Abstract

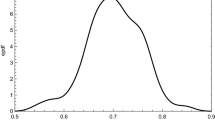

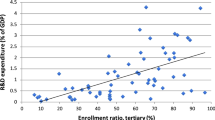

We study the impact of taxation on human capital when the mortality of household agents is endogenously determined based on their past levels of consumption. We characterize and solve the dynamic optimization problem facing household agents in the economy. Even though all households in our economy have identical preferences and have access to the same human capital accumulation technology, with endogenous mortality, there is a possibility of multiple equilibria. Households with an initial endowment of human capital above a threshold choose to accumulate human capital, while those below the threshold end up with very low levels of human capital. We use empirical estimates of the income–mortality relationship in Canada, France, and the US to simulate our model. When income has a strong protective effect against mortality, we find that multiple equilibria are empirically plausible. Our simulations suggest that changes in proportional tax rates have more than twice the impact on aggregate human capital in the endogenous mortality model compared to the infinite horizon model.

Similar content being viewed by others

Notes

This the case for instance in Becker et al. (1990).

See, for instance, Chakrabarty (2012).

In a dynamic model, one can think of the discount factor of the agents as their level of patience. In the literature, the “rate of time preference” is defined as the inverse of the discount factor. This means that more patient individuals (i.e., individuals with higher discount factors) have lower rates of time preference.

Refer to Chakrabarty (2012) for a detailed literature review on endogenous rate of time preference. We should mention that the decreasing rate of time preference requires us to assume that the period utility function is non-negative. It is needed to ensure that the lifetime welfare of a household is always increasing in consumption.

This has been captured in the literature by utilizing a human capital production function which is concave in its arguments.

An earlier version of the paper (available on request) showed that it is possible to derive similar qualitative results using any general concave production technology for human capital provided resources were the only input required for human capital production.

The condition \({\lim }_{c_{t}\rightarrow 0} u^{\prime }(\cdot )=\infty \) ensures that there are no corner solutions in \(c_{t}\).

Please refer to the appendix for more details.

We are calculating the marginal return of human capital after substituting the optimal choice of \(\nu _{t}\). A detailed derivation of this is provided with the proof of Proposition 5.

For simplicity, we have set the initial endowment of financial asset, \( a_{0}=0\). Qualitatively, our result will continue to hold if \(a_{0}>0\). The threshold human capital stock \(h_{\max }\) will simply be a decreasing function of \(a_{0}\).

Cagetti and De Nardi (2008) provide an excellent review of this literature.

For notational convenience, we suppress the terms \(\delta \) and w in the function \(\eta (\cdot ).\)

In general, if we rank the steady-state equilibria in increasing order, all the odd numbered equilibria will be stable while the even numbered equilibria will be unstable.

We get a two-point distribution in steady state. However, that can be changed quite easily by introducing some uncertainty in either the production or human capital accumulation function.

This is essentially due to our assumption of perfect capital mobility. In a closed economy, Inada conditions would ensure that some household agents would always invest in physical capital.

Redistributive tax-transfer policy is an interesting and important question. However, delving into those issues will take us far away from the main focus of our paper.

We should point out that Deaton and Paxson (2001) estimate the relationship between income and mortality while in our model income is basically labor income (or earnings). Households in our model choose to invest only in human capital because its return dominates the return of the financial asset. However, this should not alter the interpretation of our simulation exercise significantly. It is well known that poor households in US have negligible income in the form of capital or business income (see for instance (Diaz-Gimenez et al. 1997)). Therefore, the income–mortality relationship estimated by Deaton and Paxson is in fact picking up the relationship between earnings and mortality for the lower income groups. Non-labor income constitutes a significant proportion of income only for the richest quintile group in US. The gradient of the income–mortality relationship is already quite close to zero when we reach such high levels of income.

First, we set the value of “b” in US equal to 0.38. The male adult probability of survival in Canada was 3.86% higher than the US in 1980. Let \({\overline{y}}_{\rm CAN}\) and \({\overline{y}}_{\rm US}\) denote the per capita GDP of Canada and the US, respectively. We impute the value of “b” for Canada by solving \(\frac{\alpha ({\overline{y}}_{\rm CAN})}{\alpha ({\overline{y}}_{\rm US})} =1.0386\). We also did a similar imputation by comparing the relative life expectancies of Canada and the US.

