Abstract

Product-related and market-related uncertainties often cause users to defer from switching to new IT devices. There is a value of waiting (VoW) for users because waiting allows them to collect more information. At the same time, many IT switching decisions are increasingly complex due to increased connectivity and the resulting interdependencies between jointly used devices. Therefore, switching decisions for connected devices not only need to consider the new device in isolation, but must also account for the potential benefits from internally or externally connecting the device with other devices. Although crucial for users and providers alike, existing models cannot explain whether and when users switch in such connected environments.

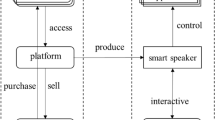

We focus on connected Smart Home Devices (SHDs) and simulate users’ actual switching timing based on a real options model which combines switching and deferral concepts in a context-specific setting. We examine how Smart Home Network (SHN) density influences switching and how providers can use incentives to accelerate switching to foster product diffusion. The findings show an accelerating effect of connectivity and a deferring effect of uncertainty on actual switching timing. We also learn that SHD providers should focus more on immediate than on delayed incentives to promote product diffusion, since the latter can also have undesired effects. Interestingly, external connectivity has almost no influence on decision timing in scenarios with highly dense SHNs, leading to further key implications for SHD providers.

Similar content being viewed by others

Notes

Note that network effects usually assume a focal user’s utility to be dependent on the diffusion or usage of the same or similar technologies by others, whereas for internal connectivity it is purely the focal user’s decision whether to establish a physical connection between their devices.

The necessary conditions \(H_{j}\left(ddt=0\right)>0\) and \(N_{j}\left(ddt=0\right)>0\) are not problematic in our scenario, because an internal network already exists and because independently of SHD2’s market success or failure in the long run, we can at least assume that some early adopters will use SHD2 already before it has seen strong market diffusion.

We performed all analyses with MATLAB R2014. We also calculated 95% confidence intervals for \(t\)* ([86.01;93.81]) and wAM ([20.39;21.78]). The results indicated that 1000 simulation runs provide a stable basis for our analysis.

This process is repeated in all later sensitivity analyses: we ensure that every simulation for every parameter variation performs \(1000\) simulation runs and that every first, second, or n‑th run uses the same number generator seeds.

References

Adner, Ron, and Daniel A. Levinthal. 2004. What is not a real option: Considering boundaries for the application of real options to business strategy. Academy of Management Review 29(1):74–85.

Aldrich, Frances K. 2003. Smart homes: Past, present and future. In Inside the smart home, ed. Richard Harper, 17–39. London: Springer.

Andrews, Melinda L., Ray L. Benedicktus, and Michael K. Brady. 2010. The effect of incentives on customer evaluations of service bundles. Journal of Business Research 63(1):71–76.

Aydinli, Aylin, Marco Bertini, and Anja Lambrecht. 2014. Price promotion for emotional impact. Journal of Marketing 78(4):80–96.

Benaroch, Michel. 2002. Managing information technology investment risk: A real options perspective. Journal of Management Information Systems 19(2):43–84.

Benaroch, Michel, and Robert J. Kauffman. 1999. A case for using real options pricing analysis to evaluate information technology project investments. Information Systems Research 10(1):70–86.

Benaroch, Michel, Mark Jeffery, Robert J. Kauffman, and Sandeep Shah. 2007. Option-based risk management: A field study of sequential information technology investment decisions. Journal of Management Information Systems 24(2):103–140.

Berger, Matthias, Christian Matt, and Thomas Hess. 2016. Connectivity is ubiquitous, but is it beneficial? A numerical approach to assess individuals valuations of smart home systems. In Proceedings of the 49th Hawaii international conference on system sciences (HICSS). 49th Hawaii international conference on system sciences (HICSS), Kauai, Hawaii. Washington DC: IEEE Computer Society.

Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81(3):637–654.

Burger-Helmchen, Thierry. 2007. Justifying the origin of real options and their difficult evaluation in strategic management. Schmalenbach Business Review 59(4):387–405.

Burnham, Thomas A., Judy K. Frels, and Vijay Mahajan. 2003. Consumer switching costs: A typology, antecedents, and consequences. Journal of the Academy of Marketing Science 31(2):109–126.

Carr, Peter. 1995. The valuation of American exchange options with applications to real options. In Real options in capital investment—models, strategies, and applications, ed. L. Trigeorgis, 109–120. Westport: Praeger.

Corbo, Jacomo, and Yevgeniy Vorobeychik. 2009. Quality and price effects on technology adoption. In Proceedings of the 30th International Conference on Information Systems (ICIS). 30th International Conference on Information Systems (ICIS), Phoenix. Atlanta: Curran Associates.

