Abstract

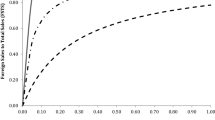

This study examines the effect of international dispersion on profitability. We use an institution-based approach to propose that increases in international dispersion lead, on average, to profitability downturns. We also argue that this liability of foreignness will affect multinationals from infrastructure industries to a lesser extent because in these industries: (1) the importance of cultural fit in products is low; (2) firms possess regulatory expertise; and (3) firms have limited aggregation opportunities at the regional level. We test our hypotheses on a panel of Spanish listed firms (1986–2007). Our findings point to a negative linear relationship between international dispersion and profitability, which is flatter for infrastructure multinationals. These results contribute to a more context-based understanding of internationalization that highlights the shortcomings of establishing a dispersed international footprint.

Similar content being viewed by others

Notes

Based on Fernández-Méndez et al. (2015), we define infrastructure firms as those operating in electricity, water, oil, gas, transportation, telecommunications, and construction.

Phrase used by The Economist to title an article on this topic (The retreat of the global company), published on 28 January 2017.

Please note that in this paragraph we have only featured those works defining performance in terms of profitability. However, additional papers have used either market measures (e.g., Collins 1990; Michel and Shaked 1986) or a combination of both market and accounting measures (e.g., Dittfeld 2017; Lu and Beamish 2004; Thomas and Eden 2004) as their dependent variables of performance.

For the purposes of this study, we follow Asmussen and Goerzen’s (2013) definition of dispersion; that is, the extent to which the international operations differ in their proximity to the home base of the focal multinational.

Example extracted from: Cola Cao abandona China: Idilia Foods vende su planta de GaoLeGao al filipino Liwayway, La Vanguardia, 17 December 2015.

Nutrexpa in China, ICEX, 13 June 2013. Available at https://www.youtube.com/watch?v=IAAv8pcZfvQ. Last accessed 6 September 2019.

La financiación es el gran reto de las constructoras en el exterior, El Economista, 3 October 2015.

Example extracted from: Aprender a hacer negocios en China, El País, 26 June 2005; and Cuentos y cuentas en China, El País, 22 May 2005.

Example extracted from Guillén and García-Canal (2010).

Lopez (Mango): “Aumenteremo il reshoring in Spagna e Italia”, Pambianco News, 23 March 2017.

César Alierta, CEO of Telefónica, Diario 155, 26 June 2001, p. 21.

At this point, we shall note that our panel-data sample is not balanced. Some of the companies included in our study got delisted or merged during the period of analysis. In addition, there are some non-systematic missing observations.

A previous version of this first stage appears in García-García et al. (2017).

We retrieved the financial data from COMPUSTAT, DATASTREAM, the Spanish Securities Market Commission, and the firms’ websites. We gathered the data on proprietary technology from ESPACENET. This platform is available online at https://worldwide.espacenet.com/ (Last accessed 6 September 2019). We extracted the data to build the ownership and management variables from press releases, directories (DICODI, DUNS, The Maxwell Espinosa Shareholders Directory), and the works of Vergés (1999, 2010).

This variable only includes domestic mergers with other companies from our sample. We ran a robustness test by excluding the firms involved in mergers from our regressions. The pattern of results remained unchanged. We do not report the findings due to space restrictions. However, they are available upon request.

We exclude firms operating in banking and financial services from our analyses because they normally have specific accounting standards (Lemmon and Lins 2003).

We define soft services as those that require simultaneous production and consumption. Consequently, the firm and the customer base must be co-located (Guillén and García-Canal 2010).

Hard services are those in which production and consumption can be separated. Therefore, they can be exported at arm’s length (Erramili 1990).

This database is available at the Penn Lauder CIBER webpage.

We followed the UNCTAD and IMF classifications to categorize countries according to their degree of development. In the Developed category, we only included those countries considered as developed by both organizations. All other countries fell in the Developing category. It shall be acknowledged that all developing countries are located outside of the EU-15 boundaries.

