Abstract

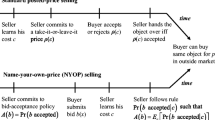

We characterize the optimal selling mechanism when bidders have ownership links among them (crossholdings). This mechanism discriminates against bidders who enjoy a value comparative advantage resulting from the extent to which they appropriate their own surplus. It is shown that since crossholdings improve the seller’s ability to selectively extract surplus from bidders, expected seller revenue is increasing with the asymmetry in these stakes. The optimal mechanism is implemented by a hybrid procedure that combines an auction with price preferences and a possible exclusive deal. An alternative negotiation procedure replicates some properties of the optimal one, and revenue-dominates most commonly used auction formats.

Similar content being viewed by others

Notes

For the case of direct cross-ownership, Claessens et al. (1998) document the fact that other (non-affiliated) companies constitute one of the most important corporate blockholders in various Asian countries. As regards indirect cross-ownership, Hansen and Lott (1996) report that the portfolios held by institutional investors in the U.S. include shares in competing firms in markets such as computers and automobiles. Similarly, Brunello et al. (2001) and Becht and Roell (1999) describe how pyramidal groups are very common in corporate ownership structures in Italy, France and Belgium.

We focus on the regular case, i.e., increasing hazard rates, as it is standard in auction theory.

This idea is formalized in the objective function described by equation (1) in the next section.

However, the objective function of a public firm should be different. In that case, it is reasonable to think that bidder i should maximize firm i’s overall surplus plus its minority stake in firm j’s.

We do, of course, recognize the importance of characterizing this mechanism under a richer environment, but that would constitute an extension of our basic model that is best left for future studies.

This ownership structure involves indirect crossholdings in which the controlling shareholder of a firm also holds a minority stake in a rival firm. However, the analysis developed in this section can also be applied to an ownership structure with direct crossholdings, that is, a situation in which the firms themselves possess minority stakes in their rivals. An example of this is provided by Chillemi (2005, pp. 3–4).

The other sufficient condition for the incentive compatibility constraints is \(\frac{\partial V_{i}(t_{i})}{\partial t_{i}}=(1-\theta _{j})Q_{i}(t_{i})\) for \(i,j=1,2\); \(i\ne j\) and \(\frac{\partial V_{3}(t_{3})}{\partial t_{3}} =Q_{3}(t_{3})\). After integrating these equations, one obtains a formulation for \(V_{i}(t_{i})\) that is useful for: (i) replacing the original participation constraints for the sufficient condition (3), and (ii) rewriting the objective function as equation (2).

This result is formally derived in “Appendix A”.

The endogenous nature of the reservation utilities and its consequences for the participation constraints can also have other sources. For instance, Jehiel et al. (1996, (1999) identify a similar phenomenon when there are auctions with externalities among bidders. They show that a revenue-maximizing procedure in this context has to include an optimal threat that induces bidders to participate in the auction by guaranteeing to the critical type (the lowest type in our case) the lowest possible reservation utility. Consequently, if externalities are negative, the seller will threaten to sell to the bidder who imposes the greatest damage to the nonparticipating bidder. By contrast, if externalities are positive the optimal threat implies that the seller keeps the object.

The analysis here is analogous to McAfee and McMillan (1989). They introduce the concept of an optimal discriminatory function in the context of an asymmetric procurement when a government faces domestic and foreign firms with different comparative advantages in costs.

For instance, the hazard rate associated with the uniform distribution satisfies this property.

It is interesting to compare this optimal allocation rule with the one obtained when bidders hold stakes in the seller’s ownership, the so-called toeholds. Unlike crossholdings, previous research has established that toeholds induce more aggressive bidding behavior (Burkart 1995; Singh 1998; Bulow et al. 1999). In particular, Loyola (2012) shows that although the optimal allocation rule in the presence of toeholds involves no bias, the price scheme does require a discriminatory policy.

A formalization of this intuition in terms of stochastic dominance will be given later.

