Abstract

Vertical disintegration in manufacturing industries has been an increasing trend since the 1990s in many countries. According to a prevailing management paradigm of focusing on core competencies, firms should have vertically disintegrated (i.e. outsourced non-core competencies) to achieve cost savings, enhance competitiveness and improve firm performance. In line with this management paradigm, most empirical studies therefore hypothesized a negative linear relationship between the degree of vertical integration and firm performance, expecting performance to rise when vertical integration decreases.

In contrast to previous studies, finding mixed results, we assume an inverted u‑shaped relationship, theoretically based on transaction cost economics and the resource-based view of the firm, and by considering advantages and disadvantages of vertical integration, with an optimal level of vertical integration, where firms with a too low degree of vertical integration could achieve higher performance by vertical integration, while firms with too broad vertical integration could achieve higher performance by vertical disintegration.

With respect to our data based on a sample of 434 German manufacturing firms between 1993 and 2013 we find a decreasing trend of vertical integration over time. Applying multiple regression analysis, our findings suggest a positive, but diminishing relationship between the degree of vertical integration and financial performance. These two findings describe a paradox of vertical disintegration. The decreasing trend mainly emerges because lower performing firms outsourced their activities significantly whereas high performing firms do not show such a development. Overall, our results indicate that German manufacturing firms might have gone too far in in their vertical disintegration strategy by following a management paradigm which needs much more critical reflection.

Similar content being viewed by others

1 Introduction

Vertical disintegration has been an influential management paradigm and an empirically detectable business trend in the manufacturing industry during the last decades which has been accompanied by the concept of supply chain management—both seen as key drivers for the financial performance of firms (Shi and Yu 2013; Otto and Obermaier 2009).

In stark contrast, during the beginning of industrialization “owning the value chain” and a high degree of vertical integration has been a predominant strategy over decades (Harrigan 1984). A classic example is Henry Ford’s River Rouge complex, built during the late 1920s, with a vertical integration of processes from coal and iron ore mines, timberlands and rubber plantations to the final assembly of the car, resulting in total control over the entire supply chain. This formerly successful strategy of high vertical integration was pushed out of fashion in the recent decades when firms realized that a concentration on core competencies and outsourcing of non-core activities has advantages as well. Hence, vertical disintegration became a prevailing management paradigm in practice (Welch and Nayak 1992).

However, recent literature indicates that vertical disintegration strategies often failed to reach the expected performance improvements. For instance, Rigby and Bilodeau (2015) analyze the usage-satisfaction relationship among different management tools and show that outsourcing in particular is on the one hand widely used but on the other hand dissatisfies managers most when asked about the results of outsourcing decisions. Furthermore, a rich body of empirical literature is interested in the performance implications of vertical integration strategies (see Lahiri (2016) for an overview). However, the results so far are inconclusive; i.e. some studies found a negative (e.g. Rumelt 1982; D’Aveni and Ilinitch 1992; Desyllas 2009), others detect positive (e.g. Novak and Stern 2008; Broedner et al. 2009) or insignificant relationships (e.g. Levin 1981).

Hence, there seem to be some striking research gaps that we aim to address in our study. First, from a methodological point of view prior research predominantly hypothesizes and investigates a linear relationship (expecting it to be negative) between vertical integration (or disintegration) and firm performance although “many intuitively appealing arguments have been offered both for and against outsourcing as a means of achieving sustainable competitive advantage” (Gilley and Rasheed 2000, p. 763). Although there are a few exceptions that investigate non-linear relationships (e.g. Rothaermel et al. 2006; Kotabe and Mol 2009), none of these studies is checking the robustness of the functional form. This is particularly important as recent literature shows that the reported findings may be spurious (Haans et al. 2016, p. 1178). Second, from a material point of view existing studies that investigate the relationship between vertical integration and financial performance do not analyze how their results are related to a decreasing degree of vertical integration in manufacturing industries during the last decades. Such research is particularly necessary because firms usually expect their performance to be increased by vertical disintegration. But as far as the vertical integration-performance relationship is non-linear, decreasing vertical integration might become a detrimental strategy under certain circumstances. Furthermore, by simply assuming a (negative) linear relationship and therefore decreasing vertical integration in order to achieve expected performance gains without empirical knowledge about the underlying assumption could lead into a vertical disintegration paradox. Third, knowledge about the relationship between vertical integration and firm performance for German manufacturing firms is scarce but essential, as Germany in general is known for a high manufacturing share relative to GDP and German manufacturing firms in particular are known for a relatively high level of vertical integration compared to other countries while being highly competitive (Obermaier 2019). While most of the existing studies focus on US samples, we are deeply convinced that it is especially important to better understand manufacturing firms in a major economy with a strong manufacturing sector and highly competitive firms and therefore expect fruitful insights from this obvious research gap. Thus, it is our goal to address these research gaps by intensively analyzing the relationship between vertical integration and financial performance as well as the trend of vertical disintegration strategies, using a large sample of German manufacturing firms between the years 1993 and 2013. Correspondingly, we formulate as our fundamental research question: What is the relationship between the degree of vertical integration and the financial performance of German manufacturing firms between 1993 and 2013?

We make several contributions to existing research. First, we expand the understanding of the relationship between the degree of vertical integration and financial performance on the one side and the decreasing trend of vertical integration during the last decades on the other side by showing that a lower (higher) degree of vertical integration decreases (increases) financial performance of German firms in the recent past. Thus, we contribute to the vertical integration literature by providing and discussing reasons for a so called vertical disintegration paradox, which is a decreasing degree of vertical integration although this strategy may have affected firms’ financial performance in a deleterious way. Second, we theoretically and empirically shed light on the hitherto often neglected inverted u‑shaped relationship between the degree of vertical integration and financial performance. Prior empirical research on vertical integration instead has solely considered a linear relationship and focused either on transaction cost economics or the resource-based view to theorize and explain the results. By considering both, transaction cost economics and the resource-based view, our findings indicate that for German manufacturing firms the advantages of vertical integration outweigh the advantages of vertical disintegration. Third, by investigating a sample of German manufacturing firms, we provide results for a major European economy with a very strong manufacturing sector and a striking decreasing degree of vertical integration during the last decades. Prior research has focused on US firms, i.e. insights for other major economies are scarce. Our findings of a positive relationship between vertical integration and financial performance indicate that the vertical disintegration strategy of German manufacturing firms, mainly motivated by lower labor costs in low-cost countries (Sinn 2005), either have outsourced too much of their activities or have not been able to realize the benefits they desired.

The structure of this study is organized as follows: Sect. 2 gives an overview of the underlying theory developing our core hypothesis and the relevant literature at hand. In Sect. 3 the research methodology is described. The results of the analysis are presented in Sect. 4 and discussed in Sect. 5. The study concludes with a summary of key findings and further research opportunities.

2 Theory and Hypothesis

Vertical integration, defined as “the combination, under a single ownership, of two or more stages of production or distribution (or both) that are usually separate” (Buzzell 1983, p. 93) and vertical disintegration, defined as “the emergence of new intermediate markets that divide a previously integrated production process between two sets of specialized firms in the same industry” (Jacobides 2005, p. 465) are classical issues for researchers and practitioners. As in prior studies, we use the concepts of vertical disintegration and outsourcing synonymously although they may slightly differ (e.g. Broedner et al. 2009; Desyllas 2009). Further, the terms “vertical integration” and “degree of vertical integration” are used interchangeable throughout this study.

