Abstract

The allocation of emission permits at no cost during the establishment of a cap-and-trade program creates opportunities for rent-seeking. I examine the consequences of such rent-seeking by exploiting an unusual feature of the UK’s permit allocation procedure in Phase 1 of the EU’s CO\(_{2}\) Emissions Trading Scheme, whereby it is possible to observe both a firm’s actual permit allocation as well as an earlier, technocratically-based provisional allocation that was never implemented. Firms had the opportunity to appeal their provisional allocation. I find that a firm’s financial connections to members of the House of Commons strongly predict its post-appeal allocation. Even after controlling for the provisional allocation, along with industry and financial characteristics, a connection to an additional member is associated with a significant increase in a firm’s actual permit allocation. Using results from a contest-theoretic framework, I estimate the welfare loss from rent-seeking to be over 100 million euros—a significant amount relative to the abatement costs firms incurred to reduce emissions.

Similar content being viewed by others

Notes

Equivalently, \(\phi \equiv \bar{A}-\sum _{i=1}^{n}A_{i}^{1-\gamma }\).

Unlike Hanley and MacKenzie (2010), I allow rent-seeking to influence only the allocation of the cap, not the cap itself. In the case I study empirically, there is no evidence that lobbying shifted the overall cap.

This contest function dates back to Tullock (1980) and has been widely used since (Grossman 2001; Hodler 2006; Hanley and MacKenzie 2010). Skaperdas (1996) argues that the class of functions propounded by Tullock (1980), which is based on ratios of efforts, is the only class that satisfies a number of desirable and plausible properties of a contest function.

The provisional allocations also remain unchanged regardless of the value of \(\gamma\) if no firm undertakes any lobbying.

I assume that firms are price-takers. This assumption would clearly not be reasonable, for example, in the extreme case where a single firm receives all the permits and behaves as a monopolist. However, studies suggest that market power is not a major concern in the EU ETS (Convery and Redmond 2007; Hahn and Stavins 2011).

The equimarginal condition will fail to hold if efforts devoted to lobbying somehow hampered production. However, for the purposes of the model, I abstract away from this potential source of inefficiency, focusing only on the efforts wasted in lobbying.

The conditions are formalized in Proposition 1 (Appendix 1).

The relevant derivatives with respect to own lobbying costs, for \(i=1,2,...,k\), are \(\frac{\partial \widetilde{A}_{i}}{\partial \omega _{i}}=\frac{-\phi (k-1)\left[ \left( \sum _{j=1}^{k}\omega _{j}\right) -\omega _{i}\right] }{\left( \sum _{j=1}^{k}\omega _{j}\right) ^{2}}<0\).

This approximation is valid if the number of permits a firm gains in the contest (i.e. \(\phi \left( 1-\frac{(k-1)\omega _{i}}{\sum _{j=1}^{k}\omega _{j}}\right)\)) is small relative to the permits the firm retains (i.e. \(A_{i}^{(1-\gamma )}\)). The high level of “persistence” of the provisional allocation (observed in the data) suggests that the approximation is reasonable.

The lead government department in charge of developing the UK plan was the Department of Environment, Food, and Rural Affairs (DEFRA), however the Department of Trade and Industry and the Environment Agency were also involved.

Matching between the two plans is possible through a unique identification number assigned to each installation.

The provisional and actual plans report the firm each installation is associated with. In some instances, the reported firm may be a subsidiary of another firm. The firm-level allocations I have constructed include allocations to the firm and its subsidiaries. I have carefully identified subsdiaries by individually ascertaining the ownership status in 2004 of each reported firm. The sources relied upon include company websites, financial reports, press releases, and company descriptions from Hoovers and Bloomberg Businessweek Company Insight Center.

In the regressions the sample sizes are lower because I exclude universities, hospitals, and government entities. These entities account for less than 0.5% of the cap in both plans. Also, lack of financial data accounts for the lower sample size in regressions that include firm financial variables.