Or equivalently, \(m_{2}(s)>m_{1}(s)>m_{3}(s).\)

An alternative interpretation is that bidder 3 does not face countervailing incentives because he has no crossholdings. As a result, he can adopt a less aggressive bidding behavior and still defeat his rivals.

Given two distribution functions F and G with the same support \(\left[ {\underline{x}},{\overline{x}}\right] \), we say that F dominates G in terms of the hazard rate (\(F\succ _{HRD}G\)) if

$$\begin{aligned} \frac{f(x)}{1-F(x)}\le \frac{g(x)}{1-G(x)} \end{aligned}$$for all \(x\in \left[ {\underline{x}},{\overline{x}}\right] \). In short, this stochastic order is also referred as hazard rate dominance (see Krishna 2010).

For the sake of simplicity, to find this optimal mechanism we assume that \( {\underline{t}}\) is sufficiently high that \({\underline{t}}H({\underline{t}})\ge 1 \). This implies that it will never be revenue-maximizing for the seller to set a reserve price and therefore that she always will assign the object to some bidder.

McAfee and McMillan (1989) also analyze the implementation of the optimal discriminatory policy through price-preferences in a model of asymmetric government procurements.

The result can be easily extended from 2 to 3 bidders as in the setting in previous sections. For simplicity we assume a uniform distribution, but the result holds for any distribution function whose hazard rate is increasing.

Since the expected revenue from a standard auction is decreasing in the level of a common crossholding (Chillemi 2005; Ettinger 2008; Dasgupta and Tsui 2004), the maximum revenue is attained when \(\theta =0\). Thus, the most demanding comparison of our negotiation mechanism with standard auctions occurs in that case.

It can be shown that if the sequential negotiation mechanism gives priority to bidder 1 over bidder 2, the resulting seller’s expected revenue is not only decreasing in the level of common crossholding, but also in the degree of asymmetry in these ownership stakes. As a consequence, for any asymmetric crossholding structure, the expected revenue from this alternative negotiation timetable is lower than that from the procedure described in Proposition 5.

Some of these deal protection devices are termination fees or other lock-up clauses.

The derivation of these expressions is available from the author upon request.

This is because each firm in the ring receives \(V_{i}^{R}\), and thus, bidder i gets \((1-\theta )V_{i}^{R}+\theta V_{i}^{R}=V_{i}^{R}\ \)for all \(i=1,2\).

Notice that \(F(z_{12}(s))=\Pr (t_{1}\le z_{12}(s))\) when \(t_{2}=s\). For simplicity, we denote \(\left( F(z_{12}(s))\right) ^{1-\Theta _{2}}\) as \( F^{1-\Theta _{2}}(z_{12}(s))\). This term appears when solving the differential equation that yields the equilibrium bid strategy in a first-price auction with crossholdings (see Dasgupta and Tsui 2004).

In particular, note that since \(b_{i}^{k}(t_{1})=0\) when \( q_{i}^{k}(t_{i},t_{-i})=0\), we can factorize the surplus of bidder 1 and 2 in terms of \(q_{i}^{k}(t_{i},t_{-i})\).

References

Aseff J, Chade H (2008) An optimal auction with identity-dependent externalities. RAND J Econ 39(3):731–746

Bartling B, Netzer N (2016) An externality-robust auction: theory and experimental evidence. Games Econ Behav 97:186–204

Becht M, Roell A (1999) Blockholdings in Europe: an international comparison. Eur Econ Rev 43:1049–1056

Brocas I (2014) Optimal allocation mechanisms with type-dependent negative externalities. Theor Decis 75(3):359–387

Brocas I (2013) Countervailing incentives in allocation mechanisms with type-dependent externalities. J Math Econ 50:22–33

Brunello G, Graziano C, Parigi B (2001) Executive compensation and firm performance in Italy. Int J Ind Organ 19:133–161

Bulow J, Huang M, Klemperer P (1999) Toeholds and takeovers. J Polit Econ 107(3):427–454

