Abstract

We justify risk neutral equilibrium bidding in commonly known fair division games with incomplete information by an evolutionary setup postulating (i) minimal common knowledge, (ii) optimal responses to conjectural beliefs how others behave and (iii) evolutionary selection of conjectural beliefs with fitness measured by expected payoffs. After justifying the game forms we derive the evolutionary games for first- and second-price fair division and determine the evolutionarily stable conjectures. The latter coincide with equilibrium bidding, irrespectively of the number of bidders, i.e., heuristic belief adaptation can imply the same bidding behavior as equilibrium analysis based on common knowledge and counterfactual bidding.

Similar content being viewed by others

Notes

See Weibull (1995) for the definition and analysis of evolutionarily stable strategies (ESS) which are essentially refined symmetric equilibria of symmetric games.

This is similar to voting rules letting election outcomes only depend on voting results.

Güth (1986) introduces and applies envyfreeness of net trades with respect to bids which, together with incentive compatibility in the sense of truthful bidding being (weakly) undominated, allows to characterise the game form of the second-price auction. Instead of the latter Güth (2011) additionally requires equal net gains with respect to bids what allows to characterise game forms of various bidding contests relying on the first-price rule.

van Damme (1985) argued that envy-freeness according to bids does not guarantee envy-free net exchanges according to values. But as values are only privately known this could not be checked interpersonally and objectively as, for instance, required for legally implementable rules.

(See also Güth and van Damme 1986, equation III.13) who assume a uniform distribution of values defined on (0, 1) and study \(\lambda \)-pricing rules where \(\lambda =0\) and \(\lambda =1\) represent the first- and second-pricing rules, respectively—for \(\lambda \in [0,1]\), the pricing rule is a convex combination of the highest and second-highest bids.

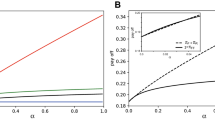

For example, when F is a Beta distribution \(B(v,\alpha ,1)\), the equilibrium bidding strategies for the first-price rule when \(\alpha =1\) and \(n=4\) are identical to those when \(\alpha =2\) and \(n=2\). This pairwise equivalence holds for the first-price rule for \(n=\{6,8,10,\ldots \}\) with \(\alpha =1\) and for \(n=\{3,4,5,\ldots \}\) with \(\alpha =2\). Similarly, when F is \(B(v,1,\beta )\), the equilibrium strategies for the second-price rule when \(\beta =1\) and \(n=4\) are identical to those when \(\beta =2\) and \(n=2\); and the equivalence holds for \(n=\{6,8,10,\ldots \}\) with \(\beta =1\) and for \(n=\{3,4,5,\ldots \}\) with \(\beta =2\).

We do not address the question of the dynamic stability of evolutionarily stable strategies, when the strategy space is continuous as this depends on the measure of closeness of mutations and is beyond the scope of the paper—See e.g., (Oechssler and Riedel 2002, Example 1) who show that a strict equilibrium can be unstable against the whole population shifting away to q’s that are closeby.

We motivate the use of affine linear bidding functions with intercept terms (c or d) depending on the slope (q or p, respectively) to keep the model tractable when trying to determine which monomorphic population composition is evolutionarily stable.

References

Berninghaus S, Güth W, Kliemt H (2012) Pull, push or both: indirect evolution in economics and beyond. In: Okasha S, Binmore K (eds) Evolution and rationality: decisions, co-operation and strategic behavior. Cambridge University Press, Cambridge

Cramton P, Gibbons R, Klemperer P (1987) Dissolving a partnership efficiently. Econometrica 55(3):615–632

de Frutos MA (2000) Asymmetric price-benefits auctions. Games Econ Behav 33:48–71

Dixon H, Somma E (2003) The evolution of consistent conjectures. J Econ Behav Organ 51(4):523–536

Güth W (1986) Auctions, public tenders, and fair division games: an axiomatic approach. Math Soc Sci 11(3):283–294

Güth W (2011) Rules (of bidding) to generate equal stated profits: an axiomatic approach. J Inst Theor Econ 167(4):608–612

Güth W (2017) Mechanism design and the law. In: Parisi F (ed) Handbook of law and economics, vol 1. Methodology and concepts. The Oxford University Press, Oxford

Güth W, Pezanis-Christou P (2015) Believing in correlated types in spite of independence: an indirect evolutionary analysis. Econ Lett 134:1–3

Güth W, van Damme E (1986) A comparison of pricing rules for auction and fair division games. Soc Choice Welf 3:177–198

Harsanyi J (1967) Games with incomplete information played by ‘Bayesian’ players, I–III. Part I. The basic model. Manag Sci 14(3):159–182

Harsanyi J (1968a) Games with incomplete information played by ‘Bayesian’ players, I–III. Part II. Bayesian equilibrium points. Manag Sci 14(5):320–334

Harsanyi J (1968b) Games with incomplete information played by ‘Bayesian’ players, I–III. Part III. The basic probability distribution of the game. Manag Sci 14(7):486–502

Maynard Smith J (1982) Evolution and the theory of games. Cambridge University Press, Cambridge

McAfee RP (1992) Amicable divorce: dissolving a partnership with simple mechanisms. J Econ Theory 56:266–293

Moldovanu B (2002) How to dissolve a partnership. J Inst Theor Econ 158:66–80

Morgan J (2004) Dissolving a partnership (un)fairly. Econ Theory 23:909–923

Oechssler J, Riedel F (2002) On the dynamic foundation of evolutionary stability in continuous models. J Econ Theory 107(2):223–252

Pezanis-Christou P, Wu H (2019) An individual decision-making approach to bidding in first-price and all-pay auctions. SSRN Working Paper #3233164

Saran R, Serrano R (2014) Ex-post regret heuristics under private values (I): fixed and random matching. J Math Econ 54:97–111

van Damme E (1985) Fair allocation of an indivisible commodity, Working Paper. University of Technology, Delft

Vickrey W (1961) Counterspeculation, auctions and competitive sealed tenders. J Finance 16:8–37

Weibull J (1995) Evolutionary game theory. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank an anonymous referee for useful comments. Support from the Max Planck Institute for Research on Collective Goods and the Australian Research Council (DP140102949) is gratefully acknowledged. The usual disclaimer applies.

Rights and permissions

About this article

Cite this article

Güth, W., Pezanis-Christou, P. An indirect evolutionary justification of risk neutral bidding in fair division games. Int J Game Theory 50, 63–74 (2021). https://doi.org/10.1007/s00182-020-00739-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-020-00739-9