Abstract

This paper investigates the role of model uncertainty in explaining the different findings in the literature regarding the determinants of government expenditure and its components. In particular, we systematically assess the evidentiary support for nine different theories using a novel model averaging method that allows for endogeneity. Our results suggest that the government size and its components are explained by multiple mechanisms that work simultaneously but differ in their impact and importance. Hence, policy makers should avoid relying on any particular model to make policy decisions. More precisely, for general government total expenditure we find decisive evidence for the demography theory and a strong evidence for the globalization and political institution theory. In the case of central government total expenditure, we find that income inequality and macroeconomic policy play a decisive role in addition to demography.

Similar content being viewed by others

Notes

Brock and Durlauf (2001) coined the term theory uncertainty due to the openendedness of theories in the context of economic growth.

Using higher-order lags leads to similar conclusions.

Each model can be estimated using standard Bayesian estimation under conjugate priors. In Online Appendix, we provide a detailed description of our estimation method and model averaging method described briefly below.

While we use most of the theories identified by Lybeck (1988) and Shelton (2007), we omit determinants related to price-inelastic demand of publicly supply goods and services and Baumol’s disease, bureaucracy, public employees as voters and ethnic fractionalization due to availability of panel data for our sample period. These omitted theories are expected to be captured by the presence of fixed effects.

This problem is analogous to the irrelevance of independent alternatives (IIA) in the discrete choice literature.

Magnus and Wang (2014) provide an alternative strategy using a hierarchical weighted least squares method assuming exogenous covariates.

While our methodology is general and can allow for model uncertainty in both the first- and second-stage regressions, for simplicity we focus on the latter by assuming just identification.

Our estimation method relies on a Gibbs sampler for the IV framework, similar to that discussed in Rossi et al. (2006) (Section B4 of Online Appendix).

The literature also discuss ethnic fractionalization, which proposes a link between ethnic fragmentation and measures of public goods (Alesina et al. 2003). We do not include ethnic fractionalization because it is measured by time invariant variables and its effect is absorbed by fixed effects.

We use one lag of each variable as instruments due to sample availability. We proceeded to the use of two lags as instruments, and our sample decreased from 414 observations to 319 observations. Nevertheless, we used that sample with only one lag as instruments for comparison reasons. Results are presented in Table C24 of Online Appendix. The results differ from the baseline model due to the different sample. Using the same sample (\(n=319\)) and estimating the model with one and two lags as instruments, we find very similar results in terms of size, sign and posterior inclusion probability.

The Database of Political Institutions (DPI), the Freedom House (FH) database, the Historical Public Debt Database (HPDD), the IMF’s Government Financial Statistics database (GFS), Lane and Milesi-Ferretti (2007), the Major Episodes of Political Violence database (MEPV), Penn World Table 8 (PWT), Political Regime Characteristics and Transitions, the 1800–2013 database of the Polity IV Project (PRCT), the Polity IV Project (PIV), Solt (2009) and the World Development Indicators database (WDI).

One concern with this measure is that it only considers the expenditure side, which can result in overestimation of the degree of decentralization because it neglects the control wielded by subnational governments over their tax revenues. However, as argued by Marlow (1988), government revenues underestimate the size of the public sector since most countries have had persistent deficits for the last 50 years. Nevertheless, in Online Appendix, we investigate the baseline specifications using revenue centralization (the ratio of central to general total government revenue from GFS) and found similar results.

The first evidence of a relationship between trade and government expenditure were documented by Cameron (1978).

In Shelton (2007), political rights, electoral rules and government type are identified as different theories. In our baseline formulation, we combine those under the theory of political institutions because they all refer to institutions constraining government and elite expropriation but also consider various robustness exercises (Acemoglu and Johnson 2005).

For robustness purposes, in Table C24 of Online Appendix, we also consider exercises using the level of GDP per capita and the logarithm of GDP. We should note, however, that the level of GDP is not a good a measure of a country’s standard of living. Likewise the use of logarithms induces linearity and avoids extreme values.

In Table C24 of Online Appendix, we present a sensitivity analysis of the baseline specification of determinants. Specifically, we present the PIP of the theories when we normalize the variables before estimation. This set of results indicates the robustness of the results which are broadly consistent with the baseline findings.

The inclusion of these additional terms limits our sample substantially (85 countries and 219 observations), which explains the reason we opted not to consider this in the baseline sample.

Rodrik (1998) finds a positive and statistically significant coefficient for the interaction terms.

The PIP of the interaction term is equal to 1, indicating decisive evidence for the effect, but the posterior mean is negative. Additionally, the PIP of the interaction term on both social protection and public goods expenditures indicates that neither matters (PIP is 0.003 and 0.038, respectively).

