which have an appreciable impact.

Expectations are drawn from the Bank of Italy’s survey of inflation and growth expectations, reconstructed backwards on the basis of previous surveys.

For the specification of the trend, various alternative formulations were assessed, partly reflecting the observations of Frale and De Nardis (2018).

The parameter \(\alpha\) has been estimated empirically at 0.63 and approximated at 0.65 by the European Commission.

Taking the unemployment rate \(U_t\) (in the original scale, not as a percentage) in place of \(e_t\) is equivalent: if we start with \(e_t = \log (1-U_t)\) and take the first-order Taylor approximation around the average unemployment rate \({\bar{U}}\), we have \(e_t = \frac{{\bar{U}}}{1-{\bar{U}}} + \log (1-{\bar{U}}) -\frac{1}{1-{\bar{U}}} U_t\). For the Italian case, the approximation has an average margin of error on the order of \(10^{-4}.\)

As it is a univariate filter, combining the cyclical components of the variables in (4) (labour, capital and TFP) gives the same result as directly applying the filter to GDP.

As demonstrated by King and Rebelo (1993), the estimator of the trend obtained with an HP filter can be derived equivalently using the Kalman filter and the associated smoothing algorithm for the corresponding state space form with appropriate restrictions. For the state space approach, see Harvey (1989) and Durbin and Koopman (2012).

Nevertheless, the filter is supported in terms of the likelihood compared with the unconstrained filter.

In this regard, it has been demonstrated (Hogg et al. 2015) that the interval between the maximum and minimum estimates is a confidence range around a median value. The only hypothesis that needs to be verified is that the reference variable is continuous, while no specific hypothesis is required concerning the probability distribution.

References

Ball, L., D. Leigh, and P. Loungani. 2017. Okun’s law: Fit at 50? Journal of Money, Credit and Banking 49(7): 1413–1441.

Ball, L., and S. Mazumder. 2011. Inflation dynamics and the great recession. NBER Working Papers No. 17044. National Bureau of Economic Research.

Bassanetti, A., M. Caivano, and A. Locarno. 2010. Modelling Italian potential output and the output gap (Temi di discussione (Economic working papers) No. 771). Bank of Italy, Economic Research and International Relations Area.

Blanchard, O. 2016. The Phillips curve: Back to the ‘60s? American Economic Review 106(5): 31–34.

Cacciotti, M., R. Conti, R. Morea, and S. Teobaldo. 2017. The estimation of potential output for Italy: An enhanced methodology. Rivista Internazionale di Scienze Sociali (4/2018): 351–388.

Casey, E. 2018. Inside the “Upside Down”: Estimating Ireland’s Output Gap. Working Paper No. 5. Irish Fiscal Advisory Council.

CBO. 2001. CBO’s Method for Estimating Potential Output: An Update. Congressional Budget Office Paper.

Clark, P.K. 1989. Trend reversion in real output and unemployment. Journal of Econometrics 40(1): 15–32.

Coibion, O., and Y. Gorodnichenko. 2015. Is the Phillips curve alive and well after all? Inflation expectations and the missing disinflation. American Economic Journal Macroeconomics 7(1): 197–232.

Cuerpo, C., Á. Cuevas, and E.M. Quilis. 2018. Estimating output gap: A beauty contest approach. SERIEs: Journal of the Spanish Economic Association 9(3): 275–304.

De Masi, P. 1997. IMF estimates of potential output: Theory and practice. Working Paper No. 177. International Monetary Fund.

Durbin, J., and S.J. Koopman. 2012. Time Series Analysis by State Space Methods, 2nd ed. Oxford: Oxford University Press.

ECB. 2018. ECB Economic Bulletin (Vol. 7). European Central Bank.

EUIFIs. 2018. A Practitioner’s Guide to Potential Output and the Output Gap. EUIFIs Papers and Reports.

Fantino, D. 2018. Potential output and microeconomic heterogeneity (Temi di discussione (Economic working papers) No. 1194). Bank of Italy, Economic Research and International Relations Area.

Fioramanti, M. 2015. Potential output, output gap and fiscal stance: Is the EC estimation of the NAWRU too sensitive to be reliable. Italian Fiscal Policy Review 1: 123.

