Abstract

We consider land rental between a single tenant and several lessors. The tenant should negotiate sequentially with each lessor for the available land. In each stage, we apply the Nash bargaining solution, as a short-cut to solving non-cooperative bargaining games. Our results imply that, when all land is necessary, a uniform price per unit is more favorable for the tenant than a lessor-dependent price. Furthermore, a lessor is better off with a lessor-dependent price only when negotiating first. For the tenant, lessors’ merging is relevant with lessor-dependent price but not with uniform price.

Similar content being viewed by others

Notes

The Airborne Light Infantry Brigade, or Brigada Ligera AeroTranspotada (BRILAT).

See Remark R.2 in Herrero (1989).

Our results do not change if we use any other criterion for choosing the first proposer, as for example make always the lessor be first proposer.

References

Akiwumi FA (2014) Strangers and Sierra Leone mining: cultural heritage and sustainable development challenges. J Clean Prod 84:773–782

Arellano-Yanguas J (2011) Aggravating the resource curse: decentralisation, mining and conflict in Peru. J Dev Stud 47(4):617–638

Bag P, Winter E (1999) Simple subscription mechanisms for excludable public goods. J Econ Theory 87(1):72–94

Bennett E, van Damme E (1991) Demand commitment bargaining: the case of apex games. In: Selten R (ed) Game equilibrium models III. Strategic bargaining, Springer, Berlin, pp 118–140

Bergantiños G, Casas-Méndez B, Fiestras-Janeiro M, Vidal-Puga J (2007) A solution for bargaining problems with coalition structure. Math Soc Sci 54(1):35–58

Bergantiños G, Lorenzo L (2004) A non-cooperative approach to the cost spanning tree problem. Math Methods Oper Res 59(3):393–403

Binmore K, Rubinstein A, Wolinsky A (1986) The Nash bargaining solution in economic modelling. RAND J Econ 17(2):176–188

Chae S, Yang J-A (1994) An n-person pure bargaining game. J Econ Theory 62(1):86–102

Conley JP, Wilkie S (1995) Implementing the Nash extension to nonconvex bargaining problems. Econ Des 1(1):205–216

Conley JP, Wilkie S (1996) An extension of the Nash bargaining solution to nonconvex problems. Games Econ Behav 13(1):26–38

Dasgupta and Chiu (1998) On implementation via demand commintment games. Int J Game Theory 27:161–198

Fraser J (2018) Mining companies and communities: Collaborative approaches to reduce social risk and advance sustainable development. Resources Policy. Forthcoming. https://doi.org/10.1016/j.resourpol.2018.02.003

Gul F (1989) Bargaining foundations of Shapley value. Econometrica 57:81–95

Gul F (1999) Efficiency and immediate agreement: a reply to Hart and Levy. Econometrica 67:913–917

Hart S, Mas-Colell A (1996) Bargaining and value. Econometrica 64(2):357–380

Hart S, Mas-Colell A (2010) Bargaining and cooperation in strategic form games. J Eur Econ Assoc 8(1):7–33

Helwege A (2015) Challenges with resolving mining conflicts in Latin America. Extr Ind Soc 2(1):73–84

Herrero MJ (1989) The nash program: non-convex bargaining problems. J Econ Theory 49(2):266–277

Jaramillo P, Kayı Ç, Klijn F (2014) Asymmetrically fair rules for an indivisible good problem with a budget constraint. Soc Choice Welfare 43(3):603–633

Kaneko M (1980) An extension of the nash bargaining problem and the nash social welfare function. Theor Decis 12(2):135–148

Kaye JL, Yahya M (2012) Land and conflict: Tool and guidance for preventing and managing land and natural resources conflict. UN Interagency Framework Team for Preventive Action, Guidance Note

Kominers SD, Weyl EG (2012) Holdout in the assembly of complements: a problem for market design. Am Econ Rev Papers Proc 102(3):360–65

Krishna V, Serrano R (1996) Multilateral bargaining. Rev Econ Stud 63(1):61–80

Mariotti M (1998) Extending Nash’s axioms to nonconvex problems. Games Econ Behav 22(2):377–383

Matsushima N, Shinohara R (2015) The efficiency of monopolistic provision of public goods through simultaneous bilateral bargaining. ISER Discussion Paper No. 948, Institute of Social and Economic Research, Osaka University

Mc Quillin B, Sugden R (2016) Backward induction foundations of the Shapley value. Econometrica 6:2265–2280

Moulin H (1984) Implementing the Kalai-Smorodinsky bargaining solution. J Econ Theory 33:32–45

Nash J (1950) The bargaining problem. Econometrica 18(2):155–162

Nash J (1953) Two person cooperative games. Econometrica 21:129–140

Nguyen N, Boruff B, Tonts M (2018) Fool’s gold: understanding social, economic and environmental impacts from gold mining in Quang Nam province, Vietnam. Sustainab 10(5):1355

Papatya D, Trockel W (2016) On non-cooperative foundation and implementation of the Nash solution in subgame perfect equilibrium via Rubinstein’s game. J Mech Inst Des 1(1):83–107

Rubinstein A (1982) Perfect equilibrium in a bargaining model. Econometrica 50(1):97–109

Sarkar S (2015) Mechanism design for land acquisition. PhD thesis, TERI University

Sarkar S (2017) Mechanism design for land acquisition. Int J Game Theory 46(3):783–812

Selten (1992) A demand commitment model of coalition bargaining. In: Selten R (ed) Rational iteration. Springer, New York, pp 345–383

Sen A (2007) The theory of mechanism design: an overview. Econ Polit Wkl 42(49):8–13

