Abstract

Conflict between channel members is of great interest to marketers given its presumed negative impact on the channel’s business performance. In a comprehensive meta-analysis of the empirical literature spanning six decades between 1960 and 2020, we observe channel performance is indeed negatively linked to channel conflict. However, we find that this conflict–performance link has evolved significantly over time, roughly in keeping with the growth and maturing of e-commerce technologies. Further, the damage caused by conflict appears to be more pronounced for channels with international operations, and for channels with greater dependency between channel members. Additionally, businesses in North America seem to suffer the consequences of channel conflict more than others. Our results also show several study characteristics related to measurement and sampling significantly impact the empirical conflict–performance links reported in the literature. We base our conclusions on correlational analyses, two-stage meta-analytic structural equation modeling (TSSEM), and meta-analytic regression analyses (MARA).

Similar content being viewed by others

Introduction

What is common between Apple, Cisco, Tesco, Kaufland and Unilever? While they operate in different product markets, have different business models, and serve different customer groups, they all suffer from channel conflict, which can be broadly defined as a consequential disagreement between members of the marketing channel. For instance, when Apple teamed up with Cisco for its enterprise sales, disagreements broke out with its channel partners with one pointing out that “its revenue from Apple products and services shrunk from 100 percent to less than 10 percent of its overall business over the past five years” (CRN 2015). Disputes over who should bear the cost of a weakening UK currency resulted in Tesco removing some Unilever products from its website and shelves, further aggravating the disputes between the two giant channel partners (Financial Times 2016). Differences over pricing prompted another retailer Kaufland, to remove more than 400 Unilever products from its portfolio, much to the latter’s resentment (Retail Detail 2018).

Such conflicts between channel members are not isolated, rather quite endemic to business relations. In a recent survey of grocery suppliers, 33% respondents complained their products were unfairly delisted during the peak of COVID-19 pandemic as retailers faced swings in consumer demand (The Grocer 2020). As much as 60% of the respondents of an IT industry survey reported increased instances of channel conflict, with 36% assessing such conflict significantly eroded their business performance (CompTIA 2013). Indeed, a secular expectation that channel conflict hurts business performance drives many companies to devote major resources to conflict management by designing systems and policies, dispute resolution, or arbitration/ litigation. But what evidence do we have of channel conflict’s impact? Our business ecosystem underwent big changes over the last few decades. Are companies better at managing conflict now? Are some channels better at handling conflict than others? Globalization meant much larger geographical footprints for many companies. How are they faring?

The practical significances notwithstanding, the answers to much of the above questions are unclear. In fact, the research literature is surprisingly ambiguous in terms of both empirical evidence as well as conceptualization of the conflict–performance link. We conclude this from a close examination of over one hundred empirical studies that studied channel conflict since the 1960s. The ambiguities span a wide range, including definitions of channel conflict, conceptualization of its effect on business performance, measures of conflict and performance, and even the empirical results pertaining to the conflict–performance links. These form the backdrop of our comprehensive meta-analysis of existing research, with “channel conflict” as the focal construct and its effects on business outcomes. Indeed, this responds to calls for a better accounting of the role of conflict in channels (Antia et al. 2013; Gilliland et al. 2010).

Specifically, we (1) estimate the aggregate evidence of channel conflict’s effect on business performance, and if the results are robust across individual and joint outcomes, as well as across different nomological networks of relational constructs such as satisfaction, trust, commitment, and interdependence; (2) examine if the conflict–performance relationship has evolved over the years; (3) check if the nature of channels affects the relationship, and (4) examine if the relationship is moderated by variation in study-specific factors such as measurement scales and sampling.

Studies of marketing channels span a diverse spectrum over time, and across different geographies and organizations. Variations in these might track differences in channel management practices and other contributing factors that determine how conflict impacts business performance. This variation will not be captured within a single study but, if it exists, will manifest itself in the context of a broader meta-analysis. Despite several meta-analyses in marketing channel studies (e.g., Geyskens et al. 1998, 1999; Palmatier et al. 2006; Scheer et al. 2015), channel conflict remains understudied using this method. This is an important gap given the mature literature on the topic. Thus, our study hopes to establish some key empirical generalizations and identify key boundary conditions of the results in the literature. To the best of our knowledge, ours is the first meta-analysis focused on channel conflict and performance.

One of our key contributions to the channel literature is, we integrate three different theoretical frameworks as part of our empirical analyses. This integration is done with channel conflict as the focal construct, thereby examining it within a broader nomological network than in the extant literature. Specifically, we adopt the Trust-Commitment (TC) and Interdependence (INT) models as our baseline frameworks (Kim and Hsieh 2003; Kumar et al. 1995, 1998; Morgan and Hunt 1994). We then draw upon Rosenberg and Stern’s (1971) Intra-Channel Conflict (ICC) model to synthesize the available empirical evidence in customized models combining ICC with TC (ICC-TC) and ICC with INT (ICC-INT). The multi-framework approach has several advantages. It allows us to go beyond bivariate correlations to estimate inter-construct relationships within different nomological networks and serves as robustness checks of our key results. Further, it allows us to study hitherto unexamined differences between models where channel conflict is an outcome versus where it is a mediator.

We find the aggregate evidence broadly supports a negative conflict–performance link and that this result is invariant to individual or joint channel outcomes as well as the different nomological networks. This offers robust empirical generalizability to results that report conflict damages performance (Crosno and Tong 2018; Jap and Ganesan 2000; Kumar et al. 1995). It is important to note that despite its intuitive appeal, the negative conflict–performance link has been questioned in the literature (Assael 1969; Brown et al. 1983). So, we conclude from our results that the natural variation in business performance is dominated by factors associated with channel conflict that reduce business performance.

Nevertheless, perhaps the most intriguing finding is conflict’s damaging effect has evolved over time, roughly in keeping with the growth and stabilization of internet technologies from the 90s to current times. In particular, channels suffered from conflicts increasingly over time till improvements in technology seem to have ushered in greater capabilities to handle them. To the best of our knowledge, we are the first to report this, and in doing so build on work that seeks to understand how businesses develop competencies for managing conflict (Kaplan and Sawhney 2000). This also addresses calls for a greater understanding of how digitization has affected channel outcomes (Frazier 1999; Hulland et al. 2007).

As a basis for the heterogeneity in resource commitments to conflict management, it seems intuitive that vulnerability to the damages of conflict will vary for different channel types. However, the aggregate evidence on this is unclear. In fact, we find greater intra-channel dependency inflates the negative impact of channel conflict. This complements the work of Palmatier et al. (2006), who shows conflict is more damaging when channels are characterized by greater dependency and power asymmetry, as in franchising arrangements. Similarly, we find the impact of conflict on performance appears to be amplified for international channel operations compared to domestic ones. This builds on Leonidou et al. (2014)‘s work on exporter–importer relationships, implicating the greater governance challenges and transaction costs of international channels. We also find channel conflict to be more damaging for North American businesses, possibly reflecting the cultural differences that drive relationship management practices across different jurisdictions (Rajamma et al. 2011).

Study design is a key issue for researchers. We offer the first empirical evidence that measurement and sampling characteristics affect the estimated conflict–performance link. This indicates the damaging effect of conflict may be over or under-stated in some research contexts.

In the rest of the paper, we first highlight the ambiguities that motivate this paper, followed by the research design. Data, empirical method, analyses, and results come next. We conclude by discussing the results, managerial implications, future research, and limitations.

Ambiguities in the literature

Despite common etymological roots, the literature varies in definitions of channel conflict. It has been seen through multiple lenses: manifest versus perceived, cognitive versus emotional (Rose et al. 2007), task-related versus affective (Lusch 1976; Jehn 1995; Rose et al. 2007), behavioral versus psychological (Duarte and Davies 2003) etc. Table 1 summarizes some of this. Our broad definition of channel conflict as a consequential disagreement between members of the marketing channel focuses on its role in business performance. The consequential nature of such disagreements derives from interdependency among channel members. Interdependency ties individual channel members’ economic well-being to each other, and thus, is a fundamental reason for disagreements when business incentives diverge (Lusch 1976). Substantively, our definition is similar to those used earlier in the literature but we keep it broad for the purposes of our study.