Transaction costs economics (TCE)—pioneered by Coase (1937) and further developed principally by Williamson (1971, 1975, 1991b)—and the resource-based view (RBV) of the firm (Penrose 1959; Wernerfelt 1984; Barney 1991) have made seminal contributions to our understanding of the existence of firms in general and make-or-buy decisions as well as vertical (dis-)integration in special. The core issue of TCE is that utilizing the market system is not for free as it causes costs for using it (so called transaction costs). Hence, the transaction costs of firm activities via market transactions have to be compared with the costs of internalization activities (i.e. vertical integration) and transactions should accordingly only be undertaken within that institutional arrangement (market or firm) which causes the lowest costs. According to the RBV, vertical integration is mainly influenced by the competitive advantage a firm has in a particular stage of the value chain relative to the market (Jacobides and Hitt 2005; Jacobides and Winter 2005). This competitive advantage is a result of a firm’s predominant resources and capabilities which arise from a unique, path-dependent learning process (Levinthal 1997; Jacobides and Winter 2005). According to Barney (1991), resources and capabilities lead to competitive advantage if they are valuable, rare, difficult to imitate and non-substitutable. In sum, TCE and RBV provide complementary explanations for the decisions whether or not a firm should change its degree of vertical integration (see McIvor (2009) for an overview).

The literature reviewed so far summarizes the determinants of the degree of vertical integration, which result in a bundle of advantages and disadvantages (Table 1).

It should be emphasized, that the advantages of vertical integration can be seen as disadvantages of vertical disintegration (respectively outsourcing) et vice versa.

These can be related to operational performance (e.g. inventory scheduling), intangibles assets (e.g. product quality) or to financial performance (e.g. revenues and costs), (Buzzell 1983; Harrigan 1984; Stuckey and White 1993; D’Aveni and Ravenscraft 1994). Of course, as operational performance and intangibles affect financial performance, the degree of vertical integration is not only directly related to financial performance but also indirectly.

A range of arguments can be applied to support a positive relationship between vertical integration and firm performance. Operational performance is improved through providing higher quality standards and having more control over input quality (D’Aveni and Ravenscraft 1994). Furthermore, vertical integration is often viewed as a strategy to increase supply assurance of critical materials and improve coordination between different stages of production (Buzzell 1983; Harrigan 1984), i.e. coordination between production, inventory and logistics scheduling is improved. Consequently, vertical integration affects operational efficiency as it improves throughput of materials and information along the supply chain resulting in lower lead times and higher delivery performance.

A higher degree of vertical integration can also help to build intangible assets which, in turn, affect financial performance as they are traditionally perceived to be the basis of competitive advantage (Dierickx and Cool 1989; Barney 1991). Based on higher operational performance, improved delivery performance and lower lead time should result in higher customer satisfaction. Further, among other things, vertical integration creates credibility for new products (Harrigan 1984) and provides protection of proprietary products or process technology (Mahoney 1992) and is thus consistent with the resource-based view. Further arguments concern a firm’s market power which is increased by building market entry barriers and price discrimination (Perry 1978; Stuckey and White 1993). Higher market entry barriers and price discrimination should increase firms’ revenues and profits.

The positive impact of a higher degree of vertical integration on financial performance is usually explained with cost savings. These cost savings are mainly related to lower transaction costs associated with less dependency on external suppliers. A higher degree of vertical integration could reduce the cost of searching, negotiating, drawing up a contract, monitoring and enforcement costs with external suppliers (Mahoney 1992). Besides transaction costs, vertical integration leads to cost savings achieved by improved coordination of production or by eliminating steps, reducing duplicate overhead costs (Buzzell 1983; Harrigan 1984).

However, it is argued that vertical integration is only beneficial to financial performance up to a certain point. Beyond that point, a higher degree of vertical integration could have detrimental effects on financial performance. A first group of arguments is concerned with additional costs that are associated with an excessively high degree of vertical integration, which consist of production, agency and coordination costs (Bettis et al. 1992; D’Aveni and Ravenscraft 1994; Desyllas 2009). The simultaneous coordination of a large number of activities and the underutilization of capacities in some stages of production (D’Aveni and Ravenscraft 1994; Harrigan 1985) could increase production costs. A higher degree of vertical integration leads to less efficient utilization of different stages of production which increases unit cost (Mahoney 1992). Further sources of production cost disadvantages are higher capital requirements and capital lockups (Mahoney 1992), higher fixed costs that lead to higher operating leverage and to a higher break-even point (Gilley and Rasheed 2000). Highly integrated firms bear the risk that they focus on additional non-core operations. This may result in information deficits among corporate-level managers due to information asymmetries about non-core activities (D’Aveni and Ilinitch 1992). Moreover, changing technology or market conditions which make products obsolete in one stage of a vertically integrated firm are key drivers of reduced flexibility and exit barriers (Buzzell 1983). A higher degree of vertical integration then reduces strategic flexibility with respect to environmental changes by switching to suppliers with newer and better technologies (Balakrishnan and Wernerfelt 1986; Gilley and Rasheed 2000; Mahoney 1992).

Therefore, to decide which activities should be integrated or outsourced are fundamental decisions for a firm, i.e. choosing between market or hierarchy or something in between (hybrid) and thereby minimizing transaction costs (Williamson 1991a). Based on TCE, such transactions should be internalized (i.e. vertically integrated) that are characterized by a high degree of asset specificity and uncertainty accompanied by a high degree of frequency (Picot and Franck 1993). Otherwise, a firm should choose the market or a hybrid form. The relationship between asset specificity and transaction costs is shown in Fig. 1.

Asset specificity, transaction costs and structural form. (Source: Williamson 1991a)

Most of a firm’s activities are characterized by a different degree of asset specificity. If a firm decides to integrate (or outsource) all of these activities, then the level of transaction costs would not be as low as possible, as some activities should be outsourced (those characterized by low asset specificity) while others should be internalized (those characterized by high asset specificity).Footnote 1

This is in line with RBV after what a firm should outsource its non-core activities and concentrate on core competencies, which is intended to result in a competitive advantage and higher financial performance. Hence, a missing focus on activities as well as vertical disintegration of all activities would lower performance.

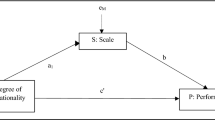

Based on both theories, an optimal degree of vertical integration can be assumed which to achieve is the result of firm specific decisions. The adequate strategy to reach the optimal degree of vertical integration, i.e. whether a higher or a lower degree of vertical scope would be profitable, depends on a firm’s initial position. Fig. 2 illustrates this relationship.

If a firm starts in position A, then the degree of vertical integration is below the optimum. In this case, a firm is not sufficiently vertically integrated, i.e. the degree of vertical integration is too low (in other words the firm uses the market although vertical integration would be beneficial). Hence, the advantages of higher vertical integration would outbalance the disadvantages and an increase would improve performance in that situation. The opposite is true if a firm’s integration-performance starting point would be point B. The initial level of vertical scope is too high and the firm conducts core and non-core activities simultaneously or uses integration instead of using the market. Thus, the concentration on core competencies or using the market increases firm performance. Once the optimum is reached (position C) deviations from that optimal level would lower performance.

Based on these arguments, we state our general hypothesis:

The relationship between the degree of vertical integration and a firm’s financial performance follows an inverted u‑shape, describing a positive relationship up to its optimum, while describing a negative relationship beyond that point.

Somewhat surprisingly many of the empirical studies at hand only hypothesize and investigate a linear relationship between the degree of vertical integration and firm performance assuming either improvements of firm performance through integration or disintegration, although most of them are based on TCE and the RBV which should result in hypothesizing an inverted u‑shaped relationship as we tried to justify, when advantages as well as the disadvantages of vertical integration are considered simultaneously.

We further expect that this might be one reason why existing empirical results show a mixed picture: some studies find a negative linear relationship (e.g. Rumelt 1982; D’Aveni and Ilinitch 1992; Desyllas 2009) others find the relationship to be positive linear (e.g. Buzzell 1983; Harrigan 1986; D’Aveni and Ravenscraft 1994; Novak and Stern 2008; Broedner et al. 2009). Only a few studies hypothesize and investigate a curvilinear relationship between vertical integration and firm performance (e.g. Rothaermel et al. 2006; Kotabe and Mol 2009). In summarizing the literature on vertical integration and firm performance also Lahiri (2016) concludes that empirical findings are inconclusive, which further motivates our endeavor.

