Abstract

The social and economic developments in European countries have put pressure on their national budgets and threaten the sustainability of public policies. The traditional fiscal indicators, specifically, the deficit and the debt, which are still used today as guiding tools, have proved to be insufficient, due to their arbitrary nature and short-term focus. In this paper, we resort to an alternative fiscal indicator, known as ‘generational accounting’, which is able to incorporate the future changes in the demographic structure of the population, and their corresponding impact on public accounts. It is also able to evaluate how current fiscal policy affects, not only, current generations, but also future generations. We apply this methodology to assess the long-term fiscal situation of Portugal, and compare the results with those obtained in 1999. In this context, we also explore additional scenarios, as well as additional indicators, in order to provide some robustness to our findings. Our results show that, if the current fiscal policy is not significantly changed, future generations will face a much heavier fiscal burden than current generations.

Similar content being viewed by others

1 Introduction

In recent years, the stability of public finances in European countries has been under pressure. Among the causes of this instability are the slowing of economic growth, and the ageing of the population. With lower economic growth, on a macroeconomic level, the economies will generate fewer resources, and governments will have a smaller base from which they are able to collect revenues. On a microeconomic level, fewer jobs will be created, implying that some agents will not find placement in the job market, and, therefore, will, not only, be unable to contribute to public budgets, but will also increase dependency on public resources, through unemployment benefits. The ageing of the population poses a problem for two reasons. On the one hand, a reduction of the working population, and on the other hand, an increase in ageing related costs, namely, on pension systems and healthcare. If we look at society as being composed by three major age groups according to the life cycle (childhood/youth, middle-aged/active, and elderly/retirement), both the elderly and youth groups would be net beneficiaries (benefits received are higher than taxes paid) of public budgets, while the middle-aged groups would, not only, be net contributors of public budgets, but also have to contribute enough to off-set the spending with the other 2 groups of net beneficiaries. Based on these arguments, it follows that the structure of the population decisively affects the balance of public budgets.

The goal of this paper is to access the sustainability of the Portuguese fiscal system in the long run, to measure the net tax burdens for current/living and future generations (those that have not been born yet), and to propose corrective policies in case of unsustainability or imbalances between the net tax payments of current and future generations. Traditional fiscal measures, namely deficit and debt accounting, focus only on the current and short term effects of fiscal policies, and may not accurately reflect government accounts, due to its arbitrary nature. Thus, we alternatively resort to Generational Accounting, a methodology that was initially developed by Auerbach et al. (1992, 1994 and 1999b), which is based on the government’s intertemporal budget constraint, stating that present and future government spending must either be covered by current or future taxes and social security contributions, or by government net wealth. Depending on how they are financed, public policies have to be paid either by current or future generations, affecting their net wealth, and, as a consequence, they entail intergenerational distribution. Generational accounting is able to incorporate these long term implications of fiscal policy on intragenerational (within generations) and intergenerational (across generations) distribution and fiscal sustainability, while including future changes in the demographic structure of the population.

To produce generational accounts, we require: projections of the population, taxes, transfers, and government expenditures; an initial value of government wealth; a growth rate and a discount rate. The analysis is forward-looking, and, therefore, it calculates only the future fiscal burdens that each generation faces. The year 2010 is set as the base year, with generations born before or in 2010 considered as the current generation, and generations born after 2010 considered as the future generations. Taxes and transfers are allocated to the population according to a micro-profile, based on their age, in order to reflect changes in these variables due to changes in the population’s demographic structure. The rest of the variables are assumed to evolve at the same rate as the overall economy.

The contribution of this paper is twofold: First, the results obtained in this paper are analyzed and compared to the results in “Generational Accounting around the World” by Auerbach et al. (1999b). In other words, we provide an update of the calculations using the same methodology, so that we can draw conclusions from the recent policies followed by Portugal in terms of the sustainability of fiscal policy, and if further changes are required. We also provide a comparison with an alternative methodology for the calculations of the underlying accounts, by the European National Transfer Accounts, and compare the potential advantages and disadvantages between them. Then, we follow this initial analysis with calculations resorting to additional indicators and different scenarios, which will allow us to overcome some of the shortcomings of the initial indicators, provide additional insight on the change of the results due to changes in different variables (including different allocation of certain expenditures, changes in the discount rate or the productivity growth rate), as well as the underlying causes for these changes.

The structure of the paper is as follows: Section 2 highlights some of the changes in the Portuguese economy and demography that will affect the sustainability of the fiscal system. Section 3 explains the relevance of the generational accounting method in comparison to the traditional methods. Section 4 describes the theoretical framework and the methodology of generational accounting, as well as some limitations of these indicators. Section 5 defines the process of estimation of the variables and parameters of the government’s intertemporal budget constraint. This includes population projections and developments; age specific micro-profiles in order to assign taxes, social security and other contributions, transfers and benefits; fiscal data and government accounts; and the choice for the growth and discount rates. Section 6 presents the applied data of generational accounting and the respective results, and compares them with the results obtained in the accounts of 1999. We also provide additional indicators, in order to overcome some of the shortcomings of the main indicator. Section 7 provides a sensitivity analysis of the obtained results, as well as some empirical limitations. Section 8 provides the conclusions of this paper.

2 Sustainability of Portugal’s fiscal system

The Portuguese economy has been characterized by lower economic growth and successive current account deficits over the past years. As described by Pina and Abreu (2013), the low interest rates provided an easier access to credit in international markets. Given the decreasing levels of savings, consumption and investment were financed through increasing levels of public, as well as private debt. The authors also mention the bias of investment and credit towards sectors that provided non-tradable goods and services, which, along with the rigidity of the labour market and the lack of adjustment of wages to productivity, hindered the competitive position of the country and its ability to attract foreign investment. These factors generated a situation of instability that became unsustainable with the global financial and sovereign debt crises, due to the large decrease of external private financing. It led Portugal to sign a three year European Union-International Monetary Fund (EU-IMF) program of financial assistance in May 2011 until May 2014, implementing structural reforms with the goal of balancing the budget and stabilizing public debt levels, as well as to generate sustained and balanced growth. In this section, we give a brief description of some of the changes in the Portuguese economy and the demographic structure of the country that are likely to affect the sustainability of the fiscal system.

2.1 Economic growth and public accounts

We start by analyzing economic growth, described in Fig. 1. As we can see, it reflects a downard tendency, stabilizing between 0 and 2%, also in accordance with the tendency of other European countries. Lower GDP growth rates tend to be associated with higher pressure on public accounts, and the reason is simple: a lower GDP growth rate will imply that the increase in the production of resources by an economy/country is lower. As a result, the taxes that fall upon those same resources will also decrease, lowering public revenues. A lower GDP growth rate is also usually associated with lower levels of employment, and the pressure on public accounts will also come from higher unemployment and other public social safety net benefits provided. Indeed, we will see later on that, in our model, a lower economic growth rate will lead to a higher pressure on public accounts, as well as a higher burden for future generations.

