- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 24, No. 1, 2020. pp. 89-124.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2020.24.1.373

Number of citation : 0Cross-Border Asset Pledgeability for Enhanced Financial Stability

Abstract

Even with the sizable Foreign Exchange (FX) holdings and good credit ratings of its top assets, Asia remains vulnerable to various shocks. This paper highlights the limited cross-border asset pledgeability as a significant factor for the lingering vulnerability in Asia. The dichotomy in asset holdings between pledgeable FX and non-pledgeable domestic assets in major economies in Asia has been the source of increasing stabilization costs as well as weakened market momentum in the region. Specifically, the peculiar feature of asset holdings in Asia reflects seriously deficient cross-border asset pledgeability that is left unaddressed. Asset pledgeability contributes toward financial stability via three channels: 1) capital market development by recognizing the role of collateral, 2) increased shock absorption capacity via collateral management, 3) and the newly activated safe asset provision. Therefore, it is crucial to go beyond the usual market development strategy and expand the overall asset pledgeability in the region that has remained unduly depressed.

JEL Classification: E40, E44, E50, F30, F34, G1

Keywords

Cross-Border Collateral, Asset Pledgeability, Safe Asset Shortage, Financial Stability, PVAR (Panel Vector Autoregression), Haircut

I. INTRODUCTION

After the global financial crisis, most of the discussions have centered on regulatory changes, e.g., leverage and liquidity aspects (Kenneth et al., Squam Lake Report, 2010). Some of the risk management failures have identified a supervisory lapse in securitized and collateralized market practices. However, the past decade has shown that regulatory preparedness has not adequately addressed the on-going challenges of lingering financial instability. Some of the features of heightened volatility and abrupt reversal of market sentiments seem entrenched features of the modern financial system that features increasingly integrated and driven by supranational guidelines. Recurrent financial instability has become the embedded feature of the post-Bretton Woods II, as evidenced by the global financial crisis in 2008 (See Figure 1). Besides, the core global financial system has contributed toward even more serious polarization and secular recessions via a series of quantitative easing and ZIRP (Zero Interest Rate Policy). Something is wrong with fundamental aspects of the global financial system at its core. And real progress other than regulatory side has yet to be made in terms of structural improvement in the global financial system. In reality, despite the need for the global financial system reform, the exigency of the recurrent stress situations has prevented authorities from seeking remedies toward the root causes of the problem consistently. What can be a realistic approach to this structural problem? What are missing in prevailing approaches to address some of the fundamental problems of nagging vulnerability with the global financial system, if not emerging markets?

Since tenacious features of emerging economies in the wake of recurrent financial crises have been sudden stops or extreme volatility that have denied conventional policy measures, the study further needs to dampen the sensitivity against external shock by relating it with underlying factors: the lack of asset pledgeability that prevails in the region. During quiet times, hoarding safe assets would give enough signals for financial stability; however, during crises, what matters is the market adjustment that requires a robust, liquid market other than official FX liquidity facilities. This observation is different from the traditional diagnosis that monitors a set of market indicators, e.g., risk premiums, that often misses out abrupt knee-jerk reactions that characterize the current global financial system. The study focuses on liquidity aspects in the region, where most of the provisions rely heavily on central authorities and policy efforts. I highlight the problems of limited asset pledgeability, i.e., the ability of an asset to serve as collateral as one of the possible factors for uncontrollable sensitivity. Despite the underlying needs of Asia to address financial plumbing issues that get easily clogged even with small shocks from everywhere, global players and mature markets have remained dominant enablers of market transactions. The market activities remain polarized despite deep market integration, with a more sizable chunk centralized in mature economies. And the efforts to address the situation usually take the form of more reserves and central bank swap arrangements, which have to remain dormant except for the tail events. By and large, there are little evidences that market capacity to deal with various shocks has improved substantially.

In this paper, I claim that the trend variable of limited cross-border asset pledgeability translates into endogenous shocks via spillovers that plague the overall financial system. It is the focus of this paper to identify some extra dynamics of the endogenous cycle associated with asset pledgeability. That is, the underlying dynamics of asset pledgeability and others result in a drastic loss in market stability. In essence, this study tries to make points that emerging markets’ unique feature of low cross-border asset pledgeability remains the underlying factor for the lingering financial instability in the region. Therefore, future policy efforts need to dig deeper to secure underlying conditions for market development rather than applying short-term policy measures. That is, lingering side-effects that interfere with organic market development are controllable with improved asset pledgeability.

In practice, because of this lower asset pledgeability, the region has developed unique ways to manage liquidity and achieve financial stability: FX reserves and central bank swaps. Fundamentally, limited asset pledgeability has remained the strong driving force behind the limited portfolio choices in emerging economies. The bad initial condition has started a vicious cycle of too much reliance on external FX assets for financial stability. Concerning home assets, foreign assets continue to “relax” the borrowing constraints because their pledgeability as collateral is superior in periods of adverse economic conditions. This sort of hedging property per se is an essential motive for investing in foreign assets. Asia’s choice of maintaining global market access is via holding on to pledgeable FX reserves. Instead of improving the pledgeability of their assets, they entirely devoted to “safe asset holdings” with proven pledgeability. To preserve pledgeability, their portfolio choice has been pretty much “buy and hold strategy.” It is unclear how much of the dichotomous asset holdings pose problems in terms of achieving financial stability as compared with asset holdings with varying degrees of pledgeability. Yet, diverse asset holdings with varying degrees of pledgeability are assumed to be better than the silo-ed holdings of a selected group of assets (Markowitz Diversification). Too many resources are tied to maintain financial access as a precautionary incentive in a bipolar manner. Further, we cannot expect markets to develop under such conditions when buy and hold strategy remains the de facto effective way to ensure necessary market pledgeability. Without improved asset pledgeability, it is impractical to expect market development in the region because there are little incentives for cross-border market transactions. Only hoarding of safe assets can enjoy broad policy support and social consensus, which only worsens the growing gap between superior sovereign ratings and limited market perception on the usability of assets.

One of the reasons why collateral needs to be “cross-border pledgeable” is that Asia’s old tradition of utilizing vehicle currency denominated assets has been the key to obtain access to the international financial market. Most Asian countries secure FX liquidity by holding on to it because of its lack of own capital market access, and the overriding needs to secure FX stability for export-oriented growth paradigm. There is a natural tendency to hoard FX assets, and limited needs to utilize it to secure FX funding. This underlying condition has been dampening the market-driven needs to develop the bond market in the region even with strong policy initiatives, e.g., The Asian Bond Markets Initiative (ABMI). Outsourcing capacity for cross-border asset pledgeability toward vehicle currency assets works well for short-term stability at the expense of longer-term capacity to absorb various shocks via market transactions. However, things are different after recurrent financial crises. Asia has finally realized the importance of having a well-developed capital market that recognizes its assets for better utilization across the border. The regional efforts have remained mostly fragmented, and often lose momentum for sustainable and inclusive engagement by countries in the region. Among others, one of the promising areas for collaboration is laying the groundwork for the cross-border collateral utilization. For instance, it is always essential to choose the right sequence to develop the capital market by recognizing its assets for pledgeable cross-border collateral before establishing financial infrastructures, e.g., regional settlement facilities that would contribute to more centralization of market capacity (ADB, 2014).