3 Research Methodology

3.1 Data

Our research is focused on the German manufacturing sector. Interestingly its share of value-added in percent of the GDP has been nearly constant over the last decades (mean =23%) and is considerably higher than it has been in other major economies as shown in Fig. 3. Furthermore and in contrast to Germany, manufacturing firms in the European Union (mean =18%) and USA (mean =14%) show a decreasing trend of value-added in percent of the GDP since 1997.

All data used for the empirical analysis of German corporations in the manufacturing sector were taken from Thomson Reuters Datastream. In some cases, firms’ annual financial reports serve as data base because manual corrections of the data was required due to false figures or because the required data were not available via Thomson.

The chosen sample covers the time frame from 1993 to 2013. The beginning of the time frame was chosen due to data availability. 2013 represents the last year for which full information was available at the beginning of the data collection. Only complete data sets were reprocessed, i.e. independent as well as dependent variables had to be available. Considering the data criteria mentioned above the sample covers 434 different firms and 3848 firm years.

The firms in the sample belong to the Standard Industrial Classification (SIC) manufacturing division. The sample distribution based on two-digit SIC codes is shown in Table 2. The three most represented manufacturing industry sectors are machinery (SIC35), electronics (SIC36) and chemicals (SIC28).

3.2 Measurement of Vertical Integration

The measurement of vertical integration has been widely discussed in literature (e.g. Adelman 1955; Laffer 1969; Maddigan 1981; Lindstrom and Rozell 1993). On the one hand, there are a number of measures which can be easily calculated based on financial statements. On the other hand, there are multidimensional constructs which require primary data to be calculated. Lindstrom and Rozell (1993) prove inconsistencies among existing measures.

One of the most used measurement approaches might be the value-added to sales (VAS) approach. It is implemented in various studies (Stigler 1951; Adelman 1955; Desyllas 2009; Hutzschenreuter and Gröne 2009; see Lajili et al. (2007) for a survey of studies).

According to VAS, vertical integration is calculated as value-added divided by sales. In order to achieve VAS there are two possible ways to calculate value-added: the first way is the so-called subtractive method. Thereby, value added is determined as the difference between output and input in value terms and expresses the value an economic entity adds to the goods and services received from other entities through own activities. The second way is the so called additive method which sums up all allocated parts of the created wealth, i.e. all expenditures without input character.

Value-added according to the subtractive method is defined as (sales–external purchases). An increase (decrease) of VAS implies that the share of external purchases falls (rises) relative to sales. This can be seen as an indicator for a change in the degree of vertical integration, i.e. an increase (decrease) of VAS is related to an extension (withdrawal) of a firm’s upstream or downstream activities in the value chain which leads to an increase (reduction) of a firm’s value-added (measured as sales minus external purchases) compared to external purchases. Backward integration will tend to reduce the amount of external purchases while leaving sales constant whereas forward integration will tend to increase sales more than external purchases (Tucker and Wilder 1977). Both backward and forward integration result in an increase of VAS. In general, two extreme cases are imaginable: a fully integrated firm which consequently has a VAS quotient of 1 and a totally dis-integrated firm that has a VAS quotient of 0. A fully integrated firm does not need any external purchases to produce an output. Therefore, VAS would be calculated as (Sales −0) / Sales =1. In contrast, a totally dis-integrated firm does not produce any output; it only deals with its external purchases, i.e. external purchases are equal to output (sales) and value-added is reduced to 0. Consequently VAS is 0.

In our study we will measure the degree of vertical integration with the VAS ratio, due to its straight forward way of calculating and interpreting the ratio with readily available accounting data. But as the coverage of external purchases in Thomson Reuters Datastream is very poor, value-added is calculated by the additive method, i.e. as the sum of salaries and benefit expense, income taxes, interest expense on debt, dividends and net income.

Another widely used measurement approach of vertical integration is the input-output approach which utilizes national input-output tables and has been implemented in a number of studies (see Lajili et al. (2007)). Maddigan’s (1981) Vertical Industry Connection (VIC) index was one of the first measures of this category. The VIC index assumes that a firm operates in more than one industry and considers that firms of one industry might be simultaneously suppliers and buyers of another industry. The major disadvantage of this approach is the assumption that aggregated national input-output tables are applicable to individual firms (Hutzschenreuter and Gröne 2009; see also for further disadvantages Lindstrom and Rozell (1993)). Besides Harrigan’s VIC index, there exist other measures based on input-output tables (e.g. Fan and Lang 2000).

Adelman (1955) suggests the inventory to sales ratio to measure the degree of vertical integration. He argues that “The longer the production line and the more successive processes are operated by one firm, the higher the ratio” (p. 283) whereas the measure could be improved by using work-in-process only. However, the major disadvantage of this measure is that inventory level is also influenced by other factors than vertical integration, mainly different production methods and different manufacturing processes across industries, i.e. a comparison of firms between different industries is not very useful (Lindstrom and Rozell 1993).

Therefore, due to their disadvantages inventory to sales ratios as well as Maddigan’s VIC index are not applied in this study.

3.3 Measurement of Performance

Performance measurement is a huge topic; both in management accounting as well as in operations or strategic management literature. Accordingly, different theoretical approaches can be differentiated (Obermaier and Donhauser 2012).

The goal-based approach measures performance by goals which a firm sets itself. It usually is based on financial or non-financial metrics. Financial metrics are either based on P&L statement and balance sheet data (e.g. ROI, ROS) or on stock market values, whereas non-financial metrics focus on operational performance dimensions such as quality, time, or flexibility (Neely et al. 1995). Moreover, management and organization theory has an even broader concept of business performance (Venkatraman and Ramanujam 1986). The systems approach measures business performance according to a firm’s capacity for long-term survival in its surrounding environment. The stakeholder approach argues that a firm should take into account the views of all the stakeholders of the business and not just the owners. Accordingly, this approach defines business performance as a firm’s ability to achieve the goals of different stakeholder groups simultaneously. The measurement issues of the latter perspectives are obvious.

Murphy et al. (1996) report that most empirical studies use financial metrics such as ROI or ROS, which are in line with the goal-based approach. In our study we also use financial data to measure performance. However, in order to account for the perils of a performance perspective which might be too narrow, we decided to use Altman’s Z‑score as a financial but multidimensional performance measure (Altman 1968), because multidimensional measures are more robust compared to traditional, single dimensional measures such as ROI or ROS.

Altman’s classic Z‑Score was originally developed to predict firm bankruptcy using empirical data from annual reports. Altman investigates a small sample of 33 bankrupt and 33 ongoing publicly held manufacturing firms. After running a multiple discriminant analysis (MDA), based on five accounting ratios (X1,…, X5), the following discriminant function resulted:

where:

- X1 =:

working capital / total assets;

- X2 =:

retained earnings / total assets;

- X3 =:

EBIT / total assets;

- X4 =:

market value of equity / total debt;

- X5 =:

sales / total assets.

Based on this function, Altman (1968) classifies 95% (31 of the bankrupt firms and 32 of the ongoing firms) of his sample correctly while a cut-off value has to be estimated for this classification (Altman 1968): The higher the Z‑Score of a firm, the lower its risk of bankruptcy (for Altman’s sample firms with a Z-Score higher than 2.99 clearly fell into the “non-bankrupt” sector). Although the emerging coefficients of X1 to X5 are sample specific estimates, the “classic” coefficients are widely used in research and practice (Agarwal and Taffler 2007; Randall et al. 2006; Swamidass 2007; Ellinger et al. 2011; Steinker et al. 2016). In contrast, and in order to avoid any shortcomings we apply Altman’s procedure to our data in order to re-estimate the coefficients and generate sample specific Z‑Scores. We start by identifying all stock listed companies in our sample which filed for bankruptcy (n =28) whereas the last year of complete data prior to the start of bankruptcy proceedings was chosen. Subsequently, a corresponding number of active (non-bankrupt) firms were randomly selected. Bankrupt and existing firms were matched by size and industry and a t-test was conducted to measure size comparability. If the null hypothesis of the t-test was rejected, a new sample was randomly created. We generated five random samples and executed a MDA to re-estimate the coefficients of X1 to X5 (see Table 3). It has to be noted that the denominator of X4 was replaced by total liabilities instead of total debt due to extreme outliers in our sample.

