Abstract

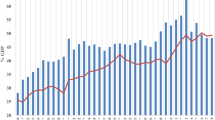

In this paper we argue that the political budget cycle test for opportunistic spending is weakened by the absence of a strong reason for why spending increases should be restricted to the time period leading into the next election. One would expect that a targeted benefit should elicit the same degree of voter support whenever it is received. Here we argue that while the political need to fulfill a list of pre-election promises serves to constrain excessive spending, the characteristic that some expenditure items better demonstrate the contributions of the current government to voters (with depreciating memories) leads to a predictable reallocation of the composition of budgetary spending across the life of a government. Our test for a predictable timing pattern to subcomponents of the budget uses capital expenditures as the budgetary item with greater visibility spillovers and a data set of 14 Indian states over 54 years (1959/60–2012/13). The predictions that capital expenditures relative to both total government expenditure and government consumption should rise across the governing interval are found to be consistent with the data and provide a better fit with the data than more traditional political budget cycle models that use aggregate spending/deficits in the pre-election period.

Similar content being viewed by others

Notes

See Hessami (2018) who provides explicit evidence of electoral response by examining the behaviour of elected versus appointed Mayors across German cities.

See Khemani (2004) for evidence that voter registration and participation in state elections is widespread in India.

Should neo-conservative voters be concerned with debt accumulating across governing terms, deficits could be run early to allow credit for pre-election budget surpluses while still fulfilling overall spending commitments (see Peltzman 1992).

There is also a supply side effect in targeted capital spending if construction jobs are valued prizes for targetable groups. Because data on the jobs created from government funded capital projects is not available in India, we could not pursue the supply side effects of targeted capital spending.

The selected states are Andhra Pradesh, Bihar, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Orissa, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh, and West Bengal. Dependence on central transfers hampers the fiscal autonomy of the small and/or special category states which is why these states are not included in the analysis. Among the selected states, Gujarat was carved out from Bombay state in 1960 and Haryana from Punjab in 1966. Data for these two states is available only from the year of their creation and that leaves us with an unbalanced panel dataset.

The fiscal deficit in India is defined as excess of total budget expenditure over total revenue receipts excluding borrowings implying an amount of borrowing. A negative (positive) number means fiscal deficit (surplus).

Over our time period there were 167 state elections arising within or 14 Indian states with 123 or 74% taking place as scheduled. Of the 44 early elections 26 or 60% involved coalition governments.

Evidence that elapse is significant is not inconsistent with Khemani’s hypothesis. However, by using the ratio in early as well as late governing years, the test permits evidence of the emergence of an election cycle even when targeted spending in the pre-election period is not significantly different from an average of all years.

Political parties that have a legislative presence in multiple states are defined as a national party and parties whose legislative presence is confined to a particular state are defined as regional parties. Regional parties are also known as state parties. In this paper, we have used the Election Commission of India’s criteria to differentiate between national and regional party. Detailed criteria are available at http://eci.nic.in/archive/press/current/PN05122k.htm.

Development expenditure constitutes the aggregate spending on social and economic services. Spending on items such as health, education, infrastructure, agriculture, and industry, rural development, roads and transport are parts of it.

See Dash and Raja (2013) for a more detailed testing of the effects of political ideology and partisanship on the level and composition of state expenditures.

We use the first generation test of the panel unit root of Fisher-type (Choi 2001), and the second generation test of the panel unit root of Pesaran (2007) to confirm that the orders of integration of all our variables are either I(0) or I(1). The individual results are presented in the data appendix as Table 9.

Stata-based xtpmg routine developed by Blackburne and Frank (2007) is used to estimate all three models (MG, PMG, and DFE).

In our sample 167 state elections were held of which 123 or 74% were scheduled elections.

See Khemani (2004, Table 5c, p. 143).

The estimated error correction terms are both large in absolute size indicating relatively rapid convergence of departures in the capital ratios to their equilibrium long run path.

Clustering to account for dependence within state groupings is relevant only for the DFE version of the test and does not significantly change the reported DFE results.

