Abstract

Internet retailers often compete fiercely for consumers through expensive marketing efforts like search engine advertising, online coupons and a variety of special deals. Against this background, it is somewhat puzzling that many online retailers have recently begun referring their website visitors to their direct competitors. In this paper, using an analytical model, we examine this counterintuitive practice and posit that an entry deterrence motive can potentially explain this marketplace puzzle. Specifically, we develop a model where two incumbents compete for consumers” business while facing a potential entrant who is deciding whether to enter the market. In addition to setting the price, each incumbent firm could potentially display a referral link to its direct competitor. Our analysis reveals that when confronted with a potential entry, an incumbent may refer consumers to its competitor, intensifying the market competition that could result in shutting off the entrant. Furthermore, we show that when referral efficiency is exogenous, it is possible that in equilibrium only one incumbent refers its customers to competitor (i.e., one-way referral) or both incumbents refer their customers to each other (i.e, two-way referral). When referral efficiency is endogenous, the ex-ante symmetric incumbents may choose asymmetric referral efficiencies ex-post. We extend the model in a number of directions including making the entrant share endogenous and allowing incumbents to be asymmetric. Overall, our results indicate that firms may be motivated by entry deterrence to voluntarily refer consumers to their direct competitors even when they are paid nothing for the referral.

Similar content being viewed by others

Notes

We are grateful to the review team for bringing forth this important point and for suggesting the conceptual arguments to address it.

As we will see that an equilibrium in the pure strategies does not exist, so the firms randomize prices in our set-up. Randomized prices are consistent with the price variation observed in the actual homogeneous goods markets and it suggests that the price changes are typically a lot more frequent than changes in a policy like competitive referral. This provides a rationale for why prices follow and respond to the referral decision in the model timeline and not the vice-versa.

As shown in Appendix B, there also exists a “No referral Entry” equilibrium in the region denoted by “Two-way referral No entry,” but it is Pareto-dominated by the latter.

The results of the consumer welfare analyses are available from the authors upon request.

References

Arbatskaya, M., & Konishi, H. (2012). Referrals in search markets. International Journal of Industrial Organization, 30, 89–101.

Athey, S., & Ellison, G. (2011). Position auctions with consumer search. The Quarterly Journal of Economics, 126(3), 1213–1270.

Baye, M.R., & Morgan, J. (2001). Information gatekeepers on the internet and the competitiveness of homogeneous product markets. American Economic Review, 91, 454–474.

Baye, M.R., Morgan, J., & Scholten, P. (2006). Information, search, and price dispersion. Handbook on economics and information systems, 1, 323–77.

Bonnington, C. (2014). How to break your phone contract without paying dearly? Available at http://www.wired.com/2014/07/carrier-contract-freedom/. Accessed in November, 2015.

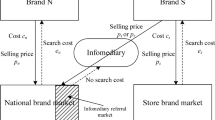

Cai, G., & Chen, Y. (2011). In-store referrals on the internet. Journal of Retailing, 87(4), 563–578.

Chen, Y., Iyer, G., & Padmanabhan, V. (2002). Referral infomediaries. Marketing Science, 21(4), 412–434.

Dixit, A. (1980). The role of investment in entry-deterrence. The economic journal, 90(357), 95–106.

Eliaz, K., & Spiegler, R. (2011). A simple model of search engine pricing. The Economic Journal, 121(556), F329–F339.

Gabaix, X., & Laibson, D. (2006). Shrouded attributes, consumer myopia, and information suppression in competitive markets. Quarterly Journal of Economics, 121(2), 505–540.

Gao, S.Y., Lim, W.S., & Tang, C.S. (2016). Entry of copycats of luxury brands. Marketing Science, 36(2), 272–289.

Garicano, L., & Santos, T. (2004). Referrals. The American Economic Review, 94(3), 499–525.

Geroski, P.A. (1995). What do we know about entry International Journal of Industrial Organization, 13(4), 421–440.

Ghose, A., Mukhopadhyay, T., & Rajan, U. (2007). The impact of internet referral services on a supply chain. Information Systems Research, 18(3), 300–319.

Grossman, G.M., & Shapiro, C. (1984). Informative advertising with differentiated products. The Review of Economic Studies, 51(1), 63–81.

Gupta, S., Lehmann, D.R., & Stuart, J.A. (2004). Valuing customers. Journal of Marketing Research, 41(1), 7–18.