There are also big differences in how the conflict–performance link is interpreted in different research frameworks. These derive mainly from the separation presumed between conflict and business performance. One view finds resonance in a synchronic notion of conflict, where conflict concurrently reduces channel performance. The other view finds resonance in an asynchronous notion where conflict and performance while related, are separated from each other. For example, while some studies like Kumar et al. (1995, 1998), Palmatier et al. (2007), and Morgan and Hunt (1994) treat conflict as an outcome concurrent with that of performance, others explicitly decouple the two by considering conflict as a mediator and process (Pondy 1967; Frazier et al. 1989; Rosenberg and Stern 1970, 1971). For example, Pondy (1967) proposes five distinct episodes of conflict: latent, perceived, felt, manifest and aftermath (conflict’s effect on performance). These differences are a key motivator for our paper and impact how we aggregate the empirical evidence linking conflict to performance. These differences also offer diverging approaches to assess firm objectives in addressing conflict, the nature of conflict itself, and of course, prescriptions on managing conflict. Table 2 summarizes these differences between the two views.

Nevertheless, the literature also shows signs of ambivalence towards these characteristics. This is evident in the matter of conflict as process versus outcome. For example, in Cordell (1989) conflict is considered an outcome of the exchange processes as well as a process in itself. Conflict as a positive or negative phenomenon offer another contradiction. While most studies consider conflict to be negative, studies that focus on the positive effect of conflict seem to position it as an anchor for mutual improvement via conflict resolution (cf. Assael 1968). The role of ex-ante design versus ex-post adjustments to manage conflict is also at issue; e.g. Lumineau and Malhotra (2011) offer rights versus interests based designs as ex-ante approaches to reducing conflict, while stating ex-post cooperation determines the functionality of conflict.

Predictably, the conceptual multiplicity leads to multiple measures of channel conflict. Latent conflict is generally measured with constructs such as goal incongruency, domain dissensus, etc., while conflict outcomes and aftermath are measured in terms of manifest (task and behavioral) and/or affective outcomes such as performance, satisfaction and dissolution (Etgar 1979).

Similar multiplicities exist even in the measures of business performance (cf. Katsikeas et al. 2016). Not only is the literature quite fragmented in terms of the scales used (e.g., subjective versus objective, latent versus manifest, separate versus aggregate), but is also divergent in terms of the locus of performance measures (e.g., operational as in Luo et al. 2009, versus organizational as in Ross et al. 1997). In particular, the literature also diverges on individual firm (channel member) performance (Brown et al. 1983; Lusch 1976) versus joint (channel) performance (LaBahn and Harich 1997; Webb and Hogan 2002).

The heterogeneity in perspectives and the resulting ambiguities carry over to the assessment of the relationship between channel conflict and business performance. While most studies show conflict hurts performance (Jap and Ganesan 2000; Kumar et al. 1992, 1995; Ross et al. 1997), others differ (Assael 1969; Brown et al. 1983). Rosenbloom (1973) proposes an inverted U-shaped curve, where conflict is functional at moderate levels and destructive at the extremes. Brown (1980) extends the non-linearity where an upright U-shaped curve is followed by the inverse U-shaped curve. Others separate functional from dysfunctional conflict to model how conflict affects performance positively or negatively (Morgan and Hunt 1994).

The widespread and ongoing internet and digitization influenced changes in the marketing ecosystem also amplify the ambiguities discussed above. The channel conflict literature dates back to the 1960s, and while the number of studies on channel conflict has dropped in recent years (Watson et al. 2015), the innovations in marketing channels continue unabated with growth in e-commerce, omni-channels, and sharing platforms. These bring new expectations, and transactional norms in place, forcing channel partners to adapt, and calling into question whether the relation between channel conflict and business performance also changed with time.

The baseline theoretical frameworks

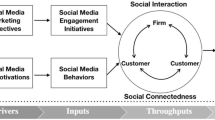

Estimating the aggregate evidence of the channel conflict–performance link requires a sufficiently large number of empirical studies that use channel conflict and performance, and overlaps in the network of relations to control for other factors. The primary frameworks to understand drivers of channel performance are: (1) Trust-Commitment (TC), (2) Interdependence (INT), (3) Transaction Cost Economics, (TCE), and (4) Relational Norms (RN) (Heide and John 1990; Hibbard et al. 2001; Morgan and Hunt 1994; Palmatier et al. 2007). These focus on different drivers of performance. For example, Morgan and Hunt (1994) propose trust and commitment as primary drivers, while Hibbard et al. (2001) suggest interdependence among channel members. A comprehensive review of the literature leads us to conclude that it is primarily the studies based on the TC and INT frameworks that include channel conflict as an explicit construct. Studies based on TCE and RN base much of their theory on channel conflict but tend to not include it in explicit terms.Footnote 1 Therefore, we focus on the TC and INT studies that have channel conflict as an outcome (Kumar et al. 1995; Morgan and Hunt 1994; Palmatier et al. 2007). We identify a third framework: Rosenberg and Stern’s (1970, 1971) Intra-Channel Conflict (ICC). This framework draws inspiration from Pondy’s (1967) classic article and models conflict as a mediator, and as part of a process with three elements: sources, level and outcomes of conflict. All three frameworks offer results linking channel conflict to channel outcomes, albeit in different forms. While TC and INT link conflict to relational channel constructs such as satisfaction, trust, commitment and interdependence, ICC sees conflict as a driver of business performance. We now briefly describe the three frameworks and in Table 3 summarize the role of conflict in each.

The trust-commitment (TC) perspective

This perspective proposes that relationship performance in a channel is determined by the level of the buyer’s trust in and/or commitment to a seller (Morgan and Hunt 1994). Initiating, maintaining and avoiding conflicts in the inter-firm interactions are considered key endeavors of channel members (Balliet and Van Lange 2013). Trust is modeled as affecting conflict, directly or indirectly through commitment. Trust is defined in multiple ways, with Morgan and Hunt’s (1994) definition, “confidence in an exchange partner’s reliability and integrity” (p. 316) being quite relevant to our context. However, despite their multiplicity, most definitions of trust revolve around expectations, predictability, and confidence in other’s behavior (Balliet and Van Lange 2013), which allow comparisons in our aggregate approach. Commitment, on the other hand, is more about expectations of relationship continuity. Moorman et al. (1992) define commitment as “an enduring desire to maintain a valued relationship” (p. 316). Dwyer et al.’s (1987) definition of relational continuity in inter-firm relationships is also similar. The exchange outcomes, conflict and cooperation are positively affected by trust and commitment if both parties act in a way that leads to the satisfaction of the exchange partners (Hibbard et al. 2001). Zaheer et al. (1998) also show that trust reduces the intensity of conflict, encouraging both parties to initiate cooperation (Deutsch 1958). Panel (a) of Fig. 1 represents the traditional TC framework.

The interdependence (INT) perspective

This perspective derives from the inter-firm power and conflict paradigms. The key motivator is the interdependence of channel members in performing channel tasks (Kim and Hsieh 2003; Kumar et al. 1995, 1998). Interdependence and drive for autonomy provide motives for both cooperation and conflict (Van De Ven and Walker 1984). The more interdependent the parties, the higher their motivations to resolve their problems and converge on mutual interests. Thus, interdependence mediates the effect of trust and commitment on conflict, which is seen as a consequence of interdependence (Zhou et al. 2007). Jap and Ganesan (2000) show that interdependence (mutual or dyadic) plays a critical role in predicting inter-firm conflicts. Studies such as Frazier and Rody (1991), Kumar et al. (1995) also investigate the role of interdependence in channel conflict. The broad findings of these studies are that interdependence positively affects the exchange outcomes because both parties are eager to maintain the relationship and resolve conflict (Hibbard et al. 2001). Nevertheless, the empirical results are not unequivocal, for others show interdependence increases conflict (cf. Brown et al. 1983; Frazier et al. 1989). Panel (b) of Fig. 1 shows the traditional Interdependence (INT) framework.

