Abstract

This study employs a differentiated Cournot model with both horizontal and vertical product differentiation. It scrutinizes the implications of frictions over manufacturing high quality (upstream market power) on the endogenous foreign market entry mode and product quality choice. Both high-quality exports and subsidiary sales require high-quality inputs supplied by a monopoly upstream firm, and thus are costly. Relative product quality, product substitutability, and product-specific trade costs are the key for the variation in input/output prices, sales and the markup between an exporter and a multinational, and have significant trade policy implications for high-quality exports and subsidiary sales.

Similar content being viewed by others

Notes

See Antràs and Yeaple (2014), Castellani and Giovannetti (2010), Arnold and Hussinger (2010), Aw and Lee (2008), Mayer and Ottaviano (2008), Castellani and Zanfei (2007), Tomiura (2007), Kimura and Kiyota (2006), Wagner (2006), Girma et al. (2004, 2005), and Helpman et al. (2004). For a review of the literature, see Hayakawa et al. (2012), Wagner (2007, 2012), and Greenaway and Kneller (2007).

Vertical differentiation can be traced back to Linder (1961) and Alchian and Allen (1964). For the related trade literature on vertical product differentiation see, among others, Falvey and Kierzkowski (1987), Flam and Helpman (1987), Motta et al. (1997), Toshimutsu (2005), Iacovone and Javorcik (2010), Anderson and Schmitt (2010), Verhoogen (2008), Johnson (2012), Bastos and Silva (2010), Baldwin and Harrigan (2011), Fajgelbaum et al. (2011), Kugler and Verhoogen (2012), Crozet et al. (2012), Manova and Zhang (2012), Amiti and Khandelwal (2013), Antoniades (2015), Feenstra and Romalis (2014), Bacchiega et al. (2016), Manova and Yu (2017).

Toshimutsu (2005) shows that if costs of quality improvements are of variable (fixed) type and increasing, then a decrease in imports—by a higher specific tariff—leads to quality upgrading (downgrading). By the same token, in a heterogeneous firm model, Antoniades (2015) finds that when quality costs are of fixed type, an increase in market toughness generates two opposing forces, a competition effect (decreasing prices, markups and quality) and a quality-differentiation effect (increasing those). The former (latter) dominates for the least (most) productive firms.

The trade literature distinguishes among inputs that are sold on an exchange (such that the market for the input is thick with many buyers and sellers), those that are not, but reference priced in trade publications (such that their market has an intermediate level of thickness), and those that are neither sold on an exchange, nor reference priced (such that they are highly specialized); see, for example, Rauch (1999) and Nunn (2007).

Note that when trade costs are positive and there is no fixed investment costs, traditional FDI models with vertically homogeneous goods predict horizontal FDI (that duplicates the production process in a foreign country) as the optimal foreign market entry mode based on the proximity-concentration trade-off; e.g., see Koska (2015).

Note that this study does not model the transport sector, and thus does not distinguish between tariffs and transport costs. See Boddin and Stähler (2018) for a model that scrutinizes the transport sector exercising market power. In this study, both t, \(\tau\) and G are given, and throughout the paper, trade-related costs (e.g., tariffs and transport costs) are referred to as trade costs.

Each firm’s market power increases as \(\sigma\) decreases such that if \(\sigma =0\), then each firm would have monopolistic market power, whereas products would be perfect substitutes when there is no vertical differentiation between the varieties and when \(\sigma =1\).

An increase in \(u_i\) ceteris paribus increases the marginal utility of good \(i=\{h,f\}\).

Changing the sequence such that product quality is chosen before the market entry mode will not change the results, but will complicate the exposition of the model.

More precisely, manufacturing higher quality has two effects: a direct demand effect that increases sales, and an indirect cost effect that decreases sales by increasing production costs. As will be clear in the following sections, the direct effect dominates for both exporters and multinationals.

More precisely, manufacturing higher quality has two effects (a direct demand effect and an indirect cost effect) both of which will increase prices.

Given positive input trade costs, in such a case, firm h will source low-quality inputs from the perfectly competitive upstream industry located in F.