This paper explicitly recognizes three dimensions of cross-border asset pledgeability as the underlying determinants for financial stability in emerging markets: Market development incentives, shock absorptive capacity, and safe asset provision. First, it emphasizes pledgeability as the basis of market incentives in a regional context. Holding on to more massive reserves with limited usability is costly. The fundamental dichotomy between FX denominated and local currency-denominated assets is that the former is pledgeable but not mainly hoarded, while the latter is not pledgeable and have limited cross-border usability. This dichotomous approach of maintaining cross-border asset pledgeability solely via dollar-denominated assets is problematic since domestic assets remain ineligible for cross-border transactions.1 And the choice is not helping Asia developing its own capital market. Second, improved asset pledgeability means enhanced shock absorptive capacity. When hit by various shocks, extra room for adjusting the portfolio using its collateral is a significant boost to absorb shocks. Thus, the renewed recognition as pledgeable assets would pave the way for Asia to develop markets organically as it entails the higher capacity to absorb shocks. Third, it touches on the pledgeability in a broader context of macro-finance linkage, e.g., a safe asset mechanism. Despite excellent credit ratings on sovereign assets, pledgeability is the first requirement to become safe assets that are missing among Asian assets.

The paper runs fact-checks on the Asian collateral map, which is followed by global practices on collateral and its implications. It then proceeds to conduct some empirical investigation to check whether limited asset pledgeability is one of the essential factors for regional vulnerability against various shocks. The rest of this paper further discusses the link of asset pledgeability with market development, financial stability, and safe asset supply. It is followed by discussions on action plans and policy implications, with the conclusion in the final section.

1)The issue of “currency denomination” matters a lot for determining the cross-border asset pledgeability. However, other determinants remain important for sizing up the asset pledgeability.

II. THE ASIAN SNAPSHOT AS A BACKGROUND CHECK

It is crucial to figure out the current status in Asia. In contrast with the full recognition of policy recommendations by the International Financial Institutions, there are surprisingly fewer market activities that continue to reflect the tight grip of the authorities over the entire spectrum of the financial market. Asia is well-known for its bank-dominant and highly-regulated financial system. As a result, the trust base for prime assets in the region largely remains in the sovereign territory. Unlike the Asian emerging markets’ limited cross-border activities, the European emerging countries have been active in cross-border collateral transactions thanks to its unified collateral framework as maintained by the European Central Bank (ECB). However, even with great economic fundamentals and potentials, government bonds in the region are not qualified for cross-border transactions due to lack of the cross-border pledgeability. Whether the currency denomination for bonds matters more for cross-border pledgeability needs to be further examined in future studies. However, given the limited cross-border transactions in the secondary markets for government bonds, we cannot identify “FX risks” as the core determinant of limited cross-border asset pledgeability. Rather, institutional and regulatory constraints are more binding cases in the region (Choi, 2019a). Pending further studies, the traditional governance structure embedded in the region has some bearings on the limited asset pledgeability. The underlying base for sovereign trust often interferes with broader market-based trust, which entails further studies with broader perspectives.

Above all, to get a sense of glaring disparity in the region for its asset holdings and its operational capability, the following snapshots are relevant. Given the lopsided distribution of pledgeable assets around the world, efforts to make a more stable and secure world without addressing fundamental resources to do it would have its limits. Therefore, the glaring disparity between the needs for pledgeable collateral and the under-utilized resources of fundamentally good collateral that exists in Asia tells the compelling need for change. Among various factors that contribute to the characteristics of the Asian financial system, the entrenched feature of limited asset pledgeability deserves serious examination because it is the most emphasized factor with little progress in the region (Choi, 2019b). Most dislocation and lock-up situation in markets during the crisis illustrate enormous frictions in markets that sometimes resemble sudden-stops (Calvo, 1998). The adjustment dynamics with polarized asset holdings between pledgeable and non-pledgeable assets are partly attributable to borrowing constraints tied with collateral value swings that get easily activated even with smaller external shocks (see, e.g., Kiyotaki and Moore, 1997; Gromb and Vayanos, 2002). However, the collateral-related dynamics are different in Asia since most of the adjustments go through the real estate channel with the backdrop of the under-developed financial system.

The lack of pledgeable assets and proper infrastructures has never surfaced as issues that caught the attention of global scholars or market practitioners. Despite related findings on the shortage of safe assets in the framework of supply and demand by Caballero and Farhi (2013), most of the findings have not been convincing enough to address the issue of finding extra good collateral for enhanced pledgeability. Instead, these studies have emphasized improving existing machinery and infrastructures to improve collateral velocity, which has remained beyond the realm of realistic solutions for the region. Only a few studies pointed out the potential of Asian prime collateral as a possible solution to this greasing issue, except for Choi (2014). Also, there has been little market-driven efforts to recognize Asian assets as possible cross-border collateral in the first place.

III. ASIAN WRINKLES ON THE REST OF THE WORLD: SPILLOVER EFFECTS AND NEGATIVE FEEDBACK LOOP

As expected, the markedly limited asset pledgeability in Asia has also contributed to global problems in an increasingly interconnected world: excess demand for safe assets, dampened market-based transactions after a series of Quantitative Easing (QE) that paralyzed legacy credit supply system, and massive capital flows uphill with increased volatility. In short, Asia’s limited cross-border asset pledgeability has contributed to the extra burden on the global financial system, triggering market anomalies, e.g., capital-flow uphill and accompanying disturbances that revert to emerging economies with convoluted shocks. As noted, European countries have focused on various measures to improve upon existing collateral machinery in response to rising demand for safe assets, including experimenting with Central Counterparty Clearing House (CCP) and tweaking the eligibility criteria to accept seemingly ineligible assets as collateral (Nyborg, 2019). It also has spilled over to the US where safe asset production facility has been expanded to private labels in the form of Collateralized Debt Obligation (CDO) and finally resulted in upheavals in the global financial system.

It is challenging to observe compelling evidence of limited cross-border pledgeability that comes from various symptoms of safe asset shortage and market underdevelopment (Brumm et al., 2018). In a nutshell, the popular discussions over safe asset shortage often resurface in the framework of supply and demand, where excess demand from emerging markets resulted in a safe asset shortage problem. However, safe asset issue has deeper roots in the concept of the lack of pledgeability among a broader category of assets, particularly that of emerging economies. It is as much of a jurisdictional issue with deep parameters as it partly reflects economic fundamentals.

The existing literature touch on the limits of safe asset suppliers who remain as vehicle currency countries. The other strand of research is about how to tackle safe asset shortage problem by emphasizing market infrastructure improvement. Neither of the two strands of research tackle the issue from the limited nature of cross-border asset pledgeability among broad spectrum of financial assets. While these findings have some bearings on macro and market situations, they do not address the question about the need to recognize a large pool of unexploited assets for improved pledgeability. Notably, the pledgeability of assets is a glaringly ignored aspect of risk management in the region in a world of liquidity provision mostly engineered via public support.

In contrast, there have been quite sizable efforts in Europe to make the system better via improving market infrastructures or enhancing collateral velocity via reuse (Brumm et al., 2018). According to Brumm et al., collateral reuse is around 2.5 to 3.5 trillion Euros during 2006-2016, which is above 30% as compared with total assets. For example, improving the financial infrastructure around the proposal of the Bank for International Settlements (BIS) and others to build CCP clearing and settlement facilities in the region have remained the critical issues for many years (Heider, 2017). As expected, the wrinkles coming from underutilization of Asian prime assets are evident in extra pressure for market developments in Europe and the US (Figure 2). The limitations of dealing with tightly selected collateral pools with jurisdictional perimeter increase Asia’s reliance on external financial infrastructure to mobilize its tightly regulated pool of FX-denominated assets. Therefore, the only consistent approach is to recognize cross-border asset pledgeability in Asia.

