Abstract

This paper introduces costly product differentiation into a mixed duopoly with strategic location choice in the first stage and price competition in the second stage. Initially, both firms locate at the center with no product differentiation. We demonstrate that the location choices critically depend on the effectiveness of investments in creating product differentiation, and the nationality of the private firm. Firstly, firms choose to move toward the edge only when the investments are sufficiently effective, regardless of whether the private firm is domestic or foreign. Secondly, a profit-maximizing (domestic or foreign) private firm invests more than the public firm which maximizes social welfare. Thirdly, a mixed duopoly with a foreign firm generates a lower degree of product differentiation in comparison to that with a domestic private firm.

Similar content being viewed by others

Notes

For some well-known products such as Coca-Cola and Pepsi, investments in advertising, packaging, and other marketing activities may help to differentiate them among new (young) consumers. For some other products such as paper towels, liquid soaps, salts, breakfast cereals, potato chips, and so on, advertising and packaging investments apparently have a significant effect on creating product differentiation in the eyes of consumers.

Horizontal product differentiation through advertising and packaging is more often observed for products discussed in footnote 1.

The authors showed that, under Bertrand competition, (i) the private firm takes a free ride on the investments by the public firm when investments are sufficiently effective; (ii) products are more (less) differentiated in a mixed duopoly than a private duopoly when investments are effective (ineffective); and (iii) furthermore, products are more likely to be differentiated under Bertrand competition than under Cournot competition.

Detailed comparisons and discussions are provided in the following sections.

An alternative setting is to consider a circular city in which the two firms initially locate at the same point (i.e., no ex-ante product differentiation). Similar analysis mirroring those in the current model suggests that our main results are robust in a circular city model without the assumption on the initial location. Details on the description of the alternative model and its analysis are available on request.

If firms are initially located at some other point rather than the center, our results in the benchmark model: (i) no firms invest in product differentiation when investments are very ineffective, and (ii) a profit-maximizing (domestic or foreign) private firm invests more than the public firm when investments are effective, will not qualitatively change.

In our paper, both firms can use advertising and other costly marketing activities to create horizontal product differentiation, represented by location choices in the linear city. Different from Matsumura and Sunada (2013) which introduce persuasive advertising with demand expansion effect, marketing activities such as advertising in our model only affect the individual demand of each firm, while keeping the market demand unchanged.

For example, in the mineral water industry, Nongfu Spring in China, which is a private firm, made a substantial amount of advertisements on TV and public electronic displayers. Also, Nongfu Spring changed its packaging often with different popular television characters and quotations. However, its competitor Cestbon, owned by a public firm, invested less on advertising, packaging, and other marketing activities that “creates” product differentiation.

We thank an anonymous reviewer for pointing out this direction.

References

Bárcena-Ruiz JC, Javier Casado-Izaga F, Hamoudi H (2014) Optimal zoning of a mixed duopoly. Ann Reg Sci 52:141–153

Brander JA, Spencer BJ (2015) Intra-industry trade with Bertrand and Cournot oligopoly: the role of endogenous horizontal product differentiation. Res Econ 69:157–165

Cremer H, Marchand M, Thisse J-F (1991) Mixed oligopoly with differentiated products. Int J Ind Organ 9:43–53

d’Aspremont C, Jaskold Gabszewicz J, Thisse J-F (1979) On hotelling’s stability in competition. Econometrica 47:1145–1150

De Giovanni F, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxf Econ Pap 41:302–311

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29:737–742

Haraguchi J, Matsumura T (2014) Price versus quantity in a mixed duopoly with foreign penetration. Res Econ 68(4):338–353

Haraguchi J, Matsumura T (2016) Cournot–Bertrand comparison in a mixed oligopoly. J Econ 117:117–136

Heywood JS, Ye G (2009) Mixed oligopoly and spatial price discrimination with foreign firms. Reg Sci Urban Econ 39:592–601

Heywood JS, Ye G (2010) Optimal Privatization in a Mixed Duopoly with Consistent Conjectures. J Econ 101:231–246

Hinloopen J, Martin S (2017) Costly location in hotelling duopoly. Res Econ 71:118–128

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Inoue T, Kamijo Y, Tomaru Y (2009) Interregional mixed duopoly. Reg Sci Urban Econ 39:233–242

Ishibashi I, Matsumura T (2006) R&D competition between public and private sectors. Eur Econ Rev 50:1347–1366

Ishida J, Matsushima N (2004) A noncooperative analysis of a circular city model. Reg Sci Urban Econ 34:575–589

Kitahara M, Matsumura T (2013) Mixed duopoly, product differentiation and competition. Manch Sch 81:730–744

