Abstract

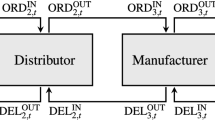

In this paper, we study the optimal ordering and inventory reallocation of the inventory service platform under the retailer demand information sharing. Due to the uncertainty of market demand, retailers’ demand information is likely to be inaccurate or even false. In this regard, retailers can reduce demand uncertainty by screening market signals. Therefore, based on the sharing of mean demand information and market signals, we explored the platform’s optimal ordering and inventory reallocation strategies, analyzed the retailer’s motivation for sharing false demand information, and proposed a corresponding penalty coordination mechanism. Our results show that the sharing of demand information and screening market signals reduces the uncertainty of market demand, thereby improving the accuracy of orders and increasing profit of the system. On the other hand, we find that the inventory reallocation strategy of the platform is affected by uncertain market information, but has nothing to do with the actual average demand and market signals shared by retailers. In this way, retailers will only share real information when the sharing system meets certain key conditions, otherwise they may share false demand information. The proposed punishment mechanism can encourage retailers to share their actual demand information with the platform.

Similar content being viewed by others

Data availability

The data used to support the findings of this study are available from the corresponding author upon request.

References

Amz. (2020). Two ways of stock sharing in Amazon Europe: EFN and Pan European. https://news.amzseo123.com/amz123/8005.html.

Anand, K. S., & Goyal, M. (2009). Strategic information management under leakage in a supply chain. Management Science, 55(3), 438–452.

Biggemann, S., & Brashear, T. (2012). The essential role of information sharing in relationship development. Journal of Business & Industrial Marketing, 27(7), 521–526.

Bimpikis, K., Candogan, O., & Saban, D. (2019). Spatial pricing in ride-sharing networks. Operations Research, 67(3), 599–904.

Benjaafar, S., & Hu, M. (2019). Operations management in the age of the sharing economy: What is old and what is new? Manufacturing & Service Operations Management, 22(1), 1–18.

Benjaafar, S., Kong, G., Li, X., & Courcoubetis, C. (2015). Peer-to-peer product sharing: Implications for ownership, usage and social welfare in the sharing economy. Social Science Electronic Publishing. https://doi.org/10.2139/ssrn.2669823.

Chan, L. M. A., Simchi-Levi, D., & Swann, J. (2006). Pricing, production, and inventory policies for manufacturing with stochastic demand and discretionary sales. Manufacturing and Service Operations Management, 8(2), 149–168.

Choi, T. M., Guo, S., Liu, N., & Shi, X. T. (2019). Values of food leftover sharing platforms in the sharing economy. International Journal of Production Economics., 213, 23–31.

Chao, X. L., Chen, H., & Zheng, S. H. (2008). Joint replenishment and pricing decisions in inventory systems with stochastically dependent supply capacity. European Journal of Operational Research, 191, 142–155.

Cömez, N., Stecke, K. E., & Cakanyldlm, M. (2012). In-season transshipments among competitive retailers. Manufacturing & Service Operations Management, 14(2), 290–300.

Chiu, C. H., Hao, G., Dai, X., & Xie, H. (2019). Inventory sharing of professional optics product supply chain with equal power agents. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03177-3.

Cui, R., Allon, G., Bassamboo, A., & Mieghem, J. V. (2015). Information sharing in supply chains: An empirical and theoretical valuation. Management Science, 61(11), 2803–2824.

Cachon, G. P., Daniels, K., & Lobel, R. (2017). The role of surge pricing on a service platform with self-scheduling capacity. Social Science Electronic Publishing. Manufacturing & Service Operations Management, 19(3), 368–384.

Cheng, T. C. E., & Wu, Y. N. (2005). The impact of information sharing in a two-level supply chain with multiple retailers. Journal of the Operational Research Society, 56(10), 1159–1165.

Cachon, G. P., & Lariviere, M. A. (2001). Contracting to assure supply: How to share demand forecasts in a supply chain. Management Science, 47(5), 629–646.

Dong, L., & Rudi, N. (2004). Who benefits from transshipment? Exogenous vs. endogenous wholesale Prices. Management Science, 50(5), 645–657.

Feng, P., Wu, F., Fung, R. Y. K., & Jia, T. (2018). Evaluation of two transshipment policies in a two-location decentralized inventory system under partial backordering. Transportation Research Part E: Logistics and Transportation Review, 118, 207–224.

