Abstract

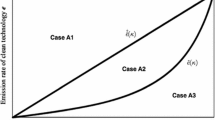

This study compares the utilization of energy and emission taxes as instruments of pollution control and the promotion of advanced abatement technology adoption in a Cournot oligopoly. We examine multistage games in which the government sets the environmental tax rate. Oligopolistic firms may produce two outputs, a final consumption good, whose production causes pollution, and an abatement product, which reduces pollution. Each firm has two types of abatement technology available. One, which we call “standard,” can be utilized without incurring any fixed cost. The other, which we call “advanced,” requires a fixed cost of adoption. The advanced technology is more efficient than the standard technology. We show that the effectiveness of either type of tax depends on the shape of the multiproduct technology. In the absence of economies of scope in the production of energy and abatement, the energy tax reduces pollution, but it is ineffective in promoting technological change. The emission tax, on the other hand, reduces pollution and it is effective in promoting technological change for sufficiently small fixed costs of adoption. In the presence of economies of scope, both types of taxes are effective whenever taxation is necessary for innovation to occur. However, in terms of innovation incentives, the energy tax outperforms the emission tax.

Similar content being viewed by others

Notes

See OECD (2005), https://stats.oecd.org/glossary/detail.asp?ID=6437.

We assume throughout that \(\chi\) is not sufficiently negative to avoid a situation in which average cost is negative in the setting with no environmental regulation.

We use superscripts “1”, “2”, and “3” to denote no tax regime, energy tax regime, and emission tax regime, respectively.

In the absence of economies of scope, no firm has incentive to produce abatement and adopt the advanced technology, because firm profits decrease in \(a_{i}\). In the presence of economies of scope, if \(n \ge 4,\) no firm has incentive to produce abatement and adopt the advanced technology, because \(\left. {\pi_{i} \left( n \right)} \right|_{{a_{i} = 0}} > \left. {\pi_{i} \left( {1,0;{\mathbf{1}},\chi ,n} \right)} \right|_{{a_{i} > 0}}\) and \(\left. {\pi_{i} \left( n \right)} \right|_{{a_{i} = 0}} > \left. {\pi_{i} \left( {{1 \mathord{\left/ {\vphantom {1 2}} \right. \kern-\nulldelimiterspace} 2},1;{{\mathbf{1}} \mathord{\left/ {\vphantom {{\mathbf{1}} {\mathbf{2}}}} \right. \kern-\nulldelimiterspace} {\mathbf{2}}},\chi ,n,f} \right)} \right|_{{a_{i} > 0}}\), as shown in Sect. 4.

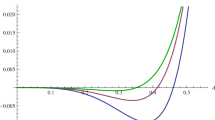

In Subsect. 5.2, we compare firm profits, consumer surpluses, environmental damage, and social welfare under the following three regimes: no tax, energy tax, and emission tax regimes. We assume \(\tilde{f} = 0.00018.\) Both energy and emission taxes promote the advanced abatement technology in the presence of economies scope at \(\tilde{f} = 0.00018.\) Assuming \(\tilde{f} = 0.00018,\) we can examine the effectiveness of taxation to observe how taxes could improve the surpluses compared to the no tax regime.

References

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2012). The environment and directed technical change. American Economic Review, 102(1), 131–166.

Bailey, E. E., & Friedlaender, A. F. (1982). Market structure and multiproduct industries. Journal of Economic Literature, 20(3), 1024–1048.

Bovenberg, A. L., & Goulder, L. H. (2002). Environmental taxation and regulation. In A. J. Auerbach & M. Feldstein (Eds.), Handbook of Public Economics (Vol. 3, pp. 1471–1545). The Netherland: Elsevier.

Cremer, H., & Gahvari, F. (2001). Second-best taxation of emissions and polluting goods. Journal of Public Economics, 80(2), 169–197.

Cremer, H., & Gahvari, F. (2002). Imperfect observability of emissions and second-best emission and output taxes. Journal of Public Economics, 85(3), 385–407.

Downing, P. B., & White, L. J. (1986). Innovation in pollution control. Journal of Environmental Economics and Management, 13(1), 18–29.

Fowlie, M. (2010). Emissions trading, electricity restructuring, and investment in pollution abatement. American Economic Review, 100(3), 837–869.

Hartman, R. S., Wheeler, D., & Singh, M. (1997). The cost of air pollution abatement. Applied Economics, 29(6), 759–774.

Jaffe, A. B., Newell, R. G., & Stavins, R. N. (2002). Environmental policy and technological change. Environmental and Resource Economics, 22(1–2), 41–69.

Johnstone, N., Labonne, J., & Thevenot, C. (2008). Environmental policy and economies of scope in facility-level environmental practices. Environmental Economics and Policy Studies, 9(3), 145–166.

Jung, C., Krutilla, K., & Boyd, R. (1996). Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. Journal of Environmental Economics and Management, 30(1), 95–111.

Katsoulacos, Y., & Xepapadeas, A. (1996). Emission taxes and market structure. In C. Carraro, Y. Katsoulacos, & A. Xepapadeas (Eds.), Environmental policy and market structure (pp. 3–22). The Netherlands: Springer.

Milliman, S. R., & Prince, R. (1989). Firm incentives to promote technological change in pollution control. Journal of Environmental Economics and Management, 17(3), 247–265.

Organisation for Economic Co-operation and Development (2005). Glossary of Statistical Terms: Environmental Taxes.https://stats.oecd.org/glossary/detail.asp?ID=6437. Accessed July 5, 2015.

Organisation for Economic Co-operation and Development. (2010). Taxation, innovation and the environment. Paris: OECD.

Panzar, J. C., & Willig, R. D. (1981). Economies of scope. American Economic Review, 71(2), 268–272.

Requate, T., & Unold, W. (2003). Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up?”. European Economic Review, 47(1), 125–146.

Schmutzler, A., & Goulder, L. H. (1997). The choice between emission taxes and output taxes under imperfect monitoring. Journal of Environmental Economics and Management, 32(1), 51–64.

Acknowledgements

We are very grateful for helpful and insightful comments by Yasunori Ouchida. Our paper has greatly benefited from comments and suggestions made by anonymous referees. Financial support from the Japan Society for the Promotion of Science KAKENHI (Grant No. 25780166) is greatly appreciated.

Funding

This study was funded by the Japan Society for the Promotion of Science KAKENHI (Grant Number. 25780166).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We declare that we have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Aoyama, N., Silva, E.C.D. Abatement innovation in a Cournot oligopoly: emission versus output tax incentives. JER 73, 325–350 (2022). https://doi.org/10.1007/s42973-020-00047-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-020-00047-7