Abstract

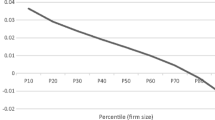

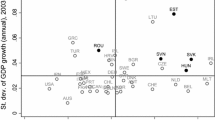

This paper scrutinizes the interlinkages between exporting, sales growth volatility, and survival probabilities for Pakistani manufacturing firms. It also studies whether variations in firms’ domestic sales induce them to start exporting and whether entry in foreign export markets helps reduce firms’ bankruptcy chances. The results indicate that exporting helps firms in lessening sales growth volatility and enhances the likelihoods of firms’ survival. The results also suggest that firms with higher sales growth volatility are more expected to be bankrupt. Yet, we show that they can reduce their chance of bankruptcy by starting exports. We also investigate whether these impacts are different between firms of different sizes. We find that compared to large-sized firms, both small- and medium-sized firms are more expected to start exporting to lessen domestic sales volatility. Finally, we observe that the volatility-lowering effects of exporting are higher for small-sized firms, whereas, the solvency-deterring effects of sales volatility are higher for large-sized firms.

Similar content being viewed by others

Notes

The coefficients in logistic regression are in log-odds units.

Since the estimates of firms-specific control variables are similar to those presented in Table 5, we present only the estimates of the interaction terms.

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609.

Altman, E. I. (2013). Predicting financial distress of companies: revisiting the Z-score and ZETA® models. Handbook of research methods and applications in empirical finance. Edward Elgar Publishing.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Badrinath, S. G., Gay, G. D., & Kale, J. R. (1989). Patterns of institutional investment, prudence, and the managerial “safety-net” hypothesis. Journal of Risk and Insurance, 56(4), 605–629.

Bartram, S. M., Brown, G. W., & Fehle, F. R. (2009). International evidence on financial derivatives usage. Financial Management, 38(1), 185–206.

Bellone, F., Musso, P., Nesta, L., & Schiavo, S. (2010). Financial constraints and firm export behaviour. The World Economy, 33(3), 347–373.

Berman, N., Berthou, A., & Héricourt, J. (2015). Export dynamics and sales at home. Journal of International Economics, 96(2), 298–310.

Bernard, A. B., & Jensen, J. B. (2004). Why some firms export. Review of Economics and Statistics, 86(2), 561–569.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Buch, C. M., Döpke, J., & Strotmann, H. (2009). Does export openness increase firm-level output volatility? The World Economy, 32(4), 531–551.

Campa, J. M., & Shaver, J. M. (2002). Exporting and capital investment: On the strategic behavior of exporters. IESE research papers, 469.

Caselli, F., Koren, M., Lisicky, M., & Tenreyro, S. (2015). Diversification through trade. National Bureau of Economic Research (No. w21498).

Čede, U., Chiriacescu, B., Harasztosi, P., Lalinsky, T., & Meriküll, J. (2018). Export characteristics and output volatility: Comparative firm-level evidence for CEE countries. Review of World Economics, 154(2), 347–376.

Chaney, T. (2016). Liquidity constrained exporters. Journal of Economic Dynamics and Control, 72, 141–154.

Cieślik, A. (2020). Determinants of foreign direct investment from OECD countries in Poland. Eurasian Economic Review, 10(1), 9–25.

Comin, D. A., & Philippon, T. (2006). The rise in firm-level volatility: Causes and consequences. NBER Macroeconomics Annual. (20), 167–228: MIT Press.

Culpan, R. (1989). Export behavior of firms: Relevance of firm size. Journal of Business Research, 18(3), 207–218.

De Loecker, J. (2007). Do exports generate higher productivity? Evidence from Slovenia. Journal of International Economics, 73(1), 69–98.

De Sousa, J., Disdier, A.-C., & Gaigné, C. (2016). Export decision under risk (No. w6134), 51.

Eaton, J., & Kortum, S. (2002). Technology, geography, and trade. Econometrica, 70(5), 1741–1779.

Esposito, F. (2017). Entrepreneurial risk and diversification through trade: Working Paper,,(February).

Esteve-Pérez, S., Gil-Pareja, S., Llorca-Vivero, R., & Martínez-Serrano, J. A. (2011). The impact of the euro on firm export behaviour: does firm size matter? Oxford Economic Papers, 63(2), 355–374.

Fillat, J. L., & Garetto, S. (2015). Risk, returns, and multinational production. The Quarterly Journal of Economics, 130(4), 2027–2073.

Fitzgerald, D., Haller, S., & Yedid-Levi, Y. (2016). How exporters grow (no. w21935): National Bureau of Economic Research.

Gaigne, C., Disdier, A. C., & De Sousa, J. (2015). Export decision under risk. In 2015 Meeting Papers (No. 1272). Society for Economic Dynamics.

Garcia-Vega, M., Guariglia, A., & Spaliara, M.-E. (2012). Volatility, financial constraints, and trade. International Review of Economics and Finance, 21(1), 57–76.

Gervais, A. (2018). Uncertainty, risk aversion and international trade. Journal of International Economics, 115, 145–158.

Giovanni, J. D., & Levchenko, A. A. (2009). Trade openness and volatility. The Review of Economics and Statistics, 91(3), 558–585.

Gkypali, A., Rafailidis, A., & Tsekouras, K. (2015). Innovation and export performance: Do young and mature innovative firms differ? Eurasian Business Review, 5(2), 397–415.

Gourlay, A., Seaton, J., & Suppakitjarak, J. (2005). The determinants of export behaviour in UK service firms. The Service Industries Journal, 25(7), 879–889.