Liu L, Henry Wang X, Zeng C (2020) Endogenous horizontal product differentiation in a mixed duopoly. Rev Ind Organ 56(3):435–462

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70(3):473–483

Matsumura T, Matsushima N (2003) Mixed duopoly with product differentiation: sequential choice of location. Aust Econ Pap 42:18–34

Matsumura T, Matsushima N (2004) Endogenous cost differentials between public and private enterprises: a mixed duopoly approach. Economica 71:671–688

Matsumura T, Matsushima N (2009) Cost differentials and mixed strategy equilibria in a hotelling model. Ann Reg Sci 43:215–234

Matsumura T, Ogawa A (2012) Price versus quantity in a mixed duopoly. Econ Lett 116:174–177

Matsumura T, Sunada T (2013) Advertising competition in a mixed oligopoly. Econ Lett 119(2):183–185

Matsumura T, Tomaru Y (2013) Mixed duopoly, privatization, and subsidization with excess burden of taxation. Can J Econ 46(2):526–554

Matsumura T, Tomaru Y (2015) Mixed duopoly, location choice, and shadow cost of public funds. South Econ J 82(2):416–429

Matsumura T, Ohkawa T, Shimizu D (2005) Partial agglomeration or dispersion in spatial Cournot competition. South Econ J 72(1):224–235

Matsushima N, Matsumura T (2006) Mixed oligopoly, foreign firms, and location choice. Reg Sci Urban Econ 36:753–772

Mayer T (2000) Spatial Cournot competition and heterogeneous production costs across locations. Reg Sci Urban Econ 30:325–352

Ogawa H, Sanjo Y (2007) Location of public firm in the presence of multinational firm: a mixed duopoly approach. Aust Econ Pap 46:191–203

Pal D, White MD (1998) Mixed oligopoly, privatization, and strategic trade policy. South Econ J 65:264–281

Tomaru Y, Wang LFS (2018) Optimal privatization and subsidization policies in a mixed duopoly: relevance of a cost gap. J Inst Theor Econ 174:689–706

Wang LFS, Zeng C (2019) Licensing, entry, and privatization. Int Rev Econ Finance 62:230–239

Ye G, Wenbin W (2015) Privatization and merger in a mixed oligopoly with spatial price discrimination. Ann Reg Sci 54:561–576

Acknowledgements

We thank the editor, Hong Sok Kim, and two anonymous reviewers for their constructive comments. We also thank Leonard F.S. Wang, Joanna Poyago-Theotoky, Sang-Ho Lee as well as seminar participants at the 5th International Workshop on Mixed Oligopolies in Japan for their helpful comments. Financial support from the Humanity and Social Science Planning Foundation of the Ministry of Education of China (Grant No. 20YJA790001), Soft Science Foundation of Science and Technology Department of Guangdong, China (Grant No. 2019A101002019), and China Postdoctoral Science Foundation Funded Project(2019T120760) are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

(i). At \(d_1=1/2\) and \(d_2=1/2\), the profit of firm 2 is \(\pi _2({1}/{2}, {1}/{2})=0\) and the social welfare is \({\text {SW}}({1}/{2}, {1}/{2})=s-{t}/{12}\). We first show that firm 2 obtains no incentive to choose \(d_2<1/2\) given \(d_1=1/2\), which holds when

for any \(d_2<1/2\). Rearranging (22) leads to

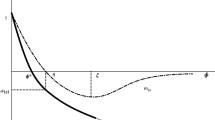

Apparently, \(f(d_2)\) is a decreasing function of \(d_2\), and

As a result, firm 2 has no motivation to move away from 1/2 if \(\beta t\le 4\).

We next prove that firm 1 obtains no incentive to choose \(d_1<1/2\) given \(d_2=1/2\). That is, \({\text {SW}}(d_1, 1/2)\le {\text {SW}}(1/2, 1/2)\), which can be obtained as the following after simple calculations

Rearranging (23) leads to

Apparently, \(g(d_1)\) is a decreasing function of \(d_1\), and

As a result, firm 1 has no motivation to move away from 1/2 if \(\beta t\le 4\).

(ii). We first prove that if \(4<\beta t\le 8\), firm 1 has no incentive to move away from 1/2 when firm 2 chooses \(d_2\in [{2}/{5}, {1}/{2})\). As before, we need to show that \({\text {SW}}(d_1, d_2)<{\text {SW}}(1/2, d_2)\) for \(d_2\in [{2}/{5}, {1}/{2})\), where

After simple calculations, \({\text {SW}}(d_1, d_2)<{\text {SW}}(1/2, d_2)\) reduces to

It is easy to obtain that \(h(d_1, d_2)\) decreases with \(d_1\) and \(d_2\) for all \(d_1<{1}/{2}\) and \(d_2< {1}/{2}\). Furthermore,

Thus, firm 1 will stay at the center if \(4<\beta t\le 8\).