Shapley LS (1953) A value for n-person games. In: Kuhn H, Tucker A (eds) Contributions to the theory of games, vol II. Annals of Mathematics Studies. Princeton NJ, Princeton University Press, pp 307–317

Sosa I (2011) License to operate: indigenous relations and free prior and informed consent in the mining industry. Sustainalytics, Amsterdam, The Netherlands

Ståhl I (1972) Bargaining theory. Stockholm School of Economics, Stockholm

Suh S-C, Wen Q (2006) Multi-agent bilateral bargaining and the Nash bargaining solution. J Math Econ 42(1):61–73

Tetreault D (2015) Social environmental mining conflicts in Mexico. Latin Am Perspect 42(5):48–66

Trockel W (2002) A universal meta bargaining implementation of the Nash solution. Soc Choice Welf 19(3):581–586

United Nations (2007) United nations declaration on the rights of indigenous peoples (UNDRIP). Adopted by the General Assembly on 2 October 2007

Valencia-Toledo A, Vidal-Puga J (2018) Duality in land rental problems. Oper Res Lett 46(1):56–59

Valencia-Toledo A, Vidal-Puga J (2019) Reassignment-proof rules for land rental problems. Int J Game Theory, Forthcoming

Van Damme E (1986) The Nash bargaining solution is optimal. J Econ Theory 38(1):78–100

van der Ploeg F, Rohner D (2012) War and natural resource exploitation. Eur Econ Rev 56(8):1714–1729

Vidal-Puga J (2004) Bargaining with commitments. Int J Game Theory 33(1):129–144

Vidal-Puga J (2008) Forming coalitions and the Shapley NTU value. Eur J Oper Res 190(3):659–671

Walter M, Urkidi L (2017) Community mining consultations in Latin America (2002–2012): the contested emergence of a hybrid institution for participation. Geoforum 84:265–279

Welker MA (2009) Corporate security begins in the community: mining, the corporate social responsibility industry, and environmental advocacy in Indonesia. Cult Anthropol 24(1):142–179

Winter E (1994) The demand commintment bargaining and snowballing cooperation. Econ Theor 4(2):255–273

Zhou L (1997) The Nash bargaining theory with non-convex problems. Econometrica 65(3):681–685

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Alfredo Valencia-Toledo thanks the Ministry of Education of Peru for its financial support through the “Beca Presidente de la República” Grant of the “Programa Nacional de Becas y Crédito Educativo (PRONABEC)”. Juan Vidal-Puga acknowledges financial support from the Spanish Ministerio de Economía y Competitividad through Grant ECO2014-52616-R., Ministerio de Economía, Industria y Competitividad through Grant ECO2017-82241-R, and Xunta de Galicia (ED431B 2019/34)

Appendix

Appendix

Proof of Theorem 4.1

We prove the following (stronger) result:

Given \(\left( a_i\right) _{i=1}^{s-1}\in A^{s-1}\) where \(a_i = (p_i,x_i)\) for all \(i<s\) in stage s, and \(\beta ^s = K - \left( \sum _{i<s}p_ic_i + r\sum _{i \ge s}^{}c_i \right) \), as \(\rho \rightarrow 1\), the final payoff allocation approaches

$$\begin{aligned} \left( \frac{\beta ^s }{2^{n-s+1}}, (p_1-r )c_1,\dots ,(p_{s-1}-r )c_{s-1}, \frac{\beta ^s }{2},\frac{\beta ^s }{2^2}, \dots , \frac{\beta ^s }{2^{n-s+1}} \right) \end{aligned}$$if \(\beta ^s > 0\) and \(x_i=c_i\) for all \(i<s\), and \((0,\dots ,0)\) if \(\beta ^s <0\) or \(x_i<c_i\) for some \(i<s\).

We proceed by backward induction on s.

Assume \(s=n\). Let \(\left( a_i\right) _{i=1}^{n-1}\in A^{n-1}\) with \(a_i=(x_i,p_i)\) for all \(i<n\). In case \(\sum _{i<n}x_i < E-c_n\), then there is not enough land left and the final payoff is zero for everyone. Since \(E=c(N)\), \(\sum _{i<n}x_i < E-c_n\) implies \(x_i<c_i\) for some \(i<n\). For the same reason, \(\sum _{i<n}x_i \ge E-c_n\) implies \(x_i=c_i\) for all \(i<n\). Hence, \(\sum _{i<n}x_i \ge E-c_n\) implies \(\sum _{i<n}x_i = E-c_n\).

If \(\beta ^n < 0\), then the prices are too high and agreement is not possible, so the final payoff is zero for everyone.

Assume now \(\beta ^n > 0\) and \(x_i=c_i\) for all \(i<n\). Then, the tenant and lessor n face the bargaining problem \((D^n,d^n)\) with \(d^n=(0,0)\).

An efficient agreement implies \(x_n=c_n\). So, the Pareto frontier of \(D^n\) is:

The Nash solution is obtained by the maximization problem

where the unique maximum is reached at \(p^*_n=\frac{\beta ^n+2r c_n}{2c_n}\). Given this, it is straightforward to check that the final payoff allocation (as \(\rho \rightarrow 1\)) becomes:

So, the hypothesis is satisfied for stage \(s=n\).

We now consider stage s.

Assume that the result is true in stage \(s+1\) for \(s<n\). Let \(\left( a_i\right) _{i=1}^{s-1}\in A^{s-1}\) with \(a_i=(x_i,p_i)\) for all \(i<s\). By analogous reasoning as in stage n, we deduce that in case \(\sum _{i<s}x_i < E-\sum _{i\ge s}c_i\), there is not enough land left and the final payoff is zero for everyone, and \(\sum _{i<s}x_i \ge E-\sum _{i \ge s}c_i\) implies \(\sum _{i<s}x_i = E-\sum _{i \ge s}c_i\).