The following graphs (Figure 3 and 4) also show the market response against excessive demand for safe assets before the global financial crisis. Markets have wanted it, yet markets could not have delivered what markets have asked for some unknown reasons. Strong demand for safe assets as amplified by Asian countries contributed to the supply of white-labeled, private manufactured safe assets as evidence by covenant-light loan packages that distorted market premiums and helped enforce a vicious cycle of leverage loans until recently. During the systemic risk build-up period, Asian assets have remained under-utilized, and the capital flow uphill has been more pronounced, precipitating immense pressure to produce private label safe assets. This situation remains mostly uncorrected. According to the International Monetary Fund (IMF)’s Global Financial Stability Report, safe assets reflect 4 main functions; safe asset is a reliable store of value; serves as a safe collateral in repurchase and derivative markets; constitutes prudential framework for banks; and benchmarks to measure relative risks of other assets (2012). However, most Asian countries, except for Japan, are ineligible to pledge collateral infrastructure. They are incapable of satisfying the second component of safe assets.

Above all, as the paper focuses, it is not the lack of safe assets per se that matter, but the narrowly defined and poorly managed pledgeable assets as collateral that matters most. Restricting the pool of safe assets among key member countries has thwarted efforts of non-member countries to develop their assets to reach the safe asset status, if not pledgeable asset status. Caballero’s safe asset mechanism (SAM) arguments acknowledge this fact that there are severe limits on the supply side given deteriorating fiscal conditions of reserve currency countries (Caballero and Farhi, 2013). Their suggestion about national insurance also has problems related to the erosion of the trust base that comes with their renewed role as suppliers of safe assets. Accordingly, the focus is not on the supply of safe assets per se but lopsided conditions regarding the lack of pledgeable assets or lack of infrastructures to mobilize pledgeable assets.

Finally, there are further implications on the US FED operations, the centerpiece of the global financial system. As a result of central bank balance sheet expansion after the global financial crisis, credit expansion has not channeled via the banking system, and the use of collateral has been depressed as a result of massive QE by major central banks that have absorbed good collateral from the market. In a world where only narrowly defined safe assets are accepted as part of central bank balance sheets, an increase in the size of asset holdings by central banks implies fundamental problems with the global financial system. Narrowly defined pool of eligible collaterals and equally restricted use of cross-border collateral in times of stress have resulted in major central banks interfering with market-based liquidity supply channels. If broader utilization of collateral were activated, the ironic fact that central banks intervened to shore up sagging market sentiment and hindered normalization of the credit channel. Given the emphasis on collateralized loans, this central bank operations resulted in less and lower quality collateral supporting the financial system. Central banks have taken away the basic building blocks of financial plumbing to achieve financial stability after the shock.

Asia’s limited cross-border asset pledgeability has been hurting global financial stability by halting collateral machinery for smoother market transactions, limiting the supply of safe assets that increased the demand for dollar-denominated safe assets, and putting pressures on the FED operations. Sizing-up the evidence with a different perspective, it is not far-fetched to conclude that limited asset pledgeability and its global spillovers are evident during the risk buildup process that has led to the global financial crisis.

IV. FACTORS FOR LIMITED CROSS-BORDER ASSET PLEDGEABILITY

Given the evidence on sizable differences between outside credit ratings and market recognition about the usability of the Asian sovereign, it is crucial to identify some of the factors that account for this persistent recognition gap. At least three aspects are identifiable: External, internal, and market perspectives.2

First, the prevailing global financial system hinges on the post-Bretton Woods framework, which is essentially a dollar-based system. Given the dominance of US influence, expanding Asia’s contribution remains a tough challenge since the current system is virtually the only option with all the infrastructures and a huge market base. As shown in the policy responses to the safe asset shortage problem, incumbents have remained hesitant about including Asia as potential players. The prevailing eligibility criteria by the ECB and the FED have jurisdictional proclivity with collateral infrastructures. Unfortunately, Asia has none.

Second, domestic issues are an even more significant problem for not being able to improve the cross-border asset pledgeability. It is clear that Asia’s growth paradigm has been export-oriented, and FX stability remains the ultimate policy objective. This agenda entails other implications that foster tight control of the authority regarding FX-based external transactions. Movement of collateral across the border carries some notion about giving up authorities’ control for maintaining domestic financial stability. A micro legal interpretation has some hidden barriers that make cross-border transactions costly and cumbersome. All the centralized financial infrastructures on the exchange, clearing, and the settlement also make private participation a problematic proposition.3 This aspect represents Asia’s unique liquidity arrangement that remains dichotomized between FX and domestic assets. The existence of the overriding objective determines a unique policy mix for the authorities faced with policy trilemma (FX stability, free flow of capital, and policy autonomy). Most of the regulations on FX related transactions remain strictly enforced. Expectedly, moving assets cross-border have been areas with many restrictions and regulations. For instance, the transfer of the collateral contract is not secure with all the centralized clearing and settlement facilities (e.g., CSDs (Central Securities Depository) and Exchanges) in the region. Therefore, it is more challenging to move collateral cross-border due to internal constraints that can only be observed by private market participants.

Third, information production via market transactions remains suppressed due to dominant positions of authorities and policy interventions. The underinvestment in pledgeability resulting from liquidity-induced leverage cannot be renegotiated away, either. The connection between limited pledgeability and credit cycle may not show up because there are other alternatives for higher leverage investment. Also, central banks typically influence markets for collateral through either the supply of assets available for use as collateral, a scarcity channel, the pledgeability of assets in private transactions, a structural channel, or both (BIS Quarterly Review, June 2015). Central bank collateral choices in the context of policy measures appear in Bindseil, Gonzalez, and Tabakis (2009) and Rule (2012). And their contribution toward a more open environment would greatly enhance asset pledgeability across the border, which is lacking in the region. To the extent that governments or central bank policies create anticipation of liquidity, there may be less concern for pledgeability issues, especially where liquidity issues are mostly the responsibilities of authorities. Ironically, highly effective authority responses conflict with market-driven operations by market participants. This practice, in turn, suppresses the need for pledgeability of assets in the region.

2)It is rather presumptuous to identify the causal ordering of these factors in this study because all three are intertwined inextricably. However, given the dominant role of bureaucratic governance in the region, and the mandate for stable market conditions, we can expect collateral-based enhanced asset pledgeability in the region by relaxing the internal regulations on cross-border transactions.

3)The interpretation of permissible transfer collateral in cross-border transactions is limited, and establishing the right of pledge is conditionally permitted

V. POST?CRISIS DEVELOPMENT IN ASIA: STATUS QUO WITH LITTLE BREAK-THROUGH

In essence, a pledgeability issue remains mainly as a safe asset shortage problem with accompanying policy implications. That is, given the safe asset supply and demand arguments, the policy implication would concentrate on expanding the safe asset supply capacity. If the US and the Euro remain as the dominant supplier, the current gap would only increase further given the binding fiscal constraints of existing authorities (i.e., the Triffin Dilemma). As the only “legitimate” supplier of safe assets, this myopic view is already a binding constraint by itself. Accordingly, Asia’s problems have resulted in global issues, yet the policy recommendations have not yet addressed this aspect of low cross-border asset pledgeability. Ruling out Asia as the potential supplier of safe assets is irrelevant because its pledgeability is very limited for unjustified reasons.

