Abstract

Several allocation rules (such as the Kalai–Smorodinsky solution) allow for possible violations of the ‘independence of irrelevant alternatives’ (IIA) axiom in cooperative bargaining game theory. Nonetheless, there is no conclusive evidence on how contractions of feasible sets exactly affect bargaining outcomes. We have been able to identify a definite behavioral channel through which such contractions actually determine the outcomes of negotiated bargaining. We find that the direction and the extent of changes in bargaining outcomes, due to contraction of the feasible set, respond to the level of (given) agent asymmetry with a remarkable degree of regularity. Alongside, we conclude that the validity of the IIA axiom is only limited to symmetric games.

Similar content being viewed by others

Change history

08 June 2020

Part of the equation in sub-section “Key findings” is missing in the original publication of the article. The error was caused by the fact that the equation, due to its length, exceeded the page width. The missing part of the equation is given below:

Notes

The ultimatum game is an example of asymmetric bargaining in this sense because the proposer clearly has a higher bargaining power relative to the responder. More examples are discussed in Bardsley et al. (2009), Smith (2008), Henrich and Henrich (2007) and Camerer (2003) (and the papers cited therein).

Cardenas and Carpenter (2008), for example, also point out that the perception of how deserving recipients are could be a strong predictor of altruism. Ball et al. (2001) interprets this effect of test performance as a 'status effect'. These interpretations are consistent with Aristotle's idea of fairness which should be proportional to some measure of agents' need, ability, effort and status (see Bolton and Karagözoğlu 2016).

Ball et al. (2001) terms this asymmetry as a 'status' advantage that favors one of the bargaining agents.

For more literature on bargaining with fairness considerations, see Binmore (2014), Birkeland and Tungodden (2014), Bruyn and Bolton (2008), and Buchan et al. (2004). The 50–50% outcome (which is almost always deemed fair) may also be seen as a focal point (see Crawford et al. 2008; Anbarci and Feltovich 2018).

To appeal to a wider audience, only the intuitions behind the Nash and the KS solutions have been presented in the subsections that follow.

Over here, by symmetry we mean the axiom of symmetry as in Nash (1950). This axiom requires that, if both the alternatives (x, y) and (y, x) are available in the feasible set of alternatives, then the payoff of each player should be equal to that of the other in the final outcome.

While there is no immediate interpretation of β, it suffices to say that for any allocation rule, the bargaining power β is a determinant of the (positive) quantity by which x exceeds y. Of course, this level of abstraction can subsume many different sources of bargaining asymmetries.

One way to think of assigning a higher bargaining power β for agent X is through the maximization of x1+βy (subject to: x + y = 1), which occurs at x* > 1/2 (i.e. X gets a higher share than Y). The derivations in Appendix 4 formally present this particular case. There are alternate interpretations of a change in bargaining power in terms of an alteration of preferences/utility of the (now) high-power agent X. Bacharach and Lawler (1981), provide (in Chapter 2), a detailed discussion on the distinction between these interpretations of existing theory and emphasizes that the integrated analysis (by each agent) of context, process and outcome, shapes agent preferences. For example, Binmore (2007) points out (in Chapter 16) that players with preferences that make them anxious for an early agreement will have less bargaining power than the patient players (additionally, see Muthoo 1999). The empirical results presented later in this paper, are fairly general, and are consistent with the alternate interpretations of theory. The results we present are consistent with any utility transformation potentially associated with the introduction of a higher bargaining power (and therefore asymmetry) in our experimental setting.

Candidates were not allowed to disclose their names/identity in the chat conversations (which were saved) violating which, entailed a penalty of the full amount earned (including the show-up fees) for both the individuals in the pair. This ensured anonymity (there is no evidence of any form of identity disclosure in the chat conversations). The login names used for this treatment were Candidate.001, Candidate.002 and so on. The sufficiency of 10 min was observed from the pilot studies.