Ha, Y. H., Tian, Q., & Tong, S. L. (2017). Information sharing in competing supply chains with production cost reduction. Manufacturing & Service Operations Management, 19(2), 246–262.

Herer, Y. T., Tzur, M., & Yücesan, E. (2006). The multilocation transshipment problem. IIE Transactions, 38, 185–200.

Hu, M., & Zhou, Y. (2019). Price, wage and fixed commission in on-demand matching. Working paper, University of Toronto, Toronto. SSRN. https://ssrn.com/abstract=2949513.

Jat, M. N., & Rafique, R. A. (2017). Impact of inventory sharing on service availability and transportation levels in time-differentiated distribution. International Journal of Inventory Research, 4(1), 23.

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management Science, 46(5), 626–643.

Norde, H., Özen, U., & Slikker, M. (2016). Setting the right incentives for global planning and operations. European Journal of Operational Research, 253(2), 441–455.

Özer, Ö., Zheng, Y., & Chen, K. Y. (2011). Trust in forecast information sharing. Management Science, 57(6), 1111–1137.

Özer, Ö., & Wei, W. (2006). Strategic commitments for an optimal capacity decision under asymmetric forecast information. Management Science, 52(8), 1238–1258.

Park, S. J., Lai, G., & Seshadri, S. (2016). Inventory sharing in the presence of commodity markets. Production and Operations Management, 25(7), 1245–1260.

Pezeshki, Y., Baboli, A., Cheikhrouhou, N., Modarres, M., & Jokar, M. R. A. (2013). A rewarding-punishing coordination mechanism based on Trust in a divergent supply chain. European Journal of Operational Research, 230(3), 527–538.

Robinson, L. W. (1990). Optimal and approximate policies in multiperiod, multilocation inventory models with transshipments. Operations Research, 38(2), 278–295.

Ren, Z. J., Cohen, M. A., Ho, T. H., & Terwiesch, C. (2010). Information sharing in a long-term supply chain relationship: The role of customer review strategy. Operations Research, 58(1), 81–93.

Sohu. (2018). JDand Wal–Mart to Fully “share inventory”. https://www.sohu.com/a/242789074_115239.

Sun, L., Teunter, R. H., Babai, M. Z., & Hua, G. W. (2019). Optimal pricing for ride-sourcing platforms. European Journal of Operational Research, 278(3), 783–795.

Seidscher, A., & Minner, S. (2013). A Semi-Markov decision problem for proactive and reactive transshipments between multiple warehouses. European Journal of Operational Research, 230(1), 42–52.

Shao, J., Krishnan, H., & McCormick, S. T. (2011). Incentives for transshipment in a supply chain with decentralized retailers. Manufacturing & Service Operations Management, 13(3), 361–372.

Sandeep, S., & Manjunath, K. (2017). Performance modeling of a two-echelon supply chain under different levels of upstream inventory information sharing. Computers & Operations Research, 77, 210–225.

Spiliotopoulou, E., Donohue, K., Gürbüz, M. C., & Heese, H. S. (2018). Managing and reallocating inventory across two markets with local information. European Journal of Operational Research, 266(2), 531–542.

Villa, S., & Castañeda, J. A. (2018). Transshipments in supply chains: A behavioral investigation. European Journal of Operational Research, 269, 715–729.

Yan, X. H., & Zhao, H. (2016). Inventory sharing and coordination among n independent retailers. European Journal of Operational Research, 243(2), 576–587.

Yu, Y. G., Zhou, S. J., & Shi, Y. (2020). Information sharing or not across the supply chain: The role of carbon emission reduction. Transportation Research Part E: Logistics and Transportation Review, 137, 101915.

Zhang, P., Yan, H., & Pang, K. W. (2019). Inventory sharing strategy for disposable medical items between two hospitals. Sustainability, 11(22), 6428.

