- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|---|

| 1 | Monetary Policy Rule and Taylor Principle in Mongolia: GMM and DSGE Approaches / 2020 / International Journal of Financial Studies / vol.8, no.4, pp.71 / |

| 2 | / 2023 / / vol.66, pp.181 / |

| 3 | / 2023 / / vol.66, pp.229 / |

| 4 | The impact of the heterogenous fiscal policy stance of euro-area member states on ECB monetary policy / 2024 / Economic Systems pp.101216 / |

Article View

East Asian Economic Review Vol. 22, No. 4, 2018. pp. 531-555.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2018.22.4.353

Number of citation : 4Monetary Policy Rule under Inflation Targeting in Mongolia

|

Saitama University |

|

|

Erdenechuluun Khishigjargal |

Saitama University |

Abstract

This article aims to review the monetary policy rule under inflation targeting framework focusing on Mongolia. The empirical analysis estimates the policy reaction function to see if the inflation targeting has been linked with a monetary policy rule emphasizing on inflation stabilization since its adoption in 2007. The study contributes to the literature by examining the linkage between Mongolian monetary policy rule and inflation targeting directly and thoroughly for the first time and also by taking into account a recent progress in the inflation targeting framework toward forward-looking mode. The main findings were: the Mongolian current monetary policy rule under inflation targeting is characterized as inflation-responsive rule with forward-looking manner (one quarter ahead); the inflation responsiveness is, however, weak enough to be pro-cyclical to inflation pressure; and the rule is also responsive to exchange rate due to the “fear of floating”, which weakens the policy reaction to inflation and output gap.

JEL Classification: E52, E58, O53

Keywords

Monetary Policy Rule, Inflation Targeting, The Bank of Mongolia, Policy Reaction Function, Fear of Floating

I. INTRODUCTION

The Central Bank of Mongolia (BOM) has adopted “inflation targeting”1 as its monetary policy framework since 2007. The background behind introducing the inflation targeting lies in the fact that the correlation between money supply and inflation had declined, hence having come the need to reform the monetary policy strategy in the 2000s. The BOM had a monetary aggregate targeting framework until 2007 with reserve money as an operating target and with M2 as an intermediate target. Since the 2000s, however, the deviation of monetary aggregate from those targets has been enlarged due to a re-monetization process and a volatility of the money multiplier. The BOM has thus introduced the inflation targeting framework since 2007, which contains the policy mandate of announcing a targeted inflation rate to the public and of taking every possible measures to maintain inflation rate at the targeted rate. At the same time, the BOM has adopted one-week central bank bills’ rate as a policy rate since July 2007, so that the policy rate can work as an operating target to attain its targeted inflation rate. Since introducing the inflation targeting in 2007, the BOM, having experienced the challenges of high and volatile inflation, has taken several steps to make the inflation targeting system more effective: the BOM has introduced the Forecasting and Policy Analysis System (FPAS) since 2011 as a forward-looking framework, and has established an interest rate corridor to enhance the policy rate transmission mechanism since 2013 as an operational framework.

The question then arises on how we can evaluate the performance of inflation target that has been operated for one decade since its adoption in Mongolia. In general, there seems to be a consensus in academic literature and policy discussions that inflation targeting has so far been successful to stabilize inflation in advanced economies with the history of its operation since the 1990s (e.g. Mishkin and Posen, 1998; Mishkin and Schmidt-Hebbel, 2007). As far as emerging market economies including Mongolia are concerned, however, there has been rather less evidence to support the performance of inflation targeting due to the relatively shorter history of its operation and due to some difficulties in its management.

The difficulties that emerging market economies have faced in operating their inflation targeting might come from exchange rate fluctuations for the following senses. First, inflation targeting can work well only when monetary autonomy is secured under floating exchange rate regime with capital mobility. Emerging market economies have, however, the problem of “fear of floating”, as suggested by Calvo and Reinhart (2002). It comes from a lack of confidence in currency value, especially given that their external debts are primarily denominated in US dollars. Their efforts to avoid exchange rate volatility prevent their monetary authorities from concentrating fully on inflation targeting. Second, as Eichengreen (2002) argued, exchange rate fluctuation itself has large influence on domestic prices through the “pass-through” effect in small, open economies. It makes it difficult for monetary authorities to control inflation and to perform inflation targeting well. There is, however, a counterargument against the pass-through effect on inflation targeting. Gagnon and Ihrig (2004) argued that an inflation targeting framework reduces the pass-through effect, in the sense that domestic agents are less inclined to change prices in response to a given exchange rate shock under the strong commitment of a monetary authority to price stability.