We also need to take into account how the public finances have been developing, and how they are likely to evolve in the future. Through the analysis of public expenditure (in % GDP), described in Fig. 2, we can see that, in the period of 1995 to 2010, Portugal followed the trend of increase in public spending (even though with a considerable lag), converging to the average of the euro area and the European Union.The large increase in 2009 is in response to the international crisis by most member states of the union, whether through automatic stabilizers, or through stabilization policies. Nevertheless, as revenues were insufficient, Portugal accumulated fiscal deficits that resulted in a growing public indebtedness. As described in the OECD (2019), in the last two decades until the intervention program, the fiscal deficit never fell significantly below 3% of GDP (see Fig. 3), which, combined with small economic growth, resulted in a gradual but sustained rise in public debt since 2000 (see Fig. 4). In 2009, the “debt increase” shifted to a much steeper path, reaching 130% of GDP in 2014.

The combination of a rising public and external debt, slowing economic growth and the instability that came with the international financial crisis, led to a loss of confidence that Portugal would be able to fulfill its financial obligations, reflected in the lack of access to long-term financing at sustainable rates, culminating in the necessity of a financial assistance program signed with the European Union and the International Monetary Fund (EU-IMF). The outcomes seem to be in line with the goals of the program. Economic growth picked up, government expenditures dropped (as we can see in Fig. 2), public deficit decreased, public debt got under control, and is declining (as we can see in Fig. 4), and its outlook is now seen as acceptable by the 4 main rating agencies. However, a closer analysis of Fig. 4 shows the fragility of the current situation. An increase in the interest rates or the inflation rates can lead the path of public debt back to unsustainability.

2.2 Population ageing

The next topic we will address in this section is population ageing, the changes in the demographic structure, and the consequences for fiscal policy. Even though Portugal (and other EU member states) are familiar with this concept, its consequences have to be taken into account for policies that will affect future generations. Many policies of the welfare state that provide citizens protection against risk (like social security), were institutionalized in a much more thriving demographic environment, with a younger population and with optimistic expectations of economic growth. However, we are now witnessing an inversion of that same environment, with the continuous fall in fertility rates, combined with the increase in life expectancy, as shown in Fig. 5 and Table 1, respectively.

The increasing life expectancy of individuals relates to economic activity in a progressively problematic way, where the benefits of the elderly are inversely adjusted to the development of life expectancy. In these circumstances, old age ceases to be a singular risk that social security prevented in the few terminal years of every pensioner, substituting the earnings when the individual leaves the labor market definitely, and creating a new risk. This additional risk is associated with the possibility of pension benefits being insufficient to guarantee a decent standard of living to the beneficiary that faces new threats associated with longevity (mainly regarding healthcare and the funding of those pensions). The risks associated with dependency and with prolonged illness have a very significant effect in Portugal, as well as in other developed countries. Until now, the socialization of these risks associated with longevity has been low. The family solution has prevailed so far and the institutionalization of the elderly in residential nursing homes works as a solution of last resort, when the situations become too complicated to be managed inside the family. However, the shift in family structures in the last decades has increased the number of people with no family support to help them against these risks, which will lead to a higher demand of public long-term care services. The need of public protection against longevity risks is likely to increase even more in the future, given the information provided in Table 1. Lastly, notice that, even though life expectancy at birth has increased, there is not only, a huge difference when compared to the healthy life years at birth indicator, but also a difference in the increase in years between the two indicators, with healthy life years increasing at a lower rate than life expectancy.

We also need to take into account the pressure of ageing on government budgets and future generations. The evidence presented in Fig. 6 and Table 2, regarding the development of public expenditures by function and old age dependency ratios, respectively, reflects the increase of government expenditures associated with the ageing phenomenon, as well as the burden that is going to fall on the working age population, or to be covered by future generations. Even though the costs regarding healthcare have been kept under control, as we can see from Fig. 6, it seems obvious that social protection is the account that is putting more pressure on public finances, and that this behavior is, mainly, due to old age related expenditures. While all other accounts are always below 10% of GDP, government expenditures with social protection are always above 10%, steadily increasing and diverging from all the other accounts, with 18,8% in 2012.

Table 2 provides how old age dependency ratios changed overtime, as well as how they are predicted to change in the future, and are a good indicator of the burden that will fall upon current middle-aged/active and future generations.This indicator reflects the number of elderly people (with 65 years or more) per 100 active/working age people (with age between 15 and 64). Therefore, a higher dependency ratio implies a higher “burden” on the working population with the expenditures of their elderly. As we can see, the projected ratios for the future are quite alarming, with more than 1 elderly per 2 people of working age. And the scenario may be even worse, if we take into account that some of the people between 15 and 64 years may be studying, unemployed or non-participating in the labor force.

2.3 Intergenerational inequality

Lastly , in light of all the previous issues we raised in this section, it is also important to refer to their impact on intergenerational equality (equality between different generations). Taking all into consideration, it is relatively simple to conclude that they are very likely to increase generational inequality, and increase the burden for future generations. In fact, this is a concern that not only affects Portugal, but many other developed countries as well. The head of the IMF, Christine Lagarde, also expressed concerns on this issue, in a conference in Davos, in January, 2018. In a presentation titled “A Dream Deferred: Inequality and Poverty Across Generations in Europe”, the IMF points out that, since the financial crisis, income inequality levels have been relatively stable in European countries, but there is a significant growing gap between the youth and the elderly income levels post-crisis. More specifically, they trace a scenario with lower income levels, higher unemployment, more debt and higher risk of poverty for younger and future generations: Incomes for young people have not grown since the 2007 crisis, but they have increased by 10% for people at 65 or older (pension protection); nearly one in five young people in Europe are still looking for work, and when they find, it will likely be at lower wages and with lower security; and the younger have the highest debt relative to their assets of any age group. Just like the IMF, this topic was also addressed by the OECD (2017) in a press release, based on a publication Preventing Ageing Unequally (2017), stating that future generations will be largely affected by population ageing and rising inequality.

2.4 Current economic outlook

According to the OECD (2019), after the IMF intervention until today, the overall economic situation of Portugal has improved remarkably: GDP growth is back to pre-crisis levels, and is likely to maintain in coming years; unemployment rate has had one of the largest declines of OECD countries in the last decade; public debt ratio is falling; and the exports market has expanded. Despite this progress, the report also expresses some concerns for future developments: public debt still remains one of the highest across OECD countries, and limits the ability of public authorities to respond to future shocks, like an increase in the interest rates (change in policy by the ECB); a rapidly ageing population, which requires reforms on the pension and healthcare systems; relatively low living standards when compared to other OECD countries, with little convergence in the past decades; and a relatively high unemployment rate for unskilled workers. National institutions have also expressed concerns on the sustainability of government programs. This includes a study published by the Fundação Francisco Manuel dos Santos on April of 2019 (more specifically, by Moreira et al. (2019)), which establishes that social security will start generating chronic deficits by 2027.

Summing up, with an ageing population and the number of beneficiaries of public budgets growing more than contributors, the distributive needs will keep increasing, which will put more pressure on national budgets. However, Portugal’s public finances are already under pressure, and even though the overall economic and financial outlook is improving, public debt is still far from assured sustainability.