Acknowledgements

This research is partially supported by the National Natural Science Foundation of China (Grant Nos. 71572033, 71832001).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interests regarding the publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proofs

Appendix: Proofs

1.1 Proof of Proposition 1

To explore the relationship between qiM* and di, we need to observe the first derivation бqiM*/бdi. However, we do not know the explicit formula that qiM* satisfies, except the formula бSπM/бqiMI*. So, we use the derivation formula of implicit function to get our solution. Let the implicit function be Z = бSπM/бqiM*, then

By taking the derivative of Eq. (12), we can obtain \({{\partial^{2} S\pi^{M} } \mathord{\left/ {\vphantom {{\partial^{2} S\pi^{M} } {(\partial q_{i}^{M*} \partial d_{i} )}}} \right. \kern-\nulldelimiterspace} {(\partial q_{i}^{M*} \partial d_{i} )}}\) and \({{\partial^{2} S\pi^{M} } \mathord{\left/ {\vphantom {{\partial^{2} S\pi^{M} } {(\partial q_{i}^{M*} )}}} \right. \kern-\nulldelimiterspace} {(\partial q_{i}^{M*} )}}^{2}\) as follows:

Comparing formula (A.2) and (A.3), we can know that \(- {{(\frac{{\partial^{2} S\pi^{M*} }}{{\partial q_{i}^{M*} \partial d_{i} }})} \mathord{\left/ {\vphantom {{(\frac{{\partial^{2} S\pi^{M*} }}{{\partial q_{i}^{M*} \partial d_{i} }})} {(\frac{{\partial^{2} S\pi^{M*} }}{{\partial (q_{i}^{M*} )^{2} }})}}} \right. \kern-\nulldelimiterspace} {(\frac{{\partial^{2} S\pi^{M*} }}{{\partial (q_{i}^{M*} )^{2} }})}} = 1\), i.e., \(\frac{{\partial q_{i}^{M*} }}{{\partial d_{i} }} = 1\). Thus, the relationship between qiMI* and di can be expressed as qiM* = di + CSiM, where CSiM is a constant.

Next, given that the mean market demand di and dj shared by retailers to the platform, we can obtain qiM* = di + CSi, which is substituted into Eq. (12) and simplify it to get

As show in Eq. (A.5), di and qiM* are eliminated, so qjM* is irrelevant to di and only related to dj.

Thus, Proposition 1 is proved.

1.2 Proof of Proposition 2

Refer to the Proof of Proposition 1.

1.3 Proof of Proposition 3

When the retailer j shares its real market demand information, the individual optimality condition for the retailer i to maximize its own profit can be transformed from Eq. (26) into Eq. (A.5):

According to Eq. (23), when the shared inventory system is optimal, qir = qiMS (dir, Sir), the condition satisfied by the retailer i is

For Eq. (A.5), if the retailer i share the real market demand information, i.e., dir, Sir, it is not equal with Eq. (A.6), which indicates that global optimization is not consistent with the local optimization, and the retailer i will share false information in order to maximize its own private profit. Particularly, only when the above two optimality conditions are equal, that is,

\((t_{ji} - s) \cdot B_{i}^{MS} (q_{i}^{r} ,q_{j}^{r} ) = (p_{j} - c_{j} - t_{ij} - r_{ij} + l) \cdot C_{i}^{MS} (q_{i}^{r} ,q_{j}^{r} )\), retailer i will share the real information.

Thus, Proposition 3 is proved.

1.4 Proof of Proposition 4

When the retailer j shares the real market demand information to the platform, before the penalty mechanism is adopted, the private profit of the retailer i is

After the penalty mechanism is adopted, the retailer i’s private profit becomes

Next, when the shared inventory system is optimized, the expected profit of the retailer i is as follows

In order to induce retailers not to lie, we only need to make sure that the retailer i’s profit in the case of sharing real demand information is always higher than that in the case of lying. Thus, for Eq. (A.8) and Eq. (A.9), we make the inequality πiPf(qif,qjr) ≦ πir(qir,qjr) permanent, and the optimal unit penalty ceiling δ* can be obtained, i.e.

\(\delta^{*} \ge \max \{ \mathop {\max }\limits_{{h_{i}^{f} \ne h_{i}^{r} }} \frac{{h_{i}^{r} \cdot [\pi_{i}^{f} (q_{i}^{f} ,q_{j}^{r} ) - \pi_{i}^{r} (q_{i}^{r} ,q_{j}^{r} )]}}{{w \cdot \left| {h_{i}^{f} - h_{i}^{r} } \right| \cdot q_{i}^{f} }},{ 0}\}\).

Thus, Proposition 4 is proved.

Rights and permissions

About this article

Cite this article

Xu, Q., Sun, Zm. & Gao, Xq. Ordering and inventory reallocation decisions in a shared inventory platform with demand information sharing. Ann Oper Res 329, 471–499 (2023). https://doi.org/10.1007/s10479-020-03803-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03803-5