If \(\beta ^s < 0\), then the prices are too high and agreement is not possible, so the final payoff is zero for everyone.

Assume now \(\beta ^s > 0\) and \(x_i=c_i\) for all \(i<s\). The tenant and lessor s face the bargaining problem \((D^s,d^s)\) with \(d^s=(0,0)\).

An efficient agreement implies \(x_s=c_s\). So, the Pareto frontier of \(D^s\) is:

The Nash solution is obtained by the maximization problem, which is given as follows. By induction hypothesis, given that the payoff for the tenant in stage \(s+1\) is \(\frac{\beta ^{s+1}}{2^{n-s}}\), \(\max \{u_0 u_s:(u_0,u_s)\in \partial D^s\}\) is equal to

where the unique maximum is reached at \(p^*_s=\frac{\beta ^s+2r c_s}{2c_s}\). Given this, the final payoff allocation (as \(\rho \rightarrow 1\)) is:

\(\square \)

Proof of Theorem 4.2

We define \(\pi ^*:{\mathbb {R}}_+ \rightarrow {\mathbb {R}}_+\) as \(\pi ^{*}(p) = \max \left\{ p,\frac{K+rE}{2E}\right\} \). We prove the following (stronger) result:

Given \(\left( a_i\right) _{i=1}^{s-1}\in A^{s-1}\) with \(a_i=(p_i,x_i)\) for all \(i<s\) at stage s, and \(p^{\prime }_{s-1}=\max _{i<s}\{p_i\} \) (for notational convenience, we assume \(p^{\prime }_{0}=0\) when \(s=1\)), the final price is \(\pi ^*\left( p^{\prime }_{s-1}\right) \) and the final payoff allocation (as \(\rho \rightarrow 1\)) becomes

if \(p^{\prime }_{s-1}< \frac{K+rE}{2E} < \frac{K}{E}\) and \(x_i=c_i\) for all \(i<s\),

if \( \frac{K+rE}{2E} \le p^{\prime }_{s-1} \le \frac{K}{E}\) and \(x_i=c_i\) for all \(i<s\), and

if \(p^{\prime }_{s-1} > \frac{K}{E}\) or \(x_i<c_i\) for some \(i<s\).

For any stage \(s\in N\), in case \(p^{\prime }_{s-1} > \frac{K}{E}\) or \(x_i<c_i\) for any \(i<s\), there is no possible agreement, so the final payoff is zero for everyone, as stated in (8). Hence, from now on, we assume \(p^{\prime }_{s-1} \le \frac{K}{E}\) and \(x_i=c_i\) for all \(i<s\).

We proceed by backward induction on s.

Assume \(s=n\). Let \(\left( a_i \right) _{i=1}^{n-1}\in A^{n-1}\) with \(a_i=(p_i,x_i)\) for all \(i<n\). The tenant and lessor n face the bargaining problem \(({\hat{D}}^n,{\hat{d}}^n)\) with \({\hat{d}}^n=(0,0)\). An efficient agreement is only possible when \(x_n=c_n\) and \(p_n\le \frac{K}{E}\), so the Pareto frontier of \({\hat{D}}^n\) is:

The Nash solution is obtained by the maximization problem:

The product \(u_0 u_n\) determines a concave parabola whose vertex is at \(\frac{K+rE}{2E}\).

We have the following three cases:

First Case: If \(p^{\prime }_{n-1}< \frac{K+rE}{2E} < \frac{K}{E}\), the maximum is reached at \(p_n^*=\frac{K+rE}{2E}\). By definition, \(\pi ^*(p_{n-1}^{\prime })=\max \{p_{n-1}^{\prime },\frac{K+rE}{2E}\}=\frac{K+rE}{2E}\). Then, the final price is \(\pi ^*(p_{n-1}^{\prime })=\frac{K+rE}{2E}\). From this, it is straightforward to check that the final payoff allocation is given as in (6).

Second Case: If \(\frac{K+rE}{2E} \le p^{\prime }_{n-1}\le \frac{K}{E}\), the maximum is reached at \(p_{n}^*=p^{\prime }_{n-1}\). The final price is \(\pi ^*(p_{n-1}^{\prime })=p_{n-1}^{\prime }\). From this, it is straightforward to check that the final payoff allocation is given as in (7).

Third Case: If \(\frac{K+rE}{2E} \ge \frac{K}{E}\), we deduce that \(rE \ge K\) which is a contradiction because of the condition \(rE < K\). Therefore, this case is not possible.

We now consider stage s.

Assume that the result is true in stage \(s+1\) for \(s<n\). Let \(\left( a_i \right) _{i=1}^{s-1}\in A^{s-1}\) with \(a_i=(p_i,x_i)\) for all \(i<s\). The tenant and lessor s face the bargaining problem \(({\hat{D}}^s,{\hat{d}}^s)\) with \({\hat{d}}^s=(0,0)\). An efficient agreement is only possible when \(x_s=c_s\) and \(p_s \le \frac{K}{E}\). By induction hypothesis, the price is \(\pi _{}^*(p_{s}^{\prime })\). So the Pareto frontier of \({\hat{D}}^s\) is:

The Nash solution is obtained by the maximization problem \(\max \{ u_0 u_s:(u_0,u_s)\in \partial {\hat{D}}^s \}\), or equivalently,

Since \(\pi _{}^*(p_{s})\) is constant for \(p_{s}^{}\le \frac{K+rE}{2E}\), the maximization problem can be rewritten as

The product \((K-p_{s}E)(p_{s}-r)c_s\) determines a concave parabola whose vertex is at \(\frac{K+rE}{2E}\).