Finally, the model with the best goodness of fit criteria (measured by Wilk’s Lambda and percentage of corrected classified firms) was chosen (run 2). Hence, the sample specific Z‑Score function is as follows:

3.4 Control Variables

In addition to the value-added to sales ratio, we controlled for a number of firm-level and industry-level variables that may explain changes in firm financial performance and that have been included in prior research. These controls are described in the following.

Firm Size (Employees):

Firm size may be a positive predictor of its current performance as large firms generally may have more resources (e.g. Rothaermel et al. 2006; Desyllas 2009; Kotabe and Mol 2009). Firm size is measured by the natural logarithm of the number of employees.

Firm Growth (SalesGrowth):

To control for firm growth, we include the year-over-year percentage change in sales in our analysis. Firm growth is likely to be positively related to financial performance (e.g. Desyllas 2009; Kotabe and Mol 2009).

Market Share (MktShare):

Firms with higher market share enjoy many advantages compared to their competitors, and therefore may be able to increase their financial performance (e.g. Rothaermel et al. 2006). Market share is measured as firm’s sales divided by the industry sales, with industry defined at the two-digit SIC level.

Herfindahl-Hirschman Index (HHI):

HHI is employed to control for industry competitiveness, with industry defined at the two-digit SIC level (e.g. Rothaermel et al. 2006). Highly concentrated industries may restrict a firm’s ability to capture value from the market place and therefore decrease financial performance. HHI is the sum of the square of all firms’ market shares in an industry.

Firm Age (Age):

Older firms tend to perform better than younger firms (e.g. Rothaermel et al. 2006; Lahiri and Narayanan 2013) because of established routines. Therefore, we control for the age of the firm. Data for the year of foundation of the sample firms was obtained via Thomson Reuters Datastream and Nexis.

Leverage (DebtRatio):

In addition, we control for the debt burden of the firm (e.g. D’Aveni and Ilinitch 1992; Desyllas 2009). Leverage could affect firm performance positive as well as negative. On the one hand, firms have incentives to increase debt ratios as this is associated with higher tax shields. On the other hand, debt decreases managerial flexibility as debt obligations have to be met, thereby negatively impacting profit. Leverage is measured as the ratio of long-term debt to total assets.

Diversification (Diversification):

We follow prior research (e.g. Rothaermel et al. 2006) and include an indicator variable that equals 1 if a firm operates in more than one industry segment. Diversification is expected to be positively related to financial performance (e.g. Rumelt 1982).

Environmental Dynamism (Dynamism):

Higher environmental uncertainty is expected to negatively affect financial performance and is therefore included in our analysis. The calculation is based on the approach first suggested by Dess and Beard (1984). First, we summed up the sales for all firms in each of the two-digit SIC industries for each year between 1988 and 2013. Then, we used five years of the two-digit SIC industry-level data to calculate environmental uncertainty for the sixth year (for instance, industry sales from 1988 through 1992 were used to estimate environmental uncertainty for 1993). For each year and each industry, we regressed the five previous years’ industry sales against year. Dynamism was then measured as the standard error of the regression coefficient of “year” divided by industry-average sales over the five-year period.

Capital Intensity (CapitalIntens):

We control for differences in financial performance across firms that are due to differences in capital intensity by including the ratio of capital expenditures to sales (e.g. D’Aveni and Ilinitch 1992; Bhuyan 2002).

Export Ratio (ExportRatio):

As prior research has shown that a firm’s export ratio affects its financial performance (e.g. Kotabe and Mol 2009), we control for this fact by including the ratio of a firm’s international sales to total sales.

3.5 Model

In order to test the proposed hypothesis which is a concave functional form regarding the degree of vertical integration and firm performance, the following regression model is estimated:

with Perfit as the performance measure of firm i in year t as measured by Z‑Score. VASit is the value-added to sales ratio. Linear and quadratic terms of the VAS were included in the regression model, thus allowing for a nonlinear relationship to be detected. In addition, firm(F)- and year(Y)-fixed effects are controlled for (whereas a Hausman-test was conducted to test if a fixed effects model is appropriate). Furthermore, we use autocorrelation- and heteroscedasticity-corrected robust standard errors.

Since we test for an inverted u‑shaped relationship between vertical integration and financial performance, the sign of β1 is expected to be positive and the sign of β2 is expected to be negative. The coefficients of VAS allow us to determine the turning point in the relationship between the degree of vertical integration and firm performance. Taking the first derivative of Eq. 3 and setting it to zero results in the turning point at −β1 / 2 β2.

4 Results

4.1 Descriptive Results

As a first step we start with some descriptive findings with respect to vertical integration of German manufacturing industries. As a brief overview Table 4 reports descriptive statistics for value-added to sales ratios of the manufacturing industries (SIC20–SIC39). Regarding means, the industry sectors with the highest degree of vertical integration are measuring instruments (SIC38) and printing, publishing, and allied industries (SIC27) whereas sectors with the lowest degree are food products (SIC20) and leather and leather products (SIC31).

Fig. 4 shows for our whole sample that the level of vertical scope has decreased over the last decades, especially until the onset of the recent financial crisis in 2008 indicating that outsourcing was forced on average over the whole manufacturing sector in Germany.

A further look at the different industries is reported in Fig. 5. 16 out of 17 industries have reduced their average degree of vertical integration between 1993 and 2008 with a reduction of 18% on average. The only exception that has a higher vertical scope in 2008 is SIC26 (“Paper and Allied Products”). Since 2008, after the financial crisis, more than 76% of the industries have increased their degree of vertical integration.

To get more insights into the decreasing trend issue, we ranked firms by financial performance and divided them into three quantiles (0–20%, 41–60%, 81–100%). Then the mean VAS-ratio ratio was calculated for each year and each performance quantile. The degree of vertical integration over time is shown in Fig. 6.

Additional, a regression analysis was conducted to detect trends in vertical integration over time. The results are shown in Table 5.

Consistently we find that especially low performing firms show a significant decline of vertical integration between 1993 and 2013 (β =−0.003) whereas no trend at all was detectable for high (and middle) performing firms. For robustness checks we were also using return on assets and return on sales which give similar results (see Appendix A). The results will be discussed in Sect. 5.

4.2 Regression Results

As a second step we continue with analyzing the relationship between vertical integration and financial performance. Table 6 provides summary statistics and correlations for our variables of interest. Despite the correlations among the variables, we examined if the results might be biased by multicollinearity. Variance inflation factors of our main variables of interest (VAS and VAS2) are above 10, indicating that multicollinearity is an issue. However, in accordance with previous literature (Haans et al. 2016), it has to be emphasized that multicollinearity cannot be avoided in polynomial regressions. None of the other independent variables had a variance inflation factor greater than 2. As the generally accepted range for variance inflation factors concerning individual variables is below 10, we conclude that multicollinearity does not negatively influence our results.

With respect to the performance aspects of our study, Fig. 7 reports the simple average Z‑Score for firms grouped by their value-added to sales ratio quintiles (1 =low, 5 =high). The figure illustrates that quintiles 1 and 2 show the lowest Z‑Score values whereas quintiles 3–5 show an increase in performance. Thus, these results provide initial evidence that higher vertical integration indicates superior financial performance.

The regression results for the relationship between a firm’s financial performance and vertical scope are summarized in Table 7.

