Abstract

In this paper, the effect of local bank branch closures on new firm formation in Sweden is analysed using a panel database that captures the geographical locations of all Swedish bank branches in 2007 and 2013. The previous research has shown that the further a firm is located away from the bank, the higher the monitoring costs will be for the banks. Furthermore, an increase in the distance to the banks will also increase information asymmetry because of the banks’ eroded ability to collect and analyse soft information. Due to the high risks associated with the lack of information and uncertainty, banks might not be as willing to extend credits to a distant firm compared to a nearby firm. Using spatial econometric analysis at a municipal level, it is shown that bank proximity to firms, unemployment rate, industry structures, income growth, change in housing price and percentage of immigrants are vital for new firm formation in Sweden. From the spatial Durbin model with fixed effects, an increase in the weighted distance to the nearest bank branches is shown to affect new firm formation negatively.

Similar content being viewed by others

1 Introduction

Over the past 20 years, a common practice within banks around the developed world has been to shut down local bank branches (Morrison and O’Brien 2001; Cole et al. 2004; Nguyen 2015). This practice results in banks becoming more geographically concentrated in financial centres, dynamic regions and metropolitan areas (Alessandrini et al. 2009). The factors that contribute to the decline of bank branches outside of metropolitan areas are the high operating costs of bank branch networks, new regulations, the advent of new financial technology and online banking services (Argent and Rolley 2000; Dick 2006). However, the disappearance of banks could potentially be unfavourable to entrepreneurs in the countryside as both proximity to banks and personal relationships are very important for small businesses to gain access to credits (Petersen and Rajan 2002; Agarwal and Hauswald 2010).

Especially in the countryside, a relatively larger proportion of entrepreneurs within cash-dependent sectors such as tourism and retail might have greater problems than entrepreneurs in other industries when the local bank branch is closed down (Leyshon et al. 2008; Berggren and Silver 2010). In addition, institutional venture capital tends to be concentrated in financial centres and metropolitan regions, which leaves remote regions at a greater disadvantage when applying for funding of comparable projects (Mason and Harrison 1995; Mason et al. 2016; Fili et al. 2013). Thus, the closure of bank branches outside of metropolitan areas is a potentially problematic issue for firms in several industries.

Whether in or outside of metropolitan areas, many entrepreneurial ventures have difficulties acquiring funding from external sources in the early stages of the development (Casey and O’Toole 2014; Townsend and Busenitz 2015). Only a very small number of new ventures are likely to attract venture capital, as venture capitalists tend to be highly selective (Cumming and Dai 2010). Besides, in many countries, bank financing constitutes the main source of external financing in many entrepreneurial ventures, particularly in the funding of day-to-day activities (Cassar 2004; Beck et al. 2011; Hernández-Cánovas and Martínez-Solano 2010). The limited access to external finance is exacerbated by the closure of bank branches since banks are usually the sole external capital provider outside of metropolitan areas (French et al. 2008). Hence, a firm located far from the bank can face an even more limited selection of financial options.

Even as geographical disparities exist, there is not yet a universal consensus that geographical disparities can have an important impact on new firm formation, especially in deprived areas. A lot of research has been undertaken on regional equity gaps in the supply of venture capital, which is mostly concentrated in metropolitan regions (Sorenson and Stuart 2001; Chemmanur et al. 2016). On the other hand, much more work is needed to investigate the regional gap in demand and supply when it comes to financing from the bank. Based on a recent survey done by the Swedish Agency for Economic and Regional Growth, almost 30% of Swedish small and medium-sized enterprises (SMEs) have applied for a bank loan in the last three years. In comparison, 13% of SMEs borrowed money from family and friends and 10% searched for external equity (Tillväxtverket 2017). Thus, bank finance is the preferred and most important external source of finance for Swedish SMEs. Therefore, it would be highly policy relevant to investigate geographical disparities in the availability of banks as a source of entrepreneurial finance.

This paper adds to the research on bank branch closure and entrepreneurship by investigating the effect of bank branch closure on new firm formation. The phenomenon of bank branch closure is analysed using the increase in the weighted distance to banks, which is an effect of the closure of bank branches. The role of proximity to banks is studied in relation to its potential to bridge the regional equity gap, especially in regions that have limited access to venture capital and business angels (Mason and Harrison 1995; Backman 2015).

The organisation of the paper is as follows: Sect. 2 presents previous related studies, the data and the variables are presented in Sect. 3, and in Sect. 4, the empirical results are presented and discussed. Section 5 concludes with the implications of the study.

2 Previous studies

2.1 The Swedish banking market

The Swedish banking market is characterised by a tight oligopoly in which the four largest commercial banks have a market share of 70% (Boström et al. 2015). For parts of the financial market, such as deposits and lending, the commercial banks, therefore, have a very dominant position (Swedish Central Bank 2016). Besides the four largest commercial banks, a fifth actor—the savings banks—has a market share of 10% at the national level, but the market share at the local level is often much larger (Swedish Bankers’ Association 2015). Savings banks operate primarily in regional or local markets in Sweden, and the number of savings banks in Sweden has declined due to mergers and acquisitions within the savings bank industry (Backman 2015; Hugo Elliot 2016).

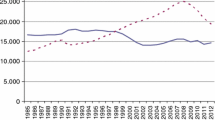

Since 1990, there has been a drastic change regarding the physical financial infrastructure in Sweden, as the number of local bank branches has been cut in half (see Fig. 1). Similar to other developed economies in the world, the bank branch network in Sweden has evolved such that the growth and the earnings of the banking industry are increasingly drawn towards metropolitan areas and growth regions (Alessandrini et al. 2009; Leyshon et al. 2008). The previous international research has shown that as banks shifted their focus to growing regions, they reduced the number of local bank branches and staff in the smaller cities and the countryside (Backman 2015; Nguyen 2015). This trend is very clear in Sweden, which shows that the large commercial banks have expanded their operations in metropolitan areas and growing regions (Backman 2015).

Bank branch closure might significantly affect the possibilities that Swedish firms have to finance their operations because bank finance has always been of utmost importance for Swedish SMEs (Berggren and Silver 2009; Yazdanfar and Öhman 2015). There is evidence that banks play a special role in their lending to smaller companies, and that it may be difficult for such borrowers to find alternative sources of financing when bank lending is reduced due to, for example, a credit crunch (Hancock and Wilcox 1998; Brunnermeier 2009).

2.2 Bank financing and entrepreneurship

Over time, several theories have been put forward to explain the financial decision making of entrepreneurs and how different sources of capital can influence the survival of a firm (Frank and Goyal 2003; De Jong et al. 2011). The pecking order theory is used to explain why most entrepreneurs prefer bank credits over other forms of external capital (Chen 2011), whilst the signalling theory is used to explain how the entrepreneurs can convince the banks to grant them a loan for their businesses (Deesomsak et al. 2004).

The pecking order theory predicts that firms in need of capital will prefer internal finance to external finance and they will prefer loans to equity if they are searching for external finance (Myers and Majluf 1984; Howorth 2001). Due to the relatively higher risk of small businesses and information asymmetries between the entrepreneurs and the capital providers, external finance can become very expensive as capital providers will charge a higher interest rate (St-Pierre and Bahri 2011). However, when the entrepreneurs’ savings are not enough to undertake the investments, they will have to resort to external finance. As new equity will dilute the ownership of the venture, most entrepreneurs are not willing to issue new shares especially if they think that their business will be profitable in the future (Silver et al. 2015; Mac an Bhaird and Lucey 2010). As credits from banks do not risk the loss of control of the ventures, entrepreneurs tend to choose bank loans over equity. Thus, bank finance is an important source of external finance for control-averse entrepreneurs (Hernández-Cánovas and Martínez-Solano 2010).

