Abstract

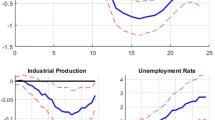

We assess the relationship between oil prices and wages in 15 top oil producing counties in the USA using data between 2001 and 2018. The analysis is conducted at the sectoral level where wages in seven industries are assessed in both the long- and short-run using a panel ARDL model. Asymmetric county level analyses are also conducted using nonlinear ARDL (NARDL) models. Results from the panel indicate that in the long-run, a positive shock to oil prices granger causes wages to increase in all sectors, with the largest (smallest) increase in the manufacturing (service) sector. Short-run coefficients indicate that oil price shocks have the largest effect on resource sector wages. County level results from the NARDL models provide evidence that there is no consistent effect on wages following oil price shocks in the long- and short-run in the overall economy.

Source: Adapted from the Bureau of Labor Statistics (2015)

Similar content being viewed by others

Availability of data and material (data transparency)

Available Upon request from authors.

Code availability (software application or custom code)

Available Upon request from authors.

Notes

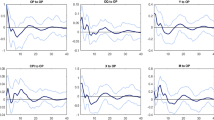

Each state represents the county from the sample. For example, the “dark-blue” in California represents the correlation of correlation (r) between oil prices and the wages in Kern County.

Estimated equations that failed all diagnostic tests (not homoskedastic, serially correlated, or not normally distributed) were omitted. For instance, total wages for Kern, Las Animas and Washington Counties were missing from Tables 10, 11 and 16, respectively, because the estimated models failed the diagnostic tests.

In this study, we do not report the cumulative long-run coefficients to save on space.

References

Acurio Vasconez V (2015) What if oil is less substitutable? A new-keynesian model with oil, price and wage stickiness including capital accumulation, Université Panthéon-Sorbonne (Paris 1), Centre d’Economie de la Sorbonne

Alsamara M, Mrabet Z, Dombrecht M, Barkat K (2017) Asymmetric responses of money demand to oil price shocks in Saudi Arabia: a non-linear ARDL approach. Appl Econ 49(37):3758–3769

Aoki K (2001) Optimal monetary policy responses to relative-price changes. J Monet Econ 48(1):55–80

Ayres RU, Warr B (2005) Accounting for growth: the role of physical work. Struct Change Econ Dyn 16(2):181–209

Bildirici ME (2014) Relationship between biomass energy and economic growth in transition countries: panel ARDL approach. GCB Bioenergy 6(6):717–726

Bildirici ME, Turkmen C (2015) Nonlinear causality between oil and precious metals. Resources Policy 46:202–211

Bodenstein M, Erceg CJ, Guerrieri L (2008) Optimal monetary policy with distinct core and headline inflation rates. J Monet Econ 55:S18–S33

Burbidge J, Harrison A (1984) Testing for the effects of oil-price rises using vector autoregressions. Int Econ Rev 25:459–484

Bureau of Economic Analysis (2019) Regional data—GDP and personal income. Bureau of Economic Analysis. https://apps.bea.gov/itable/iTable.cfm?ReqID=70&step=1. Accessed 10 Nov 2020

Bureau of Labor Statistics (2015) Counties with highest concentration of employment in oil and gas extraction, June 2014. The Economics Daily. Retrieved 7 Dec 2015, from http://www.bls.gov/opub/ted/2015/counties-with-highest-concentration-of-employment-in-oil-and-gas-extraction-june-2014.htm

Caldara D, Cavallo M, Iacoviello M (2016) Oil price elasticities and oil price fluctuations. International Finance Discussion Papers 1173. https://doi.org/10.17016/IFDP.2016.1173

Campolmi A (2008) Oil price shocks: demand vs supply in a two-country model. MNB Working Papers

Carstensen K, Hülsewig O, Timo W (2009) Price dispersion in the Euro area: the case of a symmetric oil price shock. CESifo Working Paper Series No. 2718

Charfeddine L, Barkat K (2020) Short-and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Econ 86:104680

Davidson L (2014) Oil boom leads to huge growth for Duchesne County. Daily Herald. https://www.heraldextra.com/news/state-and-regional/oil-boom-leads-to-huge-growth-for-duchesne-county/article_5c6afdd8-edb2-51cd-a27e-d512d4a92036.html