In our simulations, we found that multiple equilibria disappears once \( b>0.61 \).

Data reported in Table 3 is taken from the US Bureau of Census. All numbers are in 1980 prices.

Incomes reported here are in 1980 prices.

The average income of the top 1% of households was $134,000 which was almost 32 times the average income of the lowest quintile group. To explain this degree of income disparity the value of x has to be around 0.19.

These unusually low values of \(S_{\rm low}\) are a result of the stylized nature of our model and should be treated cautiously.

Since Dagum’s (1994) work is based on a survey carried out in 1983, it goes well with our simulations as we have tried to choose parameter values that fit the US data around 1980.

There is a large literature on Dagum distribution and it has been utilized to estimate income and wealth distributions of many countries including the US. Refer to Kleiber (2008) for an excellent survey of this literature. It can be shown that the statistical distributions such as Pareto, Singh–Maddala are special cases of the Dagum distribution.

If income distribution in top 5% of population is symmetric we should choose \(\xi _{0}\) from the following equation: \([1+\xi _{0}(y-{\underline{y}} )^{-\xi _{1}}]^{-\xi _{2}}=0.975\). As suggested by Piketty and Saez (2003), we are assuming that there is some skewness even in the top 5% of the income distribution. We did experiment with setting the right hand side of the above equation to 0.97 and 0.975 with no perceptible changes to our simulation results.

Our economy consists of a continuum of households of measure one. So aggregate human capital and income in steady state will be \({\overline{H}}= \widetilde{\Phi }_{0}({\widehat{y}})h_{\rm low}+[1-{\widetilde{\Phi }}_{0}(\widehat{y })]h_{\rm high}\) and \({\overline{Y}}=\widetilde{\Phi }_{0}({\widehat{y}})y_{\rm low}+[1- \widetilde{\Phi }_{0}({\widehat{y}})]y_{\rm high}\), respectively.

Refer to row corresponding to \(\tau ^{K}=0.44\) and column corresponding to \( \tau ^{L}=0.44\) in Table 6.

References

Aiyagari, S. R. (1994). Uninsured idiosyncratic risk and aggregate saving. Quarterly Journal of Economics, 109(August), 659–684.

Banerjee, A., & Newmann, A. (1993). Occupational choice in the process of development. Journal of Political Economy, 101(2), 274–298.

Becker, G., Murphy, K., & Tamura, R. (1990). Human capital, fertility and economic growth. Journal of Political Economy, 98(5), S12–37.

Blanchard, O. J. (1985). Debt, deficits and finite horizons. Journal of Political Economy, 93(2), 223–247.

Cagetti, M., & De Nardi, M. (2008). Wealth inequality: data and models. Macroeconomic Dynamics, 12(S2), 285–313.

Card, D., & Krueger, A. (1992). Does school quality matter? Returns to education and the characteristics of public schools in the United States. Journal of Political Economy,100(1), 1–40.

Chakrabarty, D. (2012). “Poverty traps and growth in a model of endogenous time preference”, contributions in macroeconomics. BE Journal of Macroeconomics, 12, 1–33.

Chakrabarty, D., Katayama, H., & Maslen, H. (2008). Why do the rich save more? A theory and Australian evidence. The Economic Record, 84(Special Issue), S32–S44.

Chakraborty, S., & Das, M. (2004). Mortality, human capital and persistent inequality. Journal of Economic Growth, 10(2), 159–192.

Coleman, J. (1966). Equality of educational opportunity. Washington, D.C.: Government Printing Office.

Dagum, C. (1994), “Human capital, income and wealth distribution models with applications”. In Proceedings of the Business and Economic Statistics Section, American Statistical Association, 154th meeting (pp. 253–258).

Das, M. (2003). Optimal growth with decreasing marginal impatience. Journal of Economic Dynamics and Control,27, 1881–1898.

Davies, J., & Whalley, J. (1991). Taxes and capital formation: How important is human capital? In D. Bernheim & J. Shoven (Eds.), National saving & economic performance (pp. 163–197). Chicago: University of Chicago Press.

Deaton, A. (2003). Health, inequality and economic development. Journal of Economic Literature, 41(1), 113–158.

Deaton, A., & Paxson, S. (2001). Mortality, education, income and inequality among american cohorts. In D. Wise (Ed.), Themes in economics of aging (pp. 129–170). Chicago: University of Chicago Press.

