- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 22, No. 3, 2018. pp. 307-336.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2018.22.3.346

Number of citation : 0Redefining Liquidity for Monetary Policy

|

Korea Institute for International Economic Policy |

|

|

Bank of Korea |

|

|

Bank of Korea |

Abstract

This paper proposes a monetary aggregate “Liquidity” that could serve as a useful indicator for gauging the appropriateness of monetary policy. If liquidity rises above a certain threshold, it is signaling that monetary policy is losing traction due to structural and other impediments even when the inflation gap remains open. This indicator supplements the financial cycle approach but adds value by providing a benchmark that is derived from the national account, and not based on its own trend. Over the last two decades, each time this measure rose above the threshold range, it was followed by a decline in GDP growth. The latter was greater when accompanied by a high physical asset value to GDP, e.g., an elevated property market.

JEL Classification: E52, E31, E32, G01

Keywords

Liquidity, Monetary Policy, Inflation Targeting, Financial Stability, Credit to GDP Gap

I. INTRODUCTION

The role of monetary aggregates in formulating monetary policy has been substantially reduced over the last two decades (Han and Lee, 2012). The departure from monetary aggregates was in large part inevitable as financial innovation rendered traditional monetary measures somewhat irrelevant as policy instruments and targets. Instead, monetary authorities have focused directly on targeting inflation as is well documented in Haldane (1995). Relying critically on the Phillips curve, the gap between actual and targeted inflation is seen as containing adequate information on the output gap which, monetary authorities thought, could be closed by choosing the right level of the policy rate.

Recent experience has shown, however, that inflation remains subdued even though the output gap was closed and turned positive in some cases. Reasons why the relationship embedded in the Phillips curve have weakened vary, including the large influx of cheap labor into the global market in tandem with the expanding global value chain as well as technological innovation. Such supply side expansion was matched by exuberant demand, financed in large part by leverage. Absent from borrowing, household income has remained relatively subdued as the benefit of the economic expansion was skewed towards corporate profit. The complexity of the current situation has invited various interpretations, including the consequence of a global savings glut (Bernanke), the drag from overleverage and debt overhang (Rogoff), secular stagnation (Summers), and income inequality (OECD and G20).

Irrespective of how this episode is depicted, monetary policy stance appears to have relied too narrowly on estimated inflation and output gaps while not paying enough attention to the buildup of side effects and global factors that affect individual countries’ inflation. This neglect culminated in financial instability and negative economic shocks. As highlighted in financial cycle literature (e.g. Borio, 2014), inflation by itself does not contain sufficient information to assess whether output is at or above its potential. Financial cycle peaks, defined as a combination of credit and property price to GDP, are followed by abrupt adjustments in financial markets and deeper business cycle recessions. Thus “sustainability” in the sense of growth without side effects (i.e., financial imbalance) gained more attention. In this vein, Drehmann et al. (2012) suggest that the output gap should be adjusted by the credit gap to ensure policy response promotes sustainable growth.

This paper argues that monetary aggregate is still a very important indicator in assessing the adequacy of monetary policy stance and financial condition. To this end, a monetary aggregate termed liquidity (L) is proposed, which is defined as “total financial liabilities held by the nonfinancial sector” inclusive of equity. L complements the financial cycle approach but adds value in that it has a threshold range tied to economic fundamentals, namely the repayment capacity. Thus, this measure does not rely on gaps obtained from its own trend like in the financial cycle approach, but on identities in the national account balance sheet. We also introduce a parallel concept on the real side, H, which measures total capital stock underlying productive capacity of an economy.

The remainder of this paper is organized as follows. Related literature is briefly discussed in Section 2. We define liquidity and show how it is derived from the national balance sheet in Section 3 and how it is related to the value of physical capital stock. In Section 4, we compare our set of indicators, which are L and its associated indicator H, with the credit gap. These indicators are then evaluated on their performance in predicting crises. Concluding remarks follow in Section 5.

II. LITERATURE REVIEW

Schularick and Taylor (2012) argue that we have been living in the age of credit since the World War II in which the gap between money and credit has increased due to the changes in the macroeconomics environment and financial policies. Because of the crucial role of credit, policy makers need to focus on the private sector credit-to-GDP gap, which is measured by the percentage point or percentage deviation from an ex-ante (one-sided), recursive Hodrick-Prescott trend (Borio and Drehmann 2009). While useful, it entails a weakness that the gap disappears if credit to GDP growth persists for a long time, and has no upper bound.