Bulow J, Roberts J (1989) The simple economics of optimal auctions. J Polit Econ 97(3):1060–1090

Burkart M (1995) Initial shareholdings and overbidding in takeover contests. J Finance 50(5):1491–1515

Campbell CM, Levin D (2006) When and why not to auction. Econ Theor 27(3):583–596

Chillemi O (2005) Cross-owned firms competing in auctions. Games Econ Behav 51:1–19

Claessens S, Djankov S, Fan J, Lang L (1998) Ownership Structure and Corporate Performance in East Asia. The World Bank, Mimeo

Dasgupta S, Tsui K (2004) Auctions with cross-shareholdings. Econ Theor 24:163–194

Ettinger D (2008) Auctions and shareholdings. Ann Econ Stat 90:233–257

Gatti N, Lazaric A, Rocco M, Trovò F (2015) Truthful learning mechanisms for multi-slot sponsored search auctions with externalities. Artif Intell 227:93–139

Hansen R, Lott J (1996) Externalities and corporate objectives in a world with diversified shareholders/consumers. J Financ Quant Anal 31:43–68

Jehiel P, Moldovanu B, Stachetti E (1996) How (not) to sell nuclear weapons. Am Econ Rev 86(4):814–829

Jehiel P, Moldovanu B, Stachetti E (1999) Multidimensional mechanism design for auctions with externalities. J Econ Theory 85:258–293

Krishna V (2010) Auction theory, 2nd edn. Academic Press, Cambridge

Laengle S, Loyola G (2012) Bargaining and negative externalities. Optim Lett 6(3):421–430

Loyola G (2017) Alternative equilibria in two-period ultimatum bargaining with envy. Optim Lett 11(4):855–874

Loyola G (2012) Optimal and efficient takeover contests with toeholds. J Financ Intermed 21:203–216

Lu J (2012) Optimal auctions with asymmetric financial externalities. Games Econ Behav 74:561–575

Maasland E, Onderstal S (2007) Auctions with financial externalities. Econ Theor 32:551–574

McAfee RP, McMillan J (1989) Government procurement and international trade. J Int Econ 26:291–308

Myerson R (1981) Optimal Auction Design. Math Oper Res 6(1):58–73

Povel P, Singh R (2006) Takeover contests with asymmetric bidders. Rev Financ Stud 19(4):1399–1431

Riley JG, Samuelson WF (1981) Optimal auctions. Am Econ Rev 71:381–392

Singh R (1998) Takeover bidding with toeholds: the case of the owner’s curse. Rev Financ Stud 11(4):679–704

Varma GD (2002) Standard auctions with identity-dependent externalities. RAND J Econ 33(4):689–708

Acknowledgements

This article is based on Chapter 1 of my Ph.D. dissertation at Universidad Carlos III de Madrid. I am deeply grateful to M. Angeles de Frutos for her comments and guidance. This work is dedicated to her memory. I would like to thank two anonymous reviewers and Huseyin Yildirim (editor) for their comments, which improved this article significantly. This work has also benefited from comments by Antonio Cabrales, Luciano de Castro, Juan José Dolado, Ángel Hernando, Juan-José Ganuza, Diego Moreno, Vijay Krishna, Georges Siotis and the participants in the XXII Jornadas de Economía Industrial (Barcelona, 2006), the 2007 ENTER Jamboree (Mannheim, 2007), and the 22\(^{\text {th}}\) EEA Meeting (Budapest, 2007). The usual disclaimers apply. I also thank Kenneth Rivkin for his excellent English proofreading and editing, and Javier Arce for his assistance in drawing the figures.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