Throughout the study, a sufficiently high quality difference or relative quality is referred to as the condition that \(({\overline{u}}/{\underline{u}})>(4-\sigma )/2 \iff ({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2))>0\).

Note that the second argument that is represented by a center-dot (\(\cdot\)) in the profit function is simply the local variety’s product quality (\({\underline{u}}\)).

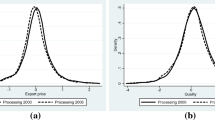

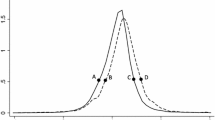

In all figures, the second argument in the profit function, which represents the local variety’s product quality is omitted, and only firm h’s product quality is registered.

A similar exercise can be carried out for the local firm, in which case, it is straightforward to show that vertical integration between the monopoly upstream and the downstream foreign firm (i) decreases local sales; (ii) increases the price of the low-quality local variety; (iii) increases aggregate sales in F (as the increase in the sales of the high-quality foreign variety is greater than the decrease in the low-quality local variety); and (iv) decreases local profits.

It should be noted that the individual benefits from vertical integration depend on each firm’s bargaining power and on each firm’s disagreement profits (threat points), especially if generalized Nash bargaining is employed to determine how the firms share the gains from vertical integration. That said, replacing upstream market power by bargaining power, however, generates qualitatively the same results as in Sects. 3 and 4 (computations are available upon request). Thus, to better highlight the role of upstream market power in a foreign firm’s product quality and market entry mode choice, in this section, only the integrated firm is considered.

References

Acharyya, R. (1998). Monopoly and product quality separating or pooling menu? Economics Letters, 61, 187–194.

Acharyya, R. (2005). Quality discrimination among income constrained consumers. Economics Letters, 86, 245–251.

Alchian, A., & Allen, W. R. (1964). University economics. Belmont CA: Wadsworth Publishing.

Anderson, S. P., & Schmitt, N. (2010). Differentiated products, international trade and simple general equilibrium effects. In G. Dow, A. Eckert, & D. West (Eds.), Industrial organization, trade and social interaction: Essays in honor of B. Curtis Eaton (Chapter 7) (pp. 136–159). Toronto: University of Toronto Press.

Antoniades, A. (2015). Heterogeneous firms, quality, and trade. Journal of International Economics, 95, 263–273.

Amiti, M., & Khandelwal, A. (2013). Import competition and quality upgrading. Review of Economics and Statistics, 95, 476–490.

Antràs, P. (2003). Firms, contracts, and trade structure. Quarterly Journal of Economics, 118, 1375–1418.

Antràs, P. (2016). Global production: Firms, contracts, and trade structure. Princeton, NJ: Princeton University Press.

Antràs, P., & Helpman, E. (2004). Global sourcing. Journal of Political Economy, 112, 552–580.

Antràs, P., & Staiger, R. W. (2012). Offshoring and the role of trade agreements. American Economic Review, 102, 3140–3183.

Antràs, P., & Yeaple, S. R. (2014). Multinational firms and the structure of international trade. In G. Gopinath, E. Helpman, & K. Rogoff (Eds.), Handbook of international economics (Vol. 4, pp. 55–130). Amsterdam: Elsevier.

Arnold, J. M., & Hussinger, K. (2010). Exports versus FDI in German manufacturing: Firm performance and participation in international markets. Review of International Economics, 18, 595–606.

Aw, B., & Lee, Y. (2008). Firm heterogeneity and location choice for Taiwanese multinationals. Journal of International Economics, 75, 67–179.

Atkeson, A., & Burstein, A. T. (2010). Innovation, firm dynamics, and international trade. Journal of Political Economy, 118, 433–484.

Bacchiega, E., Minniti, A., & Palestini, A. (2016). Quality, distance and trade: A strategic approach. Papers in Regional Science, 95(Supplement 1), S166–S191.

Baldwin, R., & Harrigan, J. (2011). Zeros, quality and space: Trade theory and trade evidence. American Economic Journal: Microeconomics, 3, 60–88.

Banerjee, T., & Nayak, A. (2017). Multinational investments and product sophistication. Economics Letters, 161, 157–163.