Now, we have the following three cases:

First Case: If \(p^{\prime }_{s-1}< \frac{K+rE}{2E} < \frac{K}{E}\), since \(\pi ^*(p_{s-1}^{\prime })=\max \{p_{s-1}^{\prime },\frac{K+rE}{2E}\}\), we deduce \(\pi ^*(p_{s-1}^{\prime })=\frac{K+rE}{2E}\). Hence, \(\pi ^*(p_{s-1}^{\prime })\le \frac{K+rE}{2E} \le \frac{K}{E}\), and thus the maximum is reached at \(p_s^*=\frac{K+rE}{2E}\). Then, the final price is \(\frac{K+rE}{2E}=\pi ^*(p_{s-1}^{\prime })\). From this, it is straightforward to check that the final payoff allocation is given as in (6).

Second Case: If \(\frac{K+rE}{2E} \le p^{\prime }_{s-1}\le \frac{K}{E}\), since \(\pi ^*(p_{s-1}^{\prime })=\max \{p_{s-1}^{\prime },\frac{K+rE}{2E}\}\), we deduce \(\pi ^*(p_{s-1}^{\prime })= p^{\prime }_{s-1}\). Hence, \(\frac{K+rE}{2E} \le \pi ^*(p_{s-1}^{\prime })\le \frac{K}{E}\), and thus the maximum is reached at \(p_s^*= \pi ^*(p_{s-1}^{\prime })\). Then, the final price is \(p_{s-1}^{\prime }=\pi ^*(p_{s-1}^{\prime })\). From this, it is straightforward to check that the final payoff allocation is given as in (7).

Third Case: If \(\frac{K+rE}{2E}\ge \frac{K}{E}\), we deduce that \(rE \ge K\) which is a contradiction, because of the hypothesis condition \(rE < K\). Therefore, this case is not possible. \(\square \)

Proof of Theorem 5.1

Assume first \(E\le c_{1},c_{2}\). The tenant, in case she does not reach an agreement with lessor 1 in stage 1, will face a bargaining problem \(\left( D^{2},d^{2}\right) \) in stage 2 with lessor 2 with \(d^{2}=\left( 0,0\right) \) and \(D^{2}=\left\{ \left( u_{0},u_{2}\right) \in \mathbb {R}^{2}:u_{0}+u_{2}\le K-rE\right\} \). The Nash solution is \(\left( \frac{K-rE}{2},\frac{K-rE}{2}\right) \). Hence, the expected final payoff for the tenant, provided there is disagreement in stage 1, is \(\frac{K-rE}{2}\). From this, in stage 1, the tenant and lessor 1 face a bargaining problem \(\left( D^{1},d^{1}\right) \) with \(d^{1}=\left( \frac{K-rE}{2},0\right) \) and

where

Now, any agreement \((p_1,x_1)\in \Delta ^0\) with \(x_1>E\) is Pareto dominated by \((p'_1,x'_1)=\left( \frac{p_1x_1}{E},E\right) \). Hence, we can rewrite \(D^{1}\) as

The Nash solution for \(\left( D{}^{1},d^{1}\right) \) maximizes \(\left( K-p_1E-\frac{K-rE}{2}\right) (p_1-r)E\). This maximum is at \(p^*_1=\frac{3r}{4}+\frac{K}{4E}\), so that the final payoff allocation, when \(\rho \rightarrow 1\), becomes \(\left( 3\frac{K-rE}{4},\frac{K-rE}{4},0\right) \).

Assume now \(c_{2}<E\le c_{1}\) or \(c_{2}<E\le c_{1}\). The smallest lessor is a dummy, so the tenant and the other lessor will equally share \(K - rE\), and the dummy receives zero.

Finally, assume \(E>c_{1},c_{2}\). Assume that the tenant and lessor 1 agree on some \(\left( p_{1},x_{1}\right) \in \left[ 0,\infty \right. \left[ \times \left[ 0,c_{1}\right] \right. \) in stage 1. In order for agreement to be possible in stage 2, suppose \(x_{1}\ge E-c_{2}\) and \(\left( p_{1}-r\right) x_{1}\le K-rE\). Now, in stage 2, any individually rational choice \(\left( p_{2},x_{2}\right) \) with \(x_{2}>E-x_{1}\) is Pareto dominated by \(\left( p_{2}',x_{2}'\right) \) with \(p_{2}'=\frac{x_{2}}{E-x_{1}}p_{2}\) and \(x_{2}'=E-x_{1}\). Hence, the tenant and lessor 2 face a bargaining problem \(\left( D^{2},d^{2}\right) \) with \(d^{2}=\left( 0,0\right) \) and

where \(\Delta ^2=\left[ r,\frac{K-p_{1}x_{1}}{E-x_{1}}\right] \). Taking \(\alpha =\left( E-x_{1}\right) p_{2}\), we can rewrite \(D^2\) as

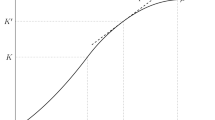

equivalently (see Fig. 1, Right),

By symmetry and efficiency, the Nash solution gives both players the same utility \(\frac{K-rE-(p_1-r)x_1}{2}\) and it is uniquely determined with \(x_{2}=E-x_{1}\) and \(p_{2}=\frac{K-p_{1}x_{1}}{2\left( E-x_{1}\right) }+\frac{r}{2}\).