The optimal mechanism problem

The optimal mechanism solves the following problem:

where (A1) is the seller’s expected revenue, (A2) and (A3) represent bidders’ participation constraints and incentive compatibility constraints, respectively, and (A4) represents the feasibility constraints of this problem. First, notice that since there exist crossholdings, the original participation constraints consider endogenous reservation utilities that depend on the allocation rule adopted by the seller in case of non-participation of a bidder. This rule is represented by \(\varphi ^{i}=(\varphi _{j}^{i},\varphi _{k}^{i})\), the vector of probabilities with which the seller assigns the object to bidder j or k if bidder i does not participate in the auction. Similarly, \({\overline{u}} ^{i}=(\overline{u_{j}}^{i},\overline{u_{k}}^{i})\) represents the vector of outside opportunity utilities of bidder i when bidder j or k gets the object. Given the cross-ownership structure assumed, it is clear that \( \overline{u_{2}}^{1}>\overline{u_{3}}^{1}\), \(\overline{u_{1}}^{2}>\overline{ u_{3}}^{2}\) and \(\overline{u_{1}}^{3}=\overline{u_{2}}^{3}\). Hence, it must be optimal that \(\varphi ^{1}=(\varphi _{2}^{1},\varphi _{3}^{1})=(0,1)\) and \(\varphi ^{2}=(\varphi _{1}^{2},\varphi _{3}^{2})=(0,1)\). As we normalize \( \overline{u_{3}}^{1}=\overline{u_{3}}^{2}=\overline{u_{1}}^{3}=\overline{ u_{2}}^{3}=0\), all of this implies that the zero reservation utility for all bidders is optimal as well.

Second, following Myerson (1981), it is possible to show that the incentive compatibility constraints are satisfied if and only if

-

(i)

\(\frac{\partial V_{i}(t_{i})}{\partial t_{i}}=(1-\theta _{j})Q_{i}(t_{i})\) for \(i,j=1,2\) and \(i\ne j\),

-

(ii)

\(\frac{\partial V_{3}(t_{3})}{\partial t_{3}}=Q_{3}(t_{3})\),

-

(iii)

\(\frac{\partial Q_{i}(t_{i})}{\partial t_{i}}\ge 0\) for all i .

Using these conditions, straightforward computations allow us to rewrite the seller’s expected payoff and simplify the maximization problem as presented in Sect. 3.

Proofs

Proof of Lemma 1

Clearly from (2), it is in the seller’s interest to make \(V_{i}({\underline{t}})=0\) for all i because \( V_{i}({\underline{t}})>0\) is suboptimal and setting \(V_{i}({\underline{t}})<0\) violates the participation constraint. Moreover, \(H^{\prime }(t_{i})>0\) implies \(m_{i}^{\prime }(t_{i})>0\) and thus \(\frac{\partial p_{i}(t)}{ \partial t_{i}}\ge 0\) , so that \(Q_{i}^{\prime }(t_{i})\ge 0\) is satisfied for all i. Finally, since \(t_{0}=0\), the optimal allocation rule is found by comparing for a given t \(=(t_{1},t_{2},t_{3})\) the terms \(m_{1}(t_{1})\) , \(m_{2}(t_{2})\) and \(m_{3}(t_{3})\) whenever they are positive. The solution sets \(p_{i}(t)=1\) iff \(m_{i}(t_{i})>\max \left\{ 0,\max _{j\ne i}m_{j}(t_{j})\right\} .\) \(\square \)

Proof of Lemma 2

-

(i)

We only show the claim for \(z_{31}\); the remaining cases are similar and hence omitted. Notice that by definition, \( z_{31}(t_{1})\equiv \) \(m_{3}^{-1}(m_{1}(t_{1}))\). Then, \(z_{31}^{\prime }(t_{1})=m_{3}^{-1\prime }(m_{1}(t_{1}))m_{1}^{\prime }(t_{1})>0\) follows from the fact that both \(m_{i}\) and its inverse are strictly increasing functions for all i.

