Abstract

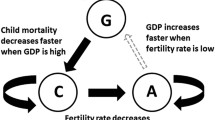

We construct a three-period overlapping generations model in which corruption, mortality and fertility rates, and economic development are determined endogenously. We consider a less developed economy suffering from a high degree of corruption and high mortality and fertility rates in a poverty trap. We focus on two policies: raising public sector wages as a means of reducing corruption and increasing public health spending as a means of improving the mortality rate. Our aim is to examine what effects each policy has on an economy and how governments can achieve economic development using one, or both, of these policies. Our theoretical analysis shows that implementing both policies simultaneously is essential for less developed economies to escape from the poverty trap and achieve economic development.

Similar content being viewed by others

Notes

The CPI is available at https://www.transparency.org. The data on mortality rates and on per capita GDP are available at https://data.worldbank.org/indicator.

Even if we plot the mortality rate of those under five or that of female adults as the mortality rate measure, the negative correlations between mortality rates and development can still be confirmed.

Other studies determine the mortality rate using the level of human capital or private payments for healthcare; for example, see Cigno (1998), Blackburn and Cipriani (2002), Kalemli-Ozcan (2002), Lagerlöf (2003), Galor and Moav (2005), Hazan and Zoabi (2006), Cervellati and Sunde (2007), Fioroni (2010), and Futagami and Konishi (2019). To be exact, both private and public health expenditures affect the mortality rate in Blackburn and Cipriani (1998) and Agénor (2015).

There are also studies that construct models in which public spending affects mortality rate, and these studies examine the effects of increasing public spending. A few notable studies include Chakraborty (2004), Aisa and Pueyo (2006), and Bhattacharya and Qiao (2007). However, they do not take fertility rates into account.

Rajkumar and Swaroop (2008) measure governance by using two indicators: quality of bureaucracy and level of corruption.

There are, however, theoretical studies that examine corruption and economic development in dynamic models, such as Ehrlich and Lui (1999), Sarte (2001), Alesina and Angeletos (2005), Blackburn et al. (2006, (2011), Blackburn and Forgues-Puccio (2007, (2009), Blackburn and Sarmah (2008), Eicher et al. (2009), Spinesi (2009), Blackburn (2012), Dzhumashev (2014a, (2014b), and Varvarigos and Arsenis (2015).

We can consider the endogenous occupational choice as follows. There are \(\lambda N_t\) seats in the public sector. Agents decide whether they will apply for jobs in the public sector at the end of childhood. If they do not apply, they become households. If the number of applications is less than or equal to the number of seats, all applicants can become bureaucrats. On the other hand, if the number of applicants is higher than the number of seats, the applicants will be randomly selected by the government. Introducing the endogenous occupational choice into the model does not change our results. Thus, for simplicity, we assume that newly born agents are divided into bureaucrats and households exogenously.

The public sector wage rate is not determined by a market mechanism. The assumption that the government decides the wage rate is in line with macroeconomic literature on corruption (e.g., Blackburn et al. 2006).

If the government offers \(\omega _t<w_t\), only corruptible bureaucrats who expect to receive compensation through illegal income will work in the public sector and are identified as being dishonest. Thus, offering a lower public sector wage implies that the government accepts corruption. Since our analysis seeks to examine methods to escape from the poverty trap, we focus only on \(\rho \in [1, \infty )\).

As explained later, public health in (9) is an increasing function of per capita capital. Economic development, represented by \(k_t\), has negative effects on the quality of public health through greater production and positive effects through more public services. In equilibrium, the positive effects dominate. Thus, as capital accumulates, the quality of public health improves.

Similar assumptions are used in Blackburn and Sarmah (2008) and Varvarigos and Arsenis (2015). The analysis of Blackburn and Sarmah (2008) assumes that households face a mortality rate, whereas bureaucrats enjoy a whole lifetime. The analysis of Varvarigos and Arsenis (2015) assumes that only households give birth and raise their children.

