Abstract

Experimental double-auction commodity markets are known to exhibit robust convergence to competitive equilibria under stable or cyclical supply and demand conditions, but little is known about their performance in truly random environments. We provide a comprehensive study of double auctions in a stochastic setting where the equilibrium prices, trading volumes and gains from trade are highly variable across periods, and with commodity traders who may buy or sell their goods depending on market conditions and their individual outcomes. We find that performance in this stochastic environment is sensitive to underlying market conditions. Efficiency is higher and convergence to the competitive equilibrium stronger when the potential gains from trade are high and when the equilibrium spans a wide range of quantities, implying a large number of marginal trades. Speculative re-trading is prevalent, especially among those who have little to gain under equilibrium pricing. Those with the largest expected gains typically earn far less than predicted, while those with little or no predicted earnings gain modestly from speculation, leading to some redistribution of gains from high to low expected earners. Excessive trading volumes are associated with negative efficiencies in markets with low gains from trade, but not in the high-gains markets, where zero-sum trading and re-trading appear to enforce efficiency and near-equilibrium pricing. Buyers earn more relative to their competitive equilibrium benchmark than sellers do. Introducing trader specialization leads to fewer trading errors and higher market efficiency, but it does not eliminate zero-sum trading and re-trading.

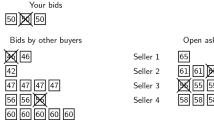

Notes: Market efficiency (percent of potential gains from trade actually realized) is displayed in the top-right corner. The dots show prices of individual trades, with the transaction order indicated by the horizontal axis

Similar content being viewed by others

Notes

A key aspect of agricultural and other commodities is storage, consideration of which is also missing from the conventional experimental literature. The experimental design that we develop here can be easily extended to consider storage, which we do in a companion paper. Financial securities, housing, and capital goods markets are also characterized by good durability and re-trading opportunities (Gjerstad and Smith 2014). We discuss the connection of our study to asset market experiments below.

The latter is in line with the active participation hypothesis suggested by Lei et al. (2001) as an explanation for asset market bubble formation.

A related literature investigates competitive commodity markets with cyclical demand with uncertain or unknown shifts in market conditions (Miller et al. 1977; Williams and Smith 1984; Plott and Agha 1983; Plott and Turocy 1997; Jamison and Plott 1997). These studies focus on the role of inter-temporal speculation in increasing overall market performances across periods, an issue that we do not address here.

Friedman (1984) is among the early theoretical models attributing observed efficiency of double auction markets to traders’ utility maximization motive. At the other extreme, Gode and Sunder (1993) demonstrate that double auction markets with non-profit-maximizing zero intelligence robots also converge under a simple discipline of budget constraint.

In contrast, Anderson and Sutinen (2005) report on a poor performance of double auctions in the markets for tradable fishing quotas.

If \(\bar{Y_t}=5\), each trader will be holding exactly 5 units in equilibrium; their opportunity cost to sell the fifth unit is 75, and their maximal willingness to pay for the sixth unit is 25, giving rise to the equilibrium price range of [25, 75] at which no strictly profitable trades are possible. See Appendix A for details.

The basic setup is similar to that often used in theoretical models of commodity pricing with storage; e.g., Deaton and Laroque (1992). Our focus here is on the performance of commodity markets under highly variable conditions that cannot be smoothed out by instruments such as storage. Stay tuned for our companion paper on markets with storage.

With N traders, the distribution of the aggregate supply of the good is given by the sum of N individual i.i.d. distributions of \(E_{it}\) plus a uniformly distributed common shock \(C_t\). The aggregate supply and the mean yield distribution are thus a mixture (sum) of discrete uniform distribution on {0,...,5} and a near-normal distribution with a mean of 2.5 and standard deviation of about \(\frac{1.44}{\sqrt{N}}\). While the variability of the mean yield will decrease with the root of the number of participants, the lower bound is tied to the variability of \(C_t\), with the standard deviation of 1.44.

Experimental instructions are available in Supplementary Materials S1.

Paid periods in ten-period sessions were then followed by another treatment not discussed here.

We are grateful to Charles Noussair for suggesting the weighted efficiency measure.