-

(iii)

By definition, \(z_{12}({\underline{t}})\equiv m_{1}^{-1}(m_{2}( {\underline{t}}))>m_{1}^{-1}(m_{3}({\underline{t}}))\equiv z_{13}({\underline{t}})\) , where the inequality follows from the fact that \(m_{2}({\underline{t}} )>m_{3}({\underline{t}})\) and the inverse of \(m_{1}\) is a strictly increasing function. Notice, however, that \(z_{13}({\underline{t}})\equiv m_{1}^{-1}(m_{3}({\underline{t}}))<m_{1}^{-1}(m_{1}({\underline{t}}))=\underline{ t}\), which is not possible and so, we must impose a truncation such that we define

$$\begin{aligned} z_{13}(t_{3})=\left\{ \begin{array}{ll} {\underline{t}} &{} \text {if }{\underline{t}}\le t_{3}<z_{31}({\underline{t}}) \\ m_{1}^{-1}(m_{3}(t_{3})) &{} \text {otherwise} \end{array} .\right. \end{aligned}$$Using the same arguments, one can verify that the other cases also hold, which includes the following definition for bidder 2

$$\begin{aligned} z_{2j}(t_{j})=\left\{ \begin{array}{ll} {\underline{t}} &{} \text {if }{\underline{t}}\le t_{j}<z_{j2}({\underline{t}}) \\ m_{2}^{-1}(m_{j}(t_{j})) &{} \text {otherwise} \end{array} \text {,}\right. \end{aligned}$$for all \(j\ne 2.\)

-

(ii)

According to definitions of the discrimination policy functions provided in the proof of (iii), and using the same arguments applied in (i), the desired result follows directly.

-

(iv)

The claim is only proved for \(z_{31}\). First, from (iii) we know that \( z_{31}({\underline{t}})>{\underline{t}}\). Second, notice that \(z_{31}(\overline{t })\equiv m_{3}^{-1}(m_{1}({\overline{t}}))={\overline{t}}\), where the last equality follows from the fact that \(m_{1}({\overline{t}})=m_{3}({\overline{t}})\) . Third, from (i), we know that \(z_{31}\) is a strictly increasing function. Fourth, it is easy to check that the condition \(H^{\prime \prime }(t_{3})\ge 2(H^{\prime }(t_{3}))^{2}/H(t_{3})\) guarantees that \(m_{3}\) is a convex function, and hence, \(z_{31}\) is a concave function. All of that implies that \(z_{31}\) has a unique fixed point \(\sigma ={\overline{t}}.\)

-

(v)

This is a direct consequence of results (i)-(iv).

\(\square \)

Proof of Proposition 1

Let us define \(J_{i}(t_{i})\equiv \frac{ H(t_{i})}{\psi _{i}}\), the modified hazard rate of bidder i’s value distribution function, where \(\psi _{i}\) is the fraction in which bidder i appropriates his own surplus, i.e., \(\psi _{1}=1-\theta _{2} \), \(\psi _{2}=1-\theta _{1}\) and \(\psi _{3}=1\). Let \(G_{i}\) denote its corresponding c.d.f. Since \(m_{i}(s)\) is increasing with s then \( z_{ij}(s) > reqqless s\) iff \(m_{i}(s)\lesseqqgtr m_{i}(z_{ij}(s))=m_{j}(s)\), where the last equality follows from the implicit definition of \(z_{ij}\). It is easy to check that this inequality is equivalent to \(J_{j}(s) > reqqless J_{i}(s)\) for all s, and for all \(i\ne j\), which means that \(z_{ij}(s)<s\) iff \(G_{j}\succ _{HRD}G_{i}\) (i.e., \(G_{j}\) hazard rate dominates \(G_{i}\)). As \(\psi _{3}>\psi _{1}>\psi _{2}\) implies that \(G_{3}\succ _{HRD}G_{1}\succ _{HRD}G_{2}\), the desired result follows. \(\square \)

Proof of Proposition 2

From (2) and Lemma 1, let us define \(V_{0}\), the seller’s expected revenue evaluated according to the optimal mechanism, as follows

From this, when \(\theta _{1}=\theta _{2}=\theta >0\), and after applying the envelope theorem, we get

because \(H(t_{i})>0\) and \(p_{i}(t)\ge 0\) for all t and i. \(\square \)