Another possible difficulty for inflation targeting management in emerging market economies is the lack of credibility of the central bank capacity. It might come from arbitrary policy reactions accompanied with unreliable inflation forecasting by central banks as well as the economic uncertainty and volatility. As long as agents do not believe that a monetary authority will be successful in achieving inflation target, it will be difficult for inflation targeting to have any significant impact on expectations and behaviors of private sectors with respect to wage and pricing contracts. As Eichengreen (2002) emphasized, the lack of credibility would thus lessen inflation targeting performance.

Some studies, among the limited literature, have assessed inflation targeting in emerging market economies as “conditional” success. For example, Mishkin (2000, 2004) argued that the success of inflation targeting could not be solely attributed to the actions of central banks, and that supportive policies such as the absence of large fiscal deficits and rigorous regulation and supervision of financial sector were crucial to its success. Lin and Ye (2009) also noted that the performance of inflation targeting could be affected by a country’s characteristics such as the government’s fiscal position, the central bank’s desire to limit movements of exchange rate and its willingness to meet the preconditions of policy adoption. Ito and Hayashi (2004) presented the following two recommendations on inflation targeting management, considering the characteristics of emerging market economies: (1) emerging market countries should set an inflation with target central rate slightly higher and with a target range slightly wider than a typical advanced country; (2) small, open economies may pursue both an inflation target range and an implicit basket band in exchange rate regime, as both targets are expressed in a range (the targets work as the source of stability in expectations, while the ranges allow some flexibility).

Mongolia is not an exception in facing the aforementioned difficulties and conditional success in inflation targeting operation as one of emerging market economies. This article, in this context, reviews the monetary policy rule under inflation targeting framework focusing on Mongolia. To be specific, this study estimates the policy reaction function to see if the inflation targeting has been linked with a monetary policy rule emphasizing on inflation stabilization since its adoption in 2007. The study samples quarterly data from the third quarter of 2007 to the fourth quarter of 2017, and the additional estimation divides the sample into the first period from the third quarter of 2007 to the fourth quarter of 2011 and the second period from the first quarter of 2012 to the fourth quarter of 2017, considering the progress made by the BOM on the inflation targeting framework.

The rest of the paper is structured as follows. Section II gives an overview of the monetary policy framework since the 1990s in Mongolia. Section III reviews previous studies on monetary policy rules in emerging market economies in Asia and clarifies this paper’s contribution. Section IV conducts the empirical analyses by describing the data, the methodology, and the estimation result with its interpretation. Section V summarizes and concludes.

1)The essence of inflation targeting framework was clearly described in

II. OVERVIEW OF MONETARY POLICY FRAMEWORK

This section first describes the short history of monetary policy framework since the 1990s in Mongolia, and then observes the performance in Mongolian inflation targeting in connection with the policy rate stances.2

The Mongolian monetary policy framework has experienced the following three phases since the 1990s: monetary aggregate targeting from 1995 to 2006, transition to inflation targeting from 2007 to 2011, and inflation targeting with forward-looking framework from 2011 to the present.

In the first phase of monetary aggregate targeting for 1995-2006, the BOM set the reserve money as an operating target and M2 as an intermediate target. Since the money multiplier became unstable mainly due to financial deepening after the mid-2000s, however, the BOM needed to apply alternative monetary policy framework. In the second phase from 2007, the BOM initiated inflation targeting, and adopted one-week central bank bills’ rate as a policy rate, so that the policy rate can work as an operating target to attain its targeted inflation rate.3 Under the wave of world financial crisis in 2009, however, the BOM adopted the IMF Stand-by program in that year, and the program’s terms temporarily required the BOM to target monetary aggregate. In 2011, the BOM finally completed 18 month Stand-by program. In the third phase from 2011, the BOM has been developing the Forecasting and Policy Analysis System (FPAS), for the purpose of upgrading the inflation targeting to a forward-looking framework. In this phase, the BOM also have improved its operational framework by establishing an interest rate corridor since February 2013. Setting the corridor is expected to contribute to reducing fluctuations in short-term interest rates and to improving interest rate channel of monetary transmission mechanism.