He, T., Kuksov, D., & Narasimhan, C. (2017). Free in-network pricing as an entry-deterrence strategy. Quantitative Marketing and Economics, 15(3), 279–303.

insurancebusinessmag.com. (2015). Auto insurers blasted for inflating rates with astronomic advertising budgets.

Ireland, N.J. (1993). The provision of information in a bertrand oligopoly. The Journal of Industrial Economics, 41, 61–76.

Jerath, K., Ma, L., Park, Y.-H., & Srinivasan, K. (2011). A position paradox in sponsored search auctions. Marketing Science, 30(4), 612–627.

Jiang, B., Jerath, K., & Srinivasan, K. (2011). Firm strategies in the mid tail of platform-based retailing. Marketing Science, 30(5), 757–775.

Klemperer, P. (1987). Markets with consumer switching costs. The quarterly journal of economics, 102(2), 375–394.

Koçaş, C., & Bohlmann, J.D. (2008). Segmented switchers and retailer pricing strategies. Journal of Marketing, 72(3), 124–142.

Kuksov, D., Prasad, A., & Zia, M. (2017). In-store advertising by competitors. Marketing Science, 36(3), 402–425.

Mehta, N., Rajiv, S., & Srinivasan, K. (2003). Price uncertainty and consumer search: A structural model of consideration set formation. Marketing science, 22(1), 58–84.

Milgrom, P., & Roberts, J. (1982). Limit pricing and entry under incomplete information: An equilibrium analysis. Econometrica: Journal of the Econometric Society, 50, 443–459.

Nalebuff, B. (2004). Bundling as an entry barrier. The Quarterly Journal of Economics, 119(1), 159–187.

Narasimhan, C. (1988). Competitive promotional strategies. Journal of Business, 61(4), 427–449.

Salop, S., & Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. The Review of Economic Studies, 44, 493–510.

Schmalensee, R. (1978). Entry deterrence in the ready-to-eat breakfast cereal industry. The Bell Journal of Economics, 9, 305–327.

Schmitt, P., Skiera, B., & Bulte, C.V.D. (2011). Referral programs and customer value. Journal of Marketing, 75, 46–59.

Shin, J., & Sudhir, K. (2010). A customer management dilemma: When is it profitable to reward one’s own customers Marketing Science, 29(4), 671–689.

Shulman, J.D., & Geng, X. (2013). Add-on pricing by asymmetric firms. Management Science, 59(4), 899–917.

Soberman, D.A. (2004). Research note: Additional learning and implications on the role of information advertising. Management Science, 50(12), 1744–1750.

Tergesen, A. (2015). Ira providers offer bonuses to attract money on the move. Available at http://blogs.wsj.com/totalreturn/2015/02/26/ira-providers-offer-bonuses-to-attract-money-on-the-move/. Accessed in November, 2015.

Varian, H.R. (1980). A model of sales. The American Economic Review, 70 (4), 651–659.

Varian, H.R. (2009). Online ad auctions. The American Economic Review, 99 (2), 430–434.

Vives, X. (2001). Oligopoly pricing: Old ideas and new tools. Cambridge: MIT Press.

Xu, L., Chen, J., & Whinston, A. (2011). Price competition and endogenous valuation in search advertising. Journal of Marketing Research, 48, 566–586.

Zappos.com. (2008). Zappos.com and 6pm.com. http://blogs.zappos.com/blogs/ceo-and-coo-blog/2008/02/19/zapposcom-and-6pmcom.

Acknowledgments

The authors are grateful to Jiwoong Shin, Dmitri Kuksov and Andreas Kraft for detailed comments on earlier drafts of this paper. This work was supported by the National Natural Science Foundation of China (No. 71602078), the Humanities and Social Sciences Fund of Ministry of Education (No. 15YJC630169), and the Qinglan Project of Jiangsu Province. Part of this work was completed when Jianqiang Zhang was visiting The University of Texas at Austin during fall of 2015, and he acknowledges the warm hospitality of the marketing department at McCombs School of Business.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Equilibrium results under main model

Our model analysis results in firms following no pure pricing strategies. We present a sketch for this finding following Varian (1980) and Narasimhan (1988). Take the no referral and no entry \(\left (\bar {R}_{1}\bar {R}_{2}\bar {E}\right )\) subgame as an example. Suppose that there exists a pair of pure prices, denoted by \((p_{1}^{*}, p_{2}^{*})\), under which the incumbents receive the maximum profits. Assume that \(p_{1}^{*}\leq p_{2}^{*}\) without loss of generality. By definition, if \(p_{1}^{*}\) is seller 1’s equilibrium price, there would not exist a price, denoted by \(p_{1}^{\ell }\), such that \(\pi _{1}(p_{1}^{\ell })>\pi _{1}(p_{1}^{*})\).