Proof of Proposition 3

Let k be a positive constant such that \(\theta _{1}+\theta _{2}=k\), and thus, \(\theta _{2}=k-\theta _{1}\) . Using this substitution to rewrite \(V_{0}\), from (A5) we obtain

According to our optimal allocation rule, \(Q_{i}(s)=\Pr (t_{j}<z_{ji}(s))\Pr (t_{i}^{*}<s)\) for \(i,j=1,2\), \(i\ne j\). Note that \(t_{1}^{*}>t_{2}^{*}\) implies that \(\Pr (t_{2}^{*}<s)\) \(\ge \Pr (t_{1}^{*}<s)\), and that from Lemma 2 it follows that \(F(z_{21}(s))<F(z_{12}(s))\) for all \(s\in \left[ {\underline{t}},{\overline{t}}\right) \). All of that implies that \(Q_{1}(s)\le Q_{2}(s)\) for a given value s. Since the exclusion of both bidders is not possible for all s, the last result implies from (A6) that \(\frac{\partial V_{0}}{\partial \theta _{1}}\ge 0\). \(\square \)

Proof of Proposition 4

We first need to state the next auxiliary result.

Lemma B1

Let us define \(\Theta _{i}\equiv \frac{\theta _{i}}{1-\theta _{j}}\) for \(i,j=1,2,\) \(i\ne j\); and \(L(s)=F^{1-\Theta _{2}}(z_{12}(s))F(z_{32}(s))\) and \( L_{1}(s)=F^{1-\Theta _{2}}(z_{12}(s))\) for all \(s\in \left[ {\underline{t}},{\overline{t}}\right] \).Footnote 25 A Bayesian Nash equilibrium of the auction-based selling procedure is the following one:

Bidder 3’ strategy Accept participation in Stage II if and only if \(t_{3}\ge z_{32}({\underline{t}})\); and in Stage II bid:

and

Bidder 1’ strategy Accept participation in Stage II if and only if \(t_{1}\ge z_{12}({\underline{t}})\); and in Stage II bid:

and

Bidder 2’ strategy Accept the offer to pay \( \underline{b_{2}}\) in Stage I; and in Stage II bid:

These are equilibrium strategies if the seller designs a modified FPA with the following characteristics:

-

(i)

\(\underline{b_{3}}=z_{32}({\underline{t}}),\)

-

(ii)

\(\underline{b_{1}}=z_{12}({\underline{t}}),\)

-

(iii)

\(\underline{b_{2}}\) such that \(\Gamma _{2}({\underline{t}})=0,\) and

-

(iv)

\(\widetilde{z_{ij}}(b)=b_{i}(z_{ij}(b_{j}^{-1}(b))),\)

where \(\Gamma _{i}(\cdot )\) represents bidder i’s expected truthtelling payoff (i.e. the average across all stages) in this sequential mechanism.

Proof of Lemma B1

We only demonstrate that these candidate bidding functions constitute an equilibrium for the most general case: bidder 1. Let us define:

\(b_{1}^{k}(t_{1})\), the candidate bidding function for bidder 1 in Stage k, as follows

\(q_{i}^{k}(t_{i},t_{-i})\) as the probability that bidder i gets the object in Stage k,

\(\Lambda _{1}^{k}(\widehat{t_{1}},t_{1})\), bidder 1’s expected payoff in Stage k when he observes \(t_{1}\), but plays a strategy as if his value were \(\widehat{t_{1}}\), as follows

\(\Gamma _{1}^{k}(t_{1})\equiv \Lambda _{1}^{k}(t_{1},t_{1})\), bidder 1’s truthtelling payoff in Stage k, and\(P_{1}^{k}(t_{1})\equiv \int _{T_{-1}}q_{1}^{k}(t_{1},t_{-1})f(t_{-1})dt_{-1}\) , bidder 1’s probability of winning in Stage k, conditional on value realization \(t_{1}\).

Let us organize this proof in two steps.