Regarding the performance of inflation targeting, this section describes briefly the trends in the actual inflation under the policy rate stances.4 For the period from 2010 to 2013, Mongolian economy entered the booming stage with double-digit inflation rate mainly due to the sore of capital inflows in the mining sector, which was mostly beyond the targeted rate that pursued a single-digit level. The BOM reacted to the hike of inflation by raising its policy rate from around 10 percent to 13.25 percent continuously until January 2013. As a result of the tight monetary policy together with price stabilization programs, the inflationary pressure was calming down to some degree, thereby the BOM cutting again its policy rate consecutively from January to June in 2013 toward 10.5 percent. For 2014-2015, under the background of the slowdown in the world economy including Chinese economy, the net inward foreign direct investment to Mongolia fell down sharply. To improve external balance, the BOM turned to tight monetary policy by raising its policy rate to 12 percent in July 2014 and further to 13 percent in January 2015. At the end of 2015, the inflation rate fell down to 1.9 percent as year-on-year rate, which was far below the targeted rate. After 2016, the BOM eased its monetary policy by cutting its policy rate to 12 percent in January 2016 and further to 10.5 in May 2016, considering that the inflation rate remained below the targeted rate. The BOM, however, raised its policy rate again to 15 percent in August 2016, since during July to August the shortage of foreign reserves incurred the rapid currency depreciation. After avoiding a currency crisis, the BOM started to reduce its policy rate gradually and continuously from December 2016 through 2017. The inflation rates in 2016 and 2017 were still below the targeted rate at the year-end.

To sum up, in the early stage of inflation targeting for 2010-2013, the actual inflation rate tended to exceed the targeted rate in spite of tight monetary policies. In the latter stage for 2015-2017, on the contrary, the inflation rate has been willrestrained under the targeted rate. The critical issue is that even under such a stagnant economic condition with low inflation for that period, the BOM has still kept its policy rate at rather high level, namely, higher than ten percent. The sticky higher policy rate has come from the danger of currency depreciation and capital flight, so-called, “fear of floating”.

2)The description on this section is based on

3)The BOM still keeps the reserve requirement ratio as a monetary policy instrument as well as the policy rate.

4)The description in this section is based on

III. LITERATURE REVIEW AND CONTRIBUTION

This section reviews previous studies on monetary policy rules under inflation targeting in emerging market economies in Asia and clarifies this paper’s contribution. On this issue, there are very few empirical studies, because only less than two decades have passed since their adoptions of inflation targeting. In fact, East Asian emerging market countries initiated inflation targeting after the 1997-1998 Asian currency crisis: Korea instituted it in 1998, followed by Indonesia and Thailand in 2000, and the Philippines in 2002. Later than these countries, Mongolia started inflation targeting in 2007, as mentioned before. Some of these countries have, however, been targeted as a quantitative study of inflation targeting: their monetary policy rules have been examined by monetary policy reaction functions to see if their rules under inflation targeting have really taken inflation-responsive policy stances.

Regarding the study of a group of East Asian emerging market economies, Taguchi and Kato (2011) examined the monetary policy rules of the four inflation-targeting adopters: Indonesia, Korea, the Philippines and Thailand. They found that Korea took an inflation-responsive and forward-looking policy stance while Indonesia and Thailand had inflation-responsive but backward-looking stances and the Philippines under the de facto pegged currency regime did not follow even inflation-responsive rule. As for the study focusing on individual economies, Korean monetary policy rule under inflation targeting operation was examined by Kim and Park (2006). They found that the Bank of Korea adjusted interest rates in response to changes in inflationary pressure in a forward-looking manner as well as to current output gaps. Chinese monetary policy rule in practice was investigated by Cai and Taguchi (2015).5 They showed that the policy rate response to contemporaneous inflation, though identified by a policy reaction function, was too weak to accommodate changes in inflation, and added the result that the response to exchange rate was insignificant. Thai monetary rule under inflation targeting was analyzed by Lueangwilai (2012), such that the contemporaneous responses to inflation and exchange rate movement well characterized the policy rate set by the Bank of Thailand. The study of Thai rule was updated by Taguchi and Wanasilp (2018), which demonstrated that the rule has been upgraded into forward-looking manner reflecting the progress in inflation targeting management.

The literature reviewed above could be reorganized into Table 1 as the table summarized by the following three perspectives. The first one is whether the rule is inflation-responsive and at the same time countercyclical to inflationary pressure. The inflation-responsiveness can be verified by a significant reaction of policy rate by inflation rate, and the countercyclical reaction can be measured by the elasticity of policy rate response against inflation rate, which should be bigger than unity for “real” policy-rate adjustment. The second perspective is whether the inflation-responsive rule has forward-looking or backward-looking stance. This criteria would be significant since emerging market economies, as stated in Introduction, might face the difficulties in forecasting inflation rate as Eichengreen (2002) pointed out. The third perspective is whether the policy rule contains an exchange rate-responsive reaction due to the “fear of floating”. This criteria would also be significant since emerging market economies, as stated in Introduction, might fall into the “fear of floating” as Calvo and Reinhart (2002) suggested. Table 1 includes the policy rules of advanced economies as a benchmark of comparison, by the representative work of Clarida et al. (1998b) targeting G3 (Germany, Japan, and the US), which will be explained in the next section.

