Abstract

Micro health insurance is an important channel for financing health expenditure for low-income people, yet the supply of such programmes lags behind demand because many of them become unsustainable. Using individual-level dynamic data from a micro health insurance programme in Pakistan, this study tests for the existence of information asymmetry (adverse selection and moral hazard) using a series of non-parametric tests so that insurers and policymakers can better understand the underlying reasons that lead to dynamic claim patterns before taking appropriate actions to improve the sustainability of these programmes. The study’s contribution lies in constructing an appropriate method and novel test statistics to detect information asymmetry using dynamic claim data in a multivariate recurrent event model framework. The results show that adverse selection exists widely for a variety of disease types and that moral hazard is only significant for chronic diseases. Furthermore, pregnancy-related claims demonstrate an increasing trend of adverse selection that needs to be addressed with priority. The analysis provides insight into the sustainable provision of micro health insurance to low-income people in developing regions.

Similar content being viewed by others

Notes

This alternative reduces the combined ratio and significantly improves sustainability. According to a survey conducted by the Microinsurance Center at Milliman in 2014, the combined ratio of sliced health products in Africa is 46%, approximately half of the ratio of comprehensive health products (91%).

The affordability of low-income people is very limited; thus, many microinsurance programmes are unable to raise their premiums while maintaining a reasonable renewal rate.

Pregnancy typically lasts 40 weeks; thus, it is very unlikely that a woman would deliver twice within a year.

The design of test statistic AS3 (or MH2) is equivalent to taking the first year’s claim (or enrollment decision) as the control group and measuring whether there is any significant change in the coefficient for the second year. This helps us detect whether the insured would eventually display a behavioural tendency toward adverse selection (or moral hazard) even if information asymmetry was not found in the first year.

It also offered outpatient vouchers for each insured individual, but the vouchers could be transferred to others and the usage was not recorded for analysis; thus, we focus on inpatient healthcare in this paper.

A complete list of all the diagnoses in the sample and their categories is provided in Appendix Table 12.

There are 20 claims records with an unspecified diagnosis and, in total, there are nine households that filed claims without a specified diagnosis, so we drop those household observations.

If a family filed a chronic disease claim in two consecutive periods as well as an acute disease claim in two consecutive periods, we count the family under both claim types. By doing so, we attempt to give an overview of the temporal connection between the claim behaviour in two consecutive periods.

Inferring from the enrollment data, most of the female-headed households are headed by widows, and the average age of these female heads is slightly higher than the spouse of male-headed households. However, we do not find a significant difference in the claim probability.

Control of the price-related factors, \(X\), is key to guaranteeing the validity of tests \(H_{0}^{AS}\) and \(H_{0}^{MH}\). In the specific case of the AKAM programme, we benefit from the simple contract design. The programme charges a flat rate, \(P\), for every individual (and the coverage is the same for every insured individual too), and it requires the entire household to enroll as a unit. Thus, the price faced by the decision maker (household head) is \(nP\), with \(n\) being the number of family members. This implies that the only variable as a pricing factor is family size, which we include as a control variable in our analysis.

Rejection of \(H_{0}^{1}\) using the test statistics (6) cannot exclude \(w_{R,s} < 0\) for some time pairs, which does not have clear theoretical or policy implications unless there is further development of the risk theory.

Specifically, we take the binary renewal decision for the next policy year as the dependent variable to measure the insured's coverage choice. We take the claims (more precisely, the expenditure reimbursed for every claim) that occurred within the current policy year as the explanatory variable. Given that the claim within the current period took place before making the renewal decision for the next period, there should not be any backward mechanism to generate reverse causality. In the AKAM programme, the insurer does not apply experience rating when the households renew their policies; thus, the renewal decision at the end of the enrolment period should not impact the households’ claims during the enrollment period.

Following Su and Spindler (2013), we formulate the existence of moral hazard at the distribution level in our test statistics. That is, we measure the existence and change in the degree of moral hazard within the entire population, in an average sense. For a single insured individual, the overuse of insurance in the second year may be completely induced by more illness. At the same time, this should not be the case for all insured individuals in a large population if we assume that the population's collective risk type is stable over a short period. We believe that this is a reasonable assumption, given that the sampling period is relatively short (2 years) and no major catastrophic health shock was reported in the target population during the sampling period.