A number of papers argue that the financial cycle should be taken into consideration when formulating monetary policy. Ma and Zhang (2016) found evidence that financial cycles have a significant impact on business cycles, and that negative shocks to the financial cycle are the main driving force for a recession especially when financial instability is high. They suggest the finance-augmented Taylor rule, which adds financial factors to the traditional Taylor rule. This finance-augmented Taylor rule would stabilized the business cycle as well as the financial cycle. Borio (2014) also emphasizes the importance of the financial cycle to understand macroeconomic fluctuations. If the financial component is included as one of the considerations in monetary policy decision-making, economic fluctuations can be somewhat eased.

The arguments made by Juselius et al. (2016) are in line with Ma and Zhang (2016) and Borio (2014). Juselius et al. (2016) argue that financial factors play an important role in influencing medium-term economic fluctuations. Once the financial cycle is taken into consideration, the natural rate of interest rises so that US policy rates are systematically lower relative to the natural rate, the benchmark for the policy rate. Given that monetary policy has a long-lasting impact on output and real interest rates, financial cycle augmented monetary policies can dampen shocks and lead to higher long-term output growth.

Drehmann et al. (2012) examine the feature of the financial cycle using two methodologies: analysis of turning points and frequency-based filters. The financial cycle is defined as a medium-term component of fluctuations in the credit and asset price, and this financial cycle is an evidence closely related to financial market integration and changes in monetary policy. This finding is different from the traditional indicator, credit-to-GDP gap, which reflects a high frequency cyclical component.

Han and Lee (2012) suggest a notional level of optimal liquidity above which asset price increases faster than the GDP deflator. The excess liquidity creates a gap between the face value and the real purchasing value of financial assets, which in turn widens the income disparity between those with capital and those living on salaries. This eventually leads to an abrupt adjustment of financial assets with repercussions on the real sector. We further develop their theoretical framework and provide empirical support in this paper.

III. A NEW SET OF INDICATORS

1. Definition of Liquidity and Physical Capital

For the purposes of this paper we define liquidity (L) as the sum of all financial liabilities that an economy holds, but excluding the financial sector to avoid double counting. This definition of L enables us to derive policy implications on the optimal level of liquidity that is sustainable in an economy.

The proposed concept of L is founded on a simple principle, namely that a creditor will lend only as much as the capacity of the debtor’s repayment. This principle should also hold for the whole economy. Therefore, an economy’s liquidity cannot exceed its productive capacity (Ypc) indefinitely. Ypc in turn can be measured as the net present discounted value of the expected income stream.

L is different from the traditional monetary indicators (M1, M2, etc.) which are based on the traditional transactional, precautionary, and speculative motives. L is linked to the expected income stream which is a core part of economic fundamentals. The optimal level, or more accurately the threshold level of L can be estimated by examining the impact of changes in L on Ypc.1

Table 1 shows how L can be defined from the national balance sheet. Financial liabilities are divided into credit and equity. We define L as a concept that includes both. This is because equity has the same economic meaning as credit at the national level in the sense that it entails financial claims in the form of expected income streams. Equity is different from credit only to the extent that in the case of equity, the lender has ownership on the capital stock that is used to generate returns.

This brings us to the next indicator, H, which is a measure of total capital stock (tangible assets such as facilities and buildings). Ypc in principle should reflect also productivity and labor which we exclude from our analysis. Inclusion should provide a more refined result but would not change the main thrust of this paper.

2. Economic Implications of L, H, and Ypc

Liquidity (L), credit (C), equity (E), productive capacity (Ypc), and physical capital (H) can be expressed as Equation (1) in steady state.

The transmission of credit to the real economy can be described as shown in Figure 1 below.

An increase in credit can be used for (I) the purchase of financial equities or (II) for investment in capital stock. In the case of (I), if the amount is used for investment in capital stock (case a), then Ypc will rise. If not, the additional amount will be accommodated by an increase in stock prices (case b). If unchecked, this could lead to a stock market bubble. In the case of (II), if the amount is invested in productive capital, then Ypc will rise (case c). Here productive capital is defined as the part of the physical assets that are used to expand production capacity linked to actual demand. Corollary, the nonproductive capital is the part of assets that are not used to increase output, e.g., constructed housing not occupied, or new machines that are standing idle due to demand shifts. If the demand for nonproductive capital exceed supply, then prices will rise, e.g., a housing bubble (case d). This is summarized in Table 2.