Although our analysis concentrates on raising public sector wages as a method of preventing corruption, we could also consider other methods. One example is paying out a bonus to bureaucrats for successful execution of a Type-1 project. No bureaucrats engage in corruption if the government pays out a bonus, \(B_t\), that is large enough to satisfy \(p \ln (\omega _t+B_t)+(1-p) \ln \omega _t \ge (1-\chi ) \ln [\omega _t+(1-\delta ) G_t/N_t^B]\), where the left-hand side is the expected utility if a bureaucrat does not engage in corruption and the right-hand side is the utility if he/she engages in corruption. Incorporating a bonus into the model yields the government’s balanced budget constraint, \(\tau _t Y_t=G_t+\omega _t N_t^B+B_tN_t^Bp(1-\sigma _t b)\). In this case, it would be complicated to clarify the macroeconomic effects of policies. Hence, in line with Becker and Stigler (1974), Besley and McLaren (1993), Acemoglu and Verdier (1998), and Wadho (2016), we concentrate on the role of public sector wages in the present study.

The case in which \(k^*(1, \theta )\) intersects with neither \({\hat{k}}(1, \theta )\) nor \(\lim _{\rho \rightarrow \infty } {\hat{k}}(\rho , \theta )\) is not considered since no policy will be effective.

We note that this result occurs in the first case when the government increases \(\theta _0\) to \({\tilde{\theta }} \in [\theta _1, \theta _2)\) or \({\tilde{\theta }} \in (\theta _3, \theta _4]\).

The steady state at which the 45-degree line intersects with \(k_{t+1}^M\) is unstable.

References

Acemoglu D, Verdier T (1998) Property rights, corruption and the allocation of talent: a general equilibrium approach. Econ J 108(450):1381–1403

Agénor PR (2015) Public capital, health persistence and poverty traps. J Econ 115(2):103–131

Aisa R, Pueyo F (2006) Government health spending and growth in a model of endogenous longevity. Econ Lett 90(2):249–253

Alesina A, Angeletos GM (2005) Corruption, inequality, and fairness. J Monet Econ 52(7):1227–1244

Barr A, Serra D (2010) Corruption and culture: an experimental analysis. J Public Econ 94(11–12):862–869

Becker GS, Stigler GJ (1974) Law enforcement, malfeasance, and compensation of enforcers. J Legal Stud 3(1):1–18

Besley T, McLaren J (1993) Taxes and bribery: the role of wage incentives. Econ J 103(416):119–141

Bhattacharya J, Qiao X (2007) Public and private expenditures on health in a growth model. J Econ Dyn Control 31(8):2519–2535

Blackburn K (2012) Corruption and development: explaining the evidence. Manch School 80(4):401–428

Blackburn K, Cipriani GP (1998) Endogenous fertility, mortality and growth. J Popul Econ 11(4):517–534

Blackburn K, Cipriani GP (2002) A model of longevity, fertility and growth. J Econ Dyn Control 26(2):187–204

Blackburn K, Forgues-Puccio GF (2007) Distribution and development in a model of misgovernance. Eur Econ Rev 51(6):1534–1563

Blackburn K, Forgues-Puccio GF (2009) Why is corruption less harmful in some countries than in others? J Econ Behav Org 72(3):797–810

Blackburn K, Sarmah R (2008) Corruption, development and demography. Econ Gov 9(4):341–362

Blackburn K, Bose N, Haque ME (2006) The incidence and persistence of corruption in economic development. J Econ Dyn Control 30(12):2447–2467

Blackburn K, Bose N, Haque ME (2011) Public expenditures, bureaucratic corruption and economic development. Manch School 79(3):405–428

Cervellati M, Sunde U (2007) Human capital, mortality and fertility: a unified theory of the economic and demographic transition. IZA Discussion Paper (2905)

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116(1):119–137

Chong A, Calderon C (2000) Causality and feedback between institutional measures and economic growth. Econ Politics 12(1):69–81

Cigno A (1998) Fertility decisions when infant survival is endogenous. J Popul Econ 11(1):21–28

Di Tella R, Schargrodsky E (2003) The role of wages and auditing during a crackdown on corruption in the city of buenos aires. J Law Econ 46(1):269–292

