Abstract

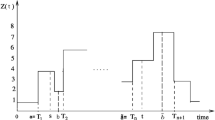

The focus of this paper is on the derivation of confidence and credibility intervals for Markov chains when discrete-time, continuous-time or discretely observed continuous-time data are available. Thereby, our contribution is threefold: First, we discuss and compare multinomial confidence regions for the rows of discrete-time Markov transition matrices in the light of empirical characteristics of credit rating migrations. Second, we derive an analytical expression for the expected Fisher information matrix of a continuous-time Markov chain which is used to construct credibility intervals using a non-informative Jeffreys prior distribution and a Metropolis-Hastings Algorithm. Third, we concretize profile and estimated/pseudo likelihood based confidence intervals in the continuous-time data settings, which in contrast to asymptotic normality based intervals explicitly consider non-negativity constraints for the parameters. Furthermore, we illustrate the described methods by Moody’s corporate ratings data with exact continuous-time transitions.

Similar content being viewed by others

Notes

We use the term estimated/pseudo likelihood instead of profile likelihood since we consider here the marginal likelihood function, see e.g., Pawitan (2001).

References

Albert A (1962) Estimating the infinitesimal generator of a continuous time, finite state Markov process. Ann Math Stat 33(2):727–753

Assoudou S, Essebbar B (2003) A Bayesian model for Markov chains via Jeffrey’s prior. Commun Stat Theory Methods 32(11):2163–2184

Bailey BJR (1980) Large sample simultaneous confidence intervals for the multinomial probabilities based on transformations of cell frequencies. Technometrics 22(4):583–589

Basel Committee on Banking Supervision (2006) International convergence of capital measurement and capital standards. A revised framework-comprehensive version https://www.bis.org/publ/bcbs128.pdf

Betancourt L (1999) Using Markov chains to estimate losses from a portfolio of mortgages. Rev Quant Finance Account 12(3):303–318

Billingsley P (1961) Statistical methods in Markov chains. Ann Math Stat 32(1):12–40

Bladt M, Sørensen M (2005) Statistical inference for discretely observed Markov jump processes. J R Stat Soc Ser B 67(3):395–410

Bladt M, Sørensen M (2009) Efficient estimation of transition rates between credit ratings from observations at discrete time points. Quant Finance 9(2):147–160

Craig BA, Sendi PP (2002) Estimation of the transition matrix of a discrete-time Markov chain. Health Econ 11(1):33–42

Crommelin DT, Vanden-Eijnden E (2006) Fitting time series by continuous-time Markov chains: a quadratic programming approach. J Comput Phys 217(2):782–805

Dempster AP, Laird NM, Rubin DB (1977) Maximum likelihood from incomplete data via the EM algorithm. J R Stat Soc Ser B 39(1):1–38

dos Reis G, Smith G (2018) Robust and consistent estimation of generators in credit risk. Quant Finance 18(6):983–1001

Efron B, Hinkley DV (1978) Assessing the accuracy of the maximum likelihood estimator: observed versus expected Fisher information. Biometrika 65(3):457–483

Efron B, Tibshirani RJ (1993) An introduction to the bootstrap. Chapman & Hall, New York

Ethier SN, Kurtz TG (2005) Markov processes: characterization and convergence. Wiley, Hoboken

Ferreira MAR, Suchard MA (2008) Bayesian analysis of elapsed times in continuous-time Markov chains. Can J Stat 36(3):355–368

Fitzpatrick S, Scott A (1987) Quick simultaneous confidence intervals for multinomial proportions. J Am Stat Assoc 82(399):875–878

Glaz J, Sison CP (1999) Simultaneous confidence intervals for multinomial proportions. J Stat Plan Inference 82(1–2):251–262

Goodman LA (1965) On simultaneous confidence intervals for multinomial proportions. Technometrics 7(2):247–254

Hou CD, Chiang J, Tai JJ (2003) A family of simultaneous confidence intervals for multinomial proportions. Comput Stat Data Anal 43(1):29–45

Hsu J (1996) Multiple comparisons: theory and methods. Chapman and Hall, New York

Hughes M, Werner R (2016) Choosing Markovian credit migration matrices by nonlinar optimization. Risks 4(3):31

Inamura Y (2006) Estimating continuous time transition matrices from discretely observed data. Bank of Japan Working Paper Series. https://www.boj.or.jp/en/research/wps_rev/wps_2006/data/wp06e07.pdf

