Abstract

Auctions are used by local Chinese governments to raise revenue while releasing land for development. Because developers reveal their valuation of parcels through winning, bids for land use rights in subsequent auctions may be influenced by outcomes of earlier government sales. A log linear hedonic regression analysis of more than 900 residential land use rights auctions in Chengdu over eight years reveals that top developers’ winning bids signal other developers who adjust their bids in subsequent auctions. Developers appear to believe that the top companies possess superior knowledge through research, experience, or insider information. The results are higher government revenue and rising land prices, which can lead to lessened competition among housing developers, higher house prices, and affordability problems in neighbourhoods where the top developers buy land.

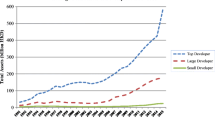

Source: Reproduced with permission from Yang, Y., Zhang, D., Meng, Q., and McCarn, C. Urban Residential Land Use Reconstruction under Dual-Track Mechanism of Market Socialism in China: A Case Study of Chengdu, Sustainability (2015), 7, p. 16853

Similar content being viewed by others

Code availability

Available upon request.

Notes

SOEs are companies in which the government owns a majority of the shares.

Under the English auction process, at least 20 days prior to the date of auction, the local land bureau makes a public announcement with information such as the location of the property up for bid, land use restrictions, floor area ratio (FAR), the intended bidding date, reserve price, and the bidding deposit requirement (often 10 per cent of the reserve price). Interested buyers bid publicly at the specified time and place. At least three qualified bidders are required, and whoever offers the highest bid wins (Wang and Yang 2020). Winners are required to initiate development on the property within a set time period. Bids may be submitted by private companies or SOEs, by an individual company or a consortium as a joint bid. Results must be published within 10 days of sale (Yee 2005).

To determine the length of time during which to measure the shock to auction prices caused by a top developer’s winning bid, we considered the time structure of the residential auction process in Chengdu. Under the English auction process, at least 20 days prior to the auction date, the local land bureau makes a public announcement of the parcel offered for sale. Suppose a signal occurs and results are published the next day. In that case, an effect could be observed in day t + 1 if another property in the area had been advertised for sale 20 days earlier, and participants in the auction could react quickly. However, if the results are not published until the deadline, 10 days after the auction, and the property is announced for auction in that area, 30 days will elapse from the signal to the subsequent auction date. If the time window is limited to 30–45 days, only properties already in the auction process or immediately advertised could be affected by the signal. At the other extreme, many leases require developers to begin work on acquired land within six months. Therefore, a time window that extends to five to six months after a signal auction may capture spillover effects from physical changes to the parcel and surrounding infrastructure rather than the immediate price shock from the winning bid. We chose to use the midpoint (90 days) between the auction date and the date development must commence under most residential leases in this market. In determining the area’s size to study as the competitive geographic market within which auction prices might have a direct and immediate influence, we considered political boundaries, the size of the parcels being auctioned, and the work of previous researchers in other markets.

Some of the companies listed in the Top 100 are parent companies of local developers. In those cases, the ranking considers the total size of real estate investment in Chengdu by the parent company.

To verify the Top 100 list as an objective measure of a developer’s influence, we surveyed 30 local developers to ask who the established developers in Chengdu are. They identified 58 developers. Almost all (88 per cent) of the observations are classified the same for the variable SIGNAL using either of the two approaches.

Because White’s test indicates that our model suffers from heteroscedasticity, we use heteroscedasticity-consistent standard errors.

Regression results based on the developers identified in the survey are similar to those obtained using the Sichuan Real Estate Yearbook’s objective classification. In addition, regression results are similar if SIGNAL is based on the Top 50 rather than the Top 100 developers.

References

Baidu Electronic Map (2019). https://map.baidu.com. Retrieved from 1 Nov 2019.

Agarwal, S., Li, J., Teo, E., & Cheong, A. (2018). Strategic sequential bidding for government land auction sales—Evidence from Singapore. Journal of Real Estate Finance and Economics, 57, 535–565.

Bao, H. X. H., Glascock, J. L., Zhou, S. Z., & Feng, L. (2014). Land value determination in an emerging market: Empirical evidence from China. International Journal of Managerial Finance, 10(2), 180–199.

Cai, H. B., Henderson, J. V., & Zhang, Q. H. (2013). China’s land market auctions: Evidence of corruption? Rand Journal of Economics, 44(3), 488–521.

Chau, K. W., Wong, S. K., Yiu, C. Y., Tse, M. K. S., & Pretorius, F. I. H. (2010). Do unexpected land auction outcomes bring new information to the real estate market? Journal of Real Estate Finance and Economics, 40(4), 480–496.

Chengdu Statistical Bureau. (2016). Chengdu statistical yearbook 2016. Beijing: China Statistical Publishing House.

China Real Estate Association. (2016). China real estate statistics yearbook. Beijing: Enterprise Management Publishing House.

Ching, S., & Fu, Y. (2003). Contestability of the urban land market: An event study of Hong Kong land auctions. Regional Science and Urban Economics, 33(6), 695–720.

Christensen, P. (2019). Suburbs or skyscrapers? The effect of China’s leasing market on housing decentralization. Land Economics, 95(4), 557–576.

Clark, W. A. V., Huang, Y., & Yi, D. (2019). Can millennials access homeownership in urban China? Journal of Housing and the Built Environment. https://doi.org/10.1007/s10901-019-09672-0.