Signalling theory focuses on how entrepreneurs try to communicate with capital providers to lower the perceived risk and uncertainty (Connelly et al. 2011). The banks have a structured process to decide whether they should lend money to an entrepreneur (Burns 2014). To understand more about the purpose of the loan and the entrepreneur, the bank manager will typically visit the firm for an assessment (Bruns and Fletcher 2008). The entrepreneur needs to convince the bank branch manager about the qualities of the ventures and his or her capabilities as an entrepreneur.

Therefore, it is important that the entrepreneur makes a good impression for the bank manager by showing his or her competence, the ability to provide collateral or third-party guarantees, detailed information about the business and a financial plan for the venture (Behr and Güttler 2007; Landström 2017). These signals are important for a new firm with a limited track record as it is difficult to prove that the firm can repay the loan (Haron et al. 2013). To communicate effectively and to build a good relationship with the bank, both the bank and the firm must meet regularly. A relatively large distance between the two actors can hinder regular meetings and prevent the entrepreneurs from signalling positively to the banks (Mercieca et al. 2009).

2.3 Drivers of local bank branch closures

Several arguments for the closure of a local bank branch have been put forward by previous studies. Apart from the closure of bank branches being part of the banks’ cost reduction and profit maximisation strategies, there are also non-financial factors relating to bank branch closure (Clawson 1974; Boufounou 1995), such as factors relating to the location and the local competition (Schneider et al. 2014).

Some location factors that are frequently used to decide which local bank branch to close include information about the local business environment and socio-demographic attributes like population density, demographics, population growth rate, size of the employed population and household income (Leyshon et al. 2008). These factors can be used to estimate the potential demand for banking services in the region. Moreover, population demographics is seen as an important factor which determines the profitability of a bank branch. A region with a high proportion of retired citizens has a lower degree of entrepreneurial activities compared to a region with a booming labour population (Clawson 1974; Backman 2015). The number of small businesses in the region can also help to explain the local region’s demand for credits (Avkiran 1997).

When it comes to the local competition, banks need to consider the competitive environment in the region where they operate in, as a high level of competition can negatively affect the profitability of a bank branch (Goddard et al. 2011). To analyse the competitive context, previous studies have used variables such as the number of key competitors’ bank branches, the number of own bank branches and the number of other financial institutions (Olsen and Lord 1979).

Notwithstanding both financial and non-financial factors, one reason that has an important impact on bank branch closure is the rise of Internet banking (Schneider et al. 2014). In Sweden, most of the services offered by the bank branch offices can also be accessed on the internet and mobile phones (Swedish Central Bank 2016). As a result, bank branches have become more focused more on selling their products and services and providing advisory services (Moraru and Duhnea 2018). Thus, the general trend within the banking sector would imply that banks have shifted their attention to invest more in transactions for the maximisation of their profits rather than the building of long-term relationships (Eriksson and Hermansson 2017).

2.4 The competitive advantage of the local bank branch

As banks and firms drift further geographically apart, several problems might occur; an increased information asymmetry between the entrepreneur and the bank, higher transaction and monitoring costs incurred by the bank and worsened agency problems (Berggren and Silver 2015).

Information asymmetry between the entrepreneur and the bank is a result of hidden information as well as a lack of market information about the venture (Hall et al. 2004). As entrepreneurs do not always disclose all information concerning their ventures, the information gap makes it difficult for the bank to assess the viability of the ventures. Furthermore, the newness of the venture can also compound the difficulty of understanding the firm and its market (Bruderl and Schussler 1990). The increasing physical distance might further aggravate the information asymmetries due to longer commuting time, especially in non-metropolitan districts where relationship-based lending is commonly used (Berger and Udell 1998).

Relationship-based lending involves the collection of soft and qualitative information about the firm and the fostering of the relationship between the bank and the firm (Elyasiani and Goldberg 2004). As firms and banks have drifted further apart, for example in the countryside, the longer commuting time and higher transport cost result in banks shifting towards transaction-based lending. The use of transaction-based lending for opaque markets where information is not readily available is problematic as banks use hard information and credit scoring techniques, which might put a new firm with no track record or tangible assets, at a disadvantage (Berger et al. 2005). Also, face-to-face meetings and personal contacts are crucial to exchange soft information when carrying out more complex bank services and to build trust between the banks and the borrower (Norberg 2016). With less focus on the individual character of the entrepreneur, entrepreneurs might be less inclined to approach banks believing that they do not have sufficient collateral to pledge.

Another major issue is the worsening of agency problems. From the perspective of the banks, the banks have a vested interest in the growth of their customers. Agency problems occur when the entrepreneur and the bank’s interest deviate (Voordeckers and Steijvers 2006). For banks to mitigate this problem, they need to assess how the firms intend to use the funds and also monitor their activities (Eisenhardt 1989; Silver and Berggren 2010). The bank’s monitoring cost increases with distance and if the higher monitoring cost results in less monitoring, the agency problems could be worsened (Degryse and Ongena 2004). Furthermore, for banks using relationship-based lending, there is a high opportunity cost for a bank to finance a firm located far away, and the opportunity cost will be relatively higher when the credit is relatively small (Parlour and Plantin 2008).

Traditional credit risk assessment is an expensive and time-consuming process which includes searching for and visiting new firms for an assessment of the firm and post-investment monitoring (Silver 2001). As a result, banks might think that it is better to invest in a firm located nearer to its bank branch than a distant firm, even if the distant firm has a more viable project (Brevoort and Wolken 2009). This adverse selection results in a risk of market failure in that it falls short of providing capital to firms that are potentially good borrowers but at a geographical disadvantage.

2.5 Hypothesis

The closures of local bank branches allow us to understand the influence of geographical proximity in determining the bank–entrepreneur relationship, and the likelihood of new ventures getting access to bank financing. Regardless of whether the bank uses relationship-based lending or transaction-based lending, proximity plays an important role in reducing the information asymmetry between the bank and the entrepreneur.

Based on the previous studies presented above, the following hypothesis is formulated:

H1: The larger the distance to banks, owing to local bank branch closures, the lower the new firm formation per capita in a municipality.

3 Data and variables

3.1 Data

On a macro-level, our study is carried out on a municipal level in Sweden, which consists of 290 municipalities. In a regional analysis of municipalities, it can be appropriate to divide the municipalities into different groups so that municipalities belonging to each group have similar characters or conditions. We use a division that is developed by the Swedish Agency for Growth Policy Analysis (Tillväxtverket 2018). This simple division comprises three groups of municipalities—29 metropolitan municipalities, 131 urban municipalities and 130 countryside municipalities.

On a micro-level, we use a classification level that is adopted by Statistics Sweden, which demarcates Sweden into 227,235 included areas (Statistics Sweden 2018). The included areas are represented by square areas of 250 m by 250 m in urban areas and 1000 m by 1000 m in rural areas. The resolution of the data enables an analysis of a high degree of detail. Figure 2 shows the map of Stockholm, demarcated into included areas.

The database that we use is panel data which covers the years 2007 and 2013 in Sweden. The data on the development of local bank branches are acquired from Argomento GIS & IT, who has kept track of the geographical coordinates of all the bank branch offices in Sweden. With this information, we can calculate the driving distance of the nearest bank branches to all the included areas. From the Swedish Agency for Growth Policy Analysis, we gather information on the number of new firm formation in each municipality by year.

From Statistics Sweden, we acquire population data in each included area. Population data refer to the number of households, demographics and income in each included area. Information on the current number of firms and the total number of employees by major industry sectors are also acquired for each included area. Data aggregated on the municipal level, such as human capital level and unemployment data are also downloaded from Statistics Sweden’s and Swedish Public Employment Service’s website, respectively.