Next, we show that firm 2 chooses \(d_2\in [{2}/{5}, {1}/{2})\) when \(d_1={1}/{2}\). We have that

Differentiating (24) with respect to \(d_2\) leads to

which implies that \(d_2\) decreases with \(\beta t\) when \(\beta t\in (4, 8]\). We thus obtain that \(d_2\in [{2}/{5}, {1}/{2})\).

(iii). By (9) and (10), we obtain that \(d_1=d_2\rightarrow 1/4\) when \(\beta t \rightarrow +\infty \). After the usual straightforward calculations mirroring those in the proof of part (ii), we obtain that firm 1 will choose \(d_1\in ({1}/{4}, {1}/{2})\). Following (9) and (10), further calculations yield that

We then obtain that firm 2 will choose \(d_2\in ({1}/{4}, {2}/{5})\).

1.2 Proof of Proposition 3

The calculations mirror those in the previous proof for Proposition 1.

(i). We first show that firm 2 obtains no incentive to choose \(d_2<1/2\) given \(d_1=1/2\), which holds when

After simple calculations, the above inequality reduces to

Apparently, \(f(d_2)\) is a decreasing function of \(d_2\), and

As a result, firm 2 has no motivation to move away from 1/2 if \(\beta t\le 16\).

Firm 1 obtains no incentive to choose \(d_1<1/2\) given \(d_2=1/2\) if \({\text {SW}}(d_1, 1/2)\le {\text {SW}}(1/2, 1/2)\), which can be reduced to

If \(-23+98d_1-100d_1^2-8d_1^3\le 0\), the inequality automatically holds; on the other hand, if \(-23+98d_1-100d_1^2-8d_1^3>0\), we need

Notice that \(g(d_1)\) is a decreasing function of \(d_1\). Hence, we have

As a result, firm 1 has no motivation to move away from 1/2 if \(\beta t\le 16\).

(ii). We first prove that if \(16<\beta t\le 32\), firm 1 has no incentive to move away from 1/2 when firm 2 chooses \(d_2\in [{2}/{5}, {1}/{2})\). As before, we need to show that \({\text {SW}}(d_1, d_2)<{\text {SW}}(1/2, d_2)\) for \(d_2\in [{2}/{5}, {1}/{2})\), where

After simple calculations, \({\text {SW}}(d_1, d_2)<{\text {SW}}(1/2, d_2)\) reduces to

It is easy to obtain that \(h(d_1, d_2)<0\) for all \(d_1\in (0,1/2)\) and \(d_2\in [2/5,1/2)\). Thus, firm 1 will never move to \(d_1<1/2\) given \(d_2\in [2/5,1/2)\).

Next, we show that firm 2 chooses \(d_2\in [{2}/{5}, {1}/{2})\) when \(d_1={1}/{2}\). We have that

Differentiating (27) with respect to \(d_2\) leads to

which implies that \(d_2\) decreases with \(\beta t\) when \(\beta t\in (16, 32]\). We thus obtain that \(d_2\in [{2}/{5}, {1}/{2})\).

(iii) By (14) and (15), we obtain that \(d_1\rightarrow 0.47\) and \(d_2\rightarrow 0.18\) when \(\beta t \rightarrow +\infty \). After the usual straightforward calculations mirroring those in the proof of part (ii), we obtain that firm 1 will choose \(d_1\in (0.47, 0.5)\). Following (14) and (15), further calculations yield that

We then obtain that firm 2 will choose \(d_2\in (0.18, 0.4)\).

1.3 Proof of Proposition 4

It is obvious from (21) that \(d_i^*>0\) and it decreases with \(\beta \). By setting \(({\sqrt{1+\frac{96}{\beta t}}-1})/{8}=1/2\), we obtain that \(\beta =4/t\). As a results, \(d_i^*=1/2\) if \(\beta \le 4/t\); otherwise, \(0<d_i^*<1/2\).

