Abstract

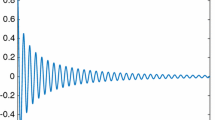

We suggest 3 families of conformal deformations and changes of variables for evaluation of integrals arising in applications of the Fourier analysis to fractional partial differential equations and evaluation of special functions, probability distribution functions, cumulative probability distribution functions and quantiles of stable distributions. For the error tolerance E-15, hypergeometric functions can be calculated much faster (in Matlab implementation) than using SFT in Matlab, Python and Mathematica; even when the index \(\alpha \) of the stable distribution is small or close to 1, the same error tolerance can be satisfied in 0.005–0.1 msec. For the calculation of quantiles in wide regions in the tails using the Newton or bisection method, it suffices to precompute several hundred values of the characteristic exponent at points of an appropriate grid (conformal principal components) and use these values in formulas for cpdf and pdf. The same three families can be used to evaluate more general distributions and solutions of boundary problems for fractional partial differential equations more general than the ones related to stable distributions. The methods of the paper are applicable to other classes of integrals, highly oscillatory ones especially.

Similar content being viewed by others

Notes

We are grateful to the anonymous referee for the suggestion to clarify the relation of this definition and notation to the definitions of the Hardy space and norm used in the literature.

Statements of the form “the following choice is approximately optimal” in the paper can be formulated as Lemmas and “the level of optimality” characterized exactly. Typically, “the optimal” choices are impossible. The recommendations which are give are supported by our numerical experiments.

The tails of the distributions decay too slowly, hence, the Monte Carlo simulations are moderately efficient only if the index of the process is close to 2, and the distribution does not differ much from the normal distribution, with the exception of far parts of the tails, which can be safely disregarded in this case.

References

Abramowitz, M., Stegun, I.: Handbook of Mathematical Functions, with Formulas, Graphs and Mathematical Tables. Dover Publications, Mineola (1965)

Ament, S., O’Neil, M.: Accurate and efficient numerical calculation of stable densities via optimized quadrature and asymptotics. Stat. Comput. 28(1), 171–185 (2018)

Boyarchenko, S., Levendorskiĭ, S.: Non-Gaussian Merton-Black-Scholes Theory. Adv. Ser. Stat. Sci. Appl. Probab., vol. 9. World Scientific Publishing, River Edge (2002)

Boyarchenko, S., Levendorskiĭ, S.: Efficient Laplace inversion, Wiener-Hopf factorization and pricing lookbacks. Int. J. Theor. Appl. Finance 16(3), 1350011 (2013) (40 pages). Available at SSRN: http://ssrn.com/abstract=1979227

Boyarchenko, S., Levendorskiĭ, S.: Efficient variations of Fourier transform in applications to option pricing. J. Comput. Finance 18(2), 57–90 (2014)

Boyarchenko, S., Levendorskiĭ, S.: Sinh-acceleration: efficient evaluation of probability distributions, option pricing, and Monte-Carlo simulations. Int. J. Theor. Appl. Finance 22(3), 1950011 (2019). https://doi.org/10.1142/S0219024919500110. Available at SSRN: http://ssrn.com/abstract=3129881

Boyarchenko, S., Levendorskiĭ, S.: Static and semi-static hedging as contrarian or conformist bets. Working paper (2019). Available at SSRN: https://ssrn.com/abstract=3329694 or http://arxiv.org/abs/1902.02854

Chambers, J.M., Mallows, C.L., Stuck, B.W.: A method for simulating stable random variables. J. Am. Stat. Assoc. 71, 340–344 (1976)

Chandrasekhar, S.: Stochastic problems in physics and astronomy. Rev. Mod. Phys. 15(1), 1–89 (1943)

Chavanis, P.: Statistics of the gravitational force in various dimensions of space: from Gaussian to Lévy laws. Eur. Phys. J. B 70(3), 413–433 (2009)

de Innocentis, M., Levendorskiĭ, S.: Calibration Heston model for credit risk. Risk, 90–95 (2017)

Eskin, G.I.: Boundary Value Problems for Elliptic Pseudodifferential Equations. American Mathematical Society, Providence (1981)