The Intra-Channel Conflict (ICC) perspective

Rosenberg and Stern’s (1971) ICC model presents channel conflict as a mediating variable, a counterpoint to both TC and INT, where it is primarily an outcome of the channel process (Palmatier et al. 2007). Conflict in ICC is seen as part of the process with three elements: sources, level, and outcomes of conflict (see panel (a) of Fig. 2). Typical antecedents of conflict investigated are goal incompatibility, drive for autonomy, and interdependence, while outcomes studied include satisfaction and financial performance (Brown 1980; Lusch 1976). The overlapping set of variables with that of TC and INT offers an opportunity to compare the aggregate empirical results on conflict and its link with channel outcomes.

To study the causal relationships between key drivers of performance, we synthesize ICC with TC and INT.Footnote 2 The customized models, ICC-TC and ICC-INT are in Fig. 2 panels (b) and (c), respectively. In ICC-TC, Trust, Commitment, and Conflict are mediators. In ICC-INT, Interdependence, Commitment, and Conflict are mediators. Outcomes in both models are satisfaction (attitudinal) and performance (economic). These models allow us to estimate the conflict–performance link and also test robustness of the results across the different frameworks. Table 4 summarizes the predicted relations between conflict and the relational constructs.

Research hypotheses

We start with our baseline predictions, followed by hypotheses for the moderating factors.

Channel conflict–performance link

With rare exceptions (cf. Assael 1969; Brown et al. 1983), most studies report channel conflict decreases business performance (cf. Crosno and Tong 2018; Jap and Ganesan 2000; Kumar et al. 1992, 1995; Ross et al. 1997), largely viewing conflict as efficiency depleting. We take this as our baseline prediction. However, while some studies focus on individual firm performance (Cronin and Morris 1989), others consider only joint channel performance (Chang and Gotcher 2010; Webb and Hogan 2002). Yet, individual outcomes can come at the cost of joint outcomes, or vice versa (Benton and Maloni 2005). Unfortunately, the conceptual arguments for this are not settled yet, and since very few empirical studies investigate both outcomes together, sorting between them is difficult. So, we treat the issue of individual versus joint outcomes as an empirical question.

Moderating hypotheses

Rational channel members will use a cost-benefit calculus in their intra-channel behavior (Frazier and Rody 1991; Tanskanen 2015). This calculus will logically be affected by factors such as the business context of the prevailing era as well as channel characteristics identifying what and how the channels function. For example, while some channels perform a straight resale function, others are value-added resellers; dependency is high in some channels (e.g. franchises), while others are more independent; some operate in highly heterogeneous regulatory regimes (e.g. international); even the cultural context can differ. At the same time, research methods, such as measurements and sampling can also impact the estimated conflict–performance links due to variation in factors such as social construction of experience, perceptions and response biases. These moderating influences can only be observed in a meta-analysis (Kang et al. 2018), and to the best of our knowledge, remain unexplored in the literature. In the following paragraphs, we discuss these in turn.

Time period

The advent of the Internet in the 90s heralded genuinely massive changes in marketing channels through the growth of e-commerce (Weis 2010). In particular, the ability of manufacturers to disintermediate their resellers and sell directly to consumers created potential for progressively intense conflict as resellers faced an increasing prospect of competing against their own suppliers (Frazier 1999; Hulland et al. 2007). As channels dealt with this change, the distraction from the usual rhythm of business naturally impacted business performance negatively. At the same time, technology also infused more capabilities into channel management by making information sharing, monitoring, and conflict resolutions easier. Indeed, a value proposition of e-commerce is making the process of demand generation and procurement to demand fulfillment more seamless (Kaplan and Sawhney 2000). Once the channels developed their capabilities to deploy these resources appropriately, they would be better able to manage conflict and its negative impact. Using 1991 as the threshold year for the start of Internet, and 2005 as the threshold year for maturing of the capabilities, we provide the following two hypotheses:

-

H1a:

The negative conflict–performance link will be stronger post-1991 than pre-1991.

-

H1b:

The negative conflict–performance link will be weaker post-2005 than in 1991–2005.

Channel characteristics

Reseller and VAR channels

Vertical marketing channels are dominated by two distinct arrangements. In a reseller channel, a manufacturer sells an end-product through resellers or dealers. Mostly, they serve the same end customer segment. In a value-added reseller (VAR) channel, the reseller will enhance the product or service procured from the supplier, for sale to its own end customer segment. The channel interdependencies are quite different. With both members serving the same segment (as in resale channels), the potential for conflict, its consequences, and the resource commitments to manage it will be higher—presenting a greater strain on performance. Thus, we propose that the negative impact of conflict will be stronger for resale compared to VAR channels:

-

H2:

The negative conflict–performance link will be stronger for resellers than VAR channels.

Agency relationships

Palmatier et al. (2006) show that conflict is more damaging when the level of dependence is high in the channel. In industrial channels, members usually have alternative suppliers and buyers, reducing their level of dependency on each other. On the other hand, channels such as franchises and dealerships are marked by strong principal–agent relationships, typically linked with high levels of dependency and power asymmetry. For example, Burger King franchisees depend on the corporate office for daily outlet operations, procurement, and advertising. Hunt and Nevin (1974) show that in such high dependency settings, more powerful channel members are more likely to use coercive powers—which leads to more intense conflict (Johnston et al. 2018). On the other hand, non-coercive strategies are more likely when there is symmetry of power, leading to less intense conflict (Johnston et al. 2018). Thus,

-

H3:

The negative conflict–performance link will be stronger for channels with stronger agency relations.

International vs. domestic channels

Channels that operate internationally have to deal with differences in language, legal systems, and organizational norms (Leonidou et al. 2006) that are largely homogenous for exclusively domestic operators. Any divergence of opinions, perceptions and understandings due to such differences are compounded by geographical separation, fluctuations in exchange rates, foreign government regulations as well as the physical movement of the products across countries (Zhang et al. 2003). The net effect is greater complexity and uncertainty. So, not only are there more possibilities of conflict, but managing conflict itself is more challenging compared to domestic channels, and likely invite greater allocation of resources to their resolutions. Thus, we expect conflict to be more consequential for international channels.

-

H4:

The negative conflict–performance link will be stronger for international channels than for domestic ones.

North America vs. other

Differences in cultural norms such as individualism (vs. collectivism), high power distance (vs. low power), and short-term orientation (vs. long-term) lead to different relationship management practices in North American firms versus others elsewhere (Rajamma et al. 2011). In particular, compared to the North American culture, other cultures, such as Japanese and Chinese, put more emphasis on relationalism, harmony, and conflict avoidance (Yen et al. 2007). This conflict avoidance is dominated by a desire to limit the harm conflict can cause to the collective enterprise. Such conflict avoidance being a relatively less dominant theme in North American cultures, we expect conflict to have a stronger negative impact there. Thus,

-

H5:

The negative conflict–performance link will be stronger for North American channels than for non–North American ones.

Measurements and sampling

Subjective vs. objective measures of performance

Many empirical studies deploy key informant surveys. Since these responses can be laden with implicit theories and socially constructed perceptions, collecting both dependent and independent variables from the same source could lead to common method bias (CMB). When subjective measures of performance are used, we expect this will amplify the negative impact of conflict on performance (Kang et al. 2018). On the other hand, objective measures, often collected from independent archival sources, are less prone to CMB. Objective measures may also tap into other unobserved processes that generate the data, diluting the impact of conflict on such measures. Thus,

-

H6:

The negative conflict–performance link will be weaker for objective performance measures than for subjective ones.

