Abstract

Economic forecasts are an important element of rational economic policy both on the federal and on the local or regional level. Solid budgetary plans for government expenditures and revenues rely on efficient macroeconomic projections. However, official data on quarterly regional GDP in Germany are not available, and hence, regional GDP forecasts do not play an important role in public budget planning. We provide a new quarterly time series for East German GDP and develop a forecasting approach for East German GDP that takes data availability in real time and regional economic indicators into account. Overall, we find that mixed-data sampling model forecasts for East German GDP in combination with model averaging outperform regional forecast models that only rely on aggregate national information.

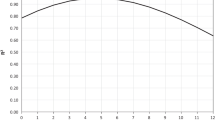

Sources: German Federal Statistical Office and own calculations

Similar content being viewed by others

Notes

For an general overview on obstacles in regional forecasting, see Lehmann and Wohlrabe (2014b).

Other studies, e.g., Lehmann and Wohlrabe (2015), refer to East Germany excluding Berlin.

In this paper, we use the terms nowcasting and forecasting similarly, both referring to the current quarter.

See IWH-flash-estimate: http://www.iwh-halle.de/en/research/data-and-analysis/macroeconomic-reports/iwh-flash-indicator/.

A drawback of the ifo survey data for East Germany is that they do not include Berlin.

In contrast to Lehmann and Wohlrabe (2017), we also take the indicators into account that are used for disaggregation of annual data to see whether there are information advantages.

To make the indicators comparable to GDP, we report them in quarterly frequency in the figures.

Table 6 in Appendix B provides an overview of the forecasting properties of our benchmark models.

In forecast round F2 and F3, the same benchmark models are used.

They consider quarterly year-on-year forecasts for the sample 1997–2013.

Data on the expenditure side are even published only with a delay of 2–3 years.

Although quarterly data have been published until 1999, these figures cannot be directly used due to revisions of the regional data up to 5 years.

References

Andreou E, Ghysels E, Kourtellos A (2013) Should macroeconomic forecasters use daily financial data and how? J Bus Econ Stat 31(2):240–251

Armesto MT, Engemann KM, Owyang MT (2010) Forecasting with mixed frequencies. Fed Reserve Bank St Louis Rev 92(6):521–536

Bragoli D, Fosten J (2018) Nowcasting Indian GDP. Oxf Bull Econ Stat 80(2):259–282

Chow GC, Al Lin (1971) Best linear unbiased interpolation, distribution, and extrapolation of time series by related series. Rev Econ Stat 53(4):372–375

Clements MP, Galvão AB (2008) Macroeconomic forecasting with mixed frequency data: forecasting US output growth. J Bus Econ Stat 26(4):546–554

Diebold FX (2015) Comparing predictive accuracy, twenty years later: a personal perspective on the use and abuse of Diebold–Mariano tests. J Bus Econ Stat 33(1):1–1

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 13(3):253–263

Drechsel K, Scheufele R (2012) The performance of short-term forecasts of the German economy before and during the 2008/2009 recession. Int J Forecast 28(2):428–445

Foroni C, Marcellino M, Schumacher C (2015) U-MIDAS: MIDAS regressions with unrestricted lag polynomials. J R Stat Soc Ser A(178):57–82

Ghysels E, Santa-Clara P, Valkanov R (2004) The MIDAS touch: mixed data sampling regression models. Tech. rep

Ghysels E, Santa-Clara P, Valkanov R (2006) Predicting volatility: getting the most out of return data sampled at different frequencies. J Econom 131:59–95

Ghysels E, Santa-Clara P, Valkanov R (2007) MIDAS regressions: further results and new directions. Econ Rev 26(1):53–90

Giacomini R, White H (2006) Tests of conditional predictive ability. Econometrica 74(6):1545–1578

Gießler S, Heinisch K, Holtemöller O (2019) (Since When) Are East and West German business cycles synchronized? IWH Discussion Paper 7, IWH

Granger CW, Newbold P (1977) Forecasting economic time series. Academic Press, London

Heinisch K, Scheufele R (2018) Bottom-up or direct? Forecasting German GDP in a data-rich environment. Empir Econ 54(2):705–745

Henzel SR, Lehmann R, Wohlrabe K (2015) Nowcasting regional GDP: the case of the Free State of Saxony. Rev Econ 66(1):71–98

Kopoin A, Moran K, Paré JP (2013) Forecasting regional GDP with factor models: How useful are national and international data? Econ Lett 121(2):267–270

Kuzin V, Marcellino M, Schumacher C (2011) MIDAS vs. mixed-frequency VAR: nowcasting GDP in the euro area. Int J Forecast 27(2):529–542

Lehmann R, Wohlrabe K (2014a) Forecasting gross value-added at the regional level: Are sectoral disaggregated predictions superior to direct ones? Rev Reg Res Jahrbuch für Regionalwissenschaft 34(1):61–90

Lehmann R, Wohlrabe K (2014b) Regional economic forecasting: state-of-the-art methodology and future challenges. Econ Bus Lett 3(4):218–231

Lehmann R, Wohlrabe K (2015) Forecasting GDP at the regional level with many predictors. Ger Econ Rev 16(2):226–254

Lehmann R, Wohlrabe K (2017) Boosting and regional economic forecasting: the case of Germany. Lett Spat Resour Sci 10(2):161–175

