Abstract

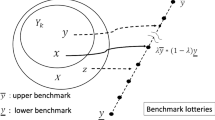

This paper develops a graphical tool – the uncertainty triangle – that allows for testing whether choices under uncertainty obey the generalized axiom of revealed preference (GARP). We find that more than 95% of subjects made choices that can be rationalized by the maximization of a well-behaved utility function. The uncertainty triangle also makes it straightforward to characterize heterogeneity in attitudes towards uncertainty. To accomplish this we propose a one-parameter extension of Expected Utility in which uncertainty attitude is everywhere constant in the triangle. Experimental data indicate that about 60% of participants made choices consistent with the model and, within this group, 48% were uncertainty averse, 22% uncertainty seeking, and 30% uncertainty neutral. The remaining 40% of participants appear to hold variable uncertainty attitudes. A model that can accommodate this variability is proposed and calibrated.

Panels (a)-(c) depict different alternatives from the same budget that corresponds to the thin solid line-segment in Fig. 2a (i.e. the budget with endpoints (0,0,1) and (0.5,0.5,0). Panel (d) depicts “Confirm” and “Cancel” buttons that appeared after participants clicked one of the thumbnails at the bottom of the screen

The dashed lines are for reference and represent uncertainty neutrality. Note that we only observe choices in a sub-domain of the uncertainty triangle – Indifference curves in the upper-right and lower-left corner are therefore extrapolations

Similar content being viewed by others

Notes

This paper uses the term ‘uncertainty’ as a concept that is related-to but distinct-from ‘ambiguity.’ Here, uncertainty is an objective quantity corresponding to the amount of unassigned probability mass in a lower envelope lottery. Ambiguity, in contrast, is “a quality depending on the amount, type, reliability, and ‘unanimity’ of information” (Ellsberg 1961, pg. 657). Thus, ambiguity is a more general concept that can include subjective components. The distinction between uncertainty and ambiguity is important because our approach permits an examination of uncertainty attitudes in the context of lower envelope lotteries. Our approach does not, however, permit an examination of ambiguity, or ambiguity attitudes, in the manner of Ghirardato et al. (2004).

The name ‘Partial Ignorance Expected Utility’ was inspired by Chapter 13.5 in Luce and Raiffa (1958).

The PEU model has been axiomatized in a more general ‘sets of lotteries’ setting in Olszewski (2007). Also related to our approach Gul (2015) introduces a source-dependent theory they coin Hurwicz Expected Utility. The Hurwicz Expected Utility Theory is itself a special case of a more general theory (Expected Uncertain Utility Theory) introduced in Gul and Pesendorfer (2014). The model in Gul (2015) is a sub-class of α-MaxMin Expected Utility (Marinacci 2002; Ghirardato et al. 2004) as it imposes further restrictions on priors. In this sense, the PEU model can also be interpreted as a variant of the α-MaxMin model that is adapted to the setting of lower envelope lotteries (Marinacci 2002; Ghirardato et al. 2004). PEU differs, however, by means of the objects of choice and its interpretation. First, PEU preferences are defined over lower envelope lotteries whereas α-MaxMin preferences are defined over acts (bets). Second, in the PEU model the best and the worst possibilities (\(\overline {L}\) and \(\underline {L}\)) are objectively defined entities. For the α-MaxMin model, however, the best and worst possibilities are determined by an individual’s subjective beliefs. Section 4 discusses some implications of these distinctions.

Burghart (2018) utilizes a triangular figure to explore a model in the setting of “upper envelope lotteries.” These objects of choice are distinct from lower envelope lotteries in that they list the maximum probability for each outcome and a term called “information” which captures how much is known about the probabilities at the time of choice.

It is tempting to draw parallels between non-constant uncertainty attitudes and non-constant risk attitudes as manifested by the Allais paradox (Allais 1953). Indeed, the β-PEU model shares similarities with risky choice models that can accommodate variable risk attitudes such as weighted utility (Chew and MacCrimmon 1979, 1983, 1989; Fishburn 1983). We further explore these similarities in Section 5.

At the time of the experiment, one CHF was worth approximately $1.10.

Following Hey et al. (2010), and the re-assessment of those data in Kothiyal et al. (2014), we wanted to insure that participants were not concerned about experimenters ‘stacking the urn’ against the participants. Thus, experimenters were blind to the exact composition of the urn. This was accomplished by giving various students, faculty, and staff in the authors’ home department envelopes with two balls, a pen, and instructions telling them to, for example, write 7 on both balls, write 8 on both balls, or 7 on one ball and 8 on the other ball, and then to seal the envelope. The balls were placed in the urn, and quality control for readability and consistency with the instructions, was done by a person not involved with the experiment. Experimental participants were told how the urn was constructed during the instructions, and informed that experimenters were blinded to the exact composition of the urn.

The transparency of the bingo blower is an important consideration when interpreting the results in Hey and Pace (2014). Transparency means that some information regarding the composition of the urn would be available to participants through visual inspection. For example, the extreme possibility of the urn being comprised of just one color of ball could be easily ruled out.