A firm was placed into one of these groupings primarily on the basis of the sectors its installations were classified under in the provisional plan. The provisional plan sectors of “Chemicals”, “Food & Drink”, and “Pulp & Paper” correspond directly to the SIC-based industry groups. The provisional plan sectors of “Bricks/Ceramics”, “Cement”, “Glass”, and “Lime” all map to the “Stone/Clay/Glass/Concrete” industry group, while the “Iron & Steel” and “Non-ferrous sectors” map to Metal Manufacture. “Power Stations” fall under the Utilities group. The Fossil Fuels group includes firms engaged in the extraction of fossil fuels and/or refining; the “Offshore” and “Refineries” sectors in the provisional plan fall in this grouping. Finally, the “Other Combustion Activities” sector includes firms whose business activities may fall into any of the industry groups; companies that manufacture Transportation Equipment are included in this sector. The installations of most firms fall into only one sector of the provisional plan. For firms with installations in more than one sector, there was typically one dominant sector that represented the core business activity. For example, British Petroleum is classified in the Fossil Fuels group even though 2 out of its 20 installations fall in the “Chemicals” sector in the provisional plan. When necessary, the Amadeus database published by Bureau van Dijk was consulted to establish a firm’s industry grouping. See http://www.bvdinfo.com/Products/Company-Information/International/AMADEUS.aspx.

Issues of the Register can be downloaded from https://www.parliament.uk/mps-lords-and-offices/standards-and-financial-interests/parliamentary-commissioner-for-standards/registers-of-interests/register-of-members-financial-interests/.

For a detailed description of disclosure rules for UK MPs, see https://publications.parliament.uk/pa/cm201516/cmcode/1076/107604.htm.

In particular, the following issues were used: November 10, 2000; May 14, 2001; May 14, 2002; November 26, 2002; December 4, 2003; and January 31, 2004.

For example, MP Peter Hain (Labour) attended Wimbledon on July 4, 1999, as a guest of British Petroleum.

The relatively few connections to MPs observed in the UK data may reflect the relatively diminished role of campaign finance in the UK political system vis-vis the political system in countries such as the US (Mahoney 2009). Non-disclosure of financial interests by MPs is unlikely to pose a major problem in this setting, as it carries non-trivial consequences. See for example http://www.bbc.co.uk/news/special/politics97/news/06/0618/wareing.shtml.

The UK does not systematically collect and release data on the financial connections of employees from any of the involved agencies.

Although the matched installations represent a total of 270 firms, the comparison in Table 3 excludes universities, hospitals, and government entities and hence covers only 247 firms. Universities, hospitals, and government entities account for less than 0.5% of the cap in both plans.

Among connected firms, emissions in 2002 ranged between 1,110 tons and 28,439,827 tons. Among non-connected firms, emissions in 2002 ranged between 57 tons and 19,348,748 tons.

The existence of a mean zero error term, \(\epsilon _{i}\), would not alter the central prediction of the theory (i.e. ceteris paribus a firm with a lower relative lobbying cost will lobby more and realize a higher permit allocation) if firms are risk-neutral. Suppose (risk-neutral) firms understand that their final allocation will not just be that specified as the first part of Eq. (1) but will also be adjusted by a mean zero idiosyncratic term. Under expected profit maximization, (3) would still capture the firm’s lobbying decision and the firm’s decisions would remain the same.

Such weighting makes my results comparable to those of Khwaja and Mian (2005), who analyze the effect of political connectedness on firm default rates on loans from state-owned banks in Pakistan. Their unit of observation is a firm-bank pair, and they weight each observation by the number of dollars loaned by the bank to the firm.

These are obtained from the Amadeus database published by Bureau van Dijk. See http://www.bvdinfo.com/Products/Company-Information/International/AMADEUS.aspx.

When not accounting for firm characteristics and industry this value is 0.8%. When accounting for only industry this value is 0.3%.

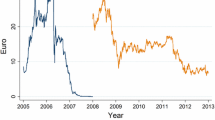

To place these estimates in economic perspective, a 3.2% increase in final allocation would represent 27,640 additional permits for a firm with a final allocation equal to the average across all firms (863,744 permits); taking an expected permit price in 2004 of 10 euros (Ellerman and Joskow 2008), this increase represents a value of 276,400 euros.

Number of connections seems to be the only measure of “strength” that matters. Distinguishing between types of connections (e.g. gifts vs. shareholdings vs. positions on boards of directors) does not yield significant results, nor do the results differ if connections are broken down by political party (e.g. Labour vs. Conservative). 53% of the connections observed in the data are to MPs in the Labour party, which was in power at the time.