When \(p_{1}^{*}< p_{2}^{*}\), all the switchers purchase from seller 1 and we have \(\pi _{1}(p_{1}^{*})=p_{1}^{*}(1-\alpha )\). Let \(p_{1}^{\ell }=p_{1}^{*}+\varepsilon <p_{2}^{*}\), where ε is infinitely small but positive. Then, all the switchers still purchase from seller 1 and we have \(\pi _{1}(p_{1}^{\ell })=(p_{1}^{*}+\varepsilon )(1-\alpha )>\pi _{1}(p_{1}^{*})\). A contradiction.

When \(p_{1}^{*}= p_{2}^{*}\), the switchers randomly purchase from the incumbents. Assume that a fraction λ i ∈ (0, 1) of the switchers choose seller i, where \({\sum }^{2}_{i = 1}\lambda _{i}= 1\), then we have \(\pi _{1}(p_{1}^{*})=p_{1}^{*}[\alpha +\lambda _{1}(1-2\alpha )]\). Let \(p_{1}^{\ell }=p_{1}^{*}-\varepsilon <p_{2}^{*}\), where ε > 0. Then, all the switchers purchase from seller 1 and \(\pi _{1}(p_{1}^{\ell })=(p_{1}^{*}-\varepsilon )(1-\alpha )\). Clearly, \(\pi _{1}(p_{1}^{\ell })>\pi _{1}(p_{1}^{*})\Leftrightarrow \varepsilon <\frac {p_{1}^{*}(1-\lambda _{1})(1-2\alpha )}{1-\alpha }\). The inequality holds as long as ε is sufficiently small. A contradiction.

The discussion above proves the non-existence of pure price strategies. The existence of mixed pricing strategies can be proved by construction, as shown in the following discussion.

No Referral and No Entry

Under \(\bar {R}_{1}\bar {R}_{2}\bar {E}\), each incumbent has a fraction α of loyalists and the remaining fraction 1 − 2α is composed of switchers. The expected profit of seller i equals

Suppose that the two sellers set prices over the interval [p min,v]. Each seller should be indifferent between charging prices p min and v. Since \(\bar {F}_{j}(p_{\min })= 1\) and \(\bar {F}_{j}(v)= 0\), we have p min(1 − α) = α v, i.e., \(p_{\min }=\frac {\alpha v}{1-\alpha }\). Furthermore, each seller must earn the same profit given any prices within [p min,v]. Thus, \(p [\alpha + (1-2\alpha ) \bar {F}_{j}(p)]=\alpha v\), from which we get \(F_{j}(p)= 1-\frac {\alpha (v-p)}{(1-2\alpha )p}\). Obviously, seller 1 and seller 2 are symmetric w.r.t. the equilibrium price and profit. Therefore, at the equilibrium \(F_{1}(p)=F_{2}(p)= 1-\frac {\alpha (v-p)}{(1-2\alpha )p}\) for \(p\in [\frac {\alpha v}{1-\alpha }, v]\), and π 1 = π 2 = α v.

One-way Referral without Entry

Under \(R_{1}\bar {R}_{2}\bar {E}\), seller 1 has a fraction n 1 = α(1 − φ) of loyalists, seller 2 has a fraction n 2 = α of loyal customers and the remaining fraction s 12 = 1 − α(2 − φ) switches between the incumbents. Sellers 1 and 2 has an expected profit, respectively,

Following Narasimhan (1988), seller 2 (with a larger base of loyal segment) is indifferent between setting p = v and p = p min, where p min is the minimum possible price. Thus, π 2 = n 2 v = (n 2 + s 12)p min, i.e., \(p_{\min }=\frac {n_{2}v}{n_{2}+s_{12}}\). By charging p = p min, the seller 1 obtains the profit \(\pi _{1}=\frac {n_{2}v}{n_{2}+s_{12}}(n_{1}+s_{12})\). Each seller must receive the same profit within the price support [p min,v]. Therefore, \(n_{2}v=pn_{2}+ps_{12}\bar {F}_{1}(p)\) and \(\frac {n_{2}v}{n_{2}+s_{12}}(n_{1}+s_{12})=pn_{1}+ps_{12}\bar {F}_{2}(p)\), from which we have

where seller 2 has a mass \(\frac {n_{2}-n_{1}}{n_{2}+s_{12}}\) at price v. This is the well-known “Hi-Lo” price strategy. Finally, the equilibrium profits of sellers 1 and 2 are, respectively, \(\pi _{1}=\frac {n_{2}v}{n_{2}+s_{12}}(n_{1}+s_{12})\) and π 2 = n 2 v.