3.2 Variables

To make a within-municipality comparison of spatial processes in new firm formation, we narrow down to ten possible determinants of new firm formation per capita (NFFPC)—proximity to banks, firm density, establishment size, unemployment rate, human capital level, industry specialisation index and industry diversification index, income growth, change in housing prices and percentage of immigrants inhabiting in the municipality.

Table 1 shows the description of all the variables utilised in our models and the expected signs of the variables affecting NFFPC. As new firm formation data are not available at a finer spatial resolution than municipalities, all the variables are aggregated at the municipal level.

3.2.1 Dependent variable: new firm formation per capita

We define new firms as the total number of newly started companies, excluding various forms of restructuring of the existing companies. The labour market approach of obtaining the value of NFFPC is to divide the number of newly started companies in a municipality by the number of inhabitants between 16 and 64 years old. According to OECD (2019), a labour market is defined as an active population which comprises everyone who satisfies the requirements for inclusion among the employed or unemployed. There is a possibility that someone from the labour force could start a new firm; therefore, the age group between 16 and 64 years old is deemed appropriate to be used as a proxy for the labour force. Furthermore, most new firms are started by individuals in the labour force and in areas close to their residence, which supports the use of the labour market approach (Audretsch and Fritsch 1994a; Michelacci and Silva 2007). By locating the firms close to where they live, entrepreneurs can make use of their existing local networks to source for partners, suppliers and customers and to remain close to their family and friends (Dahl and Sorenson 2012).

An alternative approach is an ecological approach which uses the number of existing firms. However, this approach has been criticised as the number of existing firms might not correlate with the number of new firms and the size distribution of firms is not accounted for. Hence, the ecological approach might give rise to biased estimates in NFFPC in regions with a large firm structure (Garofoli 1994). In this paper, we use the labour market approach. As a robustness check, we also use NFFPC calculated using the ecological approach in the model in Sect. 4.3.

3.2.2 Independent variable: proximity to bank branches

A recent trend within the banking sector includes computerised credit scoring of smaller companies. This means that one of the key judging criteria for approving a bank loan is the geographical location of the companies, which helps banks to determine the interest rate charged to the borrower firm. Thus, this key judging criterion supports the use of weighted mean distance to nearest bank branches as a variable in our models.

We use the weighted mean distance to the nearest bank branches in the municipality to represent the proximity to bank branches as an independent variable to test Hypothesis 1. Weighted mean distance to the first, second and third nearest bank branch is used, respectively, in separate model specifications in Sect. 4.2 to test for the robustness of our results.

Street network analysis is used to identify the shortest road route and to calculate the driving distance from each included area to the nearest bank branch. The labour force-weighted mean distance to the bank accounts for the fact that banks are usually concentrated in cities and towns that are densely populated with people in the labour force, rather than in the countryside where there is a higher population of retirees and elderly. Hence, the labour force-weighted mean distance is usually shorter than the unweighted mean distance. By using the labour force population as a weight, it allows us to consider spatially heterogeneous labour force population within the municipality and the varying proximity to the banks in different regions of the municipality.

The following formula is used to calculate the labour force-weighted mean distance to the nth nearest bank in municipality j:

where \(WeightedDist_{nij}\) is the labour force-weighted mean distance to the nth nearest bank for an included area i in municipality j. \(P_{ij}\) is the labour force population in the included area i in municipality j. Summations are across all the included areas i within municipality j in the denominator.

3.2.3 Control variables

The control variables included in our analysis are firm density, establishment size, unemployment rate, human capital level, industry specialisation index, industry diversification index, income growth, change in housing prices and percentage of immigrants in the municipality. Detailed information on the calculation of the industry specialisation and diversification index and income growth can be found in the appendix.

Firm density can be important for the economy as a high density improves the match between firms, labour, suppliers and customers and hence lowers transactions costs. For start-ups and tech companies, high firm density allows for greater opportunities for sharing of knowledge and drive innovation (Feld 2012). Even though cities with a high firm density are innovative and productive, it is argued that a high firm density can cause inequality in the economy as the established and advantaged players usually get the major shares of the market (Batabyal 2017).

Establishment size has also been shown to be important for new firm formation. Using different frameworks, establishment size is shown to have both positive and negative association with new firm formation (Audretsch and Fritsch 1994b). For the labour market approach, the coefficient of the mean establishment size on new firm formation is negative in previous studies (Audretsch and Fritsch 1994b). A reasoning is that the propensity to start a business for a worker with prior experience in a small firm is greater than in a large firm (Evans and Leighton 1990).

According to previous studies, unemployment has an ambiguous effect on NFFPC as unemployment can encourage or discourage new firm formation. On one hand, a region with prolonged increased unemployment can signal that the market condition is less favourable in the region and characterise the region with inadequate social and public infrastructure (Tervo and Niittykangas 1994; Fotopoulos 2013). On the other hand, unemployment can also propel individuals to become entrepreneurs as a recession can push unemployed individuals with a high level of education and managerial know-how to start a new company. However, the ‘unemployment-push’ hypothesis is a weak one as there are mixed results from previous empirical studies (Whittington 1984; Ashcroft et al. 1991; Love 1996).

Human capital is an important determinant of new firm formation. Human capital is measured as the proportion of the labour force population with at least three years of university education. A human capital-rich local economy can help to enhance knowledge spillovers resulted from individuals who have the skills to recognise and exploit opportunities (Reynolds et al. 1995; Acs and Armington 2004). Furthermore, an agglomeration of highly educated individuals in the region has been argued to increase start-up activity and a higher survival rate in non-service industries (Korosteleva and Belitski 2017).

The inclusion of the Theil regional diversity entropy measure and a relative specialisation index are motivated by Fotopoulos (2013). These two measures are not mutually exclusive as a region with a high diversity of industries may still own a larger share of a particular sector when compared to other regions (Fotopoulos 2013). The previous literature has proposed that a higher degree of diversity means there is a greater variety of skills available in the local region (Audretsch et al. 2010). Hence, the greater mix of different skill sets could allow greater opportunities for entrepreneurs to acquire different kinds of resources, encouraging new firm formation. The Theil regional industrial diversity entropy measure is used to measure the regional industrial diversity in this paper (Theil 1976).

Whereas for specialisation, the previous literature has shown ambiguous results. On one hand, a highly specialised region could create a barrier for entrepreneurs who are seeking to enter the market as the prerequisites in specialised skills and resources might be even more demanding to start a new business in a highly localised industry. On another hand, a highly specialised region can promote knowledge spillover and increased information flow, making it easier for entrepreneurs to start a business. A relative specialisation index measures the concentration of the share of the overall employment held by the various industries in a municipality in relative to the national level. A municipality would be considered specialised if a small number of industries hold high shares of the overall employment of the municipality (Aiginger and Davies 2004).

Income growth is seen as a positive determinant in new firm formation as it serves as a demand-side effect signalling more wealthy markets and a large body of literature has pointed out that high personal wealth increases entry into entrepreneurship (Malacrino 2016). With a high level of internal finance, entrepreneurs do not have to be constrained by the bounds induced by external finance and hence encourage individual with high personal wealth to start their business (Kerr and Nanda 2009). An example of how income growth is calculated in the previous literature is the average annual rate of increase in personal income in the region calculated over two years (Armington and Acs 2002). In this paper, income growth is calculated as the rate of growth of annual income per capita between the observed year and that of two years ago.

The change in housing prices is measured by the percentage change between the housing price level of a municipality in the current year and that of four years ago. Research shows that housing prices have an impact on entrepreneurship as rising house prices is linked to an increase in collateral and increased consumption (Berggren et al. 2017, 2018; Black et al. 1996). As a result of higher house prices, homeowners are more likely to start a business (Schmalz et al. 2017).

