Abstract

Government agencies are increasingly using economic incentives to encourage landowners to adopt conservation practices. Auctions enable agencies to identify land conservation practices with low opportunity costs. At the same time, landowners’ opportunity costs contain useful information for government agencies to rank conservation priorities. This paper introduces a new reverse auction mechanism that performs well both from the cost effectiveness and cost-revelation perspectives and compares three multi-award reverse auction mechanisms. The first mechanism is called the Uniform Price Reverse (UPR) auction, where each winning bidder is paid the lowest rejected bid. The second mechanism is called the First Price Reverse (FPR) auction, where winning bidders are paid their submitted bids. The third, novel, mechanism is called the Generalized Second Price Reverse (GSPR) auction, where each winning bidder is paid the bid that is immediately higher. Theoretically, I derive the equilibrium bidding strategy for each auction mechanism and show that a symmetric equilibrium strategy may not exist under the GSPR auction. Empirically, lab experiment results show that UPR and GSPR auctions lead to a higher efficiency level compared to FPR, while UPR auction yields the lowest auctioneer surplus and is the least cost effective. As a result, GSPR maintains good incentive properties similar to UPR and presents potential large cost-saving opportunities to the auctioneer.

Similar content being viewed by others

Notes

In the context of conservation auctions, a higher surplus for the auctioneer means more money for the government and less for the landowners from a single auction. Overall, when the government faces a limited budget, a high surplus for the auctioneer implies a higher level of realized environmental benefits when more acres are enrolled.

The “click-through rate” measures the number of clicks advertisers receive on their advertisements per number of impressions. It reflects the potential benefits and is similar to the heterogeneous environmental quality in conservation auctions.

I also assume a random tie breaking rule in case there are multiple bids at the same price.

The equilibrium bids are lower than 20 experimental dollars based on the induced cost range in theory. Experimental data suggest that only high cost individuals occasionally bid over 20 experimental dollars. The $30 upper limit is set to rule out extremely unlikely scenarios where all bidders submit unusually high bids, which could break our budget. Only a tiny fraction of the bids (0.63%) are at $30 experimental dollars.

Note that the existence of Nash equilibrium depends on the specific experimental parameters and the equilibrium outcome is less likely to be observed when N and M are large. Therefore, our parameters are chosen so that the equilibrium bidding strategy does not exist to offer more generalizable comparison among the three reverse auction mechanisms based on experimental performance.

In addition, I run a simple OLS regression using the bid as the independent variable and the cost and period as the explanatory variable. Our results show that the coefficient associated with the period is 0.0081 with a standard error of 0.0050 (\(p=0.11\)) based on the FPR subsample; the coefficient associated with the period is 0.0005 with a standard error of 0.0055 (\(p=0.93\)) based on the GSPR subsample, implying GSPR auction is less likely to lead to opportunities to game the system over time relative to the FPR auction.

References

Arnold MA, Duke JM, Messer KD (2013) Adverse selection in reverse auctions for ecosystem services. Land Econ 89(3):387–412

Babcock BA, Lakshminarayan PG, Wu JJ, Zilberman D (1996) The economics of a public fund for environmental amenities: a study of CRP contracts. Am J Agric Econ 78(4):961–971

Banerjee S (2018) Improving spatial coordination rates under the agglomeration bonus scheme: a laboratory experiment with a pecuniary and a non-pecuniary mechanism (nudge). Am J Agric Econ 100(1):172–197

Banerjee S, Conte MN (2018) Information access, conservation practice choice, and rent seeking in conservation procurement auctions: evidence from a laboratory experiment. Am J Agric Econ 100(5):1407–1426

Banerjee S, Kwasnica AM, Shortle JS (2015) Information and auction performance: a laboratory study of conservation auctions for spatially contiguous land management. Environ Resour Econ 61(3):409–431

Banerjee S, Cason TN, de Vries FP, Hanley N (2017) Transaction costs, communication and spatial coordination in Payment for Ecosystem Services Schemes. J Environ Econ Manag 83:68–89

Bower J, Bunn D (2001) Experimental analysis of the efficiency of uniform-price versus discriminatory auctions in the England and Wales electricity market. J Econ Dyn Control 25(3):561–592

Cameron AC, Miller DL (2015) A practitioner’s guide to cluster-robust inference. J Hum Resour 50(2):317–372

Caragiannis I, Kaklamanis C, Kanellopoulos P, Kyropoulou M (2011) On the efficiency of equilibria in generalized second price auctions. In: Proceedings of the 12th ACM conference on electronic commerce. ACM, pp 81–90