For example, if the number of contested permits was zero, there would be no gainers or losers and allocations would remain unchanged.

This assumes rational expectations. However, it is not inconceivable that firms might have under- or over-estimated the value of a permit given that the EU ETS was the first large-scale market of its kind.

Because I cannot directly observe lobbying, there is no way to definitively pin down k. Although there are 160 firms whose final allocation exceeds the provisional allocation, a majority of these (130) were not connected to an MP and may not have participated in lobbying. Furthermore, the predictions of the theoretical model do not guarantee that all 47 firms connected to at least one MP participated in lobbying.

A version of this proposition is established by Franke et al. (2013).

In the case of \(n=3\) firms, the conditions for an equilibrium with full participation (\(k=3\)) are tantamount to the triangle equality; i.e. there will be participation by all 3 firms only if the marginal lobbying cost of any one firm is strictly less than the sum of the marginal lobbying costs of the other two firms.

The second order sufficient conditions for a maximum are satisfied. The second derivatives of each firm’s profit function are negative when evaluated at the interior optimum. Specifically, \(-\tau \phi \frac{2x_{i}}{(x_{i}+x_{-i})^{2}}<0\) for \(i=1,\ldots ,n\).

References

Anger N, Böhringer C, Oberndorfer U (2008) Public interest vs. interest groups: allowance allocation in the EU Emissions Trading Scheme. ZEW-Centre for European Economic Research Discussion Paper 08-023

Brandt US, Svendsen GT (2004) Rent-seeking and grandfathering: the case of GHG trade in the EU. Energy Environ 15(1):69–80

Buchner B, Carraro C, Ellerman A (2006) The allocation of european union allowances: lessons, unifying themes and general principles. MIT Joint Program on the Science and Policy of Global Change Report No. 140

Coase R (1960) The problem of social cost. J Law Econ 3:1–44

Convery FJ, Redmond L (2007) Market and price developments in the European Union emissions trading scheme. Rev Environ Econ Policy 1(1):88–111

Cramton P, Kerr S (2002) Tradeable carbon permit auctions: how and why to auction not to grandfather. Energy Policy 30:333–45

Department of Environment, Food, and Rural Affairs (2005) EU emissions trading scheme: approved national allocation plan 2005–2007. http://www.decc.gov.uk/en/content/cms/emissions/eu_ets/phase_1/phasei_nap/phasei_nap.aspx. Accessed 17 Jan 2012

Department of Trade and Industry (2004) UK Draft National Allocation Plan for 2005–2007. http://fool.uk-wire.com/Article.aspx?id=200401191044023667U and http://fool.uk-wire.com/Article.aspx?id=200401191044073672U. Accessed 20 Sept 2012

Duggan J (2009) Cap and trade comes of age in Europe” World Resources Institute. http://www.wri.org/blog/2009/12/cap-and-trade-comes-age-europe

The Economist, November 16 (2006) Soot, smoke and mirrors: Europe’s flagship environmental programme is foundering. http://www.economist.com/node/8167968?story_id=8167968. Accessed 17 Jan 2012

Ellerman A, Convery F, de Perthuis C (2010) Pricing carbon: the European Union emissions trading scheme. Cambridge University Press, Cambridge

Ellerman A, Joskow P (2008) The European Union’s emissions trading system in perspective. Prepared for the Pew Center for Global Climate Change

Ellerman A, Buchner B, Carraro C (eds) (2007) Allocation in the EU Emissions trading scheme: rights, rents, and fairness. Cambridge University Press, Cambridge

Faccio M, Masulis RW, McConnell JJ (2006) Political connections and corporate bailouts. J Finance 61:2597–2635

Ferguson T, Voth H (2008) Betting on Hitler—the value of political connections in Nazi Germany. Quart J Econ 123(1):101–37

Fowlie M, Perloff JM (2013) Distributing pollution rights in cap-and-trade programs: are outcomes independent of allocation? Rev Econ Stat 95(5):1640–1652

Franke J, Kanzow C, Leininger W, Schwartz A (2013) Effort maximization in asymmetric contest games with heterogeneous contestants. Econ Theor 52(2):589–630