The combination of L/Ypc and H/Ypc provides useful information. If an increase in L is accompanied by an increase in productive physical capital, i.e. productive capacity, Ypc will increase as H increases. Therefore, L/Ypc and H/Ypc do not undergo changes. Thus, as long as Ypc increases along with L and H, the likelihood of buildup of financial imbalance is low. If L/Ypc rises, but not H/Ypc, an adjustment of L will take place at some point. If the increase in L is associated with speculation on a specific physical capital, L/Ypc and H/Ypc will rise at the same time. In this case, the financial market will adjust at some point in time, having a larger negative impact on the real economy. Obviously, if GDP deflator adjusts to ensure L/Ypc is stable, the L or H do not have to decline to restore stability.

3. L/Y and H/Y for OECD Countries

We review the 12 OECD countries where data on the financial liabilities and physical capital is available for our analysis. These countries are Australia, Austria, Belgium, Canada, France, Germany, Greece, Japan, Netherlands, Sweden, UK, and US. First, L is calculated as financial liabilities held by the non-financial sector as mentioned above. We have chosen to use the trend of nominal GDP(Y) as a proxy variable for Ypc as it is difficult to measure but is related to GDP(Y). The reason for using trend of GDP instead of GDP is to address GDP’s volatility. Finally, in the case of H, the actual capital stock data of each country are used.

Figure 2 shows that L/Y of the OECD countries is trending upwards. It rose from 3.1 times to 4.5 times of GDP during 1995-2015. The difference of L/Y from one country to another reflects the specific economic situation in each country.2 L/Y in most OECD countries increased sharply around the year 2000, in the mid-2000s, and after 2013.

All 12 countries’ L/Y exhibit mean reversion around a rising time trend. This is counter to the claim that L should be stable relative to GDP. The reason, which is more fully discussed in the Appendix, is due to financial globalization.3 The mutual spillovers of countries’ monetary expansion, essentially driven by the US as being the global financial center, is contributing to the rising trend of L/Y after the global financial crisis (GFC).4 To the extent that lenders in a country will ensure (with a lag) that total lending is equal to the sum of expected income stream, this enforcement function is undermined by the increasing share of nonresident lenders. The latter are not as fully integrated into domestic financial market as resident lenders mostly due to physical distance and information asymmetry. Therefore, as L/Y continues to rise due to globalization, domestic lenders exercise prudence only over the amount they lend, leaving a gray area for the amount lent by nonresidents. Thus, only when we adjust for the spillover from foreign countries do we get stable L/Ys. Even then, the mean reversion is still adequate in capturing vulnerability in financial system as will be explained below.

Within the two components of L, equity-to-GDP shows greater volatility (Figure 3) than Credit-to-GDP. Equity-to-GDP peaked three times since the mid-1990s, once prior to the dotcom crisis, then prior to the global financial crisis, and still rising now even exceeding the previous peaks. Credit-to-GDP has picked up speed since the first half of 2000s (Figure 4), as already explained above, due to globalization, and facilitated by quantitative easing in major financial centers. Currently, stock market overheating and the high credit to GDP ratio in major economies is a major risk to the global financial market.

On the other hand, H/Y is somewhat more stable than L/Y (Figure 5). Yet, we see in most non-Eurozone countries a similar pattern of H/Y as credit to GDP ratio. This suggests that investment in physical capital that is not being converted to productive stock continues to pile up.

4. Implications from Monetary Policy Perspective

The transmission channel through which monetary policy affects inflation can be divided into three stages. First, the policy rate has an impact on the financial market, i.e. L. Secondly, the financial market affects the real economy (H and Y). In the last stage, the real economy, i.e., the output gap affects inflation. If L/Y or H/Y rises due to an accommodative monetary policy well above the threshold level, monetary policy is likely not effective (lacking traction), and only the negative side effects will widen, i.e., the second stage of the transmission is not working.5 If L/Y and H/Y are broadly stable in response to an increase in L and H but with no notable impact on inflation, the third step of the transmission from output gap to inflation is not effective, i.e., a flat Philipps curve.