Bastos, P., & Silva, J. (2010). The quality of a firm’s exports: Where you export to matters. Journal of International Economics, 82, 99–111.

Bastos, P., & Straume, O. R. (2012). Globalization, product differentiation, and wage inequality. Canadian Journal of Economics, 45(3), 857–878.

Boddin, D., & Stähler, F. (2018). The organization of international trade. Mimeo.

Braun, S. (2008). Economic integration, process and product Innovation, and relative skill demand. Review of International Economics, 16(5), 864–873.

Castellani, D., & Giovannetti, G. (2010). Productivity and the international firm: Dissecting heterogeneity. Journal of Economic Policy Reform, 13, 25–42.

Castellani, D., & Zanfei, A. (2007). Internationalisation, innovation and productivity: How do firms differ in Italy? World Economy, 30, 156–176.

Choi, J. C., & Shin, H. S. (1992). A comment on a model of vertical product differentiation. Journal of Industrial Economics, 60, 229–231.

Crampes, C., & Hollander, A. (1995). Duopoly and quality standards. European Economic Review, 39, 71–82.

Crozet, M., Head, K., & Mayer, T. (2012). Quality sorting and trade: Firm-level evidence for French wine. Review of Economic Studies, 79, 609–644.

De Fraja, G., & Norman, G. (2004). Product differentiation and the location of international production. Journal of Economics and Management Strategy, 13(1), 151–170.

Fajgelbaum, P., Grossman, G., & Helpman, E. (2011). Income distribution, product quality, and international trade. Journal of Political Economy, 119, 721–765.

Falvey, R. E., & Kierzkowski, H. (1987). Product quality, intra-industry trade and (im)perfect competition. In H. Kierzkowski (Ed.), Protection and Competition in International Trade (pp. 143–161). New York: Basil Blackwell.

Feenstra, R., & Romalis, J. (2014). International prices and endogenous quality. Quarterly Journal of Economics, 129, 477–527.

Flam, H., & Helpman, E. (1987). Vertical product differentiation and North-South trade. American Economic Review, 77(5), 810–822.

Gabszewicz, J., & Thisse, J. F. (1979). Price competition, quality and income disparities. Journal of Economic Theory, 20, 310–335.

Girma, S., Görg, H., & Strobl, E. (2004). Exports, international investment, and plant performance: Evidence from a non-parametric test. Economics Letters, 83, 317–324.

Girma, S., Kneller, R., & Pisu, M. (2005). Exports versus FDI: An empirical test. Review of World Economics, 141, 193–218.

Greenaway, D., & Kneller, R. (2007). Firm heterogeneity, exporting and foreign direct investment. Economic Journal, 117, 134–161.

Hallak, J., & Sivadasan, J. (2013). Firm’s exporting behavior under quality constraints. Journal of International Economics, 91(1), 53–67.

Hayakawa, K., Machikita, T., & Kimura, F. (2012). Globalization and productivity: A survey of firm-level analysis. Journal of Economic Surveys, 26, 332–350.

Häckner, J. (2000). A note on price and quantity competition in differentiated oligopolies. Journal of Economic Theory, 93, 233–239.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94, 300–316.

Iacovone, L., & Javorcik, B. (2010). Multi-product exporters: Product churning, uncertainty and export discoveries. Economic Journal, 120(544), 481–499.

Johnson, R. (2012). Trade and prices with heterogeneous firms. Journal of International Economics, 86(1), 43–56.

Kim, J. H., & Kim, J. C. (1996). Quality choice of multi-product monopolist and spillover effect. Economics Letters, 52, 345–352.

Kimura, F., & Kiyota, K. (2006). Exports, FDI, and productivity: Dynamic evidence from Japanese firms. Review of World Economics, 142, 695–719.

Koska, O. A. (2015). A model of competition between multinationals. METU Studies in Development, 42(2), 271–298.

Kugler, M., & Verhoogen, E. (2012). Prices, plant size, and product quality. Review of Economic Studies, 79, 307–339.

Linder, S. B. (1961). An essay on trade and transformation. Stockholm: Almqvist and Wiksell.

