Abstract

It has been an established fact that R&D activities and international trade is correlated but the directions of causal interplays between them have not yet been unambiguously established. Most of the theoretical and empirical studies revealed that trade liberalization led to R&D expansion but not the reverse. But empirically, it may happen that R&D activity may cause more trade associations. Under this juncture, the present study aims to examine the long-run associations and short-run dynamics between trade indicator, share of net FDI inflow to GDP, and R&D intensity for the leading countries and groups and their panels in R&D spending. By developing a theoretical model, the study makes empirical verifications such as cointegration, error correction, and Granger causality tests for the individual countries and groups and then compared the results by taking dynamic panel of the countries and groups. The results reveal that R&D and FDI are unambiguously cointegrated and thus have long-run equilibrium relations in the panel data format unlike the situations of individual country and groups. Further, for the short run, the panel study reveals both way causal relations between the two variables. It is thus suggested that policy and lawmakers should implement plans such as increase in research fund in R&D through public–private partnership, ease on patent system, etc., to welcome FDI.

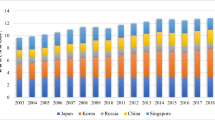

Source: Sketched by the authors

Source: Sketched by the authors

Similar content being viewed by others

Notes

This production technology is similar to that of Krugman (1979) and Aditya and Acharyya (2015), apart from the fact that instead of labor being used as both fixed and variable inputs or capital being used as the fixed input and skilled labor as the variable factor, in our case skilled labor has been used as a fixed factor and capital has been used as variable factor.

To understand the matter more intuitively one can go through the Sect. 2.

References

Aditya A, Acharyya R (2015) Trade liberalization and export diversification. Int Rev Econ Finance 39:390–410

Aghion P (2003) Empirical estimates of the relationship between product market competition and innovation. In: Touffut J (ed) Institutions, innovations and growth, selected economic papers. Edward Elgar, Cheltenham, pp 142–169

Aghion P, Howitt P (1998) Endogenous growth theory. The MIT Press, Cambridge

Ahluwalia IJ (1996) India’s opening up to trade and investment. In: Oman C (ed) Policy reform in India. Development Centre, OECD, Paris, pp 17–41

Ahmed EM (2012) Are the FDI inflow spillover effects on Malaysia’s economic growth input driven? Econ Model 29:1498–1504

Beladi H, Kar S, Marjit S (2013) Emigration, finite changes and wage inequality. Econ Politics 25(1):61–71

Bell M, Pavitt K (1997) Technological accumulation and industrial growth: contrasts between developed and developing countries. In: Archibugi D, Michie J (eds) Technology, globalisation and economic performance. Cambridge University Press, Cambridge, pp 83–137

Bertschek I (1995) Product and process innovation as a response to increasing imports and foreign direct investment. J Ind Econ 63(4):341–357

Bhagwati JN (1997) Writings on international economics. In: Balasubramanyam VN (ed) International factor movements and national advantage. Oxford University Press, New Delhi

Bozkurt C (2015) R&D expenditures and economic growth relationship in Turkey. Int J Econ Financ Issues 5(1):188–198

Branstetter LG (2000) Foreign direct investment and R&D Spillovers: is there a connection. In: The role of foreign direct investment in East Asian Economic Development: NBER-EASE, vol 9, pp 113–146. Retrieved from http://www.nber.org/chapters/c8497.pdf. Accessed 22 June 2020

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20:249–272

Chuang YC, Lin CM (1999) Foreign direct investment, R&D and spillover efficiency: evidence from Taiwan’s manufacturing firms. J Dev Stud 35(4):117–137

Cohen WM, Levinthal DA (1989) Innovation and learning: the two faces of R&D. Econ J 99:569–596

Das RC, Mukherjee S (2019) Do spending on R&D influence income? An enquiry on the World’s leading economies and groups. J Knowl Econ. https://doi.org/10.1007/s13132-019-00609-0

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation and testing. Econometrica 55(2):251–276

Erdal L, Göçer I (2015) The effects of foreign direct investment on RD and innovations: panel data analysis for developing Asian countries. Proc Soc Behav Sci 195(3):749–758

Fan CS, Hu Y (2007) Foreign direct investment and indigenous technological efforts: evidence from China. Econ Lett 96(2):253–258

Fisher RA (1932) Statistical methods for research workers. Oliver and Boyd, Edinburgh

Fracasso A, Marzetti GV (2015) International trade and R&D spillovers. J Int Econ 96(1):138–149

Frantzen D (2000) R&D, human capital and international technology spillovers: a cross country analysis. Scand J Econ 102(1):57–75

Gervais A, Thurk J (2011) Product quality differentiation and the impact of international trade. Mimeo

Griffith R, Redding S, Reenen JV (2001) Mapping the two faces of R&D: productivity growth in a panel of OECD countries. The Institute for Fiscal Studies, Working Paper, 02/00. The Institute for Fiscal Studies, London

Griliches Z, Lichtenberg F (1984) Interindustry technology flows and productivity growth: a reexamination. Rev Econ Stat 66:324–329

Gumus E, Celikay F (2015) R&D expenditure and economic growth: new empirical evidence. Margin J Appl Econ Res 9(3):205–217