Cason TN, Gangadharan L (2004) Auction design for voluntary conservation programs. Am J Agric Econ 86(5):1211–1217

Cason TN, Gangadharan L (2005) A laboratory comparison of uniform and discriminative price auctions for reducing non-point source pollution. Land Econ 81(1):51–70

Cason TN, Gangadharan L, Duke C (2003) A laboratory study of auctions for reducing non-point source pollution. J Environ Econ Manag 46(3):446–471

Cattaneo A (2005) Flexible conservation measures on working land: what challenges lie ahead? Number 5. United States Department of Agriculture, Economic Research Service

Charness G, Gneezy U, Kuhn MA (2012) Experimental methods: between-subject and within-subject design. J Econ Behav Organ 81(1):1–8

Che Y-K, Choi S, Kim J (2017) An experimental study of sponsored-search auctions. Games Econ Behav 102:20–43

Connor JD, Ward JR, Bryan B (2008) Exploring the cost effectiveness of land conservation auctions and payment policies. Aust J Agric Resour Econ 52(3):303–319

Conte MN, Griffin R (2019) Private benefits of conservation and procurement auction performance. Environ Resour Econ 73(3):759–790

Conte MN, Griffin R, Griffin RM (2017) Quality information and procurement auction outcomes: evidence from a payment for ecosystem services laboratory experiment. Am J Agric Econ 99(3):571–591

Cox JC, Smith VL, Walker JM (1984) Theory and behavior of multiple unit discriminative auctions. J Finance 39(4):983–1010

Cox JC, Smith VL, Walker JM (1988) Theory and individual behavior of first-price auctions. J Risk Uncertainty 1(1):61–99

Cramton P, Hector L, David M, Sujarittanonta P (2015) Design of the reverse auction in the FCC incentive auction

Edelman B, Ostrovsky M, Schwarz M (2007) Internet advertising and the generalized second-price auction: selling billions of dollars worth of keywords. Am Econ Rev 97(1):242–259

Ferraro PJ (2008) Asymmetric information and contract design for payments for environmental services. Ecol Econ 65(4):810–821

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fukuda E, Kamijo Y, Takeuchi A, Masui M, Funaki Y (2013) Theoretical and experimental investigations of the performance of keyword auction mechanisms. Rand J Econ 44(3):438–461

Gomes R, Sweeney K (2014) Bayes-nash equilibria of the generalized second-price auction. Games Econ Behav 86:421–437

Graham DA, Marshall RC (1987) Collusive bidder behavior at single-object second-price and English auctions. J Polit Econ 95(6):1217–1239

Hajkowicz S, Higgins A, Williams K, Faith DP, Burton M (2007) Optimisation and the selection of conservation contracts. Aust J Agric Resour Econ 51(1):39–56

Harrison GW (1989) Theory and misbehavior of first-price auctions. Am Econ Rev 79:749–762

Heimlich RE (1989) Productivity and erodibility of US cropland number 604. US Department of Agriculture, Economic Research Service

Holt CA Jr (1980) Competitive bidding for contracts under alternative auction procedures. J Polit Econ 88(3):433–445

Jeziorski P, Segal I (2015) What makes them click: empirical analysis of consumer demand for search advertising. Am Econ J Microecon 7(3):24–53

Laffont J-J, Ossard H, Vuong Q (1995) Econometrics of first-price auctions. Econ J Econ Soc 63:953–980

Liu P, Swallow SK (2016) Integrating cobenefits produced with water quality BMPs into credits markets: conceptualization and experimental illustration for EPRI’s Ohio River Basin trading. Water Resour Res 52:3387–3407

Liu P, Swallow SK (2019) Providing multiple units of a public good using individualized price auctions: experimental evidence. J Assoc Environ Resour Econ 6(1):1–42

Marks M, Croson R (1998) Alternative rebate rules in the provision of a threshold public good: an experimental investigation. J Public Econ 67(2):195–220

McAfee RP, McMillan J (1987) Auctions and bidding. J Econ Lit 25(2):699–738

McLaughlin K, Friedman D (2016) Online ad auctions: an experiment. Technical report, WZB discussion paper

Milgrom P, Segal I (2002) Envelope theorems for arbitrary choice sets. Econometrica 70(2):583–601

Milton H, Artur R (1981) Allocation mechanisms and the design of auctions. Econ J Econ Soc 49:1477–1499