3 Deficit and debt as a not well-defined measure

In general, policy and decision makers take traditional fiscal measures, specifically, the deficit and the debt, as the main guiding tools in fiscal policy. Take, for example, the target defined for public deficits at 3% of GDP or less for the countries in the European Monetary Union. The main concerns with debt and deficit accounting are their arbitrary nature, and their focus on the current and short run effects of fiscal policies. In this section, we will explore the arbitrary nature of these measures in more detail.

Government expenditures and revenues, as well as the level of public debt, are published in annual government budgets and, therefore, capture the short-run effects of fiscal policy. This implies that a change of policy in a given year that yields an impact throughout many years in the future (or for more than one year, at least), may bear the risk of only being associated with its short-run effects (given by the budget of that same year), while its effects for the other years are going to be incorporated in those yearly budgets and may be disassociated with that specific policy. If agents are rational and forward looking, they will consider the impacts of fiscal policy on their lifetime budget constraint, and will readjust their consumption and savings level according to the new policy. It is very unlikely that an annual government budget will be able to capture the whole effect of these changes, especially if they affect generations born in the future. Therefore, it is important to measure the effects of fiscal policy in the long-run, as it may affect the life cycle resources of current and future generations, by redistributing resources among them.

As established in Auerbach et al. (1999b), the arbitrary nature of these measures relies on the fact that they depend on how different governments or different countries choose to define their expenditures and their revenues. Governments can conduct any sustainable fiscal policy, and, at the same time, choose its accounting so as to report any surplus or deficit that they want. They are able to enact policies with huge intergenerational redistributive fiscal effects while reporting a “balanced budget”; or enact apparently identical fiscal policies with dramatically different time paths of reported deficits. However, the way governments choose to define their revenues and expenditures should be irrelevant for actual fiscal policy, since the economic effects of the fiscal policy followed will not depend in any way on the accounting labels chosen.

We demonstrate these concerns with an example described in Raffelhüschen and Walliser (1999). In this example, we consider a model of two generations (young and old), that only live for two periods, and where there is no government activity before period 0. It is also assumed that the interest rate is constant at 20% and that population growth is also constant at 10%. The main goal of this exercise is to evaluate the impact of four different fiscal policies on government budgets, taking into account their potential intergenerational redistribution effects, and to show how easy it is to manipulate deficit/debt values to show the same value for policies that entail different intergenerational effects, or have them show different values for policies with the same intergenerational effects. A summary of the different policies is shown in Table 3.

In scenario (a), there is a transfer of 100 units granted to the young generation in the first period, which is only paid for by that same generation in the next period. So, in period 0, there is an expenditure of 100 units that is not paid and, as a result, the budget deficit and government debt are also of 100 units in this period. In the next period (period 1), the now old generation has to cover the transfer that it has received in the previous period, so it pays taxes of 120 units, which is equal to the 100 units of transfer received in period 0, plus 20 units of interest payments on the public debt. If the policy is maintained in period 1, the young generation from period 1 receives 110 units, which increase from 100 units in period 0 due to population growth of 10%. In period 1, the government collects taxes of 120 units, and has expenditures with, not only of 110 units in transfers, but also of 20 units in interest payments, amounting to a total of 130 units. Thus, the deficit in period 1 will be of 10 units, and the government debt will accumulate to 110 units. If this policy is maintained for future periods, we can see that both government deficit and debt will grow at the same rate as the population.

In scenario (b), the policy is the institution of a tax-financed pension system, in which generations will discount for their own pensions through the payment of taxes when they are young, and receive the pension benefits in the following period, when they are old. If this policy starts in period 0, the government will report a surplus and net wealth of 100 units, since young generations of this period will be taxed in 100 units, and old generations of this period will not receive any amount, since they have not discounted in the previous period. In period 1, the government has to pay 120 units to the old generation (100 units taxed in the previous period plus interest), and amounts revenues of 20 units, from the interest on accumulated wealth in the previous period, plus 110 units in taxes from the young generations, which increased from 100 units in the previous period due to the population growth. Therefore, the surplus in period 1 is of 10 units and net wealth is of 110 units, and both these accounts will grow at the rate of the population if the policy is maintained.

We now turn to scenario (c), which is identical to scenario (b), but with one difference: the payments made by the young generations are classified as loans, which the government invests on the capital market. This implies that the amount collected from the young generations in each period does not classify as government revenue, and it will report a balanced budget and no debt in period 0. In period 1, if we assume perfect capital markets, the amount invested in period 0 (100 units) will yield a return of 20%, which is the defined interest rate. The interest receipts plus the amount invested will be enough to cover the debt to the now old generation of period 1 (loan granted plus interests). If this policy is maintained, both the loans from the young generation, and the respective debt payments in the following periods grow at the same rate as the population. However, in this case, government has a balanced budget in every period and, hence, has no debt.

The last scenario (d) describes a policy that introduces a pay-as-you-go pension system. Under this type of system, the transfers received by the old generation in each period will equal the tax payments of the young generation of the same period. Basically, young generations finance the transfers of the old generations of their own period, expecting that the young generations in the next period will do the same for them. In this case, both the taxes paid by young generations and the transfers received by the old generations will grow at the same rate as the population. Also, taxes paid and transfers received are the same in each period, the budget is always balanced and the government debt is always equal to zero.

If we analyze all four policies using the traditional fiscal measures (deficit and debt accounting), we conclude that: the policy enacted in scenario (b) achieves the most satisfying results, increasing the amount of net wealth over the years; the policy enacted in scenario (a) achieves the least satisfying results, increasing the amount of government debt over the years; policies (c) and (d) have no effect on the public budget and debt level, and are equivalent to one another.

However, if we analyze these policies in terms of intergenerational distribution, and in terms of changes in the lifetime budget constraint, we conclude that, not only are the first three policies identical, but also indifferent, since they do not present any changes in terms of the present value of the net tax payments for each generation. In each one of these policies, whether the generations are receiving first and paying in the following period, or paying first and receiving in the following period, these payments and transfers take into account the opportunity cost of money, given in this example by the interest rate of 20%. In other words, the net present value of taxes paid minus transfers received over the life cycle for each generation has not changed. For that reason, rational agents do not have any incentive or reason to change their behavior with the policies described in scenarios (a), (b) or (c). We also conclude that the policies described in scenarios (d) and (c) are not equivalent. In scenario (d), the introduction of the pay-as-you-go system automatically increases the consumption possibilities of the old generation in period 0 who did not contributed to the system. This increase is financed by all other subsequent generations, who have their consumption possibilities reduced, since their rate of return under the pay-as-you-go system is equal to the population growth, which is lower than the interest rate.

4 Generational accounting - methodology

4.1 Underlying model and main indicators

As described in Auerbach et al. (1999b), fiscal policies have real effects, due to: 1 - shifting economic incentives, 2 – redistribution between private citizens and government, 3 – intragenerational redistribution (distribution within generations), or 4 – intergenerational redistribution (distribution across generations). The authors provide an alternative methodology to study these effects, called generational accounting, which is based on the intertemporal budget constraint of the government, described in Eq. 1. This equation establishes that the present value of the net tax payments (which encompass taxes and contributions paid less social security, welfare, and other transfer payments received) of current and future generations have to be enough to cover the present value of government expenditures and the current level of net public debt. In short, it requires either current or future generations to cover overall public spending. Since one of the goals is to assess how the fiscal burden is distributed among different generations, the net tax payments of current and future generations must be analyzed separately.