Step 1. Notice that the payoff function \(\Gamma _{1}^{k}\) corresponds to the particular case of the truthtelling payoff function \( V_{1} \) defined in Sect. 3 when the optimal payment is \( x_{1}(t_{1},t_{-1})=b_{1}^{k}(t_{1})\) and the optimal allocation rule is \( p_{1}(t_{1},t_{-1})=q_{1}^{k}(t_{1},t_{-1})\).Footnote 26 It follows then directly from conditions (i) and (iii) of “Appendix A” that the incentive compatibility constraint \(\Gamma _{1}^{k}(t_{1})\) \(\ge \Lambda _{1}^{k}( \widehat{t_{1}},t_{1})\) for all \(t_{1},\widehat{t_{1}} \in \left[ {\underline{t}},{\overline{t}}\right] \) and k, is satisfied if \(\frac{\partial \Gamma _{1}^{k}(t_{1})}{\partial t_{1}} =(1-\theta _{2})P_{1}^{k}(t_{1})\) and \(\frac{\partial P_{1}^{k}(t_{1})}{ \partial t_{1}}\ge 0\) for all k.

Step 2. We show now that the strategy \(b_{1}^{k}(t_{1})\) satisfies these two sufficient conditions and therefore is an equilibrium bidding strategy of this game. First, given that \(b_{1}^{k}(t_{1})\) is increasing for stages II.1 and II.3, and, since by construction \(\widetilde{z_{ji}}\) implements the optimal allocation rule, we have that

Also, notice that \(\frac{\partial P_{1}^{k}(t_{1})}{\partial t_{1}}\ge 0\) is satisfied both for each stage and across stages, as by assumption \( f(z_{i1}(t_{1}))>0\), \(F(z_{i1}(t_{1}))>0\) and by Lemma 2\(z_{i1}^{\prime }(t_{1})\) \(>0\), for all \(t_{1}>z_{12}({\underline{t}})\). We prove now that the second sufficient condition also holds. If \(t_{1}>z_{12}({\underline{t}})\) and \(t_{3}>z_{32}({\underline{t}})\) (Stage II.1), it can be checked after some computations that \(\frac{\partial \Gamma _{1}^{II.1}(t_{1})}{\partial t_{1}} =(1-\theta _{2})F(z_{21}(t_{1}))F(z_{31}(t_{1}))=(1-\theta _{2})P_{1}^{k}(t_{1})\), where the second equality follows from (A7). Using the same argument, a similar result holds for Stage II.3. Lastly, when \(t_{1}<z_{12}({\underline{t}})\), bidder 1 does not participate in the auction. By noting that \(z_{21}(t_{1})={\underline{t}}\) for all \(t_{1}<z_{12}( {\underline{t}})\), one can verify that \(\frac{\partial \Gamma _{1}^{k}(t_{1})}{ \partial t_{1}}=0=(1-\theta _{2})P_{1}^{k}(t_{1})\), where the second equality follows from (A7). \(\square \)

We are now prepared to demonstrate Proposition 4. From Lemma 1, we know that a selling procedure is optimal if it satisfies two conditions: (1) the bidder with the lowest possible value realization gets his reservation payoff (which in “Appendix A” we have showed to be optimally the same for all bidders and normalized to zero), and (2) it uses the optimal allocation rule. Notice that by construction, the sequential selling procedure satisfies both conditions. First, the payoff for either bidder with value \( {\underline{t}}\) is zero: (i) bidder 3 does not participate in Stage II (because \(z_{32}({\underline{t}})>{\underline{t}}\)) and thus, he gets \(\Gamma _{3}^{k}({\underline{t}})=0\) for all stage k; (ii) bidder 2 loses the auction for sure if some other bidder agrees to participate in Stage II and thus, he has a positive expected payoff. Otherwise, he pays \(\underline{b_{2} }\) in the exclusive deal, which by construction, guarantees that the average payoff across all stages in the sequential mechanism for the lowest-type is \( \Gamma _{2}({\underline{t}})=0\); and (iii) bidder 1 neither participates in Stage II (because \(z_{12}({\underline{t}})>{\underline{t}}\)), and result (ii) also ensures that he gets in expected terms (as average across all stages) \( \Gamma _{1}({\underline{t}})=0\). Second, the allocation rule is the optimal one as we can check that \(b_{i}>\widetilde{z_{ij}}(b_{j})\) iff \( t_{i}>z_{ij}(t_{j})\) using the definition of \(\widetilde{z_{ij}}(\cdot )\). \(\square \)