Davis, Fred D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13(3):319–340.

Diepold, Dennis, Christian Ullrich, Alexander Wehrmann, and Steffen Zimmermann. 2009. A real options approach for valuating intertemporal interdependencies within a value-based IT portfolio management—A risk-return perspective. In Proceedings of the 17th European Conference on Information Systems (ECIS). 17th European Conference on Information Systems (ECIS), Verona. Atlanta: Association for Information Systems.

Dodson, Joe A., Alice M. Tybout, and Brian Sternthal. 1978. Impact of deals and deal retraction on brand switching. Journal of Marketing Research 15(1):72–81.

Dong, Diansheng, and Atanu Saha. 1998. He came, he saw, (and) he waited: An empirical analysis of inertia in technology adoption. Applied Economics 30(7):893–905.

Dos Santos, Brian L. 1991. Justifying investments in new information technologies. Journal of Management Information Systems 7(4):71–89.

Fan, Liu, and Yung-Ho Suh. 2014. Why do users switch to a disruptive technology? An empirical study based on expectation-disconfirmation theory. Information & Management 51(2):240–248.

Geroski, P.A. 2000. Models of technology diffusion. Research Policy 29(4):603–625.

Haenlein, Michael, Andreas M. Kaplan, and Detlef Schoder. 2006. Valuing the real option of abandoning unprofitable customers when calculating customer lifetime value. Journal of Marketing 70(3):5–20.

Harmantzis, Fotios C., and Venkata Praveen Tanguturi. 2007. Investment decisions in the wireless industry applying real options. Telecommunications Policy 31(2):107–123.

Heinrich, Bernd, Andreas Huber, and Steffen Zimmermann. 2011. Make-and-sell or buy of web services: A real option approach. In Proceedings of the 19th European Conference on Information Systems (ECIS). Helsinki.

Henseler, Jörg, and Ellen Roemer. 2013. ‘Let’s wait and see!’ The real option to switch as a new element of customer value. Schmalenbach Business Review 65(2):112–136.

Janney, Jay J., and Gregory G. Dess. 2004. Can real-options analysis improve decision-making? Promises and pitfalls. The Academy of Management Executive 18(4):60–75.

Ji, Yonghua. 2010. Incorporating knowledge building in real options analysis of technology project investment. In Proceedings of the 31th international conference on information systems (ICIS). 31th international conference on information systems (ICIS), Saint Louis. Atlanta: Curran Associates.

Jørgensen, Steffen, and Georges Zaccour. 1999. Price subsidies and guaranteed buys of a new technology. European Journal of Operational Research 114(2):338–345.

Katz, Michael L., and Carl Shapiro. 1994. Systems competition and network effects. Journal of Economic Perspectives 8(2):93–115.

Kauffman, Robert J., and Ajay Kumar. 2008. Network effects and embedded options: Decision-making under uncertainty for network technology investments. Information Technology and Management 9(3):149–168.

Kauffman, R.J., and Xiaotong Li. 2005. Technology competition and optimal investment timing: A real options perspective. IEEE Transactions on Engineering Management 52(1):15–29.

Kim, Hee-Woong, and Atreyi Kankanhalli. 2009. Investigating user resistance to information systems implementation: A status quo bias perspective. MIS Quarterly 33(3):567–582.

Kou, Steven G. 2002. A jump-diffusion model for option pricing. Management Science 48(8):1086–1101.

Kretschmer, Tobias. 2008. Splintering and inertia in network industries. The Journal of Industrial Economics 56(4):685–706.

Kuebel, Hannes, and Ruediger Zarnekow. 2015. Exploring platform adoption in the smart home case. In Proceedings of the 36th International Conference on Information Systems (ICIS). 36th International Conference on Information Systems (ICIS), Fort Worth, Texas. Atlanta: Curran Associates.

Kumar, Ram L. 1996. A note on project risk and option values of investments in information technologies. Journal of Management Information Systems 13(1):187–193.

Li, Xiaotong. 2009. Preemptive learning, competency traps, and information technology adoption: A real options analysis. IEEE Transactions on Engineering Management 56(4):650–662.

Lin, Tung-Ching, and Shiu-Li Huang. 2014. Understanding the determinants of consumers’ switching intentions in a standards war. International Journal of Electronic Commerce 19(1):163–189.

Longstaff, Francis A., and Eduardo S. Schwartz. 2001. Valuing American options by simulation: A simple least-squares approach. Review of Financial Studies 14(1):113–147.

Loraas, Tina, and Christopher J. Wolfe. 2006. Why wait? Modeling factors that influence the decision of when to learn a new use of technology. Journal of Information Systems 20(2):1–23.