Relative vs. absolute measures of performance

Performance is measured in absolute terms in some studies (Webb and Hogan 2002), but in relative terms in others, comparing current to past outcomes, outputs to inputs (e.g., ROI), and to those of rivals or industry average (Katsikeas et al. 2016; Brown et al. 1983). In line with Anderson and Narus (1984) that firms’ expectations of their own channel performance are based on that of other similar channels, we expect relative measures will capture the underlying impact of conflict more, compared to absolute measures. Thus,

-

H7:

The negative conflict–performance link will be stronger for relative measures of performance than for absolute measures.

Latent vs. separate vs. aggregate measures of performance

Three conceptual approaches outline measures of performance (Miller et al. 2013). As a latent construct, it is an abstract, superordinate phenomenon, modeled as shared variance among its components (Katsikeas et al. 2016). As a separate construct, it is seen as composed of several components, researchers usually picking one to measure. As an aggregate construct, it is a mathematically combined measure of various dimensions. We contend that a “separate” measure of performance could end up underestimating the true impact of conflict by missing a key component that is negatively impacted by conflict (Katsikeas et al. 2016). Conversely, the broader latent (shared variance) or aggregate approaches are more likely to incorporate dimensions that bear the impact of conflict. Hence,

-

H8:

The negative conflict–performance link will be stronger for latent or aggregate compared to separate conceptualizations of performance.

Affective vs. manifest conflict

Affective conflict reflects itself in emotions such as anger, antagonism, and personality clashes (Palmatier et al. 2007). Manifest conflict reflects in disagreements over channel activities or a combination of affective and manifest task-related dimensions (Brown et al. 1983; Lusch 1976). In line with arguments that purely emotion-driven conflict is more damaging (Jehn 1995; Rose et al. 2007), we hypothesize:

-

H9:

The negative conflict–performance link will be stronger for measures of affective than for measures of manifest conflict.

Multi-industry vs. single-industry studies

Multi-industry studies have higher levels of variability than single-industry studies. More targeted measures for the specific industry can also be developed for single-industry studies (Wowak et al. 2013). We expect the conflict–performance link for multi-industry studies will be weaker due to this higher variability (Johnston et al. 2018).

-

H10:

The negative conflict–performance link will be weaker for multiple-industry studies than for single-industry ones.

Focal firm vs. cross-sectional samples

Studies that comprise data from a sample of independent channels hold greater variability in the conflict management practices compared to studies that comprise data from channel members of one focal firm (i.e., supplier, buyer, reseller, etc.). The relative homogeneity of conflict management practices in the latter sample portends a higher level of effectiveness compared to a more heterogeneous sample. Thus,

-

H11:

The negative conflict–performance link will be weaker for focal firm samples than for multi-firm ones.

Research design

We first identify the overlapping common constructs in the empirical studies that predominantly employ the TC or INT where conflict is an outcome, and then “customize” the two models by modeling conflict as a mediator to performance, as per the ICC framework. So, we have two pairs of related models: (1) TC and the customized TC model (ICC-TC); (2) INT and the customized ICC model (ICC-INT). While we do not need all the models to estimate the conflict–performance link per se, the overlapping constructs across the three base frameworks allow us to estimate the link across different nomological networks, controlling for several related constructs. This provides greater robustness to the relationships we estimate. For example, we can test whether shifting the role of conflict from an outcome to a mediator would change the nature or valence of its relations with other key variables such as trust and interdependence. See Figs. 1 and 2.

Data

We conduct a detailed bibliographic search of all empirical studies appearing in marketing and management between 1960 and 2020 that report relationships between channel conflict and other channel constructs. We search multiple search engines: ABI/INFORM, Google Scholar, and Social Sciences Citation Index, as well as the following journals: the Academy of Management Journal, Journal of Marketing, Journal of Marketing Research, Journal of the Academy of Marketing Science, Journal of Retailing, Management Science, Marketing Science, Organization Science, Strategic Management Journal, and the Proceedings of the Academy of Management and American Marketing Association. We look for terms such as conflict and dispute that convey conflict. Then we select studies that study conflict in vertical marketing channels. Typical examples of such channels will be Dealerships, Retailing, Franchise, Distribution, etc. We exclude cases of conflict in horizontal arrangements, e.g., product development joint ventures. We identify more studies by checking the references in the selected articles. To avoid the “file drawer problem” (Rosenthal 1979), we search the UMI Dissertation Abstract for relevant doctoral dissertations. We request several authors for correlation tables and other statistics not reported in their published studies and also seek unpublished studies by posting on ELMAR, a listserv for marketing scholars.Footnote 3

Sample

We identify 92 empirical studies comprising 120 samples (aggregate N of 23,693) and record a total of 371 correlations for 25 channel and inter-firm constructs, including conflict. Since we need at least three correlation coefficients for each pair of constructs for our structural equation modeling (Palmatier et al. 2006; Scheer et al. 2015), we exclude constructs with less than three correlations with other included constructs (e.g., cooperation, interdependence asymmetry, etc.). This retains 219 out of the 371 correlation coefficients collected.Footnote 4

Variables

Following Geyskens et al. (1999), we cumulate similar constructs to generate our variables. The final sample includes six usable constructs: conflict, trust, commitment, interdependence, satisfaction, and performance. In addition, we create several other variables for robustness checks, moderation analyses and controls, as described below. All details are in the Web Appendix.

We separate performance into individual firm and joint channel performance for our causal model and categorize them into objective and subjective measures for moderation analysis. Overall, we have 26 objective and 67 subjective measures of performance. Objective measures of performance (coded 1) include accounting-based and capital market-related ones such as the percentage of profit, sales growth, and return on asset. Subjective measures (coded 0) include any perceptual measures (e.g., using survey data with scales similar to Likert). We also use the framework provided by Katsikeas et al. (2016) to classify studies based on how performance is modeled theoretically and empirically (latent, separate, or aggregate constructs) and the reference used to measure performance (absolute and relative—temporal, inputs, or competition).Footnote 5 We also classify studies on whether they measure manifest task conflict, affective (emotional) conflict, or both; unfortunately, there weren’t enough correlations for this to be used in the causal model.

To capture the evolution of the conflict–performance link, we look at three variables: (1) Year, the year in which the study was published. If there were a specific impact of time on the relationship, this would capture it. (2) Year-1991, a dummy variable, 0 if the study is before 1991, 1 if it is after; 1991 is when the World Wide Web (www) project, the precursor to the emergence of the e-commerce platforms, went public (Weis 2010). This would enable us to check if there was a difference in the conflict–performance relations before and after 1991. (3) A categorical variable that tracked if the research was published before 1991 (Pre-1991), between 1991 and 2005, or after 2005 (Post-2005). The fifteen years between 1991 and 2005 were taken as a long enough time for industries to have appropriately deployed the evolving capabilities of digitization.

For channel characteristics, we code the following variables: (1) Reseller (1 if channel only resales to another party; 0 if channel sales to a final user after value addition). (2) International (1 if channel is international, e.g., export-import; 0 otherwise, i.e., domestic). (3) Agency (1 if there is a clear principal-agent dependency relation common in many channels such as franchising, and dealerships; 0 if that dependency is absent). Dependency in the first group is high (the agents—franchisees, dealers, resellers, etc.—often cannot make decisions independently from the principal), compared to other channels (e.g., VAR channels of industrial buyers and customers). (4) North America (1 if study channel is North American, 0 otherwise).