See “Model estimation and test statistics design” section for details on construction of the test statistics.

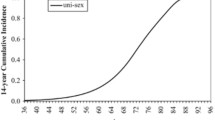

We regard a woman entering the programme being aware of her pregnancy as a form of adverse selection in a broad sense. Specifically, there is a benchmark (comparison group), as shown in Pakistan's national crude birth rate. The birth rate in the AKAM programme is almost double the national average, demonstrating the existence of adverse selection (Yao et al. 2017). The adverse selection in pregnancy-related claims was so severe that it led to a typical ‘death spiral’ in that the programme ceased operations in 2010. Yao et al. (2019) propose a risk-adjusted subsidy provided by the local government to reimburse the micro insurer for the maternity service it provides as a means to boost its sustainable operation.

For example, two claims that both cost PKR 2000, one for normal delivery (pregnancy-related claim) and the other for asthma (chronic disease), have different implications for the future claim amount.

Although the risk type measure is still constructed based on the claim amount, it provides extra information to the model, because the claim amount, \(C_{s,i}\), only measures the absolute severity level of a given claim, which does not reveal how severe a given claim is relative to the other claims. In contrast, the severity score, \(V_{s,i}\), encodes relative severity information for different illness types.

References

Abbring, J.H., P.A. Chiappori, and J. Pinquet. 2003a. Moral hazard and dynamic insurance data. Journal of the European Economic Association 1 (4): 767–820.

Abbring, J.H., J.J. Heckman, P.A. Chiappori, and J. Pinquet. 2003b. Adverse selection and moral hazard in insurance: Can dynamic data help to distinguish? Journal of the European Economic Association 1 (2–3): 512–521.

Abbring, J.H., P.A. Chiappori, and T. Zavadil. 2008. Better safe than sorry? Ex-ante and ex-post moral hazard in dynamic insurance data. SSRN working paper.

Akerlof, G. 1970. The market for “lemons”: Quality uncertainty and the market mechanism. Quarterly Journal of Economics 84 (3): 488–500.

Bajari, P., C. Dalton, H. Hong, and A. Khwaja. 2014. Moral hazard, adverse selection, and health expenditures: A semiparametric analysis. The RAND Journal of Economics 45 (4): 747–763.

Banerjee, A., E. Duflo, and R. Hornbeck. 2014. Bundling health insurance and microfinance in India: There cannot be adverse selection if there is no demand. American Economic Review: Papers & Proceedings 104 (5): 291–297.

Bauchet, J., C. Marshall, L. Starita, J. Thomas, and A. Yalouris. 2011. Latest findings from randomized evaluations of microfinance. Reports by CGAP and its partners. No. 2.

Bauchet, J., and A. Damon. 2019. Asymmetric information in microinsurance markets: Experimental evidence from Mexico. Economic Development and Cultural Change 68 (1): 165–188.

Biener, C., and M. Eling. 2011. The performance of microinsurance programs: A data envelopment analysis. Journal of Risk and Insurance 78 (1): 83–115.

Biener, C., M. Eling, and S. Pradhan. 2016. Can group incentives alleviate moral hazard? The role of pro-social preferences. New York: Social Science Electronic Publishing.

Brau, J., C. Merrill, and K. Staking. 2011. Insurance theory and challenges facing the development of microinsurance markets. Journal of Developmental Entrepreneurship 16 (4): 411–440.

Browne, M. 1992. Evidence of adverse selection in the individual health insurance market. Journal of Risk and Insurance 59 (1): 13–33.

Browne, M. 2006. Adverse selection in the long-term care insurance market. In Competitive failures in insurance markets: Theory and evidence, CESifo seminar series, ed. P.-A. Chiappori and C. Gollier, 97–112. Cambridge: MIT Press.

Chen, X. 2007. Large sample sieve estimation of semi-nonparametric models. In Handbook of econometrics, 5549–5632.