As Eterovic and Eterovic (2012) argue, there are at least four reasons why enhanced political competition is likely to decrease government expenditure: (1) the theory of fiscal illusion, (2) enhanced political competition allows more pressure groups to be catered to in the political calculus, (3) political competition enhances political accountability and (4) in societies with severe restrictions on political competition (dictatorship) political leaders need to spend substantial public funds on securing and maintaining power.

Wagner’s law suggests that as states grow wealthier they simultaneously grow more complex, increasing the need for public regulatory and protective action to ensure the smooth operation of a modern, specialized economy. Additionally, it postulates that certain public goods, such as education and health, are luxury goods, which means that the demand for those goods increases more than proportionally as income rises. Finally, Shelton (2007) indicates that richer countries have a bigger fraction of people over 64 years old, who demand more social protection.

Brennan and Buchanan (1980) suggest that an increase in fiscal centralization will lead to more total government spending.

In particular for general government social protection expenditure, we find a positive effect of income inequality in lower-income countries (PIP \(=0.893\)) and a negative effect in lower–middle-income countries (PIP \(=1\)) which is close to the prospect of upward mobility (POUM) hypothesis of Benabou and Ok (2001). For the central government public goods expenditure, we find a positive effect of inequality only for high-income countries. This is consistent with Benabou (2000) who examines the role of the presence of capital market imperfections. In the presence of credit constrains, redistribution will command less political support in an unequal society than in a more homogeneous one.

In particular, we get a small positive effect on the components (use of goods and services, economic affairs, public order and safety, health and education expenditures), which after being summed together provide us with the positive effect on total expenditure.

They suggest that as urbanization increases, a greater demand for government services is expected if education and health are mainly public responsibilities.

He suggests that in presidential regimes government tends to be more efficient due to the competition between the policy makers.

For example, political institutions can affect government expenditure directly or indirectly via their effect on globalization. By excluding the globalization theory from the model space, we can assess its mediation role vis-a-vis the other theories of government expenditure using a posterior odds ratio analysis.

\(\text {PIP}^i\) is the posterior inclusion probability of theory i in the baseline model, which gives us the direct effect of theory i on government expenditure, \(\text {PIP}^{i,-j}\) is the posterior inclusion probability of theory i after we exclude the theory j and \(\Delta \text {PIP}^{i,-j}=\text {PIP}^{i,-j}-\text {PIP}^i\) is the difference of the two, which gives us the mediation effect.

This is recognized by Durlauf and Johnson (1995) in the context of cross-country growth behavior.

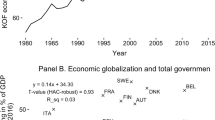

For the centralization theory, we use the percentage of central to general total government expenditure; for the conflict theory, we use the magnitude score of episode(s) of warfare involving that state in that year; for the country size theory, we use population; for the demographic theory, we use the percentage of people older than 64 to the working-age population; for the globalization theory, we use trade openness; for the income inequality theory, we use gross income Gini inequality; for the macroeconomic policy theory, we use total central government debt; for the political institution theory, we use the combined polity democracy score; and for the Wagner’s law theory, we use GDP per capita.

Following Shelton (2007), we let democracy score, political competition index, presidential and plurality dummy and political rights index to be theories on its own.

References

Acemoglu D, Johnson S (2005) Unbundling Institutions. J Political Econ 113:949–995

Adsera A, Boix C (2002) Trade, democracy, and the size of the public sector: the political underpinnings of openness. Int Organ 56:229–262

Alesina A, Devleeschauwer A, Easterly W, Kurlat S, Wacziarg R (2003) Fractionalization. J Econ Growth 8:155–194

Alesina A, Wacziarg R (1998) Openness, country size and government. J Public Econ 69:305–321

Baraldi AL (2008) Effects of electoral rules, political competition and corruption on the size and composition of government consumption spending: an Italian regional analysis. BE J Econ Anal Policy 8:24

Benabou R (1996) Inequality and growth. NBER Macroecon Annu 11:11–74

Benabou R (2000) Unequal societies: income distribution and the social contract. Am Econ Rev 90:96–129

Benabou R, Ok EA (2001) Social mobility and the demand for redistribution: the poum hypothesis. Q J Econ 116:447–487

Benarroch M, Pandey M (2008) Trade openness and government size. Econ Lett 101:157–159

Brennan G, Buchanan J (1980) The power to tax: analytical foundations of a fiscal constitution. Cambridge University Press, Cambridge

Brock W, Durlauf SD (2001) Growth empirics and reality. World Bank Econ Rev 15:229–272