Diaz-Gimenez, J., Quadrini, V., & Rios-Rull, J. (1997). Dimensions of inequality: Facts on the U.S. distributions of earnings, income and wealth. Federal Reserve Bank of Minneapolis Quarterly Review, 21(2), 3–21.

Duleep, H. O. (1986). Measuring the effect of income on adult mortality using longitudinal administrative record data. Journal of Human Resources, 21(2), 238–251.

Dynan, K. E., Skinner, J., & Zeldes, S. P. (2004). Do the rich save more? Journal of Political Economy, 112(2), 397–444.

Erosa, A., & Koreshkova, T. (2007). Progressive taxation in a dynastic model of human capital. Journal of Monetary Economics,54, 667–685.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. Review of Economic Studies, 60(1), 35–52.

Heckman, J. J. (1976). A life-cycle model of earnings, learning and consumption. Journal of Political Economy, 84(4), 11–44.

Heckman, J.J., Lochner, L. J. & Todd, P. (2003). Fifty years of mincer earnings regressions. NBER Working Paper Number 9732 downloadable athttps://www.nber.org/papers/w9732.

Heijdra, B. J., & Romp, W. E. (2008). A life-cycle overlapping-generations model of the small open economy. Oxford Economic Papers, 60, 89–122.

Hendricks, L. (2004). Taxation and human capital accumulation. Macroeconomic Dynamics, 8(3), 310–334.

Hirose, K., & Ikeda, S. (2008). On decreasing marginal impatience. The Japanese Economic Review, 59(3), 259–274.

Investment Company Institute and the Securities Industry Association (2002) “Equity Ownership in America,” downloadable at http://www.ici.org/pdf/.

Iwai, K. (1972). Optimal economic growth and stationary ordinal utility—a Fisherian approach. Journal of Economic Theory, 5, 121–151.

Jorgenson, D. W., & Fraumeni, B. M. (1990). Investment in education and US economic growth. In M. Bloomfield, E. C. Walker, & M. Thorning (Eds.), The US savings challenge (pp. 114–141). Boulder: Westview Press.

Jusot, F. (2006). The shape of the relationship between mortality and income in France. Annales d’Economie et de Statistique, 83(84), 89–122.

Kalemli-Ozcan, S. (2002). Does the mortality decline promote economic growth? Journal of Economic Growth, 7(4), 411–439.

Kendrick, J. W. (1976). The formation and stocks of total capital. New York: Columbia University Press.

King, R.G. & Rebelo, S. (1990), “Public Policy and Economic Growth: Developing Neoclassical Implications”, Journal of Political Economy, 98, (5) pt. 2, S126–S150.

Kleiber, C. (2008). A guide to Dagum distributions. In D. Chotikapanich (Ed.), Modelling income distributions and lorenz curves: essays in memory of Camilo Dagum (pp. 97–118). Berlin: Springer.

Krussell, P., & Smith, A. A. (1998). Income and wealth heterogeneity in the macroeconomy. Journal of Political Economy, 106(5), 867–896.

Lawrance, E. C. (1991). Poverty and the rate of time preference: Evidence from the panel data. Journal of Political Economy, 99(1), 54–77.

Levine, L. (2012) The U.S. income distribution and mobility: Trends and international comparisons. Congressional Research Service report for Congress, November 2012.

Lucas, R. E. (1990). Supply-side Economics: An analytical review. Oxford Economic Papers, 42(2), 293–316.

Mendoza, E. G., Razin, A., & Tesar, L. (1994). Effective tax rates in macroeconomics: Cross-country estimates of tax rates on factor incomes and consumption. Journal of Monetary Economics,34(3), 297–323.

Mincer, J. (1993). Studies in human capital. Cambridge: Cambridge University Press.

Pappas, G., Queen, S., Hadden, W., & Fisher, G. (1993). The increasing disparity in mortality between socioeconomic groups in the United States. New England Journal of Medicine, 329(2), 103–109.

Piketty, T., & Saez, E. (2003). Income inequality in the United States 1913–1998. Quarterly Journal of Economics, 118(1), 1–39.

Preston, S. H. (1975). The changing relation between mortality and level of economic development. Population Studies, 29(2), 231–248.