Colwell, P. F., & Munneke, H. J. (1997). The structure of urban land prices. Journal of Urban Economics, 41(3), 321–336.

Cooper, A., & Cowling, A. (2015). China’s property sector. Reserve Bank of Australia Bulletin, 45–54.

Deng, C., Ma, Y., & Chiang, Y.-M. (2009). The dynamic behavior of Chinese housing prices. International Real Estate Review, 12(2), 121–134.

Dong, Z., & Sing, T. F. (2014). Developer heterogeneity and competitive land bidding. Journal of Real Estate Finance and Economics, 48(3), 441–466.

Du, H., Ma, Y., & An, Y. (2011). The impact of land policy on the relation between housing and land prices: Evidence from China. The Quarterly Review of Economics and Finance, 51(1), 19–27.

Gao, L. (2010). Achievements and challenges: 30 years of housing reforms in the People’s Republic of China. ADB Economics Working Paper Series, No. 198. Manila, Philippines: Asian Development Bank. https://www.adb.org/sites/default/files/publication/28408/economics-wp198.pdf. Retrieved from 27 Sept 2019.

Goeree, J. K. (2003). Bidding for the future: Signaling in auctions with an aftermarket. Journal of Economic Theory, 108(2), 345–364.

Liu, X., & Qu, W. (2015). Winner’s curse or signaling? Bidding outcomes in the Chinese land market. International Real Estate Review, 18(1), 113–129.

Mailath, G. J. (1988). An abstract two-period game with simultaneous signaling—existence of separating equilibria. Journal of Economic Theory, 46(2), 373–394.

Milgrom, P. R., & Weber, R. J. (1982). A theory of auctions and competitive bidding. Econometrica, 50(5), 1089–1122.

Mills, E. S. (1971). The value of urban land. In H. S. Perloff (Ed.), The quality of the urban environment (pp. 231–253). Baltimore: John Hopkins University Press.

Ooi, J. T. L., & Sirmans, C. F. (2004). The wealth effects of land acquisition. Journal of Real Estate Finance and Economics, 29(3), 277–294.

Ooi, J. T. L., Sirmans, C. F., & Turnbull, G. K. (2006). Price formation under small numbers competition: Evidence from land auctions in Singapore. Real Estate Economics, 34(1), 51–76.

Qu, W., & Liu, X. (2012). Assessing the performance of Chinese land lease auctions: evidence from Beijing. Journal of Real Estate Research, 34(3), 291–310.

Shen, J., Pretorius, F., & Li, X. (2019). Does joint bidding reduce competition? Evidence from Hong Kong land auctions. Journal of Real Estate Finance and Economics, 58(1), 111–132.

Sichuan Real Estate Society. (2016). Sichuan real estate yearbook 2016. Chengdu: Sichuan Real Estate Society.

Spence, M. (1973). Job market signalling. Quarterly Journal of Economics, 87(3), 355–374.

TianYanCha.com (2019). https://www.tianyancha.com. Retrieved from 10 Oct 2019.

Tse, M. K. S., Pretorius, F., & Chau, K. W. (2011). Market sentiments, winner’s curse and bidding outcome in land auctions. Journal of Real Estate Finance and Economics, 42(2), 247–274.

Wang, L., & Yang, Y. (2020). Political connections in the land market: Evidence from China’s state-owned enterprises. Real Estate Economics, 1–29. Wileyonlinelibrary.com/journal/reec. DOI: https://doi.org/10.1111/1540-6229.12329. Retrieved from July 13, 2020.

Wang, W., Wu, Y., & Sloan, M. (2018a). A framework and dynamic model for reform of residential land supply policy in urban China. Habitat International, 82, 28–37.

Wang, Y., & Hui, E. C. (2017). Are local governments maximizing land revenue? Evidence from China. China Economic Review, 43, 196–215.

Wang, Y., Yu, Y., & Su, Y. (2018b). Does the tender, auction and listing system in land promote higher housing prices in China? Housing Studies, 33(4), 613–634.

Wu, J., Gyourko, J., & Deng, Y. (2012). Evaluating conditions in major Chinese housing markets. Regional Science and Urban Economics, 42(3), 531–543.

Wu, W., & Dong, G. (2014). Valuing the “green” amenities in a spatial context. Journal of Regional Science, 54(4), 569–585.

Wu, Y., Luo, J., Zhang, X., & Skitmore, M. (2016). Urban growth dilemmas and solutions in China: Looking forward to 2030. Habitat International, 56, 42–51.

Yang, Y., Zhang, D., Meng, Q., & McCarn, C. (2015). Urban residential land use reconstruction under dual-track mechanism of market socialism in China: A case study of Chengdu. Sustainability, 7(12), 16849–16865.

Yee, T. O. (2005). A bid for a new future: What are the effects and challenges of the new national public bidding regulations on land use rights assignments in China? Washington University Global Studies Law Review, 4(2), 447–462.

Zhang, D., Liu, Z., Fan, G.-Z., & Horsewood, N. (2016). Price bubbles and policy interventions in the Chinese housing market. Journal of Housing and the Built Environment, 32(1), 133–155.

Funding

None.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Availability of data and material

Available upon request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhou, X., Zahirovic-Herbert, V. & Gibler, K.M. Price impacts of signalling in Chinese residential land auctions. J Hous and the Built Environ 36, 1299–1321 (2021). https://doi.org/10.1007/s10901-020-09806-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-020-09806-9