Chiappori, P.A., and B. Salanié. 2013. Asymmetric information in insurance markets: predictions and tests. In The handbook of insurance, ed. G. Dionne, 397–422. New York: Springer.

Clement, O. 2009. Asymmetry information problem of moral hazard and adverse selection in a national health insurance: The case of Ghana national health insurance. Management Science and Engineering 3 (3): 101–106.

Cohen, A., and P. Siegelman. 2010. Testing for adverse selection in insurance markets. Journal of Risk and Insurance 77 (1): 39–84.

Cook, R.J., and J.F. Lawless. 2007. The statistical analysis of recurrent event. New York: Springer.

Dardanoni, V., and P. Li-Donni. 2012. Incentive and selection effects of Medigap insurance on inpatient care. Journal of Health Economics 31 (3): 457–470.

Dionne, G., C. Gourieroux, and C. Vanasse. 2001. Testing for evidence of adverse selection in the automobile insurance market: A comment. Journal of Political Economy 109 (2): 444–453.

Dionne, G., C. Gourieroux, and C. Vanasse. 2006. Informational content of household decisions with applications to insurance under asymmetric information. In Competitive failures in insurance markets: Theory and policy implications, ed. P.A. Chiappori and C. Gollier, 159–184. Cambridge: MIT Press.

Dionne, G., P. St-Amour, and D. Vencatachellum. 2009. Asymmetric information and adverse selection in Mauritian slave auctions. Review of Economic Studies 76: 1269–1295.

Dionne, G., P.C. Michaud, and M. Dahchour. 2013. Separating moral hazard from adverse selection and learning in automobile insurance: Longitudinal evidence from France. Journal of the European Economic Association 11 (4): 897–917.

Dionne, G., and Y. Liu. 2019. Effects of insurance incentives on road safety: Evidence from a natural experiment in China. Scandinavian Journal of Economics. https://doi.org/10.1111/sjoe.12402.

Dror, D., E. Soriano, M. Lorenzo, J. Sarol, R. Azcuna, and R. Koren. 2005. Field based evidence of enhanced healthcare utilization among persons insured by micro health insurance units in Philippines. Health Policy 73 (3): 263–271.

Dror, D., R. Radermacher, and R. Koren. 2007. Willingness to pay for health insurance among rural and poor persons: Field evidence from seven micro health insurance units in India. Health Policy 82 (1): 12–27.

Dror, D., R. Radermacher, S.B. Khadilkar, P. Schout, F. Hay, A. Singh, and R. Koren. 2009. Microinsurance: Innovations in low-cost health insurance. Health Affairs 28 (6): 1788–1798.

Dror, M.D., and L.A. Firth. 2014. The demand for micro health insurance in the informal sector. The Geneva Papers on Risk and Insurance—Issues and Practice 39: 693–711.

Einav, L., and A. Finkelstein. 2011. Selection in insurance markets: Theory and empirics in pictures. Journal of Economics Perspectives 25 (1): 115–138.

Fang, H., M.P. Keane, and D. Silverman. 2008. Sources of advantageous selection: Evidence from the Medigap Insurance Market. Journal of Political Economics 116 (2): 303–349.

Finkelstein, A., and K. McGarry. 2006. Multiple dimensions of private information: Evidence from the long-term care insurance market. American Economic Review 96 (4): 938–958.

Finkelstein, A., K. McGarry, and A. Sufi. 2005. Dynamic inefficiencies in insurance markets: Evidence from long-term care insurance. American Economic Review 95 (2): 224–228.

Frimpong, J.A., S. Helleringer, J.K. Awoonor-Williams, T. Aguilar, J.F. Phillips, and F. Yeji. 2014. The complex association of health insurance and maternal health services in the context of a premium exemption for pregnant women: A case study in northern Ghana. Health Policy and Planning 29 (8): 1043–1053.

Hendel, I., and A. Lizzeri. 2003. The role of commitment in dynamic contracts: Evidence from life insurance. The Quarterly Journal of Economics 118 (1): 299–328.