Entry without referral

The derivation of equilibria under \(\bar {R}_{1}\bar {R}_{2}E\) directly follows Koçaş and Bohlmann (2008). First define the supports of each firm’s CDF of price. Clearly, the upper bound of the feasible price set cannot exceed v. The minimum price for any firm is when it is indifferent between selling only to its loyal segment and quoting a lower price to capture the switchers. The minimum prices are \(p_{1}^{\min }=\frac {n_{1}v}{n_{1}+s_{12}+s_{13}+s_{123}}=\frac {\alpha (1-\beta )v}{1-\alpha }\) for seller 1, \(p_{2}^{\min }=\frac {n_{2}v}{n_{2}+s_{12}+s_{23}+s_{123}}=\frac {\alpha (1-\beta )v}{1-\alpha }\) for seller 2, and \(p_{3}^{\min }= 0\) for seller 3. Clearly, \(p_{1}^{\min }=p_{2}^{\min }>p_{3}^{\min }\).

Sellers 1 and 2 are symmetric w.r.t. their price strategies; hence they have the same price ranges. Seller 3 has the lowest minimum price; hence seller 3 shares the same lower bound as sellers 1 and 2. However, since sellers 1 and 2 have the same upper bound v and seller 3 has the weakest power in setting high price, it is possible that seller 3 sets the upper bound lower than v. Denote the common lower bound of the three sellers as p min, and denote the upper bound of seller 3 as p max.

Within the higher price region [p max,v], sellers 1 and 2 compete with each other. Seller 1 is indifferent between setting p = v and p = p max. Thus,

Within the lower price region [p min,p max], the three firms compete and they are indifferent among charging any prices. Thus,

Solving Eqs. A4, A5 and A6 and F 1(p max) = F 2(p max) simultaneously yields

To determine F 1(p) and F 2(p) within the interval [p max,v], we should solve the equation \(\pi _{1}=n_{1} v=n_{1} p+ s_{12} p \bar {F}_{2}(p)\), from which we have

To determine F 1(p), F 2(p) and F 3(p) within the interval [p min,p max], we should solve the following equations (F 1(p) = F 2(p)):

By algebra, we have

where we define \(h(p)=\sqrt {p^{2}+\frac {(1-\beta )(1-2\alpha )v}{\alpha (1-\alpha )}p}\). It is clearly shown that F 1(p) and F 2(p) will degenerate to the case where there is no entrance if β = 0. In case that β > 0, we can simplify F 1(p) and F 2(p) to, respectively,

To sum up, we obtain the CDFs of the equilibrium mixed prices as shown in the base model. The equilibrium profits of sellers 1, 2 and 3 are, respectively, π 1 = π 2 = n 1 v = α(1 − β)v and \(\pi _{3}=(s_{13}+s_{23}+s_{123})p_{\min }-G=\frac {\alpha \beta (1-\beta )}{1-\alpha }v-G\).

One-way referral with entry

In the subgame \(R_{1}\bar {R}_{2}E\), we have n 1 = α(1 − φ)(1 − β), n 2 = α(1 − β), s 12 = (1 − 2α + α φ)(1 − β), s 13 = α(1 − φ)β, s 23 = α β and s 123 = (1 − 2α + α φ)β. The pattern of mixed prices is similar to that under \(\bar {R}_{1}\bar {R}_{2}E\) and thus we omit the derivation process.

Two-way referral

The subgames \(R_{1}R_{2}\bar {E}\) is similar with \(\bar {R}_{1}\bar {R}_{2}\bar {E}\). The subgame R 1 R 2 E is similar with \(\bar {R}_{1}\bar {R}_{2}E\). The derivation process of these two subgames is analogue to previous subgames and thus we omit the derivation process.

Appendix B: Proof of Propositions

1.1 Proof of Proposition 1

When \(G\leq \frac {\alpha \beta (1-\beta )(1-\varphi )}{1-\alpha (1-\varphi )}v\), seller 3 always enters the market under no referral or one-way referral or two-way referral. The payoffs of sellers 1 and 2 under different referral strategies are listed in Fig. 12. It is easily seen from Fig. 12 that \(\bar {R}_{1}\bar {R}_{2}\) is the unique Nash equilibrium.