Israel RB, Rosenthal JS, Wei JZ (2001) Finding generators for Markov chains via empirical transition matrices, with applications to credit ratings. Math Finance 11(2):245–265

Jackson CH (2011) Multi-state models for panel data: the msm package for R. J Stat Softw 38(8):1–29

Jafry Y, Schuermann T (2004) Measurement, estimation and comparison of credit rating migration matrices. J Bank Finance 28(11):26032639

Jeffreys H (1961) Theory of probability, 3rd edn. Oxford University Press, Oxford

Kalbfleisch JD, Lawless JF (1985) The analysis of panel data under a Markov assumption. J Am Stat Assoc 80(392):863–871

Kreinin E, Sidelnikova M (2001) Regularization algorithms for transition matrices. Algo Res Q 4(1):23–40

Kremer A, Weißbach R (2014) Asymptotic normality for discretely observed Markov jump processes with an absorbing state. Stat Probab Lett 90:136–139

Lee AJ, Nyangoma SO, Seber GAF (2002) Confidence regions for multinomial parameters. Comput Stat Data Anal 39(3):329–342

Lee PM (1997) Bayesian statistics. Arnold, London

Levin B (1981) A representation for multinomial cumulative distribution functions. Ann Stat 9(5):1123–1126

May WL, Johnson WD (1997) Properties of simultaneous confidence intervals for multinomial proportions. Commun Stat Simul Comput 26(2):495–518

May WL, Johnson WD (2000) Constructing two-sided simultaneous confidence intervals for multinomial proportions for small counts in a large number of cells. J Stat Softw 5(6):1–24

Metzner P, Dittmer E, Jahnke T, Schütte C (2007a) Generator estimation of Markov jump processes. J Comput Phys 227(1):353–375

Metzner P, Horenko I, Schütte C (2007b) Generator estimation of Markov jump processes based on incomplete observations nonequidistant in time. Phys Rev E 76(6):066702

Norris JR (1998) Markov chains. Cambridge University Press, Cambridge

Oakes D (1999) Direct calculation of the information matrix via the EM algorithm. J R Stat Soc Ser B 61(2):479–482

Pawitan Y (2001) In all likelihood: statistical modelling and inference using likelihood. Oxford University Press, Oxford

Pfeuffer M (2017) ctmcd: an R package for estimating the parameters of a continuous-time Markov chain from discrete-time data. R J 9(2):127–141

Pfeuffer M, Möstel L, Fischer M (2019) An extended likelihood framework for modelling discretely observed credit rating transitions. Quant Finance 19(1):93–104

Quesenberry CP, Hurst DC (1964) Large sample simultaneous confidence intervals for multinomial proportions. Technometrics 6(2):191–195

R Core Team (2017). R: a language and environment for statistical computing. R Foundation for Statistical Computing, Vienna

Sison CP, Glaz J (1995) Simultaneous confidence intervals and sample size determination for multinomial proportions. J Am Stat Assoc 90(429):366–369

Trück S, Rachev ST (2009) Rating based modeling of credit risk: theory and application of migration matrices. Academic Press, Boston

Van Loan CF (1978) Computing integrals involving the matrix exponential. IEEE Trans Autom Controls 23(3):395–404

Villacorta PJ (2015) MultinomialCI: simultaneous confidence intervals for multinomial proportions according to the method by Sison and Glaz. R package

Wilcox RM (1967) Exponential operators and parameter differentiation in quantum physics. J Math Phys 8(4):962–982

Wilson AJ (2010) Volume of n-dimensional ellipsoid. Sci Acta Xaveriana 1(1):101–106

Withers CS, Nadarajah S (2017) A new confidence region for the multinomial distribution. Commun Stat Simul Comput 46(5):4113–4126

Acknowledgements

The authors would like to thank two anonymous referees for their helpful comments and suggestions, which significantly contributed to improving the quality of this publication. Marius Pfeuffer gratefully acknowledges funding by DZ Bank Foundation and Universitätsbund Erlangen-Nürnberg.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Möstel, L., Pfeuffer, M. & Fischer, M. Statistical inference for Markov chains with applications to credit risk. Comput Stat 35, 1659–1684 (2020). https://doi.org/10.1007/s00180-020-00978-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-020-00978-0