Abstract

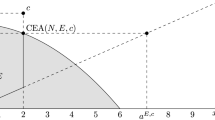

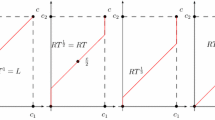

This paper axiomatically studies bankruptcy problems with nontransferable utility by focusing on generalizations of consistency and the contested garment principle. On the one hand, we discuss several consistency notions and introduce the class of parametric bankruptcy rules which contains the proportional rule, the constrained relative equal awards rule, and the constrained relative equal losses rule. On the other hand, we introduce the class of adjusted bankruptcy rules and characterize the relative adjustment principle by truncation invariance, minimal rights first, and a weak form of relative symmetry.

Similar content being viewed by others

Notes

Alternatively, one can interpret a bankruptcy problem with nontransferable utility as a bargaining problem with claims (cf. Chun and Thomson 1992) where the disagreement point equals the zero vector, or as a Nash rationing problem (cf. Mariotti and Villar 2005) where the admissible allocations are nonnegative. Contrary to these models, we allow for a nonconvex estate and claims which exceed the maximal individual payoffs within the estate.

This type of theorem can be formulated for any bankruptcy rule satisfying bilateral consistency and converse consistency.

Peters et al. (1994) introduced a similar property for bargaining solutions.

For an arbitrary number of claimants, this formula corresponds to the adjusted proportional rule.

References

Aumann R, Maschler M (1985) Game theoretic analysis of a bankruptcy problem from the Talmud. J Econ Theory 36(2):195–213

Chun Y, Thomson W (1992) Bargaining problems with claims. Math Soc Sci 24(1):19–33

Curiel I, Maschler M, Tijs S (1987) Bankruptcy games. Zeitschrift für Oper Res 31(5):143–159

Dagan N (1996) New characterizations of old bankruptcy rules. Soc Choice Welf 13(1):51–59

Dietzenbacher B (2018) Bankruptcy games with nontransferable utility. Math Soc Sci 92:16–21

Dietzenbacher B, Estévez-Fernández A, Borm P, Hendrickx R (2016) Proportionality, equality, and duality in bankruptcy problems with nontransferable utility. In: CentER Discussion Paper, 2016–026

Estévez-Fernández A, Borm P, Fiestras-Janeiro M (2019) Nontransferable utility bankruptcy games. TOP. https://doi.org/10.1007/s11750-019-00527-z

Herrero C (1997) Endogenous reference points and the adjusted proportional solution for bargaining problems with claims. Soc Choice Welfare 15(1):113–119

Herrero C, Villar A (2001) The three musketeers: four classical solutions to bankruptcy problems. Math Soc Sci 42(3):307–328

Mariotti M, Villar A (2005) The Nash rationing problem. Int J Game Theory 33(3):367–377

Moreno-Ternero J, Villar A (2004) The Talmud rule and the securement of agents’ awards. Math Soc Sci 47(2):245–257

Moreno-Ternero J, Villar A (2006) New characterizations of a classical bankruptcy rule. Rev Econ Des 10(2):73–84

O’Neill B (1982) A problem of rights arbitration from the Talmud. Math Soc Sci 2(4):345–371

Orshan G, Valenciano F, Zarzuelo J (2003) The bilateral consistent prekernel, the core, and NTU bankruptcy problems. Math Oper Res 28(2):268–282

Peters H, Tijs S, Zarzuelo J (1994) A reduced game property for the Kalai–Smorodinsky and egalitarian bargaining solutions. Math Soc Sci 27(1):11–18

Thomson W (2003) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: a survey. Math Soc Sci 45(3):249–297

Thomson W (2011) Consistency and its converse: an introduction. Rev Econ Des 15(4):257–291

Thomson W (2013) Game-theoretic analysis of bankruptcy and taxation problems: recent advances. Int Game Theory Rev 15(3):1340018

Thomson W (2015) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: an update. Math Soc Sci 74:41–59

Thomson W, Yeh C (2008) Operators for the adjudication of conflicting claims. J Econ Theory 143(1):177–198

Young H (1987) On dividing an amount according to individual claims or liabilities. Math Oper Res 12(3):398–414

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

B. Dietzenbacher: Support from the Basic Research Program of the National Research University Higher School of Economics is gratefully acknowledged.

Rights and permissions

About this article

Cite this article

Dietzenbacher, B., Borm, P. & Estévez-Fernández, A. NTU-bankruptcy problems: consistency and the relative adjustment principle. Rev Econ Design 24, 101–122 (2020). https://doi.org/10.1007/s10058-019-00227-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-019-00227-x

Keywords

- NTU-bankruptcy problems

- Consistency

- Relative adjustment principle

- Parametric bankruptcy rules

- Adjusted bankruptcy rules