When \(G>\frac {\alpha \beta (1-\beta )}{1-\alpha }v\), seller 3 never enters the market under no referral or one-way referral or two-way referral. The payoffs of sellers 1 and 2 under different referral strategies are listed in Fig. 13. It is easily seen from Fig. 13 that \(\bar {R}_{1}\bar {R}_{2}\) is the unique Nash equilibrium.

When \(\frac {\alpha \beta (1-\beta )(1-\varphi )}{1-\alpha (1-\varphi )}v<G\leq \frac {\alpha \beta (1-\beta )}{1-\alpha (1-\varphi )}v\), seller 3 is blocked out of the market only if the incumbents simultaneously offer referrals. The payoffs of sellers 1 and 2 under different referral strategies are listed in Fig. 14.

As shown in Fig. 14, \(\bar {R}_{1}\bar {R}_{2}\) is a Nash equilibrium. However, there may exist another one Nash equilibrium depending on the value of β. If β ≤ φ, there is no other Nash equilibrium. If β > φ, R 1 R 2 is the other Nash equilibrium. It is clear that R 1 R 2 is a Parato-dominating strategy relative to \(\bar {R}_{1}\bar {R}_{2}\). Thus, R 1 R 2 will be the unique equilibrium over the long run.

When \(\frac {\alpha \beta (1-\beta )}{1-\alpha (1-\varphi )}v<G\leq \frac {\alpha \beta (1-\beta )}{1-\alpha }v\), seller 3 can be blocked out of the market under one-way referral or two-way referral. The payoffs of sellers 1 and 2 under different referral strategies are listed in Fig. 15. As shown in Fig. 15, \(\bar {R}_{1}\bar {R}_{2}\) is the unique Nash equilibrium if \(\beta \leq \frac {\alpha \varphi }{1-\alpha +\alpha \varphi }\). If \(\beta >\frac {\alpha \varphi }{1-\alpha +\alpha \varphi }\), there exist two Nash equilibria: \(R_{1}\bar {R}_{2}\) and \(\bar {R}_{1}R_{2}\). In this case, assume that each seller applies referral with probability τ and does not apply referral with probability 1 − τ. Under the mixed referral strategy, each seller earns the same expected profit between applying referral and not applying. Thus, \(\tau \cdot \alpha (1-\varphi )v+(1-\tau )\cdot \frac {\alpha (1-\alpha )}{1-\alpha (1-\varphi )}v=\tau \cdot \alpha v+(1-\tau )\cdot \alpha (1-\beta )v \Leftrightarrow \tau =\frac {\beta (1-\alpha )-(1-\beta )\alpha \varphi }{\beta (1-\alpha +\alpha \varphi )+\varphi (1-2\alpha +\alpha \varphi )}\).

1.2 Proof of Proposition 2

Equations 20–21 imply that the simultaneous referral decisions may result in multiple Nash equilibria.

-

(a)

When φ 1 and φ 2 are sufficiently small such that \(G<\frac {\alpha \beta (1-\beta )(1-\varphi _{2}) v}{1-\alpha +\alpha \varphi _{1}}\), seller 3 will enter the market. In this case, the profit of each incumbent decreases with their own referral efficiency, implying that neither incumbent should do referral, i.e., φ 1 = φ 2 = 0. As a consequence, π 1 = π 2 = α(1 − β)v and \(\pi _{3}=\frac {\alpha \beta (1-\beta ) v}{1-\alpha }-G\).

-

(b)

When φ 1 and φ 2 are sufficiently large such that \(G\geq \frac {\alpha \beta (1-\beta )(1-\varphi _{2}) v}{1-\alpha +\alpha \varphi _{1}}\), seller 3 will not enter the market. In this case, the profit of each incumbent also decreases with their own referral efficiency. Thus, as long as \(G>\frac {\alpha \beta (1-\beta )(1-\varphi _{2}) v}{1-\alpha +\alpha \varphi _{1}}\), at least one incumbent could decrease its referral efficiency by ε > 0 to improve profit without affecting seller 3’s entry decision. As such, another set of Nash equilibria is determined by \(\frac {\alpha \beta (1-\beta )(1-\varphi _{2}) v}{1-\alpha +\alpha \varphi _{1}}=G\). This will block seller 3 out of the market; hence π 2 = α(1 − φ 2)v and \(\pi _{1} =\frac {\alpha (1-\varphi _{2})(1-\alpha +\alpha \varphi _{2})v}{1-\alpha +\alpha \varphi _{1}}\).