We attempted alternative specifications with continuous equilibrium price and trading volume variables, but none of these specifications improved the explanatory power of regressions.

As the equilibrium prices fell on point estimates in the overwhelming majority of observed markets (237 out of 260, or 91 percent, of a market periods; see Table 13 in Appendix A), here we loosely denote the “equilibrium price range” as the narrowest price range that allows to fully realize market gains from trade. Graphically, it corresponds to the narrowest vertical (price) gap before the intersection of supply and demand curves; see Fig. 1. We do not use this notion elsewhere in the paper; in the price convergence analysis below, we use the point value for the equilibrium price for the markets with the unique price prediction, and midpoint of the equilibrium price range, as given in Table 13 in Appendix A, as the equilibrium price prediction for the markets with the range of equilibrium prices.

Tobit regression specification is used to account for many periods with zero equilibrium prices and many price observations near zero. Trading prices at or below 0.5 experimental dollars are treated as censored. The estimation results are qualitatively the same for any censoring threshold between 0.1 (the lowest actual transaction price) and 1 experimental dollar.

The mean equilibrium quantity spread was 4.29 units across all 260 markets. Correspondingly, “low” spread is defined as \((Q_U - Q_L)\le 4\), and “high” spread as \((Q_U - Q_L)\ge 5\).

As high equilibrium quantity spread is often associated with zero equilibrium price and low gains from trade (Pearson’s correlation coefficients are \(\rho = 0.67\) and \(\rho = 0.68\), respectively), we performed additional price convergence estimations for markets with high and low market gains from trade, and markets with zero and above-zero equilibrium price, each time dividing them into low- and high-equilibrium-quantity spread markets. The findings reported above are robust: the prices converge to the competitive equilibrium in market with high \((Q_U - Q_L)\) irrespective of equilibrium price levels and gains from trade available, whereas price asymptotes are significantly different from equilibrium predictions in markets with low \((Q_U - Q_L)\) irrespective of equilibrium price levels. We could not reject the hypothesis of price convergence to equilibrium for markets with low quantity spread and low gains from trade, likely because of a very small number of markets (six out of 260 total) in this category.

While the role of marginal traders in providing competitive pressures and driving price convergence is commonly accepted, there are not many studies that quantify the effect of the number of marginal trades on market outcomes. Smith (1965) varies the number of excess sellers in markets with extreme rent asymmetries, and documents that “competitive equilibrating tendencies... are weakest when excess supply is small, strongest when excess supply is large” (p. 393). Gode and Sunder (1997) explore analytically the effect of the number of extra-marginal traders and the surplus lost due to a trade with an extra-marginal seller on market efficiency. Makowski and Ostroy (1987) show theoretically that perfect competition can be identified with the condition that no individual trader is able to change the Walrasian equilibrium price; Friedman and Ostroy (1995) further points out that in experimental laboratory markets with single-unit individual demand and supply, this condition implies a horizontal overlap of supply and demand curves. Charles Plott (personal communication, 2020) summarizes the effect of marginal units as follows: “Typically (many) marginal units... on the interior of the [price] tunnel and also many marginal units excluded... will cut down the [price] variance. It will also support high efficiencies since the high surplus units will get traded and those that are not the surplus-starved marginal units.” Our data are consistent with Plott’s explanation: simple regression analysis indicates that a higher equilibrium quantity spread leads to significantly lower price variance (\(p<0.05\)) and significantly lower deviation from the competitive equilibrium price (\(p<0.01\)).

Simple regression analyses confirm that efficiency is significantly negatively associated with trading volume above \(Q_U\) for markets with low GFT, and is significantly positively associated with trading volume above \(Q_U\) for markets with normal GFT (\(p<0.05\) in both cases).

“The Marshallian path ... suggests that market adjustment follows the path of the most rapid wealth creation. Wealth creation is through realized gains from trade and the Marshallian path has those that represent the greatest gains trading first” (Plott et al. 2013).

See more details on the individual trading analysis in Supplementary Materials S3.

Weak traders are present in the market if the average market yield falls on a non-integer number; see Table 2 for illustration.

The overall average per period predicted earning was 47 experimental dollars. Because of the presence of markets with zero equilibrium prices, predicted gains from trade were zero for 7% of predicted strong buyers and 26% of predicted strong sellers, as well as for all predicted weak and no-traders.