Unsurprisingly, there have also been genuine efforts to develop the capital market in the region, especially the bond market after the Asian financial crisis. Despite such regional efforts as Asian Bond Markets Initiative (ABMI), Chiang Mai Initiative Multilateralization (CMIM), and Asian Monetary Fund (AMF), there has been limited progress in terms of inclusiveness and region-wide cross-border activities. In order to boost the trust base for more complete market transactions, joint programs, such as ASEAN+3, need to be carried out. Specifically, cross-border collateral needs to be given a new meaning as catalysts for liquidity and profit opportunities because it is the best choice for trust-building and allows lower initial entry-level of counterparty risk than outright sales. The underlying gap between superior credit ratings and limited asset pledgeability is due to hidden restrictions on the cross-border usability of sovereign assets in the region. The FX related restrictions and tight internal regulations put restrictions on the mobility of assets across the border and led to derivatives or securities lending practices that always need real-time adjustments to ensure expected features of the collateral property.

In addition to global guidelines regarding cross-border transactions, local rules and operations of local infrastructure are also essential to allow assets to move cross-border for market transactions. Besides legal and regulatory harmonization, each country has its war chests to prepare against speculative attacks, and some of its legacy ramifications are visible in inhibiting market players from considering various market transactions that involve assets move cross-border. This literature focuses on pledgeability, which does not distinguish the domestic and regional market setting since dollar assets are tradeable everywhere. The embedded features of cross-border pledgeability of eligible assets are difficult to observe since vehicle assets are mostly pledgeable even with poor ratings. Currency risks remain as the dominant criteria. Are currency risks related to pledgeability or vice versa? Park, Shin and Tian (2018) claim that when countries with a high dependency on vehicle currencies face an unexpected depreciation in the domestic currency, it entails damage to its balance sheet, which destabilizes the financial system and economy. Well, this is a confidence-building exercise, and the repo market allows a lower entry barrier for non-vehicle assets due to its repo features. Currently, this practice of emphasizing the vehicle currency status over others seems to prevail without enough merits. Pledgeability is a more coherent measure to monitor the progress in trustbuilding, and credit ratings need to be combined with pledgeability to convey better information.

VI. ASSET PLEDGEABILITY AND FINANCIAL STABILITY: AN EMPIRICAL INVESTIGATION

1. Data Description

In this section, I examine the correlation between cross-border asset pledgeability as measured by the market perception gap and the financial vulnerability as measured by changes in exchange rates. Two aspects of the issues touch on either the potential availability of pledgeable assets or the actual pledgeability in times of stress. Indeed, the consequences of ignoring eligible assets as cross-border pledgeable are far-reaching and massive. In recognition of the fact that collateral grease the wheels of global finance, lack of collateral in response to shocks has further put additional pressure on the global financial system. On the other hand, if cross-border collateral is better utilized, it can significantly moderate the impact of various shocks on a specific region or country. It is a rather unexpected development in the highly integrated financial market environment globally; the use of collateral is minimal under jurisdictional practices. Fewer transactions during regular times can result in precarious situations that cannot deal with usual market adjustment (Corradin et al., 2017). As shown, this tendency also contributed to over-stressed financial systems in core countries, as evidenced by spillovers. Panel data analyses allow you to control for pledgeability that is unobservable; or variables that change over time but not across entities (i.e., supervisory guidelines or international agreements). That is, it allows individual heterogeneity in terms of asset pledgeability. Some later studies would include measuring spillovers to other regions as well.

The importance of asset pledgeability as a de facto market indicator of liquidity, financial stability, and bond market development is measurable with the empirical findings. The underperformance of these underlying factors is identified as a contribution toward recurrent instability because other vital indicators have served as policy targets and have shown little anomaly before the crises. This observation also raises a fundamental question about the policy recommendations of International Financial Institutions (IFIs) for emerging economies, which resulted in the “indicator becoming target problem.” In an ex-post sense, this sensitivity cannot be overcome ex-ante with conventional macro measures for stability, e.g., FX reserves and swap arrangement, and pre-emptive policy responses. Given that it is the operational freeze of the system under stress, not the stability during regular times, a more in-depth approach is in order. The focus of future research efforts remains to identify this process that paralyzes market transactions all of a sudden.

In a similar setting, there are various studies with some bearings on asset pledgeability. For instance, there is a link between asset pledgeability and asset price in a specific setting. Ignoring information from collateral transactions is equivalent to missing out market functioning for price discovery. For instance, the equilibrium price of an asset not only depends on its fundamentals but also on its pledgeability as shown by Chen et al. (2019), whose insight rigged on the fact that difference in the price of the same product with different regulatory settings reflects the impact of asset pledgeability on asset valuation. Likewise, the interplay between various characteristics of pledgeable assets is reflected in most market transactions because asset pledgeability carries lots of information that reflect changes in complex activities.4 For example, repo transactions are essentially collateralized borrowing with the bond serving as collateral (Krishnamurthy, 2010), which shows itself in the equilibrium pricing on the spot market. In a related context, these haircut-implied funding costs have also been used by Chen, Cui, He, and Milbradt (2018) to endogenize the holding costs and, in turn, the liquidity discounts of illiquid assets. Likewise, asset pledgeability is a vital channel to look into this interplay between markets and participants.

Further, Caballero’s safe asset mechanism (SAM) has some bearings on the pledgeability issue since the extra demand for safe assets in the region has roots in the limited pledgeability of its assets. By emphasizing the underpinnings of collateral in capital flow and asset choices, Caballero and Farhi (2013) highlighted the role of safe assets with full pledgeability in the international financial system. Their focus is mainly on the availability of safe assets supplied as compared with demand, yet the underlying feature of pledgeability still plays a vital role in greasing the wheels of international finance. If there is a growing gap between the supply and demand for safe assets, especially in emerging economies where there are little safe vehicles for long-term savings with safety features, it plays out as a depressed global interest rate. Notably, near-zero interest rates, abundant liquidity, and continued instability stand out as some of the symptoms for the shortage of safe assets (Caballero, Farhi, and Gourinchas, 2017). Specifically, this approach toward supply and demand factor for safe assets is misplaced since it tends to gloss over more important underlying cross-border pledgeability, which has a different dimension. The full spectrum of relevant topics remains for future studies, and this paper concentrates on figuring out the impact of asset pledgeability on financial vulnerability using annual panel data. Also, the time dimension kicks in with the asset pledgeability. The related literature has single-mindedly focused on the pledgeability of assets and credit cycle, which implies that leveraged financial cycle is attributable to mispricing of its pledgeability, which seem to matter little in times of the leverage-buildup cycle.

Ignoring the pledgeability aspect of assets contribute to the inherent bias among emerging market bonds. Especially in times of stress, when pledgeability matters, and the gap between the asset holdings and pledgeable asset holdings remains the underlying causes for financial lockup that paralyzes financial markets. This sudden stop is a salient feature of emerging economies and has a close connection with the limited asset pledgeability of Asian bonds. The sharp distinction among assets in terms of pledgeability especially matters for emerging economies where FX liquidity dictates the creditworthiness of debtor nations. Given the lopsided discrepancy among sovereign balance sheets in the composition of core assets, emerging markets sit on the underutilized, sizable assets that cannot function in times of stress. The seemingly essential FX reserves are not enough to guard against external shocks because holdings of FX reserves are mostly insurance and cannot be used to raise liquidity when it matters most (due to signaling effect). Therefore, when faced with an exogenous shock, emerging market economies, and financial systems destabilize, which entails a sudden currency depreciation (Park, Shin, and Tian, 2018). Overall, Asia is sitting on resources that remain unusable in times of crisis. In fact, it has long been recognized, e.g., by Duffie (2010), that equilibrium asset prices depend not only on asset fundamentals but also “liquidity” factors that are broadly related to the frictions prevalent in modern financial markets.