Dioikitopoulos EV (2014) Aging, growth and the allocation of public expenditures on health and education. Canadian Journal of Economics/Revue Canadienne d’économique 47(4):1173–1194

Dong B, Dulleck U, Torgler B (2012) Conditional corruption. J Econ Psychol 33(3):609–627

Dzhumashev R (2014a) Corruption and growth: The role of governance, public spending, and economic development. Econ Modell 37:202–215

Dzhumashev R (2014b) The two-way relationship between government spending and corruption and its effects on economic growth. Contemp Econ Policy 32(2):403–419

Ehrlich I, Lui FT (1999) Bureaucratic corruption and endogenous economic growth. J Polit Econ 107(S6):S270–S293

Eicher T, García-Peñalosa C, Van Ypersele T (2009) Education, corruption, and the distribution of income. J Econ Growth 14(3):205–231

Fanti L, Gori L (2014) Endogenous fertility, endogenous lifetime and economic growth: the role of child policies. J Popul Econ 27(2):529–564

Fioroni T (2010) Child mortality and fertility: public vs private education. J Popul Econ 23(1):73–97

Futagami K, Konishi K (2019) Rising longevity, fertility dynamics, and R&D-based growth. J Popul Econ 32(2):591–620

Galor O, Moav O (2005) Natural selection and the evolution of life expectancy. CEPR Discussion Paper (5373)

Goel RK, Nelson MA (1998) Corruption and government size: A disaggregated analysis. Public Choice 97(1–2):107–120

Hazan M, Zoabi H (2006) Does longevity cause growth? a theoretical critique. J Econ Growth 11(4):363–376

Kalemli-Ozcan S (2002) Does the mortality decline promote economic growth? J Econ Growth 7(4):411–439

Ki H, Tabata K (2005) Health infrastructure, demographic transition and growth. Rev Develop Econ 9(4):549–562

Lagerlöf NP (2003) From malthus to modern growth: can epidemics explain the three regimes? Int Econ Rev 44(2):755–777

Lee WS, Guven C (2013) Engaging in corruption: The influence of cultural values and contagion effects at the microlevel. J Econ Psychol 39:287–300

Lorentzen P, McMillan J, Wacziarg R (2008) Death and development. J Econ Growth 13(2):81–124

Mauro P (1995) Corruption and growth. Q J Econ 110(3):681–712

Okada K (2020) Dynamic analysis of demographic change and human capital accumulation in an R&D-based growth model. J Econ 130:225–248

Osang T, Sarkar J (2008) Endogenous mortality, human capital and economic growth. J Macroecon 30(4):1423–1445

Rajkumar AS, Swaroop V (2008) Public spending and outcomes: does governance matter? J Develop Econ 86(1):96–111

Sarte PDG (2001) Rent-seeking bureaucracies and oversight in a simple growth model. J Econ Dyn Control 25(9):1345–1365

Spinesi L (2009) Rent-seeking bureaucracies, inequality, and growth. J Develop Econ 90(2):244–257

Treisman D (2000) The causes of corruption: a cross-national study. J Public Econ 76(3):399–457

Van Rijckeghem C, Weder B (2001) Bureaucratic corruption and the rate of temptation: do wages in the civil service affect corruption, and by how much? J Develop Econ 65(2):307–331

Varvarigos D (2017) Cultural norms, the persistence of tax evasion, and economic growth. Econ Theory 63(4):961–995

Varvarigos D, Arsenis P (2015) Corruption, fertility, and human capital. J Econ Behav Org 109:145–162

Wadho WA (2016) Corruption, tax evasion and the role of wage incentives with endogenous monitoring technology. Econ Inquiry 54(1):391–407

World Bank (2003) World development report 2004: making services work for poor people. World Development Report

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

An earlier version of this study, titled “’Corruption, Mortality and Fertility Rates, and Development” (Discussion Papers In Economics And Business, Osaka University) was presented at a seminar at Kwansei Gakuin University, the 2018 China Meeting of the Econometric Society, the 2018 Asian Meeting of the Econometric Society, and the 2018 European Summer Meeting of the Econometric Society. I am especially grateful to Koichi Futagami for helpful discussions and suggestions. I also thank Ken Tabata, Takaaki Morimoto, and the participants in the seminars and conferences. Furthermore, I am grateful to the two anonymous referees for their valuable comments. The financial support from the Grant-in-Aid for JSPS Fellows (Grant No. JP17J05419) is gratefully acknowledged. There are no conflicts of interest to declare. Any errors are my responsibility.

