Abstract

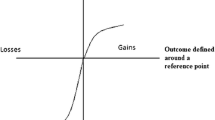

When people take decisions under risk, it is not only the expected utility that is important, but also the shape of the distribution of utility: clearly the dispersion is important, but also the skewness. For given mean and dispersion, decision-makers treat positively and negatively skewed prospects differently. This paper presents a new behaviourally-inspired model for decision making under risk, incorporating both dispersion and skewness. We run a horse race of this new model against six other models of decision making under risk and show that it outperforms many in terms of goodness of fit and shows a reasonable performance in predictive ability. It can incorporate the prominent anomalies of standard theory such as the Allais paradox, the valuation gap, and preference reversals, and also the behavioural patterns observed in experiments that cannot be explained by Rank Dependent Utility Theory.

Similar content being viewed by others

Notes

See Bayrak and Hey (2020) for a review of relevant literature.

\( S\left(\tilde{z}\right)={\mu}^3/{\sigma}^3, \) where μ3 is the third central moment and σ is standard deviation. If σ is zero (so that the lottery is degenerate and the Pearson measure undefined), we naturally put the skewness equal to zero.

Note that in the most general form of the new model given in (3), \( {\alpha}_{S\left(\tilde{z}\right)} \) is introduced as a function of skewness, but here we adopt a simplification. Alternatively, pessimism can have a more complicated functional form that, for example, includes the DM’s experience in the past; we leave this issue for future work.

We note that Hagen (1991) also proposes a model involving dispersion and skewness. Hagen incorporates these in an additive manner in the preference functional; they are seen as the source of extra utility and disutility, respectively. Instead our theory has behavioural motivations for the way that dispersion and skewness affect the preference functional.

The literature on the relationship between the skewness and preferences dates back to the 1990s: The common finding is that individuals favour positively/right skewed lotteries more than the negatively/left skewed lotteries (Ebert 2015). One explanation for this behaviour is that people feel excited and hopeful for the large gains that come with a low probability such as national lotteries. For example, national lotteries can be interpreted as one is actually “buying a dream” which includes for example imagining how one can spend the prize and the joy of quitting one’s job (Forrest et al. 2002; Garrett and Sobel 1999). Possibly the most direct evidence comes from a study which employs neuroimaging measures: Wu et al. (2011) found that positively skewed gambles increased positive arousal, but negatively skewed gambles increased negative arousal and perceived risk. Subjects preferred positively skewed and high dispersion lotteries more than the negatively skewed gambles. Tversky and Kahneman (1992) found that subjects exhibit risk-loving preferences for positively skewed lotteries and risk-averse preferences for negatively skewed lotteries. Golec and Tamarkin (1998) find that people tend to favour the long-shot options in horse races with high prizes but low probabilities. Grossman and Eckel (2015) developed a new protocol consisting of 3 tasks. In task 1 subjects make a choice between 6 lotteries which are zero-skewed lotteries but differ in dispersion. In task 2, subjects are asked to keep the preferred lottery in task 1 or to choose one of the new 6 lotteries. The new 6 lotteries are the modified versions of Task 1 lotteries in a way to keep their dispersion same but have a skewness level of 1. Finally, in task 3, a new set of 6 lotteries are presented which have a skewness level of 2. There are two important results from that study: firstly more than 88.2% of the subjects prefer the skewed lotteries over the zero-skewed lotteries. Secondly, and more importantly, is that an increase in skewness leads 37.6% of the subjects to take on greater risk/seek for higher dispersion in their choice for lotteries.

We could insert a fourth component—an editing phase, in which the DM looks for (first-order stochastically) dominating lotteries in the lottery pair and simply chooses them without evaluating them first. We discuss this in Appendix C.

For a reader unfamiliar with the anomalies see online Appendix G for a brief summary.

Formally, under EU, putting u(x1) = 0, u(x2) = u and u(x3) = 1, S1 is preferred to R1 if and only if u > cc∙u + (1-a-cc), while S2 is preferred to R2 if and only if u∙(1-cc) > 1-a-cc.

Formally, under EU, putting u(x1) = 0, u(x2) = u and u(x3) = 1, M1 is preferred to N1 if and only if u > a, while M2 is preferred to N2 if and only if u∙cr > a∙cr.

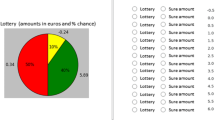

There was a participation fee of £25. See online Appendix D for the lotteries used in the experiment.

Clearly this is not the only way that we can posit how subjects do the juxtaposing.

The distribution of estimated values of the parameter k can be found in Appendix B, results with White Noise specification are presented in Tables F3a and F3b in online Appendix F.

We agree that we could also incorporate an editing phase and a tremble in the other models, yet these models—except for the original version of RDUT (Prospect Theory)—did not include these things when they were first introduced.

Though this depends upon the version. See Appendix C.