Lack of pledgeability is the critical reason for Asian asset underpricing, if not a lack of re-deployability. Some would argue that FX volatility and limited hedging capacity remain the overriding constraints of Asian assets over pledgeability (Caruana, 2011). Yet, it is mostly an empirical issue of sizing up convertibility vs. pledgeability as determinants of the asset price. Given our preliminary understanding of the cross-border asset pledgeability, it is still necessary whether the data support our claim about its importance. The interplay among eligibility, pledgeability, and credit-ratings needs in-depth investigation. Therefore, it is crucial to examine the relative contribution of various factors that determine asset pledgeability: the limited pool of pledgeable assets or lack of market infrastructure to support transactions.

As discussed, there are related studies on specific aspects of asset pledgeability in a micro context. Even with the lack of micro-data, I try to find some link between asset pledgeability and financial stability in a macro context. As expected, most studies touch on micro aspects of pledgeability in the financial market, such as risk premium pricing. Even though previous studies shed light on the inner workings of collateral-based market transactions, macro aspects of collateral usage have not been adequately studied (Anderson and Joeveer, 2014). It is hard to expect market development in the region without market mechanism on price discovery, which is mostly driven by policy drive in one form or the other. This finding also reveals the importance of asset pledgeability with an implication that maintaining stable pledgeability remains the key to securing financial stability in a micro context.

Further, if shocks impact this, some broader recognition of the problem needs to be installed before preparing policy responses because some inner workings remain the actual cause for such discrepancy. Too often, policy responses aim to stabilize market sentiments with little subsequent efforts to improve necessary market functioning during regular times. Notably, the collateral underpinnings of the bond market need to identify the growth momentum that would prove to be sustainable. Above all, securing pledgeable assets is the first step toward enjoying most benefits financial markets have to offer. For instance, more sophisticated Value-at-risk-based, data-driven haircut models are subject to data quality issues and lack flexibility for further analysis.5

Specifically, Lou (2016) develops a complementary parametric haircut model to conduct sensitivity tests, capture market liquidity risk, allow idiosyncratic risk adjustments, and incorporate relevant market information. Computational results show potential uses in designing collateral haircuts for collateral agreements, such as credit support annexes (Lou, 2016). Collateral-related information remains a critical piece for any risk assessment. Likewise, with the derivatives industry moving towards greater use of collateralization, deciding the level of haircut to apply to an asset lodged as collateral is an increasingly critical question. Haircuts, the discount applied to the value of a collateral asset for calculating margin or regulatory capital, are usually determined using historical price data to calculate a Vector Autoregression (VAR) loss for a given confidence level. Lou (2016) proposes an alternative model to fix problems related to an inherently backward-looking measure of VAR exercise that imply post-adjustment of haircuts after market conditions change by using parameters to calculate the haircuts. He uses explanatory factors to determine the value of the asset, instead of a purely data-driven approach that typically use a jump-diffusion model to reflect the impact of credit rating changes on haircuts.6 This piece of linkage can help us come up with cross-pledgeability measures in future studies when market data remains scant. In practice, both the Basel capital framework and the margin rules for non-cleared derivatives allow haircuts to be calculable using either a standardized approach or internal estimates. The regulatory approaches in existence and internal models used at banks rely on data-driven estimation of haircuts, only applying more intuitive considerations on individual assets where necessary.

Regulatory haircuts of BIS, which are essentially PIC3 subsequently used in empirical analyses of this paper, are divided into five parts: AAA to AA-/A-1, A+ to BBB-/A-2/A-3/P-3, BB+ to BB?, main index equities and gold, other equities and convertible (See Table 2). This study deals with haircuts of residual maturity with 10 or more years. Accordingly, the applicable haircut is 12%, 20%, not eligible, 20%, 30%, respectively. Credit ratings are grouped into three levels, with credit rating 1 corresponds to BB+ to BB?, credit rating 2 tags BB+ to BB?, and credit rating 3 refers to AAA to AA-/A-1, respectively. However, third grade is recognized as not eligible, so I took the haircuts of other equities and convertible bonds, which is 30%, i.e., credit rating 1 = haircut 30%, credit rating 2 = haircut 20%, credit rating 3 = haircut 12%.

Some central banks publish their haircut schedules. For instance, the ECB schedule serves as the main categories. The CCP also publish haircut schedules for the much narrower range of collateral that they accept. The Basel Accord has prescribed a schedule of haircuts as Standard Supervisory Haircuts for institutions that calculate the credit risk mitigation provided by eligible financial collateral under the Standardized Supervisory Approach. The use of these haircuts is limited to revalued transactions and margined daily (assuming a 10-day holding period). There is an additional 8% haircut for cross-currency repos and securities lending transactions. On the other hand, there is provision for national supervisors to carve out repos and securities lending transactions and apply a zero haircut, where the counterparty is “core market participants” and the collateral is a security issued by a government qualifying for a zero right weight under the Standardized Approach and certain other conditions apply. For instance, Gorton and Metrick famously acquired a database of haircuts from a US broker-dealer for structured security collateral (e.g., CDO (Collateralized Debt Obligation) and CLO (Collateralized Loan Obligation)).

2. Modeling Strategy

I chose the panel regression as a benchmark model to investigate the statistical significance of asset pledgeability on financial vulnerability as measured by log-differences of nominal exchange rate.7 Using the panel data on 19 countries8 panel regression results show that some aspects of the market perception gap have a significant impact on vulnerability against various shocks. In the subsequent empirical investigations, the above three aspects related to limited asset pledgeability have particular meanings: lower market efficiency, extra demand for safe assets, and limited usability of FX holdings in times of stress.

In this paper, the first indicator for financial stability, exchange rate volatility as measured by nominal exchange rate changes,9 is related to various indicators of cross-border asset pledgeability and other control variables (Park, Shin, and Tian, 2018). Specifically, the study reveals the impact of asset pledgeability on a narrowly defined measure of financial vulnerability in emerging economies. Building on studies by Park, Shin, and Tian (2018), the separate impact of asset pledgeability is measured using a set of panel regression. Given the lack of haircut data,10 I construct proxy variables as follows: PI Index represents cross-border pledgeability by classifying as non-pledgeable = 1, narrowly pledgeable = 2, pledgeable = 3. Similarly, credit ratings under BBB+ = 1, credit rating A = 2, credit rating over AA = 3. Based on this classification, PIC Index (Total pledgeability) = PI*Credit rating, and PIC2 Index (Gap Indicator) = Credit rating/PI, respectively. Also, PIC3 = supervisory haircuts, PIC4 = 1/PIC3 - country risk premium.11 In reality, the asset pledgeability remains fixed in most emerging economies as they do not recognize LCY (Local Currency) bonds beyond national borders as accepted collaterals. In this paper, PIC2 asset pledgeability is measured over time as the gap between standings in credit ratings and given pledgeability in a cross-border setting. It is difficult to construct empirical measures for cross-border asset pledgeability, and the empirical studies largely reflect the link between pledgeability and a measure of financial vulnerability as measured by changes in the nominal exchange rate. With crisis dummies, pledgeability measures could prove to be insignificant with the existence of other control variables, yet the influence would be greater when crises episodes are controllable. Extra explanatory power of cross-border asset pledgeability during normal times shows its significance in the context of financial stability.