As before, the negotiation happened over Skype, but this time with rank-defining usernames such as Rank.001, Rank.002 etc.

The usernames were the same as in the baseline treatment.

As in the Rank-based bargaining treatment above, the Skype usernames were rank-defining (Rank.001, Rank.002 etc.).

Note that for α0, to represent the average share of the control group, each variable included in Xij needs to be appropriately normalized to have mean zero.

T test results for a simple test of means for individuals with RelPos = 1, in the rank bargaining treatment against those in the rank contraction treatment, yield a t-statistic (d.f. = 36) with a value of 1.59 and an associated p value of 0.06, suggesting some evidence of significance. A similar comparison between those with RelPos = 1, in the random contraction treatment, and those with RelPos = 1 (after randomly assigning RelPos = 1 to exactly one member in each bargaining pair) in the control group shows no significant difference (p value of 0.30, for a t statistic (d.f. = 25) with a value of 0.52).

We look at characteristics such as gender, family background (families in business or shop-ownership are more accustomed to negotiation on a daily basis, and could therefore, be thought to possess certain negotiation-specific skills to settle on more favorable outcomes), and parents' education, among others.

That is, if subjects agree on a 62% and 38% split, we include both 0.62 and 0.38 in the regression. Thus, the errors associated with both the subjects in any given pair, will be correlated with each other.

Putting \({\Delta }^{j}\) before a variable indicates differencing that variable over the index j for any given pair (that is, by holding that pair i, fixed).

This is true since RelPos = 1 for the subject with a higher rank or a contraction advantage, and RelPos = − 1, for his/her partner, and we are looking at the difference between the two.

Direct differencing gives us: \(2{s}_{ih}-1=2{\alpha }_{1}{\mathrm{RankBar}g}_{i}+2{\alpha }_{2}{\mathrm{RandmContr}}_{i}+2{\alpha }_{3}{\mathrm{RankContr}}_{i}+ \left({\Delta }^{j}{{\varvec{X}}}_{ij}\right){\varvec{\upbeta}}+{{\Delta }^{j}\varepsilon }_{ij}\). On rearranging the terms and dividing this equation throughout by 2, gives us the expression shown. Note that we get identical estimates for fixed-effects and random-effects regressions. Our inferences are based on the more efficient standard errors.

On a closer look, this is one of the rare instances where using fixed-effects regressions actually eradicates problems related to autocorrelation (rather than contributing to them). Random-effects regressions (that further account for autocorrelation) and tobit regressions also produce almost identical results to those reported in this paper (with similar test results, and almost identical coefficient values for the significant variables of this paper) and can be made available on request (although neither adds significantly more to the existing discussion on our already established conclusions—we continue to reject Hypotheses 1 and 3, and as before do not reject Hypothesis 2).

Note that there is no institution dummy for St. Stephen's College in our specification. This is because, the following linear relation always holds:

RankBarg*RelPos + RandmContr*RelPos + RankContr*RelPos = FORE*RelPos + HansRaj*RelPos + Stephens*RelPos.

These results persist when we introduce further controls for: education levels attained by the subjects' parents; subjects' home income levels; whether subjects belong to business families; subjects' age; whether subjects lived in hostel etc. The introduction of institution dummies only confirms that subjects from different institutions reacted to treatments with some variation. Students from Hansraj College, for instance were perhaps more serious about the tests than those from the other institutions. In any given pair, the two subjects belonged to the same institution.

Note that in Panels 1 and 3, there are only 76 observations, whereas in Panel 2, there are 130 observations. This is because only 76 individuals belonged to the treatments that involved ranks and therefore had individual ranks (for the remaining 54, it was missing data). However, rank difference is defined to be zero for those in treatments that did not involve ranks (consistent with our definition of symmetry). Note also that the coefficient of individual rank is negative. This is because Rank 1 is considered higher than Rank 10. Thus, low rank values are associated with higher observed shares.