Mai, J., & Zhou, J. (2017). A note on foreign direct investment and exports in vertically differentiated industries. Bulletin of Economic Research, 69(2), 138–146.

Manova, K., & Yu, Z. (2017). Multi-product firms and product quality. Journal of International Economics, 109, 116–137.

Manova, K., & Zhang, Z. (2012). Export prices across firms and destinations. Quarterly Journal of Economics, 127, 379–436.

Markusen, J. R. (2002). Multinational firms and the theory of international trade. Cambridge: The MIT Press.

Mayer, T., & Ottaviano, G. I. P. (2008). The happy few: The internationalisation of European firms. Intereconomics: Review of European Economic Policy, 43, 135–148.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71, 1695–1725.

Motta, M. (1993). Endogenous quality choice: Price vs. quantity competition. Journal of Industrial Economics, 41(2), 113–131.

Motta, M. (1994). International trade and investments in a vertically differentiated industry. International Journal of Industrial Organization, 12, 179–196.

Motta, M., Thisse, J.-F., & Cabrales, A. (1997). On the persistence of leadership or leapfrogging in international trade. International Economic Review, 38(4), 809–824.

Mussa, M., & Rosen, S. (1978). Monopoly and product quality. Journal of Economic Theory, 18, 301–317.

Nabin, M. H., Nguyen, X., & Sgro, P. M. (2013). Technology transfer, quality standards, and North-South trade. Review of International Economics, 21(4), 783–796.

Navaretti, G. B., & Venables, A. J. (2004). Multinational firms in the world economy. Princeton, NJ: Princeton University Press.

Nunn, N. (2007). Relationship-specificity, incomplete contracts, and the pattern of trade. Quarterly Journal of Economics, 122, 569–600.

Rauch, J. E. (1999). Networks versus markets in international trade. Journal of International Economics, 48, 7–35.

Schmitt, N. (1995). Product imitation, product differentiation, and international trade. International Economic Review, 36, 583–608.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. Review of Economic Studies, 49, 3–13.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated oligopoly. RAND Journal of Economics, 15, 546–554.

Symeonidis, G. (2003). Comparing Cournot and Bertrand equilibria in a differentiated duopoly with product R&D. International Journal of Industrial Organization, 21, 39–55.

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: The MIT Press.

Tomiura, E. (2007). Foreign outsourcing, exporting, and FDI: A productivity comparison at the firm level. Journal of International Economics, 72, 113–127.

Toshimutsu, T. (2005). Tariffs, quality choice, and cost functions: A foreign monopoly case. Review of International Economics, 13(2), 376–384.

Verhoogen, E. (2008). Trade, quality upgrading and wage inequality in the Mexican manufacturing sector. Quarterly Journal of Economics, 123, 489–530.

Wagner, J. (2006). Exports, foreign direct investment, and productivity: Evidence from German firm level data. Applied Economics Letters, 13, 347–349.

Wagner, J. (2007). Exports and productivity: A survey of the evidence from firm-level data. World Economy, 30, 60–82.

Wagner, J. (2012). International trade and firm performance: A survey of empirical studies since 2006. Review of World Economics, 148, 235–267.

Wauthy, X. (1996). Quality choice in the model of vertical differentiation. Journal of Industrial Economics, 44, 345–353.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A.1 Proof of Proposition 1

Comparing a multinational’s profits from subsidiary sales of different quality, given by Eqs. (3) and (5) shows that

which is clearly negative for \(({\overline{u}}/{\underline{u}})<(4-\sigma )/2 \iff ({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2))<0\). Moreover, \(\partial [\pi _h^{FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )]/\partial t < 0\) for any \(t<{\overline{t}}={\overline{u}}-(\sigma {\underline{u}}/2)\), and at \(t=({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2))<{\overline{t}}\), \([\pi _h^{FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )]=0\). Thus, for \(({\overline{u}}/{\underline{u}})>(4-\sigma )/2\), \([\pi _h^{FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )]>0\) so long as \(t<({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2))\), whereas for \(({\overline{u}}/{\underline{u}})<(4-\sigma )/2\), \([\pi _h^{FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )]<0\) for any \(t<{\overline{t}}\) completing the proof.