Additionally, it remains to be seen whether the jurisdictional classification is more important than economic evaluations for gauging financial vulnerability. Economic zone classification based on monetary union matters for financial stability, as evidenced by the Euro example. If that is the overriding factor for financial stability, Asia needs to follow a similar strategy to go forward. Geographical dummies in the panel regressions capture this aspect. If the cross-border asset pledgeability is the ultimate protection against financial instability, it is more important to foster a market-friendly ecosystem to secure the critical factor for a sustainable environment. The contrasting picture of favorable credit ratings and unfavorable asset pledgeability in Asia is a clear reflection that there has been a lack of collaboration among member countries to secure critical elements for financial stability. We also need to study whether asset pledgeability is primarily a geographical factor, while its economic implications are about economic fundamentals. Further, the interplay of collective dynamics among asset pledgeability and Local Currency Bond Market (LCBM) size in the presence of external shock can reveal itself with impulse function analyses of VAR. Particular attention applies to the causality among shocks and vulnerability, given various asset pledgeability settings. This line of analysis allows us to formulate the VAR model with pledgeability, vulnerability, and other macro variables in a more relaxed setting.

3. Empirical Results

Overall empirical results suggest that the asset pledgeability measures demonstrated marginally significant power in explaining changes in the nominal exchange rate when crises episodes are controlled, especially with PIC3. With the general lack of available data on Over-the-counter (OTC) transactions for the cross-border, PIC3 and its times series equivalent PIC4 showed limited success in explaining changes in the nominal exchange rate. With crisis episodes dominating the explanatory power over changes in the nominal exchange rate, PIC2, which shows the gap between credit ratings and pledgeability, exercises extra power when all macro variables are controlled (Table 5 (1)). This difference is because extra dynamics that limit cross-border asset pledgeability kick in during the episodes of market stress compared with regular times. In contrast, another proxy for cross-border asset pledgeability, especially PIC3 of regulatory haircut, shows statistically significant extra influence (Table 6 (2)-(5)) during the crises, possibly due to its pro-cyclical adjustments.

As demonstrated, the results are mostly supportive of the proposition that asset pledgeability matters for financial vulnerability in situations when the sample contains crisis episodes. Also, regulatory changes that differentiate asset pledgeability need to be implemented first in favor of Asian government bonds before overall market recognition takes hold. Substantively, fixed-effects models cannot be rejected and can be used to study the causes of changes within a country. A time-invariant characteristic, which is defined by how we measure cross-border asset pledgeability, cannot cause such a change for financial vulnerability, allowing global factors play a more significant role. By construction, PIC4 allows for time effects without entity effects, so that unlike PIC2, PIC3, it shows impulse responses (See Figure 5) of changes in the nominal effective exchange rate. Overall, the ability to pledge cross-border collateral determines financial vulnerability during times of market stress, while it matters relatively little during regular times.12 To measure whether the volatility of markets post-crisis has been tamed and not clustered in a multivariate framework, a multivariate GARCH model has generated conditional variance (Refer to Figure 1).

Besides, when countries face crises, assets that initially served as cross-border collateral lose their pledgeability to some extent; therefore, countries should strive to maintain their asset utilization as well as collateral holding safely. This paper focuses on the lack of cross-border pledgeability as one of the causes of global anomaly about capital flow uphill and inherent instability in emerging economies that have shaken the basis of global financial stability. The preliminary empirical results largely support initial claims that jurisdictional classification and asset pledgeability as compared with credit rating matter for reduced vulnerability. Results support the policy implications that Asia needs to collaborate on improving its asset pledgeability, among other things.

4)Regarding repo transactions, the interbank market allows key transaction terms to be negotiated bilaterally, while the exchange market unilaterally determines terms across all repo investors. More specifically, the higher the bond rating, the greater (lower) the asset pledgeability (haircut). The centralized nature of CCP on the exchange market implies that haircuts can depend on security-level characteristics only. So even individual investors can borrow using AAA corporate bonds at a haircut of 90%, while bonds with AA- ratings have no pledgeability even if the most reputable mutual funds own them.

5)There are very few empirical surveys of haircuts in the repo and securities lending markets. The BIS Committee conducted one of the more comprehensive on the Global Financial System for June 2007-2009.

6)Because illiquid assets have very different haircuts in reality versus the index used to calibrate the model ? so to reflect the specific characteristics of the collateral asset, adjustments are necessary to calculate parameters in the form of sensitivities.

7)Log of nominal exchange rate has been taken as the dependent variable as exchange rate volatility adversely affects real and financial sectors

8)Australia, Belgium, France, Germany, Italy, Portugal, Sweden, Switzerland, Spain, UK, Canada, US, China, Hong Kong, Indonesia, Japan, Singapore, South Korea, Thailand.

9)Exchange market pressure variables are chosen as the dependent variable in panel regressions to reflect the reality where emerging economies often intervene to stabilize the exchange rate. Further, alternative variables of asset pledgeability include the proportion of pledgeable assets as compared with the total holdings of assets among central banks.

10)A useful perspective on the composition of repo collateral is also available from the survey of the main tri-party repo agents in Europe included in the ICMA (International Capital Market Association)’s semi-annual European repo market survey.

11)Similarly, it is possible to follow

12)When crisis dummies are controllable, the influence of pledgeability becomes more pronounced, as shown by significance levels.

VII. SUMMARY AND CONCLUSION

Despite the remarkable bond market development in the region by size, bond market transactions as collateral are still limited, and this is due to the low level of cross-border asset pledgeability. Further, this feature has been the underlying reason for low participation in the market-based trust-building efforts. Development has been mostly single-minded pursuit of policy goals that have not encouraged cross-border trading. It turns out that if this situation about collateral usage remains unaddressed, other policy efforts to achieve financial stability would not be enough to bring about real changes. This finding is mainly due to spillovers from Asia with very limited cross-border asset pledgeability, even with the growing size of the bond market since the Asian financial crisis. What matters for global financial stability is the expansion of trust, which is based on inclusive pledgeable collateral in favor of external plumbing machinery to improve the velocity of the restricted collateral pool. Among other important factors that hinder the cross-border asset pledgeability, the absence of collateral eligibility for cross-border activities, and the export-oriented growth paradigm with restricting regulatory framework are also identifiable. Because of this critical agenda, authorities in the region have difficulty with liberalizing capital flows that involve cross-border collateral movement. This aspect of the legacy framework interferes with the natural evolution of Asia’s financial system to transform into being more adaptive and open.

The preliminary empirical findings show that cross-border asset pledgeability is a rough measure for financial stability as a defense against vulnerability. It is also possible that exchange rate volatility itself limits the cross-border asset pledgeability in the region. Given the market mechanism available for collateral transformation and other extra guarantee facilities and the lack of eligible assets for securitized funding in the region, efforts toward building a comprehensive collateral framework would only underscore the importance of cross-border asset pledgeability for financial stability. The preliminary evidence suggests that enhancing cross-border asset pledgeability contributes to enhanced financial stability. The issue with the prevailing gap between sovereign credit ratings and the de facto cross-border pledgeability is that the persistent recognition gap would not help future efforts in the right direction. This insight stems from the need to have better credit ratings hinge on measures that interfere with market development with active secondary market activities. Efforts to narrow the gap promote market development by creating an environment for voluntary market transactions during normal times as compared with policy measures in times of stress. It also increases shock absorptive capacity against various shocks as agents can sustain market transactions even under stressful conditions. Finally, it would ensure that collateral assets can develop into safe assets via numerous filters based on market evaluations. As reality dictates, market-tested trust is the ultimate foundation for financial market development, and future efforts need to concentrate on improving conditions for cross-border asset pledgeability of qualified Asian assets. Therefore, a more comprehensive database on collateral and risk-mitigating collateral transformation services is also necessary to improve the inclusiveness of eligible collateral from the region.