Appendices

The case of bureaucrats who also give birth and face a mortality rate

To ensure concreteness, we confirm that our results about the relationships between corruption, mortality and fertility rates, and development as well as the dynamics of an economy and multiple steady states hold in a scenario in which both households and bureaucrats give birth and face the mortality rate.

The utility of bureaucrats is

First, we derive the optimal choices of non-corruptible bureaucrats (\(i=NB\)). Non-corruptible bureaucrats maximize (32) subject to \(c_{a, t}^{NB}+s_t^{NB}=\omega _t-en_t^{NB}\omega _t\) and \(c_{o, t+1}^{NB}=R_{t+1}s_t^{NB}/\pi _t\). Then, we obtain

Second, we derive the optimal choices of corruptible bureaucrats (\(i=CB\)). The choices of corruptible bureaucrats who do not engage in corruption (i.e., honest bureaucrats) are the same as those of non-corruptible bureaucrats. In addition, corruptible bureaucrats who engage in corruption (i.e., dishonest bureaucrats) behave in a similar way as honest bureaucrats. If the government finds a bureaucrat behaving differently, such as larger savings, it can detect his/her corruption. Thus, to avoid being caught, dishonest bureaucrats must match their decisions regarding consumption in adulthood, savings, and number of children to those of honest bureaucrats. Furthermore, they invest illegal income in a foreign market (e.g., an offshore bank) where it is difficult for the government to observe their investmentFootnote 16. The return of the foreign market is \(\mu R_{t+1}\). \(\mu \in (0, 1)\) represents the costs and risk of investing illegal income in the foreign market. The optimal choices of honest and dishonest bureaucrats are summarized as follows.

and

This leads to the following indirect utility for each type of corruptible bureaucrat:

As in the basic model, dishonest bureaucrats face the cost of engaging in corruption, and this cost is proportional to their utility from consumption in adulthood. Since corruption occurs in adulthood, they lose a part of the utility from consumption in adulthood. We note that \(U_t^{CB(honest)}\) and \(U_t^{CB(dishonest)}\) depend on the stock of per capita capital, \(k_t\), and the share of dishonest bureaucrats among the corruptible bureaucrats, \(\sigma _t\), since \(\omega _t\), \(R_{t+1}\), and \(G_t\) are a function of \(k_t\), and \(\pi _t\) is a function of \(\sigma _t\).

A corruptible bureaucrat j chooses the probability of engaging in corruption, \(\sigma _{jt} \in [0, 1]\), to maximize \(U(\sigma _{jt}, \sigma _t, k_t)=\sigma _{jt} U^{CB(dishonest)}_t+(1-\sigma _{jt})U^{CB(honest)}_t\) given \(k_t\) and \(\sigma _t\). Since \(U(\sigma _{jt}, \sigma _t, k_t)\) is affected by the strategies of other corruptible bureaucrats, we consider a Nash equilibrium.

Definition 1

\(\sigma _{jt}^*\) is a Nash equilibrium if \(\sigma _{jt}^*\) is the best response to \(\sigma _{t}^*\) under the given \(k_t\), for all corruptible bureaucrats. That is, \(U(\sigma _{jt}^*, \sigma _t^*, k_t) \ge U(\sigma '_{jt}, \sigma _t^*, k_t)\) for all \(\sigma '_{jt} \in [0,1]\) and all corruptible bureaucrats.

In the Nash equilibrium, \(\sigma _{jt}^*=\sigma _{-jt}^*\) so that \(\sigma _{jt}^*=\sigma _t^*\).