In assessing the appropriateness of monetary policy, it is critical to understand the regulatory or structural impediments that might hinder proper transmission of the policy intentions to the real economy. Current structural challenges that impede the effectiveness of monetary policy could include, for example, the gap between actual and targeted savings despite the already high savings ratio on account of rapid aging, large liquidity, and/or debt overhang that raise expectations of higher taxes in the future, and a worsening income/wealth inequality that subjects a large part of the population to tight budget constraints.

The relative values of L, H, and Y can be used as a major inputs to monetary policy formulation. Specifically, they could supplement the use of the unobservable natural rate, inflation and output gaps. For example, a neutral interest rate is defined as a level at which it is neither inflationary nor deflationary and output is growing at its potential (Laubach and Willams, 2003). However, recent studies have shown great uncertainty on whether there was a structural shift around the time of the global financial crisis. Given the model uncertainty, e.g., random walk model or structural model, studies (Luo and Startz, 2014; Chan and Grant, 2017), output gap estimations could be grossly off—a key indicator of estimating the neutral rate. Furthermore, some empirical studies by BIS show that inflation gaps in respective economies are influenced more by global rather than domestic factors such as the global output gap (Borio, 2016).

These external factors, along with structural uncertainties suggest the need to add other indicators of financial stability to output and inflation gaps in formulating monetary policy, i.e., L/Y and H/Y. These indicators are useful for gauging the degree of financial imbalance, or equivalently an indicator that monetary policy is losing traction. Monetary accommodation has to be scaled back even when there is still an inflation gap if the financial imbalance worsens.

1)The threshold of L/Y could rise in case of countries undergoing monetization and if due to precautionary motive individuals decides to hold both large financial assets and liabilities.

2)L/Y is affected by financial development, capital account openness, manufacturing vs services sector weights, population density and country specific preferences.

3)See

4)If L/Y would have been stable in the US, the magnitude of the spillover to other countries would also have been smaller or insignificant as this would have limited the scope of outflows from non-US countries.

5)L/Y and H/Y can rise not just for the monetary policy but for other reasons. We do not control other factors affecting L/Y and H/Y in this paper because our main interest lies in the comparison of indicators’ performance in predicting the crisis using the signal extraction method. We leave an extended empirical analysis including a broad set of variables for the future research.

IV. IMPACT OF EXCESS LIQUIDITY AND PHYSICAL CAPITAL ON GDP GROWTH RATES

In section III, we show that L/Y and H/Y cannot continue to increase indefinitely and eventually has to adjust back to a level that is consistent with fundamentals. Such adjustments will accompany a decline in real GDP. In particular, the higher the L/Y and H/Y, the steeper the downturn of real GDP. In this section, we first review briefly such a relationship using the US case6 as an illustration, and then examine more formally whether L/Y and H/Y are useful indicators relative to other indicators, e.g., credit to GDP gap.

Figure 6 shows L/Y, H/Y, and real GDP growth rates in the US from 1995-2016. L/Y evolves around an increasing trend reflecting the cumulating excess liquidity from accommodative policies in the 2000s and subsequent quantitative easing. As already noted in the case of OECD countries, three peaks in L/Y are observed; one that is associated with the dot com bubble in 2000, the global financial crisis in 2008, and the present situation. There is only one peak for H/Y although it has remained at that elevated level since the peak, i.e., around the time of the global financial crisis. During the dot com bubble, H/Y was low compared with the level during the global financial crisis.

Two observations are noteworthy. First, as L/Y and/or H/Y revert back to the mean (or trend), it is indeed associated with a negative shock in GDP growth. Second, the negative shock is larger if both L/Y and H/Y were elevated.

We now compare L/Y and H/Y against the credit to GDP gap indicator. We use the signal extraction method developed by Kaminsky and Reinhart (1999) to calculate the thresholds of liquidity (L) and its associated indicator, physical capital (H) for each individual country. We test whether our set of indicators are useful in forecasting economic recessions (the degree of which itself is measure of the scope of the financial imbalance preceding the recession). We compare its performance with the credit-to-GDP gap indicator.

1. Data and Methodology

Our dataset includes 12 countries7 and the sample period covers from 1995 to 2014, a 20-year annual data. Table 3 shows the summary statistics of our set of indicators, L/Y and H/Y. Mean and percentage changes in our indicators for 12 individual countries are reported as well as the mean credit-to-GDP ratio. The long-term levels of L/Y and H/Y (20-year averages) are diverse across countries though the fluctuations in those indicators are quite low over the sample period. In order to de-trend L and find stable thresholds of normalized indicators over time, we introduce the simultaneous equations model (Appendix A). We find that L/Y and H/Y are stable after excluding external liquidity spillovers form the financial center, the US.