In conclusion, this paper claims that one of the fundamental causes of the problem also lies in narrowly defined pledgeable assets as collateral that underpins the global financial system. There has been no improvement in broadening asset categories, especially among possible candidates from Asia that qualify as potentially safe assets. As partly evidenced by preliminary empirical investigations, tapping more significant markets beyond national borders needs to target this aspect above anything else for the following reasons: First, improving pledgeability is a marketfriendly approach in contrast with policy-driven agenda of previous efforts. Market participants themselves need to behave better to maintain financial stability. Second, it is incentive-driven so that we can expect sustainable improvement with strong market momentum. Profit-seeking with proper market signals would help secure a viable ecosystem in the volatile environment. Third, pledgeability would help Asia to narrow the growing market recognition gap. It is Asia’s most needed qualities in light of its excellent credit ratings and limited FX risks with a massive backdrop of reserve holdings. Compared with other mandates regarding exchange rate stability and credit ratings, improving on pledgeability is urgently needed. Finally, broader support of cross-border asset pledgeability is also suitable for financial stability for the region as well as for the global economy.

What Asia needs instead is operable, implementable resources, which calls for the well-functioning capital market that support the pledgeability of its assets in a broader context. Essentially, this is not just a regional issue, but a global solution to a safe asset shortage problem. By being more open and inclusive about the collateral definition and management, the global community can better achieve financial stability because the broader collateral base is better against various shocks and ensure conditions that cannot be secured solely with safe legacy assets. Above all, the narrow definition of ultimate trust in the global financial system, i.e., cross-border pledgeable assets largely detach themselves from the reality where sizable value creations come from Asia. If Asia remains ill-equipped to supply pledgeable assets, not being safe assets, the future of the global financial system is not promising since tweaking the current system with all kinds of special arrangements would not save it from occasional jolts going forward. In other words, Asia should be ready to expand the narrowly-defined trust base globally by allowing its assets to be more pledgeable in cross-border transactions, which requires harmonization of fragmented regulatory guidelines on a global scale.

Tables & Figures

Figure 1.

Multivariate GARCH Model / NEER of Korea, US, and Japan*

Note: The dynamic multivariate GARCH model was taken in consideration of volatility clustering in exchange rates. The model consists of monthly time series on log-differenced nominal exchange rate of Korea, United States, and Japan from 1993 to 2011. Vertical reference lines were drawn to indicate times of Asian Financial crisis (May 1997) and Global Financial Crisis (May 2008). The results explain that post-crisis periods are as volatile as it has been during the aforementioned crises. K_neer_diff, US_neer_diff, and J_neer_diff denote three monthly time series log-differenced nominal effective exchange rate (NEER) of Korea, US, and Japan, respectively.

Source: Author’s calculation, STATA M-GARCH DCC (Dynamic Conditional Correlation) model.

Figure 2.

Shortage of Safe Assets: Pre? and Post?Crisis

Source: Federal Reserve, BIS debt securities data, Bloomberg.

Figure 3.

Covenant-Lite Leverage Loan in U.S.

Source: Bloomberg.

Figure 4.

Federal Reserve Asset Composition

Source: Federal Reserve.

Table 1.

Definitions of Variables and Data Sources

BIS= Bank for International Settlements, CPI = Consumer Price Index, GDP = Gross Domestic Product, IMF = International Monetary Fund, LCBM = Local Currency Bond Market, QE = Quantitative Easing, US = United States.

Source: Author’s compilation.

Table 2.

Supervisory Haircuts for PIC3

Source:

Table 3.

Summary of Statistics

CPI = consumer price index, GDP = gross domestic product, LCBM = local currency bond market.

Notes: The dependent variable is monthly exchange rate depreciation. Exchange rate regime is annual fine classification in

Source: Author’s calculation.

Table 4.

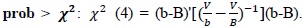

Hausman Results

Note:  b = consistent under Ho and Ha; obtained from xtreg. B = inconsistent under Ha, efficient under Ho; obtained from xtreg. If the value of prob >

b = consistent under Ho and Ha; obtained from xtreg. B = inconsistent under Ha, efficient under Ho; obtained from xtreg. If the value of prob >

Source: Author’s calculation.

Table 5.

PIC2 Index and Exchange Rate Depreciation

Notes: The dependent variable is monthly exchange rate depreciation. Exchange rate regime is annual fine classification in

Note:

Source: Author’s calculation.

Table 6.

PIC3 Index and Exchange Rate Depreciation

Notes: The dependent variable is monthly exchange rate depreciation. Exchange rate regime is annual fine classification in

Source: Author’s Calculation.

Figure 5.

Panel VAR Analysis

Note: Impulse response of NEER against pledgeability (PIC4) shock based on PVAR. It describes the path of financial vulnerability over time against pledgeability shock.

Source: Author’s calculation, Stata models of

APPENDIX A. ABBREVIATIONS

ABMI Asian Bond Markets Initiative

ADB Asian Development Bank

AMF Asian Monetary Fund

BIS Bank for International Settlements

CCP Central Counterparty Clearing House

CDO Collateralized Debt Obligation

CLO Collateralized Loan Obligation

CMIM Chiang Mai Initiative Multilateralization

CPI Consumer Price Index

CSD Central Securities Depository

ECB European Central Bank

FX Foreign Exchange

ICMA International Capital Market Association

IFIs International Financial Institutions

IMF International Monetary Fund

LCBM Local Currency Bond Market

LCY Local Currency

NEER Nominal Effective Exchange Rate

OTC Over-The-Counter

QE Quantitative Easing

VAR Vector Autoregression

ZIRP Zero Interest Rate Policy

References

- Abrigo, M. and I. Love. 2016. Estimation of Panel Vector Autoregression in Stata: A Package of Programs. University of Hawaii, Department of Economics Working Paper, no. 16-2.

- Agenor, P. and L. Silva. 2013. Inflation Targeting and Financial Stability: A Perspective from the Developing World. Banco Central do Brasil Working Papers, no. 324.

- Anderson, R. and K. Joeveer. 2014. The Economics of Collateral. SRC Discussion Paper, no. 12. London School of Economics and Political Science.

-

Asian Development Bank (ADB). 2014.

Basic Principles on Establishing a Regional Settlement Intermediary and Next Steps Forward: Cross-border Settlement Infrastructure Forum . Mandaluyong City. -

Bank for International Settlements (BIS). 2013. Asset encumbrance, financial reform and the demand for collateral assets. DGFS Papers, no. 49. <

https://www.bis.org/publ/cgfs 49.pdf > (accessed November 21, 2019) -

Bank for International Settlements (BIS). 2014. Developments in collateral management service. Committee on Payments and Market Infrastructures. <

https://www.bis.org/cpmi/publ/d119.pdf > (accessed November 21, 2019) -

Bank for International Settlements (BIS). 2015. “International Banking and Financial Market Developments,”

BIS Quarterly Review , (June) pp. 1-11. <https://www.bis.org/publ/qtrpdf/r_qt1506.pdf > (accessed November 21, 2019) -

Bank for International Settlements (BIS). 2017. Basel III: Finalizing post-crisis reforms. <

https://www.bis.org/bcbs/publ/d424.pdf > (accessed November 21, 2019) -

Bindseil, U., Gonzalez, F. and E. Tabakis. 2009.

