Abstract

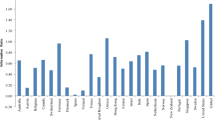

Stock returns are generally difficult to explain, as they are comprised of many discrete channels of risk. Empirical asset pricing models (EAPM), such as the Fama-French five-factor model (FF5), have been used to partition these channels across a series of systematic risk factors, such as company size (total market equity), value (book-to-market ratio), investment, and operating profitability. Prior EAPMs only accounted for how such factors contributed to risk at the market-level, ignoring any potential variation across sector. This study developed a sector-heterogenous model (SHM) which directly accounts for this variation by generalizing the Fama-French methodology to sector-subsets of stocks. The results demonstrated that risk is meaningfully heterogenous across sectors for each of the factors in the FF5, with different subgroups of factors being statistically significant within each sector. In a direct comparison of explanatory power, the SHM outperformed the FF5 and improved adjusted R2 by an average of 5% for stocks across all sectors. Several applications of sector-heterogeneity were then demonstrated for stock-picking purposes, including a high-beta portfolio strategy using the SHM-beta which outperformed the S&P 500 in backtesting. This study concludes that meaningful sector-heterogeneity exists in market risk. This information is materially useful to investors.

Similar content being viewed by others

Notes

The Sharpe Ratio measures the risk-adjusted rate of return, estimated by: Sharpe Ratio = (Portfolio Returns - Risk-Free Rate) / Portfolio Volatility.

References

Booth School of Business. (2018). Center for Research in Security Prices (CRSP). University of Chicago. http://www.crsp.com/ (Date Last Accessed : May 1, 2018).

Chang, W. (2017). Fama-French Three-Factor Model R Code. https://sites.google.com/site/waynelinchang/r-code

ETF. (2018a). Invesco S&P 500 high beta EFT (SPHB). ETF www.etf.com/SPHB

ETF. (2018b). Salt truBeta high exposure ETF (SLT). ETF www.etf.com/SLT

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427–465. https://doi.org/10.1111/j.1540-6261.1992.tb04398.x.

Fama, E. F., & French, K. R. (April 2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1–22. https://doi.org/10.1016/j.jfineco.2014.10.010.

French, K. R. (2018). Data library. Dartmouth University. http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html (date last accessed : May 1, 2018).

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425. https://doi.org/10.2307/2977928.

Standard & Poor’s Global Market Intelligence. (2018). Compustat. www.compustat.com (Date Last Accessed : May 1, 2018).

Treynor, J. L. (1961). Market value, time, and risk. SSRN Electronic Journal, https://doi.org/10.2139/ssrn.2600356.

Acknowledgements

I would like to personally thank Professor Lewis Segal for mentoring me throughout the entirety of this process, as well as Professor Kenneth Bulko and Casey Kohler (with the University at Albany Center for Undergraduate Research and Creative Engagement) for their continued support. Additionally, I would like to thank Dean Hui-Ching Chang and Professor Adrian Masters for helping to provide support and funding for me to be able to present this paper at multiple academic conferences.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Papenkov, M. An Empirical Asset Pricing Model Accommodating the Sector-Heterogeneity of Risk. Atl Econ J 47, 499–520 (2019). https://doi.org/10.1007/s11293-019-09637-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-019-09637-2