See Brender and Drazen (2005, p. 1283) who write ”one way to address the endogeneity bias from reverse causation or from shocks affecting both the election date and the fiscal balance is to separate out those elections whose timing is pre-determined. We do this by looking at the constitutionally determined election interval taking as pre-determined those elections which were held either at the fixed interval or within the expected year of the constitutionally fixed term”.

Fully sixty percent of early state elections (26 of 44) arose from the inability to form or hold together a coalition of governing parties for reasons that ranged from personality/cultural incompatibilities to fundamental program disagreements on spending/deficit priorities.

During the period of our study, 167 state elections were held and of them 44 involved mid-term elections while the remaining 123 were scheduled elections.

Note that neither coefficient estimate differs significantly from the combined average of 0.028. To economize on space the full results of this and the following sensitivity tests are not presented but are available on request. The same separation was used to test for a difference on the pre-election period of scheduled elections only (rather than elapse). The results were similar in that they indicate a smaller (rather than larger) response in the initial governing period than in the second or subsequent governing terms.

References

Abrams BA, Iossifov P (2012) Does the Fed contribute to a political business cycle? Public Choice 129:249–262

Arulampalam W, Dasgupta S, Dhillon S, Dutta B (2009) Electoral goals and center-state transfers: a theoretical model and empirical evidence from India. J Dev Econ 88:103–119

Baskaran T, Uppal Y, Min B (2015) Election cycles and electricity provision: evidence from a quasi-experiment with Indian special elections. J Public Econ 126:64–73

Besley T, Burgess R (2002) The political economy of government responsiveness: theory and evidence from India. Q J Econ 117:1415–1451

Blackburne E, Frank M (2007) Estimation of nonstationary heterogeneous panels. Stata J 7:197–208

Brender A, Drazen A (2005) Political budget cycles in new versus established democracies. Journal of Monetary Economics 52(7):1271–1293

Castro V, Martins R (2017) Budgets, expenditure composition and political manipulation. Int Rev Appl Econ (forthcoming)

Chakraborty P, Dash B (2017) Fiscal reforms, fiscal rule and development spending: how Indian states have performed? Public Budg Finance 37(4):111–133

Chaudhuri K, Dasgupta S (2006) The political determinants of fiscal policies in the states of India: an empirical investigation. J Dev Stud 42:640–661

Choi I (2001) Unit root tests for panel data. J Int Money Banking 20:249–272

Dash B, Raja A (2013) Do political determinants affect the size and composition of public expenditure? A study of the Indian states. Int Rev Econ 60:293–317

De Haan J, Klomp J (2013) Conditional political business cycles: a review of the evidence. Public Choice 157:387–410

Drazen A (2001) The political business cycle after 25 years. MIT Press, Cambridge

Drazen A, Eslava M (2010) Electoral manipulation via voter-friendly spending: theory and evidence. J Dev Econ 92:39–52

Funashima Y (2016) The Fed-induced political business cycle: empirical evidence from a time-frequency view. Econ Model 54:402–411

Gonzales M (2002) Do changes in democracy affect the political budget cycle? Evidence from Mexico. Rev Dev Stud 6:204–224

Hankins W, Hoover C, Pecorino P (2017) Party polarization, political alignment, and federal grant spending at the state level. Econ Gov 18(4):351–389

Herzog B, Haslanger P (2014) Does e-governance mitigate the political business cycle. Int Proc Econ Dev Res 82:1–8

Hessami Z (2018) Accountability and incentives of appointed and elected public officials. Rev Econ Stat 100(1):51–64

Jha R (2007) Investment and subsidies in Indian agriculture. ASARC working paper 2007/03

Katsimi M, Sarantides V (2012) Do elections affect the composition of fiscal policy in developed, established democracies? Public Choice 151(1):325–362

Keefer P, Knack S (2007) Boondoggles, rent-seeking, and political checks and balances: public investment under unaccountable governments. Rev Econ Stat 89(3):566–572

Khemani S (2004) Political cycles in a developing economy: effect of elections in the Indian states. J Dev Econ 73:125–154

Klomp J, de Haan J (2013) Conditional election and partisan cycles in government support to the agricultural sector: an empirical analysis. Am J Agric Econ 95:793–818