In Model 1 we regress financial performance (Z-Score) on our set of control variables. Results show that larger and older firms, as well as firms with larger debt burdens have lower Z‑Scores. The coefficients of the other control variables do not statistically differ from zero. In order to save space, we do not report fixed effects here but they are available upon request.

Model 2 introduces our (linear) measure of vertical integration (VAS). We find a positive and significant link between the degree of vertical integration and financial performance. That is, as firms vertically integrate, their financial performance increases. However, Model 2 does not include a quadratic term of VAS but detects a positive linear relationship between vertical integration and performance.

Model 3 explicitly investigates the hypothesized functional form. The coefficient of the linear term of VAS is positive (and significant) while the coefficient of the squared term of VAS is negative (and significant), i.e. there exists an optimal degree of vertical integration indicating a maximum of firm performance. Prima facie our hypothesis of an inverted u‑shaped relationship between the degree of vertical integration and firm performance is confirmed by the regression results. According to the first derivative of our regression equation and to the coefficients of VAS and VAS2, the turning point lies at −β1 / 2 β2 =−4.008 / 2 · (−2.857) =0.70. Thus, the average manufacturing firm might maximize its performance at a degree of vertical integration of 70%. A deviation from this optimum would lower its financial performance.

As reported by Haans et al. (2016), most empirical studies that investigate an (inverted) u‑shaped relationship with the help of regression analyses, miss to report the turning point or to conduct some further analysis to test the robustness of the results. Therefore, we adopt the method suggested by Lind and Mehlum (2010) who propose a three-step procedure after a regression had detected an inverted u‑shaped relationship:

- 1.

The coefficients are in the expected opposite direction,

- 2.

the slope of the curve is sufficiently steep at the left and the right side of the data range, and

- 3.

the turning point of the inverted u‑curve is located well within the data range.

As shown in Table 7, condition (1) is met. The linear term of the value-added to sales ratio is positive and significant (4.008) and the squared term is negative and significant (−2.857). The results for conditions (2) and (3) are shown in Table 8.

The slope at the lower bound of the data range of vertical integration is negative and significant and positive and significant at the upper bound. Thus, condition (2) is also met. However, a closer look at the confidence interval and the extreme point shows that condition (3) is not met. In particular, the estimated extreme point is not well within the data range of the value-added to sales ratios. This is caused by our data, because only 21 observations out of our 3848 firm-year observations are above the estimated extreme point. Furthermore, the upper bound of the 95% confidence interval is outside the data range (1.001), as the degree of vertical integration is restricted to values between 0 and 1.

After these robustness checks, we would argue more carefully, that in general the hypothesized inverted u‑shaped relationship between vertical integration and firm performance might exist but the structure of our data is not sufficient to definitely support the non-linear form, as only a few values are above the estimated extreme point. These robustness checks are therefore helpful to better understand the results of Model 2 and 3. While Model 2 indicates a positive linear relationship, the somewhat surprising result of Model 3, that an inverted u‑shaped relationship would exist, becomes explicable: as most of our data obviously lies on the increasing slope of our relationship we find ground to argue that there is a positive but diminishing and therefore not necessarily linear relationship. With respect to our hypothesis we find support for the left side of an inverted u‑shaped relationship, while for the right side there is not sufficient data to support it statistically.

4.3 Robustness Checks

A number of checks were carried out to further assess the robustness of our results (especially of Model 3; see Appendix B). First, the natural logarithms of sales is used as alternative proxies for firm size (instead of the natural logarithm of the number of employees). In both cases, the results were nearly identical and consistent. Second, we use return on sales (measured as EBITt / salest) and return on assets (measured as EBITt / total assetst−1) as an alternative measure for firm performance following prior research. Using return on sales and return on assets as measures for financial performance, the results remain similar to Model 3 of Table 7 (see Appendix B), i.e. the coefficients are in the expected direction but the extreme point is at the upper bound of the data range. Third, we checked our results for robustness over time. We split our time frame in the periods 1993–2002 and 2003–2013. Again, the results remained nearly the same. Fourth, we estimate alternative-fixed effects at the industry level. In this case, neither the linear nor the squared term of VAS is significant. However, our results considering industry-fixed effects show a positive relationship between the degree of vertical integration and financial performance when the squared term is excluded. Thus, this result would be consistent with our previous findings of Model 2 of Table 7 (not shown in Appendix B for brevity). Fifth, we conduct the regression analysis with winsorized data at the 1% level. In sum, all robustness checks are consistent with our previous analysis and support our main finding of a positive (but diminishing) relationship between the degree of vertical integration and financial performance.

5 Discussion

Our study reveals two key results. First, we detect a positive but diminishing and therefore not necessarily linear relationship between vertical integration and firm performance for German manufacturing firms and find partial support for our hypothesis. Even if our data structure is not in total support of the inverted u‑shaped relationship, as the maximum point lies at the extreme range of our sample, our empirical analysis suggests a positive but rather diminishing relationship between the vertical integration level and financial performance. As there are only some data points beyond the turning point, this might at least indicate an inverted u‑shaped relationship from a theoretical point of view, although there is not sufficient data from German manufacturing firms to empirically support it. From a methodological point of view, our study extends prior research as it assumes a non-linear relationship between the degree of vertical integration and firm performance and conducts further robustness checks to investigate the hypothesized u‑shaped relationship by applying a three step procedure. But perhaps more importantly, from a material point of view our results indicate that the advantages of a higher degree of vertical integration outweigh the disadvantages in most cases for German manufacturing firms. Or in other words: German manufacturing firms have obviously been surprisingly capable to gainfully manage relatively high degrees of vertical integration. Hence, for the longstanding, in literature and practice popularized and very broadly generalized proposition that lowering vertical integration would increase financial performance of firms per se, we find no supporting evidence in our sample; i.e. the management paradigm of vertical dis-integration requires revision—at least for German manufacturing firms. From a managerial perspective, managers should be cautious in following management fashions and fads in general and vertical disintegration and outsourcing as a redeemer in special. Managers should therefore not simply believe in an expected increase of firm performance through vertical disintegration per se, as recommended by some lean management gurus (Lonsdale and Cox 2000). Moreover, our results give reason to encourage managers not only to critically reflect potential disintegration strategies but also to reconsider potential integration strategies as we are able to show that financially successful German manufacturing firms were able to manage levels of vertical integration far beyond what was expected. Managers might find it therefore helpful to think about the advantages (disadvantages) of vertical integration or disintegration strategies rather as goals (threats) to be achieved (avoided). Besides, the performance outcomes of such strategies might need closer monitoring in order to better understand and control cause and effects.

As a second key result, we are able to show a decreasing trend of vertical integration for German manufacturing firms over the time frame of our study, while having found a positive but diminishing relationship between the degree of vertical integration and financial performance. From a theoretical point of view, this finding might depend on the stage and starting point of the outsourcing process of firms. Various scenarios are imaginable: Thus, there might be a negative (positive) relationship between vertical integration and performance at work for firms with excessively high (low) integration levels which are in an early stage of their outsourcing process. In accordance with our findings, excessive vertical disintegration below the optimal level might confront firms with an initial degree of vertical integration below (above) the optimal level surrounded by an area of a positive (negative) relationship and therefore negative (positive) performance effects. As our empirical results highlight on average a positive diminishing relationship for our sample, it appears that firms which might have outsourced too much of their activities could have been fallen below an optimal level of vertical integration, or that firms could have been much more capable in managing even higher vertical integration levels. This empirical coincidence of decreasing vertical integration surrounded by a positive vertical integration-performance-relationship raises further questions. The most interesting question for us seems to be why firms reduced the degree of vertical integration over decades, although, as our results suggest, this decline is associated with decreasing financial performance on average. We term this the paradox of vertical disintegration, which will be elaborated in detail in the following subsections by providing several arguments such as: (a) (reversed) causality, (b) structural inertia and the bandwagon effect, (c) management fashions, (d) the shareholder value paradox, (e) lack of knowledge and uncertainty and (f) supply chain control in order to discuss why managers might have gone too far in reducing the degree of vertical integration by following a management paradigm focused on core competencies and outsourcing although this might have been detrimental to the financial performance of the firm.