Proof of Proposition 5

Applying backward induction, we first need to characterize the Nash equilibrium resulting from Stage II. In this stage, bidder 1 accepts the offer if \((1-\theta _{2})(t_{1}-\rho _{1})>0\), i.e., if \(t_{1}>\rho _{1}\), and rejects otherwise. The seller therefore has to optimally choose the offer given by \(\rho _{1}^{*}=\arg \max _{\rho _{1}}(1-\rho _{1})\rho _{1}\). After solving, we get that \(\rho _{1}^{*}=1/2\) and the optimal seller’s expected revenue from this stage is equal to 1/4.

In Stage I, bidder 2 accepts any seller’s offer if his payoff is larger than the expected payoff at the equilibrium of stage II. That is, if

which is equivalent to the condition \(t_{2}>\rho _{2}+\theta _{2}/8(1-\theta _{1})\). Thus, the seller’s optimal offer is characterized by

The solution is given by \(\rho _{2}^{*}=5/8-\theta _{2}/16(1-\theta _{1}) \), which yields an optimal seller’s expected revenue equal to \( V_{0}^{N}=(100-\lambda (12-\lambda ))/256\), where \(\lambda \equiv \theta _{2}/(1-\theta _{1})\) and N highlights that this is the revenue generated by the negotiation mechanism. Since \(\lambda \le 1\), it is easy to verify that \(\rho _{2}^{*}>\rho _{1}^{*}\), which proves the first statement of the proposition.

In order to show the second result, notice that in the presence of asymmetric crossholdings it is not possible to find an analytical expression for the equilibrium bidding strategy in both FPA and SPA, and thereby, it is neither possible to obtain a closed expression for the seller’s revenue (see Dasgupta and Tsui 2004, Section 5). However, we can alternatively perform a comparison between the proposed mechanism with crossholdings and the FPA and SPA without crossholdings. It is well known that without crossholdings these two auction formats yield larger expected revenues than their versions with crossholdings, as these ownership stakes hurt the seller (see, for instance, Chillemi 2005, and Ettinger 2008). So, it suffices to show that expected revenues of our sequential mechanism exceeds that of standard FPA and SPA. Thanks to the revenue equivalence theorem, the last expected revenue is the same for both auction formats and equal to 1/3. Since \(V_{0}^{N}\) is decreasing in \(\lambda \), the worst case for our sequential negotiation mechanism arises when \(\lambda \) is equal to its upper bound. Under the symmetric case, since \(\partial \lambda /\partial \theta >0\), \(\lambda \) reaches its upper bound at 1 when \(\theta _{1}=\theta _{2}=\theta \) converges to 1/2, situation in which the expected revenue is equal to \(89/256>1/3\). Under the asymmetric case, since \( \partial \lambda /\partial \theta _{1}<0\) (with \(\theta _{1}+\theta _{2}=1/2\) ), \(\lambda \) converges to an upper bound of 1/3 when \(\theta _{1}\downarrow 1/4\) and \(\theta _{2}\uparrow 1/4\), situation in which the seller’s expected revenue converges to \(0.375>1/3\). In both cases, the respective result implies that the second part of the proposition holds. \(\square \)

Rights and permissions

About this article

Cite this article

Loyola, G. Optimal selling mechanisms with crossholdings. Rev Econ Design 25, 1–32 (2021). https://doi.org/10.1007/s10058-020-00240-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-020-00240-5