McCarten W (2003) The challenge of fiscal discipline in the Indian states. In: Rodden J, Eskeland G, Litvack J (eds) Fiscal decentralization and the challenges of hard budget constraint. MIT Press, Cambridge

Min B, Golden M (2014) Electoral cycles in electricity losses in India. Energy Policy 65:619–625

Nerlich C, Reuter WH (2015) Fiscal rules, fiscal space and procyclical fiscal policy. European Central Bank working paper no. 1872. Downloaded August 26, 2016 from URL: http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1872.en.pdf

Nordhaus W (1975) The political business cycle. Rev Econ Stud 42:169–190

Peltzman S (1992) Voters as fiscal conservatives. Q J Econ 107:327–361

Persyn D, Westerlund J (2008) Error-correction-based cointegration tests for panel data. Stata J 8:232–241

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Shin Y, Smith RJ (1997) Estimating long-run relationships in dynamic heterogeneous panels. DAE working papers amalgamated series 9721, University of Cambridge

Pesaran MH, Shin Y, Smith RJ (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Phillips AQ (2016) Seeing the forest through the trees: a meta-analysis of political business cycles. Public Choice 168:313–341

Potrafke N (2011) Does government ideology influence budget composition? Empirical evidence from OECD countries. Econ Gov 12:101–134

Rao G (2002) State finances in India—issues and challenges. Econ Polit Wkly 37:3261–3271

Rogoff K, Sibert A (1988) Elections and macroeconomic policy cycles. Rev Econ Stud 55:1–16

Schuknecht L (2000) Fiscal policy cycles and public expenditure in developing countries. Public Choice 102:115–130

Sen K, Vaidya R (1996) Political budget cycles in India. Econ Polit Wkly 31:2023–2027

Tanzi V, Davoodi H (1997) Corruption, public investment and growth. IMF working paper: WB/97/139, International Monetary Fund, Washington, DC

Wagner R (1976) Revenue structure, fiscal illusion, and budgetary choice. Public Choice 25:45–61

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:709–748

Acknowledgements

Earlier versions of this paper were presented at the Winter School 2016, Delhi School of Economics, New Delhi; the 53rd Annual Conference of The Indian Econometric Society (TIES), Bhubaneswar; and the Papers in Public Economics and Policy (PPEP) 2017, NIPFP, New Delhi. Errors and omissions remain the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Data Appendix: Description and sources of data used

Data Appendix: Description and sources of data used

The data used in this paper covers 14 major Indian states: Andhra Pradesh, Bihar, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Orissa, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh, and West Bengal; and spans the fiscal years 1959–1960 to 2012–2013. Variables are collected from a variety of sources as detailed below (See Tables 8, 9, 10).

1.1 Public finance variables

The Reserve Bank of India (RBI) Bulletin provides longest time-series public finance data at the state level. Data for relatively less disaggregated fiscal outcomes such as capital expenditure, current expenditure, development and non-development expenditure, spending on debt servicing, revenue receipts from tax and non-tax sources, intergovernmental transfers, and debt are available from fiscal year 1959–1960 onwards. All expenditure variables are net of interest. Various issues of the RBI Bulletin have been used to collate this dataset.

1.2 Political variables

The Election Commission of India (ECI) publishes details of both parliamentary and assembly elections on their website (http://eci.nic.in/eci/eci.html). Information available in ECI’s reports is used to prepare the coding of the qualitative variables: election year, elapse, political alignment, congress party, and regional party.

1.3 Economic and demographic variables

Our study has used economic and demographic variables such as per capita state domestic product in constant prices (2004–2005 rupees), the share of agriculture in state domestic product, and state population. Data for these variables are obtained from the National Accounts Statistics. Time-series data for variable state domestic product in constant prices (2004–2005 rupees) is not readily available for the entire period. The base year changes approximately once in every decade, and the method of back-ward splicing is used to account for base year adjustment.

Rights and permissions

About this article

Cite this article

Ferris, J.S., Dash, B.B. Expenditure visibility and voter memory: a compositional approach to the political budget cycle in Indian states, 1959–2012. Econ Gov 20, 129–157 (2019). https://doi.org/10.1007/s10101-018-0216-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10101-018-0216-1