Rebelo, S. (1991). Long-run policy analysis and long-run growth. Journal of Political Economy, 99(3), 500–521.

Smith, J. P. (1999). Healthy bodies and thick wallets: The dual relation between health and economic status. Journal of Economic Perspectives, 13(2), 145–166.

Torrey, B. B., & Haub, C. (2004). A comparison of US and Canadian mortality in 1998. Population and Development Review, 30(3), 519–530.

Trostel, P. A. (1993). The effect of taxation on human capital. Journal of Political Economy, 101(2), 327–350.

U.S. Census Bureau. (2018). Educational Attainment in the United States: 2018. Retrieved from https://www.census.gov/data/tables.html.

Ventura, L. (2003). Direct measures of time preference. The Economic and Social Review, 34(3), 293–310.

Warren, R. J., & Hernandez, E. M. (2007). Did socioeconomic inequalities in morbidity and mortality change in the U.S. over the course of the 20th century? Journal of Health and Social Behavior, 38(4), 335–351.

Wilkins, R., Tjepkema, M., Mustard, C., & Chioniere, R. (2008). The Canadian census mortality follow-up study, 1991 through 2001. Statistics Canada Health Reports, 19(3), 25–43. (Ottawa: Statistics Canada).

Wilson, A. E. (2009). Fundamental causes of health disparities: A comparative analysis of Canada and the United States. International Sociology, 24(1), 93–113.

Wolff, E. N. (1998). Recent trends in the size distribution of household wealth. Journal of Economic Perspectives, 12(3), 131–150.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Debajyoti Chakrabarty declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank Xiaodong Fan, Ben Heijdra, Lutz Hendricks, Fedor Ishakov, Robert Kollmann, Kishor Sharma, and seminar participants at Australian National University for several helpful comments and discussions. I also acknowledge two anonymous referees for their feedback and suggestions. For comments, please write to debajyoti.chakrabarty@cdu.edu.au.

Appendix

Appendix

Proof of Lemma 1

The objective of a household is to choose a consumption sequence \(\{c_{t}\}_{t=0}^{\infty }\) to maximize

where

and \(\rho _{0}=1\). For ease of exposition, let us suppress \(\theta \) while denoting the function \(\phi (\cdot )\). Consider two feasible consumption sequences \( {\mathbb {C}} ^{1}=\left\{ c_{t}^{1}\right\} _{t=0}^{\infty }\) and \( {\mathbb {C}} ^{2}=\left\{ c_{t}^{2}\right\} _{t=0}^{\infty }\) such that \( {\mathbb {C}} ^{1}\ge {\mathbb {C}} ^{2}\) and \( {\mathbb {C}} ^{1}\ne {\mathbb {C}} ^{2}\), i.e., \(c_{t}^{1}\ge c_{t}^{2}\) for all t and \(c_{t}^{1}>c_{t}^{2}\) for some t. Let \(\rho _{t}^{1}\) and \(\rho _{t}^{2}\) denote the discount functions generated by sequences \( {\mathbb {C}} ^{1}\) and \( {\mathbb {C}} ^{2}\) respectively. Since \(\phi (\cdot )\) is increasing in \(c_{t}\), we have \( \rho _{t}^{1}\ge \rho _{t}^{2}\), for all t and \(\rho _{t}^{1}>\rho _{t}^{2}\) for some t. From Assumption 1, it follows that

For quasi-concavity it is sufficient to show that for any \(j\in (0,1)\), \(V(j {\mathbb {C}} ^{1}+(1-j) {\mathbb {C}} ^{2})>V( {\mathbb {C}} ^{2})\). Note that both \(u(\cdot )\) and \(\phi (\cdot )\) are a strictly increasing and concave in \(c_{t}\). Therefore, \(u(jc_{t}^{1}+(1-j)c_{t}^{2}) \ge u(c_{t}^{2})\) and \(\phi (jc_{t}^{1}+(1-j)c_{t}^{2})\ge \phi (c_{t}^{2}) \) with the inequality holding strictly for some t. This implies \(V(j {\mathbb {C}} ^{1}+(1-j) {\mathbb {C}} ^{2})>V( {\mathbb {C}} ^{2})\). \(\square \)

Proof of Lemma 2

Substituting (6) in (7) we can write the Lagrangian for a household agent’s problem as follows:

The first-order condition for optimal choice of \(v_{t}\) is

Simplifying the above expression and assuming \(h_{t}>0\), we get

First-order condition with respect to \(x_{t}\) implies

or

Combining (21) and (22) we get

Since the period utility function of the household is strictly increasing in \(c_{t}\) Eq. (7) will bind at an optimum. Using the budget constraint to substitute for \(x_{t}\), we have

or

Substituting the optimal value of \(\nu _{t}\) in Eq. (23 ) we get

\(\square \)

Derivation of equation (13)

Using (11), we can write

Substituting the equation above and (7) in (1), we get

and after simplifying further we can write

or

where \({\widehat{B}}=B\left( \frac{\gamma }{\gamma +\sigma }\right) ^{\gamma }\left( \frac{\sigma }{\gamma +\sigma }\right) ^{\sigma }\left( \frac{1}{{\widehat{w}}}\right) ^{\gamma }\).

Proof of Proposition 1

Since human capital production function satisfies the Inada conditions, for any level of human capital \(h_{t}\), \(h_{t+1}>0\). To prove this proposition, we will first derive the first-order condition for an interior solution in both \(h_{t+1}\) and \(a_{t+1}\). From this condition, we will implicitly derive a minimum threshold level of human capital \(h_{\max }\) such that if \(h_{t}\le h_{\max }\), \(a_{t+1}=0\).

Consider the Lagrangian for the household’s maximization problem [Eq. ( 20)]. First-order condition for optimum with respect to \(h_{t+1}\) yields

We can use Eq. (21) to express \({\widetilde{\pi }}_{t+1}\) as

Using the equation above to substitute for \({\widetilde{\pi }}_{t+1}\) in Eq. (26) we get

Necessary condition for optimum with respect to \(a_{t+1}\) implies

if \(a_{t+1}\)

\(>0\). Using Eq. (21), we can write

Combining with (27) and (28), we have

Let \([\gamma B(\nu _{t+1}h_{t+1})^{\gamma -1}x_{t+1}^{\sigma }+(1-\delta ^{h})]=R_{t+1}^{h}\). This is the marginal return from investing in human capital. Equation (23) implies \(\nu _{t}h_{t}=\left( \frac{ \gamma }{\sigma {\widehat{w}}}\right) x_{t}\). Substituting in the equation above we get

Equation (30) implies that resource investment in human capital becomes stationary when return from human capital and the risk free are equalized, i.e., if \(R_{t+1}^{h}={\widehat{R}}\Longrightarrow \) \( x_{t+1}=x_{t}=x\) for all t. It follows that \(\nu \) and h will also be stationary, i.e., \(\nu _{t}=\) \(\nu _{t+1}=\nu \) and \(h_{t}=h_{t+1}=h\) for all t.

We will now characterize the minimum level of human capital needed to induce household agents to invest in the financial asset. When \(R_{t+1}^{h}= {\widehat{R}}\) Eq. (30) becomes

While the return from the financial asset is constant, the return from human capital accumulation, \(R^{h}\) is high for low values of h and decreasing in h. To characterize \(h_{\max }\) we will substitute for x and \(\nu \) in (31). Since equation (7) always binds at an optimum, we can write

Using Eq. (11) and (25) we can write Eq. (31) as

where \({\widehat{B}}=\) \(B\left( \frac{\gamma }{\gamma +\sigma } \right) ^{\gamma }\left( \frac{\sigma }{\gamma +\sigma }\right) ^{\sigma }\left( \frac{1}{{\widehat{w}}}\right) ^{\gamma }\).

We have shown that if \(a_{t+1}>0\), \(h_{t+1}=h_{t}=h_{\max }\).

When human capital level becomes stationary equation (13) implies \(( {\widehat{R}}a_{t}+{\widehat{w}}h+\Gamma _{t}-c_{t}-a_{t+1})=\left( \frac{\delta ^{h}h}{{\widehat{B}}}\right) ^{\frac{1}{\gamma +\sigma }}\). Substituting in (33), we have

or,

The left hand side of the above equation is decreasing in h. Define \(h_{\max }=\left( \frac{{\widehat{B}}}{\delta ^{h}}\right) \left( \frac{ {\widehat{R}}+\delta ^{h}-1}{(\gamma +\sigma ){\widehat{B}}{\widehat{w}}}\right) ^{ \frac{\gamma +\sigma }{^{\gamma +\sigma -1}}}\). \(h_{\max }\) has been defined so that the rate of return from the two assets are equalized. Therefore, it follows that if \(h_{t}\le h_{\max }\) \(\Longrightarrow \) \(R^{h}\ge {\widehat{R}}\) \(\Longrightarrow a_{t+1}=0\). We have assumed that \(a_{0}=0\) for all households, so only those households with \(h_{0}>h_{\max }\) will choose to invest in the financial asset.