Parkhurst GM, Shogren JF, Bastian C, Kivi P, Donner J, Smith RBW (2002) Agglomeration bonus: an incentive mechanism to reunite fragmented habitat for biodiversity conservation. Ecol Econ 41(2):305–328

Reeson AF, Rodriguez LC, Whitten SM, Williams K, Nolles K, Windle J, Rolfe J (2011) Adapting auctions for the provision of ecosystem services at the landscape scale. Ecol Econ 70(9):1621–1627

Riley JG, Samuelson WF (1981) Optimal auctions. Am Econ Rev 71(3):381–392

Rolfe J, Whitten S, Windle J (2017) The Australian experience in using tenders for conservation. Land Use Policy 63:611–620

Schilizzi S, Latacz-Lohmann U (2007) Assessing the performance of conservation auctions: an experimental study. Land Econ 83(4):497–515

Schilizzi S, Latacz-Lohmann U (2016) Incentivizing and tendering conservation contracts: the trade-off between participation and effort provision. Land Econ 92(2):273–291

Stoneham G, Chaudhri V, Ha A, Strappazzon L (2003) Auctions for conservation contracts: an empirical examination of Victoria’s BushTender trial. Aust J Agric Resour Econ 47(4):477–500

Thompson DRM, Leyton-Brown K (2017) Computational analysis of perfect-information position auctions. Games Econ Behav 102:583–623

Tilman B, Ingemar C, Martin P, Vaclav P (2007) Equilibrium bids in sponsored search auctions: theory and evidence. Am Econ J Microecon 5(4):163–187

Varian HR (2007) Position auctions. Int J Ind Organ 25(6):1163–1178

Varian HR (2009) Online ad auctions. Am Econ Rev 99(2):430–434

Vickrey W (1962) Auctions and bidding games. Recent Adv Game Theory 29:15–27

Windle J, Rolfe J (2008) Exploring the efficiencies of using competitive tenders over fixed price grants to protect biodiversity in Australian rangelands. Land Use Policy 25(3):388–398

Woodward RT (2011) Double-dipping in environmental markets. J Environ Econ Manag 61(2):153–169

Zammit C (2013) Landowners and conservation markets: social benefits from two Australian government programs. Land Use Policy 31:11–16

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix

A: Equilibrium Strategy in GSPR

Following Gomes and Sweeney (2014), the bidder i’s (with a private cost c) expected payment in equilibrium is denoted by E(p(c)), by the Revelation Principle, the E(p(c)) has to satisfy

According to the Integral-form Envelop Theorem (Milgrom and Segal 2002), equation (22) implies that,

where \(E(p(\hat{c}))=0\) as the highest cost bidder expects to receive zero payment with a zero probability of winning the auction. According to the definition of GSPR,

Based on equations (23) and (24)

where

Differentiating w.r.t. c on both sides,

Differentiating equation (26),

Combining equations (27) and (28),

Rewrite the above equation,

Therefore, we have

where

Specifically, when \(N=5\), \(M=2\), equation (31) implies

or

which can be further simplified to

Rewrite the above equation as

Non-existence of Symmetric Equilibrium Take the first order derivative with respect to c,

When \(s(c)>0\) and \(c\in [5,20]\), according to equation (37), we can show that \(s^{\prime }<0\), which violates the requirement that \(s^{\prime }(c)\) must be strictly increasing for an efficient equilibrium, and a symmetric equilibrium does not exist in our case (Caragiannis et al. 2011; Gomes and Sweeney 2014).

B: Additional Regression Results and Figures

See Tables 11, 12 and Figs. 5, 6, 7, 8, 9, 10 and 11.

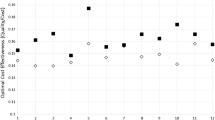

Allocation of realized surplus and total realized social surplus. Notes: Figure a shows the allocation of realized surplus between the auctioneer and bidders across different reverse auction mechanisms by period. Figure b shows the realized total social surplus across different reverse auction mechanisms by period

Rights and permissions

About this article

Cite this article

Liu, P. Balancing Cost Effectiveness and Incentive Properties in Conservation Auctions: Experimental Evidence from Three Multi-award Reverse Auction Mechanisms. Environ Resource Econ 78, 417–451 (2021). https://doi.org/10.1007/s10640-021-00538-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-021-00538-0

Keywords

- Conservation programs

- Environmental market

- Procurement auction

- Generalized second price reverse auction

- Experimental economics