Comparing the two alternatives we can obtain the conditions under which (b) is the equilibrium. First, the larger incumbent should earn a higher profit by applying referral, i.e., α(1 − φ 2)v > α(1 − β)v ⇔ φ 2 < β. Similarly, the smaller incumbent should also earn a higher profit by applying referral, i.e., \(\frac {\alpha (1-\varphi _{2})(1-\alpha +\alpha \varphi _{2})v}{1-\alpha +\alpha \varphi _{1}}>\alpha (1-\beta )v\Leftrightarrow \varphi _{1}< \frac {(1-\varphi _{2})(1-\alpha +\alpha \varphi _{2})}{\alpha (1-\beta )}-\frac {1-\alpha }{\alpha }\). Thus, the conditions under which the incumbents set \(\varphi _{2}^{*}\) and \(\varphi _{1}^{*}\) according to alternative (b), i.e., \(\frac {\alpha \beta (1-\beta )(1-\varphi _{2}) v}{1-\alpha +\alpha \varphi _{1}}=G\), are

Now, we should derive the thresholds for parameters to ensure the possibility of conditions shown in Eq. B1. To this end, we make a numerical example by setting α = 0.4, β = 0.3, v = 10 and G = 0.8 or 1 or 1.5, as shown in Fig. 16. The two solid curves depict the conditions \(\varphi _{2}^{*}\leq \varphi _{1}^{*}<\frac {(1-\varphi _{2}^{*})(1-\alpha +\alpha \varphi _{2}^{*})}{\alpha (1-\beta )}-\frac {1-\alpha }{\alpha }\), so they cover the possible regions for (\(\varphi _{1}^{*},\varphi _{2}^{*}\)). The dotted line named L1 (L2, L3) depicts the condition \(\varphi _{1}^{*}=\frac {\beta (1-\beta )(1-\varphi _{2}^{*})v}{G}-\frac {1-\alpha }{\alpha }\) given G = 1.5 (G = 1, G = 0.8).

Conditions Shown in Eq. B1

See first L1. This case implies that only if \(\varphi _{1}^{*}<0\) can the equation \(\frac {\alpha \beta (1-\beta )(1-\varphi _{2}^{*}) v}{1-\alpha +\alpha \varphi _{1}^{*}}=G\) hold, even when \(\varphi _{2}^{*}= 0\). Putting \(\varphi _{2}^{*}= 0\) into \(\varphi _{1}^{*}=\frac {\beta (1-\beta )(1-\varphi _{2}^{*})v}{G}-\frac {1-\alpha }{\alpha }<0\) we have \(G>\frac {\alpha \beta (1-\beta )v}{1-\alpha }\). Under this case, \(\frac {\alpha \beta (1-\beta )(1-\varphi _{2}^{*}) v}{1-\alpha +\alpha \varphi _{1}^{*}}<G\) given any \(\varphi _{1}^{*}\) and \(\varphi _{2}^{*}\). Thus, seller 3 does not enter the market and \(\varphi _{1}^{*}=\varphi _{2}^{*}= 0\).

See L2 then. This case implies that L2 and the solid curves have at least one crossing point. Solving \(\varphi _{1}^{*}=\frac {\beta (1-\beta )(1-\varphi _{2}^{*})v}{G}-\frac {1-\alpha }{\alpha }\) and \(\varphi _{1}^{*}=\varphi _{2}^{*}\) yields \(\varphi _{2}^{*}=\frac {\alpha \beta (1-\beta )v-(1-\alpha ) G}{\alpha \beta (1-\beta )v+\alpha G}\). Solving \(\varphi _{1}^{*}=\frac {\beta (1-\beta )(1-\varphi _{2}^{*})v}{G}-\frac {1-\alpha }{\alpha }\) and \(\varphi _{1}^{*}=\frac {(1-\varphi _{2}^{*})(1-\alpha +\alpha \varphi _{2}^{*})}{\alpha (1-\beta )}-\frac {1-\alpha }{\alpha }\) yields \(\varphi _{2}^{*}= 1-\frac {1}{\alpha }+\frac {\beta (1-\beta )^{2}v}{G}\). Checking the two possible crossing points we have \(\varphi _{2}^{*}=\frac {\alpha \beta (1-\beta )v-(1-\alpha ) G}{\alpha \beta (1-\beta )v+\alpha G}<\beta \Leftrightarrow G>\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\) and \(\varphi _{2}^{*}= 1-\frac {1}{\alpha }+\frac {\beta (1-\beta )^{2}v}{G}<\beta \Leftrightarrow G>\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\). Thus, when \(\frac {\alpha \beta (1-\beta )v}{1-\alpha } \geq G>\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\), the equilibrium is characterized by Eq. B1.