The Economist discusses this new attitude of multinationals in the article The retreat of the global company, published on 28 January 2017.

References

Abdi, M., & Aulakh, P. S. (2018). Internationalization and performance: Degree, duration, and scale of operations. Journal of International Business Studies,49(7), 832–857.

Aguilera, R. V., Flores, R., & Kim, J. U. (2015). Re-examining regional borders and the multinational enterprise. Multinational Business Review,23(4), 374–394.

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies,27(4), 633–653.

Almodóvar, P., & Rugman, A. M. (2014). The M curve and the performance of Spanish international new ventures. British Journal of Management,25(S1), 6–23.

Amsden, A. H., & Hikino, T. (1994). Project execution capability, organizational know-how and conglomerate corporate growth in late industrialization. Industrial and Corporate Change,3(1), 111–147.

Arregle, J. L., Miller, T. L., Hitt, M. A., & Beamish, P. W. (2016). How does regional institutional complexity affect MNE internationalization? Journal of International Business Studies,47(6), 697–722.

Asmussen, C. G., & Goerzen, A. (2013). Unpacking dimensions of foreignness: Firm-specific capabilities and international dispersion in regional, cultural, and institutional space. Global Strategy Journal,3(2), 127–149.

Athias, L., & Nuñez, A. (2008). Winner’s curse in toll road concessions. Economics Letters,101(3), 172–174.

Avloniti, A., & Filippaios, F. (2018). Evaluating the effects of cultural and psychic distance on multinational corporate performance: A meta-analysis. Global Business and Economics Review,20(1), 54–87.

Bae, J.-H., & Salomon, R. (2010). Institutional distance in international business research. In T. Devinney, T. Pedersen, & T. Laszlo (Eds.), Advances in international management, Vol. 23, The past, present and future of international business and management (pp. 327–349). Bingley: Emerald Group Publishing.

Bamiatzi, V., Bozos, K., Cavusgil, S. T., & Hult, G. T. M. (2016). Revisiting the firm, industry, and country effects on profitability under recessionary and expansion periods: A multilevel analysis. Strategic Management Journal,37(7), 1448–1471.

Banalieva, E. R., & Robertson, C. J. (2010). Performance, diversity, and multiplicity of foreign cross-listing portfolios. International Business Review,19(6), 531–547.

Banalieva, E. R., Santoro, M. D., & Jiang, J. R. (2012). Home region focus and technical efficiency of multinational enterprise. Management International Review,52(4), 493–518.

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization–performance relationship: Evidence from meta-analysis. Management International Review,47(3), 319–347.

Benito, G. R. G. (2015). Why and how motives (still) matter. Multinational Business Review,23(1), 15–24.

Benito-Osorio, D., Colino, A., Guerras-Martín, L. Á., & Zúñiga-Vicente, J. Á. (2016). The international diversification-performance link in Spain: Does firm size really matter? International Business Review,25(2), 548–558.

Berry, H. (2006). Shareholder valuation of foreign investment and expansion. Strategic Management Journal,27(12), 1123–1140.

Berry, H., Guillén, M. F., & Zhou, N. (2010). An institutional approach to cross-national distance. Journal of International Business Studies,41(9), 1460–1480.

Berry, J. W., & Poortinga, Y. H. (2006). Cross-cultural theory and methodology. In J. Georgas, J. W. Berry, F. V. de Vijver, C. Kagitcibasi, & Y. H. Pootinga (Eds.), Families across cultures. Cambridge: Cambridge University Press.

Beugelsdijk, S., Kostova, T., Kunst, V. E., Spadafora, E., & van Essen, M. (2018). Cultural distance and firm internationalization: A meta-analytical review and theoretical implications. Journal of Management,44(1), 89–130.

Beugelsdijk, S., Kostova, T., & Roth, K. (2017). An overview of Hofstede-inspired country-level culture research in international business since 2006. Journal of International Business Studies,48(1), 30–47.