Feng, L., Linetsky, V.: Pricing discretely monitored barrier options and defaultable bonds in Lévy process models: a fast Hilbert transform approach. Math. Finance 18(3), 337–384 (2008)

Gonzalez, D.S., Kuruoglu, E.E., Rulz, D.P.: Modelling with mixture of symmetric stable distributions using Gibbs sampling. Signal Process. 90(3), 774–783 (2010)

Katznelson, Y.: An Introduction to Harmonic Analysis, 2 edn. Dover Publications, New York (1976)

Levendorskiĭ, S.: Efficient pricing and reliable calibration in the Heston model. Int. J. Theor. Appl. Finance 15(7), 125050 (2012) (44 pages)

Madan, D.B., Carr, P., Chang, E.C.: The variance gamma process and option pricing. Eur. Finance Rev. 2, 79–105 (1998)

Mandelbrot, B.B.: The variation of certain speculative prices. J. Bus. 36(2), 394–419 (1963)

Mandelbrot, B.B.: Fractals and Scaling in Finance: Discontinuity, Concentration, Risk. Springer, New York (1997)

Mittnik, S., Rachev, S.T.: Modeling asset returns with alternative stable distributions. Econom. Rev. 12(3), 261–330 (1993)

Nikias, C.L., Shao, M.: Signal Processing with Alpha-Stable Distributions and Applications. Wiley, New York (1995)

Nolan, J.P.: Numerical calculation of stable densities and distribution functions. Commun. Stat., Stoch. Models 13(4), 759–774 (1997)

Nolan, J.P.: Parameterizations and modes of stable distributions. Stat. Probab. Lett. 38(1), 187–195 (1998)

Nolan, J.P.: Modeling financial data with stable distributions. In: Rachev, S.T. (ed.) Handbook of Heavy Tailed Distributions in Finance, pp. 105–130. Elsevier/North Holland, New York (2003)

Olver, F.W.J.: Asymptotics and Special Functions. A.K. Peters, Wellesley (1997)

Saenko, V.V.: Fractional-stable statistics of the genes expression in the next generation sequence results. Math. Biol. Bioinform. 11(2), 278–287 (2016)

Samorodnitsky, G.C., Taqqu, M.C.: Stable Non-Gaussian Random Processes. Chapman and Hall, New York (1994)

Sato, K.: Lévy Processes and Infinitely Divisible Distributions. Cambridge Stud. Adv. Math., vol. 68. Cambridge University Press, Cambridge (1999)

Schröder, M.: Brownian excursions and Parisian barrier options: a note. J. Appl. Probab. 40(4), 855–864 (2003)

Stein, E., Weiss, G.: Introduction to Fourier Analysis on Euclidean Spaces. Princeton University Press, Princeton (1971)

Stenger, F.: Numerical Methods Based on Sinc and Analytic Functions. Springer, New York (1993)

Trefethen, L.N., Weideman, J.A.C.: The exponentially convergent trapezoidal rule. SIAM Rev. 56(3), 385–458 (2014)

Vilenkin, N.Ya., Klimchuk, A.U.: Representation of Lie Groups and Special Functions. Volume I. Simplest Lie Groups, Special Functions and Integral Transforms. Kluwer Academic Publishers, Dordrecht (1991)

Weron, R.: On the Chambers-Mallows-Stuck method for simulating skewed stable random variables. Stat. Probab. Lett. 28(2), 165–171 (1996)

Zolotarev, V.M.: One-Dimensional Stable Distributions. American Mathematical Society, Providence (1986)

Acknowledgements

We acknowledge valuable suggestions for improvements of the paper made by Chief Editors John King and Benoit Perthame, and two anonymous referees. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Boyarchenko, S., Levendorskiĭ, S. Conformal Accelerations Method and Efficient Evaluation of Stable Distributions. Acta Appl Math 169, 711–765 (2020). https://doi.org/10.1007/s10440-020-00320-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10440-020-00320-2

Keywords

- Stable Lévy processes

- Fractional partial differential equations

- Special functions

- Signal processing

- Spectral methods

- Conformal acceleration

- Sinh-acceleration

- Conformal principal components

- Fourier transforms