Table 1 tells us first that the policy rules of G3 is inflation responsive with countercyclical and forward-looking manner. Among the emerging market economies, Korean and Thai rules by Kim and Park (2006) and Taguchi and Wanasilp (2018) are advanced similarly to the G3 rules, although the Thai rule is also exchange-rate responsive. China and Indonesia are behind Korea and Thailand in their policy rules, in the sense that their rules have not been forward-looking yet, and in particular Chinese rule is not even countercyclical.

Although there are several studies of the policy rules focusing on individual economies as above, there are no studies of Mongolian monetary policy rule under inflation targeting.6 Khishigjargal (2018) addresses the recent monetary policy issue under inflation targeting in Mongolia. The study, however, aims to examine how the monetary policy has affected the macro-economy through its transmission mechanism by applying a vector-autoregressive model, and not to investigate how the Mongolian monetary policy has been determined as a policy rule under inflation targeting.

This study’s contribution is thus to examine the linkage between Mongolian monetary policy rule and inflation targeting directly and thoroughly by applying policy reaction functions for the first time, and further to evaluate a progress in the inflation targeting framework toward forward-looking mode by dividing the sample periods. From the viewpoint of comparison with the policy rules in the other emerging market economies, the analytical concern is at what position Mongolian policy rule stands now in aforementioned three dimensions in Table 1, which will be clarified at the end of next section.

5)China has not introduced the inflation targeting officially, but inflation rate has been one of the government indicators for the decision making of monetary policy.

6)

IV. EMPIRICAL ANALYSES

This section conducts the empirical analyses in order to examine the monetary policy rule under inflation targeting focusing on Mongolia. For examining it, the study estimates policy reaction functions to see if the adoption of inflation targeting has been linked with an inflation-responsive policy rule. The section first represents sample data and key variables for the estimation, followed by the estimation methodology and the estimation outcome with its interpretation.

1. Sample Data and Key Variables

The analysis here samples the quarterly data running from the third quarter of 2007 to the fourth quarter of 2017 during which the BOM has operated the inflation targeting. The source of all the data used for the estimation is the International Financial Statistics (IFS) of the International Monetary Fund (IMF).7 The analytical indicators are selected as follows (see Table 2): “Central Bank Policy Rate” for policy interest rate (denoted by

The combination between policy interest rate and the other variables of inflation rate, production gap and exchange rate, are simply displayed in Figure 1. This observation itself does not tell us clear correlations and causalities in any combinations since the variables interact with each other, and so they should be statistically tested in the more sophisticated way in the later section.

Before conducting the estimation below, the study investigates the stationary property of the data for each variable, by employing the Ng-Perron unit root test8 on the null hypothesis that each variable has a unit root in the test equation including “trend and intercept”. This test constructs four test statistics: modified forms of Phillips and Perron (1988) statistics (MZa, MZt), the Bhargava (1986) statistic (MSB), and the Point Optimal statistic (MPT). Table 3 reports the test results for the data for all the indicators, i.e., policy interest rate (

2. Methodology: Policy Reaction Function

The policy reaction function is one of the useful analytical tools to describe a monetary policy rule in practices managed by a central bank. Its standard specification is that a central bank adjusts the nominal policy interest rate in response to the gaps between expected inflation and output, and their respective targets. It can be interpreted as a more generalized rule of the Taylor rule (see Taylor, 1993) – the simple contemporaneous policy reaction function. The estimable policy reaction functions were presented for the first time by Clarida and Gertler (1997) for the Bundesbank monetary policy, Clarida et al. (1998a) for the US monetary policy, and Clarida et al. (1998b) for monetary policies of two sets countries: the G3 (Germany, Japan, and the US) and the E3 (UK, France, and Italy). Among them, Clarida et al. (1998b) demonstrated the most comprehensive estimation of policy reaction functions. For estimating the G3 monetary policy rules, they took the forward-looking specification as the baseline and the backward-looking function as an alternative for their comparison, and they found that the G3 pursued forward-looking rules, responding to anticipated inflation as opposed to lagged inflation. As for the E3 estimation, they added such explanatory terms as German interest rate and exchange rate in their functions, to examine how the constraints of the European Monetary System that collapsed in late 1992 influenced the E3 monetary policy rules.