Goulder LH, Parry IWH, Williams RC III, Burtraw D (1999) The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J Public Econ 72(3):329–60

Grossman HI (2001) The creation of effective property rights. Am Econ Rev 91(2):347–352

Guardian The, September 12 (2008) Britain’s worst polluters set for windfall of millions. http://www.guardian.co.uk/environment/2008/sep/12/emissionstrading. Accessed 17 Jan 2012

Hahn RW (1984) Market power and transferable property rights. Quart J Econ 99(4):753–65

Hahn RW, Stavins RN (2011) The effect of allowance allocations on cap-and-trade system performance. J Law Econ 54(4):S267–S294

Hanley N, MacKenzie IA (2010) The effects of rent seeking over tradable pollution permits. B E J Econ Anal Policy 10(1):56

Hanoteau J (2003) Lobbying for emissions allowances: a new perspective on the political economy of the US acid rain program. Riv Polit Econ 43:289–313

Hodler R (2006) The curse of natural resources in fractionalized countries. Eur Econ Rev 50:1367–1386

Joskow P, Schmalensee R (1998) The political economy of market-based environmental policy: the US acid rain program. J Law Econ 41:37–83

Khwaja AI, Mian A (2005) Do lenders favor politically connected firms? Rent-seeking in an emerging financial market. Quart J Econ 120:1371–1411

MacKenzie IA, Ohndorf M (2012) Cap-and-trade, taxes, and distributional conflict. J Environ Econ Manag 63:51–65

MacKenzie IA (2017) Rent creation and rent seeking in environmental policy. Public Choice 171:145–166

Mahoney C (2009) Why lobbying in America is different Politico, June 4, 2009. https://www.politico.eu/article/why-lobbying-in-america-is-different/. Accessed 21 Dec 2019

Mallard G (2009) The European Union’s emission trading scheme: political economy and bureaucratic rent-seeking bath economics research papers no. 22/09. http://opus.bath.ac.uk/15957/1/2209.pdf. Accessed 23 Aug 2013

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5:395–418

Nordhaus WD (2006) After Kyoto: alternative mechanisms to control global warming. Am Econ Rev 96(2):31–34

Nordhaus WD (2007) To tax or not to tax: alternative approaches to slowing global warming. Rev Environ Econ Policy 1(1):26–44

Skaperdas S (1996) Contest success functions. Econ Theor 7:283–90

Solon G, Haider SJ, Wooldridge JM (2015) What are we weighting for? J Hum Resour 50(2):301–316

Stavins RN (1995) Transaction costs and tradable permits. J Environ Econ Manag 29:133–148

Stavins RN (1998) What have we learned from the grand policy experiment: lessons from SO2 allowance trading. J Econ Perspect 12(3):69–88

Tullock G (1967) The welfare costs of tariffs, monopolies, and theft. Western Econ J (now Econ Inquiry) 5:224–32

Tullock G (1980) Efficient rent-seeking. In: Buchanan JM, Tollison RD, Tullock G (eds) Toward a theory of the rent-seeking society. Texas A&M University Press, College Station, pp 97–112

Acknowledgements

This paper has benefited greatly from the feedback of others, most notably Bob Deacon, Olivier Deschenes, Kyle Meng, Paulina Oliva, Sanjay Patnaik, Dick Startz, and Douglas Steigerwald. I am also grateful for the valuable comments offered by participants in the Econometrics Research Group and Environmental Lunch Seminar at UC Santa Barbara. While conducting this research, I was a recipient of the Joseph L. Fisher Doctoral Dissertation Fellowship, awarded by Resources for the Future.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Proposition 1

(Nash equilibrium of the n-firm contest):

-

(a)

Only the k firms with the lowest ranking lobbying costs participate in lobbying, where \(k\in \{2,\ldots ,n\}\) and is uniquely determined (See Proposition 2for proof of uniqueness).

-

(b)

If firm i participates in lobbying, its lobbying cost must be strictly less than the sum of the lobbying costs of the k lobbying firms, divided by \(k-1\).

-

(c)

If firm i does not participate in lobbying, its lobbying cost must be greater than or equal to the sum of the lobbying costs of the k lobbying firms, divided by \(k-1\).

-

(d)

The lobbying efforts of the participating firms are defined by (12).