References

Bayrak, O. K., & Kriström, B. (2016). Is there a valuation gap? The case of interval valuations. Economics Bulletin, 36(1), 218–236.

Bayrak, O. K., & Hey, J. D. (2020). Understanding preference imprecision. Journal of Economic Surveys, 34(1), 154–174. https://doi.org/10.1111/joes.12343.

Banerjee, P., & Shogren, J. F. (2014). Bidding behavior given point and interval values in a second-price auction. Journal of Economic Behavior & Organization, 97, 126–137.

Bateman, I., Munro, A., Rhodes, B., Starmer, C., & Sugden, R. (1997). A test of the theory of reference-dependent preferences. The Quarterly Journal of Economics, 112(2), 479–505.

Birnbaum, M. H., & Navarrete, J. B. (1998). Testing descriptive utility theories: Violations of stochastic dominance and cumulative independence. Journal of Risk and Uncertainty, 17(1), 49–79.

Birnbaum, M. (2005). Three new tests of independence that differentiate models of risky decision making. Management Science, 51(9), 1346–1358.

Blavatskyy, P. R. (2010). Reverse common ratio effect. Journal of Risk and Uncertainty, 40(3), 219–241.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2012). Salience theory of choice under risk. The Quarterly Journal of Economics, 127(3), 1243–1285.

Busemeyer, J. R., & Wang, Y. M. (2000). Model comparisons and model selections based on generalization criterion methodology. Journal of Mathematical Psychology, 44(1), 171–189.

Butler, D., & Loomes, G. (1988). Decision difficulty and imprecise preferences. Acta Psychologica, 68(1–3), 183–196. https://doi.org/10.1016/0001-6918(88)90054-6.

Carbone, E., & Hey, J. (1995). A comparison of the estimates of EU and non EU preference functionals. Geneva Papers on Risk and Insurance–Issues and Practice, 20(1), 111–133.

Chew, S. H. (1983). A generalization of the quasilinear mean with applications to the measurement of income inequality and decision theory resolving the Allais paradox. Econometrica, 51, 1065–1092.

Cubitt, R. P., Navarro-Martinez, D., & Starmer, C. (2015). On preference imprecision. Journal of Risk and Uncertainty, 50(1), 1–34. https://doi.org/10.1007/s11166-015-9207-6.

Dekel, E. (1986). An axiomatic characterization of preferences under uncertainty: Weakening the independence axiom. Journal of Economic Theory, 40(2), 304–318.

Dubourg, W. R., Jones-Lee, M. W., & Loomes, G. (1994). Imprecise preferences and the WTP-WTA disparity. Journal of Risk and Uncertainty, 9(2), 115–133.

Dubourg, W. R., Jones-Lee, M. W., & Loomes, G. (1997). Imprecise preferences and survey design in contingent valuation. Economica, 64(256), 681–702.

Ebert, S. (2015). On skewed risks in economic models and experiments. Journal of Economic Behavior & Organization, 112, 85–97.

Forrest, D., Simmons, R., & Chesters, N. (2002). Buying a dream: Alternative models of the demand for lotto. Economic Inquiry, 40(3), 485–496.

Garrett, T., & Sobel, R. (1999). Gamblers favor skewness not risk: Further evidence from United States lottery games. Economics Letters, 63(1), 85–90.

Golec, J., & Tamarkin, M. (1998). Betters love skewness, not risk, at the horse track. Journal of Political Economy, 106(1), 205–225.

Green, J. R., & Jullien, B. (1988). Ordinal independence in nonlinear utility theory. Journal of Risk and Uncertainty, 1(4), 355–387.

Gul, F. (1991). A theory of disappointment aversion. Econometrica: Journal of the Econometric Society, 667–686.

Grossman, P. J., & Eckel, C. C. (2015). Loving the long shot: Risk taking with skewed lotteries. Journal of Risk and Uncertainty, 51(3), 195–217.

Hagen, O. (1991). Decisions under risk: A descriptive model and a technique for decision making. European Journal of Political Economy, 7(3), 381–405.

Hey, J. D. (2001). Does repetition improve consistency? Experimental Economics, 4(1), 5–54.

Håkansson, C. (2008). A new valuation question: Analysis of and insights from interval open-ended data in contingent valuation. Environmental and Resource Economics, 39(2), 175–188.

Loomes, G., & Sugden, R. (1998). Testing different stochastic specifications of risky choice. Economica, 65(260), 581–598.

Morrison, G. C. (1998). Understanding the disparity between WTP and WTA: Endowment effect, substitutability, or imprecise preferences? Economics Letters, 59(2), 189–194.

Plott, C. R., & Zeiler, K. (2005). The willingness to pay-willingness to accept gap, the “endowment effect,” subject misconceptions, and experimental procedures for eliciting valuations. American Economic Review, 95(3), 530–545.