Bonardi, J. P. (2004). Global and political strategies in deregulated industries: The asymmetric behaviors of former monopolies. Strategic Management Journal,25(2), 101–120.

Botero, J. C., Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2004). The regulation of labor. The Quarterly Journal of Economics,119(4), 1339–1382.

Brouthers, K. D., Brouthers, L. E., & Werner, S. (2008). Resource-based advantages in an international context. Journal of Management,34(2), 189–217.

Buckley, P. J., & Casson, M. (1976). The future of the multinational enterprise. London: Macmillan.

Campbell, J. T., Eden, L., & Miller, S. R. (2012). Multinationals and corporate social responsibility in host countries: Does distance matter? Journal of International Business Studies,43(1), 84–106.

Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firms. Journal of International Business Studies,34(4), 345–355.

Capen, E. C., Clapp, R. V., & Campbell, W. M. (1971). Competitive bidding in high-risk situations. Journal of Petroleum Technology,23(6), 641–653.

Carney, M., Estrin, S., Liang, Z., & Shapiro, D. (2019). National institutional systems, foreign ownership and firm performance: The case of understudied countries. Journal of World Business,54(4), 244–257.

Carow, K., Heron, R., & Saxton, T. (2004). Do early birds get the returns? An empirical investigation of early-mover advantages in acquisitions. Strategic Management Journal,25(6), 563–585.

Caves, R. E. (1971). International corporations: The industrial economics of foreign investment. Economica,38(149), 1–27.

Chang, S. J., & Rhee, J. H. (2011). Rapid FDI expansion and firm performance. Journal of International Business Studies,42(8), 979–994.

Chao, M. C. H., & Kumar, V. (2010). The impact of institutional distance on the international diversity–performance relationship. Journal of World Business,45(1), 93–103.

Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s q. Financial Management,23(3), 70–74.

Collins, J. M. (1990). A market performance comparison of US firms active in domestic, developed and developing countries. Journal of International Business Studies,21(2), 271–287.

Contractor, F. J. (2007). The evolutionary or multi-stage theory of internationalization and its relationship to the regionalization of firms. In A. M. Rugman (Ed.), Regional aspects of multinationality and performance (pp. 11–29). Oxford: Elsevier.

Contractor, F. J., Kundu, S. K., & Hsu, C. C. (2003). A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies,34(1), 5–18.

Cosmen, A. (2004). Los sistemas de gestión de las empresas de transporte en China. Economía Exterior,30, 85–92.

Cuervo-Cazurra, A., Ciravegna, L., Melgarejo, M., & Lopez, L. (2018). Home country uncertainty and the internationalization–performance relationship: Building an uncertainty management capability. Journal of World Business,53(2), 209–221.

Cuervo-Cazurra, A., Maloney, M. M., & Manrakhan, S. (2007). Causes of the difficulties in internationalization. Journal of International Business Studies,38(5), 709–725.

Cuervo-Cazurra, A., Narula, R., & Un, C. A. (2015). Internationalization motives: Sell more, buy better, upgrade and escape. Multinational Business Review,23(1), 25–35.

Darendeli, I. S., & Hill, T. L. (2016). Uncovering the complex relationships between political risk and MNE firm legitimacy: Insights from Libya. Journal of International Business Studies,47(1), 68–92.

Dastidar, P. (2009). International corporate diversification and performance: Does firm self-selection matter? Journal of International Business Studies,40(1), 71–85.

Dittfeld, M. (2017). Multinationality and performance: A context-specific analysis for German firms. Management International Review,57(1), 1–35.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2002). The regulation of entry. The Quarterly Journal of Economics,117(1), 1–37.

Doh, J. P., Teegen, H., & Mudambi, R. (2004). Balancing private and state ownership in emerging markets’ telecommunications infrastructure: Country, industry, and firm influences. Journal of International Business Studies,35(3), 233–250.

Dowell, G., Hart, S., & Yeung, B. (2000). Do corporate global environmental standards create or destroy market value? Management Science,46(8), 1059–1074.