The procedure introduced by Beatty and Crawford (2011) yields the same conclusion: Given our set of budgets it is very unlikely to pass GARP with uniform random choice. Put differently, our GARP test has very high power.

More details on the quality of classification can be found in Section A.2 of the Electronic Supplementary Material.

We also estimated models with C = 3 types. The additional type can be broadly described as a subgroup of the ‘everywhere uncertainty averse’ type when C = 2. We also validated the β-PEU model by estimating it with the sub-sample of 120 ‘vanilla’ PEU types from Section 3.2 above. As expected for these validations, all estimated β’s are not statistically different than zero.

More details on the quality of classification can be found in Section B of the Electronic Supplementary Material.

Putting aside the difference in domain (i.e. lower envelope lotteries vs. acts), these two models can make identical behavioral predictions if an α-MaxMin Expected Utility maximizer has priors over the full range of probabilities.

The observations in this paragraph were generously provided by a referee.

References

Abdellaoui, M, Baillon, A, Placido, L, & Wakker, PP. (2011). The rich domain of uncertainty: Source functions and their experimental implementation. The American Economic Review, 101, 695–723.

Afriat, SN. (1967). The construction of utility functions from expenditure data. International Economic Review, 8, 67–77.

Ahn, DS. (2008). Ambiguity without a state space. The Review of Economic Studies, 75, 3–28.

Ahn, D, Choi, S, Gale, D, & Kariv, S. (2014). Estimating ambiguity aversion in a portfolio choice experiment. Quantitative Economics, 5, 195–223.

Allais, M. (1953). Le comportement de l’homme rationnel devant le risque: Critique des postulats et axiomes de l’école américaine. Econometrica, 21, 503–546.

Baillon, A, & Bleichrodt, H. (2015). Testing ambiguity models through the measurement of probabilities for gains and losses. American Economic Journal: Microeconomics, 7, 77–100.

Baillon, A, Huang, Z, Selim, A, & Wakker, PP. (2018). Measuring ambiguity attitudes for all (natural) events. Econometrica, 86, 1839–1858.

Baillon, A, & Placido, L. (2019). Testing constant absolute and relative ambiguity aversion. Journal of Economic Theory, 181, 309–332.

Beatty, TKM, & Crawford, IA. (2011). How demanding is the revealed preference approach to demand? The American Economic Review, 101, 2782–2795.

Bronars, SG. (1987). The power of nonparametric tests of preference maximization. Econometrica, 55, 693–698.

Bruhin, A, Fehr-Duda, H, & Epper, T. (2010). Risk and rationality: Uncovering heterogeneity in probability distortion. Econometrica, 78, 1375–1412.

Burghart, DR. (2018). Maximum probabilities, information, and choice under uncertainty. Economics Letters, 167, 43–47.

Burghart, DR. (2020). The two faces of independence: Betweenness and homotheticity. Theory and Decision, 88, 567–593.

Camerer, C, & Weber, M. (1992). Recent developments in modeling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty, 5, 325–370.

Camerer, C. (1995). Individual decision making. In Kagel, A, & Roth, J (Eds.) The handbook of experimental economics (pp. 587–683). Princeton: Princeton University Press.

Chew, S, & MacCrimmon, K. (1979). Alpha utility theory, lottery compositions and the Allais paradox. Unpublished manuscript, University of British Columbia.

Chew, S. (1989). Axiomatic utility theories with the betweenness property. Annals of Operations Research, 19, 273–298.

Chew, SH. (1983). A generalization of the quasilinear mean with applications to the measurement of income inequality and decision theory resolving the Allais paradox. Econometrica, 51, 1065–1092.

Dempster, AP. (1967). Upper and lower probabilities induced by a multivalued mapping. Annals of Mathematical Statistics, 38, 325–339.

Dempster, A, Laird, N, & Rubin, D. (1977). Maximum likelihood from incomplete data via the EM algorithm. Journal of the Royal Statistical Society: Series B, 39, 1–38.

Efron, B, & Tibshirani, RJ. (1993). An introduction to the bootstrap. New York: Chapman & Hall.

El Gamal, MA, & Grether, DM. (1995). Are people Bayesian? Uncovering behavioral strategies. Journal of the American Statistical Association, 90, 1137–1145.

Ellsberg, D. (1961). Risk, ambiguity, and the Savage axioms. Quarterly Journal of Economics, 75, 643–669.

Etner, J, Jeleva, M, & Tallon, J-M. (2010). Decision theory under ambiguity. Journal of Economic Surveys, 26, 234–270.

Fehr-Duda, H, Bruhin, A, Epper, T, & Schubert, R. (2010). Rationality on the rise: Why relative risk aversion increases with stake size. Journal of Risk and Uncertainty, 40, 147–180.

Fehr-Duda, H, & Epper, T. (2012). Probability and risk: Foundations and economic implications of probability-dependent risk preferences. Annual Review of Economics, 4, 567–593.