Proposition 1 formalizes the idea that the number of firms that participate in lobbying depends critically on the dispersion of the marginal costs of lobbying across firms.Footnote 34 Those firms whose costs are too high relative to those of other firms will choose to refrain from lobbying. In the extreme case where all n firms face equal marginal costs, the equilibrium will have participation by all firms (\(k=n\)). At the other extreme, a sufficiently high degree of dispersion in costs can produce an equilibrium where only the two firms with the lowest costs will participate (\(k=2\)).Footnote 35

Proof

Differentiating (3) with respect to \(x_{i}\) yields the following first order conditions for an interior solution:

where \(x_{-i}\) refers to the sum of lobbying efforts of firms other than firm i. These conditions state that each firm chooses a level of lobbying effort that equalizes its marginal benefits and marginal cost.Footnote 36

The first order conditions together with the non-negativity constraints on lobbying efforts lead to the following best response functions:

A strategy profile in which all firms exert zero lobbying effort cannot constitute a Nash equilibrium. According to the contest function specified in (1), the best response of firm i to \(x_{-i}=0\) is to exert an arbitrarily small amount of lobbying effort, \(x_{i}=\epsilon >0\), and thereby capture the entire quantity of contested permits. However, this cannot constitute a Nash equilibrium either. Suppose for example that \(x_{-i}=0\) and \(x_{i}=\epsilon >0\). Although firm i’s choice of an arbitrarily small amount of lobbying effort, \(\epsilon\), is a best response to \(x_{-i}=0\), the best response function (10) indicates that the other (non-i) firms’ choices of zero lobbying effort are not best responses to a sufficiently small \(\epsilon\). This reasoning implies that a Nash equilibrium cannot involve only one firm with strictly positive effort while all other firms refrain from lobbying. Thus at least two firms must exert strictly positive lobbying effort in a Nash equilibrium.

Generally, there exists a unique Nash equilibrium to this contest in which k firms exert strictly positive lobbying effort, with \(k\in [2,n]\). To see this, let \(j=1,2,...,k\) index the lobbying firms. For these k firms, the first order condition (9) holds with equality. Summing both sides of (9) over \(i=1,2,...,k\) and rearranging, the total equilibrium lobbying effort is

and combining (11) with the best response function (10),

A Nash equilibrium can involve \(k\le n\) lobbying firms if the lobbying costs of these k firms are sufficiently close to each other, and the lobbying costs of the non-lobbying firms are sufficiently higher than those of the lobbying firms. In particular, for (12) to be a Nash equilibrium, it is required that \(\omega _{i}<\frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\,\,for\,i=1,2,...,k\). Furthermore, the best response function (10) requires that \(x_{-i}\ge \frac{\tau \phi }{\omega _{i}}\,for\,i=k+1,k+2,...,n\). Noting that for the non-lobbying firms \(x_{-i}=x\), this requirement can be expressed as \(\omega _{i}\ge \frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\,\,for\,i=k+1,k+2,...,n\).

These requirements for a Nash equilibrium imply that the k lobbying firms must be the k firms with the lowest ranking lobbying costs. Also, because \(\omega _{i}<\sum _{j=1}^{2}\omega _{j}\,for\,i=1,2\) is trivially true, an equilibrium cannot involve fewer than two lobbying firms. \(\square\)

Proposition 2

(Uniqueness of equilibrium) The number of lobbying firms in equilibrium, k, is uniquely determined.

Proof

Suppose there exists a Nash equilibrium with k lobbying firms and another Nash equilibrium with \(k'\) lobbying firms. Without loss of generality, suppose \(k'>k\). The equilibrium conditions stipulate

and

where i indexes firms in order of lobbying cost (i.e. firm 1 is the firm with lowest lobbying cost; firm n is the firm with the highest lobbying cost).

