Abstract

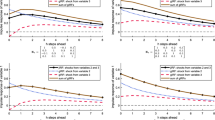

A set of RLS-type models with ARMA and ARFIMA dynamics is estimated and compared in a forecasting exercise with ARFIMA, GARCH and FIGARCH models. It is an extension of Rodríguez (N Am J Econ Financ 42:393–420, 2017) but using more countries and working with squared returns in the forecasting exercise. The estimation results show: (i) existence of RLS; (ii) measurement errors except in Chile and Colombia. Regarding the fractional parameter, the estimates are quite small indicating the possible absence of long memory with possible exceptions of Chile and Colombia. The forecast exercise using the 10% MCS of Hansen et al. (Econometrica 79:453–497, 2011) and the ratios of MSFE indicate absence of the RLS-ARFIMA models while RLS-ARMA models are selected. In general, the results of the estimations and forecasts indicate probable absence of long memory or its small magnitude, which would makes this characteristic not only unnecessary but also irrelevant to capture the variations of the low frequencies of the series.

Similar content being viewed by others

Notes

Complete set of results is available upon request.

The selection of the models has been done by looking at the statistical significance of the parameters as well as the value of the likelihood function.

All these results are available upon request.

Some evidence in favor of RLS-ARFIMA(p,d,q) models is found in Rodríguez (2017) only for τ = 1.

References

Antonakakis N, Darby J (2013) Forecasting volatility in developing countries nominal exchange results. Appl Financ Econ 23(21):1675–1691

Baillie RT (1996) Long memory processes and fractional integration in econometrics. J Econ 73:5–59

Baillie T, Bollerslev T, Mikkelsen HO (1996) Fractionally integrated generalized autoregressive conditional heteroskedasticity. J Econ 74:3–30

Babikir A, Gupta R, Mwabutwa CH, Owusu-Sekyere E (2012) Structural breaks and GARCH models of stock return volatility: the case of South Africa. Ecol Model 29(6):2435–2443

Barunik J, Krehlik T, Vacha L (2016) Modeling and forecasting exchange rate volatility in time-frequency domain. Eur J Oper Res 251(1):329–340

Beine M, Laurent S (2000) Structural change and long memory in volatility: new evidence from daily exchange rates, Econometric Society World Congress 2000 Contributed Papers 0312, Econometric Society

Brooks C, Burke S (1998) Forecasting exchange rate volatility using conditional variance models selected by information criteria. Economic Letters 61(3):273–278

Diebold F, Inoue A (2001) Long memory and regime switching. J Econ 105:131–159

Ding Z, Engle RF, Granger CWJ (1993) A long memory property of stock market returns and a new model. J Empir Financ 1:83–106

Fuller WA (1996) Introduction to time series, 2nd. Wiley, New York

Gonzáles Tanaka JC, Rodríguez G (2016) An empirical application of a random level shifts model with time-varying probability and mean reversion to the volatility of Latin American Forex Markets Returns, WP415, Pontificia Universidad Católica del Perú

Granger CWJ, Hyung N (2004) Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns. J Empir Financ 11:399–421

Granger CWJ, Joyeux R (1980) An introduction to long memory time series models and fractional differencing. J Time Ser Anal 1:15–39

Hansen PR, Lunde A (2005) A forecast comparison of volatility models: does anything beat a GARCH (1,1)?. J Appl Economet 20:873–889

Hansen PR, Lunde A (2006) Consistent ranking of volatility models. J Economet 131:97–121

Hansen PR, Lunde A, Nason JM (2011) The model confidence set. Econometrica 79:453–497

Hosking JRM (1981) Fractional differencing. Biometrika 68:165–176

Klaassen F (2002) Improving GARCH volatility forecasts with regime-switching GARCH. Empirical Economics 27(2):363–394

Li Y, Perron P, Xu J (2017) Modeling exchange rate volatility with random level shifts. Appl Econ 49:2579–2589

Lobato IN, Savin NE (1998) Real and Spurious Long Memory Properties of Stock-market Data. J Bus Econ Stat 16:261–268