Cason and Friedman (1996) distinguish market-level efficiency losses due to trades of extra-marginal units (“EM-inefficiency”), and losses due to profitable trades that do not occur (low volume, or “V-inefficiency”). EM-inefficiency stems from individual traders making too many net trades, and V-inefficiency stems from individual traders making too few net trades compared to equilibrium. Our results imply the presence of both types of inefficiencies, with net under-trading (V-inefficiency) prevailing on average.

Let \(n_b\) and \(n_s\) be the number of trader’s buy and sell transactions, with the total number of trades being \(n_{all}=n_b+n_s\). Then the number of net transactions is \(n_{net}=\max \{ n_b, n_s\} - \min \{ n_b, n_s\}\), and the number of re-trade transactions is \(n_r=n_{all} - n_{net}= 2\times \min \{ n_b, n_s\}\). See Appendix B for details.

Figure 4 in Supplementary Materials S2 illustrates the distribution of re-trading frequencies by predicted trader roles.

See the footnote to Table 12 and Appendix B for more details.

Considerable cash endowments and good durability, in addition to re-trading, are among other features that distinguish traditional experimental commodity and asset double auction markets. We are exploring the roles of these features in a companion project.

The equilibrium price was 75 experimental dollars or above in half of all markets, and 50 experimental dollars or below in the other half of markets.

Financial asset markets are another obvious setting where re-trading is prevalent and excessive trading volumes are commonly observed.

References

Anderson, C. M., & Sutinen, J. G. (2005). A laboratory assessment of tradable fishing allowances. Marine Resource Economics, 20(1), 1–23.

Barrett, C. B. (2008). Smallholder market participation: Concepts and evidence from eastern and southern Africa. Food Policy, 33(4), 299–317.

Cason, T. N., & Friedman, D. (1996). Price formation in double auction markets. Journal of Economic Dynamics and Control, 20(8), 1307–1337.

Cason, T. N., & Gangadharan, L. (2006). Emissions variability in tradable permit markets with imperfect enforcement and banking. Journal of Economic Behavior & Organization, 61(2), 199–216.

Cason, T. N., & Gangadharan, L. (2013). Cooperation spillovers and price competition in experimental markets. Economic Inquiry, 51(3), 1715–1730.

Davis, D. D., Harrison, G. W., & Williams, A. W. (1993). Convergence to nonstationary competitive equilibria: an experimental analysis. Journal of Economic Behavior & Organization, 22(3), 305–326.

Davis, D. D., & Holt, C. A. (1993). Experimental economics. New Jersey: Princeton University Press.

Deaton, A., & Laroque, G. (1992). On the behaviour of commodity prices. The Review of Economic Studies, 59(1), 1–23.

Dickhaut, J., Lin, S., Porter, D., & Smith, V. (2012). Commodity durability, trader specialization, and market performance. Proceedings of the National Academy of Sciences, 109(5), 1425–1430.

Easley, D., & Ledyard, J. O. (1993). Theories of price formation and exchange in double oral auctions. In D. Friedman & J. Rust (Eds.), The Double Auction Market. SFI Studies in the Sciences of Complexity (pp. 63–97). US: Addison-Wesley.

Edelman, B., Lee, H. L., Mabiso, A., Pauw, K., et al. (2015). Strengthening storage, credit, and food security linkages: The role and potential impact of warehouse receipt systems in Malawi. MaSSP Working Paper 12. Washington, D.C: International Food Policy Research Institute (IFPRI).

Efron, B., & Tibshirani, R. J. (1994). An introduction to the bootstrap. US: CRC Press.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Friedman, D. (1984). On the efficiency of experimental double auction markets. The American Economic Review, 74(1), 60–72.

Friedman, D., & Ostroy, J. (1995). Competitivity in auction markets: An experimental and theoretical investigation. The Economic Journal, 105(428), 22–53.

Gjerstad, S. D., & Smith, V. L. (2014). Rethinking housing bubbles: The role of household and bank balance sheets in modeling economic cycles. England: Cambridge University Press.