As can be seen in Eq. 1, there are 4 main variables. Starting from left to right, the first element consists of the sum of the generational accounts of current generations. The term Nt,k represents the net tax payments of the generation born in year k, discounted to year t (the base year), and k goes from t – D (where D stands for the maximum age, in the base year) to t (the generation born in the base year).The second element of Eq. 1 represents the present value of the sum of the generational accounts of future generations. It is important to point out that these two variables encompass all the public revenues and expenditures that are directly dependent on the age structure of the population, and whose payments or benefits can be directly attributed to the population according to their age.Therefore, the third element of Eq. 1 consists of the present value of the sum of the net public expenditures (expenditures minus revenues) that do not depend on the age structure of the population. This includes government’s purchases of goods and services whose benefits are difficult to attribute to specific generations. This implies two things: 1 – generational accounting only tells us which generations will have to pay for the net public expenses defined by G, but it does not tell us which generation benefits from them, or how valuable or beneficial they are; 2 – generational accounting is not able to completely show the full net benefit or burden for each generation from fiscal policy as a whole, but it is able to show the full net benefit or burden for a generation if there are changes from fiscal policy affecting variables included in the net tax payments (taxes and transfers), from all levels of government (federal, state, and local).The last element of Eq. 1, \({W_{t}^{g}}\), encompasses the government’s net wealth in year t (basically, the public assets minus public debt). Finally, looking at Eq. 1 overall, we can identify a “zero sum” characteristic for this intergenerational budget constraint. This implies that, for example, given a certain level of government net wealth, an increase in the present value of net public expenditures (third element of Eq. 1) requires an increase in the present value of the generational accounts of either the current or future generations, or a combination of both (first and second element of Eq. 1).

We now proceed to a more detailed analysis on how to estimate the generational accounts, which follows a two-step process: 1 - Projecting the average taxes and transfer payments of each living generation for each year in the future, during which, at least, some members of the current generation will be alive; 2 – Taking the projections estimated in the first step, and discounting them to the base year, and also taking into account the probability of the people from each generation to be alive in the future years. Thus, the generational account Nt,k is given by Eq. 2:

where λ=máx(t,k). The Ts,k variable stands for the net tax payments that are expected to be paid in year s by an average person of the generation born in year k. This can be better described by Eq. 3, where hs,k,i stands for the average tax (if h > 0) or average transfer (if h < 0) of type i paid or received, respectively, in year s by an average person born in year k. The term Ps,k stands for the expected number of people who were born in year k and are still alive in year s. Notice that Eq. 2 is defined for the members of the current generation that were born before or after the base year, but we only take into account the net tax payments after the base year, discounted according to the year which they were made, on a present value base analysis. For the people born before year t, the sum begins in year t and is discounted to year t (this analysis is forward looking, so we don’t take into account the net taxes already paid prior to the base year). For the people born in year k > t, the sum begins in year k and is discounted to that same year k. The net tax payments of the people born after year t will also have to be discounted to year t, as it can be seen in Eq. 1.

One of the crucial assumptions in generational accounting is that the behavior of economic agents will not change, and that fiscal policy is stable. In other words, generational accounting provides us with some insights regarding the fiscal burdens that fall upon current and future generations, if the current fiscal policy is maintained. With this assumption, it is possible to calculate the age profile of the expected average taxes paid and transfers received per capita for the future, starting from the age profile of payments of the base year:

Basically, Eq. 4 states that the taxes paid and transfers received of a person in year s (given s > k), with an age of s – k, will be the same as those observed for people of the same age in year t, and adjusted for the gains in productivity between year s and the base year. These gains in productivity are given by the annual growth rate of productivity (g), which we will assume to be constant. For the future values of net public expenditures, we will also assume that they evolve at the same rate as taxes and transfers included in the net tax payments, that is, G grows at the rate of productivity, given by g, for future years.

Since we know the government’s net wealth \({W_{t}^{g}}\), and we can determine the sum of the generational accounts of current generations and the present value of the sum of net public expenses, we can use them to determine the sum of the generational accounts of future generations, as a residual. More specifically:

Thus, the fiscal burden that will fall upon future generations is the part of the sum of present value of the net public expenditures that are not covered by government net wealth and by the net tax payments of current generations. With this information, even though we are not able to explain exactly how this fiscal burden that is left to the future generations is going to be distributed among them, if we assume that the average net tax payments per capita of the future generations increases by a fixed growth rate of productivity, we can actually estimate the average per capita present value lifetime net tax payments for the people of each future generation (making lifetime net tax payments a fixed share of lifetime income). Hence, we define the generational account of a representative agent born in year k and still living at time t in the following equation:

If we use the definition established in Eq. 2, we can rewrite Eq. 6 as:

Finally, we need to determine the generational accounts of a representative agent of future generations, which is given in Eq. 8.

This equation (which is a rewrite of Eq. 5) gives us the part of net government expenses that is not financed by current generations, which is then allocated equally to be covered by future generations.

But we need to take into account that the expected remaining years of life of people who are still alive, at year t (given by k + D – t), is different according to the year that each person was born. Therefore, the per capita generational accounts are not directly comparable among themselves. However, we can compare the per capita generational accounts of the people born in the base year (\(GA^{CURR}_{t,t}\)), and a representative agent of the future generation (\(GA^{f}_{t+1}\)), since both take into account the net tax payments over their entire lifetimes and are discounted back to the base year. We can also use a relative approach, given by:

4.2 Additional indicators

However, as described in Bonin and Patxot (2004), there are some drawbacks to the indicators we are using: 1 – Ignoring the aging process of future generations. These indicators only take into account the population levels of current generations and future newborns; 2 – Difficulties in reflecting the effects of potential solutions (ex: increase in labor force participation; or structural restrictions on future net taxes); 3 – Difficulties in the prediction of the impact of corrective policies in demographic groups with different payment structures; 4 – Both are measured in current generational account terms, and a high value could just mean a low value of the denominator (generational accounts of current newborns) instead of a serious fiscal imbalance. In light of these shortcomings, we resort to the sustainability gap indicator, described in Cardarelli et al. (2000):

This will allow us to take into account the population levels and payment structures of future generations. Instead of calculating the generational accounts for future generations as a residual, we calculate them in the same way we calculate for current generations, assuming that current fiscal policy is maintained. Therefore, if the sustainability gap is positive, it indicates that current fiscal policy is not sustainable, and there is a need to readjust net tax payments or government expenditures. However, it is difficult to interpret the size of the sustainability gap, due to the lack of a benchmark. Bonin and Patxot (2004) point out a solution that is usually tried out, which consists of using current GDP as a benchmark, similar to a debt-to-GDP ratio. The obvious problem is the short-sightedness of this indicator, which collides with the long term view of the generational account method. To solve this problem, the authors propose to use the present value of the aggregate future yearly GDP, instead of just current GDP. Recall that we assume that productivity grows at a constant rate (g), which we use to estimate the future values of GDP. This measure will give us the % by which the deficit must be reduced each year, in terms of GDP.