This study basically applies the methodology of Clarida et al. (1998b) to estimate the policy reaction function for Mongolia during the third quarter of 2007 to the fourth quarter of 2017. The analysis employs both of forward-looking and backwardlooking specifications for the estimation, and also includes the exchange rate term as one of the monetary policy determinants, in accordance with the analytical perspectives of the policy rules characterized in emerging market economies as shown in Table 1.

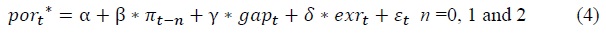

The original policy reaction function presented by Clarida et al. (1998b) is shown as the following equation (1).

where  is the long-run equilibrium nominal interest rate;

is the long-run equilibrium nominal interest rate;

Equation (1) can be rewritten for empirical specification by defining  −

−

where

The coefficients of β, γ and

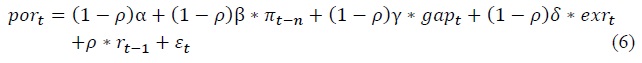

The equation (3) and (4) are further modified for obtaining estimable equations since the central bank tends to conduct smooth changes in its policy interest rate in their practices. By assuming that the actual rate partially adjusts to the target as

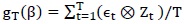

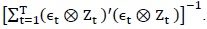

For the technique to estimate the parameter vector [

3. Estimation Outcome and its Interpretation

Table 4 reports the estimation outcomes of policy reaction functions in two kinds of specifications: the forward-looking specification in the equation (5) and the backward-looking specification in the equation (6). Based on the estimated short-term coefficients in the equations of (5) and (6), the long-term coefficients are worked out in the equations of (3) and (4), which are displayed in the lower part of each table.

When we focus on the long-term coefficients, it is only in the case of

As was described in Section II, however, the inflation targeting itself has made a progress by introducing the FPAS in 2011 as a forward-looking framework. Suppose that the FPAS came into effect after 2012, the sample can be divided into the first period from the third quarter of 2007 to the fourth quarter of 2011 and the second period from the first quarter of 2012 to the fourth quarter of 2017. The sample division could also be justified statistically by the Chow’s breakpoint test to diagnose a breakpoint by the statistics with probabilities for the hypothesis of parameter stability over different periods. Table 5 identified the existence of a breakpoint in the first quarter of 2012 in the benchmark case. Thus the estimations for the different periods are justified by the breakpoint of the first quarter of 2012.

Table 6 reports again the estimation outcomes of policy reaction functions for the first and second periods on the benchmark case, and Figure 3 represents the actual and fitted policy rates in both estimations. The first period estimation of policy reaction function shows no significant coefficients. In the second period estimation, on the other hand, the coefficients of inflation rate and exchange rate are significantly positive whereas that of production gap is negative11; and the magnitude of inflation coefficient, β, is less than unity, 0.444. All in all, among the estimated policy reaction functions, the forward-looking specification with one quarter ahead for the second period seems to be the best illustration of the current monetary policy rule in Mongolia. Regarding the robustness of estimation results above, however, it should be noted that the degree of freedom for the first and second estimations was quite limited considering the number of sample data and of estimation variables, and also that the alternative choice of instrumental variables and estimation methods such as two-stage estimation produced no significant outcomes as policy reaction functions. In this sense, the estimation results in this study are preliminary ones, and they should be updated by cumulative time-series data at a future time.

We interpret the estimation results above as follows. First, the current BOM appears to have adopted the inflation-responsive and forward-looking (one quarter ahead) monetary policy rule under its inflation targeting framework. It might reflect the progress in inflation targeting framework toward forward-looking mode by adopting the FPAS since 2011. Second, the current BOM inflation-responsiveness is, however, not powerful enough to stabilize inflation in the sense that the real policy rate tends to be still pro-cyclical to inflation pressure. It should also be noted, however, that the policy rate is not the only instrument but often supplemented by the reserve requirement ratio in Mongolian monetary policy. Third, the Mongolian monetary policy rule is also responsive to exchange rate movement. The policy reaction to exchange rate is typically represented by the fact that the BOM has still kept its policy rate at higher than ten percent even under the inflation rate below the targeted rate after 2015 to prevent currency value from falling. This kind of exchange-rate reaction, so-called “fear of floating”, tends to sacrifice monetary autonomy by weakening the policy reaction to inflation and output gap. As a matter of fact, the estimation result in this study shows the less-than-unity β magnitude and the negative reaction to production gap.