The last case is L3 with \(G\leq \frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\). Under this case, \(\frac {\alpha \beta (1-\beta )(1-\varphi _{2}^{*}) v}{1-\alpha +\alpha \varphi _{1}^{*}}>G\) given any \(\varphi _{1}^{*}\) and \(\varphi _{2}^{*}\) that can improve both incumbents’ profits. Thus, seller 3 enters the market and \(\varphi _{1}^{*}=\varphi _{2}^{*}= 0\).

1.3 Proof of Proposition 4

To solve the maximization problem Eq. 28, we should first derive the optimal β in the absence of the constraint, denoted by \(\hat {\beta }\) (i.e., the inner solution of the maximization problem). We easily have \(\hat {\beta }=\frac {\alpha v}{2\alpha v+c(1-\alpha )}\). Then, we should ensure that the constraint is satisfied. Since \(\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\) reaches its maximum value at \(\beta =\frac {\sqrt {(1-\alpha )(9-\alpha )}-3(1-\alpha )}{4\alpha }\equiv \bar {\beta }\), we know that if \(G>\frac {\alpha \bar {\beta }(1-\bar {\beta })^{2}v}{1-\alpha (1-\bar {\beta })}\), the constraint cannot hold. In this case, seller 3 would not enter the market and earn zero profit.

Suppose now \(G\leq \frac {\alpha \bar {\beta }(1-\bar {\beta })^{2}v}{1-\alpha (1-\bar {\beta })}\). To derive the conditions under which the constraint holds, define \(H(\beta )=\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\) which is a quasi-concave function with respect to β; that is, with the increase of β, H(β) first increases and finally decreases. When β = 0 or β = 1, we have H(β) = 0. The properties of H(β) implies that the equation \(G=\frac {\alpha \beta (1-\beta )^{2}v}{1-\alpha +\alpha \beta }\) has two solutions, denoted as β l and β h (i.e., the corner solutions of the maximization problem). Clearly, seller 3 has to set β within (β l ,β h ) to satisfy the constraint. As a result, if \(\hat {\beta }\) is located within β l and β h , we have \(\beta ^{*}=\hat {\beta }\); if \(\hat {\beta }\) is smaller than β l , we have β ∗ = β l ; and if \(\hat {\beta }\) is larger than β h , we have β ∗ = β h .

1.4 Proof of Proposition 5

The sketch of proof is as follows. In the absence of new entry or competitor referral, the equilibrium profit is the guaranteed profits are

If seller 1 applies referral and seller 3 does not enter, we have n 1 = 0, n 2 = α and s 12 = 1 − α − γ. The minimum prices each incumbent might charge are \(p_{1\min }=\frac {n_{1}v}{n_{1}+s_{12}}= 0\) and \(p_{2\min }=\frac {n_{2}v}{n_{2}+s_{12}}=\frac {\alpha v}{1-\gamma }\). Thus, the lower bound of the equilibrium mixed pricing is p min = max{p 1 min,p 2 min} = p 2 min, resulting in the equilibrium profits

If seller 3 enters the market and neither incumbent applies referral, the market will be segmented as follows: n 1 = n 2 = α(1 − β o ), n 3 = γ β b , s 13 = s 23 = α β o , s 12 = (1 − 2α − γ)(1 − β s ) and s 123 = (1 − 2α − γ)β s . The minimum prices each seller might set are \(p_{1\min }=p_{2\min }=\frac {n_{1}v}{n_{1}+s_{12}+s_{13}+s_{123}}=\frac {\alpha (1-\beta _{o})v}{1-\alpha -\gamma }\) and \(p_{3\min }=\frac {n_{3}v}{n_{3}+s_{13}+s_{23}+s_{123}}=\frac {\gamma \beta _{b}v}{2\alpha \beta _{o}+(1-2\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\). Whether the system minimum price equals p 1 min or p 3 min depends on whether \(\frac {\alpha (1-\beta _{o})}{1-\alpha -\gamma }\) is larger or smaller than \(\frac {\gamma \beta _{b}}{2\alpha \beta _{o}+(1-2\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\). When the parameters satisfy \(\frac {\alpha (1-\beta _{o})}{1-\alpha -\gamma }>\frac {\gamma \beta _{b}}{2\alpha \beta _{o}+(1-2\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\), we have p min = p 1 min, and therefore, \(\pi _{1}^{\bar {R}E}=\pi _{2}^{\bar {R}E}=\alpha (1-\beta _{o})v\) and \(\pi _{3}^{\bar {R}E}=p_{1\min }(n_{3}+s_{13}+s_{23}+s_{123})\). Otherwise, we have p min = p 3 min, \(\pi _{1}^{\bar {R}E}=\pi _{2}^{\bar {R}E}=p_{3\min }(n_{1}+s_{12}+s_{13}+s_{123})\) and \(\pi _{3}^{\bar {R}E}=\gamma \beta _{b} v-G\). To sum up, we have