The percentage of immigrants is the number of immigrants as a proportion of the total population in the municipality. The percentage of immigrant inhabitants can have a positive and significant impact on new firm formation. In a Swedish study conducted by Baycan and Öner (2013), the percentage of immigrant inhabitants has a positive and significant effect on new firm formation. This finding can be explained in two ways. Due to a sorting mechanism, the share of immigrants is generally higher in places with a higher level of entrepreneurial spirit. Moreover, immigrants who face obstacles in looking for employment can be pushed into starting their businesses out of necessity reasons.

3.3 Descriptive statistics

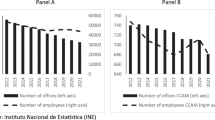

Table 2 shows the number of bank branches and the number of bank branches per capita according to municipality types in 2000, 2007 and 2013. The largest decline in the number of bank branches occurred in the countryside municipalities, where almost 30% of bank branches closed from 2000 to 2013. For urban municipalities, the number of bank branches decreased by 10%. As for metropolitan municipalities, the change in the number of bank branches is rather small compared to the countryside and urban municipalities. A similar pattern is exhibited for the number of bank branches per capita. Hence, urbanisation is not the only reason which has resulted in a decline in the number of bank branches (Backman and Wallin 2018).

Figure 3 further supports Table 2 that more bank branch closures occur in the countryside municipalities from 2007 to 2013. Furthermore, it is also observed from Fig. 3 that bank branch closures occur in most Swedish municipalities and there exist bank deserts in a few municipalities which have only one bank branch in 2007 and 2013. These municipalities with only one bank branch are very vulnerable to access to finance when their only bank branch closes down or when the bank branches in their neighbouring municipalities start closing down, or both.

In Table 3, there is a general upward trend in the means of WeightedDist_1 from 2007 to 2013, especially for the countryside and urban municipalities. Whereas for the means of WeightedDist_2 and WeightedDist_3 from 2007 to 2013, there is no observable significant increase in the weighted distance, except for WeightedDist_3 for the countryside municipalities. There is a high standard deviation of 21 km in WeightedDist_3 for countryside municipalities.

Even though it is observed from Fig. 3 that there are bank branch closures in almost all the Swedish municipalities, it is important to know if the reduction in the number of bank branches has resulted in longer travelling distances for the consumers. Figure 4 shows that even if there is a reduction in the number of bank branches in the south of Sweden, it does not necessarily mean an increase in the weighted mean distance to the banks and vice versa. Figure 4 generally shows an increase in the weighted mean distance to the first nearest bank branch in the majority of the municipalities from 2007 to 2013.

4 Empirical models and results

In this section, we aim to estimate the effects of the change in proximity to bank branches on new firm formation over time between 2007 and 2013. Our approach is divided into three steps, which follows Elhorst’s framework when estimating a spatial panel data model (Elhorst 2014). First, we estimate nonspatial panel data models to determine whether the spatial lag model or the spatial error model is more appropriate. We also test for the extension of the model with spatial and time-period fixed effects, which is also known as the two-way fixed effects model. Second, we then consider the spatial Durbin specification of the two-way fixed effects model to test whether it can be simplified to the spatial lag or the spatial error model. Thirdly, we test for the robustness of our results by using different spatial weight matrices and new firm formation rate calculated using the ecological approach as a dependent variable.

Two years are used for the panel data analyses—2007 and 2013. Since the years used in our panel data analysis did not include the recession period in Sweden, we do not have the issue of including the recession effects in our analysis.

4.1 Nonspatial panel data model

The following model for new firm formation based on a panel from 290 municipalities is estimated for two years—2007 and 2013 (\(t = 2007, 2013\)),

where \(y_{it}\) is new firm formation per capita in municipality i in year t. \(x_{it}\) are the ten independent variables, namely proximity to banks (WeightedDist_n), firm density (FirmDensity), establishment size (EstSize), unemployment rate (UnempRate), human capital (HumanCap), specialisation index (SpecIndex), diversification index (TheilIndex), income growth (lncomeGrowth), changes in housing prices (ChangeHP) and percentage of immigrants (ImmigrantsShare). We only consider the weighted distance to the first nearest bank branch in the nonspatial panel data models. All the dependent and independent variables are logged except for IncomeGrowth to make the distribution of the transformed variables more normal. The IncomeGrowth variable is not logged because it includes negative values.

We can assume that region-specific effects (\(c_i\)) and time-specific effects (\(\alpha _t\)) fixed, which in this case, region dummy variables and time dummy variables for each year are included in equation 2. The region dummy variable includes heterogeneity between municipalities that are fixed over the period, such as structural differences between municipalities and physical preconditions—natural landscapes, past infrastructure investments and cultural heritage (Baumgartner et al. 2013). The time dummy variable includes heterogeneity between the economic conditions and regulatory changes for limited companies, such as lower requirements for auditing and capital, which can affect new firm formation (Berggren et al. 2018).

Table 7 in the appendix reports the estimation results of the nonspatial panel data models to determine if a spatial model is more appropriate for estimation. The hypothesis that the spatial fixed effects are jointly insignificant is rejected based on the LR test (703.0, with 290 degrees of freedom [df], \(p<0.01\)). Similarly, the hypothesis that the time-period fixed effects are jointly insignificant is also rejected (14.9, 2 df, \(p<0.01\)). These results justify the extension of the model with spatial and time-period fixed effects (Elhorst 2014).

The results from Table 7 point to the spatial Durbin specification of the two-way fixed effects model as results from the classic LM tests report p values less than 0.01 for both hypotheses \({H}_0: \theta = 0\) and \({H}_0: \theta + \rho \beta = 0\). Since the spatial Durbin model generalises both the spatial lag and the spatial error model, it is better to adopt this more general model (LeSage 2014; Elhorst 2014).

4.2 Spatial panel data model

In order to assess the influence of bank branch closure on new firm formation in Sweden, spatial Durbin models are used. Two years—2007 and 2013—are used for the estimation of the spatial Durbin models (t = 2007, 2013).

The spatial Durbin model is specified as follows:

where \(w_{ij}\) is the spatial weight matrix which describes the dependence across all the spatial units. \(\sum _{j} w_{ij} y_{jt}\) describes the interaction effect between the dependent variable \(y_{it}\) and the dependent variables in its neighbouring municipalities, \(y_{jt}\). \(\sum _{j} w_{ij} x_{ijt}\) describes the characteristics of neighbouring municipalities. \(\rho \) is the spatial autoregressive coefficient and \(\theta \) indicates a spatial autocorrelation coefficient on the observed exogenous variables x. \({c_i}\) and \({\alpha _t}\) represent the region-specific effect and time-specific effects, respectively, whilst \({{v_i}_t}\) is an idiosyncratic component. Assuming that \(c_i\) and \(\alpha _t\) are fixed, the intercept \(\phi \) can only be estimated, given that the conditions \(\sum _{i} c_i = 0\) and \(\sum _{t} \alpha _t = 0\) are satisfied (Elhorst 2014).

Three types of spatial weights have been tested, and they are the inverse distance weight matrix, k-nearest neighbours (KNN) weight matrix and the Queen’s contiguity weight matrix of the first order. Subsequently, we proceed with a 4 nearest-neighbours weight matrix, as it provides a useful compromise between the Queen’s contiguity and the inverse distance weight approaches. The Queen’s contiguity approach leads to exclusion of 5 municipalities which might lead to misleading results and the inverse distance weight matrix has a bimodal distribution which leads to some municipalities with too few neighbours and some with too many neighbours.