Fioramanti, M., F. Padrini, and C. Pollastri. 2015. La stima del PIL potenziale e dell’output gap: analisi di alcune criticità. Nota di lavoro UPB 1.

Fioramanti, M., and R.J. Waldmann. 2017. The Econometrics of the EU Fiscal Governance: Is the European Commission methodology still adequate?. Rivista Internazionale di Scienze Sociali (4/2017): 389–404.

Frale, C., and S. De Nardis. 2018. Which gap? Alternative estimations of the potential output and the output gap in the Italian economy. Politica economica 34(1): 3–22.

Giorno, C., P. Richardson, D. Roseveare, and P. van den Noord. 1995. Estimating Potential Output, Output Gaps and Structural Budget Balances. OECD Economics Department Working Papers No. 152. OECD Publishing.

Gordon, R.J. 1997. The time-varying NAIRU and its implications for economic policy. Journal of Economic Perspectives 11(1): 11–32.

Harvey, A. 1989. Forecasting, Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge University Press.

Havik, K., K. Mc Morrow, F. Orlandi, C. Planas, R. Raciborski, W. Röger, A. Rossi, A. Thum-Thysen, and V. Vandermeulen. 2014. The Production Function Methodology for Calculating Potential Growth Rates & Output Gaps. European Economy Economic Papers No. 535. Directorate General Economic and Financial Affairs (DG-ECFIN), European Commission.

Hodrick, R.J., and E.C. Prescott. 1997. Postwar US business cycles: An empirical investigation. Journal of Money, Credit, and Banking 29(1): 1–16.

Hogg, R.V., E. Tanis, and D. Zimmerman. 2015. Probability and Statistical Inference, 9th ed. Pearson: Oxford University Press.

Jarociński, M., and M. Lenza. 2018. An inflation-predicting measure of the output gap in the Euro area. Journal of Money, Credit and Banking 50(6): 1189–1224.

King, R.G., and S.T. Rebelo. 1993. Low frequency filtering and real business cycles. Journal of Economic Dynamics and Control 17(1): 207–231.

Kuttner, K.N. 1994. Estimating potential output as a latent variable. Journal of Business & Economic Statistics 12(3): 361–368.

Mavroeidis, S., M. Plagborg-Møller, and J.H. Stock. 2014. Empirical evidence on inflation expectations in the new Keynesian Phillips curve. Journal of Economic Literature 52(1): 124–188.

Murray, J. 2014. Output Gap measurement: Judgement and uncertainty. Working Paper No. 5. Office for Budget Responsibility.

Okun, A.M. 1962. Potential GNP: Its measurement and significance. In Proceedings of the Business and Economics Statistics Section, American Statistical Association, 98–103.

Orphanides, A., and S. Van Norden. 2002. The unreliability of output-gap estimates in real time. The Review of Economics and Statistics 84(4): 569–583.

Parigi, G., and S. Siviero. 2001. An investment-function-based measure of capacity utilisation: Potential output and utilised capacity in the Bank of Italy’s quarterly model. Economic Modelling 18(4): 525–550.

Proietti, T., A. Musso, and T. Westermann. 2007. Estimating potential output and the output gap for the Euro area: A model-based production function approach. Empirical Economics 33(1): 85–113.

Shackleton, R. 2018. Estimating and Projecting Potential Output Using CBO’s Forecasting Growth Model. Working Papers No. 03. Congressional Budget Office.

Szörfi, B., and M. Töth. 2018. Measures of slack in the Euro area. Economic Bulletin No. 3. European Central Bank.

Vetlov, I., M. Pisani, T. Hlédik, M. Jonsson, and H. Kucsera. 2011. Potential Output in DSGE Models. Working Paper Series No. 1351. European Central Bank.

Yule, G.U. 1927. On a method of investigating periodicities disturbed series, with special reference to Wolfer’s sunspot numbers. Philosophical Transactions of the Royal Society of London. Series A, Containing Papers of a Mathematical or Physical Character 22(6): 267–298.

Zizza, R. 2006. A measure of output gap for Italy through structural time series models. Journal of Applied Statistics 33(5): 481–496.