To sum up, the Mongolian current monetary policy rule under inflation targeting is characterized as inflation-responsive rule with forward-looking manner (one quarter ahead); the inflation responsiveness is, however, weak enough to be procyclical to inflation pressure; and the rule is also responsive to exchange rate due to the “fear of floating”, which weakens the policy reaction to inflation and output gap. In comparison with the policy rules in the other emerging market economies, the position of Mongolian policy rule could be confirmed in the policy rule map in Table 1. Mongolian rule is more advanced than China and Indonesia due to its forward-looking mode, while it is less than Korea and Thailand due to its weak inflation-responsiveness (not countercyclical reaction). In this sense, Mongolia stands in between a group of Korea and Thailand and that of China and Indonesia, in the sophistication of monetary policy rule.

4. Policy Suggestions

The purpose of this section is to provide some strategic policy suggestions to improve monetary autonomy in the Mongolian monetary policy. Although emerging market economies cannot avoid the problem of “fear of floating” perfectly, some economies are keeping their monetary autonomy by allowing exchange rate fluctuations in a similar way to advanced economies. According to Taguchi and Wanasilp (2018), for instance, the Thailand policy reaction function is similar to those of advanced nations in the sense that the Thailand β magnitude is bigger than unity just like advanced economies. The followings are some possible suggestions for Mongolia economy to enhance its monetary autonomy by extracting some lessons from forerunners’ economies.

First, Mongolian economy should have more foreign reserves to cope with foreign capital mobility. There have been several studies to argue that the accumulation of foreign reserves has contributed to retaining monetary autonomy. Aizenman et al. (2010) provided empirical evidence, for instance, that a higher level of foreign reserves enables a country to pursue a higher level of monetary independence even under the constraint of impassible trinity. Taguchi (2011) interpreted this contribution of foreign reserves as the anchoring role for retaining monetary autonomy in emerging market economies facing the “fear of floating.” Looking at the trend in total reserves in months of imports of Mongolia in comparison with those of Indonesia, Thailand and lower middle incomers in Figure 4, Mongolian foreign reserves are far less than the other economies’ ones so that the BOM should sensitively manage its policy rate against foreign capital flights. Hence comes the need to accumulate foreign reserves at least to the average level in lower middle incomers to improve monetary autonomy in Mongolia.

Second, from the long-term perspective, Mongolian economy should diversify manufacturing industries to maximize the advantage of currency depreciation in export side and to minimize its disadvantage in import side. Currency depreciation, as far as it does not lead to a crisis, push up exports, and this export recovery can be a growth momentum of total economy in case the export activities involve diversified industries in an economy. The depreciation is also not so harmful in import side in case an economy does not depend too much on imports under domestic production capacities enough in diversified industries. Regarding the Mongolian trading items, the exports concentrate on mining products and animal husbandry products, and the imports concentrate on machinery and consumption goods. Looking at the trade indices of Mongolia in comparison with those of Indonesia, Thailand, developing economies and the world in Table 7, the Mongolian trade structure shows the highest concentration on a few products by Product Concentration Indices, and the highest diversification from the world average structure by Product Diversification Indices.12 The industrial diversification may provide a resilience against currency depreciation so that the BOM care for “fear of floating” can be mitigated and its monetary autonomy can be recovered to some extent.

7)The data are retrieved from the website:

8)

9)The coefficient of exchange rate, δ, is expected to be positive. The exchange rate here is expressed by national currency per US Dollar, and so the large number represents currency depreciation. In that case, the policy rate should be raised to prevent its depreciation following the “fear of float” argument.

10)The specific GMM estimation procedure is as follows. E(ϵt ⊗ Zt) = 0 is the orthogonality conditions, where ϵt and Zt are an error term and a nine instrumental variable set, respectively. In this study, we test four over-identifying restrictions under five parameters and nine orthogonality conditions. Then, as a GMM estimator, we define the function g*(β) = E(ϵt ⊗ Zt) , which has a zero at β = β* under the null hypothesis. The method of moments estimator of the function g*(β) for a sample is  (

( We obtain the initial estimates of parameters by using an identity matrix for WT and minimizing JT(θ) = gT(β)'WTgT(β). We use these parameters to calculate ϵt and new weighting matrix. We then carry out continued iteration on the weighting matrix until convergence.

We obtain the initial estimates of parameters by using an identity matrix for WT and minimizing JT(θ) = gT(β)'WTgT(β). We use these parameters to calculate ϵt and new weighting matrix. We then carry out continued iteration on the weighting matrix until convergence.