The share of the higher-ranked individual (on an average) in the rank-based bargaining treatment (T1) will be represented by α0 + α1 if he is only one position ahead of the subject he is paired with. It is α0 + 2α1 if he is two positions ahead and so on. The idea is exactly the same for the rank-based contraction treatment. The maximum observed rank difference for both the treatments (involving ranks) was 13.

Note that β > 0.

→ β > (β/2).

→ 1 + β > 1 + (β/2).

→ (1 + β)/[1 + (β/2)] > 1.

→ (1/2)⋅ (1 + β)/[1 + (β/2)] > (1/2).

→ (1 + β)/(2 + β) > (1/2).

References

Anbarci, N., & Feltovich, N. (2018). How fully do people exploit their bargaining position? The effects of bargaining institution and the 50–50 norm. Journal of Economic Behavior & Organization, 145, 320–334.

Anbarci, N., & Feltovich, N. (2013). How sensitive are bargaining outcomes to changes in disagreement payoffs? Experimental Economics, 16(4), 560–596.

Andreoni, J., & Vesterlund, L. (2001). Which is the fair sex? Gender differences in altruism. The Quarterly Journal of Economics, 116, 293–312.

Bacharach, S. B., & Lawler, E. J. (1981). Bargaining—power, tactics and outcomes. San Francisco: Jossey-Bass.

Ball, S., Eckel, C., Grossman, P., & Zame, W. (2001). Status in markets. The Quarterly Journal of Economics, 116(1), 161–188.

Bardsley, N., Cubitt, R., Loomes, G., Moffatt, P., Starmer, C., & Sugden, R. (2009). Experiments in economics: Rethinking the rules. Princeton: Princeton University Press.

Binmore, K. (2014). Bargaining and fairness. Proceedings of the National Academy of Sciences of the United States of America, 111(3), 10785–10788.

Binmore, K. (2007). Playing for real. Madison Ave: Oxford University Press.

Birkeland, S., & Tungodden, B. (2014). Fairness motivation in bargaining: A matter of principle. Theory and Decision, 77(1), 125–151.

Bolton, G. E., & Karagözoğlu, E. (2016). On the influence of hard leverage in a soft leverage bargaining game: The importance of credible claims. Games and Economic Behavior, 99, 164–179.

Bohnet, I., & Zeckhauser, R. (2004). Social comparisons in ultimatum bargaining. The Scandinavian Journal of Economics, 106(3), 495–510.

Bruce, C., & Clark, J. (2012). The impact of entitlements and equity on cooperative bargaining: An experiment. Economic Inquiry, 50(4), 867–879.

Bruyn, A. D., & Bolton, G. E. (2008). Estimating the influence of fairness on bargaining behavior. Management Science, 54(10), 1774–1791.

Buchan, N. R., Croson, R. T., & Johnson, E. J. (2004). When do fair beliefs influence bargaining behavior? Experimental bargaining in Japan and the United States. Journal of Consumer Research, 31(1), 181–190.

Camerer, C. (2003). Behavioral game theory: Experiments in strategic interaction. Princeton: Princeton University Press.

Cardenas, J., & Carpenter, J. (2008). Behavioral development economics: Lessons from field labs in the developing world. Journal of Development Studies, 44(3), 311–338.

Castillo, M., Petrie, R., Torero, M., & Vesterlund, L. (2013). Gender differences in bargaining outcomes: A field experiment on discrimination. Journal of Public Economics, 99, 35–48.

Crawford, V. P., Gneezy, U., & Rottenstreich, Y. (2008). The power of focal points is limited: Even minute payoff asymmetry may yield large coordination failures. The American Economic Review, 98(4), 1443–1458.

DeMartino, G. E., & McCloskey, D. N. (2016). Oxford handbook of professional economic ethics. Madison Ave: Oxford University Press.