Dunning, J. H., Fujita, M., & Yakova, N. (2007). Some macro-data on the regionalisation/globalisation debate: A comment on the Rugman/Verbeke analysis. Journal of International Business Studies,38(1), 177–199.

Dyer, D., & Kagel, J. H. (1996). Bidding in common value auctions: How the commercial construction industry corrects for the winner’s curse. Management Science,42(10), 1463–1475.

Eden, L., & Miller, S. R. (2001). Opening the black box: Multinationals and the cost of doing business abroad. Academy of Management Proceedings,1, C1–C6.

Eden, L., & Miller, S. R. (2004). Distance matters: Liability of foreignness, institutional distance and ownership strategy. In M. A. Hitt, & J. L. C. Cheng (Eds.), Advances in International Management, Vol. 16, Theories of the Multinational Enterprise: Diversity, Complexity and Relevance (pp. 187–221). Bingley: Emerald Group Publishing.

Erramili, M. (1990). Entry mode choice in service industries. International Marketing Review,7(5), 50–62.

Estrin, S., Meyer, K. E., Nielsen, B. B., & Nielsen, S. (2016). Home country institutions and the internationalization of state owned enterprises: A cross-country analysis. Journal of World Business,51(2), 294–307.

Fernández-Méndez, L., García-Canal, E., & Guillén, M. F. (2015). Legal family and infrastructure voids as drivers of regulated physical infrastructure firms’ exposure to governmental discretion. Journal of International Management,21(2), 135–149.

Fernández-Méndez, L., García-Canal, E., & Guillén, M. F. (2018). Domestic political connections and international expansion: It’s not only ‘who you know’ that matters. Journal of World Business,53(2), 695–711.

Fisch, J. H., & Oesterle, M.-J. (2003). Exploring the globalization of German MNCs with the complex spread and diversity measure. Schmalenbach Business Review,55(1), 2–21.

Flores, R., Aguilera, R. V., Mahdian, A., & Vaaler, P. M. (2013). How well do supranational regional grouping schemes fit international business research models? Journal of International Business Studies,44(5), 451–474.

Fortwengel, J. (2017). Understanding when MNCs can overcome institutional distance: A research agenda. Management International Review,57(6), 793–814.

Friedman, T. (2005). The world is flat: A brief history of the twenty-first century. New York: Farrar, Straus and Giroux.

Galán, J. I., & González-Benito, J. (2006). Distinctive determinant factors of Spanish foreign direct investment in Latin America. Journal of World Business,41(2), 171–189.

Gande, A., Schenzler, C., & Senbet, L. W. (2009). Valuation effects of global diversification. Journal of International Business Studies,40(9), 1515–1532.

García-Canal, E., & Guillén, M. F. (2008). Risk and the strategy of foreign location choice in regulated industries. Strategic Management Journal,29(10), 1097–1115.

García-García, R., García-Canal, E., & Guillén, M. F. (2017). Rapid internationalization and long-term performance: The knowledge link. Journal of World Business,52(1), 97–110.

Gaur, A. S., & Lu, J. W. (2007). Ownership strategies and survival of foreign subsidiaries: Impacts of institutional distance and experience. Journal of Management,33(1), 84–110.

Geringer, J. M., Beamish, P. W., & DaCosta, R. C. (1989). Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal,10(2), 109–119.

Ghemawat, P. (2001). Distance still matters. Harvard Business Review,79(8), 137–147.

Ghemawat, P. (2003). Semiglobalization and international business strategy. Journal of International Business Studies,34(2), 138–152.

Ghemawat, P. (2005). Regional strategies for global leadership. Harvard Business Review,83(12), 98–108.

Ghemawat, P. (2007). Why the world isn’t flat. Foreign Policy,159, 54–60.

Glaum, M., & Oesterle, M.-J. (2007). 40 years of research on internationalization and firm performance: More questions than answers? Management International Review,47(3), 307–317.