Given this, the bargaining problem in stage 1 is \(\left( D^{1},d^{1}\right) \) given by \(d^{1}=\left( 0,0\right) \) and

where

Taking \(\beta =\left( p_{1}-r\right) x_{1}\), we can rewrite \(D^{1}\) as

equivalently (Fig. 2),

The Nash solution maximizes \(\left( K-rE-\beta \right) \beta \). This maximium is at \(\beta ^{o}=\frac{K-rE}{2}\). Hence the final payoff allocation , when \(\rho \rightarrow 1\), becomes

\(\square \)

Proof of Theorem 5.2

We focus on the case \(c_{1},c_{2}<E\). The proof for the other cases is analogous to the proof of Theorem 5.1.

Assume that the tenant and lessor 1 agree on some \(\left( p_{1},x_{1}\right) \in \left[ 0,\infty \right. \left[ \times \left[ 0,c_{1}\right] \right. \) in stage 1. In order for agreement to be possible in stage 2, we also assume \(x_{1}\ge E-c_{2}\) and \(p_{1}\le \frac{K}{E}\). Given this, the tenant and lessor 2 face the bargaining problem \(\left( {\hat{D}}^{2},{\hat{d}}^{2}\right) \) with \({\hat{d}}^{2}=\left( 0,0\right) \) and

where

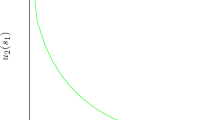

The individually rational Pareto frontier of \({\hat{D}}^{2}\) are the points \(\left( u_0,g_{2}\left( u_{0}\right) \right) \), where \(u_{0}\in \left[ 0,K- p_{1} E\right] \) and \(g_{2}\left( u_{0}\right) \) is a function defined as follows: \(g_2(u_0)\) the maximum of \(\left( p_{2}-r\right) x_{2}\) subject to \(p_{2}\ge p_{1}\), \(p_{2}\ge r\), \(E-x_{1}\le x_{2}\le c_{2}\) and \(K-\left( x_{1}+x_{2}\right) p_{2}=u_{0}\).

Assume first \(r=0\), this means that \(g_2(u_0)\) reaches its maximum at \(x_2=c_2\). Thus, we have that \(g_2(u_0)=\frac{K-u_0}{x_1+c_2}c_2\).

Assume now \(r>0\). The maximization is equivalent to maximizing the function

on the interval \(x_{2}\in \left[ E-x_{1}, m_2 \right] ,\) where \(m_2 = \min \left\{ c_{2}, \frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\right\} .\)

The derivative of f is given by \(f'(x_2) = \frac{(K - u_0)x_1}{(x_1+x_2)^2} - r\), whose unique positive root is

associated to the price \(p_{2}^{o}=\sqrt{\frac{\left( K-u_{0}\right) r}{x_{1}}}\). The second derivate is \(f''(x_2) = -\frac{2(K-u_0)x_1}{(x_1 + x_2)^3}.\) Since \(f''(x_2) < 0,\) we deduce that the maximum is unique, it is located at \(x_2^o\) when it belongs to \([E - x_1, m_2]\), at \(E - x_1\) when \(x_2^o < E - x_1,\) and at \(m_2\) when \(m_2 < x_2^o.\)

Hence, we have three cases:

Case 1 If \(x_{2}^{o}<E-x_{1}\) or, equivalently, \(u_{0}>K-\frac{rE^{2}}{x_{1}}\), the unique maximum is at \(x_{2}=E-x_{1}\) (with \(p_{2}=\frac{K-u_{0}}{E}\)), and it gives

$$\begin{aligned} g_{2}\left( u_{0}\right) =f\left( E-x_{1}\right) =\left( \frac{K-u_{0}}{E}-r\right) \left( E-x_{1}\right) =\frac{E-x_{1}}{E}\left( K-rE-u_{0}\right) \end{aligned}$$which implies that, for \(u_{0}>K-\frac{rE^{2}}{x_{1}}\), the frontier of \({\hat{D}}^{2}\) is a line with slope \(-\frac{E-x_{1}}{E}\).

Case 2 If \(x_{2}^{o} \ge m_2,\) we have two subcases:

Case 2a If \(c_{2}\le \frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\) and \(x_{2}^{o}\ge c_{2}\), or, equivalently, \(u_{0}\le K - \left( x_{1} + c_{2}\right) \max \left\{ \max \{r, p_{1}\}, \frac{x_{1}+c_{2}}{x_{1}} r\right\} \), the maximum is at \(x_{2}=c_{2}\) (with \(p_{2}=\frac{K-u_{0}}{x_{1}+c_{2}}\)), and it gives

$$\begin{aligned} g_{2}\left( u_{0}\right) =f\left( c_{2}\right) =\frac{c_{2}}{x_{1}+c_{2}}\left( K-\left( x_{1}+c_{2}\right) r-u_{0}\right) \end{aligned}$$which implies that, for \(u_{0}\le K-\left( x_{1}+c_{2}\right) \max \left\{ p_{1},\frac{x_{1}+c_{2}}{x_{1}}r\right\} \), the frontier of \({\hat{D}}^{2}\) is a line with slope \(-\frac{c_{2}}{x_{1}+c_{2}}\).