The crises are defined by the two standard deviations from the trend of the GDP (Crisis 1) or the 25% deviation from the trend of the GDP (Crisis 2).

Equation (2) shows the signal extraction method where the indicators are L/Y and H/Y, which are liquidity (L) and physical capital (H) normalized by the trend of GDP (Y), respectively. The signal is turned on when both indicators are above thresholds. The signal is turned off when any one of two indicators are below the thresholds.

There are two types of errors in the prediction of the crisis. It is defined by the type 1(

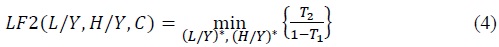

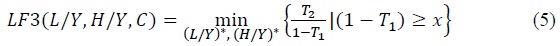

LF1 is the loss function that minimizes the weighted average of type 1 and 2 errors, and the weighting coefficients of type 1 error and type 2 error are α and (1 − α), respectively. As α increases, policy authorities become more concerned about the type 1 error. LF2 is the loss function that minimizes a noise-to-signal ratio defined by

2. Thresholds of Indicators and Its Performance

Given our set of indicators, we can obtain the thresholds of L/Y and H/Y for each country with different loss functions, parameters (α and x), and definition of the crisis (Crisis 1 and Crisis 2). In order to compare the performance of our set of indicators in predicting the crisis, we take the averages of the indicators across 12 countries in our dataset and then compare those with the conventional indicator, credit gaps.

Table 5 (a) shows that compared to the credit gaps, our set of indicators, L/Y and H/Y, perform well as a 1-year leading indicator predicting the crisis 1. Though we cannot say that the performance of our indicators is always dominant over that of the conventional indicators with respect to all the different α and x, it gives us a predicted probability as high as the conventional indicators with low noise-to-signal ratios (LF3). Similar performances can be seen in (2) where crisis 2 is used. Overall our set of indicators performs as well as the credit gap.

3. Evaluation for 12 OECD Countries

Using the signal extraction method proposed by Kaminsky and Reinhart (1999), we obtained the thresholds of L/Y and H/Y i.e., (L/Y)∗ and (H/Y)∗ for the 12 OECD countries. We compare these thresholds to actual levels of L/Y and H/Y in 2014 to investigate whether the recently increased L and H exceed the thresholds or not. Thresholds can vary depending on the type of loss function (LF1-3), type of crisis (crisis 1 or 2), and parameter values. We set the benchmark thresholds where the loss function is LF3 which minimizes the noise-to-signal ratio with the 75% minimum prediction probability (x≥75%).

Table 6 shows the actual values in 2014 and thresholds of L/Y and H/Y for each OECD country. Countries of which L and H are both above thresholds are Australia, Austria, Canada, France, Germany, Greece, Sweden, and United States. The number of countries in which the signal (

6)We have also reviewed other major OECD countries but only report the US case here. The results are almost exactly the same as that of the US case shown here.

7)These are the countries which have the complete set of indicators, liquidity (L) and physical capital (H).

8)Terms in curly brackets represent predicted probability.

V. CONCLUSION

Structural changes in the global economy over the last two decades have weakened the transmission mechanism of monetary policy. Lower interest rates, including a flatter yield curve through quantitative easing, have had only gradual, if not little, impact on consumption and investment. Instead, a prolonged accommodative monetary policy is creating financial imbalance. Central banks under inflation target regimes have little choice but to keep policy rates low even when it is becoming obvious that they face a flattened Phillips curve.

A monetary aggregate that can gauge financial imbalance would be useful. The BIS-proposed financial cycle is in the right direction in that it tries to incorporate financial stability concerns in shaping monetary policy. Yet the weakness of this approach is that the credit gap, a key indicator, has to rely on a benchmark which is its own trend and lacks economic rationale. A prolonged smooth credit/GDP expansion reduces and eventually eliminates the credit gap even when the ratio goes to infinity and thereby undermines the seriousness of the cumulating size of excess liquidity or financial imbalance.