Globerman, S., & Shapiro, D. (2009). Economic and strategic considerations surrounding Chinese FDI in the United States. Asia Pacific Journal of Management,26(1), 163–183.

Goerzen, A., & Beamish, P. W. (2003). Geographic scope and multinational enterprise performance. Strategic Management Journal,24(13), 1289–1306.

Goerzen, A., & Beamish, P. W. (2005). The effect of alliance network diversity on multinational enterprise performance. Strategic Management Journal,26(4), 333–354.

Gomez-Mejia, L. R., & Palich, L. E. (1997). Cultural diversity and the performance of multinational firms. Journal of International Business Studies,28(2), 309–335.

Grant, R. M., Jammine, A. P., & Thomas, H. (1988). Diversity, diversification, and profitability among British manufacturing companies, 1972–1984. Academy of Management Journal,31(4), 771–801.

Grimsey, D., & Lewis, M. (2007). Public private partnerships: The worldwide revolution in infrastructure provision and project finance. Cheltenham: Edward Elgar Publishing.

Guillén, M. F., & García-Canal, E. (2007). La expansión internacional de la empresa española: Una nueva base de datos sistemática. Información Comercial Española, ICE: Revista de Economía. Revista de Economía,839, 23–34.

Guillén, M. F., & García-Canal, E. (2010). The New Multinationals. Spanish firms in a global context. Cambridge: Cambridge University Press.

Gupta, V., Hanges, P. J., & Dorfman, P. (2002). Cultural clusters: Methodology and findings. Journal of World Business,37(1), 11–15.

Guthrie, G. (2006). Regulating infrastructure: The impact on risk and investment. Journal of Economic Literature,44(4), 925–972.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica,47(1), 153–161.

Henisz, W. J. (2002). The institutional environment for infrastructure investment. Industrial and Corporate Change,11(2), 355–389.

Henisz, W. J. (2003). The power of the Buckley and Casson thesis: The ability to manage institutional idiosyncrasies. Journal of International Business Studies,34(2), 173–184.

Hennart, J.-F. (2007). The theoretical rationale for a multinationality-performance relationship. Management International Review,47(3), 423–452.

Hitt, M. A., Ahlstrom, D., Dacin, M. T., Levitas, E., & Svobodina, L. (2004). The institutional effects on strategic alliance partner selection in transition economies: China vs. Russia. Organization Science,15(2), 173–185.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal,40(4), 767–798.

Hofstede, G., & Bond, M. H. (1988). The Confucius connection: From cultural roots to economic growth. Organizational Dynamics,16(4), 5–21.

Holmes, R. M., Jr., Miller, T., Hitt, M. A., & Salmador, M. P. (2013). The interrelationships among informal institutions, formal institutions, and inward foreign direct investment. Journal of Management,39(2), 531–566.

Hymer, S. H. (1976). The international operations of national firms: A study of direct foreign investment. Cambridge: MIT Press.

Jackson, G., & Deeg, R. (2008). Comparing capitalisms: Understanding institutional diversity and its implications for international business. Journal of International Business Studies,39(4), 540–561.

Javalgi, R. G., Hall, K. D., & Cavusgil, S. T. (2014). Corporate entrepreneurship, customer-oriented selling, absorptive capacity, and international sales performance in the international B2B setting: Conceptual framework and research propositions. International Business Review,23(6), 1193–1202.

Kaasa, A., Vadi, M., & Varblane, U. (2014). Regional cultural differences within European countries: Evidence from multi-country surveys. Management International Review,54(6), 825–852.

Keim, G. D., & Hillman, A. J. (2008). Political environments and business strategy: Implications for managers. Business Horizons,51(1), 47–53.

Kim, J. U., & Aguilera, R. V. (2015). The world is spiky: An internationalization framework for a semi-globalized world. Global Strategy Journal,5(2), 113–132.

Kim, H., Hoskisson, R. E., & Lee, S. H. (2015). Why strategic factor markets matter: “New” multinationals’ geographic diversification and firm profitability. Strategic Management Journal,36(4), 518–536.