5.1 (a) (Reversed) Causality

The development of vertical integration over time varies across performance quantiles, as shown above (see Sect. 4.1). Thus, instead of interpreting performance as a function of vertical integration, the latter could also be a function of performance. Several arguments might reason vertical integration as a function of performance. First of all, vertical integration is a complex, cost intensive and hard to reverse strategy (Stuckey and White 1993). Secondly, a high degree of vertical integration offers a number of potential benefits as it improves coordination and scheduling, reduces foreclosure to inputs, services or markets, increases the opportunity to create product differentiation (Harrigan 1984), builds higher market entry barriers for potential competitors (Mahoney 1992) and helps to develop a market in young industries (Stuckey and White 1993). But firms need to be able to afford these very cost-intense benefits. As a third argument, there are a number of challenges which could arise from a high degree of vertical integration; e.g. increasing operating leverage due to a disadvantageous cost structure (Gilley and Rasheed 2000), increasing capital required and bureaucratic costs and increasing required management capacity and capability as well as decreasing strategic flexibility (Mahoney 1992). Therefore, low performing firms may try to reduce costs and risks which arise from these challenges by reducing their degree of vertical integration. Fourth, as Hutzschenreuter and Gröne (2009) show firms which reduce their degree of vertical integration are faced with higher competitive pressure from foreign competition; i.e. higher competitive pressure could trigger vertical disintegration. Based on these results, firms might become less profitable while facing higher competitive pressure and being therefore forced to decrease their vertical integration. In sum, the issue of causality is hard to tackle, as not only the direction but also the causality between vertical integration and performance might switch under certain circumstances. While firms with low performance might have been forced into vertical disintegration this is not the same as to say lowering vertical integration will increase performance; even more taking into account that the underlying relationship is assumed to be an inverted u‑shape.

5.2 (b) Structural Inertia and the Bandwagon Effect

In general, structural inertia exists if “organizations respond relatively slowly to the occurrence of threats and opportunities in their environments” (Hannan and Freeman 1984), while outsourcing inertia can be defined as “the slow adaptation by organizations to changing circumstances that accommodate higher outsourcing levels” (Mol and Kotabe 2011) under which firms may suffer. We therefore argue that inertia prevents firms from responding quickly to changes in business processes after outsourcing manufacturing activities. Outsourcing inertia could therefore be detrimental for business performance. Mol and Kotabe (2011) detect a negative relationship between a firm’s outsourcing inertia and its performance. Furthermore, Desyllas (2009) finds time-lag effects between vertical disintegration and improvements of business performance of firms, due to short performance declines before achieving higher performance levels in later periods (Desyllas 2009). These findings indicate the existence of significant disintegration costs which reduce financial performance at a first glance. Those consist of restructuring costs, costs of organizational redesign or investments in information and communication technologies. Firms need to be able to handle such disintegration costs.

5.3 (c) Management Fashions

Vertical (dis-)integration is not a trivial but rather a serious interference in business processes which takes a long time. Nevertheless, managers might have been “infected” by some best practice reports on outsourcing decisions; e.g. during the early 1990s by Japanese competitors and their reliance on the philosophy of lean management and so called keiretsu alliances with external suppliers (Womack and Jones 1994). While Mol and Kotabe (2011) argue that bandwagon effects might help to overcome initial inertia by providing outsourcing guidelines for managers, we propose that a bandwagon effect could lead to even more detrimental outsourcing projects which consequently results in “overriding the system”. Accordingly, Cabral et al. (2014) find that bandwagon behavior is one reason for outsourcing failure. Their analyses indicate that managers have been influenced by business schools, scholars, consultants and other managers “who brought that (outsourcing) into the organization” (Cabral et al. 2014; p. 369). Thus, their results highlight the view on vertical disintegration during the 1990s as a management fashion because “[o]utsourcing was a fever” because “[e]verybody was outsourcing” (Cabral et al. 2014, p. 369). Management fashions in general describe a collective belief that a management technique is new, efficient, and at the forefront of management progress (Abrahamson 1996). This belief increases pressure on organizations to adopt the “management tool” because firms’ stakeholders expect managers to employ modern and efficient techniques to manage their organizations (Meyer and Rowan 1977). Kieser (1997) further argues that management fashions create myths of extraordinary performance which are initiated and further transmitted by rhetoric, either by managers or consultants. As vertical disintegration and the expected success is always a firm specific decision and result, one firm’s success is not a guarantee for disintegration success per se as the circumstances always need to be taken into account. Furthermore, there might have existed fadlike dynamics; i.e. mechanisms of overtaking beliefs of others, observational learning and therefore ignoring own information and emulating choices made earlier by other firms (Bikhchandani et al. 1998).Footnote 2 With respect to vertical disintegration, Broedner et al. (2009) point out that there might have been too many outsourcing projects which could be detrimental for financial performance. This is in line with recent reports such as Bain’s Management Tools and Trends 2015 which reveal that outsourcing has the lowest satisfaction rates among managers in relation to the use of this management tool (Rigby and Bilodeau 2015). Moreover, recent research examines reasons why firms re-insource or re-integrate activities that had been outsourced before (e.g. Drauz 2014; Hartman et al. 2017). These reasons consist of hidden costs of outsourcing, external triggers like the recent financial crisis or supply chain disruptions and rethinking of core competencies, indicating that managers recently might have recognized or revalued contrary to their longstanding belief that the opportunities of vertical integration might outweigh the challenges under certain circumstances.

5.4 (d) Shareholder Value Paradox

Since the 1990s, the shareholder value approach dominates the behavior of many managers. Accordingly, managers might want to reduce the degree of vertical integration in order to reduce capital employed and as an expected consequence to increase shareholder value. This will usually be stimulated by compensation schemes which rely on annual accounting-based performance measures (Das et al. 2009). But even if managers would find a strategy to vertically integrate reasonable, the paradox could emerge that they would not do so, if this strategy would reduce their compensation. This paradox might be strengthened by short-term oriented (and impatient) managers, often propelled by incentive schemes based on annual accounting numbers, when potential benefits are in the further future while the costs of additional capital required immediately appear causing managerial compensation to drop. Furthermore, conducting too many vertical integration projects during their tenure would be detrimental for business performance, as the process of vertical integration takes a certain amount of time and the organizations need time to adapt to new circumstances.

5.5 (e) Lack of Knowledge and Uncertainty

Another argument is concerned with the lack of knowledge and the uncertainty which firms have to face when deciding to vertically integrate or to disintegrate. Lack of knowledge in this context, refers to knowledge about a firm’s initial position on the inverted u‑shaped relationship of vertical integration and performance, the measurement of costs related to vertical (dis-)integration and the identification of core and non-core competencies. Uncertainty refers to the difficulties in forecasting the performance outcomes of (dis-)integration decisions.

On the one hand, lack of knowledge about a firm’s initial position can cause difficulties when deciding to vertically disintegrate. Reconsidering Fig. 2 illustrates the inverted u‑shaped relationship: assuming that a firm’s starting point is A, it would be profitable if the firm vertically integrates. However, an initial degree of vertical integration related to point B would suggest vertical disintegration. But how should firms be aware of their optimal vertical integration level? This question is obviously hard to be answered, but if management fashion tells managers that vertical disintegration is favorable per se, there is significant probability that they may choose the wrong direction.

On the other hand, lack of knowledge related to the measurement of costs of vertical (dis-)integration and the characterization of core competencies may lead managers to solely take production costs (especially labor costs) into account rather than a combination of transaction costs and the competence perspective.