Derivation of equation (15) and (16):

To complete our analysis of the household’s optimization problem, let us consider the optimal choice of consumption of a household. First-order condition with respect to \(c_{t}\) implies

if \(a_{t+1}>0\). Define \(\pi _{t}=\frac{{\widetilde{\pi }}_{t}}{\rho _{t}}\) and \(\lambda _{t}=\frac{{\widetilde{\lambda }}_{t}}{\rho _{t}}\). The equation above can be written as

The optimality condition with respect to \(\rho _{t+1}\) gives us

Re-arranging we have

Substituting one period forward for \(\mu _{t+1}\) gives us,

If we carry out this substitution repeatedly, we find that \(\mu _{t} \) is the present discounted value of utility from period \(t+1\) onwards, i.e.,

Since \(u(c_{t}) 0\) and \(\rho _{t}>0\), it follows that \(\mu _{t}>0\) . Notice, the Lagrange multiplier \(\mu _{t}={\widehat{V}}_{t}\), the variable we constructed in proving lemma 1. Using equation (10), we can express Eqs. (28) and (29) as

if \(a_{t+1}=0\). If \(h_{t}\le h_{\max }\) the household will only invest in human capital, i.e., \(a_{t+1}=0\). Equation (36) becomes

where \(R_{t+1}^{h}=[(\gamma +\sigma ){\widehat{B}}{\widehat{w}}( {\widehat{w}}h_{t+1}+\Gamma _{t+1}-c_{t+1})^{\gamma +\sigma -1}+(1-\delta ^{h})]\). We can combine Eqs. (36) and (37) and write it more compactly as

with the equality between \(R_{t+1}^{h}\) and \({\widehat{R}}\) holding if \(h_{t}>h_{\max }\). \(\square \)

Proof of Proposition 2

Consider the function \(\Psi (h)=\phi \left[ \eta (h),\theta \right] R^{h}(h)-1\). We want to show that there exists at least one point in the interval \((0,h_{\max })\) where \(\Psi (h)\) intersects the horizontal axis. When \(h=0\), \(\Psi (0)=\phi (0,\theta )R^{h}(0)-1\). The effective discount factor of the household \(\phi [0,\theta ]\) is bounded between 0 and 1. Since the human capital production function satisfies the Inada conditions, it follows that \(\Psi (0)>0\). From the definition of \(h_{\max }\), we know that when \(h=h_{\max }\), \(R^{h}={\widehat{R}}=(1+{\widehat{r}})\). From assumption 3, we have \(\beta (1+r)-1=0\). Therefore, \(\Psi (h_{\max })=\phi \left[ \eta (h_{\max }),\theta \right] (1+{\widehat{r}})<\beta (1+r)-1=0\). We know that sum, product and composition of continuous functions are continuous. The functions \(\eta (h)\), \(R^{h}(h)\) and \(\phi (\cdot )\) are all continuous functions. This would imply that \(\Psi (h)\) is also continuous. Since \(\Psi (h)\) is a continuous function of h there will be a \(h^{1}\in (0,h_{\max })\) such that \(\Psi (h^{1})=0\) and \(\Psi (h)<0\) for some \(h\in (h^{1},h_{\max })\). There must be at least one locally unique steady-state solution. Suppose there are two locally unique steady-state solutions to the household’s maximization problem. It means there are two values of h, say \( 0<h^{1}<\) \(h^{2}<h_{\max }\) such that \(\Psi (h^{1})=\Psi (h^{2})=0\) and \( \Psi (h)>0\) for some \(h\in (h^{2},h_{\max })\). Since \(\Psi (h_{\max })<0\), continuity of \(\Psi (h)\) would ensure the existence of another value of h, say \(h^{3}\in (h^{2},h_{\max })\) such that \(\Psi (h^{3})=0\) and \(\Psi (h)<0\) for some \(h\in (h^{3},h_{\max })\). This argument can be generalized to prove that the number of locally unique steady-state solutions is odd. \(\square \)