We employ the ‘Matlab Software for Spatial Panels’ in MATLAB for estimating all the spatial panel data models in this paper (Elhorst 2014). In this toolbox, the maximum likelihood-based approach is implemented for spatial panel models, which allows one to estimate spillover effects.

4.2.1 Empirical results

For the spatial panel models utilised in our study, the dependent variable and the independent variables are the same as the ones used in the nonspatial panel model in Sect. 4.1. For robustness, we consider the weighted distance to first, second and third nearest bank branch in three different model specifications (n = 1, n = 2 or n = 3 in WeightedDist_n). The results of the three model specifications are reported in columns 1, 2 and 3 of Table 4.

We perform both Wald and LR tests to determine if the spatial Durbin model can be simplified to the spatial lag or spatial error model. For all three different model specifications (n = 1, n = 2 or n = 3 in WeightedDist_n) in Table 4, the Wald and LR tests indicate that both the spatial error model and the spatial lag model must be rejected in favour of the spatial Durbin model.

We also perform a Hausman’s specification test to test if the random effects model is favoured over the fixed effects model. The results (130.900, 21 df, \({p}<0.01\)) reject the null hypothesis that the random effects model is preferred over the fixed effects model. The results of the random effects model are reported in column 4 of Table 4. \(\psi \) in Table 4 refers to the weight attached to the cross-sectional component of the data and takes values on the interval [0, 1] (Elhorst 2014). If \(\psi \) equals to 0, the random effects model converges to a fixed effects model; if it equals to 1, then it converges to a model which does not control for any spatial effects. \(\psi \) is found to be 0.0847, with a t-value of 16.993, which aligns with the results of Hausman’s specification test and indicates that the fixed and random effects models are significantly different from each other.

In the two-way fixed effects nonspatial model (column 4 of Table 7 in the appendix), the coefficients of UnempRate, TheilIndex and ChangeHP are significantly different from zero. Higher unemployment rate and housing prices encourage new firm formation, whilst higher industry diversification index restrains new firm formation. As the spatial Durbin model with spatial and time-period fixed effects is found to be more appropriate, the results from the nonspatial model are biased and we proceed to investigate the results from the spatial models.

As the parameter estimates in the spatial models in Table 4 do not represent the marginal effect of a change of the independent variable on NFFPC, we need to interpret the direct effect estimates in Table 5. The reason is that the direct and indirect estimates consider the feedback effects which result due to impacts passing through neighbouring municipalities and back to the municipalities (Elhorst 2014).

4.2.2 Discussion of results

Based on the t-statistics calculated from a set of 1000 simulated parameter values, we discuss the results which appear to be significantly different from zero in column 1 of Table 5. The significant variables are weighted mean distance to banks, unemployment rate, diversification index, specification index, income growth, change in housing prices and percentage of immigrants.

Weighted mean distance to banks The findings from Table 5 show that own-municipality increases in the weighted mean distance to the first nearest bank will discourage people from setting up a new firm in their own-municipality (elasticity 0.071). This indicates that as the weighted mean distance to the first nearest bank branch is doubled, there is a 5 per cent decrease in the number of firms that are being started, for every 1000 people in the municipality, since \((2^{-0.071}-1)\approx -0.05\). That means, for a NFFPC of 20, i.e 20 new firms for every 1000 people in the municipality, a 5 per cent decrease is one less firm formed. One possible reasoning for the negative direct effects of the increased distance to the bank branches on new firm formation is higher monitoring costs and information asymmetries for the banks. This means that the bank managers have to travel further to the firms for monitoring on the firm’s financial status and well-being. Hence, banks might not be willing to lend money to firms that are situated far away. As a consequence, firms located far from the bank might have greater difficulty in getting loan approval from the banks.

As for weighted mean distance to the second nearest bank, the effects on new firm formation are not significant. Weighted mean distance to first and third nearest bank branches is both significant and negative. This indicates that proximity to the first and third nearest bank branch has more influence on the formation of new firms.

Table 5 shows that own-municipality increases in the weighted mean distance to the third nearest bank branch will discourage people from setting up their firm in their municipality (elasticity 0.044) but somehow encourages new firm formation in neighbouring municipalities (elasticity 0.186). A possible explanation is that since the third nearest bank branches are now further away from potential borrowers in the target municipality, there is lesser competition in these branches, and hence, entrepreneurs from other municipalities have a higher chance of getting loan approval for their business in these branches. This results in a potential increase in new firm formation in the neighbouring municipalities.

Unemployment rate Own-municipality increases in the unemployment rate have been shown to encourage people to set up firms in their municipalities based on two out of three model specifications in Table 5 (elasticity ranges from 0.074 to 0.077). A possible reason is that more unemployed people might be pushed to become entrepreneurs due to necessity reasons (Glocker and Steiner 2007).

Diversification index Own-municipality increases in diversification index have been shown to discourage people from setting up firms in their municipalities for all the three model specifications in Table 5 (elasticity ranges from 0.714 to 0.766). This is opposite to our expected sign of diversification index on new firm formation. These results seem to favour a notion formalised by Arrow (1962) and Romer (1986) that knowledge is sector-specific and spillover effects result through intra-sector externalities, also known as the Marshall–Arrow–Romer externalities. Hence, a high diversification rate of industries in the municipality does not necessarily benefit the formation of new firms as a greater variety in the knowledge spillovers from different sectors might not be relevant for a new firm in a specific sector.

Specialisation index Own-municipality increases in specialisation index have been shown to encourage people to set up firms in its neighbouring municipalities for all the three model specifications in Table 5 (elasticity ranges from 0.201 to 0.23). This shows that neighbouring municipalities around a municipality with a highly specialised industry can benefit from knowledge spillover and it can also benefit from economies of scale (lower average cost with higher output) based on theories of agglomeration like production sharing and labour pooling (Fotopoulos 2013; Rosenthal and Strange 2001).

Income growth Own-municipality increases in income growth have been shown to discourage people from setting up firms in their municipalities for all the three model specifications in Table 5 (elasticity ranges from 0.064 to 0.079). The negative sign of this variable is the opposite of what we have expected. There were a financial crisis and a recession in 2008 and this could have lowered potential entrepreneurs’ confidence to set up their businesses, despite the positive growth rate in annual income per capita in the municipality (OECD 2009).

Change in housing prices Own-municipality increases in housing prices have been shown to encourage people to set up firms in their municipality for all the three model specifications in Table 5 (elasticity 0.001). This is in line with the findings from previous studies which show that homeowners from regions with house price appreciation are more likely to start a business as they have more collateral to offer to the bank when they apply for a loan (Berggren et al. 2017; Schmalz et al. 2017).

Percentage of immigrants Own-municipality increases in the percentage of immigrants have been shown to discourage people from setting up firms in the neighbouring municipalities for all the three model specifications in Table 5 (elasticity ranges from 0.641 to 0.691). It could be due to a sorting mechanism, a region with an influx of immigrants, usually has a higher level of entrepreneurial spirit (Baycan and Öner 2013). Economic immigrants can bring along essential knowledge, and labour immigrants are also more willing to accept a lower payment for their work. Hence, the inflow of immigrants in a specific municipality can reduce the attractiveness of setting up a business in its neighbouring municipalities.

4.3 Robustness tests

We further build additional spatial Durbin models with different weight matrices and use NFFPC calculated using an ecological approach as a dependent variable, to increase the robustness of our results. The results of these models are shown in Table 8 in the appendix.