For study characteristics related to sampling, we code the following: (1) Multi-industry (1 if study sample is multi-industry; 0 if single). (2) Focal (1 if data is from channel members of one focal firm, often the firm sponsoring the study; 0 otherwise, i.e., data from independent firms). We also code whether the data collection is self-administered (coded 1), or it is collected directly from managers (coded 0). If the data collection is conducted directly, managers may be driven by desirability bias to exaggerate performance and discount conflict. We also use two dummy variables to record if the study data is from upstream (seller, supplier, manufacturer, etc.), downstream (buyer, dealer, reseller, etc.) or both sides.

Method

Our key empirical tools for this study are pair-wise correlation analyses, Two-Stage Meta-Analytic Structural Equation Modeling (TSSEM), and Meta-Analytic Regression Analysis (MARA), a type of weighted least squares regression. The TSSEM technique (Cheung and Chan 2005) combines traditional meta-analysis with structural equation modeling (SEM) and allows us to compare different frameworks. One popular combined approach is the Meta-Analytic SEM (MASEM) method of Viswesvaran and Ones (1995). Our choice of Cheung and Chan’s (2005, 2009) TSSEM method for the analyses is largely motivated by their discussions of the advantages of TSSEM over MASEM. We use a mixed effect MARA (Lipsey and Wilson 2001) for the moderation analyses.

Analyses and results

Our main goal is to estimate the aggregate relations between the key constructs. Before moving to this, we briefly address some key data and measurement challenges of the analyses.

Data integrity and study precision

To test for publication bias in our study, we follow the “failsafe N” tests of Rosenthal (1979) and Orwin (1983), as well as the “funnel plot” test of Rothstein et al. (2006). These tests failed to reject the null hypothesis of no bias. Following Hunter and Schmidt (1990), we convert Student’s t and F ratios to correlation coefficients. We examine the independence of studies (i.e., when multiple studies use the same sample) following Wood’s (2008) method. To identify outliers, we calculate the sample-adjusted meta-analytic deviancy statistic (SAMD) (Huffcutt and Arthur 1995).

We compute the correlations corrected for reliabilites (Hunter and Schmidt 1990), and compute z-values (Fisher’s Z score), “transformed-back correlation r,” and the Q-statistic. We also calculate the I2 heterogeneity index that indicates the proportion of total variation in the pooled effect sizes due to heterogeneity among the studies (Higgins and Thompson 2002). To check if the correlations vary systematically across studies, we model the variation using a random-effects (RE) parameter. (See Table 5 for most of the relevant statistics. More details are in Web Appendix A.)

We present the results in three parts. First, we report results relating conflict to performance and the relational channel constructs. We combine individual and joint performance and use subjective measures of performance for this (we did not have enough correlations to run similar analyses with the objective measure). Next, we separate individual and joint performance. We then conduct the moderation analyses, first by collating both subjective and objective measures of performance, and then checking for robustness using only the subjective measures.

Correlation analysis

Table 5 reports the different observed and calculated correlations. Inferences here are drawn from the significance and sign of the correlations. The conflict–performance correlation is significantly negative. Correlations of conflict and other relational constructs—satisfaction, interdependence, trust and commitment are also significantly negative. While we use subjective measures of performance for the bulk of our analyses, to check the robustness of the results, we created an overarching measure of performance combining available objective measures (Performance(c)). We find this overarching measure is also significantly negatively correlated with conflict. These indicate preliminary support for the baseline prediction.

Two-stage SEM (TSSEM)

The correlation analyses do not allow us to infer how the constructs are related within a nomological network. Therefore, we used the TSSEM procedure of Cheung (2014) to analyze the relations in more detail. The first stage of this analysis draws upon the data integrity checks (in particular, whether to use an RE or FE model) to estimate an asymptotic covariance matrix (ACM) from the pooled correlation matrix (Cheung and Chan 2005). The second stage uses this ACM and the aggregated sample size of all studies to conduct the SEM analysis. While our primary motivation is to assess the conflict–performance relation, SEM analysis allows us to compute path coefficients for the other inter-construct relationships as well. We first report on model fit, and then the detailed findings relevant to the relationships of conflict with performance and other relational constructs. We do not pose any specific directional hypotheses for the latter, but for comparison and robustness checks, report the canonical directional hypotheses in Table 6.

Model fit

There are five key models we estimate (see Table 6). Models 1 and 3 are the original Trust Commitment (TC) and Interdependence (INT) models, respectively. Models 2, 4, and 5 are the customized Intra-Channel Conflict (ICC) frameworks that are key to our analyses for this section. Model 2 is the customized ICC- Trust Commitment model (ICC-TC). Models 4 and 5 are the customized ICC-Interdependence models (ICC-INT) with full and partial mediation, respectively. We compute the goodness-of-fit indices (TLI, CFI, and RMSEA) and the path coefficients using Cheung’s (2014) procedure. TLI measures parsimony of the model; CFI measures relative fit; RMSEA measures absolute fit. Models with RMSEA values less than 0.05 and CFI and TLI of at least 0.90 indicate a very good fit with the data (Hu and Bentler 1999). For model estimation, we use the Weighted Least Squares (WLS) method.

The fit indices of all the three models (2, 4, and 5) exhibit very good fit to the related meta-analytic data (Model 2, ICC-TC: TLI = .774; CFI = .955; RMSEA = .010; Model 4, ICC-INT, full mediation: TLI = .707; CFI = .863; RMSEA = .011; Model 5, ICC-INT, partial mediation: TLI = .700; CFI = .900; RMSEA = .012). While the TLI and CFI fit indices of Model 2 (ICC-TC) are higher than those of Models 4 and 5 (ICC-INT), the RMSEA of the three models are close to each other. Note that goodness-of-fit indices (e.g., TLI) for SEM methods such as WLS tend to be lower than SEM methods such as maximum likelihood (Cheung and Chan 2005). We use the OpenMx and metaSEM packages of R (version 3.1.3) for the SEM analyses (see Cheung 2014).

Conflict and performance

We find conflict and performance are negatively related, as in the correlational analysis. From Table 6, in Model 2 (ICC-TC), the conflict–performance coefficient is significantly negative (β = −.120, p < .05). The result is robust to alternate model specifications since in both Models 4 and 5 (ICC-INT, full and partial mediation), the relevant coefficients are also significantly negative (β = −.135 and β = −.134 respectively, p < .05).

Different nomological networks

As in the correlational analysis, we find conflict is negatively related to the relational variables of satisfaction, trust, and commitment. These results are robust across Models 2 (ICC-TC) as well as 4 and 5 (ICC-INT). The signs are consistent with the canonical hypotheses, thus, attesting to the nomological validity of our frameworks. For example, the conflict-satisfaction coefficient is negative for Model 2 (ICC-TC) (β = −.183, p < .05) as well as for both Models 4 and 5 (ICC-INT, Full and Partial) (β = −.203, and − .201 p < .05). Trust and commitment are positively related in all the three models (Models 2, 4, and 5: β = −.607, p < .05). Both are positively related to satisfaction and performance in most models.

Individual vs. joint channel performance

In the correlation and TSSEM analyses above, we pool both individual and joint performances together. So, after separating individual from joint performances, we run the analyses separately for each measure.Footnote 6 The results of the pairwise correlational analyses are in Web Appendix D (Table D1). Conflict is correlated significantly negatively to both individual and joint performance. Correlations of Satisfaction, Interdependence, and Trust are all significantly positive with both performances. Commitment is correlated positively only with individual performance (not enough data to check joint performance). Overall, the results mirror the earlier ones, attesting to their robustness. Following the correlational analyses, we run the TSSEM estimations separately for individual and joint performances. While we lose some variables in the process (e.g., we had to drop commitment for the models with joint performance), all models exhibit good fit (see Table D5 and Table D6 in Web Appendix D).