Proof of Proposition 3

The inverse of the discount factor, \(\frac{1}{\phi (\eta (h_{0}),\theta )}\), is called the rate of time preference. We need to show that if the return from human capital accumulation at the initial endowment of human capital exceeds the rate of time preference then \( \{h_{t}=h_{0}\}_{t=0}^{\infty }\) and \(\{c_{t}=\eta (h_{0},{\widehat{w}},\delta ^{h})={\widehat{w}}h_{0}-(G^{-1})(\delta ^{h}h_{0})\}_{t=0}^{\infty }\) cannot be an optimum for an agent. Furthermore \(h_{1}>h_{0}\). Suppose

If we reduce consumption for only one period by \(\epsilon \), where \(\epsilon \) is close to zero the resultant loss in utility will be \([u^{\prime }(c_{0})+\mu _{0}\phi _{c}(c_{0},\theta )]\), where \(\mu _{0}=\frac{u(c_{0})}{ 1-\phi (c_{0},\theta )}\). The saved amount can be used to accumulate human capital which will provide higher wage income in the next period. If that increased income were to be consumed the discounted value of its utility will be \(\phi (c_{0},\theta )[{\widehat{w}}G^{\prime }({\widehat{w}} h_{0}-c_{0})+(1-\delta ^{h})][u^{\prime }(c_{0})+\mu _{0}\phi _{c}(c_{0},\theta )]\). Since \(\phi (\eta (h_{0}),\theta )[{\widehat{w}} G^{\prime }({\widehat{w}}h_{0}-\eta (h_{0}))+(1-\delta ^{h})]>1\), from the condition above it follows that the gain in utility will outweigh the loss. Hence \(\{h_{t}=h_{0}\}_{t=0}^{\infty }\) and \(\{c_{t}=\eta (h_{0},w,\delta ^{h})=wh_{0}-(G^{-1})(\delta ^{h}h_{0})\}_{t=0}^{\infty }\) cannot be an optimal sequence for an agent and the agent will want to accumulate human capital, i.e., \(h_{1}>h_{0}\). We can use a similar argument to show that if

then human capital must be strictly decreasing. \(\square \)

Proof of Proposition 4

By definition \(\Psi ({\widehat{h}})=0\). Consider \(\Psi (h)=\phi (\eta (h,\cdot ),\theta )[{\widehat{w}}G^{\prime }({\widehat{w}}h-\eta (h,\cdot ))+(1-\delta ^{h})]-1\). \(\frac{\partial }{\partial \theta }\Psi (h,\cdot )=\phi _{\theta }(\cdot ,\theta )[{\widehat{w}}G^{\prime }({\widehat{w}}h-\eta (h,\cdot ))+(1-\delta ^{h})]>0\). The entire \(\Psi (h)\) curve shifts upward as \(\theta \) increases. The proportion of households converging to \(h_{\rm low}\) will fall as \(\theta \) increases.\(\square \)

Proof of Proposition 5

We will prove this proposition by showing that if either \(\tau ^{K} \) or \(\tau ^{L}\) increases the entire \(\Psi (h)\) will shift downwards. Recall, \({\widehat{w}}=(1-\tau ^{L})w(r,\tau ^{K})\) where \(w(\cdot )\) is a decreasing function of \(\tau ^{K}\). Therefore, \({\widehat{w}}\) decreases if either \(\tau ^{K}\) or \(\tau ^{L}\) increase. It is easy to see that the function \(\Psi (h)=\phi [\eta (h,{\widehat{w}},\delta ^{h}),\theta ]\{ {\widehat{w}}G^{\prime }[(G^{-1})(\delta ^{h}h)]+(1-\delta ^{h})\}-1\) will shift downwards if \({\widehat{w}}\) decreases. In case there are two stable steady-state solutions to a household’s problem a downward shift of \(\Psi (h) \) implies that a higher threshold is needed to induce a household to accumulate high level of human capital in steady state. \(\square \)

Rights and permissions

About this article

Cite this article

Chakrabarty, D. Taxation and human capital accumulation with endogenous mortality. JER 73, 555–596 (2022). https://doi.org/10.1007/s42973-020-00071-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-020-00071-7