Acknowledgements

We are very grateful to Giuseppe Pisauro, Chiara Goretti and Alberto Zanardi for supporting the research project from which this article originated. We also thank Sergio De Nardis for his insightful comments and suggestions in the initial phase of the project. Finally we thank the anonymous referees for their careful reading that helped improving the quality of the manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The European Commission Model

In the CAM, the estimates of the potential level of four variables are aggregated within the framework of the production function (see Havik et al. 2014). Total Factor Productivity—TFP (A), unemployment rate (U), participation rate (PR) and hours worked per worker (H). For the last two series, a univariate decomposition using the Hodrick-Prescott filter is adopted. The greatest modelling effort has been devoted to the specification and estimation of the two bivariate models for the two remaining components. The TFP model is treated with Bayesian inference, while that for the NAWRU is based on a maximum likelihood approach. The output decomposition model is not log-additive. A mixed multiplicative-additive approach is adopted (as far as the NAWRU is concerned). The CAM obtains the potential value of TFP using a bivariate structural model that links the logarithm of the Solow residual to a cyclical composite indicator (the CUBS, obtained as a weighted average of measurements from qualitative surveys of capacity utilisation in the manufacturing sector and the climate of confidence in construction and services).

Potential labour input (in terms of total hours worked) is obtained first by factoring L into the product of four components:

where H is the number of annual hours per employed person, E is the employment rate, PR is the participation rate (active population of working age) and POP is the population of working age (those aged 15–74).

The potential level for PR and H is obtained by applying the Hodrick-Prescott filter, while for \(E=1-U\), where U is the unemployment rate, the following decomposition is used

where the subscript P indicates the potential level of the variable. In addition to information drawn from the characteristics of the series and extracted through decomposition of unobserved components, the natural unemployment rate (Non-Accelerating Wage Rate of Unemployment) is obtained using information from the Phillips curve that links the growth rate of wages to cyclical unemployment, represented as a second-order autoregressive process. We thus have

The EC’s estimate of the NAWRU for Italy is based on the accelerationist version of the Phillips curve (see Havik et al. 2014), such that a reduction in the inflation rate in wages is associated with a positive unemployment gap (i.e. the NAWRU is below the observed rate). The estimate is then corrected by an ad hoc procedure for anchoring it to a long-term reference value obtained using a panel estimate that explains the unemployment rate as a function of structural variables for the labour market. The constraints adopted by the EC give rise to procyclical estimates of the NAWRU. Fioramanti (2015) has studied the role played by the constraints imposed on the variance of the model’s stochastic disturbances, highlighting how the choice of upper and lower limits crucially determines the evolution of NAWRU over time.

The Bivariate Model with Output and Inflation

The bivariate model presented in “The Bivariate Model with Output and Inflation” section can be represented as follows:

in which the GDP series, \(y_t\), is decomposed into trend \(\mu _{t}\) and cycle \(\psi _{t}\) and the inflation series \(\pi _t\), measured using the GDP deflator, follows a standard Phillips curve, with an inertial component, \(\pi _t^*\), expectations \(\pi _t^e\), the output gap and a number of exogenous variables \(x_{kt}\), such as the terms of trade and the oil price. The extension with the shock in the cycle is obtained by substituting the specification of the cycle with the following: \(\psi _{t} =\phi _1 \psi _{t-1} + \phi _2 \psi _{t-2} + \kappa _{t}+ \lambda I(t = \tau )\), with \(\tau = 2009\).

Table 2 shows the maximum likelihood estimates of the parameters of the model based on the series from 1970 to 2018. The regression coefficient associated with inflation expectations is not significantly different from 1. The estimated period of the cycle is very high (the estimated cyclical frequency is not different from zero).

The introduction of an intervention variable in the cycle equation—in the specification with cyclical shocks—reduces the estimated variance of cyclical shocks. The coefficient associated with the variable (in the last row of Table 2) is negative and highly significant. Furthermore, it substantially improves the fit of the model, as shown in Table 3 which reports the value of the log-likelihood, the Wald test for the joint significance of the two coefficients of the Phillips curve, together with the test of the hypothesis of the long-term neutrality of the output gap, \(H_0:\theta _0+\theta _1 = 0\), and a number of diagnostics concerning the GDP equation and calculated on the standardised residuals of the Kalman filter: the Ljung-Box autocorrelation test with 4 lags, the Jarque-Bera normality test, the Goldfeld and Quandt heteroscedasticity test and the first-order conditional heteroscedasticity test (ARCH (1)).