The path coefficients for conflict- individual performance (see panel [a] of Table D2 in Web Appendix D), are negative and significant for Model 2, ICC-TC (β = −.081, p < .05), Model 4, ICC-INT, Full mediation (β = −.092, p < .05), and Model 5, ICC-INT, Partial mediation (β = −.092, p < .05). Similarly, the corresponding path coefficients for conflict- “joint” performance (Table D2 panel [b]) are also all negative and significant (β = −.088, −.095, and − .095, p < .05). With minor changes and omissions due to missing data, the directional results relating to the different relational variables also remain largely unchanged to the consideration of individual versus joint performance. These suggest that the aggregate relations, in particular the negative conflict–performance link, is robust to consideration of the two performance types. Moreover, the relative invariance of the results between TC and INT models, even under this more granular test, suggests further robustness of our key empirical results.

Moderation analyses

We now investigate the moderators of the estimated conflict–performance link starting with the impact of time, then considering channel characteristics, and study factors. In Table 5, the significant Q statistics for both the conflict –performance(s) link (Q = 3404.7441, df = 66) as well as the conflict –performance(c) link (Q = 4058.872, df = 92) suggest heterogeneity in the estimated links, attesting to the appropriateness of moderation analyses. For estimation, we use the mixed effect meta-analytic regression analysis (MARA) (Lipsey and Wilson 2001), first with the combined (subjective and objective) measure of performance and then with just the subjective measure to check the robustness of our results. See Table 7 for results of our moderation with the combined performance measure. The results for the subjective measure are in Web Appendix E, models B-Table E1.

We first run the benchmark, constant only models, separately for the combined and subjective performance (Models A1 and B1). Both show a negative (significant) intercept (conflict–performance link). We then run different models with variables pertaining to time, channels, measurement, and sample. Other than the two performance-related variables (latent and aggregate), two time-related variables (Pre-1991 and Post-2005), two conflict-related variables (manifest and combined), the interpretation of the other coefficients are fairly straightforward. A positive (negative) coefficient suggests weakening (strengthening) of the estimated negative conflict–performance link.

Evolution of the conflict–performance link over time

We run several models to check if the conflict–performance link changes over time. First, we only use the variable Year in models A6, A9, B5, and B8. The coefficients are significantly negative in all, showing that the conflict–performance link has become more negative over time, indicating a worsening impact of channel conflict on performance. To check if the advent of the internet-based commerce has a bearing on this, we run a second set of models (A7, A11, B6, and B10) with the dummy variable Year-1991. The coefficients of this variable were significant and negative in all models, indicating that the conflict–performance link in the post-1991 period is more negative than pre-1991 and that conflict has a more negative impact on performance after the advent of the internet-based commerce. These results support H1a.

In the last set of models, we investigate if part of the worsening conflict–performance link could be due to the newness of internet-based commerce and the inability of firms to properly deploy the evolving technologies to generate and capture value in their channel relationships. In that case, one would expect the worsening impact would be slowed, if not reversed, once a sufficiently long time has passed, allowing firms to learn and adapt. For this, we include two dummy variables in the model: Pre-1991 and Post-2005 (models A8, A10, B7, and B9). The coefficients are to be interpreted with respect to the base period 1991–2005. The significant and positive coefficients of Pre-1991 in all models suggest that the conflict–performance link in the pre-1991 period is less negative compared to the period in 1991–2005. This is consistent with the earlier results that suggest the link is more negative post-1991 than pre-1991. The coefficient of Post-2005 is significantly positive in models A8 and B7. This offers partial support for H1b that the conflict–performance link is less negative in the post-2005 period compared to the 1991–2005 period and is consistent with the notion that emerging industry-wide capabilities to deploy internet technologies can blunt some of the sharp negative consequences of conflict in channels.

Channel characteristics

The moderating role of channel characteristics returns mixed results. The coefficients for Reseller are not significant, so, no support for H2. On the other hand, the significantly negative coefficients of Agency (models A9-A11, B8, B10) suggest channels with greater dependency, such as franchisor-franchisee, exhibit stronger negative conflict–performance links, supporting H3. This indicates that conflict is more damaging when such dependence is high in the channel (Palmatier et al. 2006). The coefficients of International are all negative (models A9-A11, and B8-B10), i.e., channels with international transactions such as export-import exhibit a stronger negative conflict–performance link compared to domestic operations, supporting H4. This indicates that greater governance challenges of international operations inflate the transaction costs of channel conflict, thereby hurting performance. The coefficients of North America are largely negative (models A9, A11, B8, and B10), i.e., the negative conflict–performance link is stronger for studies based on US/Canadian samples, offering support for H5. This indicates the possibility that cultures in firms outside North America, such as in Asia, who put more emphasis on relationalism, may blunt the negative impact of conflict.

Measurement and sampling

To check if differences in measures of performance is a key moderator, we use several dummy variables. The coefficient for the dummy variable Objective is positive in model A2, consistent with H6 that CMB inflates the negative impact of conflict for subjective measures more than objective ones. However, the evidence is weak since it is not significant in the other models. We find no significant effect for Referent, which indicates when performance is measured against some criteria (such as past performance or competitors’ performance, as opposed to an absolute measure), in models A4, A9–11, B3, and B8–10—thus, H7 is not supported. For the dummy variables, Latent and Aggregate we find significant and negative effects in all models except A3 and B4 (for Latent) and B2 (for Aggregate). So, overall, when performance is measured as either Latent or Aggregate constructs, the estimated conflict–performance link is more negative than when performance is measured based on the “separate” approach (base). This is consistent with H8. To check if manifest or affective dimensions of conflict affect the conflict–performance link, we use the dummy variables Manifest and Combined. None of those coefficients are significant (models A5, A9-A11, B4, and B8-B10). Thus, we find no support for H9.

Coefficients of Multi-industry are positive and significant in all models (except B10), indicating the conflict–performance link is weaker for study samples that include multiple industries (support for H10). With multiple industries in the sample, there is more heterogeneity, possibly diluting the strength of the relationship between conflict and performance. The coefficients of Focal are also largely significant and positive (models A9-A11), indicating studies with a focal firm report weaker conflict–performance relation (support for H11). This is consistent with the idea that the relative homogeneity of conflict management practices in a sample comprising a focal firm (as opposed to multiple independent channels) may accentuate the effectiveness of these practices in the estimated results, weakening the conflict–performance link.

Among the control variables pertaining to data collection procedures, we find no support for self-administration as well as if the constructs are measured from seller’s (or buyer’s) perspectives. However, the coefficient of the dummy variable Dyadic is positive and significant (at p < .1) in models A10 and A11, indicating dyadic studies return a weaker negative conflict–performance link than studies with one-sided data (e.g., buyer). Since dyadic measures are more appropriate for dyadic constructs like conflict or performance, this might suggest these measurement errors overestimate the negative conflict–performance link.

Post-hoc analysis

To compare the two different roles of conflict—as a mediator vs. as an outcome—we use the TSSEM results in Table 6. There are two key comparisons: (1) between the original TC model where conflicts is an outcome (TC, Model 1) vs. the customized TC model where conflict is a mediator (ICC-TC, Model 2), and (2) between the original INT model where conflict is an outcome (INT, Model 3) vs. the customized INT model where conflict is a mediator (ICC-INT—Full and Partial mediation, Models 4 and 5). We compare the models first with a combined performance measure and then check robustness of the results by conducting the comparisons separately for individual and joint performance. In addition to TLI, CFI, and RMSEA statistics, we used the Akaike Information Criterion (AIC) for our comparisons. Lower AIC indicates higher parsimony and fit. In all the comparisons, models with conflict as a mediator (ICC-TC and ICC-INT) exhibit a better fit than the corresponding original (TC and INT) models. More details are in Web Appendices C and D.