11)The policy rate responsiveness to production (or GDP) gap differs according to individual economies without any commonality. Even among G3 in

12)The Product Concentration Indices are measured by a Herfindahl-Hirschmann Index, and the Product Diversification Indices measure the absolute deviation of the trade structure of a country from world structure. Both indices are retrieved from UNCTAD Stat and are defined in UNCTAD Handbook of Statistics 2016.

V. CONCLUDING REMARKS

This article reviewed the monetary policy rule under inflation targeting framework focusing on Mongolia. The empirical analysis estimated the policy reaction function to see if the inflation targeting has been linked with a monetary policy rule emphasizing on inflation stabilization since its adoption in 2007. The study contributed to the literature by examining the linkage between Mongolian monetary policy rule and inflation targeting directly and thoroughly for the first time and also by taking into account a recent progress in the inflation targeting framework toward forward-looking mode.

The main findings through the estimation outcomes of policy reaction functions were as follows. First, the Mongolian current monetary policy rule under inflation targeting is characterized as inflation-responsive rule with forward-looking manner (one quarter ahead). It might reflect the progress in inflation targeting framework toward forward-looking mode by adopting the FPAS since 2011. Second, the inflation-responsiveness is, however, not powerful enough to stabilize inflation in the sense that the real policy rate tends to be still pro-cyclical to inflation pressure. It would be quite different from the monetary policy reactions of advanced economies. Third, the Mongolian monetary policy rule is also responsive to exchange rate movement, due to the “fear of floating”. The policy reaction to exchange rate is typically represented by the fact that the BOM has still kept its policy rate at higher than ten percent even under the inflation rate below the targeted rate after 2015 to prevent currency value from falling. The “fear of floating” might weaken the policy reaction to inflation and output gap.

The strategic policy implication to enhance monetary autonomy in the Mongolian monetary policy would be the serious necessities to have more foreign reserves to cope with foreign capital mobility and to diversify manufacturing industries to acquire a resilience against currency depreciation in the long run.

Tables & Figures

Table 1.

Summary of Literature on Monetary Policy Rule

Sources: Author’s description

Table 2.

List of Variables and Data Source

Sources: Author’s description

Figure 1.

Observation of Analytical Indicators

Source: IFS of IMF

Table 3.

Unit Root Test

Note: ***, ** denote the rejection of null hypothesis at the 99% and 95% level of significance.

Sources: IFS of IMF

Table 4.

Policy Reaction Functions

Notes: 1) The sample period is from 2007Q3 to 2017Q4.

2) ***, **, * denote the rejection of null hypothesis at the 99%, 95% and 90% level of significance. The t-statistic is in parentheses.

3) The instrumental variables for the estimations above are three-quarter lagged explanatory variables in the equation (5) and (6): the estimation of the, case of

4) The estimations above adopt “HAC (newey-west)” as an estimation weighting matrix and “Iterate Convergence” as a weight updating.

Sources: IFS of IMF

Figure 2.

Actual and Fitted Policy Rate in Case of

Source: IFS of IMF

Table 5.

Chow Breakpoint Test

Sources: IFS of IMF

Table 6.

Policy Reaction Functions for First and Second Periods

Notes: 1) ***, ** denote the rejection of null hypothesis at the 99% and 95% level of significance. The t-statistic is in parentheses.

2) The instrumental variables for the estimations above are three-quarter lagged explanatory variables:

3) The estimations above adopt “HAC (newey-west)” as an estimation weighting matrix and “Iterate Convergence” as a weight updating.

Sources: IFS of IMF

Figure 3.

Actual and Fitted Policy Rate in the First and Second Periods

Source: IFS of IMF

Figure 4.

Total Reserves in Months of Imports

Source: World Bank Open Data

Table 7.

Trade Indices

Sources: UNCTAD Stat

References

-

Aizenman, J., Chinn, M. D. and H. Ito. 2010. “The Emerging Global Financial Architecture: Tracing and Evaluating New Patterns of the Trilemma Configuration,”

Journal of International Money and Finance , vol. 29, no. 4, pp. 615-641.

-

Bayardavaa, B., Undral, B. and C. Altan-ulzii. 2015.

Monetary Policy Transmission in Mongolia . Bank of Mongolia Research Book, vol. 10, pp. 92-133. <https://www.mongolbank.mn/documents/tovhimol/group10/01.pdf > (accessed January 21, 2018) -

Bernanke, B. S. and F. S. Mishkin. 1997. “Inflation Targeting: A New Framework for Monetary Policy?,”

Journal of Economic Perspectives , vol. 11, no. 2, pp. 97-116.

-

Bernanke, B. S., Laubach, T., Mishkin, F. S. and A. S. Posen. 1999.