When \(\partial U(\sigma _{jt}, \sigma _t, k_t)/\partial \sigma _{jt}>0\), \(\sigma _{jt}=1\) becomes optimal, from (33) and (34), \(\partial U(\sigma _{jt}, \sigma _t, k_t)/\partial \sigma _{jt}>0\) is rewritten as \(k_t < {\tilde{k}}(\sigma _t)\), where

We note \(\kappa (\sigma _t) \equiv [1+(1-a)\beta \pi (\sigma _t)]/[\rho (1-a)(1-\tau )(1-\alpha )]\). If \(k_t<{\tilde{k}}(\sigma _t)\), a corruptible bureaucrat j takes \(\sigma _{jt}=1\). Thus, \(\sigma _t=1\) is realized since all the other corruptible bureaucrats choose the same strategy. This leads to \(k_t<{\tilde{k}}(1)\). Then, the strategy \(\sigma _{jt}=1\) if \(k_t<{\tilde{k}}(1)\) is the Nash equilibrium. When \(\partial U(\sigma _{jt}, \sigma _t, k_t)/\partial \sigma _{jt}<0\), we obtain \(k_t>{\tilde{k}}(\sigma _t)\). \(\sigma _{jt}=0\) is optimal if \(k_t>{\tilde{k}}(\sigma _t)\) holds; then, \(\sigma _t=0\) is realized. Thus, the strategy \(\sigma _{jt}=0\) if \(k_t>{\tilde{k}}(0)\) is the Nash equilibrium. We note that \(d\pi (\sigma _t)/d\sigma _t<0\); the degree of corruption, \(\sigma _t\), affects the survival rate, \(\pi _t\), through which it determines the amount of public services. Then, we can prove that \({\tilde{k}}(1)<{\tilde{k}}(0)\) holds by using \(d{\tilde{k}}(\sigma _t)/d\pi (\sigma _t)>0\). A similar discussion can be applied to the case of \(\partial U(\sigma _{jt}, \sigma _t, k_t)/\partial \sigma _{jt}=0\). \(\partial U(\sigma _{jt}, \sigma _t, k_t)/\partial \sigma _{jt}=0\) yields \(k_t={\tilde{k}}(\sigma _t)\). In this case, \(\sigma _{jt} \in [0,1]\) becomes optimal. However, there is a unique \(\sigma _{jt}\) that satisfies \(\sigma _{jt}={\tilde{\sigma }}_t\) and \(k_t={\tilde{k}}({\tilde{\sigma }}_t)\) in the interval \({\tilde{k}}(1) \le k_t \le {\tilde{k}}(0)\) since \({\tilde{k}}(\sigma _t)\) is a decreasing function of its argument. Its inverse function, \({\tilde{\sigma }}_j(k_t)\), becomes the unique strategy. In addition, since \({\tilde{k}}(\sigma _t)\) is a decreasing function, \({\tilde{\sigma }}_j(k_t)\) must decrease with \(k_t\); that is, \(d{\tilde{\sigma }}_j(k_t)/dk_t<0\). Thus, the strategy \({\tilde{\sigma }}_j(k_t)\) if \({\tilde{k}}(1) \le k_t \le {\tilde{k}}(0)\) is the Nash equilibrium.

By summarizing the above discussion, we obtain a strategy of a corruptible bureaucrat:

This correspond to Eq. (22) in the basic model. The difference between the two equations is whether corruptible bureaucrats take a mixed strategy in the middle stages of development. In the extended model, some corruptible bureaucrats engage in corruption, while the others do not. The mixed strategy becomes optimal since a corruptible bureaucrat faces a mortality rate that is affected by strategies of other corruptible bureaucrats. The difference slightly changes the per capita public services, \(f_t\); the quality of public health, \(h_t\); the survival rate, \(\pi _t\); and fertility rates, \(n_t\), \(n_t^{NB}\), \(n_t^{CB(honest)}\), and \(n_t^{CB(dishonest)}\). However, the intuition and mechanism behind the relationships between corruption, mortality and fertility rates, and economic development hold. That is, as economic development proceeds, the degree of corruption decreases, amount of public services increases, quality of public health improves, and mortality and fertility rates decrease.