In particular, for the specification with a cyclical shock, the output gap has a significant impact (at the 5% level) on the level of inflation, but not on the acceleration of prices. In general, the introduction of the shock improves the statistics.

The Trivariate Model with Output, Inflation and Unemployment

The trivariate model is an extension of the bivariate and is obtained by adding the relationship linking the unemployment gap to the output gap to the specification presented in “The Bivariate Model with Output and Inflation” section:

where \(U_t\) is the unemployment rate and \(\psi _{u,t-1}\) is the unemployment gap. The unemployment gap model is sufficiently generic and contains a number of particularly interesting cases. Where \(\delta _0 = \delta _1 = 0\), the unemployment gap model becomes purely idiosyncratic. Okun law can manifest itself in two ways: rewriting

we see that under the restrictions \(\phi _u=0\) and \(\delta _1=0\), \(\psi _{ut}= \delta _0 \psi _t +\kappa _{ut}\). If \(\sigma ^2_{\kappa u} = 0\), the relationship between the gaps is strictly proportional, with the output gap generating the common cycle with unemployment. Otherwise, in case \(\delta _1 = -\delta _0\phi _u\), \(\psi _{ut}\) has one component proportional to the output gap and a specific component represented by an AR(1) process.

The likelihood associated with the unrestricted model is equal to − 188.73. The maximum likelihood estimates for the parameters are reported in Table 4. The model estimated for the output gap is more persistent than the bivariate model (\(\phi _1\) and \(\phi _2\) are 1.3687 and − 0.4699 respectively) and characterised by cyclical shocks with low variabilities. The relationship connecting inflation to the gap through the Phillips curve seems to have loosened, but the output gap is significantly linked to the unemployment gap, as shown by the Wald test of the hypothesis \(H_0:\delta _0+\delta _1=0\) reported in Table 5. The coefficient \(\phi _u\) is high and significant, and the restriction \(\phi _u=0\) is clearly rejected.

The Integrated Multivariate Model Based on the Production Function

Starting with (6), the integrated multivariate model can be represented as follows. Let \(\mathbf {y}_t = (f_t, a_t, h_t, e_t, c_t)'\), where the series \(c_t\) represents the CUBS composite indicator, \(\varvec{\mu }_t = (\mu _{ft}, \mu _{ht}, \mu _{at}, \mu _{et})',\)\(\varvec{\psi }_t = (\psi _{ft}, \psi _{ht}, \psi _{at}, \psi _{et})',\)\(\psi _t=\varvec{\gamma }' \varvec{\psi }_t,\)\(\varvec{\gamma }= (1, \alpha , \alpha , \alpha )'\).

where it is assumed that \(\Sigma _\zeta\) is a diagonal matrix, while \(\Sigma _\kappa\) is a full matrix. The multivariate cycle has scalar coefficients and is such that the output gap also has an AR(2) representation with the same coefficients. The CUBS replicates that used in the CAM’s TFP model. The maximum likelihood estimation of the matrix \(\Sigma _\kappa\) implies correlations between relatively small cyclical disturbances:

f | a | h | e | |

|---|---|---|---|---|

f | 1.00 | − 0.05 | − 0.30 | 0.32 |

a | − 0.05 | 1.00 | 0.18 | − 0.26 |

h | − 0.30 | 0.18 | 1.00 | 0.10 |

e | 0.32 | − 0.26 | 0.10 | 1.00 |

The complexity of the model and the small number of observations, compared with the large number of parameters, makes the estimation especially difficult and the measurement of standard errors using the Delta Method imprecise. Future applications envisage the use of bootstrap simulation techniques to overcome this drawback.

Rights and permissions

About this article

Cite this article

Proietti, T., Fioramanti, M., Frale, C. et al. A Systemic Approach to Estimating the Output Gap for the Italian Economy. Comp Econ Stud 62, 465–493 (2020). https://doi.org/10.1057/s41294-020-00127-y

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-020-00127-y