Fishburn, PC. (1983). Transitive measurable utility. Journal of Economic Theory, 31, 293–317.

Ghirardato, P, Maccheroni, F, & Marinacci, M. (2004). Differentiating ambiguity and ambiguity attitude. Journal of Economic Theory, 118, 133–173.

Gilboa, I, & Schmeidler, D. (1989). Maxmin expected utility with non-unique prior. Journal of Mathematical Economics, 18, 141–153.

Gul, F, & Pesendorfer, W. (2014). Expected uncertain utility theory. Econometrica, 82, 1–39.

Gul, F. (2015). Hurwicz expected utility and subjective sources. Journal of Economic Theory, 159, 465–488.

Halevy, Y. (2007). Ellsberg revisited: An experimental study. Econometrica, 75, 503–536.

Hey, JD, Lotito, G, & Maffioletti, A. (2010). The descriptive and predictive adequacy of theories of decision making under uncertainty/ambiguity. Journal of Risk and Uncertainty, 41, 81–111.

Hey, JD, & Pace, N. (2014). The explanatory and predictive power of non two-stage-probability theories of decision making under ambiguity. Journal of Risk and Uncertainty, 49, 1–29.

Houser, D, Keane, M, & McCabe, K. (2004). Behavior in a dynamic decision problem: an analysis of experimental evidence using a Bayesian type classification algorithm. Econometrica, 72, 781–822.

Houtman, M, & Maks, JAH. (1985). Determining all maximal data subsets consistent with revealed preference. Kwantitatieve Methoden, 19, 89–104.

Jaffray, J-Y. (1994). Dynamic decision making with belief functions. In Yager, RR, Fedrizzi, M, & Kacprzyk, J (Eds.) Advances in the Dempster-Shafer theory of evidence (pp. 331–352). New York: Wiley.

Knight, FH. (1921). Risk, uncertainty and profit. Boston: Hart, Schaffner & Marx; Houghton Mifflin Co.

Kothiyal, A, Spinu, V, & Wakker, PP. (2014). An experimental test of prospect theory for predicting choice under ambiguity. Journal of Risk and Uncertainty, 48, 1–17.

Luce, RD, & Raiffa, H. (1958). Games and decisions, 3rd edn. New York: Wiley.

Machina, M. (1982). Expected utility: Analysis without the Independence Axiom. Econometrica, 50, 277–323.

Machina, MJ. (2014a). Ambiguity aversion with three or more outcomes. The American Economic Review, 104, 3814–3840.

Machina, M, & Viscusi, WK. (2014b). Ambiguity and Ambiguity Aversion, 1st ed, North-Holland.

Marinacci, M. (2002). Probabilistic sophistication and multiple priors. Econometrica, 70, 755–764.

McFadden, D. (1981) In Manski, C (Ed.), Econometric models of probabilistic choice. Cambridge: MIT Press.

McLachlan, G, & Peel, D. (2000). Finite mixture models. Wiley series in probabilities and statistics. New York: Wiley.

Olszewski, W. (2007). Preferences over sets of lotteries. The Review of Economic Studies, 74, 567–595.

Schmeidler, D. (1989). Subjective probability and expected utility without additivity. Econometrica, 57, 571–587.

Shafer, G. (1976). A mathematical theory of evidence. Princeton: Princeton University Press.

Siniscalchi, M. (2009). Vector expected utility and attitudes toward variation. Econometrica, 77, 801–855.

Stahl, DO, & Wilson, PW. (1995). On players’ models of other players: Theory and experimental evidence. Games and Economic Behavior, 10, 218–254.

Stahl, DO. (2014). Heterogeneity of ambiguity preferences. The Review of Economics and Statistics, 96, 609–617.

Varian, HR. (1982). The nonparametric approach to demand analysis. Econometrica, 50, 945–973.

Acknowledgments

Special thanks go to Aurélien Baillon and Peter Wakker as they gave us detailed feedback on an early draft of this paper, in addition to some key references. All authors gratefully acknowledge valuable input from Jim Cox, Charles Efferson, Tony Williams, anonymous referees, participants in the seminars at Princeton University, University of Zurich, Virginia Tech, and Wesleyan University, participants at the 2014 Economic Science Association North American meeting held in Fort Lauderdale, Florida, participants at RUD 2016 (Paris-Dauphine), and participants at the 2016 European Meeting of the Econometric Society in Geneva. Sonja Vogt was instrumental in preparing the urn used to resolve uncertainty. And we also thank the students, faculty and staff in the Department of Economics at UZH for their assistance in composing the urn. Stefan Wehrli, Oliver Brägger and Nadja Jehli provided technical and practical assistance during data collection. Christina Stoddard provided excellent editing and typesetting advice. This work was supported by a grant from the European Research Council on the Foundations of Economic Preferences (#295642).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Burghart, D.R., Epper, T. & Fehr, E. The uncertainty triangle – Uncovering heterogeneity in attitudes towards uncertainty. J Risk Uncertain 60, 125–156 (2020). https://doi.org/10.1007/s11166-020-09331-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-020-09331-8