In general, the results from Table 8 are quite similar to results obtained from the spatial Durbin models in Sect. 4.2.1. In comparison to the two-way fixed effect spatial Durbin model for n = 1 and using a 4-NN weight matrix (column 1 of Table 5), the models using 3-NN and 5-NN weight matrices (columns 1 and 2 in Table 8) also have the same variables which have significant indirect effects, namely the logged variable SpecIndex and ImmigrantsShare. However, UnempRate as a significant variable for direct effect is absent in the model using a 5-NN weight matrix. Overall, we notice that the logged variable WeightedDist_1 shows consistent results throughout, which appear to have a significant negative direct impact on NFFPC for the models using 3-NN, 4-NN and 5-NN weight matrices for weighted distance to the first nearest bank branch.

As for the model with NFFPC calculated using an ecological approach as a dependent variable (column 3 of Table 8), the results are also quite similar to the model with NFFPC calculated using a labour market approach as a dependent variable (column 1 of Table 5). In addition, for the model with NFFPC calculated using an ecological approach as a dependent variable, the logged variable FirmDensity appears to have a significant negative direct impact on NFFPC, which is opposite of our expected sign. A high density of large firms could result in higher barriers to entry for new and small firms due to competition, therefore reducing new firm formation (Garofoli 1994).

Garofoli (1994) also argues that the use of the ecological approach in calculating NFFPC is misleading as a small number of new firms formation could provide an artificially high NFFPC in areas with a small number of firms because of the small denominator problem. Hence, we still favour the results which use NFFPC calculated using the labour market approach over the ecological approach.

5 Conclusion

To the best of our knowledge, our study is the first one to show how the change in the proximity to bank branches can have an influence on new firm formation over time, considering the spillover effects. There are several strengths to our study. First, in this study, it is very valuable to get access to individual-level data to measure the proximity to bank branches. For example, there is varying proximity to bank branches in different parts of the municipality, and hence, it is useful to calculate a weighted mean distance to the bank branches. The statistically significant negative association between NFFPC and weighted mean distance to the nearest banks can be taken as indicative of a potential determinant to increase entrepreneurship in a region even though it might not be necessarily causative. The association justifies a further investigation of how an increase in the distance to bank branches can affect new firm formation adversely.

Furthermore, an advantage of analysing at a municipal level is that it does not follow administrative borders like labour market regions (LLMs). LLMs take into account intra-regional commuting flows and it divides Sweden into 81 functional regions. However, analysis at an LLM level is susceptible to the modifiable areal unit problem (MAUP), which can lead to biased results in the analysis.

We also consider the effects of spatial autocorrelation in our models by using a weight contiguity matrix. For models incorporating spatial effects, the traditional ordinary least squares (OLS) regression model is inappropriate (Cheng and Li 2011). The consideration of the effects of temporal and spatial factors is important as spillover effects are included in the model. Since an entrepreneur in a municipality can also travel to a bank in another municipality to apply for a bank loan, this means that the impact of a bank branch closure in a specific municipality can also affect its neighbouring municipalities.

There are a few limitations in this study. The first limitation is that there could be other potential confounding factors such as the size of bank branches and the hierarchical structure of the bank branches, which we lack data of. Some smaller bank branches are not allowed to approve large loans without first consulting their regional or central office. Decisions can be made in another municipality if there are only small bank branches in the local municipality. Hence, bank branches higher up in the hierarchy suffer even more severe asymmetric information, which can negatively affect the grant of a bank loan (Backman 2015).

The second limitation is that we only use the years 2007 and 2013 data in our models as we lack the data for the other years. It would be more desirable to get a balanced panel data which includes all the years between 2007 and 2013. The third limitation is that some explanatory variables are not exogenous, they could be determined simultaneously with NFFPC, and thus, they may affect NFFPC but also depend on NFFPC. Finding appropriate instruments that are correlated with the endogenous explanatory variable but not correlated to the error terms is also a difficult task as appropriate instrumental variables are rarely available (Fischer and Nijkamp 2014).

The empirical results in this paper highlight the importance of considering how the bank branch closures could affect the entrepreneurial activities beyond a municipality’s administrative borders. The strategic collaboration between municipalities in creating a sustainable financial environment for entrepreneurs might be a step in the right direction. Even though the study is based on Swedish data, the results are likely to apply to developed countries around the world that shares some features of the Swedish’s economy, such as SMEs’ reliance on bank financing. Through the financial supervision authority that regulates and controls banks, policymakers and regulators have an important role to play in the development of the financial infrastructure, especially in the countryside. An example is state-owned company Almi, which provides loans, venture capital and advice for start-ups and established companies (Almi 2020). Almi can increase the accessibility of the loans and monitor the development of bank branches in vulnerable regions that are susceptible to becoming bank deserts. All in all, banks, municipalities and policymakers need to collaborate so that they can implement policies that potentially boost entrepreneurship in the local community.

Change history

22 October 2021

A Correction to this paper has been published: https://doi.org/10.1007/s00168-021-01083-w

References

Acs ZJ, Armington C (2004) The impact of geographic differences in human capital on service firm formation rates. J Urban Econ 56(2):244–278

Agarwal S, Hauswald R (2010) Distance and private information in lending. Rev Financ Stud 23(7):2757–2788

Aiginger K, Davies SW (2004) Industrial specialization and geographic concentration: two sides of the same coin? Not for the European Union. J Appl Econ 7(2):231–248

Alessandrini P, Presbitero AF, Zazzaro A (2009) Global banking and local markets: a national perspective. Camb J Reg Econ Soc 2(2):173–192

Almi (2020) About Almi. https://www.almi.se/en/in-english/

Argent NM, Rolley F (2000) Financial exclusion in rural and remote New South Wales, Australia: a geography of bank branch rationalisation, 1981–98. Aust Geogr Stud 38(2):182–203

Armington C, Acs ZJ (2002) The determinants of regional variation in new firm formation. Reg Stud 36(1):33–45. https://doi.org/10.1080/00343400120099843

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29:155–173

Ashcroft B, Love JH, Malloy E (1991) New firm formation in the British counties with special reference to Scotland. Reg Stud 25(5):395–409

Audretsch D, Fritsch M (1994a) On the measurement of entry rates. Empirica 21(1):105–113

Audretsch D, Dohse D, Niebuhr A (2010) Cultural diversity and entrepreneurship: a regional analysis for Germany. Ann Reg Sci 45(1):55–85

Audretsch DB, Fritsch M (1994b) The geography of firm births in Germany. Reg Stud 8(3):217–244

Avkiran NK (1997) Models of retail performance for bank branches: predicting the level of key business drivers. Int J Bank Mark 15(6):224–237

Backman M (2015) Banks and new firm formation. J Small Bus Enterp Dev 22(4):734–761

Backman M, Wallin T (2018) Access to banks and external capital acquisition: perceived innovation obstacles. Ann Reg Sci 61(1):161–187. https://doi.org/10.1007/s00168-018-0863-8

Batabyal AA (2017) The new urban crisis: how our cities are increasing inequality, deepening segregation, and failing the middle class—And what we can do about it. Reg Stud 52(2):310–311

Baumgartner D, Schulz T, Seidl I (2013) Quantifying entrepreneurship and its impact on local economic performance: a spatial assessment in rural Switzerland. Entrep Reg Dev 25(3–4):222–250

Baycan T, Öner Ö (2013) Accessibility to knowledge and new firm formation in Sweden. Stud Reg Sci 43(1):89–104

Beck T, Demirgüç-Kunt A, Pería MSM (2011) Bank financing for SMEs: evidence across countries and bank ownership types. J Financ Serv Res 39(1–2):35–54

Behr P, Güttler A (2007) Credit risk assessment and relationship lending: an empirical analysis of German small and medium-sized enterprises. J Small Bus Manag 45(2):194–213