To conclude this section, we find the aggregate conflict–performance relation is negative in our causal models; and that this result is robust to different analyses, model specifications, and locus of performance measures (individual or joint). However, when we control for sample, measurement scales, and channel characteristics, this significant effect fades away in some models. We find that conflict is negatively related to the relational variables of trust, commitment, and satisfaction. These results that are robust across different specifications, and in their consistency with the canonical hypotheses, attest to the nomological validity of our frameworks. We observe models with conflict as a mediator fit the data better than models with conflict as an outcome. We find strong evidence of the evolution of the conflict–performance link in keeping with the evolution and maturing of internet technology—initially getting more negative over time, but less so later. We find evidence that the conflict–performance relation is moderated by whether the channel is international, strongly dependent, and North American. We also find whether performance is measured objectively or subjectively, or as a Latent, Aggregate, or Separate construct, moderates the relation. Whether the study sample comprises multiple industries and from one focal firm, are also important. Finally, whether the constructs in the model are collected and measured from both sides of the dyadic relationship, also matters. We summarize the results in Table 8.

Discussion

Channel conflict is a key business concern in light of its consequences. Indeed, analyzing the results from more than 100 related studies since 1960, we find the channel conflict-business performance link is negative. The results are invariant across individual or joint channel outcomes and robust across multiple models. While models with conflict as mediator have better fit with the data than models where it is an outcome, conflict’s links to relational variables match the canonical hypotheses and are consistent across different nomological frameworks.

A key finding is the conflict–performance link has evolved over time. In particular, we find that it has become more negative, suggesting the growth of a more unforgiving business climate in some sense. We can only speculate as to what processes have driven these specific results, although several authors have argued that the growth of the internet technologies and the spurt in e-commerce have changed marketing channels in significant ways (Frazier 1999; Hulland et al. 2007). The emergence of the e-commerce ecosystem has fostered myriad multi-channel formats where sellers more easily disintermediate their resellers by going direct. At the same time, it has consolidated the power of resellers in certain domains. Thus, there has not only been more competition for demand downstream but also for supply upstream. We find that the year 1991, a coming of age of the internet, served as somewhat of a breakpoint.

Yet, we also find that with time, the strength of the negative relationship has mellowed. Specifically, post-2005, we find that the link is less strong than pre-2005. It is unlikely that the degree of competition has reduced. However, we speculate that with time, digitization technology may have matured to the point of realizing greater value from channel coordination. Further, companies may also have developed competencies to better adapt to the changing technology, gaining better control over the processes that lead to deadweight performance loss or costly conflict (cf. Kaplan and Sawhney 2000). To the best of our knowledge, we are the first to report this result.

Some channel relationships are characterized by high dependency. Some franchisees, for example, may have little freedom to operate independent of the franchisor. This may be designed to ensure consistent product and service quality for end-users across the network, and even as a buffer against business uncertainties. However, the dependency can also breed power asymmetry in the channel and cause more intense conflict as suggested in Hunt and Nevin (1974), Palmatier et al. (2006), and Johnston et al. (2018). So, our result that the negative conflict–performance link is stronger for channels with higher dependency highlights a critical tradeoff—the presumed transactional efficiency of dependency versus the organizational penalties of power asymmetry.

With increasing cross border trade and globalization of supply chains, many marketing channels operate internationally. These global operations “increases the pie” and have supported sustained global prosperity in recent times. Our result that the negative conflict–performance link is stronger for international channel operations highlights an important boundary condition for such outcomes. As proposed in Zhang et al. (2003), navigating different regulatory and cultural regimes across borders, amplify the usual complications and uncertainties of geographic distance. This makes channel conflict more damaging.

One of our intriguing findings is North American businesses suffer a greater negative impact of channel conflict compared to others elsewhere. Business practices in North America are often exported as companies expand to other places in the world. The large consumer market and business friendly regulations in North America also attract companies from outside to operate in the continent. Yet, several authors comment on the cultural differences that frame relationship management practices in North American versus other cultures (cf. Rajamma et al. 2011; Yen et al. 2007). So, being intertwined with culture, business protocols are not entirely fungible. Our results show any presumed best practices around channel management cannot be taken as absolute, in particular, cultural factors in North America might make channel conflict less forgiving than elsewhere.

Underlining the importance of accounting for research methods in interpreting the empirical conflict–performance links, we find several measurement and sampling related moderators of the negative conflict–performance link, not yet reported in the literature. While weak, we find evidence that the link is weaker for objective measures of performance—potentially due to common method bias in subjective measures. We find the link is also weaker for samples from multiple industries—possibly due to heterogeneity that dilutes strong results (Geyskens et al. 1998). Studies that sample multiple channel members of a focal firm also exhibit a weaker link, compared to a cross-sectional sample—possibly due to efficiencies of shared conflict management practices.

Managerial implications

From a managerial perspective, our key result is the robust evidence that conflict and channel performance are negatively related. Meta-analysis studies estimate the aggregate effects in the published literature. So, this suggests a pervasiveness of the negative association between conflict and performance. The practical significance of this derives in part from the notion that efforts at managing conflicts involve the allocation of significant managerial and monetary resources. To this end, our results show that conflict management efforts can have a clear bottom-line impact for the channel partners. So, channel managers considering investing in conflict management efforts should feel encouraged.

In light of the negative conflict–performance link strengthening over time, it is fair to say managers will find these investments increasingly valuable. The post-2005 dip in the link is a provocative result in the backdrop of generally increasing competition in current times. This may be due to increasingly effective technology to manage conflict, including easier analyses and data sharing protocols. Therefore, in assessing the ROI of new technology for their channel operations, managers should explicitly assess the resulting capabilities to deal with channel conflict. However, how should managers sort and prioritize between different situations as they consider deployment of conflict management resources? Also, what should be the nature of such a deployment? While the correlational nature of meta-analysis studies limits our ability to draw fine-grained causal inferences, some of our results offer interesting insights for practitioners. We point out some that we find particularly compelling.

One potential challenge for channel conflict management is agreeing to a joint commitment of relevant resources. To this end, we find the negative relation between conflict and joint channel performance, instructive. Clearly, this result challenges the notion of conflict as a zero-sum, where one party wins, and the other loses. Rather it points to conflict as a universal deadweight loss for the channel. Therefore, managers should commit to such joint efforts within the channel.

Further, with conflict as a spectrum between potential to manifest, recognizing appropriate key performance indicators (KPI) for deploying conflict management resources is complicated. To this end, conflict’s negative relations to satisfaction, trust, and commitment indicate managers could identify these relational channel constructs as appropriate intermediate KPIs.

Yet, another challenge is governance costs that impose boundary conditions on the effectiveness of conflict management. We find that the negative impact of conflict is higher in channels with greater dependency, e.g., in resale franchises, compared to value-added resellers (VARs). These franchises tend to be governed by more formal mechanisms with greater franchisor oversight. Franchise Disclosure Documents (FDD-s) are an example. These are key information sources for potential franchisees and often include detailed guidelines to deal with conflict. However, these documents are costly to write, and their details sets expectations of monitoring and compliance costs for potential franchisees. This makes some franchisors wary of publishing them in a highly detailed form when they have a choice. Indeed, FDD-s are not mandatory for all jurisdictions (e.g., in Canada). In light of our results, franchisors should not shy away from incurring the transaction costs associated with these conflict management guidelines, for these costs may well be worth it in measurable bottom-line terms.

Our results around differences in the conflict–performance link across different channels are important but more nuanced in terms of direct managerial implications. For example, the tighter negative coupling between conflict and performance for channels with greater dependencies and international channels suggests a need for greater attention to those contexts but not that conflict is less important in their counterparts. Similarly, while the stronger negative conflict–performance link in north American samples suggest international firms be mindful of developing resources for effective conflict management as they plan for North American operations, it does not suggest conflict is less important outside of American shores. We summarize some of these insights in Table 8. Our more granular results around different measures and samples seem less compelling in terms of direct managerial implications. Nevertheless, true to meta-analytic studies, all of these indicate promising areas of further research, which we describe next.