However, Bonin and Patxot (2004) explain that the sustainability gap indicators are dependent on the structure of the government budget and the age specific micro-profiles, and are not fully comparable between countries and different periods of time. In his earlier work, Bonin (2001), he proposes an indicator that is neutral to these structural differences, given by:

This indicator reflects a flat tax on each person, in each year, adjusted in terms of productivity growth and present value, needed to achieve fiscal sustainability. With the denominator, we are, not only, taking into account the population levels, but also, making the necessary corrective measure neutral in terms of life expectancy. However, the authors point out that this indicator ignores variations in gross income. We can conclude that each indicator has its own advantages and disadvantages, so we should rely on more than one of them to take conclusions.

4.3 Theoretical limitations of generational accounting

According to Raffelhüschen and Walliser (1999), the two main criticisms regarding the theoretical framework behind generational accounting are: 1 – the validity of the underlying life-cycle hypothesis (which impacts consumption patterns); 2 – the underlying incidence assumptions.

4.3.1 Life-cycle hypothesis

The neoclassical theory establishes that agents are rational and, therefore, plan their consumption and savings behavior throughout the life-cycle, right at the beginning of their planning horizon, taking into account all the relevant information and the expected lifetime resources available to them, given by the present value of future income. As long as this present value does not change, agents will not alter their consumption behavior, even if the exact intertemporal distribution of income changes. This conclusion implies that the timing of taxes and transfers is irrelevant, as long as they are appropriately discounted (according to the discount factor) relatively to the period they are paid/received. However, there are three main criticisms regarding this theory: 1 - altruism (that is, a private-level intergenerational redistribution as described in Barro (1974)); 2 - agents may be myopic; 3 - or they may face liquidity constraints (as stated by Buiter (1995) or Diamond (1996)). Altruism implies that one’s generation well-being is positively impacted by the well-being of other generations, leading to intergenerational transfers. However, these private intergenerational transfers are not taken into consideration by generational accounts. It may be the case that, for this reason, in case of imbalance, generational accounts overestimates the burden left to future generations (if we assume that these private transfers are more likely to come from current generations in favor of future generations, like education). Regarding Buiter’s criticisms, on one hand, if agents are myopic, they would give more importance to income and consumption in the short run than what the life-cycle model predicts, or they would not be able to incorporate all the relevant information and plan their consumption as well as in the life-cycle model. On the other hand, even if agents are not myopic, but they face liquidity constraints, they would not be able to distribute their income over their life-cycle (or, at least, not as freely as without the constraints). Either one (or both) of these problems would imply that the timing of taxes and transfers will affect the agents’ utility. Overall, the empirical evidence suggest that both altruism (as seen in Altonji et al. (1992)) and liquidity constraints in the long run (as described in Hayashi (1987)) don’t have a significant effect in questioning the validity of generational accounts. However, Congressional Budget Office (CBO) (1995) found significant evidence that agents give more importance to current income and less to lifetime income than the life-cycle model predicts, implying, indeed, that the myopic criticism is corroborated by the data.

4.3.2 Incidence assumptions

Regarding the concerns about the incidence assumptions, as we stated before, it is assumed that tax payments and transfer benefits are borne by those who formally pay or receive them, and that a change in the taxes or transfers will not have an impact on the choices of consumers and/or investors. However, as described in Buiter (1997), this may not be the case. For example, an increase in taxes on labor income might be partially shifted to firms. From a partial equilibrium analysis, the burden of the tax (and the correspondent deadweight loss) will depend on the elasticity of supply and demand on the labor market. For the tax to fall completely upon workers, and for there not to be any deadweight loss, labor supply would have to be completely inelastic. Even though estimating the demand and supply elasticity’s seems to solve this problem, we also have to take into account the possibility of the effects of a change in taxes on a specific market affecting other markets as well. In our example of an increase in labor income taxes, the cost of the wage for the firm increases, which will likely increase output prices as well. This effect will have a higher impact on labor intensive goods. Also, this tax will lead to a rearranging of the optimal combination of factors of production, with the goal of minimizing costs, given that this will decrease the relative price of factors of production that can be used as a substitute for labor. Buiter (1997) also argues that generational accounting may not take into account the changes on the side of the consumer, specifically, that consumers will simply change to less taxed substitute goods or services. Nevertheless, Fehr and Kotlikoff (1997) have attempted to analyze to what extent the incorporation of macroeconomic feedback effects may change the notion of intergenerational redistribution as measured by generational accounts based on simple incidence assumptions, and they conclude that generational accounts provide fairly good approximations.

5 Data analysis

The empirical evaluation of the intertemporal budget constraint requires: projections of population, taxes, transfers, and government expenditures; an initial value of government wealth; a growth rate and a discount rate. We consider the impact of total, not just national, government. We establish 2010 as the base year, and consider a 100 years range of analysis, that is, from 2010 to 2110. It is important to understand that the choice of the base year does not imply that the information on the several variables will only be taken into account until that respective year. For example, even though we define the base year as 2010, we take into account in the calculations all the information for government budgets after 2010 and until the last year available. The choice of the base year yields 2 purposes: 1 – split between current generations (people born before or during the base year) and future generations (people born after the base year); 2 – all future values of the variables that have an impact on the generational accounts will be discounted until the base year.

5.1 Population

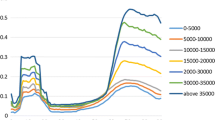

Since generational accounts are defined as per capita net taxes in present terms, the values are influenced by the size and age of the population in each generation. The size of the population is relevant in order to distribute the amount of net taxes needed to cover government expenditures and to service the debt. Since the size of future generations is expected to decrease in the coming years, the total amount of net taxes are going to be divided by a smaller number of people. In addition, the structure of the population critically influences the absolute amount of net taxes, since most taxes paid and transfers received are age-specific or highly related to the person’s age. The projections used to compute the generational accounts are based on the 2009 population projection estimates by age and gender provided by INE (Instituto Nacional de Estatística) from 2010, which is the base year, until 2060. These estimates provide four different scenarios (central, low, high and without migration), which are described in Table 4.

For each of these scenarios, the initial values (of 2008) are identical, but they incorporate different hypothesis regarding future values of fertility, mortality and migration rates. Regarding the projections for net migration, they are always positive. They display a linear trend (significantly increasing for the high and central hypothesis, and slightly decreasing for the low hypothesis) from 2007 until 2018, and they remain constant for the rest of the period in analysis. Since we consider these migration scenarios questionable (and the hypothesis for the other two variables are “moderate”), we decided to use the scenario without migration for population projections by age and gender from 2010 until 2060. Given that we are aiming for a 100 year period analysis, we made our own calculations to extend the population projections to 2110. For that, we needed to estimate the number of people who would be born each year, as well as the number of people who would die each year, for each age group, from 2061 to 2110. Hence, we calculate birth rates and age specific death rates (ASDR) for the 2010-2060 period, by year, gender and age. Then, we used these rates to estimate a trend function for each age group, and used this function to estimate the birth rates and age specific death rates from 2061 until 2110.