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Finance 22(6–8):613–673

Berger AN, Miller NH, Petersen MA, Rajan RG, Stein JC (2005) Does function follow organizational form? Evidence from the lending practices of large and small banks. J Financ Econ 76(2):237–269

Berggren B, Silver L (2009) The effect of bridging networks on entrepreneurial activity: the rational-legal framework and embeddedness in local social capital networks. J Enterp Communit: People Places Glob Econ 3(2):125–137

Berggren B, Silver L (2010) Financing entrepreneurship in different regions: the failure to decentralise financing to regional centres in Sweden. J Small Bus Enterp Dev 17(2):230–246

Berggren B, Silver L (2015) Entrepreneurial control aversion and bank financing in Swedish SMEs. Banks Bank Syst 10(1):65–74

Berggren B, Fili A, Wilhelmsson MH (2017) Does the increase in house prices influence the creation of business startups? The case of Sweden. REGION 4(1):1–16

Berggren B, Fili A, Wilhelmsson M (2018) Homeownership and entrepreneurship: a regional and industrial analysis of house prices and startups. Int J Hous Mark Anal 12(3):456–473. https://doi.org/10.1108/IJHMA-01-2018-0007

Black J, de Meza D, Jeffreys D (1996) House prices, the supply of collateral and the enterprise economy. Econ J 106(434):60–75

Boström GO, Lindbergh L, Wilson TL (2015) Sweden: bank of the year recognition and performance. Serv Mark Q 36(1):1–21. https://doi.org/10.1080/15332969.2015.976500

Boufounou PV (1995) Evaluating bank branch location and performance: a case study. Eur J Oper Res 87(2):389–402

Brevoort KP, Wolken JD (2009) Does distance matter in banking? The changing geography of banking and finance. Springer, Boston, chap 3, pp 27–56

Bruderl J, Schussler R (1990) Organizational mortality: the liabilities of newness and adolescence. Adm Sci Q 35(3):530–547

Brunnermeier MK (2009) Deciphering the liquidity and credit crunch 2007–2008. J Econ Perspect 23:77–100

Bruns V, Fletcher M (2008) Banks’ risk assessment of Swedish SMEs. Venture Cap 10(2):171–194

Burns P (2014) New venture creation: a framework for entrepreneurial start-ups. Palgrave, London

Casey E, O’Toole CM (2014) Bank lending constraints, trade credit and alternative financing during the financial crisis: evidence from European SMEs. J Corp Finance 27:173–193

Cassar G (2004) The financing of business start-ups. J Bus Ventur 19(2):261–283

Chemmanur TJ, Hull TJ, Krishnan K (2016) Do local and international venture capitalists play well together? The complementarity of local and international venture capitalists. J Bus Ventur 31(5):573–594

Chen LJ (2011) How the pecking-order theory explain capital structure. J Int Manag Stud 6(3):92–100

Cheng S, Li H (2011) Spatially varying relationships of new firm formation in the United States. Reg Stud

Clawson CJ (1974) Fitting branch locations, performance standards, and marketing strategies to local conditions: a straightforward approach to establishing goals and reevaluating marketing strategies for individual branch locations. J Mark 38(1):8–14

Cole RA, Goldberg LG, White LJ (2004) Cookie cutter vs. character: the micro structure of small business lending by large and small banks. J Financ Quant Ana 39(2):227–251

Connelly BL, Certo ST, Ireland RD, Reutzel CR (2011) Signaling theory: a review and assessment. J Manag 37(1):39–67

Cumming D, Dai N (2010) Local bias in venture capital investments. J Empir Finance 17(3):362–380

Dahl MS, Sorenson O (2012) Home sweet home: entrepreneurs’ location choices and the performance of their ventures. Manag Sci 58(6):1059–1071

De Jong A, Verbeek M, Verwijmeren P (2011) Firms’ debt-equity decisions when the static tradeoff theory and the pecking order theory disagree. J Bank Finance 35(5):1303–1314

Deesomsak R, Paudyal K, Pescetto G (2004) The determinants of capital structure: evidence from the Asia Pacific region. J Multinatl Financ Manag 14(4–5):387–405

Degryse H, Ongena S (2004) The impact of technology and regulation on the geographical scope of banking. Oxf Rev Econ Policy 20(4):571–590

Dick AA (2006) Nationwide branching and its impact on market structure, quality and bank performance. J Bus 79(2):567–592

Eisenhardt KM (1989) Agency theory: an assessment and review. Acad Manag Rev 14(1):57–74

Elhorst JP (2014) Matlab software for spatial panels. Int Reg Sci Rev 37(3):389–405

Elyasiani E, Goldberg LG (2004) Relationship lending: a survey of the literature. J Econ Bus 56(4):315–330

Eriksson K, Hermansson C (2017) Do consumers subjectively perceive relationships in objectively defined relational, interimistic, and transactional exchange in financial services? Int J Bank Mark 35(3):472–494

Evans DS, Leighton LS (1990) Small business formation by unemployed and employed workers. Small Bus Econ 2(4):319–330

Feld B (2012) Startup communities: building an entrepreneurial ecosystem in your city. Wiley, Hoboken

Fili A, Berggren B, Silver L (2013) The impact of financial capital, human capital and social capital on the evolution of Business Angel Networks. Int J Corp Gov 4(3):209–228

Fischer MM, Nijkamp P (2014) Handbook of regional science. In: Handbook of Regional Science. Springer, Berlin, chap 16, p 303. https://doi.org/10.1007/978-3-642-23430-9

Fotopoulos G (2013) On the spatial stickiness of UK new firm formation rates. J Econ Geogr 14(3):651–679

Frank MZ, Goyal VK (2003) Testing the pecking order theory of capital structure. J Financ Econ 67(2):217–248

French S, Leyshon A, Signoretta P (2008) “All gone now”: the material, discursive and political erasure of bank and building society branches in Britain. Antipode 40(1):79–101

Garofoli G (1994) New firm formation and regional development: the Italian case. Reg Stud 28(4):381–393

Glocker D, Steiner V (2007) Self-Employment: A Way to End Unemployment?. Empirical Evidence from German Pseudo-Panel Data, IZA Discussion Paper No 2561

Goddard J, Liu H, Molyneux P, Wilson JO (2011) The persistence of bank profit. J Bank Finance 35(11):2881–2890

Hall GC, Hutchinson PJ, Michaelas N (2004) Determinants of the capital structures of European SMEs. J Bus Finance Acc 31(5–6):711–728

Hancock D, Wilcox JA (1998) The “credit crunch” and the availability of credit to small business. J Bank Finance 22(6–8):983–1014

Haron H, Said SB, Jayaraman K, Ismail I (2013) Factors influencing small medium enterprises (SMES) in obtaining loan. Int J Bus Soc Sci 4(15):182–195

Hernández-Cánovas G, Martínez-Solano P (2010) Relationship lending and SME financing in the continental European bank-based system. Small Bus Econ 34(4):465–482

Howorth CA (2001) Small firms’ demand for finance: a research note. Int Small Bus J 19(4):78–86

Hugo Elliot V (2016) Institutional entrepreneurship and change; a contemporary history of the Swedish banking industry and its performance management systems. J Acc Organ Change 12(2):223–251

Kerr WR, Nanda R (2009) Financing constraints and entrepreneurship

Korosteleva J, Belitski M (2017) Entrepreneurial dynamics and higher education institutions in the post-Communist world. Reg Stud 51(3):439–453

Landström H (2017) Advanced introduction to entrepreneurial finance. Elgar, Cheltenham

LeSage JP (2014) What regional scientists need to know about spatial econometrics. Rev Reg Stud 44:13–32