The proposed L addresses this weakness by constructing a threshold, i.e., a measure with a limit based on the national balance sheet. It rests on a simple principle that a person will lend only to the extent that it expects to be repaid and ultimately a society as a whole cannot have liabilities that exceeds its capacity to meet this expected repayment obligation. Thus, if the total lending in an economy starts to exceed the total value of the discounted stream of income, the situation becomes unsustainable. Either the amount of goods and services has to increase or lending has to decline. The net present value of the expected income stream, excluding the labor share, should be equivalent to the value of productivity embedded in the capital stock, H. Equivalently, this should be equal to the value of the total physical capital in the economy.

Based on the combination of L/Y and H/Y, the global economy has again accumulated too much liquidity since the global financial crisis. In fact, the degree of financial imbalance is more severe now than before the GFC. To some extent, it was a price that had to be paid in order to avoid a severe recession that could have followed after the global financial crisis. However, the monetary policy framework that narrows the central banks’ policy focus to the inflation gap only has resulted in tilting the balance towards excessive easing perhaps not so much in the scope as much as in duration. There should thus be a tightening bias with somewhat less weight given to inflation gaps. While the reason for the persistent inflation gap cannot yet be fully explained, the cost of the current policy, potentially a financial adjustment and a negative GDP shock, appear to outweigh the benefit of closing the inflation gap.

Tables & Figures

Table 1.

National Balance Sheet and Productive Capacity

Figure 1.

Transmission Channel of L

Table 2.

L/Ypc and H/Ypc Depending on Transmission Channel of L

Figure 2.

L/Y for 12 OECD Countries

Source: OECD, author’s calculation

Figure 3.

Equity-to-GDP Ratio for 12 OECD Countries

Source: OECD, author’s calculation

Figure 4.

Credit-to-GDP Ratio for 12 OECD Countries

Source: OECD, author’s calculation

Figure 5.

H/Y for 12 OECD Countries

Source: OECD, author’s calculation

Figure 6.

L/Y, H/Y and Real GDP Growth in the US

Source: OECD, author’s calculation

Table 3.

Summary Statistics (Mean) of L/Y and H/Y from 1995 ~ 2014

Note: L/Y and H/Y denote liquidity and physical capital normalized by GDP, respectively. Credit/GDP are measured as deviations from one-sided Hodrick-Prescott trends.

Source: author’s calculation

Table 4.

Country List and Economic Crises Since 1996

Note: Crisis 1 is defined by the 2 standard deviations from the trend of the GDP. Crisis 2 is defined by the 25% deviation from the trend of the GDP.

Source: Author’s calculation

Table 5.

Performance Comparison (in-sample): L/Y & H/Y vs. Credit-to-GDP Gap

Note: Crisis 1 is defined by the 2 standard deviations from the trend of the GDP. (L/Y)∗ and (H/Y)∗ are the averages of thresholds of liquidity and physical capital (normalized by GDP) across countries, respectively. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

Note: Crisis 2 is defined by the 25% deviation from the trend of the GDP. (L/Y)∗ and (H/Y)∗ are the averages of thresholds of liquidity and physical capital(normalized by GDP) across countries, respectively. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

Table 6.

Thresholds of L/Y and H/Y and Actual Values in 2014

Note: L/Y and H/Y denote liquidity and physical capital normalized by GDP, respectively. Thresholds of (L/Y)∗ and (H/Y)∗ for each OECD country are taken from Appendix where LF3 and x ≥ 75%.

Source: author’s calculation

Appendix A. Foreign Liabilities for 12 OECD Country

Financial liabilities from nonresidents are rising steadily in most OECD countries (Figure A1) as a consequence of financial globalization. At the core of this process has been the rapid expansion of US$ liquidity in the global market in the form of spillover to other countries. Since outflows from the US induced similar inflows from other countries, including from emerging market economies, most countries in OECD has been experiencing rising L/Y.

We show below that the spillover from the financial center, i.e., the US, can explain a large part of this increasing trend in individual countries. We find that L/Y and H/Y are stable after excluding external liquidity spillovers form the financial center, the US. We introduce the simultaneous equations model.

In order to check on whether or not the thresholds of normalized indicators ((

where subscript i represents country i, and t denotes time t. L/Y and H/Y are liquidity and physical capital normalized by GDP(Y), respectively.

Given the coefficient estimated in Table A1, we obtain fitted values of L/Y. After excluding external liquidity spillovers, which is (

This raises the question as to why L/Y should rise if this measure is tied to economic fundamental, namely the repayment capacity in each country. Another way of posing the same question is as to why domestic market forces do not ensure that L/Y is stable, or return to its stable rate after deviation.