Godby, R. (2000). Market power and emissions trading: theory and laboratory results. Pacific Economic Review, 5(3), 349–363.

Godby, R. W., Mestelman, S., Muller, R. A., & Welland, J. D. (1997). Emissions trading with shares and coupons when control over discharges is uncertain. Journal of Environmental Economics and Management, 32(3), 359–381.

Gode, D. K., & Sunder, S. (1993). Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of Political Economy, 101(1), 119–137.

Gode, D. K., & Sunder, S. (1997). What makes markets allocationally efficient? The Quarterly Journal of Economics, 112(2), 603–630.

Gondwe, A., Baulch, B., et al. (2017). The case for structured markets in Malawi. MaSSP Policy Note 29. Washington, D.C.: International Food Policy Research Institute (IFPRI).

Greiner, B. (2015). Subject pool recruitment procedures: organizing experiments with orsee. Journal of the Economic Science Association, 1(1), 114–125.

Jamison, J. C., & Plott, C. R. (1997). Costly offers and the equilibration properties of the multiple unit double auction under conditions of unpredictable shifts of demand and supply. Journal of Economic Behavior Organization, 32(4), 591–612.

Key, N., Sadoulet, E., & Janvry, A. D. (2000). Transactions costs and agricultural household supply response. American Journal of Agricultural Economics, 82(2), 245–259.

Kotani, K., Tanaka, K., & Managi, S. (2019). Which performs better under trader settings, double auction or uniform price auction? Experimental Economics, 22(1), 247–267.

Ledyard, J. O., & Szakaly-Moore, K. (1994). Designing organizations for trading pollution rights. Journal of Economic Behavior Organization, 25(2), 167–196.

Lei, V., Noussair, C. N., & Plott, C. R. (2001). Nonspeculative bubbles in experimental asset markets: Lack of common knowledge of rationality vs actual irrationality. Econometrica, 69(4), 831–859.

Makowski, L., & Ostroy, J. M. (1987). Vickrey-clarke-groves mechanisms and perfect competition. Journal of Economic Theory, 42(2), 244–261.

Miller, R. M., Plott, C. R., & Smith, V. L. (1977). Intertemporal competitive equilibrium: an empirical study of speculation. The Quarterly Journal of Economics, 91(4), 599–624.

Muller, R. A., Mestelman, S., Spraggon, J., & Godby, R. (2002). Can double auctions control monopoly and monopsony power in emissions trading markets? Journal of Environmental Economics and Management, 44(1), 70–92.

Noussair, C. N., Plott, C. R., & Riezman, R. G. (1995). An experimental investigation of the patterns of international trade. The American Economic Review, 85(3), 462–491.

Noussair, C. N., Plott, C. R., & Riezman, R. G. (1997). The principles of exchange rate determination in an international finance experiment. Journal of Political Economy, 105(4), 329–368.

Plott, C., Roy, N., & Tong, B. (2013). Marshall and Walras, disequilibrium trades and the dynamics of equilibration in the continuous double auction market. Journal of Economic Behavior & Organization, 94, 190–205.

Plott, C., & Turocy, T. (1997). Intertemporal speculation under uncertain future demand: Experimental results. In W. Albers, W. Guth, P. Hammerstein, B. Moldovanu, & E. van Damme (Eds.), Understanding Strategic Interaction (pp. 475–493). Springer, Berlin, Heidelberg.

Plott, C. R. (1982). Industrial organization theory and experimental economics. Journal of Economic Literature, 20(4), 1485–1527.

Plott, C. R., & Agha, G. (1983). Intertemporal speculation with a random demand in an experimental market. In Tietz (Ed.), Aspiration levels in bargaining and economic decision making. Lecture notes in economics and mathematical systems, No. 213 (pp. 201–216). Berlin: Springer-Verlag.

Singh, I., Squire, L., & Strauss, J. (1986). Agricultural household models: Extensions, applications, and policy. Number 11179. The World Bank.

Smith, V. L. (1962). An experimental study of competitive market behavior. Journal of Political Economy, 70(2), 111–137.

Smith, V. L. (1965). Experimental auction markets and the walrasian hypothesis. Journal of Political Economy, 73(4), 387–393.

