Abstract

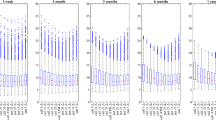

Considering the floating interest rate and the uncertainty of the strike price, we derive the pricing formulas of lookback options including lookback call option and lookback put option. Furthermore, we give the numerical algorithms to illustrate our results and analyze the relationships between the price of lookback options and all the parameters.

Similar content being viewed by others

References

Chen, X. (2011). American option pricing formula for uncertain financial market. International Journal of Operations Research, 8(2), 32–37.

Dai, L., Fu, Z., & Huang, Z. (2017). Option pricing formulas for uncertain financial market based on the exponential Ornstein–Uhlenbeck model. Journal of Intelligent Manufacturing, 28(3), 597–604.

Gao, J. (2013). Uncertain bimatrix game with applications. Fuzzy Optimization and Decision Making, 12(1), 65–78.

Gao, R., Liu, K., Li, Z., et al. (2019). American barrier option pricing formulas for stock model in uncertain environment. IEEE Access, 7, 97846–97856.

Gao, Y., Yang, X., & Fu, Z. (2018). Lookback option pricing problem of uncertain exponential Ornstein–Uhlenbeck model. Soft Computing, 22(17), 5647–5654.

Jiao, D., & Yao, K. (2015). An interest rate model in uncertain environment. Soft Computing, 19(3), 775–780.

Kahneman, D., & Tversky, A. (1979). Prospect theory: Analysis of decision under risk. Econometrica, 47(2), 263–291.

Liu, B. (2007). Uncertainty theory (2nd ed.). Berlin: Springer.

Liu, B. (2008). Fuzzy process, hybrid process and uncertain process. Journal of Uncertain systems, 2(1), 3–16.

Liu, B. (2009). Some research problems in uncertainty theory. Journal of Uncertain systems, 3(1), 3–10.

Liu, B. (2010). Uncertainty theory: A branch of mathematics for modeling human uncertainty. Berlin: Springer.

Liu, B. (2013a). A new definition of independence of uncertain sets. Fuzzy Optimization and Decision Making, 12(4), 451–461.

Liu, B. (2013b). Toward uncertain finance theory. Journal of Uncertainty, Analysis and Applications., 1(1), 1.

Liu, B. (2014). Uncertain random graph and uncertain random network. Journal of Uncertain systems, 8(1), 3–12.

Liu, B. (2015). Uncertainty theory. Berlin: Springer.

Peng, J., & Yao, K. (2011). A new option pricing model for stocks in uncertainty markets. International Journal of Operations Research, 8(2), 18–26.

Sun, J., & Chen, X. (2015). Asian option pricing formula for uncertain financial market. Journal of Uncertainty Analysis and Applications, 3(1), 11.

Sun, Y., Yao, K., & Fu, Z. (2018). Interest rate model in uncertain environment based on exponential Ornstein–Uhlenbeck equation. Soft Computing, 22(2), 465–475.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Yao, K. (2013). Extreme values and integral of solution of uncertain differential equation. Journal of Uncertainty Analysis and Applications, 1(1), 1–21.

Yao, K., & Chen, X. (2013). A numerical method for solving uncertain differential equations. Journal of Intelligent and Fuzzy Systems, 25(3), 825–832.

Yu, X. (2012). A stock model with jumps for uncertain markets. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems, 20(3), 421–432.

Zhang, L., & Sun, Y. (2020). Power options pricing in uncertain environment. Acta Scientiarum Naturalium Universitatis Nankaiensis, 53(2), 1–6.

Zhang, L., Sun, Y., & Meng, X. (2020). European spread option pricing with the floating interest rate for uncertain financial market. Mathematical Problems in Engineering, 2020, 1–8.

Zhang, Z., & Liu, W. (2014). Geometric average asian option pricing for uncertain financial market. Journal of Uncertain Systems, 8(4), 317–320.

Acknowledgements

The authors would like to thank the anonymous referee and the editor for their helpful comments and valuable suggestions that led to several important improvements.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This research was supported in part by The Youth Project of Humanities and Social Sciences of Ministry of Education (Grant No. 19YJCZH251) and in part by The Scientific Research Program of Tianjin Education Commission (Grant No. 2018KJ113).

Rights and permissions

About this article

Cite this article

Zhang, L., Sun, Y., Du, Z. et al. Uncertain strike lookback options pricing with floating interest rate. Rev Deriv Res 24, 79–94 (2021). https://doi.org/10.1007/s11147-020-09170-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-020-09170-4