The simple response is that this may be because source countries have incomplete information about the indebted counties, so they may be providing credit exceeding the production capacity of the recipient countries. The other side of the coin is that the lenders in each country are concerned on whether they will be repaid, but not fully factoring in obligation to nonresidents.

Consider country A and B below. The nonfinancial sector in country A holds financial assets in other countries as shown in Table A2. Investors may not have full information on country B to ensure that total financial claims in Country B, i.e., b+b’ is equal to country B’s productive capacity. The larger the b’, the more likely it is that financial claims in country B exceed its productive capacity

9)Capital flows include portfolio investment(debt and equity) and direct investment.

10)Reinhart, C. M. Dates for Banking Crises, Currency Crashes, Sovereign Domestic or External Default (or Restructuring), Inflation Crises, and Stock Market Crashes (Varieties). <

Appendix B. Thresholds for Each OECD Country

Appendix Tables & Figures

Figure A1.

Foreign Liabilities to GDP Ratio for 13 OECD Countries

Table A1.

Regression Result of Simultaneous Equations Model

Note: Three-stage least squares (3SLS) and two-step GMM are implemented respectively. For the GMM results, robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10, 5, and 1-percent levels, respectively.

Table A2.

Thresholds of L/Y and H/Y for 12 OECD Countries

Table A3.

Thresholds of L/Y and H/Y for 12 OECD Countries

Note: Crisis 1 is defined by the 2 standard deviations from the trend of the GDP. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

Note: Crisis 2 is defined by the 25% deviation from the trend of the GDP. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

Table A4.

Thresholds of Credit-to-GDP Gap for 12 OECD Countries

Note: Crisis 1 is defined by the 2 standard deviations from the trend of the GDP. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

Note: Crisis 2 is defined by the 25% deviation from the trend of the GDP. Predicted % = percentages of crises predicted, Type 1 error = no signal is issued and a crisis occurs, Type 2 error = a signal is issued but no crisis occurs, Noise/Signal =

References

-

Borio, C. 2014. “The Financial Cycle and Macroeconomics: What Have We Learnt?,”

Journal of Banking & Finance , vol. 45, no. 1, pp. 182-198.

-

Borio, C. and M. Drehmann. 2009. “Assessing the Risk of Banking Crises–Revisited,”

BIS Quarterly Review , March. pp. 29-46. - Chan, J. C. C. and A. L. Grant. 2017. Measuring the Output Gap Using Stochastic Model Specification Search. CAMA Working Paper, no. 2/2017.

- Davis, J. S. and E. van Wincoopz. 2017. Globalization and the Increasing Correlation between Capital Inflows and Outflows. NBER Working Paper, no. 23671.

- Drehmann, M., Borio, C. and K. Tsatsaronis. 2012. Characterising the Financial Cycle: Don’t Lose Sight of the Medium Term!. BIS Working Papers, no. 380.

-

Haldane, A. G. 1995.

Targeting Inflation: A Conference of Central Banks on the Use of Inflation Targets Organised by the Bank of England, 9-10 March 1995 . London: Bank of England. - Han, L. and I. H. Lee. 2012. Optimal Liquidity and Economic Stability. IMF Working Paper, no. 12/135.

- Juselius, M., Borio, C., Disyatat, P. and M. Drehmann. 2016. Monetary policy, the Financial Cycle and Ultralow Interest Rates. BIS Working Papers, no. 569.

-

Kaminsky, G. L. and C. M. Reinhart. 1999. “The Twin Crises: The Causes of Banking and Balance-of-Payments Problems,”

American Economic Review , vol. 89, no. 3, pp. 473-500.

-

Laubach, T. and J. C. Williams. 2003. “Measuring the Natural Rate of Interest,”

Review of Economics and Statistics , vol. 85, no. 4, pp. 1063-1070.

-

Luo, S. and R. Startz. 2014. “Is it One Break or Ongoing Permanent Shocks that Explains U.S. Real GDP?,”

Journal of Monetary Economics , vol. 66, pp. 155-163.

-

Ma, Y. and J. Zhang. 2016. “Financial Cycle, Business Cycle and Monetary Policy: Evidence from Four Major Economies,”

International Journal of Finance & Economics , vol. 21, no. 4, pp. 502-527.

-

Schularick, M. and A. M. Taylor. 2012. “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008,”

American Economic Review , vol. 102, no. 2, pp. 1029-1061.