5.2 Fiscal data

The information regarding government revenues and expenditures was retrieved from the DGO (Direção-Geral do Orçamento), more specifically, from the consolidated general government accounts (public account basis) presented in the CGE reports (Conta Geral do Estado) for the years available (2010 to 2019). For the years after these reports, as mentioned before, it is assumed that government’s revenues and expenditures that do not depend on demographics (the ones included in variable G) evolve at the rate of productivity, given by g. In other cases, we break the purchases down into age-specific components (e.g.: Expenditures with current transfers, mostly consisting of pension benefits) and assume that each component remains constant per member of the relevant population, adjusted for the overall growth in productivity g. This causes different components of government purchases to grow more or less rapidly than productivity, according to whether the relevant population grows or shrinks as a share of the overall population.

Finally, since we are considering a finite period of 100 years, we will not assume that the government’s net debt has to be fully paid by current or future generations until the last period considered in the analysis. Instead, we will consider that the generations will have to “service” the debt, and assume that it grows less quickly than the rate of discount, as to not become explosive. Therefore, in our calculations, we have assumed that the variable \({W_{t}^{g}}\) is equal to zero, and the interest payments on public debt were included in the variable Gs, hence, growing at the same rate.

5.3 Micro-profiles

The general rule regarding tax incidence is to assume that taxes are paid by according to the base on which they fall upon: income taxes on income, consumption taxes on consumers, and so forth. In small open economies (like Portugal), there is a need to modify generational accounting by allocating changes in corporate capital income taxes to generations in proportion to their labor income. The reason is that an increase in the corporate income tax rate in a small open economy will produce an immediate capital outflow, thereby lowering the marginal product of labor and the wage; i.e., the corporate tax will be immediately shifted to workers. As we established in the previous section, the categories of taxes and transfers are set according to the consolidated general government accounts (public account basis) presented in the CGE (Conta Geral do Estado) of each year that are available. The taxes and transfers are then allocated according to income, transfer and consumption micro-profiles, estimated from the survey Inquérito às Despesas das Famílias from 2010/2011. Direct taxes were distributed based on a wage earnings profile (which is grossed up to include property income and self-employment earnings), as well as corporate income taxes. Since social security contributions are imposed as employment taxes, they were also distributed according to the wage profile. Indirect taxes (which mainly consist of taxes on consumption) were distributed according to a consumption expenditures profile. Expenditures with current transfers (consisting of social security and other transfers), were distributed according to a general transfers receipt (which consist of pensions and other transfers). As a general rule, the profiles obtained from the microdata are assumed to stay constant over the entire projection period. This procedure maintains base-year economic structures indefinitely. We have made the calculations and computed the micro-profiles following the same methodology used to compute the generational accounts of Portugal in 1995, provided in Auerbach et al. (1999a), for comparability reasons. We will later compare our calculations for the micro-profiles with those obtained by the European National Transfer Accounts, for 2010, using an alternative methodology.Footnote 1

5.4 Growth and discount rates

It is necessary to specify an appropriate annual rate of productivity growth, since it will influence the projections of future values of age-specific tax payments and transfers, and an appropriate discount rate, in order to discount all future payments and be able to express them in present value terms of the base year. Despite there being a lot of uncertainty surrounding the definition of both the discount rate and the future productivity growth rate, the appropriate discount rate is mainly influenced by the inflation rate, while the appropriate growth rate is mainly influenced by the EU average and the country’s own economic outlook in the future. Starting with the discount rate, recall that it is used simply for discounting all future values (revenues and expenditures), in order to express them in present value terms. Therefore, it would make sense to use the inflation rate as a proxy for the choice of this rate, since the inflation rate discounts the value of the currency for future periods, in terms of purchasing power. The inflation rate reflects the increase in the average price level of the goods and services of an economy overtime. It implies that, as the prices increase, so do the revenues of firms and, as a result, the tax base for collection of public resources. It also implies all future values have to be discounted by the inflation rate, in order to reflect the decrease in purchasing power in future years for the same amount of money. This discount follows the same reasoning as the discount rate. On the other hand, the economic growth rate is likely to be influenced both by country’s own economic conditions, and the economic outlook of the European countries. In the case of Portugal, the country’s inability to finance itself at sustainable interest rates led to the need of a financial assistance program signed in 2011, and even though it is now able to finance itself at reasonable interest rates, the large deviations in the interest rate over the last decade generate uncertainty regarding the country’s capacity to keep financing itself at the current rates in the long run. This also had an impact on the prospects of the future productivity growth rate, given that the corrective measures applied during these years to reduce government deficits and stabilize public debt had a negative impact on economic growth, and since these corrective policies have to be maintained for future years in order to generate public surpluses and decrease public debt. Furthermore, the growth rates of European countries have been relatively modest, and Portugal is likely to accompany that tendency. Given the sensitivity of generational accounts with respect to the values of these rates, and, as we pointed above, the uncertainty surrounding the definition of appropriate discount and productivity rates, it remains a standard practice to estimate generational accounts for a range of discount rates and productivity growth rates. Also, it seems that the discount rates can be more volatile in comparison to the economic growth rate. Hence, we define six discount rates and three productivity growth rates, based on Portugal’s own expected interest and growth rates for different possible scenarios, provided in Table 5. We have also established an additional scenario, in which the variable Gs grows at a rate of 0,8%. The results from these scenarios will be further discussed in Section 7.

6 Results

6.1 Main indicators and Comparisons

In this section, we start by making a brief analysis of the net tax payments in 2010, by age. As we can see in Fig. 7, the set of accounts exhibits a concave pattern with respect to age. When people are young, they receive transfers (e.g., child benefits or educational allowances) and pay consumption taxes. During their working lives, they continue to pay consumption taxes but also pay taxes on their labor and capital income in the form of personal income taxes and payroll taxes, so we can see that their net tax payments increase. When workers reach older ages, they start receiving transfer receipts (e.g., pensions), and so the net tax payments start to decline. From 60 onwards, we can see that transfer payments received generally start to exceed the tax payments so that net tax payments become negative, that is, they become net transfers. We can also see that the absolute amount of net transfers’ declines from 75 onwards, due to a decrease in the population levels. However, one would not expect the net tax payments to be positive for younger generations. This has to do with the distribution of indirect taxes by age, which are allocated according to a micro-profile of consumption expenditures. Since the data provided the expenditures by households, and we needed to allocate them to individuals, we resorted to an equivalence scale defined as “OECD-modified scale”, which assigns a value of 1 to the household head, of 0,5 to each additional adult member, and of 0,3 to each person with less than 18 years old. And given our results, even in the case when education expenditures are allocated as transfers, the consumption taxes outweigh them, resulting in positive net tax payments.