Case 2b If \(c_{2}\ge \frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\) and \(x_{2}^{o}\ge \frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\), or, equivalently, \(u_{0}\ge K - \frac{\max \{r, p_1\}x_1}{r} \min \left\{ \max \{r,p_{1}\}, \frac{x_{1} + c_2}{x_1}r \right\} \), the maximum is at \(x_{2}=\frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\) (with \(p_{2}=\max \{r,p_{1}\}\)), and it gives

$$\begin{aligned} g_{2}\left( u_{0}\right)&=f\left( \frac{K-u_{0}}{\max \{r,p_{1}\}}-x_{1}\right) \\&=\frac{\max \{r,p_{1}\}-r}{\max \{r,p_{1}\}}\left( K-\max \{r,p_{1}\}x_{1}-u_{0}\right) \end{aligned}$$which implies that, for

$$\begin{aligned} u_{0}\ge K - \frac{\max \{r, p_1\}x_1}{r} \min \left\{ \max \{r,p_{1}\}, \frac{x_{1} + c_2}{x_1}r \right\} , \end{aligned}$$the frontier of \({\hat{D}}^{2}\) is a line with slope \(-\frac{\max \{r,p_{1}\}-r}{\max \{r,p_{1}\}}\).

Case 3 In any other case, the maximum is at \(x_{2}=x_{2}^{o}\) (with \(p_{2}=p_{2}^{o}\)), and it is

$$\begin{aligned} g_{2}\left( u_{0}\right) =f\left( \sqrt{\frac{x_{1}}{r}\left( K-u_{0}\right) }-x_{1}\right) =\left( \sqrt{K - u_0} - \sqrt{rx_1}\right) ^2 \end{aligned}$$which implies that, in some cases, the frontier of \({\hat{D}}^2\) is a convex function.

From these cases allow us to define \(g_{2}\left( u_{0}\right) \), for any \(u_{0}\in \left[ 0,K-\max \left\{ p_{1},r\right\} E\right] \), as follows:

for any \(u_{0}\in \left[ 0,K-\max \left\{ p_{1},r\right\} E\right] \). Notice that Case 1 only applies when \(K - \frac{rE^{2}}{x_{1}}<K-p_{1}E\) or, equivalently, \(p_{1}x_{1}<rE\). In that case, and since \(E\le x_{1}+c_{2}\), we have \(\max \{r,p_{1}\} < \frac{x_{1} + c_{2}}{x_{1}}r\) and hence case 2b reduces to \(u_{0}\ge K - \frac{\max \{r,p_{1}\}^{2}x_{1}}{r}\) which implies \(u_{0}\ge K - \max \{r,p_{1}\}E\), which is impossible. Hence, case 1 and case 2b cannot happen simultaneously, and so \(g_{2}\) is well-defined on the interval \(\left[ 0,K - \max \left\{ p_{1}, r\right\} E\right] \).

Since \(E\le x_{1}+c_{2}\), we have \(\frac{rE}{x_{1}} \le \frac{x_{1}+c_{2}}{x_{1}}r\). There are three possibilities depending on \(p_{1}x_{1}\):

Small\(p_{1}x_{1}\) If \(p_{1}x_{1}<rE\), then case 2b vanishes:

$$\begin{aligned} g_{2}\left( u_{0}\right) ={\left\{ \begin{array}{ll} \frac{E-x_{1}}{E}\left( K-rE-u_{0}\right) &{} \text{ if } u_{0}\ge K-\frac{rE^{2}}{x_{1}}\\ \frac{c_{2}}{x_{1}+c_{2}}\left( K-\left( x_{1}+c_{2}\right) r-u_{0}\right) &{} \text{ if } u_{0}\le K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r\\ \left( \sqrt{K-u_{0}}-\sqrt{rx_{1}}\right) ^{2} &{} \text{ if } u_{0}\in \left[ K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r,K-\frac{rE^{2}}{x_{1}}\right] . \end{array}\right. } \end{aligned}$$In this case, \(g_{2}\) is convex. There are three candidates for the Nash solution:

Case 1\(u_{0}^{s1}=\frac{K-rE}{2}\) only if \(u_{0}^{s1}\ge K-\frac{rE^{2}}{x_{1}}\), but this case is not possible when K is large enough (\(K>K^{s1}:=\frac{E+c_2}{E-c_{2}}rE\));

Case 2a\(u_{0}^{s2}=\frac{K-\left( x_{1}+c_{2}\right) r}{2}\) only if \(u_{0}^{s2}\le K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r\), which always holds for K large enough (\(K>K^{s2}:=\frac{E+c_{2}}{E-c_{2}}\left( c_{1}+c_{2}\right) r\)); and

Case 3\(u_{0}^{s3}=\frac{K-r x_{1}}{8}\left( 1-\sqrt{1-\frac{16K}{K-r x_{1}}}\right) \) only if \(K-rx_{1}\ge 16K\), which is not possible.

Hence, for \(K=\min \{K^{s1},K^{s2}\}=K^{s1}\) large enough, and for each pair \(\left( x_{1},p_{1}\right) \) with \(x_{1}p_{1}<rE\), the tenant and lessor 2 will agree on some \(\left( p_{2}^{*},x_{2}^{*}\right) \) such that the tenant’s final payoff is \(u_{0}^{2a}\) (case 2a). This implies \(p_{2}^{*}=r+\frac{K}{\left( x_{1}+c_{2}\right) }\) and \(x_{2}^{*}=c_{2}\).