Kirkpatrick, C., Parker, D., & Zhang, Y. (2006). Foreign direct investment in infrastructure in developing countries: Does regulation make a difference? Transnational Corporations,15(1), 143–171.

Kogut, B. (1985). Designing global strategies: Comparative and competitive value-added chains. Sloan Management Review,26(4), 15–28.

Konara, P., & Shirodkar, V. (2018). Regulatory institutional distance and MNCs’ subsidiary performance: Climbing up vs. climbing down the institutional ladder. Journal of International Management,24(4), 333–347.

Kostova, T. (1999). Transnational transfer of strategic organizational practices: A contextual perspective. Academy of Management Review,24(2), 308–324.

Kostova, T., Nell, P. C., & Hoenen, A. K. (2018). Understanding agency problems in headquarters-subsidiary relationships in multinational corporations: A contextualized model. Journal of Management,44(7), 2611–2637.

Kostova, T., & Roth, K. (2002). Adoption of an organizational practice by subsidiaries of multinational corporations: Institutional and relational effects. Academy of Management Journal,45(1), 215–233.

Kostova, T., & Zaheer, S. (1999). Organizational legitimacy under conditions of complexity: The case of the multinational enterprise. Academy of Management Review,24(1), 64–81.

Kutner, M. H., Nachtsheim, C. J., Neter, J., & Li, W. (2004). Applied linear regression models. New York: McGraw-Hill/Irwin.

La Porta, R., Lopez-de-Silanes, F., Pop-Eleches, C., & Shleifer, A. (2004). Judicial checks and balances. Journal of Political Economy,112(2), 445–470.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of Political Economy,106(6), 1113–1155.

Lemmon, M. L., & Lins, K. V. (2003). Ownership structure, corporate governance, and firm value: Evidence from the East Asian financial crisis. The Journal of Finance,58(4), 1445–1468.

Liou, R. S., & Rao-Nicholson, R. (2019). Age matters: The contingency of economic distance and economic freedom in emerging market firm’s cross-border M&A performance. Management International Review,59(3), 355–386.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal,22(6–7), 565–586.

Lu, J. W., & Beamish, P. W. (2004). International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal,47(4), 598–609.

Luo, Y., & Peng, M. W. (1999). Learning to compete in a transition economy: Experience, environment, and performance. Journal of International Business Studies,30(2), 269–295.

Madhok, A. (1997). Cost, value and foreign market entry mode: The transaction and the firm. Strategic Management Journal,18(1), 39–61.

Makino, S., Isobe, T., & Chan, C. M. (2004). Does country matter? Strategic Management Journal,25(10), 1027–1043.

Mallon, M. R., & Fainshmidt, S. (2017). Assets of foreignness: A theoretical integration and agenda for future research. Journal of International Management,23(1), 43–55.

Mendoza, X., Espinosa-Méndez, C., & Araya-Castillo, L. (2019). When geography matters: International diversification and firm performance of Spanish multinationals. BRQ Business Research Quarterly. https://doi.org/10.1016/j.brq.2018.

Meyer, K. E., & Tran, Y. T. T. (2006). Market penetration and acquisition strategies for emerging economies. Long Range Planning,39(2), 177–197.

Michel, A., & Shaked, I. (1986). Multinational corporations vs. domestic corporations: Financial performance and characteristics. Journal of International Business Studies,17(3), 89–100.

Miller, S. R., Lavie, D., & Delios, A. (2016). International intensity, diversity, and distance: Unpacking the internationalization–performance relationship. International Business Review,25(4), 907–920.

Morosini, P., Shane, S., & Singh, H. (1998). National cultural distance and cross-border acquisition performance. Journal of International Business Studies,29(1), 137–158.

Moschieri, C., Ragozzino, R., & Campa, J. M. (2014). Does regional integration change the effects of country-level institutional barriers on M&A? The case of the European Union. Management International Review,54(6), 853–877.