Longmore R, Robinson W (2004) Modelling and forecasting exchange rate dynamics: an application of asymmetric volatility models, Working Paper 03, Bank of Jamaica

Lu YK, Perron P (2010) Modeling and forecasting stock return volatility using a random level shift model. J Empir Financ 17:138–156

McMillan DG, Speight AEH (2004) Daily volatility forecasts: reassessing the performance of GARCH models. J Forecast 23:449–460

Mohnot R (2011) Forecasting forex volatility in turbulent times. Global J Bus Res 5(1):27–38

Morana C, Beltratti A (2004) Structural change and long-range dependence in volatility of exchange rates: either, neither or both. J Empir Financ 11:629–658

Nunes LC, Newbold P, Kuan C-M (1995) Spurious breaks. Econ Theory 11:555–577

Ojeda Cunya JA, Rodríguez G (2016) An application of a random level shifts model to the volatility of peruvian stock and exchange rate returns. Macroeconomics and Finance in Emerging Market Economies 9(1):34–55

Palma W (2007) Long-memory time series, Wiley series in probability and statistics. Wiley, New Jersey

Perron P, Qu Z (2010) Long-Memory And level shifts in the volatility of stock market return indices”. J Bus Econ Stat 28:275–290

Perron P, Wada T (2016) Measurement business cycles with structural breaks and outliers: Applications to international data. Res Econ 70:281–303

Pong S, Shackleton MB, Taylor SJ, Xu X (2004) Forecasting currency volatility: a comparison of implied volatilities and AR(FI)MA models. J Bank Financ 28:2541–2563

Qu Z (2011) A test against spurious long memory. J Bus Econ Stat 29:423–438

Rapach DE, Strauss JK (2008) Structural breaks and GARCH models of exchange rate volatility. J Appl Econom 23:65–90

Rodríguez G (2016) Modeling Latin-American stock markets volatility: Varying probabilities and mean reversion in a random level shifts model. Review of Development Finance 6:26–45

Rodríguez G (2017) Modeling Latin-American stock and forex markets volatility: empirical application of a model with random level shifts and genuine long memory. N Am J Econ Financ 42:393–420

Varneskov RT, Perron P (2018) Combining long memory and level shifts in modeling and forecasting the volatility of asset returns. Quant Econ 18(3):371–393

Vilasuso J (2002) Forecasting exchange rate volatility. Econ Lett 76:59–64

West KD, Cho D (1995) The predictive ability of several models of exchange rate volatility. J Econ 69:367–391

Xu J, Perron P (2014) Forecasting return volatility: Level shifts with varying jump probability and mean reversion. Int J Forecast 30:449–463

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This is a subtantially revised and reduced version of Gonzáles Tanaka and Rodríguez (2016) which circulated under the title “An Empirical Application of a Random Level Shifts Model with Time-Varying Probability and Mean Reversion to the Volatility of Latin-American Forex Markets Returns.” We thank useful comments of Paul Castillo B. (Central Reserve Bank of Peru), Jiawen Xu (Shangai University of Finance and Economics), Zhongjun Qu and Pierre Perron (Boston University), Patricia Lengua Lafosse (UPC), Miguel Ataurima Arellano (PUCP) and participants to the Latin American Meeting of the Econometric Society (Guayaquil, November 8-10, 2018). We also appreciate the helpful and constructive comments from two anonymous referees and the Editor Professor Paulo M. M. Rodrigues who have helped improve and focus the document. Any remaining errors are our responsibility.

About this article

Cite this article

Rodríguez, G., Ojeda Cunya, J.A. & Gonzáles Tanaka, J.C. An empirical note about estimation and forecasting Latin American Forex returns volatility: the role of long memory and random level shifts components. Port Econ J 18, 107–123 (2019). https://doi.org/10.1007/s10258-019-00156-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-019-00156-1

Keywords

- Random Level Shifts

- Long memory

- Latin American Forex Markets

- Volatility

- Time Varying Probability

- Mean reversion

- ARFIMA models

- GARCH model

- FIGARCH model