Smith, V. L., Suchanek, G. L., & Williams, A. W. (1988). Bubbles, crashes, and endogenous expectations in experimental spot asset markets. Econometrica, 56(5), 1119–1151.

Smith, V. L., & Williams, A. W. (1982). The effects of rent asymmetries in experimental auction markets. Journal of Economic Behavior & Organization, 3(1), 99–116.

Taylor, J. E., & Adelman, I. (2003). Agricultural household models: genesis, evolution, and extensions. Review of Economics of the Household, 1(1–2), 33–58.

Williams, A. W., & Smith, V. L. (1984). Cyclical double-auction markets with and without speculators. Journal of Business, 57(1), 1–33.

Acknowledgements

Financial support by the International Foundation for Research in Experimental Economics is gratefully acknowledged. We would like to thank Daniel Friedman, John Ledyard, Charles Plott, Vernon Smith, participants of the Economic Science Association meetings, the Editors and two anonymous reviewers for valuable comments and discussion. Sherstyuk is grateful to the participants of 2019 symposium in honor of Charlie Plott at Caltech for inspiration.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix A: equilibrium predictions

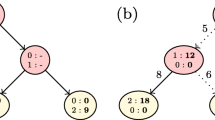

Equilibrium prices Since all traders have the same valuation schedules, the equilibrium price \(P^{eq}\) in each period equates mean supply and mean demand, and is determined by the marginal unit value, as given in Table 1, at the average yield \(\bar{Y_t} = \frac{1}{N}\sum _i Y_{it}\). The mapping from average market yields to equilibrium prices is displayed in Table 13. The equilibrium price spans a range of values when the average yield is an integer between 1 and 6; in this case market supply and demand curves overlap vertically, see, e.g., Fig. 1, market periods 1, 4, 19 and 20. The equilibrium price takes a single value for average yields that are non-integer or above 6 units; in this case market supply and demand curves overlap horizontally, yielding a range of equilibrium trading volumes; see Fig. 1, other market periods.

Equilibrium trading volumes The equilibrium trading volumes are determined by the intersection of the net market supply and demand curves. If the average market yield is an integer between 1 and 6 units, the market supply and demand curves intersect over a vertical interval, as discussed above, yielding a unique prediction for the equilibrium trading volume:

where \(\{i: Y_{it}>\bar{Y_t}\}\) is the set of net sellers, and \(\sum _{{i: Y_{it}>\bar{Y_t}}} (Y_{it}-\bar{Y_t})\) is the net market supply; \(\{j: Y_{jt}<\bar{Y_t}\}\) is the set of net buyers, and \(\sum _{j: Y_{jt}<\bar{Y_t}} (\bar{Y_t}-Y_{jt})\) is the market demand, as predicted by the equilibrium theory.

If the average market yield is not an integer, or is greater than 6 units, the net market supply and demand overlap over a horizontal range, yielding a range of volumes \([Q_L,Q_U]\) consistent with the equilibrium prediction. This happens because of the discrete nature of unit values: while \(Q_L\) is the lowest number of trades necessary to fully realize all potential gains from trade, additional marginal trades may be available in equilibrium; traders may be holding units that they are just indifferent between trading and not trading, as any such trade would bring zero profit.

The lower and upper bounds of equilibrium trading volumes, \(Q_L\) and \(Q_U\), are given by:

In the above, the bounds on market supply and demand quantities \(Q^S\) and \(Q^D\), evaluated at the equilibrium price, are calculated as follows. If \(\bar{Y_t}<6\) then \(P^{eq}>0\). Hence:

where \(\lfloor \bar{Y_t}\rfloor \equiv\) floor\((\bar{Y_t})\) and \(\lceil \bar{Y_t}\rceil \equiv\) ceil\((\bar{Y_t})\) denote the floor and the ceiling of \(\bar{Y_t}\), respectively.