Future research

Episodic nature of conflict

Several studies on conflict as a process notwithstanding, very little empirical work is devoted to conflict as interlocking episodes: latent, perceived, felt, manifest conflict, and conflict aftermath (Pondy 1967). Lengers et al. (2015)‘s work on how formal and relational governance affect the transition between different episodes; and Rose et al. (2007)‘s work documenting a positive relation between task- and emotional conflict, are notable exceptions. We call for more such studies to elaborate on the channel conflict–performance link.

Individual and joint performance

Our finding that the impact of channel conflict is invariant across individual or joint performance, highlights a big gap in the literature. While some writers use joint performance (e.g., Chang and Gotcher 2010; Webb and Hogan 2002), and others use measures based on only one channel member (Cronin and Morris 1989), few empirical studies use both individual and joint performance in the same model (Benton and Maloni 2005 is an exception). Thus, both the theory and empirical bases of individual versus joint performance are underdeveloped. We feel this is an important area for channels research.

The conflict–performance link as a moving target

While our results pertaining to the evolution of the conflict–performance link are unequivocal, it is unclear what firm/channel capabilities might be implicated. As new technologies populate our channel ecosystems (e.g., sharing platforms), understanding their impact on channel conflict and performance will become increasingly more important. To the best of our knowledge, we are the first to document this evolution and will hope other researchers will explore this further.

Metrics for channel performance

One of our clear takeaways is that the metric makes a difference. We find objective measures such as return on asset, profits, and sales metrics such as success, level, and growth, exhibit different relationship strength than subjective and perceptual measures such as level of satisfaction with performance and expected performance. However, several other variations remain unaccounted for (For example, the difference between long-term measures [e.g., firm survival] and short-term impacts [e.g., return on investment]). The discipline is alive to the need for more robust metrics for marketing performance with different approaches—Kumar et al. (1992) customize their measures to the research question and context, while Katsikeas et al. (2016) propose a theory-based framework. We feel these will continue to be important and fruitful areas of study in channels research.

Channel conflict as a functional phenomenon

While the aggregate evidence says conflict is dysfunctional, the potential functional role of conflict is understudied, prompting calls for more research in the domain (Koza and Dant 2007). Some studies (Dant and Schul 1992; Hunt 1996) point to conflict type, channel interdependency, and particularly, conflict resolution techniques, as sources of variation in outcomes. Yet, most studies in the domain are cross-sectional in design and have been criticized as unsuited for the purpose (Frazier 1999). Thus we call for more longitudinal designs to study channel conflict.

Conclusions

In a comprehensive meta-analysis of the literature, we find a negative channel conflict–performance link that is robust to both individual and joint outcomes, as well as across different nomological networks of various relational channel constructs. We estimate the conflict–performance link has evolved over time, roughly in keeping with the growth and maturing of e-commerce technologies. The impact of conflict seems to increase with time till technology improvements appear to usher greater capabilities to manage its effects. We find whether the channel is characterized by strong dependency, whether it is international, and whether it is North American moderate the negative conflict–performance link. We also identify some research method related variables that are significant moderators. The link is moderated by whether the measure of performance is objective or subjective and whether it is measured as a latent, aggregate or separate construct. Whether the sample is multi-industry, and whether the sample comprises one focal firm, also moderate the conflict–performance link. To the best of our knowledge, we are the first to document these and also the first meta-analysis focused on channel conflict and performance, certainly the most current.

As with any study, ours has limitations. Our efforts at rigor come at the cost of some completeness. The number of constructs in our analyses is limited by the number of correlation coefficients for several important inter-firm constructs such as opportunism and interdependence asymmetry, as well as important firm-level constructs such as goal incompatibility, drive for autonomy, and miscommunication. We hope our paper will motivate other researchers to overcome these limitations and contribute more to this important area in marketing.

Notes

Some include channel conflict as an outcome, but there are not enough studies with relevant variables for our purpose.

Our approach is similar to the common practice in meta-analysis studies, of employing an overlapping set of constructs with different causal orderings in a focal framework (cf. Palmatier et al. 2007).

In particular, we contacted 35 authors, and of the 27 responses received, 23 provided the required information.

Four studies were also excluded because the corresponding correlation matrices were not positive-definite. he full list of studies and details of the measures used in this study is reported in the Web Appendices A and B.

We thank the AE for suggesting this framework.

We lose some variables and degrees of freedom when parsing individual and joint performances, unfortunately.

References

Anderson, J. C., & Narus, J. A. (1984). A model of the distributor's perspective of distributor-manufacturer working relationships. Journal of Marketing, 48(4), 62–74.

Anderson, J. C., & Narus, J. A. (1990). A model of distributor firm and manufacturer firm working partnerships. Journal of Marketing, 54(1), 42–58.

Antia, K. D., Zheng, X., & Frazier, G. L. (2013). Conflict management and outcomes in franchise relationships: the role of regulation. Journal of Marketing Research, 50(5), 577–589.

Assael, H. (1968). The political role of trade associations in distributive conflict resolution. Journal of Marketing, 32(2), 21–28.

Assael, H. (1969). Constructive role of interorganizational conflict. Administrative Science Quarterly, 14(4), 573–582.

Balliet, D., & Van Lange, P. A. (2013). Trust, conflict, and cooperation: A meta-analysis. Psychological Bulletin, 139(5), 1090.

Benton, W. C., & Maloni, M. (2005). The influence of power driven buyer/seller relationships on supply chain satisfaction. Journal of Operations Management, 23(1), 1–22.

Brown, J. R. (1980). More on the channel conflict-performance relationship. Theoretical Developments in Marketing, 328–345.

Brown, J. R., Lusch, R. F., & Muehling, D. D. (1983). Conflict and power-dependence relations in retailer-supplier channels. Journal of Retailing, 59(4), 53–80.

Brown, J. R., Johnson, J. L., & Koenig, H. F. (1995). Measuring the sources of marketing channel power: A comparison of alternative approaches. International Journal of Research in Marketing, 12(4), 333–354.

Chang, K. H., & Gotcher, D. F. (2010). Conflict-coordination learning in marketing channel relationships: The distributor view. Industrial Marketing Management, 39(2), 287–297.

Cheung, M. W. L. (2014). Fixed- and random-effects meta-analytic structural equation modeling: Examples and analyses in R. Behavior Research Methods, 46(1), 29–40.

Cheung, M. W. L., & Chan, W. (2005). Meta-analytic structural equation modeling: A two-stage approach. Psychological Methods, 10(1), 40.

Cheung, M. W. L., & Chan, W. (2009). A two-stage approach to synthesizing covariance matrices in meta-analytic structural equation modeling. Structural Equation Modeling, 16(1), 28–53.

CompTIA. (2013). CompTIA’s 3rd Annual state of channel study: Channel conflict & deal Registration Trend (May 2013).

Cook, K. S., & Emerson, R. M. (1978). Power, equity and commitment in exchange networks. American Sociological Review, 43(5), 721–739.

Cordell, V. V. (1989). A Model of Conflict Comparison Between International and Domestic Channels: The Manufacturer’s Perspective. In Proceedings of the 1989 Academy of Marketing Science (AMS) Annual Conference (pp. 455–459). Cham: Springer.

CRN (2015). Bas Apple: An inside look at the rotting relationship between Apple and its partners. https://www.crn.com/news/mobility/300078386/bad-apple-an-inside-look-at-the-rotting-relationship-between-apple-and-its-partners.htm?itc=refresh. Accessed 2019/12/10.

Cronin Jr., J. J., & Baker, T. L. (1993). The effects of a distributor’s attribution of manufacturer influence on the distributor’s perceptions of conflict, performance and satisfaction. Journal of Marketing Channels, 3(2), 83–110.