Abstract

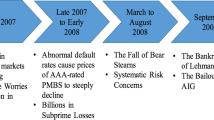

We investigate the effect of bank transparency on systematic and idiosyncratic risk in the stock market. Using the extent of individual banks’ timely recognition of expected loan losses and the amount of discretionary loan loss provisions as proxies for bank transparency, we find that more transparent banks are associated with lower idiosyncratic, and total, stock market risk. We also find that banks that use more discretionary loan loss provisions are associated with a lower ratio of systematic to idiosyncratic risk. In addition, the effect of bank transparency on stock market risk is mainly observed during the financial crisis period. Our results are robust to alternative transparency measures, the possibility of a non-linear relationship, and application of a dimensionality reduction procedure, and offer empirical evidence that providing more bank-specific information about loan portfolio risk mitigates uncertainty about a bank’s future events.

Similar content being viewed by others

Notes

Available at http://www.nber.org/cycles/cyclesmain.html.

For example, Kanagaretnam et al. (2010) argue that negative discretionary LLP reflect a greater incentive to increase reported earnings under the earnings management hypothesis.

References

Acharya VV, Ryan SG (2016) Banks’ financial reporting and financial system stability. J Account Res 54:277–340

Ahmed AS, Takeda C, Thomas S (1999) Bank loan loss provisions: a reexamination of capital management, earnings management and signaling effects. J Account Econ 28:1–25

Balasubramanyan L, Thomson JB, Zaman S (2017) Evidence of forward-looking loan loss provisioning with credit market information. J Financ Serv Res 52:191–223

Baumann U, Nier E (2004) Disclosure, volatility, and transparency: an empirical investigation into the value of bank disclosure. Federal Reserve Bank of New York Economic Policy Review 10:31–45

Beatty A, Liao S (2011) Do delays in expected loss recognition affect banks’ willingness to lend? J Account Econ 52:1–20

Beatty A, Liao S (2014) Financial accounting in the banking industry: a review of the empirical literature. J Account Econ 58:339–383

Belloni A, Chernozukov V, Hansen C (2014a) High-dimensional methods and inference on structural and treatment effects. J Econ Perspect 28:29–50

Belloni A, Chernozukov V, Hansen C (2014b) Inference on treatment effects after selection among high-dimensional controls. Rev Econ Stud 81:608–650

Bliss RR, Flannery MJ (2002) Market discipline in the governance of U.S. bank holding companies: monitoring vs. influencing. Rev Financ 6:361–396

Bushman RM, Hendricks BE, Williams CD (2016) Bank competition: measurement, decision-making, and risk-taking. J Account Res 54:777–826

Bushman RM, Williams CD (2012) Accounting discretion, loan loss provisioning, and discipline of banks’ risk-taking. J Account Econ 54:1–18

Bushman RM, Williams CD (2015) Delayed expected loss recognition and the risk profile of banks. J Account Res 53:511–553

Cohen LJ, Cornett MM, Marcus AJ, Tehranian H (2014) Bank earnings management and tail risk during the financial crisis. J Money Credit Bank 46:171–197

Dasgupta S, Gan J, Gao N (2010) Transparency, price informativeness, and stock return synchronicity: theory and evidence. J Financ Quant Anal 45:1189–1220

Dechow P, Ge WL, Schrand C (2010) Understanding earnings quality: a review of the proxies, their determinants and their consequences. J Account Econ 50:344–401

Flannery MJ (2001) The faces of “market discipline”. J Financ Serv Res 20:107–119

Flannery MJ, Kwan SH, Nimalendran M (2013) The 2007–2009 financial crisis and bank opaqueness. J Financ Intermed 22:55–84

Fonseca AR, Gonzalez F (2008) Cross-country determinants of bank income smoothing by managing loan-loss provisions. J Bank Financ 32:217–228

Gambera M (2000) Simple forecasts of bank loan quality in the business cycle. Emerging Issues Series, Federal Reserve Bank of Chicago

Hirtle B (2016) Public disclosure and risk-adjusted performance at bank holding companies. Fed Reserve Bank New York Econ Policy Rev 22:151–173

Hutton AP, Marcus AJ, Tehranian H (2009) Opaque financial reports, R2, and crash risk. J Financ Econ 94:67–86

Jiang L, Levine R, Lin C (2016) Competition and bank opacity. Rev Financ Stud 29:1911–1942

Jin L, Myers SC (2006) R2 around the world: new theory and new tests. J Financ Econ 79:257–292

Jordan JS, Peek J, Rosengren ES (2000) The market reaction to the disclosure of supervisory actions: implications for bank transparency. J Financ Intermed 9:298–319

Kanagaretnam K, Krishnan GV, Lobo GJ (2010) An empirical analysis of auditor independence in the banking industry. Account Rev 85:2011–2046

Kane EJ, Unal H (1988) Change in market assessments of deposit-institution riskiness. J Financ Serv Res 1:207–229

Kapinos P, Mitnik OA (2016) A top-down approach to stress-testing banks. J Financ Serv Res 49:229–264

Kelly PJ (2014) Information efficiency and firm-specific return variation. Q J Financ 4:1450018

Laeven L, Majnoni G (2003) Loan loss provisioning and economic slowdowns: too much, too late? J Financ Intermed 12:178–197

Lee DW, Liu MH (2011) Does more information in stock price lead to greater or smaller idiosyncratic return volatility? J Bank Financ 35:1563–1580

Lown C, Morgan DP (2006) The credit cycle and the business cycle: new findings using the loan officer opinion survey. J Money, Credit, Bank 38:1575–1597

Mergaerts F, Vander Vennet R (2016) Business models and bank performance: a long-term perspective. J Financ Stab 22:57–75

Morck R, Yeung B, Yu W (2000) The information content of stock markets: why do emerging markets have synchronous stock price movements? J Financ Econ 58:215–260

Morgan DP (2002) Rating banks: risk and uncertainty in an opaque industry. Am Econ Rev 92:874–888

Nichols DC, Wahlen JM, Wieland MM (2009) Publicly traded versus privately held: implication for conditional conservatism in bank accounting. Rev Acc Stud 14:88–122

Nier E, Baumann U (2006) Market discipline, disclosure and moral hazard in banking. J Financ Intermed 15:332–361

Semaan E, Drake PP (2016) TARP and the long-term perception of risk. J Bank Financ 68:216–235

Stiroh KJ (2004) Diversification in banking: is noninterest income the answer? J Money, Credit, Bank 36:853–882

Stiroh KJ (2006) New evidence on the determinants of bank risk. J Financ Serv Res 30:237–263

Tibshirani R (1996) Regression shrinkage and selection via the Lasso. J R Stat Soc Ser B 58:267–288

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kim, J., Kim, M. & Kim, Y. Bank Transparency and the Market’s Perception of Bank Risk. J Financ Serv Res 58, 115–142 (2020). https://doi.org/10.1007/s10693-019-00323-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-019-00323-7