If seller 3 enters the market and seller 1 applies referral, the sizes of each market segment are n 1 = s 13 = 0, n 2 = α(1 − β o ), n 3 = γ β b , s 23 = α β o , s 12 = (1 − α − γ)(1 − β s ) and s 123 = (1 − α − γ)β s . The minimum prices each seller might charge are p 1 min = 0, \(p_{2\min }=\frac {n_{2}v}{n_{2}+s_{12}+s_{23}+s_{123}}=\frac {\alpha (1-\beta _{o})v}{1-\gamma }\) and \(p_{3\min }=\frac {n_{3}v}{n_{3}+s_{23}+s_{123}}=\frac {\gamma \beta _{b}v}{\alpha \beta _{o}+(1-\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\). Whether the system minimum price equals p 2 min or p 3 min depends on whether \(\frac {\alpha (1-\beta _{o})}{1-\gamma }\) is larger or smaller than \(\frac {\gamma \beta _{b}}{\alpha \beta _{o}+(1-\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\). When \(\frac {\alpha (1-\beta _{o})}{1-\gamma }>\frac {\gamma \beta _{b}}{\alpha \beta _{o}+(1-\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\), we have p min = p 2 min, under which case π 1 = p 2 min(s 12 + s 123), π 2 = α(1 − β o )v, and π 3 = p 2 min(n 3 + s 23 + s 123). Otherwise, we have p min = p 3 min, under which π 1 = p 3 min(s 12 + s 123), π 2 = p 3 min(n 2 + s 12 + s 23 + s 123) and π 3 = γ β b v − G. To sum up, we have

Then, we should ensure that (a) seller 1 can improve profit by deterring entry, i.e., \(\pi _{1}^{R\bar {E}}>\pi _{1}^{\bar {R}E}\), and (b) conditional on entry, seller 3 earns positive profit in the absence of referral but earns negative profit in the presence of referral, i.e., \(\pi _{3}^{\bar {R}E}>0\) and \(\pi _{3}^{RE}<0\). Note that when \(\frac {\alpha (1-\beta _{o})}{1-\alpha -\gamma }\leq \frac {\gamma \beta _{b}}{2\alpha \beta _{o}+(1-2\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\), as shown in Eq. B4, \(\pi _{3}^{\bar {R}E}=\gamma \beta _{b} v-G\) which is equal to or lower than \(\pi _{3}^{RE}\). This could not be the equilibrium. Thus, we must have \(\frac {\alpha (1-\beta _{o})}{1-\alpha -\gamma }>\frac {\gamma \beta _{b}}{2\alpha \beta _{o}+(1-2\alpha -\gamma )\beta _{s}+\gamma \beta _{b}}\), under which \(\pi _{1}^{\bar {R}E}=\alpha (1-\beta _{o})v\). Simplifying \(\pi _{1}^{R\bar {E}}>\pi _{1}^{\bar {R}E}\) yields the condition α < β o (1 − γ). Finally, define

Obviously, seller 3 will be blocked out of the market for \(\underline {G}<G<\bar {G}\). Note that simplifying the condition \(\underline {G}<G<\bar {G}\) is not worth doing because the expression(s) will be rather complicated with few new insights. In the main text, we give a numerical example to show the existence of the equilibrium.

1.5 Proof of Proposition 6

The derivation process is quite similar to the main model and we omit it here.

Rights and permissions

About this article

Cite this article

Zhang, J., Liu, Z. & Rao, R.S. Flirting with the enemy: online competitor referral and entry-deterrence. Quant Mark Econ 16, 209–249 (2018). https://doi.org/10.1007/s11129-017-9196-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-017-9196-7