If \(\bar{Y_t}>6\) then \(P^{eq}=0\), and the market supply \(Q^S\) at zero price is bounded from below by zero, while the market demand \(Q^D\) is unbounded from above; and the upper bound of supply and the lower bound of demand are determined by the condition that each trader should hold at least 6 units in equilibrium. Hence:

Example 1

Consider Session 1, Period 1 individual yields for 12 traders as presented in Table 14. \(\bar{Y_t}=4\), and each trader will hold exactly 4 units in equilibrium; their opportunity cost of selling the fourth unit is 125, and their maximal willingness to pay for the fifth unit is 75 (Table 1), giving rise to the equilibrium price range of [75, 125] at which no strictly profitable trades are possible. The equilibrium trading volume is uniquely determined at 13 units; see Fig. 1, Period 1 for illustration.

Example 2

Now consider Session 1, Period 5 individual yields (Table 14). \(\bar{Y_t}=8\), hence in equilibrium \(P^{eq}=0\), all traders hold at least 6 units, and no strictly profitable trades are available for any trader. The equilibrium trading volume ranges between 2 and 26 units, depending on whether the traders are willing or not to engage in marginal zero-profit trades. See Fig. 1, Period 5.

Example 3

Consider further individual yields in Session 1, Period 7 (Table 14). \(\bar{Y_t}=2.25\), with nine traders holding two units, and three traders holding three units in equilibrium. Traders holding two units are willing to buy the third unit at a price no more than their marginal value, 175; traders holding three units are willing to sell their third unit at a price no less than their opportunity cost, 175. Hence the equilibrium price is 175, allowing no strictly profitable trades at an equilibrium allocation. The equilibrium trading volume ranges between 7 and 10 units, depending on whether the traders are willing or not to engage in marginal zero-profit trades. See Figure 1, Period 7.

We emphasize again that if net market supply and demand overlap horizontally, as in Examples 2 and 3 above, then the equilibrium allocation of units among traders is not unique, and marginal zero-gain trades between traders are still possible in equilibrium, as long as such trades lead to another allocation consistent with equilibrium.

Appendix B: net trade and re-trade earnings calculation

The number of each trader’s net trade and re-trade transactions in a given period, and her period earnings from net trade and re-trade, are calculated as follows. Let be \(n_b\) and \(n_s\) the number of trader’s buy and sell transactions, and let \(n_{all}= n_b+n_s\) be her total number of transactions. Then the number of net trades is:

and the number of re-trades is:

Further, let \(\Pi ^{all}\) be this trader’s total earnings in a period, and let \({\bar{p}}_b\) and \({\bar{p}}_s\) be her average buying and selling prices. Then her earning from re-trade are calculated as

The remaining trader earnings are attributed to net trades:

Equivalently, the earnings from net trade can be calculated in the following way. Let i be the initial number of units on hand, and let k be the number on hand at the end of trading. Then \(k>i\) with \(n_{net}=k-i\) for net buyers; \(i>k\) with \(n_{net}=i-k\), for net sellers; and \(i=k\) for net no-traders. Let \(v_j\) denote j-th unit value, as presented in Table 1 in the main paper.

The profit from net trade for net buyers is then calculated as:

and the profit from net trade for net sellers is calculated as:

The profit from re-trade is then calculated as the difference between total profit and net profit, \(\Pi ^{r}=\Pi ^{all}-\Pi ^{net}\), or, equivalently, using expression 11 above.

For example, suppose a trader initially held \(i=2\) units in a period. She sold two units, \(n_s=2\), at the prices of 130 and 180, and bought three units, \(n_b=3\), at the prices of 150, 100 and 80. This trader is a net buyer with one net trade, \(n_{net}=3-2=1\), and four re-trades, \(n_r=(2+3)-1=4\), or two re-trade pairs: \(\min \{ n_b, n_s\}=2\), holding \(k=3\) units at the end of trading. The average selling price is \({\bar{p}}_s = 155\), and the average buying price is \({\bar{p}}_b= 110\). Trader total earnings in this period are \(\Pi ^{all}=105\), with earnings from net trade \(\Pi ^{net}=v_3-1*(110)=125-110=15\), and earnings from re-trade \(\Pi ^{r}=2*(155-110)=90\).

Rights and permissions

About this article

Cite this article

Sherstyuk, K., Phankitnirundorn, K. & Roberts, M.J. Randomized double auctions: gains from trade, trader roles, and price discovery. Exp Econ 24, 1325–1364 (2021). https://doi.org/10.1007/s10683-021-09700-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-021-09700-3