Cameron D (1978) The expansion of the public economy: a comparative analysis. Am Political Sci Rev 72:1243–1261

Case AC, Rosen HS, Hines JR (1993) Budget spillovers and fiscal policy interdependence: evidence from the states. J Public Econ 52:285–307

Cassette A, Paty S (2010) Fiscal decentralization and the size of government: a European country empirical analysis. Public Choice 143:173–189

Cuaresma JC, Feldkircher M (2013) Spatial filtering, model uncertainty and the speed of income convergence in Europe. J Appl Econom 28:720–741

Dickey JM, Gunel E (1978) Bayes factors from mixed probabilities. J R Stat Soc Ser B 40:43–46

Dreher A, Sturm JE, Ursprung H (2008) The impact of globalization on the composition of government expenditures: evidence from panel data. Public Choice 134:263–292

Durlauf SN, Johnson PA (1995) Multiple regimes and crosscountry growth behaviour. J Appl Econom 10:365–384

Durlauf SN, Kourtellos A, Tan CM (2008) Are any growth theories robust? Econ J 118:329–346

Durlauf SN, Kourtellos A, Tan CM (2011) Is god in the details? A reexamination of the role of religion in economic growth. J Appl Econom 27:1059–1075

Eicher TS, Papageorgiou C, Raftery AE (2011) Default priors and predictive performance in Bayesian model averaging, with application to growth determinants. J Appl Econom 26:30–55

Eterovic D, Eterovic N (2012) Political competition versus electoral participation: effects on government’s size. Econ Gov 13:333–363

Fernández C, Ley E, Steel MFJ (2001) Benchmark priors for Bayesian model averaging. J Econom 100:381–427

Ferris S, Park SB, Winer S (2008) Studying the role of political competition in the evolution of government size over long horizons. Public Choice 137:369–401

Garrett G, Mitchell D (2001) Globalization, government spending and taxation in the OECD. J Political Res 39:145–177

Gibbons S, Overman H, Pelkonen P (2014) Area disparities in Britain: understanding the contribution of people vs. place through variance decompositions. Oxford Bull Econo Stat 76:745–763

Grossmann V (2003) Income inequality, voting over the size of public consumption, and growth. Eur J Political Econ 19:265–287

Holmes C, Denison D, Mallick B (2002) Bayesian model order determination and basis selection for seemingly unrelated regression. J Comput Gr Stat 11:511–533

Klenow P, Rodriguez-Clare A (1997) The neoclassical revival in growth economics: has it gone too far? NBER Macroecon Annu 12:73–114

Kourtellos A, Lenkoski A, Petrou K (2018a) Measuring the strength of the theories of government size: methodology–instrumental variable Bayesian model averaging, University of Cyprus, Working Paper

Kourtellos A, Lenkoski A, Petrou K (2018b) Measuring the strength of the theories of government size: supplementary results. University of Cyprus, Working Paper

Lane P, Milesi-Ferretti GM (2007) The external wealth of nations mark II: revised and extended estimates of foreign assets and liabilities, 1970–2004. J Int Econ 73:223–250

Ley E, Steel MFJ (2009) On the effect of prior assumptions in Bayesian model averaging with applications to growth regression. J Appl Econom 24:651–674

Liberati P (2007) Openness, capital openness and government size. J Public Policy 27:215–247

Lybeck JA (1988) Comparing government growth rates: the non-institutional vs. the institutional approach. Contrib to Econ Anal 171:29–47

Magnus JR, Powell O, Prufer PC (2010) A comparison of two model averaging techniques with an application to growth empirics. J Econom 154:139–153

Magnus JR, Wang W (2014) Concept-based Bayesian model averaging and growth empirics. Oxford Bull Econ Stat 76:874–897

Malik A, Temple JRW (2009) The geography of output volatility. J Dev Econ 90:163–178

Marlow M (1988) Fiscal decentralization and government size. Public Choice 56:259–269

Masanjala W, Papageorgiou C (2008) Rough and lonely road to prosperity: a reexamination of the sources of growth in Africa using Bayesian model averaging. J Appl Econom 23:671–682

Mcgarvey M, Walker MB, Turnbull GK, (2006) Copycat spending across states: a new approach, Urban and Regional Analysis Group–Working Paper No. 06-04

Meltzer A, Richard S (1981) A rational theory of the size of government. J Political Econ 89:914–927

Mirestean A, Tsangarides CG (2016) Growth determinants revisited using limited-information Bayesian model averaging. J Appl Econom 31:106–132

Persson T, Tabellini G (1999) The size and scope of government: comparative politics with rational politicians. Eur Econ Rev 43:699–735