As an alternative, in Fig. 8, we provide the same standard scenario, but without allocating the consumption expenditures to people with less than 18 years old. In this case, the net tax payments of minors will converge to 0, and start increasing at the age of 16. Although we could consider this scenario more realistic (in the sense that the resources from the consumption expenditures are provided by older generations), it has the downside of the consumption expenditures (and corresponding indirect tax revenues) being concentrated on older generations. This would imply that, if there is a decrease of the number of younger people, that would not have an impact on consumption and indirect taxes. However, this may not be the case. Even if the resources are provided by the older generations, they are spent on consumption for younger generations. As a result, if there is a decrease of younger generations, the spending on consumption for them will decrease, and so will the indirect taxes.

We proceed by comparing the Net Tax Payments in 2010 from our calculations with those obtained using the data from the European National Transfer Accounts (Figs. 9 and 10). The first breaks down the several components of the Net Tax Payments into the different categories, and shows how they differ according to age, while the second figure combines all of them into the total of the Net Tax Payments. The categories that compose the Net Tax Payments in this methodology are the following: Labour Income “YL”; Asset Income “YA”; Private Consumption “CF”; Public consumption “CG”; Net Private Transfers “TF”; Net Public Transfers “TG”; and Savings “S”. Figure 9 is constructed with the data provided by the European National Transfer Accounts, and we construct the overall accounts for Fig. 10 with our own calculations, using that data. Essentially, we consider that all income obtained (either from labour or assets), has to be used for either consumption (public or private), transfers (public or private), or savings. We construct the Net Tax Payments considering a positive sign for the production or accumulation of resources (labour income, asset income and savings), and a negative sign for the use or consumption of resources (which consist of the remaining variables). Notice that, in Fig. 9, the negative values for the transfers imply a transfer of resources from those generations to the generations with positive values, while consumption values are positive for all ages. We can see that the results follow a very similar pattern to our own, exhibiting the same concave pattern: they are lower for younger and older generations, and are higher for working-age generations. The big difference seems to be for the younger generations: in our case, the payments are either close to zero, or slightly positive; while, in the case using the data from the European National Transfer Accounts, the payments are largely negative, even more than those of older generations.

There are several potential explanations for this difference: 1 – As we pointed out before, the allocation of indirect taxes increases the payments for younger generations. In our case, the increase in consumption leads to increase in indirect taxes, pushing the net tax payments up. In the data from European National Transfer Accounts, consumption decreases overall resources, and, therefore, the net tax payments. Also, it takes into account that consumption of younger generations is either partially or fully covered by working age generations; 2 – In our calculations, we are focusing on the public aspect of the payments and expenditures (that is, on the several variables that are likely to impact public accounts), while the European National Transfer Accounts also takes into account the private aspect of the payments and expenditures. As we can see from Fig. 9, private transfers are very high for younger generations, being financed by working age generations, while being close to zero for older generations. This would imply that both younger and older generations are net beneficiaries, who are financially supported by transfers from the working age generations, who are net contributors, as we saw before. The difference is the source of the financing. While for younger generations, the transfers are mostly private, while for older generations, the transfers are mostly public. This reflects that, usually, younger generations are mostly financially supported by their parents, or their families, while older generations are mostly financially supported by public entities, whose funds are provided by working age people; 3 – Public consumption and public transfers. If we focus on these two categories, the data from the European National Transfer Accounts show that they are around the same levels for the younger and older generations. However, our data from the Inquérito às Despesas das Famílias and the Conta Geral do Estado (CGE) establishes higher values of public expenditures for older generations than for younger generations. This reflects differences in the data and on the allocation of household data to individuals by age. It could also be due to some of the public expenditures in our calculations not being allocated by age (recall the G variable in the first equation), and simply considered equal amongst the different generations. However, we would argue that our data and calculations make more sense, at least, for this last point. Recall that we saw in Fig. 6 that the highest government expenditure in the more recent years is, by far, with social protection. By examining the information of this category with the Conta Geral do Estado (CGE), it is mainly composed of retirement pensions and social security expenditures. Evidently, these expenditures are more concentrated on older generations, and not on younger generations. As a result, it would make more sense that most public expenditures (combination of consumption and transfers) are allocated to older generations (while private transfers would be more concentrated on younger generations).

Now, we follow with an analysis of the generational accounts in 2010 (see Fig. 11 and Table 6), and compare with the generational accounts in 1995 (see Fig. 12 and Table 7).Footnote 2 The tables give information on the several components of Generational Accounts, and their corresponding values, by age: Income Taxes (+), Property Taxes (+), Social Security Contributions (+), Indirect Taxes(+), Transfers (-), and Education Expenditures (-). The total constitute the Generational Accounts, described in the last column. We can see that the accounts are positive and increase initially with age. The present value of a generation’s remaining lifetime net tax payments is generally highest for generations at the beginning or at the middle of their work spans, as it does not include child and educational benefits received in youth, and they progress in their working career, earning higher levels of income and, therefore, paying more taxes. When workers reach older ages, the sum of future net tax payments tends to decline as future transfer receipts (e.g., pensions) gain in importance compared with future tax payments. The generations that become net transfers start at 47, and then, the absolute amount of net transfers’ declines from 65 onwards, and net tax payments start increasing again, although, never becoming positive again. This increase happens for 2 reasons: 1 – part of the net transfer payments were prior to the base year; 2 – decrease in the population levels, as people get older.

Generational accounts 1995 (thousands of dollars). Source: Auerbach et al. (1999a)

If we compare our results with the generational accounts of Portugal in 1995, provided in Auerbach et al. (1999a), we can see that the accounts follow a very similar pattern, with respect to age. However, we can see that the generational accounts hit lower values after 50 years. Comparing Figs. 11 and 12,Footnote 3 in 1995, the lowest level is between 50.000 and 100.000 dollars, while in 2010, it’s close to 150.000 dollars. We can also see that the fiscal burden that will fall upon future generations increased significantly. In 1995, a representative member of future generations would have to pay 48,7% (or 1,5 times) more taxes than a representative member of the current generation. In 2010, that value increased to an alarming 372,4% (or to 4,9).

6.2 Additional indicators and scenarios

As we established at the end of Section 4, there are some shortcomings to the indicators we have calculated so far and the ones provided in Auerbach et al. (1999b). Thus, we provide the additional indicators for 2010 in Table 8. Later on, we will see that different indicators will be able to tell us different aspects of the accounts, or change differently according to changes in our standard scenario.

We follow with a separate analysis of generational accounts between men and women, which is given by Tables 12 and 13 in the appendix. The sustainability gap indicators are a proportion of the values in Table 8. If we compare the two Tables, we can see that the generational accounts of men are higher than those of women. An analysis of each component that constitutes the generational accounts shows that this difference results from: 1 - higher income taxes and social security contributions, 2 - lower transfers for men than for women. The first point can be easily explained by the lower wages, on average, that women earn when compared to men, while the second can, mainly, be attributed to women’s higher life expectancy.