Medium\(p_{1}x_{1}\) If \(p_{1}x_{1}\in \left[ rE,\left( x_{1}+c_{2}\right) r\right] \), then case 1 vanishes:

$$\begin{aligned} g_{2}\left( u_{0}\right) ={\left\{ \begin{array}{ll} \frac{c_{2}}{x_{1}+c_{2}}\left( K-\left( x_{1}+c_{2}\right) r-u_{0}\right) &{} \text{ if } u_{0}\le K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r\\ \frac{p_{1}-r}{p_{1}}\left( K-p_{1}x_{1}-u_{0}\right) &{} \text{ if } u_{0}\ge K-\frac{x_{1}}{r}p_{1}^{2}\\ \left( \sqrt{K-u_{0}}-\sqrt{rx_{1}}\right) ^{2} &{} \text{ if } u_{0}\in \left[ K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r,K-\frac{x_{1}}{r}p_{1}^{2}\right] . \end{array}\right. } \end{aligned}$$In this case, \(g_{2}\) is again convex and there are three candidates for the Nash solution:

Case 2a\(u_{0}^{2a}=\frac{K-\left( x_{1}+c_{2}\right) r}{2}\) only if \(u_{0}^{2a}\le K-\frac{\left( x_{1}+c_{2}\right) ^{2}}{x_{1}}r\), which always holds for K large enough (\(K>K^{s3}=\frac{E+c_{2}}{E-c_{2}}\left( c_{1}+c_{2}\right) r\));

Case 2b\(u_{0}^{2b}=\frac{K-p_{1}x_{1}}{2}\) only if \(u_{0}^{2b}\ge K-\frac{x_{1}}{r}p_{1}^{2}\), which does not hold for K large enough (\(K>K^{s4}=\left( c_{1}+2c_{2}\right) \frac{rE}{E-c_{2}}\)); and

Case 3\(u_{0}^{3}=\frac{K-r{ x_{1}}}{8}\left( 1-\sqrt{1-\frac{16K}{K-r{ x_{1}}}}\right) \) only if \(K-rx_{1}\ge 16K\), which is not possible.

Hence, for \(K=\min \{K^{s3},K^{s4}\}=K^{s4}\) large enough, and for each pair \(\left( p_{1},x_{1}\right) \) with \(p_{1}x_{1}\in \left[ rE,\left( x_{1}+c_{2}\right) r\right] \), the tenant and lessor 2 will agree on some \(\left( p_{2}^{*},x_{2}^{*}\right) \) such that the tenant’s final payoff is \(u_{0}^{2a}\) (case 2a). This implies again that \(p_{2}^{*}=r+\frac{K}{\left( x_{1}+c_{2}\right) }\) and \(x_{2}^{*}=c_{2}\).

Large\(x_{1}p_{1}\) If \(x_{1}p_{1}\ge \left( x_{1}+c_{2}\right) r\), then cases 1 and 3 vanish

$$\begin{aligned} g_{2}\left( u_{0}\right) ={\left\{ \begin{array}{ll} \frac{c_{2}}{x_{1}+c_{2}}\left( K-\left( x_{1}+c_{2}\right) r-u_{0}\right) &{} \text{ if } u_{0}\le K-\left( x_{1}+c_{2}\right) p_{1}\\ \frac{p_{1}-r}{p_{1}}\left( K-p_{1}x_{1}-u_{0}\right) &{} \text{ if } u_{0}\ge K-\left( x_{1}+c_{2}\right) p_{1}. \end{array}\right. } \end{aligned}$$In this case, \(g_{2}\) is concave and the unique (generalized) Nash solution if given by:

$$\begin{aligned} u_{0}^{*}={\left\{ \begin{array}{ll} u_{0}^{2a} &{} \text{ if } u_{0}^{2a}\le K-\left( x_{1}+c_{2}\right) p_{1}\\ u_{0}^{2b} &{} \text{ if } u_{0}^{2b}\ge K-\left( x_{1}+c_{2}\right) p_{1}\\ K-\left( c_{1}+c_{2}\right) p_{1} &{} \text{ otherwise } \end{array}\right. } \end{aligned}$$which is equivalent to:

$$\begin{aligned} u_{0}^{*}={\left\{ \begin{array}{ll} \frac{K-\left( x_{1}+c_{2}\right) r}{2} &{} \text{ if } p_{1}\le \frac{K}{2\left( x_{1}+c_{2}\right) }+\frac{r}{2}\\ \frac{K-p_{1}x_{1}}{2} &{} \text{ if } p_{1}\ge \frac{K}{x_{1}+2c_{2}}\\ K-\left( c_{1}+c_{2}\right) p_{1} &{} \text{ if } p_{1}\in \left[ \frac{K}{2\left( x_{1}+c_{2}\right) }+\frac{r}{2},\frac{K}{x_{1}+2c_{2}}\right] . \end{array}\right. } \end{aligned}$$For K large enough (\(K>K^{s5}=\left( c_{1}+c_{2}\right) \left( 1+2\frac{c_{2}}{E-c_{1}}\right) r\)), case \(p_{1}\le \frac{K}{2\left( x_{1}+c_{2}\right) }+\frac{r}{2}\) is compatible with \(x_{1}p_{1}\ge \left( x_{1}+c_{2}\right) r\) and hence the three cases are nondegenerate. Hence, for each pair \(\left( p_{1},x_{1}\right) \) with \(p_{1}x_{1}\ge \left( x_{1}+c_{2}\right) r\), the tenant and lessor 2 will agree on some \(\left( p_{2}^{*},x_{2}^{*}\right) \) such that the tenant’s final payoff is \(u_{0}^{*}\) given as before.

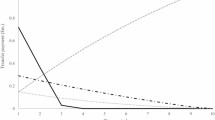

See Fig. 3 for three examples of \(({\hat{D}}^2,{\hat{d}}^2)\) for three possible choices of \((p_1,x_1)\).