Dubey P, Geanakoplos J (2005) Grading in games of status: Marking exams and setting wages. Cowles Foundation Discussion Papers 1544, Yale University

Feltovich N (2019) Is earned bargaining power more fully exploited? Journal of Economic Behavior and Organization (In press)

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Flinn, C. J., Todd, P. E., & Zhang, W. (2018). Personality traits, intra-household allocation and the gender wage gap. European Economic Review, 109, 191–220.

Henrich, N., & Henrich, J. (2007). Why humans cooperate: A cultural and evolutionary explanation. Madison Avenue: Oxford University Press.

Hoffman, E., McCabe, K., Shachat, K., & Smith, V. (1994). Preferences, property rights and anonymity in bargaining games. Games and Economic Behavior, 7(3), 346–380.

Huberman, B. A., Loch, C. H., & Önçüler, A. (2004). Status as a valued resource. Social Psychology Quarterly, 67, 103–114.

Kalai, E., & Smorodinsky, M. (1975). Other solutions to Nash’s bargaining problem. Econometrica, 43(3), 513–518.

Karagözoğlu, E., & Urhan, Ü. B. (2017). The effect of stake size in experimental bargaining and distribution games: A survey. Group Decision and Negotiation, 26(2), 285–325.

Maniadis, Z., Tufano, F., & List, J. A. (2014). One swallow doesn’t make a summer: New evidence on anchoring effects. The American Economic Review, 104(1), 277–290.

Moulin, H. (1988). Axioms of cooperative decision making. Cambridge: Cambridge University Press.

Moulin, H. (2003). Fair division and collective welfare. Massachusetts: MIT Press.

Muthoo, A. (1999). Bargaining theory with applications. Cambridge: Cambridge University Press.

Nash, J. (1950). The bargaining problem. Econometrica, 18(2), 155–162.

Nydegger, R. V., & Owen, G. (1974). Two-person bargaining: An experimental test of Nash’s axioms. International Journal of Game Theory, 3(4), 239–249.

Perles, M. A., & Maschler, M. A. (1981). Super additive solution for the Nash bargaining game. International Journal of Game Theory, 10(3), 163–193.

Peters, H., & vanDamme, E. (1991). Characterizing the Nash and Raiffa bargaining solutions by disagreement point axioms. Mathematical Operations Research, 16(3), 447–461.

Raiffa, H. (1953). Arbitration schemes for generalized two person games. In H. W. Kuhn & A. W. Tucker (Eds.), Contributions to the theory of games. Princeton University Press: Princeton.II

Roth, A. (1979). Axiomatic models of bargaining. Lecture notes in economics and mathematical systems. Berlin: Springer.

Roth, A. (1985). Game-theoretic models of bargaining. Cambridge: Cambridge University Press.

Rousu, M. C., Colson, G., Corrigan, J. R., Grebitus, C., & Loureiro, M. L. (2015). Deception in experiments: Towards guidelines on use in applied economics research. Applied Economic Perspectives and Policy, 37(3), 524–536.

Smith, V. (2008). Rationality in economics: Constructivist and ecological forms. New York: Cambridge University Press.

Sutter, M., Bosman, R., Kocher, M. G., & Winden, F. (2009). Gender pairing and bargaining—beware the same sex! Experimental Economics, 12, 318–331.

Thomson, W. (1994). Cooperative models of bargaining. In R. J. Aumann & S. Hart (Eds.), Handbook of game theory with economic applications (pp. 1237–1284). New York: Elsevier.

Yu, P. L. (1973). A class of solutions for group decision problems. Management Science, 19, 936–946.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original version of this article was revised: Part of the equation in sub-section “Key findings” was missed. Now, it has been corrected.