Condition (10) implies \((k'-1)\omega _{k'}<\sum _{j=1}^{k'}\omega _{j}\), which can be equivalently expressed as \((k-1)\omega _{k'}+(k'-k)\omega _{k'}<\sum _{j=1}^{k}\omega _{j}+\sum _{j=k+1}^{k'}\omega _{j}\). Condition (9) implies \((k-1)\omega _{k'}>\sum _{j=1}^{k}\omega _{j}\), therefore it must be that \((k'-k)\omega _{k'}<\sum _{j=k+1}^{k'}\omega _{j}\). However, because \(\forall \,j<k'\), \(\omega _{j}<\omega _{k'}\), \(\omega _{k'}>\frac{1}{k'-k}\sum _{j=k+1}^{k'}\omega _{j}\), which implies \((k'-k)\omega _{k'}>\sum _{j=k+1}^{k'}\omega _{j}\) leading to a contradiction. Therefore there cannot exist two Nash equilibria with different numbers of lobbying firms. \(\square\)

Proposition 3

(Equilibrium lobbying effort and unit lobbying cost) The equilibrium lobbying effort of a lobbying firm is decreasing in the firm’s own unit cost of lobbying. The effect of an increase in another firm’s unit lobbying costs is ambiguous.

Proof

For a lobbying firm i, \(x_{i}=\frac{\tau \phi (k-1)}{(\sum _{j=1}^{k}\omega _{j})^{2}}\cdot \left( \left( \sum _{j=1}^{k}\omega _{j}\right) -\omega _{i}(k-1)\right)\).

Differentiating \(x_{i}\) with respect to \(\omega _{i}\) yields

which is strictly negative if and only if \(\frac{2\omega _{i}}{k}<\frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\). Because \(k\ge 2\), \(\frac{2\omega _{i}}{k}\le \omega _{i}\). The condition for a lobbying firm i is that \(\omega _{i}<\frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\). Together these imply \(\frac{2\omega _{i}}{k}<\frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\).

Differentiating \(x_{i}\) with respect to \(\omega _{i'}\) (with \(i'\ne i\)) yields

The denominator is obviously positive. Because \(\omega _{i}\) may be greater or less than \(\frac{1}{2(k-1)}\sum _{j=1}^{k}\omega _{j}\), the sign of \(\frac{\partial x_{i}}{\partial \omega _{i'}}\) is ambiguous. \(\square\)

Proposition 4

(Rent dissipation) When the number of lobbying firms, k, is arbitrarily large, total expenditures on lobbying effort equal the value of the rents, \(\tau \phi\).

Proof

For a given k, an upper bound on total lobbying expenditure is \(\left( \frac{k-1}{k}\right) \tau \phi\). The upper bound is reached when the lobbying costs of the k lobbying firms are equal; higher variance in the lobbying costs of the k firms leads to lower total lobbying expenditure. This is because the quantity \(\frac{\sum _{j=1}^{k}\omega _{j}^{2}}{\left( \sum _{j=1}^{k}\omega _{j}\right) ^{2}}\) is monotonically increasing in the variance of the \(\omega _{j}\)’s and attains a minimum value of \(\frac{1}{k}\) when the variance of the \(\omega _{j}\)’s is zero (i.e. when \(\frac{\sum _{j=1}^{k}\omega _{j}^{2}}{k}-\frac{\left( \sum _{j=1}^{k}\omega _{j}\right) ^{2}}{k^{2}}=0\)).

When the number of lobbying firms, k, is arbitrarily large, total lobbying expenditures are equal to \(\tau \phi\). The reason for this is twofold. First, the larger the value of k, the more stringent are the limitations on the variance of the lobbying costs. Specifically, when k is arbitrarily large, the conditions for a Nash equilibrium imply that the variance of the lobbying costs of the k firms must be zero. (Recall that, for any Nash equilibrium in which k firms lobby, it must be that \(\omega _{i}<\frac{1}{k-1}\sum _{j=1}^{k}\omega _{j}\,for\,i=1,2,...,k\).) Second, as the variance of the lobbying costs of the k firms reaches zero, total lobbying expenditure must itself reach its upper bound, \(\left( \frac{k-1}{k}\right) \tau \phi\). It is evident that this upper bound reaches \(\tau \phi\) for an arbitrarily large k. \(\square\)

Appendix 2

See Tables 10, 11, 12, 13, 14, 15 and 16.

Rights and permissions

About this article

Cite this article

Rode, A. Rent Seeking over Tradable Emission Permits. Environ Resource Econ 78, 257–285 (2021). https://doi.org/10.1007/s10640-020-00531-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-020-00531-z