Hallak JC, Levinsohn J (2004) Fooling ourselves: evaluating the globalization and growth debate. NBER Working Paper No. 10244, National Bureau of Economic Research

Hughes K (1986) Export and technology. Cambridge University Press, Cambridge

Im KS, Pesaran MH, Shin Y (1997) Testing for unit roots in heterogeneous panels. Mimeo

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics 115:53–74

Inekwe J (2014) The contribution of R&D expenditure to economic growth in developing economies. Soc Indic Res 124(3):727–745

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2–3):231–254

Jones RW (1971) A three-factor model in theory, trade and history. In: Bhagwati J, Jones RW, Mundell RA, Vanek J (eds) Trade, balance of payments and growth. North-Holland, Amsterdam, pp 3–21

Jones CI (1995) Time series test of endogenous growth models. Q J Econ 110(2):495–525

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90:1–44

Kathuria V (2008) The impact of FDI inflows on R&D investment by medium- and high-tech firms in India in the post-reform period. Transnatl Corp 17(2):45–66

Kikuchi T, Marjit S (2011) Growth with time zone differences. Econ Model 28(1–2):637–640

Krugman PR (1979) Increasing returns, monopolistic competition and international trade. J Int Econ 9:469–479

Krugman PR (1980) Scale economics, product differentiation, and the pattern of trade. Am Econ Rev 70(5):1695–1725

Kumar N (1987) Technology imports and local R&D in Indian manufacturing. Dev Econ 25(3):220–233

Lee J (1996) Technology imports and R&D efforts of Korean manufacturing firms. J Dev Econ 50(1):197–210

Lin HC (2010) Technology diffusion and global welfare effects: imitative R&D vs. South-bound FDI. Struct Change Econ Dyn 21:231–247

Levin A, Lin CF (1993) Unit root tests in panel data: new results. UC San Diego Working Paper 93-56

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108:1–24

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Marjit S, Kar S (2013) International capital flow, vanishing industries and two-sided wage inequality. Pac Econ Rev 18(5):574–583

Markusen JR, Melvin JR (1989) The gains-from-trade theorem with increasing returns to scale. In: Kierzkowski H (ed) Monopolistic competition and international trade. Clarendon Press, Oxford

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1691–1725

Mitra S, Chatterjee T, Gupta K (2018) Product differentiation, quality of innovation, and capital mobility: a general equilibrium analysis. In: Marjit S, Kar S (eds) International trade, welfare and the theory of general equilibrium. Cambridge University Press, Cambridge, pp 149–162

Parameswaran M (2010) International trade and R&D investment: evidence from manufacturing firms in India. Int J Technol Glob 5(1/2):43–60

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bull Econ Stat 61:653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory 20:597–625

Pillai PM (1979) Technology transfer, adaptation and assimilation. Econ Polit Wkly 14(47):M121–M126

Rodriguez F, Rodrik D (2000) Trade policy and economic growth: a skeptic’s guide to the cross-national evidence. In: Bernanke BS, Rogoff K (eds) NBER Macro Economic Annual 2000. The MIT Press, Cambridge, pp 261–325

Rodrik D (1992) Closing the productivity gap: does trade liberalisation really help? In: Helleiner GK (ed) Trade policy, industrialisation and development: new perspectives. Clarendon Press, Oxford, pp 155–175

Romer PM (1986) Increasing returns and long run growth. J Polit Econ 94:1002–1037

Romer PM (1994) New goods, old theory, and the welfare costs of trade restrictions. J Dev Econ 43(1):5–38

Sasidharan S, Kathuria V (2011) Foreign direct investment and R&D: substitutes or complements—a case of Indian manufacturing after 1991 reforms. World Dev 39(7):1226–1239

Scherer FM (1982) Inter-industry technology flows and productivity growth. Rev Econ Stat 64:627–634

Sen P, Ghosh A, Barman A (1997) The possibility of welfare gains with capital inflows in a small-tariff-ridden economy. Economica 64:345–352

Smulders S, van de Klundert T (1995) Imperfect competition, concentration and growth with firm-specific R&D. Eur Econ Rev 39:139–160

Telatar OM, Genc MC, Keser HY, Ay S, Deger MK (2014) The causality relationships between FDI and RD in European union. J Econ Soc Dev 1(1):106–114

Ulku H (2004) R&D, Innovation, and economic growth: an empirical analysis, IMF working paper, WP/04/185, IMF

Zachariadis M (2003) R&D, innovation, and technological progress: a test of the Schumpeterian framework without scale effects. Can J Econ 36(3):566–686

Zhang KH (2014) How does foreign direct investment affect industrial competitiveness? Evidence from China. China Econ Rev 30:530–539

Acknowledgements

The authors deeply acknowledge the insightful comments and suggestions offered by the anonymous referees that helped immensely in enriching the article. Besides, they acknowledge the data supplying sources as mentioned in the text which helped us to make empirical investigations on the said objectives.

Funding

The study has been done without the help of any funding agency.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Further it is to disclose that we have no conflict of interest in preparing the manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Das, R.C., Chatterjee, T. Trade liberalization and R&D activity: examining long-run and short-run linkages for individual and panel of leading countries and groups. Econ Change Restruct 54, 1091–1118 (2021). https://doi.org/10.1007/s10644-020-09294-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-020-09294-5