Lastly, we provide two alternative scenarios, described in Tables 14 and 15, in the Appendix. In the first one, we treat education expenditures as transfer payments, and allocate them to individuals according to their age, while in the second one, we do the same procedure, but for health expenditures instead. While it would make sense to allocate these expenditures by age in the standard scenario (as they are very likely dependent on the age structure of the population), we have not done so for comparability reasons with the standard scenario from the generational accounts of Portugal in 1995, provided in Auerbach et al. (1999a). In the scenario where we allocate education expenditures by age, this allocation has 2 opposing effects: 1 – Since education expenditures are highly concentrated on younger generations, this allocation pushes for an increase in their fiscal burden when compared to older generations; 2 – The allocation of education expenditures as transfer payments will decrease the net tax payments, but also the Gs expenditures, since these do not include education’s expenditures in this scenario. This second effect decreases the fiscal burden left for future generations accumulated in the Gs expenditures. If we compare the results (in Table 14) with the standard scenario (in Table 6), we can see that the change depends on the indicator used, that is, for some indicators, the fiscal burden for future generations increases, while, for others, it decreases. The main reason for this difference has to do with one of the points we covered above in this section, which is the incorporation of the aging process for future generations. It’s important to understand that, since we expect the ageing process of the population to get accentuated in the future, an indicator which does not take into account the ageing process of future generations will have a higher number of younger and working age people (as it assumes the ageing process will be the same as for current generations), when compared to indicators which take into account the ageing process of future generations. As a result, a higher number of younger and working age people in future generations implies that the Gs expenditures will be allocated to a higher number of people and, therefore, decrease the burden allocated to each person. Consequently, for the indicators that don’t take into account the ageing process of future generations, the first effect dominates, and the fiscal burden for future generations increases, while, for indicators that take into account the ageing process of future generations, the second effects dominates, and the fiscal burden for future generations decreases. For the second case (in Table 15), the allocation of health expenditures by age leads to an increase of the fiscal burden for future generations, as expected. Since these expenditures are more concentrated on older generations, combined with the ageing of the population (wether for current and future generations), all the indicators show an increase in the fiscal burden for future generations.

7 Sensitivity Analysis

7.1 Additional scenarios

As we stated in Section 5.4 of this paper, generational accounts are highly sensitive to the values of the discount rate and the productivity growth rate. Therefore, in addition to our initial values (r = 5% and g = 1,5%)Footnote 4 we have defined two additional discount rates (r = 3% and r = 7%) and two additional productivity growth rates (g = 1% and g = 2%). The results can be seen in Table 9. For a given productivity growth rate, a higher discount rate will decrease the generational accounts of both the current and future generations. Since generational accounts are expressed in present value terms, it makes sense that they are lower the higher the rate at which they are discounted. In relative terms, the burden for the future generations increases with a higher discount rate. Given that Portugal has a high pressure on its public finances, which would require future generations to make higher net tax payments than current generations, a higher discount rate would decrease the present value of these net tax payments, and, therefore, increase the fiscal burden for future generations. However, notice that the sustainability gap indicators decrease with an increase in the discount rate. Recall that, for these indicators, we are calculating the net tax payments of future generations assuming current fiscal policy is maintained. Under the current fiscal policy, the combination of transfers, interests and government consumption is higher than tax payments, resulting in public deficits each year. With a higher discount rate, the present value for the future deficits will be lower. Given that the sustainability gap indicators are a variation of the present value of the cumulative of these deficits, they will decrease with a higher discount rate.

For a given discount rate, the overall indicators show an increase of the fiscal burden for future generations, given an increase in the productivity growth rate. Since transfers and government consumption is higher than tax payments, and all these variables grow at the same constant productivity rate, it is expected that the gap between current and future generations would increase with productivity growth. However, one could argue that, instead of these variables growing with productivity growth, they should grow at different rates. It is highly unlikely that, with higher economic growth, governments would accelerate public consumption continuously, putting an increasing pressure on the country’s finances and rise its default risk. It is much more likely that the country would take the opportunity to improve public finances, either through lower spending, or, at least, spending growth at a lower rate. Hence, we have provided an additional scenario, described in Table 10. For this case, we have government consumption growing at a smaller rate than taxes and transfers (more specifically, they grow at a rate of g = 0,8%). Now, for a given discount rate, the overall indicators decrease when the productivity growth rate increases. A higher productivity growth will increase the value of taxes and transfers, and, therefore, widen the gap between net tax payments/net transfers and government consumption. Even when taking into account the aging structure of future generations (through the sustainability gap indicators), we see that overall net tax payments increase. In conclusion, higher productivity rates will decrease the fiscal burden of future generations if most of net tax payments are positive, and there is higher pressure from government consumption.

In the scenarios so far, the discount rate is always above the productivity growth rate. For that reason, we provide additional scenarios on Table 11, with discount rates closer to or lower than the productivity growth rate. The first thing we notice right away is that, in some cases, we have negative generational accounts. If we look carefully, we can see that this happens when the discount rate is lower than the productivity growth rate. As we saw for Table 9, this is a reflection of higher expenditures than revenues, and a discount rate lower than the productivity growth rate implies that the future values will be higher than the current values, as they grow more than they are discounted. Not only that, the further into the future, the higher the present value will be. We can also see that the relative indicators (the Difference and π indicators) for these cases give odd results, with lower burdens for future generations when the accounts for current and future show otherwise. This is simply because the negative sign for the current generations distorts the calculations for these indicators. The other indicators seem to yield the same reasoning we made in Table 9. Given that we can establish the discount rate as a proxy for the inflation rate, and the reasoning we used for Table 10, the main conclusion we can take from Tables 9, 10 and 11 is that a lower productivity growth rate and a lower inflation rate will increase the fiscal burden for future generations. A higher productivity growth rate implies the economy will be producing more resources, and a higher tax base from which the country is able to collect public revenues from. Given the high level of public expenditures compared to public revenues, a higher inflation rate would decrease the present value of future deficits. Another way to interpret it is that a higher inflation rate will increase overall resources for the economy, therefore also increasing public resources, making it easier to cover public expenditures.

7.2 Empirical limitations

Many of the empirical objections are related to the assumptions regarding the projections of the variables, not only for the population, but mainly, regarding our economic variables. Haveman (1994) begins his argument by pointing out the underlying assumption that current government behavior is static. Basically, with the exception of demographic influences, we are assuming that no other fundamental changes in the economy occur (or that they change at the same constant rate), and therefore, we are perpetuating the current fiscal policy indefinitely. The author argues that this assumption is not likely to hold, given that government policies tend to be reactive, and that fiscal policy will change in case of accumulation of excessive expenditures. And as a result, it is likely that the actual outcomes will be very different from the projections. Also, the assumption implies that only future generations will bear the fiscal burden of the necessary adjustments.

However, as we established in Section 4.1, the goals of generational accounting is to access the magnitude of the fiscal burden being left to future generations, and what corrective policies have to be put into place, if the current policy is maintained. Nevertheless, even population projections, which do not assume that population size and structure are maintained, are subject to errors, as it may be the case of some studies that underestimate life expectancy and old age dependency ratios (see Balassone et al. (2009), regarding the projection of the Working Group on Ageing Population (AWG) of the EU’s Economic Policy Committee).