Assume now we are in stage 1 and K is large enough (\(K>K^{s6}=\frac{\left( c_{1}+2c_{2}\right) \left( c_{1}+c_{2}\right) r}{E-c_{2}}\)). For each possible agreement \(\left( p_{1},x_{1}\right) \), the above cases allow us to anticipate the agreement \(\left( p_{2}^{\left( p_{1},x_{1}\right) },x_{2}^{\left( p_{1},x_{1}\right) }\right) \) in stage 2:

Therefore, we have a bargaining problem \(\left( {\hat{D}}^{1},{\hat{d}}^{1}\right) \) with \({\hat{d}}^{1}=\left( 0,0\right) \) and

where \({\hat{\Delta }}^1 = \left[ 0,\frac{K}{E}\right] \times \left[ E-c_{2},c_{1}\right] \).

In particular, given an agreement \(\left( p_{1},x_{1}\right) \in {\hat{\Delta }}^1\), the final payoff for the tenant and lessor 1, as \(\rho \rightarrow 1\), is given by \(\left( u^*_{0},u^*_{1}\right) =\)

The generalized Nash solution is given by a pair \((p_1,x_1)\) that maximizes \(u^*_0 u^*_1\) (when this maximization problem has a unique solution). Let \(u_{0}\in \left[ 0,K-rE\right] \) be the utility that the tenant can get. The Pareto frontier of \({\hat{D}}^{1}\) is determined by a function \(g_{1}\left( u_{0}\right) \) which gives the maximum that lessor 1 can get when the tenant gets \(u_{0}\), i.e.

with \(g_1(u_0)\) the maximum of \(u^*_1\) subject to \(u^*_0 = u_0\). From (10), we have three cases depending on \(p_1\). If \(p_{1}\le \frac{K}{2\left( x_{1}+c_{2}\right) }+\frac{r}{2}\), we maximize \(\frac{K-\left( x_{1}+c_{2}\right) r}{2\left( x_{1}+c_{2}\right) }x_{1}\) subject to \(\frac{K-\left( x_{1}+c_{2}\right) r}{2}=u_{0}\), which is equivalent to maximize \(\frac{ru_{0}x_{1}}{K-2u_{0}}\). Since it is increasing on \(x_{1}\), we deduce that the optimal \(x_1\) satisfies \(p_{1}\ge \frac{K}{2\left( x_{1}+c_{2}\right) }+\frac{r}{2}\). If \(p_{1}\ge \frac{K}{x_{1}+2c_{2}}\), we maximize \(\left( p_{1}-r\right) x_{1}\) subject to \(\frac{K-p_{1}x_{1}}{2}=u_{0}\), which is equivalent to maximize \(K-2u_{0}-rx_{1}\). Since it is decreasing on \(x_{1}\), we deduce that the optimal \(x_1\) satisfies \(p_{1}\le \frac{K}{x_{1}+2c_{2}}\).

We then maximize \(\left( p_{1}-r\right) x_{1}\) subject to \(K-\left( x_{1}+c_{2}\right) p_{1}=u_{0}\), which is equivalent to maximizing \(\left( \frac{K-u_{0}}{x_{1}+c_{2}}-r\right) x_{1},\) equivalent to function f. Hence, by an analogous reasoning as before, we deduce that the maximum is at

Hence, we have three cases depending on wherever \(x_{1}^{o}\ge c_{1}\) (equivalently, \(u_{0}\le K-\frac{\left( c_{1}+c_{2}\right) ^{2}r}{c_{2}}\)), \(x_{1}^{o}\in \left[ E-c_{2},c_{1}\right] \) (equivalently, \(u_{0}\in \left[ K-\frac{\left( c_{1}+c_{2}\right) ^{2}r}{c_{2}},K-\frac{rE^{2}}{c_{2}}\right] \)), or \(x_{1}^{o}\le E-c_{2}\) (equivalently, \(u_{0}\ge K-\frac{rE^{2}}{c_{2}}\)). The maximum is obtained, respectively, with \((p_1,x_1)=\left( \frac{K-u_{0}}{c_{1}+c_{2}},c_1\right) \), \((p_1,x_1)=\left( \sqrt{\frac{\left( K-u_{0}\right) r}{c_{2}}},x_{1}^{0}\right) \), and \((p_1,x_1)=\left( \frac{K-u_{0}}{E},E-c_{2}\right) \). From this, we have

which determines the bargaining problem in stage 1 (see Fig. 4). For K large enough (\(K>K^{s7}=\frac{2c_{1}+c_{2}}{c_{2}}\left( c_{1}+c_{2}\right) r\)), the generalized Nash bargaining solution determines \(u_{0}=\frac{K-\left( c_{1}+c_{2}\right) r}{2}\) as final payoff for the tenant, with \((p_1,x_1)=\left( \frac{K}{2(c_1+c_2)}+\frac{r}{2},c_1\right) \). From (9), we deduce that, at stage 2, the final agreement, as \(\rho \rightarrow 1\), becomes \((p^*_2,x^*_2)=\left( \frac{K}{2(c_1+c_2)}+\frac{r}{2},c_2\right) \) and so the final payoff for each lessor \(i\in \{1,2\}\) becomes \(u_i = (p_2-r)x_i = \frac{c_iK}{2\left( c_{1} + c_{2}\right) } - \frac{c_ir}{2}\). \(\square \)

Rights and permissions

About this article

Cite this article

Valencia-Toledo, A., Vidal-Puga, J. A sequential bargaining protocol for land rental arrangements. Rev Econ Design 24, 65–99 (2020). https://doi.org/10.1007/s10058-020-00230-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-020-00230-7