Ito, S., and H. Kono. 2010. Why is the take-up of microinsurance so low? Evidence from a health insurance scheme in India. The Developing Economies 48 (1): 74–101.

Jang, J., and A. Dassios. 2013. A bivariate shot noise self-exciting process for insurance. Insurance: Mathematics and Economics 53 (3): 524–532.

Jedidi, H., and G. Dionne. 2019. Nonparametric testing for information asymmetry in the mortgage servicing market. Working Paper 19–01, Canada Research Chair in Risk Management, HEC Montréal. SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3351417.

Jutting, J. 2004. Do community-based health insurance schemes improve poor people’s access to health care? Evidence from rural Senegal. World Development 32 (2): 273–288.

Karlan, D., and J. Zinman. 2009. Observing unobservables: Identifying information asymmetries with a consumer credit field experiment. Econometrica 77 (6): 1993–2008.

Keane, M., and O. Stavrunova. 2016. Adverse selection, moral hazard and the demand for Medigap insurance. Journal of Econometrics 190 (9): 62–78.

Keeler, E.B., and J.E. Rolph. 1988. The demand for episodes of treatment in the health insurance experiment. Journal of Health Economics 7 (4): 337–357.

Koç, Ç. 2011. Disease-specific moral hazard and optimal health insurance design for physician services. Journal of Risk and Insurance 78 (2): 413–446.

Koopman, S.J., A. Lucas, and A. Monteiro. 2008. The multi-state latent factor intensity model for credit rating transitions. Journal of Econometrics 142 (1): 399–424.

Lammers, J., and S. Warmerdam. 2010. Adverse selection in voluntary micro health insurance in Nigeria. AIIA Research Series 10–06.

Levine, D., R. Polimeni, and I. Ramage. 2016. Insuring health or insuring wealth? An experimental evaluation of health insurance in rural Cambodia. Journal of Development Economics 119: 1–15.

Liu, R., and L. Yang. 2010. Spline-backfitted kernel smoothing of additive coefficient model. Econometric Theory 26 (1): 29–59.

Lopez, A.D., C.D. Mathers, M. Ezzati, D.T. Jamison, and C.J. Murray. 2006. Global burden of disease and risk factors. Washington: The World Bank.

Ma, S., and P. Song. 2015. Varying index coefficient models. Journal of the American Statistical Association 110 (509): 341–356.

Manning, W.G., J.P. Newhouse, N. Duan, E.B. Keeler, and A. Leibowitz. 1987. Health insurance and the demand for medical care: Evidence from a randomized experiment. American Economic Review 77 (3): 251–277.

Mukherjee, P., A. Oza, L. Chassin, and R. Ruchismita, Microinsurance Center at Milliman. 2014. The landscape of microinsurance in Asia and Oceania 2013. Munich Re Foundation and GIZ-RFPI. http://www.microinsurancecentre.org/resources/documents/market-development/landscape-of-microinsurance-in-asia-and-oceania.html.

Munkin, M., and P.K. Trivedi. 2008. Bayesian analysis of the ordered probit model with endogenous selection. Journal of Econometrics 143 (2): 334–348.

Nyman, J.A., C. Koc, B.E. Dowd, E. McCreed, and H.M. Trenz. 2018. Decomposition of moral hazard. Journal of Health Economics 57 (11): 168–178.

Pauly, M.V. 1974. Overinsurance and public provision of insurance: The role of moral hazard and adverse selection. Quarterly Journal of Economics 88 (1): 44–62.

Radermacher, R., S. Srivastava, M. Walsham, C. Sao, and F. Paolucci. 2016. Enhancing the inclusion of vulnerable and high-risk groups in demand-side health financing schemes in Cambodia: A concept for a risk-adjusted subsidy approach. The Geneva Papers on Risk and Insurance—Issues and Practice 41 (2): 244–258.

Rothschild, M., and J. Stiglitz. 1976. Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. Quarterly Journal of Economics 90 (4): 629–649.

Rowell, D., S. Nghiem, and L.B. Connelly. 2017. Two tests for ex ante moral hazard in a market for automobile insurance. Journal of Risk and Insurance 84 (4): 1103–1126.