Marcellino M, Schumacher C (2010) Factor MIDAS for nowcasting and forecasting with ragged-edge data: a model comparison for German GDP. Oxf Bull Econ Stat 72(4):518–550

Rossi B, Inoue A (2012) Out-of-sample forecast tests robust to the choice of window size. J Bus Econ Stat 30(3):432–453

Stock JH, Watson MW (2003) Forecasting output and inflation: the role of asset prices. J Econ Lit 47(3):788–829

Stock JH, Watson MW (2004) Combination forecasts of output growth in a seven-country data set. J Forecast 23(6):405–430

Timmermann A (2006) Forecast combinations. In: Elliot G, Granger CW, Timmermann A (eds) Handbook of forecasting, vol 1. Elsevier, Amsterdam, pp 135–196 chap 4

West KD (1996) Inference about predictive ability. Econometrica 64(5):1067–1084

Acknowledgements

We would like to thank Klaus Wohlrabe and Robert Lehmann, the participants of the IWH-CIREQ-GW-Macroeconometric Workshop 2017 and of the 1. Vienna Workshop on Economic Forecasting 2018 and an anonymous referee for helpful comments and suggestions. Research assistance by Franziska Exß is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The temporal disaggregation approach of quarterly GDP data for East Germany

This appendix describes the estimation of quarterly gross domestic product (GDP) for East Germany (Fig. 4). The quarterly series is provided on the Web site of the Halle Institute for Economic Research (IWH).Footnote 12

The IWH has regularly provided GDP estimates for East Germany (excluding Berlin) based on quarterly gross value added until 2015. (See Konjunktur-barometer-Ost.) From 2016 onwards, the calculation is carried out using interpolation methods based on annual regional GDP data as well as quarterly regional indicators.

The most important data sources are the publications of the working group “Regional Accounts” and official employment statistics. Based on gross value added calculations, recent GDP figures are only available at annual frequency and are published with a delay of three months after the end of the reference period.Footnote 13 Updates for the first half of a year are published in the summer of the corresponding year. Official quarterly data have not been published since 1999.

Therefore, following the guidelines of the European Statistical System (ESS) (2018), temporal disaggregation, benchmarking and reconciliation methods are used. The use of temporal disaggregation techniques allows the conversion of a lower-frequency time series into a higher-frequency time series, i.e., from annual to quarterly data. Based on the official annual data for the German regions (East and West), quarterly data are disaggregated using regional quarterly indicators. Deviations from previous publications by the IWH can arise due to the fact that the national accounts of the states are revised up to 5 years into the past.

For the years 1991–1994, corresponding statistics of the Federal Statistical Office (so-called Schienenhefte) were used as source, in which quarterly figures for the gross domestic product were published for the states.Footnote 14 The distribution of current annual values for the gross domestic product is made using the quarterly shares of these former official values. For the period 1995–2015, the IWH uses its own quarterly series, which were determined on the basis of a bottom-up approach (IWH Konjunkturbarometer). Starting in 2016, appropriate regional indicators that best reflect the quarterly trend of East German gross domestic product are used to break down the quarters. This approach is described in more detail below.

For temporal disaggregation, it is useful to select a number of appropriate higher-frequency indicators that cover at least the same period as the annual indicator. Indicators should be timely available and not too volatile. In addition, indicators should have a high correlation with the original target variable when converted to the low frequency. Nevertheless, the selection of possible indicators is hampered by the lack of official regional statistics at monthly and/or quarterly frequency and by considerable delay in publication.

In a first step, various eligible indicators were identified. However, the use of all variables in the temporal disaggregation process is not recommended as it may also increase the risk of collinearity. Empirical evidence has shown that the joint use of both output indicators (e.g. turnover) and input indicators (such as employees) is particularly well suited for disaggregation of GDP in East Germany. Due to high correlation with GDP, monthly data on employees subject to social security contributions and turnover in the manufacturing sector, as well as the quarterly figures for the production index in the manufacturing have been selected. Together, these economic indicators can well reflect the underlying dynamics in East Germany.

Standard temporal disaggregation methods are usually only applicable to one target series and do not consider relationships between multiple time series. However, the use of various indicators may result in an inconsistent picture of the time-disaggregated series, although the annual data are consistent. Therefore, reconciliation methods aim to use a plurality of time series at the same time to disaggregate the target series, without losing consistency. For this approach, the IWH uses the ECOTRIM package provided by EUROSTAT, which includes the multivariate Chow and Lin method (Chow and Lin 1971) and other temporal disaggregation options for time series.

By using the X-12-ARIMA procedure, we can finally adjust the data for seasonal and calendar irregularities in Germany. As we perform benchmarking first and then do seasonal adjustment, we end up with small differences in the annual alignment, which are compensated by an annual sum adjustment factor.

Appendix B

See Tables 4, 5, 6 and Figs. 5, 6.

Forecast performance. Mean squared forecast errors are shown for each quarter and different forecast methods in percentage points. Black—AR model, dark gray—ARDL + IWH forecast, light gray—MIDAS, white and dots—UMIDAS, gray striped—forecast combination. The ARDL models include the IWH forecast for the current quarter. Forecast combination refers to the forecast averaging models based on MIDAS models

Rights and permissions

About this article

Cite this article

Claudio, J.C., Heinisch, K. & Holtemöller, O. Nowcasting East German GDP growth: a MIDAS approach. Empir Econ 58, 29–54 (2020). https://doi.org/10.1007/s00181-019-01810-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01810-5