1.4 Proof of Proposition 5

Firstly, we show that \((d_1^*+d_2^*)|_{\mathrm {Case\, I}}\le (d_1^*+d_2^*)|_{\mathrm{Case\,II}}\). To this end, we rewritten the equilibrium locations under private duopoly from (21) as the following:

-

(i).

if \(\beta t \le 4,\) we have that \(d_1^*=d_2^*=1/2\);

-

(ii).

if \(4<\beta t \le 8,\) we have that \(0.33\le d_1^*=d_2^*<1/2\);

-

(iii).

if \(8<\beta t\le 12,\) we have that \(1/4\le d_1^* =d_2^*<0.33\);

-

(iv).

if \(\beta t >12\) we have that \(0< d_1^* =d_2^*<1/4.\)

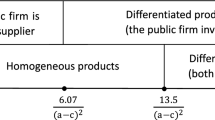

By looking at Proposition 2, it is obvious that (a) when \(\beta t \le 4\), \((d_1^*+d_2^*)|_{\mathrm{Case\,I}}=(d_1^*+d_2^*)|_{\mathrm{Case\,II}}\), and (b) when \(\beta t > 12\), \((d_1^*+d_2^*)|_{\mathrm{Case\,I}}<(d_1^*+d_2^*)|_{\mathrm{Case\,II}}\). Thus, we only need to prove that \((d_1^*+d_2^*)|_{\mathrm{Case\,I}}<(d_1^*+d_2^*)|_{\mathrm{Case\,II}}\) when \(4<\beta t <12\).

For \(4<\beta t \le 8\), we observe that \(d_1^*|_{\mathrm{Case\,I}}<d_1^*|_{\mathrm{Case\,II}}\). Furthermore, by (21) and (25), we obtain that \(d_2^*|_{\mathrm{Case\,I}}<d_2^*|_{\mathrm{Case\,II}}\) after standard calculations. As a result, \((d_1^*+d_2^*)|_{\mathrm{Case\,I}}<(d_1^*+d_2^*)|_{\mathrm{Case\,II}}\) holds for \(4<\beta t \le 8\).

For \(8<\beta t \le 12\), we have \(0.25\le d_1^*=d_2^*<0.33\) in Case I, and \(0.44 \le d_1^* <0.5\), and \(0.36\le d_2^* <0.4\) in Case II. It is straightforward to see that \(d_1^*|_{\mathrm{Case\,I}}<d_1^*|_{\mathrm{Case\,II}}\) and \(d_2^*|_{\mathrm{Case\,I}}<d_2^*|_{\mathrm{Case\,II}}\). It thus follows that \((d_1^*+d_2^*)|_{\mathrm{Case\,I}}<(d_1^*+d_2^*)|_{\mathrm{Case\,II}}\) holds for \(8<\beta t \le 12\).

Secondly, we show that \((d_1^*+d_2^*)|_{\mathrm{Case\,II}}<(d_1^*+d_2^*)|_{\mathrm{Case\,III}}\). From Proposition 1 and Proposition 3, we have \((d_1^*+d_2^*)|_{\mathrm{Case\,II}}\le (d_1^*+d_2^*)|_{\mathrm{Case\,III}}\) for all \(\beta t \le 32\). Next, we will prove \((d_1^*+d_2^*)|_{\mathrm{Case\,II}}<(d_1^*+d_2^*)|_{\mathrm{Case\,III}}\) for \(\beta t > 32\).

Simple calculations yield that \(0.25<d_1^*<0.35\) and \(0.25<d_2^*<0.29\) in Case II. Furthermore, from Proposition 3, we have that \(0.47<d_1^*<0.5\) and \(0.18<d_2^*<0.4\) in Case III. Notice that the upper limit of \(d_1^*+d_2^*\) in Case II is smaller than the lower limit of \(d_1^*+d_2^*\) in Case III. As a result, \((d_1^*+d_2^*)|_{\mathrm{Case\,II}}<(d_1^*+d_2^*)|_{\mathrm{Case\,III}}\) holds.

1.5 Proof of Proposition 6

Recall that both firms charge equal prices in equilibrium in both Case I and Case II. The demand of firm 1 is thus \(x^*=\frac{1+d_1-d_2}{2}\). We then write down social welfare as

The socially optimal locations solve the following first-order conditions:

Notice that the first-order condition in (29) is the same as that in (10). We then evaluate (30) at the equilibrium location choices under a mixed duopoly in (9), and obtain that

Hence, a decrease in \(d_2\) reduces social welfare. We next show that the private firm invests more on product differentiation in a private duopoly than that in a mixed duopoly. Evaluating \(\partial \pi _2/\partial d_2\) in (9) at the equilibrium location choices under a private duopoly in (20) leads to that

which indicates that \(d_2^*|_{\mathrm{Case\,II}}>d_2^*|_{\mathrm{Case\,I}}\). As a result, \({\text {SW}}^*|_{\mathrm{Case\,I}}<{\text {SW}}^*|_{\mathrm{Case\,II}}\).

Rights and permissions

About this article

Cite this article

Ma, H., Wang, X.H. & Zeng, C. Location choice and costly product differentiation in a mixed duopoly. Ann Reg Sci 66, 137–159 (2021). https://doi.org/10.1007/s00168-020-01014-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-020-01014-1