1.2 A.2 Proof of Proposition 3

Comparing an exporter’s profits from its sales of different quality, given by Eqs. (6) and (8) shows that

which is clearly negative for \(({\overline{u}}/{\underline{u}})<(4-\sigma )/2 \iff ({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2))<0\). When \(\tau\) approaches to its prohibitive level \({\overline{\tau }}={\underline{u}}-(\sigma {\underline{u}})/2\), this difference gets

which is positive. Note that \(\partial [\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]/\partial \tau > 0\) at \(\tau < {\underline{u}}-(\sigma {\underline{u}})/2-({\overline{u}}-{\underline{u}})/3\), and that at \(\tau ={\underline{u}}-(\sigma {\underline{u}})/2-({\overline{u}}-{\underline{u}})\), \([\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]=0\). It is now straightforward to show that, when \(({\overline{u}}/{\underline{u}})<(4-\sigma )/2\), \([\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]<0\) for \(\tau < {\underline{u}}-(\sigma {\underline{u}})/2-({\overline{u}}-{\underline{u}})\), and \([\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]>0\) for \({\underline{u}}-(\sigma {\underline{u}})/2-({\overline{u}}-{\underline{u}})< \tau < {\overline{\tau }}\). As for \(({\overline{u}}/{\underline{u}})>(4-\sigma )/2\), \([\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]>0\) at both \(\tau =0\) and \(\tau ={\overline{\tau }}\), and \(\partial ^{2} [\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]/\partial \tau ^{2} < 0\), and thus \([\pi _h^{T}({\overline{u}},\cdot )-\pi _h^{T}({\underline{u}},\cdot )]>0\) for any \(\tau <{\overline{\tau }}\), completing the proof.

1.3 A.3 Proof of Proposition 5

The fixed investment cost thresholds are such that \(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )=0\) at \(G=G_1\), and \(\pi _h^{FDI} ({\overline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )=0\) at \(G=G_2\), where

\(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )>0\) when \(G<G_1\), and \(\pi _h^{FDI} ({\overline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )>0\) when \(G<G_2\), where \(G_1\ge 0\) if (and only if) \(\tau \ge (({\overline{u}}-{\underline{u}})-({\underline{u}}-(\sigma {\underline{u}}/2)))\), and \(G_2\ge 0\) if (and only if) \(\tau \ge t\), completing the proof. As for the changes in the fixed investment cost thresholds:

Note that the prohibitive cost thresholds are such that \({\overline{\tau }}={\underline{u}}-\sigma {\underline{u}}/2\) and \({\overline{t}}={\overline{u}}-\sigma {\underline{u}}/2\).

1.4 A.4 Proof of Proposition 6

The fixed investment cost thresholds are such that \(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )=0\) at \(G=G_3\), and \(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\underline{u}}, \cdot )=0\) at \(G=G_4\), where

\(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\overline{u}}, \cdot )>0\) when \(G<G_3\), and \(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{T} ({\underline{u}}, \cdot )>0\) when \(G<G_4\), completing the proof. As for the changes in the fixed investment cost thresholds:

Note that the prohibitive cost thresholds are such that \({\overline{\tau }}={\underline{u}}-\sigma {\underline{u}}/2\) and \({\overline{t}}={\overline{u}}-\sigma {\underline{u}}/2\).

1.5 A.5 Proof of Proposition 7

Comparing a multinational’s profits from subsidiary sales of different quality (in the case that high quality products are manufactured through vertical integration), given by Eqs. (3) and (9) shows that