Leyshon A, French S, Signoretta P (2008) Financial exclusion and the geography of bank and building society branch closure in Britain. Trans Inst Br Geogr 33(4):447–465

Love JH (1996) Entry and exit: a county-level analysis. Appl Econ 28(4):441–451

Mac an Bhaird C, Lucey B (2010) Determinants of capital structure in Irish SMEs. Small Bus Econ 35(3):357–375

Malacrino D (2016) Entrepreneurs’ wealth and firm dynamics

Mason C, Botelho T, Harrison R (2016) The transformation of the business angel market: empirical evidence and research implications. Venture Cap 18(4):321–344

Mason CM, Harrison RT (1995) Closing the regional equity capital gap: the role of informal venture capital. Small Bus Econ 7(2):153–172

Mercieca S, Schaeck K, Wolfe S (2009) Bank market structure, competition, and SME financing relationships in European regions. J Financ Serv Res 36(2–3):137–155

Michelacci C, Silva O (2007) Why so many local entrepreneurs? Rev Econ Stat 89(4):615–633

Moraru AD, Duhnea C (2018) E-banking and customer satisfaction with banking services. Strateg Manag 23(3):3–9

Morrison PS, O’Brien R (2001) Bank branch closures in New Zealand: the application of a spatial interaction model. Appl Geogr 21(4):301–330

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13(2):187–221

Nguyen HLQ (2015) Do bank branches still matter? The effect of closings on local economic outcomes, haas school of business

Norberg M (2016) On the nature of the multidimensional firm-bank exchange. PhD thesis, Mid Sweden University

OECD (2009) The impact of the global crisis on SME and entrepreneurship financing and policy responses. Policy

OECD (2019) Employment rate by age group (indicator). https://doi.org/10.1787/084f32c7-en

Olsen L, Lord J (1979) Market area characteristics and branch bank performance. J Bank Res 10(2):102–110

Parlour CA, Plantin G (2008) Loan sales and relationship banking. J Finance 63(3):1291–1314

Petersen MA, Rajan RG (2002) Does distance still matter? The information revolution in small business lending. J Finance 57(6):2533–2570

Reynolds PD, Miller B, Maki WR (1995) Explaining regional variation in business births and deaths: U.S. 1976-88. Small Bus Econ 7(5):389–407

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Rosenthal SS, Strange WC (2001) The determinants of agglomeration. J Urban Econ 53:300–320

Schmalz MC, Sraer DA, Thesmar D (2017) Housing Collateral and Entrepreneurship. J Finance 72(1):99–132

Schneider S, Seifert F, Sunyaev A (2014) Market potential analysis and branch network planning: application in a German retail bank. In: Proceedings of the annual Hawaii international conference on system sciences

Silver L (2001) Credit risk assessment in different contexts—The influence of local networks for bank financing of SMEs. PhD thesis, Uppsala University

Silver L, Berggren B (2010) The close relationship strategy—corporate brand development in banking. J Brand Manag 17(4):289–300

Silver L, Lundahl N, Berggren B (2015) Revisiting control aversion: the role of financiers in connecting entrepreneurs to the marketplace. J Small Bus Enterp Dev 22(3):417–432

Sorenson O, Stuart T (2001) Syndication networks and the spatial distribution of venture capital investments. Am J Sociol 106(6):1546–1588

St-Pierre J, Bahri M (2011) The determinants of risk premium: the case of bank lines of credit granted to SMEs. J Dev Entrep 16(4):459–476

Statistics Sweden (2018) DeSO - Demographic Statistics. https://www.scb.se/hitta-statistik/regional-statistik-och-kartor/regionala-indelningar/deso---demografiska-statistikomraden/

Swedish Bankers’ Association (2015) Banks in Sweden. Tech. rep., Swedish Bankers Association, Sweden. https://www.swedishbankers.se/media/2669/1503-banks-in-sweden.pdf

Swedish Central Bank (2016) The Swedish Financial Market. Tech. rep., Swedish Central Bank, Stockholm. https://www.riksbank.se/globalassets/media/rapporter/den-svenska-finansmarknaden/engelska/2016/rap_finansm_160831_eng.pdf

Tervo H, Niittykangas H (1994) The impact of unemployment on new firm formation in Finland. Int Small Bus J 13(1):38–53

Theil H (1976) Statistical decomposition analysis. Amsterdam, North-Holland Publishing Co, 1972, XV p. 337 p., DFL 65.00. Recherches Économiques de Louvain/Louvain Econ Rev 42(2):166–166. https://www.cambridge.org/core/product/44E6A9399F746B3ADB0C22EE746C6166

Tillväxtverket (2017) Företagens villkor och verklighet 2017. Tech. rep., Tillväxtverket https://tillvaxtverket.se/vara-tjanster/publikationer/publikationer-2017/2017-09-27-foretagens-villkor-och-verklighet-2017.html

Tillväxtverket (2018) Kommuntyper. https://tillvaxtverket.se/statistik/regional-utveckling/regionala-indelningar/kommuntyper.html

Townsend DM, Busenitz LW (2015) Turning water into wine? Exploring the role of dynamic capabilities in early-stage capitalization processes. J Bus Ventur 30(2):292–306

Voordeckers W, Steijvers T (2006) Business collateral and personal commitments in SME lending. J Bank Financ 30(11):3067–3086

Whittington RC (1984) Regional bias in new firm formation in the UK. Reg Stud 18(3):253–256

Yazdanfar D, Öhman P (2015) Debt financing and firm performance: an empirical study based on Swedish data. J Risk Finance 16(1):102–118

Acknowledgements

Open access funding provided by Royal Institute of Technology.

Funding

The funding was provided by Bostad 2.0 and Handelsbankens Forskningsstiftelse.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was reported by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Equations

1.1 Regional industrial diversity index (Theil)

Let \({empl_r}_i\) be the number of employed people in industrial sector i in municipality r. The regional industrial diversity index (Theil) for municipality r is:

where \({{}P_r}_i=\frac{{{}empl_r}_i}{\sum _r \sum _i {{}empl_r}_i}\), \(P_r = \frac{\sum _i {{{}empl_r}_i}}{\sum _r \sum _i {{}empl_r}_i}\), \(\frac{{{}P_r}_i}{P_r} = \frac{{{}empl_r}_i}{\sum _i {{}empl_r}_i}\), and \(\sum _r\sum _i{{{}P_r}_i} = 1.\)

The Theil index is equal to 0 when there is only one industrial sector in municipality r and the value log(6) when all the 6 industrial sectors have the same number of employed people in municipality r. The Theil index is bounded in the range [0, log(6)] as we define 6 industry sectors in the equation. The index obtained from equation A.1 is further divided by log(6) so that the index is bounded in the [0, 1] interval. The 6 broadly defined sectors are defined in Table 6 in the appendix.

1.2 Specialisation index

The formula for the relative specialisation index is as follows:

where \({{{}E_r}_i}\) and \({{{}E_n}_i}\) are the number of employed people in industry i at the municipality level and national level, respectively. \(E_r\) and \(E_n\) refer to the total number of people who are employed at the municipality and national level, respectively. The specialisation index is bounded in the range [0, 1]. The specialisation index is 0 when the sectoral structure of the municipality is the same as that on the national level and equal to 1 when there is only one sector in the municipality.

1.3 Income growth

Income growth is calculated as follows:

where \(IncomeGrowth_t\) is the average rate of change in the mean income per capita between \(Year_t\) and two years before \(Year_t\) in the municipality.

Tables

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ho, C.S.T., Berggren, B. The effect of bank branch closures on new firm formation: the Swedish case. Ann Reg Sci 65, 319–350 (2020). https://doi.org/10.1007/s00168-020-00986-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-020-00986-4