Enders A, Enders Z (2017) Second-round effects after oil-price shocks: evidence for the Euro area and Germany. Econ Lett 159:208–213

Erdem E, Guloglu B, Nazlioglu S (2010) The macroeconomy and Turkish agricultural trade balance with the EU countries: panel ARDL analysis. Int J Econ Manag Perspect 4(1):371

Fousekis P, Katrakilidis C, Trachanas E (2016) Vertical price transmission in the US beef sector: evidence from the nonlinear ARDL model. Econ Model 52:499–506

Frías-Pinedo I, Díaz-Vázquez R, Iglesias-Casal A (2017) Oil prices and economic downturns: the case of Spain. Appl Econ 49(16):1637–1654

Hamilton JD (1988) A neoclassical model of unemployment and the business cycle. J Polit Econ 96(1988):593–617

Hirsch BT, Macpherson DA, Vroman WG (2001) Estimates of union density by state. Mon Labor Rev 124(7):51–55

Hou K, Mountain DC, Wu T (2016) Oil price shocks and their transmission mechanism in an oil-exporting economy: a VAR analysis informed by a DSGE model. J Int Money Finance 68:21–49

Keane MP, Prasad ES (1996) The employment and wage effects of oil price changes: a sectoral analysis. Rev Econ Stat 78(3):389–400

Kehrig M, Ziebarth NL (2017) The effects of the real oil price on regional wage dispersion. Am Econ J: Macroecon 9(2):115–148

Lardic S, Mignon V (2006) The impact of oil prices on GDP in European countries: an empirical investigation based on asymmetric cointegration. Energy Policy 34(18):3910–3915

Loungani P (1986) Oil price shocks and the dispersion hypothesis. Rev Econ Stat 68(3):536–539

Marchand J, Weber J (2015) The labor market and school finance effects of the Texas shale boom on teacher quality and student achievement. University of Alberta, Department of Economics, Working Paper 2015–2015

Michieka MN, Gearhart RS (2018) Resource curse? The case of Kern County. Resources Policy. 59:446–459

Morissette R, Chan PCW, Lu Y (2015) Wages, youth employment, and school enrollment recent evidence from increases in world oil prices. J Hum Resources 50(1):222–253

Nusair SA (2016) The effects of oil price shocks on the economies of the Gulf Co-operation Council countries: nonlinear analysis. Energy Policy 91:256–267

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Rotemberg JJ, Woodford M (1996) Imperfect competition and the effects of energy price increases on economic activity. National Bureau of Economic Research

Saphir A (2018) Boom time comes early to West Texas oil patch. Reuters. Business News. https://uk.reuters.com/article/uk-usa-oil-record-economy-analysis/boom-time-comes-early-to-west-texas-oil-patch-idUKKBN1I22TD. Accessed 10 Nov 2020

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Shin Y, YuMatthew B, Greenwood N (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickles R, Horrace W (eds) Festschrift in honor of Peter Schmidt. Springer, New York, NY, pp 281–314

U.S. Bureau of Labor Statistics (2019) State and county employment and wages (Quarterly Census of Employment & Wages—QCEW). https://www.bls.gov/data/. Accessed 10 Nov 2020

U.S. Census Bureau (2020) QuickFacts. Bowman County, North Dakota. https://www.census.gov/quickfacts/bowmancountynorthdakota. Accessed 10 Nov 2020

U.S. Energy Information Administration (2019) Domestic crude oil first purchase prices by area. https://www.eia.gov/dnav/pet/pet_pri_dfp1_k_a.htm. Accessed 10 Nov 2020

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20(1):25–44

Acknowledgement

We acknowledge the useful comments made by the reviewers. We would also like to thank Jasneet Kaur and Jordy De Jesus for their help with data collection.

Funding

N/A.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

N/A.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Panel unit root tests

Appendix 2: Zivot Andrews unit root tests

See Tables 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35.

Rights and permissions

About this article

Cite this article

Michieka, N.M., Gearhart, R.S. Oil price changes and wages: a nonlinear and asymmetric approach. Econ Change Restruct 55, 1–71 (2022). https://doi.org/10.1007/s10644-020-09314-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-020-09314-4