Nguyen, Q. T. (2017). Multinationality and performance literature: A critical review and future research agenda. Management International Review,57(3), 311–347.

North, D. C. (1990). A transaction cost theory of politics. Journal of Theoretical Politics,2(4), 355–367.

North, D. C. (1991). Institutions. Journal of Economic Perspectives,5(1), 97–112.

Oh, C. H., & Contractor, F. (2014). A regional perspective on multinational expansion strategies: Reconsidering the three-stage paradigm. British Journal of Management,25(S1), S42–S59.

Oh, C. H., & Li, J. (2015). Commentary: Alan Rugman and the theory of the regional multinationals. Journal of World Business,50(4), 631–633.

Oh, C. H., Sohl, T., & Rugman, A. M. (2015). Regional and product diversification and the performance of retail multinationals. Journal of International Management,21(3), 220–234.

Osegowitsch, T., & Sammartino, A. (2008). Reassessing (home-) regionalisation. Journal of International Business Studies,39(2), 184–196.

Parker, D. (2003). Performance, risk and strategy in privatised, regulated industries: The UK’s experience. International Journal of Public Sector Management,16(1), 75–100.

Peng, M. W. (2002). Towards an institution-based view of business strategy. Asia Pacific Journal of Management,19(2–3), 251–267.

Peng, M. W., Sun, S. L., Pinkham, B., & Chen, H. (2009). The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives,23(3), 63–81.

Peng, M. W., Wang, D. Y., & Jiang, Y. (2008). An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies,39(5), 920–936.

Picone, P. M., Dagnino, G. B., & Minà, A. (2014). The origin of failure: A multidisciplinary appraisal of the hubris hypothesis and proposed research agenda. Academy of Management Perspectives,28(4), 447–468.

Qian, G., Khoury, T. A., Peng, M. W., & Qian, Z. (2010). The performance implications of intra-and inter-regional geographic diversification. Strategic Management Journal,31(9), 1018–1030.

Qian, G., Li, L., & Rugman, A. M. (2013). Liability of country foreignness and liability of regional foreignness: Their effects on geographic diversification and firm performance. Journal of International Business Studies,44(6), 635–647.

Ral-Trebacz, A., Eckert, S., & Dittfeld, M. (2018). The value of internationalization: Disentangling the interrelationship between regionalization strategies, firm-specific assets related to marketing and performance. Multinational Business Review,26(1), 71–90.

Ramamurti, R. (2003). Can governments make credible promises? Insights from infrastructure projects in emerging economies. Journal of International Management,9(3), 253–269.

Ramamurti, R., & Doh, J. P. (2004). Rethinking foreign infrastructure investment in developing countries. Journal of World Business,39(2), 151–167.

Rangan, S., & Sengul, M. (2009). The influence of macro structure on the foreign market performance of transnational firms: The value of IGO connections, export dependence, and immigration links. Administrative Science Quarterly,54(2), 229–267.

Riahi-Belkaoui, A. (1998). The effects of the degree of internationalization on firm performance. International Business Review,7(3), 315–321.

Ronen, S., & Shenkar, O. (2013). Mapping world cultures: Cluster formation, sources and implications. Journal of International Business Studies,44(9), 867–897.

Rugman, A. M. (2003). Regional strategy and the demise of globalization. Journal of International Management,9(4), 409–417.

Rugman, A. M., & Verbeke, A. (2004). A perspective on regional and global strategies of multinational enterprises. Journal of International Business Studies,35(1), 3–18.

Rugman, A. M., & Verbeke, A. (2007). Liabilities of regional foreignness and the use of firm-level versus country-level data: A response to Dunning et al. (2007). Journal of International Business Studies,38(1), 200–205.

Rugman, A. M., & Verbeke, A. (2008). A new perspective on the regional and global strategies of multinational services firms. Management International Review,48(4), 397–411.

Ruigrok, W., Amann, W., & Wagner, H. (2007). The internationalization–performance relationship at Swiss firms: A test of the S-shape and extreme degrees of internationalization. Management International Review,47(3), 349–368.