Margrabe, William. 1978. The value of an option to exchange one asset for another. The Journal of Finance 33(1):177–186.

Matutes, Carmen, and Pierre Regibeau. 1996. A selective review of the economics of standardization. Entry deterrence, technological progress and international competition. European Journal of Political Economy 12(2):183–209.

McDonald, Robert, and Daniel Siegel. 1986. The value of waiting to invest. The Quarterly Journal of Economics 101(4):707–728.

Mennicken, Sarah, Jo Vermeulen, and Elaine M. Huang. 2014. From today’s augmented houses to tomorrow’s smart homes: New directions for home automation research. In Proceedings of the 2014 ACM International Joint Conference on Pervasive and Ubiquitous Computing. Seattle.

Merton, Robert C. 1976. Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics 3(1):125–144.

Moreno, Manuel, and Javier F. Navas. 2003. On the robustness of least-squares monte Carlo (LSM) for pricing American derivatives. Review of Derivatives Research 6(2):107–128.

Müller, Marcel Philipp, Sebastian Stöckl, Steffen Zimmermann, and Bernd Heinrich. 2016. Decision support for IT investment projects. Business & Information Systems Engineering 58(6):381–396.

Naylor, Rebecca Walker, Rajagopal Raghunathan, and Suresh Ramanathan. 2006. Promotions spontaneously induce a positive evaluative response. Journal of Consumer Psychology 16(3):295–305.

Ranganathan, C., Dong Back Seo, and Yair Babad. 2006. Switching behavior of mobile users: do users’ relational investments and demographics matter? European Journal of Information Systems 15(3):269–276.

Rijsdijk, Serge A., and Erik Jan Hultink. 2009. How today’s consumers perceive tomorrow’s smart products. Journal of Product Innovation Management 26(1):24–42.

Rogers, Everett M. 2010. Diffusion of innovations. New York: Simon and Schuster.

Rothschild, Michael L., and William C. Gaidis. 1981. Behavioral learning theory: Its relevance to marketing and promotions. Journal of Marketing 45(2):70–78.

Saya, S., Loo Geok Pee, and Atreyi Kankanhalli. 2010. The impact of institutional influences on perceived technological characteristics and real options in cloud computing adoption. In Proceedings of the 31st International Conference on Information Systems (ICIS). 31st International Conference on Information Systems (ICIS), St. Louis. Atlanta: Curran Associates.

Schwartz, Eduardo S., and Carlos Zozaya-Gorostiza. 2003. Investment under uncertainty in information technology: Acquisition and development projects. Management Science 49(1):57–70.

Sollars, Gordon G., and Sorin A. Tuluca. 2012. The optimal timing of strategic action–A real options approach. Journal of Entrepreneurship, Management and Innovation 8(2):78–95.

Taudes, Alfred, Markus Feurstein, and Andreas Mild. 2000. Options analysis of software platform decisions: A case study. MIS Quarterly 24(2):227–243.

Trigeorgis, Lenos. 1996. Real options: managerial flexibility and strategy in resource allocation. Cambridge: MIT Press.

Ullrich, Christian. 2013. Valuation of IT investments using real options theory. Business & Information Systems Engineering 5(5):331–341.

Wong, Kit Pong. 2007. The effect of uncertainty on investment timing in a real options model. Journal of Economic Dynamics and Control 31(7):2152–2167.

Wymer, Scott A., and Elizabeth A. Regan. 2005. Factors influencing e‐commerce adoption and use by small and medium businesses. Electronic Markets 15(4):438–453.

Yi, Youjae, and Hoseong Jeon. 2003. Effects of loyalty programs on value perception, program loyalty, and brand loyalty. Journal of the Academy of Marketing Science 31(3):229–240.

Zhang, Q., and X. Guo. 2004. Closed-form solutions for perpetual American put options with regime switching. SIAM Journal on Applied Mathematics 64(6):2034–2049.

Zhang, Kem Z.K., Matthew K.O. Lee, Christy M.K. Cheung, and Huaping Chen. 2009. Understanding the role of gender in Bloggers’ switching behavior. Decision Support Systems 47(4):540–546.

Zhang, Z. John, Aradhna Krishna, and Sanjay K. Dhar. 2000. The optimal choice of promotional vehicles: Front-loaded or rear-loaded incentives? Management Science 46(3):348–362.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Berger, M., Matt, C., Gönsch, J. et al. Is the Time Ripe? How the Value of Waiting and Incentives Affect Users’ Switching Behaviors for Smart Home Devices. Schmalenbach Bus Rev 71, 91–123 (2019). https://doi.org/10.1007/s41464-018-0055-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41464-018-0055-1