Raftery A, Madigan D, Hoeting J (1997) Bayesian model averaging for linear regression models. J Am Stat Assoc 92:179–191

Rodrik D (1998) Why do more open economies have bigger governments? J Political Econ 106:997–1032

Roemer J (1998) Why the poor do not expropriate the rich: an old argument in new garb. J Public Econ 70:399–424

Rosh RM (1988) Third world militarization: security webs and the states they ensnare. J Confl Resolut 32:671–698

Rossi PE, Allenby GM, McCulloch R (2006) Bayesian statistics and marketing. New York, Wiley

Saint-Paul G (2001) The dynamics of exclusion and fiscal conservatism. Rev Econ Dyn 4:275–302

Sala-i Martin X, Doppelhofer G, Miller R (2004) Determinants of long-term growth: a Bayesian averaging of classical estimates (BACE) approach. Am Econ Rev 94:813–835

Shelton C (2007) The size and composition of government expenditure. J Public Econ 91:2230–2260

Solt F (2009) Standardizing the world income inequality database. Soc Sci Q 90:231–242

Tiefelsdorf M, Parent DA (2007) Semiparametric filtering of spatial autocorrelation: the eigenvector approach. Environ Plann A 39:1193–1221

Wallis JJ, Oates W (1988) Decentralization in the public sector: an empirical study of state and local government. In: Rosen HS (ed) Fiscal federalism: quantitative studies, pp 5–32. University of Chicago Press, Chicago

Funding

First author, Kourtellos acknowledges that this research has received funding from Marie Skodowska-Curie Actions (Work Programme 2016–17) of the Excellence Science Pillar of the Horizon 2020 Research and Innovation Programme of the European Union under REA grant agreement No. 707990.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Research involving human participants and/or animals

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix

A.1 Variance decomposition

While the posterior inclusion probabilities of theories can inform us about their relative importance, they do not take into account the magnitude of their effects. To do so, we complement our main analysis with a variance decomposition analysis presented in Tables A1 and A2 of Appendix to determine the contribution of each theory in explaining the variation of total expenditure and its components.

Firstly, we compute the posterior mean of each theory t: \(\hat{T_t} = X_{t,1}{\hat{\beta }}_{t,1} + X_{t,2}{\hat{\beta }}_{t,2} + \ldots + X_{t,p}{\hat{\beta }}_{t,p}\), where \({\hat{\beta }}_{t,j}\) is the set of estimates for the coefficients of the determinants for theory t. Secondly, following Klenow and Rodriguez-Clare (1997), we decompose the variance of each theory using:

where \(y_{c}\) denotes the total government expenditures (\(c=1\)) and its components (\(c=2,\ldots ,11\)).

Following Gibbons et al. (2014), we consider two methods: the balanced variance share (BVS) which is calculated as the share of the covariance between the posterior mean of theory t and of expenditure category c, to the variance of expenditure category c (\(\text {BVS} = \frac{\text {Cov}(\hat{T_r}_{t},y_{c})}{\text {Var}({y_{c}})}\)), and the correlated variance share (CVS) which is calculated as the share of the posterior mean of theory t to the variance of expenditure category c (\(\text {CVS} = \frac{\text {Var}(\hat{T_r}_{t})}{\text {Var}({y_{c}})}\)). The results from BVS and CVS are presented in Appendix Tables A1 and A2, respectively, providing similar results.

The variation of general government total expenditure is mainly explained by the demography theory (40.3%), the political institution theory (38.3%), the centralization theory (22.6%) and the income inequality theory (6.7%). Furthermore, the globalization (3.4%) and Wagner’s law theory (3%) seem to explain only a small part of the total expenditure variation. For the central government total expenditure, only the demography theory explains a large fraction of the variation (32%). One notable difference is that while the macroeconomic policy and income inequality theories exhibited a decisive role in terms of PIP, their impact in terms of their ability to explain the variation of expenditure is small, suggesting that the effect is significant but small in magnitude. With the exception of the conflict and the country size theories, all others explain a fraction between 3 and 9% of the variation of central government total expenditure. Importantly, our results show that country and time heterogeneity do not explain the variation of total expenditure, neither on the general nor the central level.

In sum, our results are in agreement with the results from the posterior inclusion probability. The determinants that have a high PIP explain more than 5% of the various expenditure and component variations.

Rights and permissions

About this article

Cite this article

Kourtellos, A., Lenkoski, A. & Petrou, K. Measuring the strength of the theories of government size. Empir Econ 59, 2185–2222 (2020). https://doi.org/10.1007/s00181-019-01718-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01718-0