For all the support, valuable inputs and feedback, I thank John List, Arunava Sen, Ariel Rubinstein, Lata Gangadharan, Keith Ericson, Bharat Ramaswami, Debasis Mishra, Dilip Mookherjee, Seema Jayachandran, Abhiroop Mukhopadhyay, Jacques-François Thisse, Margaret Slade, Marilda Sotomayor, Eswaran Somanathan, Penélope Hernández, Prabal Roy Chowdhury, Lionel Page, Martin Cripps, Joël van der Weele, Uwe Dulleck, and Gigi Foster. I also thank Anjan Mukherji, Botond Kőszegi and Alan Sorensen for their interest and encouragement. I am grateful to the Planning and Policy Research Unit (PPRU) for the generous grant to support this research; and acknowledge the efforts of our programmer Dushyant Rai for the use of z-Tree software for a part of the experiment. Our coordinator Priyanka Kothari, and all the z-Tree web-group members went out of their way to help us whenever needed. This research has also benefited from the comments received at the UECE Meetings in Game Theory and Applications, Lisbon (Instituto Superior Economia e Gestão, 2013); the Annual Conference on Economic Growth and Development, New Delhi (Indian Statistical Institute, 2013); the IGC-ISI Summer School in Development Economics, New Delhi (Indian Statistical Institute, 2014); the Latin American Meeting of the Econometric Society, São Paulo (University of São Paulo, 2014); the Australasian Development Economics Workshop (University of New South Wales, 2017); the Royal Economic Society Annual Conference (University of Sussex, 2018). Finally, I extend my sincerest gratitude to two anonymous referees who have given my paper its final shape. This paper was previously titled 'Set contractions and bargaining outcomes: An experiment'.

Appendices

Appendix 1: Thought experiment

Appendix 2: Test details

Appendix 3: Working of sample size for the control group

Let the ith pair of shares be (\(x_{1}^{i}\),\(x_{2}^{i}\)), where \(x_{1}^{i}\) + \(x_{2}^{i}\) = 1. Since |\(x_{1}^{i}\) – 0.5| =|\(x_{2}^{i}\) – 0.5|, we can define, without loss of generality Zi =|\(x_{1}^{i}\) – 0.5|. Then let \(\overline{Z}\) = \(\frac{{Z_{1} + \cdots + Z_{n} }}{n}\) (where n is the number of observed pairs). \(\overline{Z}\) measures the average deviation of the negotiated shares from the equal division solution (0.5, 0.5). Suppose that the population mean of this variable is μ. Now, consider the test of the null hypothesis that μ0 = 0 (i.e. the equal division solution is the population mean). The question is: what would be the minimum sample that is required for such a test to have reasonable power against an alternative hypothesis that the population mean is μ1 > 0? We consider the alternative hypothesis to be μ1 = 0.02. It is clear that the sample size that has reasonable power for this alternative hypothesis would also have at least that much power for any μ1 > 0.02. We do not make any assumption(s) on the distribution of Zi (and therefore \(\overline{Z}\)) under the null or the alternate hypothesis (Maniadis et al. 2014).

Let α be the size of the type-I error. Let c be a non-negative constant such that P(\(\overline{Z}\) – μ0 > c |μ = μ0) ≤ α. In other words, the null is rejected whenever \(\overline{Z}\) > μ0 + c. To determine c as a function of α and n, we note the following inequalities (the first one of which is P(\(\overline{Z }\) ≤ μ0 + c) ≥ P(μ0 – c ≤ \(\overline{Z}\) ≤ μ0 + c) ≥ P(μ0 – c < \(\overline{Z }\) < μ0 + c)).

We combine the two inequalities above as follows

Thus, the probability of a Type-I error does not exceed α when c = \(\frac{{\sigma_{Z} }}{{\sqrt {\alpha n} }}\). Now we turn to Type II error (which should not exceed β).