Inflation Targeting: Lessons from the International Experience . Princeton: Princeton University Press. -

Bhargava, A. 1986. “On the Theory of Testing for Unit Roots in Observed Time Series,”

Review of Economic Studies , vol. 53, no. 3, pp. 369-384.

-

Buyandelger, O. E. 2015. “Exchange Rate Pass-through Effect and Monetary Policy in Mongolia: Small Open Economy DSGE Model,”

Procedia Economics and Finance , vol. 26, pp. 1185-1192.

-

Cai, Y. and H. Taguchi. 2015. “Monetary Policy Rule under Financial Deregulation in China,”

Economics Bulletin , vol. 35, no.1, pp. 122-132. -

Calvo, G. and C. Reinhart. 2002. “Fear of Floating,”

Quarterly Journal of Economics , vol. 107, no. 2, pp. 379-408.

-

Clarida, R. and M. Gertler. 1997. How the Bundesbank Conducts Monetary Policy. In Romer, C. and D. Romer. (eds.)

Reducing Inflation . Chicago: University of Chicago Press, pp. 363-412. - Clarida, R., Gali, J. and M. Gertler. 1998a. Monetary Policy Rules and Macroeconomic Stability: Theory and Some Evidence. NBER Working Paper, no. 6442.

-

Clarida, R., Gali, J. and M. Gertler. 1998b. “Monetary Policy Rules in Practice: Some International Evidence,”

European Economic Review , vol. 42, no. 6, pp. 1033-1067.

- Eichengreen, B. 2002. Can Emerging Markets Float? Should They Inflation Target?. Working Paper, no. 36. Banco Central do Brazil.

-

Gagnon, J. E. and J. Ihrig. 2004. “Monetary Policy and Exchange Rate Pass-through,”

International Journal of Finance and Economics , vol. 9, no. 4, pp. 315-338.

- Ito, T. and T. Hayashi. 2004. Inflation targeting in Asia. Occasional Paper, no. 1. Hong Kong Institute for Monetary Research.

-

Khishigjargal, E. 2018. “Monetary Policy Transmission under Inflation Targeting in Mongolia,”

Research in Applied Economics , vol. 10, no. 2, pp. 1-17.

- Kim, S. and Y. C. Park. 2006. Inflation Targeting in Korea: A Model of Success?. Bank for International Settlements (BIS) Papers, no. 31.

-

Lin, S. and H. Ye. 2009. “Does Inflation Targeting Make a Difference in Developing Countries?,”

Journal of Development Economics , vol. 89, no. 1, pp. 118-123.

-

Lueangwilai, K. 2012. “Monetary Policy Rules and Exchange Rate Uncertainty: A Structural Investigation in Thailand,”

Procedia Economics and Finance , vol. 2, pp. 325-334.

-

Mishkin, F. S. 2000. “Inflation Targeting in Emerging Market Countries,”

American Economic Review , vol. 90, no. 2, pp. 105-109.

- Mishkin, F. S. 2004. Can Inflation Targeting Work in Emerging Market Countries?. NBER Working Paper, no. 10646.

- Mishkin, F. S. and A. S. Posen. 1998. Inflation Targeting: Lessons from Four Countries. NBER Working Paper, no. 6126.

- Mishkin, F. S. and K. Schmidt-Hebbel. 2007. Does Inflation Targeting Make a Difference?. NBER Working Paper, no. 12876.

-

Ng, S. and P. Perron. 2001. “Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power,”

Econometrica , vol. 69, no. 6, pp. 1519-1554.

-

Phillips, P. and P. Perron. 1988. “Testing for Unit Root in Time Series Regression,”

Biometrika , vol. 74, no. 2, pp. 335-346.

-

Taguchi, H. 2011. “Monetary Autonomy in Emerging Market Economies: The Role of Foreign Reserves,”

Emerging Markets Review , vol. 12, no. 4, pp. 371-388.

-

Taguchi, H. and C. Kato. 2011. “Assessing the Performance of Inflation Targeting in East Asian Economies,”

Asian-Pacific Economic Literature , vol. 25, no. 1, pp. 93-102.

-

Taguchi, H. and M. Wanasilp. 2018. “Monetary Policy Rule and its Performance under Inflation Targeting in Thailand,”

Asian Journal of Economics and Empirical Research , vol. 5, no. 1, pp. 19-28.

-

Taylor, J. B. 1993. “Discretion versus Policy Rules in Practice,”

Carnegie-Rochester Conference on Public Policy , vol. 39, pp. 195-214.