Gourlay, A., & Seaton, J. (2004). Explaining the decision to export: evidence from UK firms. Applied Economics Letters, 11(3), 153–158.

Greenaway, D., Guariglia, A., & Kneller, R. (2007). Financial factors and exporting decisions. Journal of International Economics, 73(2), 377–395.

Gruber, M. J., & Warner, J. B. (1977). Bankruptcy costs: Some evidence. The Journal of Finance, 32(2), 337–347.

Hirsch, S., & Adar, Z. (1974). Firm size and export performance. World Development, 2(7), 41–46.

Hirsch, S., & Lev, B. (1971). Sales stabilization through export diversification. The Review of Economics and Statistics, 53(3), 270–277.

Imbs, J. (2007). Growth and volatility. Journal of Monetary Economics, 54(7), 1848–1862.

Juvenal, L., & Santos Monteiro, P. (2013). Export market diversification and productivity improvements: Theory and evidence from Argentinean firms. FRB of St. Louis Working Paper No. 2013–015

Kalaitzi, A. S., & Cleeve, E. (2018). Export-led growth in the UAE: multivariate causality between primary exports, manufactured exports and economic growth. Eurasian Business Review, 8(3), 341–365.

Krebs, T., Krishna, P., & Maloney, W. (2010). Trade policy, income risk, and welfare. The Review of Economics and Statistics, 92(3), 467–481.

Krugman, P. (1980). Scale economies, product differentiation, and the pattern of trade. The American Economic Review, 70(5), 950–959.

Kurz, C., & Senses, M. Z. (2016). Importing, exporting, and firm-level employment volatility. Journal of International Economics, 98, 160–175.

Lensink, R., Steen, P. V., & Sterken, E. (2005). Uncertainty and growth of the firm. Small Business Economics, 24(4), 381–391.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Nosheen, A., & Rashid, A. (2019). Business orientation, efficiency, and credit quality across business cycle: Islamic versus conventional banking. Are there any lessons for Europe and Baltic States? Baltic Journal of Economics, 19(1), 105–135.

Ohlin, B. (1933). International and interregional trade. Cambridge, MA: Harvard Economic Studies.

Patibandla, M. (1995). Firm size and export behavior: an Indian case study. Journal of Development Studies, 31(6), 868–882.

Ramey, G., & Ramey, V. A. (1994). Cross-country evidence on the link between volatility and growth (no. w4959): National Bureau of Economic Research.

Ramondo, N., & Rodríguez-Clare, A. (2013). Trade, multinational production, and the gains from openness. Journal of Political Economy, 121(2), 273–322.

Rashid, A., & Waqar, S. M. (2017). Exchange rate fluctuations, firm size, and exprt behvior: An empirical investigation. Small Business Economics, 49(3), 609–625.

Rashid, A., & Saeed, M. (2017). Firms’ investment decisions—explaining the role of uncertainty. Journal of Economic Studies, 44(5), 833–860.

Rehman, N. U. (2017). Self-selection and learning-by-exporting hypotheses: Micro-level evidence. Eurasian Economic Review, 7(1), 133–160.

Riaño, A. (2010). The decision to export and the volatility of sales. Univeresity of Nottingham Research Paper (2010/12).

Riaño, A. (2011). Exports, investment and firm-level sales volatility. Review of World Economics, 147(4), 643–663.

Ricardo, D. (1819). Proposals for an economical and secure currency: With observations on the profits of the Bank of England, as they regard the public and the proprietors of bank stock. John Murray.

Ruzzier, M., & Ruzzier, M. K. (2015). On the relationship between firm size, resources, age at entry and internationalization: The case of Slovenian SMEs. Journal of Business Economics and Management, 16(1), 52–73.

Shaver, J. M. (2011). The benefits of geographic sales diversification: How exporting facilitates capital investment. Strategic Management Journal, 32(10), 1046–1060.

SunKim, H. (2016). Differential impact of uncertainty on exporting decision in risk-averse and risk-taking firms. Seoul Journal of Economics, 29, 379–409.

Tsen, W. H. (2016). Exchange rate volatilities and disaggregated bilateral exports of Malaysia to the United States: Empirical evidence. Eurasian Economic Review, 6(2), 289–314.

Tyler, W. G. (1981). Growth and export expansion in developing countries: Some empirical evidence. Journal of Development Economics, 9(1), 121–130.

Vannoorenberghe, G. (2012). Firm-level volatility and exports. Journal of International Economics, 86(1), 57–67.

Vannoorenberghe, G., Wang, Z., & Yu, Z. (2016). Volatility and diversification of exports: Firm-level theory and evidence. European Economic Review, 89, 216–247.

Wagner, J. (1995). Exports, firm size, and firm dynamics. Small Business Economics, 7(1), 29–39.

Wagner, J. (2014). Is export diversification good for profitability? First evidence for manufacturing enterprises in Germany. Applied economics, 46(33), 4083–4090.

Acknowledgements

We are thankful to Maria Karim for reading first draft of the paper and giving valuable suggestions.

Funding

We did not receive any funding to complete this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animal performed by any of the authors.

Data availability statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Rashid, A., Hassan, M.K. & Karamat, H. Firm size and the interlinkages between sales volatility, exports, and financial stability of Pakistani manufacturing firms. Eurasian Bus Rev 11, 111–134 (2021). https://doi.org/10.1007/s40821-020-00162-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-020-00162-w