Sinn (2005) analyzes the decreasing trend of vertical integration in the German manufacturing sector, a phenomenon he denoted as a “bazaar economy”, argues that vertical disintegration of German manufacturing firms was mainly motivated by lower labor costs in low-cost countries. One of his main arguments for the decreasing trend is the increase of foreign external sourcing (especially from East Europe and China) compared to a more or less low increase of value-added. It is doubtful if managers have sufficiently taken into account other influencing variables than potential advantages through lower labor costs, as the measurement of transaction costs is difficult (if not impossible) in general, therefore often denoted as the “hidden costs of outsourcing” (Hendry 1995), related to outsourcing towards low-cost countries and unproven suppliers (Gümüş et al. 2012). And of course, cost savings through lower labor costs could have been (over-)compensated by higher transactions costs or strategic risks related to a loss of control over competencies. Even worse: labor costs in China and East Europe have increased over the last 20 years so that vertical disintegration has become less attractive over time. Furthermore, if managers decide to outsource non-core activities, they have to clearly distinguish between core and non-core competencies in a first step as only the latter should be outsourced in order to gain competitive advantage and to improve firm performance. But the appropriate identification of core and non-core competencies is a non-trivial decision for managers. As Prahalad and Hamel (1990) point out only outsourcing of non-core competencies leads to competitive advantages, (German) manufacturing firms (in particular low performing firms) may have outsourced too many and thereby also the wrong ones, i.e. core activities. Hartman et al. (2017) point out that the revival of vertical integration since the onset of the recent financial crisis is, among others, attributed to firms rethinking their core competencies. Overall, managers have recognized the uncertainty related to the outsourcing decision as a risk in their supply chains (Kenyon et al. 2016).

5.6 (f) Supply Chain Control

Firms that (are forced to) reduce their degree of vertical integration might lose sufficient control over their supply chain. Hendricks and Singhal (2005) show in a seminal study that supply chain disruptions may cause severe damage to shareholder value, i.e. control of supply chains is a key performance driver. But how could firms with a low degree of vertical integration keep control over their supply chain and remain successful yet? One option might be a form of quasi-integration like strategic alliances. Previous research has shown that firms with a low degree of vertical integration but high control over the value chain through supply chain integration gain competitive advantages (Dietl et al. 2009). However, such quasi-integrations require investments and management capacities as well and low performing firms have neither capacity for real nor quasi integration to keep their supply chain under control. Our previous arguments have shown that especially low performing firms have reduced their degree of vertical integration significantly for several reasons. But while such firms could not afford a sufficiently higher degree of vertical integration, and tried to achieve cost savings by lowering their degree of vertical integration, they slipped into the paradox of vertical disintegration.

6 Conclusion

Our study theoretically establishes and empirically investigates a hypothesized inverted u‑shaped relationship between the degree of vertical integration and financial performance for a large sample of German manufacturing firms using longitudinal data. To put it in a nutshell: Considering the inverted u‑shaped relationship between vertical integration and performance we interpret its right half, beyond the turning point, as the longstanding management paradigm of vertical disintegration. Accordingly disintegration would enhance performance, although nearly no firm level data of our sample describes that part. In contrast, most of the data fills the left half of the inverted u‑shaped relationship, below the turning point, for which we are able to detect a positive but diminishing and therefore non-linear relationship between vertical integration and firm performance, which coincides with a decreasing trend of vertical integration for German manufacturing firms, and discuss this paradox of vertical disintegration in detail. The decreasing trend mainly emerges because lower performing firms outsourced their activities significantly whereas high performing firms do not show such a development. Overall, our results indicate that German manufacturing firms might have gone too far in in their vertical disintegration strategy by following a management paradigm which needs much more critical reflection. Obviously, a high degree of vertical integration costs money, but provides a bundle of advantages with respect to firm performance as well. Financially successful firms can afford such a strategy and cope with the challenges of a high degree of vertical integration while low performing firms cannot. This might be a reason why low performing firms reduced their degree of vertical integration during the last decades. Our results therefore suggest a much more sophisticated evaluation of vertical (dis-)integration strategies. On the one hand it should be paid much more attention how to realize the benefits of vertical integration. And on the other hand a considerable amount of critical reflection of expected benefits of vertical disintegration is required which might have been overestimated over a long time, ignoring the detrimental effects of vertical disintegration on financial performance.

Of course, our study also has some limitations which nevertheless might open fruitful avenues for further research. First, further analyses might be helpful in clarifying the interplay of causality as we have indicated that poor performing firms have reduced their degree of vertical integration more than high and medium performing firms. Second, by focusing on the manufacturing sector, we provide insights for a major industry. Future research could examine if the hypothesized inverted u‑shaped relationship between the degree of vertical integration and financial performance holds for other industry sectors, as the degree of vertical integration also plays an important role in other industrial sectors, which are still largely unexplored. Third, it can be assumed that there are many more boundary conditions at work, which influence the relationship between vertical integration and financial performance. We did not offer this research but tried to pave the way. It would therefore be a deserving task to further investigate moderating effects, to get more and deeper insights into such a relevant and fundamental issue of business economics at the interface of operations, accounting and strategy.

Notes

Fig. 1 could be similarly interpreted for uncertainty or the frequency of transactions as they have similarly been identified as a determinant of the decision to vertically integrate (Williamson 1981). Within highly uncertain environments, contracts will be incomplete and transaction costs will rise. If uncertainty is lower, vertical disintegration is more favorable.

Shiller (2017) recently pointed out the relevance of popular narratives in economics when they spread out over markets like epidemics causing irrational exuberance.

References

Abrahamson, E. 1996. Management fashion. The Academy of Management Review 21(1):254–285.

Adelman, M.A. 1955. Concept and statistical measurement of vertical integration. In Business concentration and price policy, ed. George Stigler, 281–330. Princeton: Princeton University Press.

Agarwal, V., and R.J. Taffler. 2007. Twenty-five years of the Taffler z‑score model: does it really have predictive ability? Accounting & Business Research (Wolters Kluwer UK) 37(4):285–300.

Altman, E.I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23(4):589–609.

Balakrishnan, S., and B. Wernerfelt. 1986. Technical change, competition and vertical integration. Strategic Management Journal 7(4):347–359.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management 17(1):99–120.

Bettis, R.A., S.P. Bradley, and G. Hamel. 1992. Outsourcing and industrial decline. Academy of Management Executive 6(1):1–22.

Bhuyan, S. 2002. Impact of vertical mergers on industry profitability: an empirical evaluation. Review of Industrial Organization 20(1):61–79.

Bikhchandani, S., D. Hirshleifer, and I. Welch. 1998. Learning from behavior of others: conformity, fads and informational cascades. Journal of Economics Perspectives 12(3):15–70.

Broedner, P., S. Kinkel, and G. Lay. 2009. Productivity effects of outsourcing. International Journal of Operations & Production Management 29(2):127–150.

Buzzell, R.D. 1983. Is vertical integration profitable? Harvard Business Review 61(1):92–102.

Cabral, S., B. Quelin, and W. Maia. 2014. Outsourcing failure and reintegration. The influence of contractual and external factors. Long Range Planning 47(6):365–378.

Coase, R.H. 1937. The nature of the firm. Economica 4(16):386–405.

Das, S., P.K. Shroff, and H. Zhang. 2009. Quarterly earnings patterns and earnings management. Contemporary Accounting Research 26(3):797–831.

D’Aveni, R.A., and A.Y. Ilinitch. 1992. Complex patterns of vertical integration in the forest products industry: systematic and bankruptcy risks. Academy of Management Journal 35(3):596–625.

D’Aveni, R.A., and D.J. Ravenscraft. 1994. Economies of integration versus bureaucracy costs: does vertical integration improve performance? Academy of Management Journal 37(5):1167–1206.

Dess, G.G., and D.W. Beard. 1984. Dimensions of organizational task environments. Administrative Science Quarterly 29:52–73.