Next, we consider the dynamics of per capita capital. The capital market clearing condition is \(K_{t+1}=s_tN_t^H+s_t^{NB}(1-b)N_t^B+s_t^{CB(honest)}[1-\sigma (k_t)]bN_t^B+s_t^{CB(dishonest)}\sigma (k_t)bN_t^B\). From \(N_{t+1}=n_tN_t^H+n_t^{NB}(1-b)N_t^B+n_t^{CB(honest)}[1-\sigma (k_t)]bN_t^B+n_t^{CB(dishonest)}\sigma (k_t)bN_t^B\), the condition is rewritten as follows:

Subsequently, taking into account (35), we obtain the following three dynamic equations:

where \({\underline{\pi }}=\varPi \left( [1-b(1-\gamma )]\theta \right)\), \(\pi ({\tilde{\sigma }}(k_t))=\varPi \left( [1-{\tilde{\sigma }}(k_t)b(1-\gamma )]\theta \right)\), \({\bar{\pi }}=\varPi \left( \theta \right)\), and \({\underline{\pi }} \le \pi ({\tilde{\sigma }}(k_t)) \le {\bar{\pi }}\). As in the basic model, two stable steady states can existFootnote 17: \(E_C\) and \(E_{NC}\). \(E_C\) is characterized by severe corruption, high mortality and fertility rates, and low development, while \(E_{NC}\) is characterized by no corruption, low mortality and fertility rates, and high development. This result is the same as that in the basic model. However, we should note that it would be complicated in the extended model to consider the effective policy for a less developed country caught in a poverty trap since there are three dynamic equations (\(k_{t+1}^C\), \(k_{t+1}^M\), and \(k_{t+1}^{NC}\)) and two thresholds (\({\tilde{k}}(1)\) and \({\tilde{k}}(0)\)).

Proof of Lemma 1

By taking the partial derivatives of \({\hat{k}}(\rho , \theta )\), represented by (30) with respect to \(\rho\) and \(\theta\), respectively, we obtain

and

In addition, we obtain

Thus, \({\hat{k}}(\rho , \theta )\) decreases with \(\rho\) and increases with \(\theta\). As \(\rho\) approaches infinity, \({\hat{k}}(\rho , \theta )\) converges to a finite value.

Proof of Lemma 2

By taking the partial derivative of \(k^*(\rho , \theta )\), represented by (29) with respect to \(\rho\), we obtain

That is, \(k^*(\rho , \theta )\) decreases with \(\rho\). Similarly, by taking the partial derivative of \(k^*(\rho , \theta )\) with respect to \(\theta\), we obtain

\((d{\underline{\pi }}/{\underline{\pi }})/(d\theta /\theta )\) represents the degree to which a change in \(\theta\) leads to a change in the survival rate, \({\underline{\pi }}\). Since the survival rate is given by (31), it has the following characteristics:

On the other hand, we can show that

Thus, there is a threshold, \({\hat{\theta }}=[-1+(1+\phi )^\frac{1}{2}]/\phi\), that satisfies \((d{\underline{\pi }}/{\underline{\pi }})/(d\theta /\theta )|_{\theta ={\hat{\theta }}}={\hat{\theta }}/(1-{\hat{\theta }})\). We also confirm \({\hat{\theta }}\) in Fig. 8. If \(\theta \in (0, {\hat{\theta }})\), \((d{\underline{\pi }}/{\underline{\pi }})/(d\theta /\theta )>\theta /(1-\theta )\) holds. On the contrary, if \(\theta \in [{\hat{\theta }}, 1)\), \((d{\underline{\pi }}/{\underline{\pi }})/(d\theta /\theta ) \le \theta /(1-\theta )\) holds. Thus, we obtain

That is, \(k^*(\rho , \theta )\) is hump-shaped in \(\theta\).

Rights and permissions

About this article

Cite this article

Akimoto, K. Corruption, mortality rates, and development: policies for escaping from the poverty trap. J Econ 133, 1–26 (2021). https://doi.org/10.1007/s00712-020-00719-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-020-00719-3