Prelec, D. (1998). The probability weighting function. Econometrica, 66(3), 497. https://doi.org/10.2307/2998573.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior and Organization, 3(4), 323–343.

Tversky, A., & Kahneman, D. (1986). Rational choice and the framing of decisions. Journal of Business, 59(S4), S251–S278.

Teitelbaum, J. C., & Zeiler, K. (Eds.). (2018). Research handbook on behavioral law and economics. Edward Elgar Publishing.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Viscusi, W. K. (1989). Prospective reference theory: Toward an explanation of the paradoxes. Journal of Risk and Uncertainty, 2(3), 235–263.

Wilcox, N. T. (2008). Stochastic models for binary discrete choice under risk: A critical primer and econometric comparison. In James C. Cox & Glenn W. Harrison (Eds.), Risk Aversion in Experiments (Research in Experimental Economics, Volume 12). Emerald Group Publishing Limited, 197–292.

Wu, G. (1994). An empirical test of ordinal independence. Journal of Risk and Uncertainty, 9(1), 39–60.

Wu, C. C., Bossaerts, P., & Knutson, B. (2011). The affective impact of financial skewness on neural activity and choice. PLoS One, 6(2), e16838.

Acknowledgements

We thank an anonymous referee, Glenn W. Harrison, Bo Ranneby, Gábor J. Székely, Nathaniel T. Wilcox and Wenchao Zhou for suggestions and/or comments. All errors are ours. The financial support from Tore Browaldh and the Jan Wallanders Foundations is also acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Estimated Preference Functionals

1) EU: Expected Utility—subjects choose on the basis of expected utility:

Parameters estimated: u2, u3 and u4.

2) DA: Disappointment Aversion—subjects choose on the basis of expected (modified) utility—where utility is modified ex post to take account of any disappointment or delight experienced:

Parameters estimated u2, u3, u4 and β.

3) DS: See Section 2.

Parameters estimated u2, u3, u4 and k.

4) PR: Prospective Reference—subjects choose on the basis of a weighted average of the expected utility calculated using the correct probabilities and the expected utility calculated using equal probabilities for all the non-null outcomes:

ai = 1/n(p) andn(p) is the number of non-zero elements in p.

Parameters estimated: u2, u3, u4 and λ.

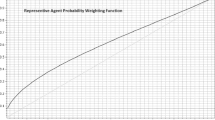

5) RL: Rank dependent with Prelec weighting function—subjects choose on the basis of expected utility where the (cumulative) probabilities are distorted by a weighting function which takes the power function form:

wherew(.) is the Prelec functionw(p) = exp(−β ⋅ (− ln p)α).

Parameters estimated u2, u3, u4, αandβ..

6) ST: Salience Theory—When choosing between (x,p) and (y,q) (each of which has at most four states) subjects consider the 16 possible states: with probabilitypiqj(i = 1..4, j = 1..4) getxi if (x,p) chosen and getyjif (y,q) chosen. Then decide on the basis of whether V is positive (choose (x,p)) or negative (choose (y,q)) where V is given by:

where u(x1) = 0, u(x2) = u2, u(x3) = u3,andu(x4) = u4,andμ(x, y) = |x − y|β..

This is the Salience Function.

Parameters estimated: u2, u3, u4 andβ.

7) WU: Weighted Utility—subjects choose on the basis of expected weighted utility:

Parameters estimated: u2, u3, u4, w2andw3.

Appendix B

Appendix C

A Possible Editing Phase

Ideally, we would prefer to include an editing phase conducted by the DM before the evaluation phase of the theory: in this editing phase, the DM looks to see if one lottery first-order dominates the other. In such a case, the DM chooses the dominant option without proceeding with the evaluation phase of the theory. In the other problems the DM proceeds as in the theory.

While we think that this editing phase is an important feature of our theory, we want to be fair to the other theories in our ‘horse race’. It seems that the only other theory which also has an explicit editing phase is Rank Dependent Expected Utility, at least in its earliest incarnation—Prospect Theory. However, recent descriptions of both it and the other theories seem to omit descriptions of such an editing phase—perhaps regarding it as implicit.

So, to be fair to the other theories, we omit any editing phase in any of the models in all the econometric analyses reported in the main body of the paper. For those readers interested in the effects of the incorporation of an editing phase in DS we include online Appendices E and F which report the results. There are two Versions reported there: Version A in which the DM trembles in the dominating problems with an exogenous probability; and Version B in which the DM trembles in the dominating problems with an endogenous probability. Not surprisingly DS does much better with this editing phase included. These are in addition to the model without editing, which is referred to as Version C.

Rights and permissions

About this article

Cite this article

Bayrak, O.K., Hey, J.D. Decisions under risk: Dispersion and skewness. J Risk Uncertain 61, 1–24 (2020). https://doi.org/10.1007/s11166-020-09333-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-020-09333-6