Rumelt, R. P. (2011). Good strategy/bad strategy: The difference and why it matters. New York: Crown Business.

Sawant, R. J. (2010). The economics of large-scale infrastructure FDI: The case of project finance. Journal of International Business Studies,41(6), 1036–1055.

Shirodkar, V., & Konara, P. (2017). Institutional distance and foreign subsidiary performance in emerging markets: Moderating effects of ownership strategy and host-country experience. Management International Review,57(2), 179–207.

Tallman, S., & Li, J. (1996). Effects of international diversity and product diversity on the performance of multinational firms. Academy of Management Journal,39(1), 179–196.

Taras, V., Steel, P., & Kirkman, B. L. (2016). Does country equate with culture? Beyond geography in the search for cultural boundaries. Management International Review,56(4), 455–487.

Thomas, D. E., & Eden, L. (2004). What is the shape of the multinationality-performance relationship? Multinational Business Review,12(1), 89–110.

Verbeke, A., & Asmussen, C. G. (2016). Global, local, or regional? The locus of MNE strategies. Journal of Management Studies,53(6), 1051–1075.

Verbeke, A., & Forootan, M. Z. (2012). How good are multinationality–performance (M-P) empirical studies? Global Strategy Journal,2(4), 332–344.

Verbeke, A., Kano, L., & Yuan, W. (2016). Inside the regional multinationals: A new value chain perspective on subsidiary capabilities. International Business Review,25(3), 785–793.

Vergés, J. (1999). Balance de las políticas de privatización de empresas públicas en España, 1985-1999. Economía Industrial,330, 121–139.

Vergés, J. (2010). Privatización de empresas públicas y liberalización. Working paper.

Vernon, R. (1971). Sovereignty at bay: The multinational spread of U.S. enterprises. New York: Basic Books.

Villalonga, B. (2004). Intangible resources, Tobin’s q, and sustainability of performance differences. Journal of Economic Behavior and Organization,54(2), 205–230.

Wan, W. P., & Hoskisson, R. E. (2003). Home country environments, corporate diversification strategies and firm performance. Academy of Management Journal,46(1), 27–45.

Wiersema, M. F., & Bowen, H. P. (2011). The relationship between international diversification and firm performance: Why it remains a puzzle. Global Strategy Journal,1(1–2), 152–170.

Wu, Z., & Salomon, R. (2016). Does imitation reduce the liability of foreignness? Linking distance, isomorphism, and performance. Strategic Management Journal,37(12), 2441–2462.

Zaheer, S. (1995). Overcoming the liability of foreignness. Academy of Management Journal,38(2), 341–363.

Zhou, N., & Guillén, M. F. (2015). From home country to home base: A dynamic approach to the liability of foreignness. Strategic Management Journal,36(6), 907–917.

Zhou, N., & Guillén, M. F. (2016). Categorizing the liability of foreignness: Ownership, location, and internalization-specific dimensions. Global Strategy Journal,6(4), 309–329.

Acknowledgements

We thank the comments and suggestions received from Álvaro Cuervo-Cazurra, Kimberly Eddleston, Jedrzej George Frynas, Anthony Goerzen, Rajneesh Narula, Xavier Martin and the anonymous reviewers and conference participants at the 2016 Strategic Management Society Annual Conference and the 44th AIB (UK&I) and 6th Reading IB Conference 2017. We are grateful for the funding provided by the Spanish Ministry of Economy (project ECO2017-86101-P). Raquel García-García would also like to acknowledge the financial support received from the FPI program of the Ministry of Economy in which she was enrolled. Esteban García-Canal likewise appreciates the support of Fundación Banco Sabadell, through the Cátedra de Crecimiento e Internacionalización Empresarial.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

García-García, R., García-Canal, E. & Guillén, M.F. International Dispersion and Profitability: An Institution-Based Approach. Manag Int Rev 59, 855–888 (2019). https://doi.org/10.1007/s11575-019-00402-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-019-00402-w