Abstract

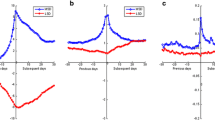

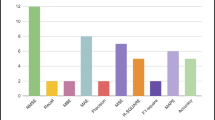

A Japanese candlestick chart consists of not only the closing price but also the high, low and opening price information. Using the Japanese candlestick, this paper investigates the forecasting power of the shadow in Japanese candlestick chart. Empirical studies performed with the US stock market show that 1) there is a significant Halloween effect in the shadow; 2) shadow is valuable for predicting the stock market returns in both statistical and economic sense; 3) the predictability reported by the shadow can not be explained by either the CAPM model or the Fama-French three-factor model. This paper confirms that predictability of the stock market can be improved if more price information is used.

Similar content being viewed by others

References

Cochrane J H, New facts in finance, Economic Perspectives, 1999, 23: 36–58.

Goyal A and Welch I, A comprehensive look at the empirical performance of equity premium prediction, Review of Financial Studies, 2008, 21: 1455–1508.

Neely C J, Rapach D E, Tu J, et al., Forecasting the equity risk premium: The role of technical indicators, Management Science, 2014, 60: 1772–1791.

Baker M and Wurgler J, Investors sentiment and the cross-section of stock returns, Journal of Finance, 2006, 61: 1645–1680.

Stambaugh R F, Yu J, and Yuan Y, Arbitrage asymmetry and the idiosyncratic volatility puzzle, Journal of Finance, 2015, 70: 1903–1948.

Huang W, Nakamori Y N, and Wang S Y, Forecasting stock market movement direction with support vector machine, Computer & Operations Research, 2005, 32: 2513–2522.

Campbell J Y and Thompson S B, Predicting the equity premium out-of-sample: Can anything beat the historical average? Review of Financial Studies, 2008, 21: 1509–1531.

Ferrerira M I and Santa-Clara P, Forecasting stock market returns: The sum of the parts is more than the whole, Journal of Financial Economics, 2011, 100: 514–537.

Rapach D E, Strauss J K, and Zhou G, Out-of-sample equity prediction: Combination forecasts and links to the real economy, Review of Financial Studies, 2010, 23: 821–862.

Ludvigson S C and Ng S, The empirical risk-return relation: A factor analysis approach, Journal of Financial Economics, 2007, 83: 171–222.

Kelly B and Pruitt S, Market expectations in the cross section of present values, University of Chicago Booth School of Business Working Paper, 2012, 11–08.

Guidolin M and Timmermann A, Asset allocation under multivariate regime switching, Journal of Economic Dynamics and Control, 2007, 31: 3503–3544.

Henkel S J, Martin J S, and Nadari F, Time-varying short-horizon predictability, Journal of Financial Economics, 2011, 99: 560–580.

Dangl T and Halling M, Predictive regressions with time-varying coefficients, Journal of Financial Economics, 2012, 106: 157–181.

Johannes M, Korteweg A, and Polson N, Sequential learning, predictability, and optimal returns, Journal of Finance, 2014, 69: 611–644.

Xie H B, Fan K K, and Wang S Y, Range-Decomposition Technique and Financial Market Prediction Research, Science Press, Beijing, 2014.

Nison S, Japanese Candlestick Charting Techniques, New York Institute of Finance, New York, 1991.

Xie H B, Zhao X J, and Wang S Y, A comprehensive look at the predictive information in Japanese candlestick, Procedia Computer Science, 2012, 9: 1219–1227.

Xie H B, Fan K K, and Wang S Y, The role of Japanese candlestick in DVAR model, Journal of Systems Science and Complexity, 2015, 28(5): 1177–1193.

Bouman S and Jacobsen B, The Halloween indicator, sell in May and go away: Another puzzle, American Economic Review, 2002, 92: 1618–1635.

Inoue A and Killian L, In-sample or out-of-sample tests of predictability: Which one should we use? Econometric Reviews, 2004, 23: 371–402.

Clark T E and West K D, Approximately normal tests for equal predictive accuracy in nested models, Journal of Econometrics, 2007, 138: 291–311.

Haug M and Hirschey M, The January effect, Financial Analysts Journal, 2006, 62: 78–88.

Balduzzi P and Lynch A, Transaction costs and predictability: Some utility cost calculations, Journal of Financial Economics, 1999, 52: 47–78.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported in part by the Fundamental Research Funds for the Central Universities under Grant No. 20180233, the National Natural Science Foundation of China under Grant No. 71901066, and the Fundamental Research Funds for the Central Universities in UIBE under Grant No. 19YB03.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Meng, X., Ma, J., Qiao, H. et al. Forecasting US Stock Market Returns: A Japanese Candlestick Approach. J Syst Sci Complex 34, 657–672 (2021). https://doi.org/10.1007/s11424-020-9126-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-020-9126-8