which is clearly positive if \(t<({\overline{u}}-{\underline{u}})\), and negative if otherwise, given input trade costs are below their prohibitive levels such that \(t<{\overline{t}}={\overline{u}}-\sigma {\underline{u}}/2\), completing the proof of (i). Replacing t by \(c+t\) in profits given by Eq. (9) leads to a difference in profits given above, in which t should be replaced by \(c+t\) (and assuming away prohibitive costs should follow \(c+t<{\overline{u}}-\sigma {\underline{u}}/2\)). Thus, in such a case, \(\pi _h^{v,FDI}({\overline{u}},\cdot )>\pi _h^{FDI}({\underline{u}},\cdot )\) if \(c<({\overline{u}}-{\underline{u}})-t\), completing the proof of (ii). Similarly, including fixed costs specific to vertical integration in profits given by Eq. (9) leads to a fixed costs threshold (e.g., \({\overline{C}}\)), such that \(\pi _h^{v,FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )=0\) at \({\overline{C}}\) which is given by the displayed equation above. Consequently, \(\pi _h^{v,FDI}({\overline{u}},\cdot )-\pi _h^{FDI}({\underline{u}},\cdot )>0\) for fixed costs smaller than \({\overline{C}}\), completing the proof of (iii).

1.6 A.6 Proof of Proposition 8

Comparing an exporter’s profits from its sales of different quality (in the case that high quality products are manufactured through vertical integration), given by Eqs. (6) and (10) shows that

which is clearly positive for any non-prohibitive trade costs in final goods such that \({\overline{\tau }}<{\overline{\tau }}={\underline{u}}-\sigma {\underline{u}}/2\). In the case that vertical integration warrants some variable costs, \(\tau\) in profits given by Eq. (10) should be replaced by \(c+\tau\). In the case of additional variable costs (where prohibitive costs would be assumed away such that \(c+\tau <{\underline{u}}-\sigma {\underline{u}}/2\)), the difference between profits would be

which is clearly positive for \(c<({\overline{u}}-{\underline{u}})\). If vertical integration warrants some additional fixed costs (e.g., \({\overline{C}}\)), then this should be subtracted from profits given by Eq. (10). In such a case, depending on whether or not there is an additional variable cost (due to vertical integration), either of the two expressions above will be the threshold fixed cost below which exporting a high-quality foreign variety will be preferred over exporting a low-quality foreign variety, completing the proof.

1.7 A.7 Proof of Proposition 10

Propositions 7 and 8 and “Appendix A.5 and A.6” have already shown that producing a high-quality foreign variety is optimal for any non-prohibitive trade costs for an exporter, whereas a multinational prefers manufacturing high quality only if \(t<({\overline{u}}-{\underline{u}})\). That is, so as to determine the equilibrium outcome, when \(t<({\overline{u}}-{\underline{u}})\), \(\pi _h^{v,FDI} ({\overline{u}}, \cdot )\) and \(\pi _h^{v,T} ({\overline{u}},\cdot )\) has to be compared, whereas when \(t>({\overline{u}}-{\underline{u}})\), \(\pi _h^{FDI} ({\underline{u}}, \cdot )\) and \(\pi _h^{v,T} ({\overline{u}},\cdot )\) has to be compared. This leads to the fixed investment cost thresholds such that \(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{v,T} ({\overline{u}}, \cdot )=0\) at \(G=G_5\), and \(\pi _h^{v,FDI} ({\overline{u}}, \cdot )-\pi _h^{v,T} ({\overline{u}}, \cdot )=0\) at \(G=G_6\), where

\(\pi _h^{FDI} ({\underline{u}}, \cdot )-\pi _h^{v,T} ({\overline{u}}, \cdot )>0\) when \(G<G_5\), and \(\pi _h^{v,FDI} ({\overline{u}}, \cdot )-\pi _h^{v,T} ({\overline{u}}, \cdot )>0\) when \(G<G_6\), where \(G_5\ge 0\) if (and only if) \(\tau \ge ({\overline{u}}-{\underline{u}})\), and \(G_6\ge 0\) if (and only if) \(\tau \ge t\), completing the proof. As for the changes in the fixed investment cost thresholds:

Note that the prohibitive cost thresholds are such that \({\overline{\tau }}={\underline{u}}-\sigma {\underline{u}}/2\) and \({\overline{t}}={\overline{u}}-\sigma {\underline{u}}/2\).

About this article

Cite this article

Koska, O.A. Sourcing product quality for foreign market entry. Rev World Econ 156, 669–702 (2020). https://doi.org/10.1007/s10290-020-00375-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-020-00375-1

Keywords

- Vertical product differentiation

- Horizontal product differentiation

- Upstream market power

- Trade

- Foreign direct investment