Risk management for Central Banks and Other Public Investors . New York: Cambridge University Press. -

Bordo, M. and R. McCauley. 2017. “A Global Shortage of Safe Assets: A New Triffin Dilemma?”

Atlantic Economic Journal , vol. 45, no. 4, pp. 443-451.

- Brumm, J., Grill, M., Kubler, F. and K. Schmeders. 2018. Re-use of collateral: Leverage, volatility, and welfare. ECB Working Paper Series, no. 2218.

- Caballero, R. and E. Farhi. 2013. A Model of the Safe Asset Mechanism (SAM): Safety Traps and Economic Policy. NBER Working Paper, no.18737.

- Caballero, R. and E. Farhi. 2014. The Safety Trap. NBER Working Paper, no.19927.

-

Caballero, R. J., Farhi, E. and P. Gourinchas. 2017. “The Safe Assets Shortage Conundrum,”

Journal of Economic Perspectives , vol. 31, no. 3, pp. 29-46.

-

Calvo, G. A. 1998. “Capital Flows and Capital-Market Crises: The Simple Economics of Sudden Stops,”

Journal of Applied Economics , vol. 1, no. 1, pp. 35-54.

- Caruana, J. 2011. Foreign participation and bond market development in Asia and the Pacific, BoJ-BIS high-level seminar on “The Development of Regional Capital Markets,” Yokohama, Japan, 20-22 November 2011. Bank for International Settlements.

-

Chen, H., Cui, R., He, Z. and K. Milbradt. 2018. “Quantifying Liquidity and Default Risks of Corporate Bonds Over the Business Cycle,”

Review of Financial Studies , vol. 31, no. 3, pp. 852-897.

-

Chen, H., Sally, Chow, K., Longmei, Z., Harjes, T. and N. Porter. 2019. “Sovereign Bonds: What the Yield Curve Tells Us?” In Schipke, A., Rodlauer, M and L. Zhang. (eds.)

The Future of China’s Bond Market . Washington: International Monetary Fund. - Choi, G. 2014. Growing Global Needs for ACU-Denominated Reserve Assets. Korea Institute of Finance. Working Paper, no. 14-01.

- Choi, G. 2019a. Identifying internal constraints for cross-border collateral-based transactions in the region, Unpublished Internal report to the Ministry of Finance and Strategy.

-

Choi, G. 2019b. Progress Report Task Force 4: Inclusive Collateral Strategy for Inclusive Bond Market Development, Presentation Material to the Asian Development Bank. <

http://www.asianprimecollateralforum.org/wp-content/uploads/2019/03/1903086APCFProgress-Report.pdf > (accessed November 21, 2019) - Corradin, S., Heider, F. and M. Hoerova. 2017. On collateral: implications for financial stability and monetary policy. ECB Working Paper Series, no. 2107.

-

Duffie, D. 2010. “Presidential address: Asset price dynamics with slow-moving capital,”

Journal of Finance , vol. 65, no. 4, pp. 1237-1267.

-

Gourinchas, P. and M. Obstfeld. 2012. “Stories of the Twentieth Century for the Twenty-First,”

American Economic Journal: Macroeconomics , vol. 4, no. 1. pp. 226-265.

-

Gromb, D. and D. Vayanos. 2002. “Equilibrium and Welfare in Markets with Financially Constrained Arbitrageurs,”

Journal of Financial Economics , vol. 66, no. 2-3, pp. 361-407.

-

Heider, F. 2017. “Collateral, Central Clearing Counterparties and Regulation,”

European Central Bank Research Bulletin , no. 41. <https://www.ecb.europa.eu/pub/economicresearch/resbull/2017/html/ecb.rb171206.en.html > (accessed February 2, 2020) - Ilzetzki, E., Reinhart, C. and K. Rogoff. 2017. Exchange Arrangements Entering the 21st Century: Which Anchor Will Hold? NBER Working Paper, no. 23134.

- Ilzetzki, E., Reinhart, C. and K. Rogoff. 2017. The Country Chronologies to Exchange Rate Arrangements into the 21st Century: Will the Anchor Currency Hold? NBER Working Paper, no. 23135.

-

International Monetary Fund (IMF). 2018. “Chapter 1: A Decade after the Global Financial Crisis: Are We Safer?” IMF Global Financial Stability Report. 2018. <

https://www.imf.org/en/Publications/GFSR/Issues/2018/09/25/Global-Financial-Stability-Report-October-2018 > (accessed November 21, 2019) -

International Monetary Fund (IMF). 2012. “The Quest for Lasting Stability,” IMF Global Financial Stability Report. <

https://www.imf.org/en/Publications/GFSR/Issues/2016/12/31/The-Quest-for-Lasting- Stability > (accessed November 21, 2019) -

Kenneth, R. et al. 2010.

The Squam Lake Report: Fixing the Financial System . Princeton: Princeton University Press. -

Kiyotaki, N. and J. Moore. 1997. “Credit Cycles,”

Journal of Political Economy , vol. 105, no. 2, pp. 211-248.

-

Krishnamurthy, A. 2010. “How Debt Markets Have Malfunctioned in the Crisis,”

Journal of Economic Perspectives , vol. 24, no. 1, pp. 3-28.

- Lane, P. R. and G. M. Milesi-Ferretti. 2017. International Financial Integration in the Aftermath of the Global Financial Crisis. IMF Working Paper, no. 17/115.

-

Lou, W. 2016. Repo Haircuts and Economic Capital. SSRN. <

http://dx.doi.org/10.2139/ssrn.2725633 > (accessed November 21, 2019) -

Marling, H. and S. Emanuelsson. 2012. The Markowitz Portfolio Theory. <

http://www.math.chalmers.se/Stat/Grundutb/CTH/mve220/1213/gr1_HannesMarling_SaraEmanu elsson_MPT.pdf > (accessed November 21, 2019) - Nyborg, K. G. 2019. Repo Rates and the Collateral Spread Puzzle. CEPR Discussion Paper, no. 113546.

- Park, C. 2011. Asian Financial System: Development and Challenges. ADB Economics Working Paper Series, no. 285.

- Park, D., Shin, K. and S. Tian. 2018. Do Local Currency Bond Markets Enhance Financial Stability? ADB Economics Working Paper Series, no. 563.

-

Park, Y. C. and K. Shin. 2011. Internationalisation of currency in East Asia: implications for regional monetary and financial cooperation. In Currency internationalization: lessons from the global financial crisis and prospects for the future in Asia and the Pacific, BIS papers, no. 61. pp. 180-197. Bank for International Settlements. <

https://www.bis.org/repofficepubl/arpresearch200903.09.pdf > (accessed November 21, 2019) -

Reinhart, V. and B. Sack. 2002. “The Changing Information Content of Market Interest Rate,”

Market Functioning and Central Bank Policy , BIS Papers, no. 12, pp. 340-357. -

Rule, G. 2012.

Collateral Management in Central Bank Policy Operations . Centre for Central Banking Studies, Bank of England. -

Singh, M. 2014.

Collateral and Financial Plumbing . Washington: International Monetary Fund. - Singh, M. 2014. Financial Plumbing and Monetary Policy. IMF Working Paper, no. 14/111.