Now μ0 = 0, and we substitute for c from (4), we get

Note that for any k, we know from Chebyshev’s inequality that

We now take k = μ1 – \(\frac{{\sigma_{Z} }}{{\sqrt {\alpha n} }}\) in the above inequality to get

But

The LHS above spans more values since:

On combining the inequalities (5) and (6), we get

Thus, the probability of a Type II error does not exceed β when \(\frac{{\sigma_{Z}^{2} }}{{nk^{2} }}\) = β. Substituting for k = μ1 – \(\frac{{\sigma_{Z} }}{{\sqrt {\alpha n} }}\), we get

In this expression, we fix the probabilities of Type I error (α) and Type II error (β) to be 0.05 and 0.10 respectively. We take μ1 = 0.02. The only limitation is that we do not know the value of \(\sigma_{Z}\). To estimate \(\sigma_{Z}\), we use a pilot study that had 14 subjects (7 pairs) in the control group. In this sample, \(\widehat{{\sigma_{Z} }}\) = 0.0075592. Using this value gives us n* = 8.33 ≈ 9 pairs (18 subjects). Note that c equals 0.01 for this value of n. In other words, with just 18 subjects, we can be 95% confident that the average outcome is the 50–50% split (and not a 51–49% split).

Appendix 4: Derivations of the bargaining solutions

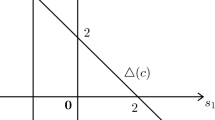

The axioms of symmetry and efficiency together, in the Nash and the KS bargaining framework, are sufficient to guarantee that X and Y get 50% each (of the pie). We verify this in our context where our agents X and Y receive payoffs x and y, with x + y = 1. I assume a zero disagreement–payoff vector. The feasible set of interest is shown in the shaded region of Fig. 1a.

The symmetric Nash solution: This solution can be formulated as follows (ignoring the non-negativity constraint)

which is the same as the following problem

which involves feeding the constraint into the objective function. The solution to the above problem x = y = 1/2 is our unique (symmetric) Nash Bargaining solution.

The symmetric Kalai–Smorodinsky solution: The coordinates of the ideal point are given by (1, 1). The equation of the line joining the disagreement payoff (0, 0) and the ideal point is given by

feeding the constraint (y = 1 − x) into which gives us x = 1 − x, or x = y = 1/2 as our KS solution.

To summarize, for a symmetric game involving the division of a given pie size (say $1) in the absence of any (favorable) contraction, theory (Nash, KS and others) predicts an equal split i.e. both the individuals X and Y, get to keep 50 cents each.

The asymmetric Nash solution: For individual X with a higher bargaining power β, this allocation rule that puts more weight on agent X’s payoff, is formulated as follows.

The solution to the above problem is x = (1 + β)/(2 + β) > 1/2.Footnote 28 In other words, the agent with a higher bargaining power gets the higher share.

The asymmetric Kalai–Smorodinsky solution: Here, agent X’s higher bargaining power (β) can be captured in a different way. This solution concept is explained in Fig. 2. The equation of the line joining the disagreement payoff and the ideal point (1 + β, 1) is given by

Feeding the constraint (y = 1 − x) into which again gives us x = (1 + β)/(2 + β) > 1/2 (the person with a higher bargaining power gets the higher share). Both the solutions predict the same asymmetric outcome in the presence of asymmetric bargaining power. Note that putting β = 0 above gives back the symmetric solution.

The symmetric Kalai–Smorodinsky solution with contraction: There is a cap on individual Y′s payoff equivalent to 1 − α. The coordinates of the ideal point now become (1, 1 − α). The equation of the line that intersects this point with the disagreement payoff is given by

x > y. Finally, using the constraint y = 1 − x gives us xKS = 1/(2 − α);∀ α ∈ [0,1], the Nash solution is given as

The KS solution (written below) is therefore, different from Nash when there is feasible set contraction.

Asymmetric bargaining in the presence of contraction: The Nash solution remains as above but the KS solution changes to xKS = (1 + β)/(2 + β − α). Note again that in the absence of asymmetry (β = 0), the KS solution above is identical to the one involving only contraction.

Appendix 5: Instructions to candidates

Rights and permissions

About this article

Cite this article

Banerjee, S. Effect of reduced opportunities on bargaining outcomes: an experiment with status asymmetries. Theory Decis 89, 313–346 (2020). https://doi.org/10.1007/s11238-020-09754-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-020-09754-4