Savage, E., and D.J. Wright. 2003. Moral hazard and adverse selection in Australian private hospitals: 1989–1990. Journal of Health Economics 22 (11): 331–359.

Su, L., and M. Spindler. 2013. Nonparametric testing for asymmetric information. Journal of Business & Economic Statistics 31 (2): 208–225.

Swishchuk, A. 2018. Risk model based on compound hawkes process. Wilmott 2018 (94): 50–57.

Wang, H., L. Zhang, W. Yip, and W. Hsiao. 2006. Adverse selection in a voluntary rural mutual health care health insurance scheme in China. Social Science & Medicine 63 (5): 1236–1245.

Yao, Y. 2013. Development and sustainability of emerging health insurance markets: Evidence from microinsurance in Pakistan. The Geneva Papers on Risk and Insurance—Issues and Practice 38 (1): 160–180.

Yao, Y., J.T. Schmit, and J.R. Sydnor. 2017. The role of pregnancy in micro health insurance: Evidence of adverse selection from Pakistan. Journal of Risk and Insurance 84 (4): 1073–1102.

Yao, Y., J.T. Schmit, and J. Shi. 2019. Promoting sustainability for micro health insurance: A risk-adjusted subsidy approach for maternal healthcare service. The Geneva Papers on Risk and Insurance—Issues and Practice 44 (3): 382–409.

Zhang, L., and H. Wang. 2008. Dynamic process of adverse selection: evidence from a subsidized community-based health insurance in rural China. Social Science & Medicine 67 (7): 1173–1182.

Zhao, H. 2012. A dynamic contagion process for modelling contagion risk in finance and insurance. Ph.D. thesis, The London School of Economics and Political Science.

Zryumov, P. 2015. Dynamic adverse selection: Time-varying market conditions and endogenous entry. SSRN Working Paper No. 2653129.

Funding

This research is supported by the National Key R&D Program of China (Grant No. 2018YFA0703900) and the Research Seed Fund of the School of Economics in Peking University. We are grateful to Michael McCord, Peter Wrede and Rui Wang for their generous help and valuable suggestions. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Hypothesis test for the difference in test statistics under homogeneous and heterogeneous claim assumptions

The test statistics designed to test the difference between \(\tilde{w}_{R,s} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} - 12} \right) - \tilde{w}_{R,C} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} - 12} \right)\) and \(\tilde{w}_{s,R} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} } \right) - \tilde{w}_{C,R} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} } \right)\) for various claim types is almost identical to test (10). The formal expression is as follows:

Test statistics (12) and (13) follow the \(\chi^{2}\) distribution with degrees of freedom, M, under the null hypothesis, which hypothesises that no difference exists for the estimated coefficient function under the heterogeneous claim assumption versus the homogeneous claim assumption.

(12) is based on the difference \(\tilde{w}_{s,R} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} } \right) - \tilde{w}_{C,R} \left( {t_{1}^{*} ,t_{1}^{*} + t_{0} } \right)\) between the coefficients measuring the impact of renewal on later claims under the heterogeneous and homogeneous claim assumptions. (13) is based on the difference \(\tilde{w}_{R,s} \left( {t_{1}^{*} ,t_{1}^{*} + t_{{0,{\text{j}}}} - 12} \right) - \tilde{w}_{R,C} \left( {t_{1}^{*} ,t_{1}^{*} + t_{{0,{\text{j}}}} - 12} \right)\) measuring the impact of previous claims on renewal decisions under the heterogeneous and homogeneous claim assumptions. The test results are reported in Table 10.

We find significant differences in (12) and (13) for all claim types. These results verify the significant difference between homogeneous and heterogeneous claim assumptions, which validates the necessity of performing type-specific tests on adverse selection and moral hazard (Tables 11, 12).

Rights and permissions

About this article

Cite this article

Zhang, X., Chen, Y. & Yao, Y. Dynamic information asymmetry in micro health insurance: implications for sustainability. Geneva Pap Risk Insur Issues Pract 46, 468–507 (2021). https://doi.org/10.1057/s41288-020-00200-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-020-00200-8