Desyllas, P. 2009. Improving performance through vertical disintegration: evidence from UK manufacturing firms. Managerial and Decision Economics 30(5):307–324.

Dierickx, I., and K. Cool. 1989. Asset stock accumulation and sustainability of competitive advantage. Management Science 35(12):1504–1511.

Dietl, H., S. Royer, and U. Stratmann. 2009. Wertschöpfungsorganisation und Differenzierungsdilemma in der Automobilindustrie. Schmalenbachs Zeitschrift für betriebswirtschaftliche Forschung 61:439–462.

Drauz, R. 2014. Re-insourcing as a manufacturing-strategic option during a crisis—Cases from the automobile industry. Journal of Business Research 67(3):346–353.

Ellinger, A.E., et al, 2011. Supply chain management competency and firm financial success. Journal of Business Logistics 32(3):214–226.

Fan, J.P.H., and L.H.P. Lang. 2000. The measurement of relatedness: an application to corporate diversification. The Journal of Business 73(4):629–660.

Gilley, K.M., and A. Rasheed. 2000. Making more by doing less. An analysis of outsourcing and its effects on firm performance. Journal of Management 26(4):763–790.

Gümüş, M., S. Ray, and H. Gurnani. 2012. Supply-side story: risks, guarantees, competition, and information asymmetry. Management Science 58(9):1694–1714.

Haans, R., C. Pieters, and Z.-L. He. 2016. Thinking about U. Theorizing and testing U‑ and inverted U‑shaped relationships in strategy research. Strategic Management Journal 37(7):1177–1195.

Hannan, M.T., and J. Freeman. 1984. Structural inertia and organizational change. American Sociological Review 49(2):149–164.

Harrigan, K.R. 1984. Formulating vertical integration strategies. The Academy of Management Review 9(4):638–652.

Harrigan, K.R. 1985. Strategies for intrafirm transfers and outside sourcing. Academy of Management Journal 28(4):914–925.

Harrigan, K.R. 1986. Matching vertical integration strategies to competitive conditions. Strategic Management Journal 7(6):535–555.

Hartman, P.L., J.A. Ogden, and B.T. Hazen. 2017. Bring it back? An examination of the insourcing decision. International Journal of Physical Distribution & Logistics Management 47(2/3):198–221.

Hendricks, K.B., and V.R. Singhal. 2005. Association between supply chain glitches and operating performance. Management Science 51(5):695–711.

Hendry, J. 1995. Culture, community and networks: the hidden cost of outsourcing. European Management Journal 13(2):193–200.

Hutzschenreuter, T., and F. Gröne. 2009. Changing vertical integration strategies under pressure from foreign competition: the case of US and German multinationals. Journal of Management Studies 46(2):269–307.

Jacobides, M.G. 2005. Industry change through vertical disintegration: how and why markets emerged in mortgage banking. Academy of Management Journal 48(3):465–498.

Jacobides, M.G., and L.M. Hitt. 2005. Losing sight of the forest for the trees? Productive capabilities and gains from trade as drivers of vertical scope. Strategic Management Journal 26(13):1209–1227.

Jacobides, M.G., and S.G. Winter. 2005. The co-evolution of capabilities and transaction costs: explaining the institutional structure of production. Strategic Management Journal 26(5):395–413.

Kenyon, G.N., M.J. Meixell, and P.H. Westfall. 2016. Production outsourcing and operational performance. An empirical study using secondary data. International Journal of Production Economics 171:336–349.

Kieser, A. 1997. Rhetoric and myth in management fashion. Organization 4(1):49–74.

Kotabe, M., and M.J. Mol. 2009. Outsourcing and financial performance: a negative curvilinear effect. Journal of Purchasing and Supply Management 15(4):205–213.

Laffer, A.B. 1969. Vertical integration by corporations, 1929–1965. The Review of Economics and Statistics 51(1):91.

Lahiri, S. 2016. Does outsourcing really improve firm performance? Empirical evidence and research agenda. International Journal of Management Reviews 18(4):464–497.

Lahiri, N., and S. Narayanan. 2013. Vertical integration, innovation, and alliance portfolio size: implications for firm performance. Strategic Management Journal 34(9):1042–1064.

Lajili, K., M. Madunic, and J.T. Mahoney. 2007. Testing organizational economics theories of vertical integration. In Research methodology in strategy and management, Vol. 4, ed. David Ketchen, Don Berg, 343–368. Amsterdam: Elsevier.

Levin, R.C. 1981. Vertical integration and profitability in the oil industry. Journal of Economic Behavior & Organization 2(3):215–235.

Levinthal, D.A. 1997. Adaptation on rugged landscapes. Management Science 43(7):934–950.

Lind, J.T., and H. Mehlum. 2010. With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics 72(1):109–118.

Lindstrom, G., and E. Rozell. 1993. Is there a true measure of vertical integration? American Business Review 11(1):44.

Lonsdale, C., and A. Cox. 2000. The historical development of outsourcing: the latest fad? Industrial Management & Data Systems 100(9):444–450.

Maddigan, R.J. 1981. The measurement of vertical integration. The Review of Economics and Statistics 63(3):328–335.

Mahoney, J.T. 1992. The choice of organizational form: vertical financial ownership versus other methods of vertical integration. Strategic Management Journal 13(8):559–584.

McIvor, R. 2009. How the transaction cost and resource-based theories of the firm inform outsourcing evaluation. Journal of Operations Management 27(1):45–63.

Meyer, J.W., and B. Rowan. 1977. Institutionalized organizations: formal structure as myth and ceremony. American Journal of Sociology 83(2):340–363.

Mol, M.J., and M. Kotabe. 2011. Overcoming inertia. Drivers of the outsourcing process. Long Range Planning 44(3):160–178.

Murphy, G.B., Trailer, J.W., and Hill, R.C., 1996. Measuring performance in entrepreneurship research. Journal of Business Research, 36(1),15–23.

Neely, A., M. Gregory, and K. Platts. 1995. Performance measurement system design: a literature review and research agenda. International Journal of Operations and Production Management 25(12):1228–1263.

Novak, S., and S. Stern. 2008. How does outsourcing affect performance dynamics? Evidence from the automobile industry. Management Science 54(12):1963–1979.

Obermaier, R. 2019. Industrie 4.0 und Digitale Transformation als unternehmerische Gestaltungsaufgabe. In Handbuch Industrie 4.0 und Digitale Transformation: Betriebswirtschaftliche, technische und rechtliche Herausforderungen, 1st edn., ed. R. Obermaier, 3–46. Wiesbaden: Springer.

Obermaier, R., and A. Donhauser. 2012. Zero inventory and firm performance: a management paradigm revisited. International Journal of Production Research 50(16):4543–4555.

Otto, A., and R. Obermaier. 2009. How can supply networks increase firm value? A causal framework to structure the answer. Logistics Research 1:131–148.

Penrose, E. 1959. The theory of the growth of the firm. New York: John Wiley & Sons.

Perry, M.K. 1978. Price discrimination and forward integration. The Bell Journal of Economics 9(1):209–217.

Picot, A., and E. Franck. 1993. Vertikale Integration. In Ergebnisse betriebswirtschaftlicher Forschung: Zu einer Realtheorie der Unternehmung – Festschrift für Eberhard Witte, ed. Jürgen Hauschildt, Oskar Grün, 179–219. Stuttgart: Schaffer-Poeschel.

Prahalad, C.K., and G. Hamel. 1990. The core competence of the corporation. Harvard Business Review 68(3):79–91.

Randall, T., S. Netessine, and N. Rudi. 2006. An empirical examination of the decision to invest in fulfillment capabilities: a study of Internet retailers. Management Science 52(4):567–580.

Rigby, D., and B. Bilodeau. 2015. Management tools & trends 2015. Boston: Bain and Company.